Related Videos

Maryland MCA Prohibition Bill - Senate Hearing |

Stories

The Commercial Finance Coalition Applauds Actions by the Federal Trade Commission and New York State to Thwart Bad Actors in Business Lending

June 11, 2020 The Federal Trade Commission (FTC) and the office of New York State Attorney General Letitia James have filed formal actions against two small business financing companies for allegedly using egregious and deceptive tactics to seize assets from small businesses, non-profits, religious organizations, and medical offices.

The Federal Trade Commission (FTC) and the office of New York State Attorney General Letitia James have filed formal actions against two small business financing companies for allegedly using egregious and deceptive tactics to seize assets from small businesses, non-profits, religious organizations, and medical offices.

“The Commercial Finance Coalition whole-heartedly applauds the efforts of the FTC and Attorney General James. As a coalition of responsible financial services companies committed to funding small businesses, the CFC believes there should be zero tolerance for bad actors and deceptive practices in our industry,” said Executive Director Dan Gans.

Gans added, “Hopefully this will serve as a warning to all companies in the business finance space to serve merchants through best practices centered on respect and integrity in compliance with state and federal law.”

The CFC is a not-for-profit alliance of innovative financial technology companies that are working together to deploy capital to help small and mid sized businesses grow.

Press Release

Contact

Dan Gans

626-755-6545

Release Date

June 11, 2020

Commercial Finance Coalition to Host Open House in NYC

December 11, 2018The Commercial Finance Coalition, an industry trade group, is hosting an open house for current and prospective members on December 18 in New York City. It’s at the Park Avenue Tavern from 6pm to 8pm. If you are interested in attending, please contact Mary Donohue at mdonohue@polariswdc.com.

Commercial Finance Coalition Continues to Engage

June 1, 2017

A sign of a mature industry? The Commercial Finance Coalition is becoming a major liaison between the merchant cash advance industry and Washington. Just as peer-to-peer lenders and electronic payment companies have their own trade associations, the CFC is regularly engaging with legislators to offer their input where needed. And that requires a concerted effort, as evidenced by the group’s most recent trip that included meetings with 26 Members of Congress and senior staff. Those are typically separate individual meetings so you can imagine the amount of time and preparation involved.

“The Commercial Finance Coalition (CFC) conducted our third Washington, DC legislative fly-in last week,” Dan Gans, the CFC’s executive director, said to deBanked. “Fifteen members of the organization attended as well as a few prospective members. The CFC continues to establish itself as the premier trade group in the MCA and alternative small business finance space.”

The CFC also gets involved at the state level and played a role in preventing harmful legislation in New York a few months back. Most importantly, their mission is to simply tell their story.

“Studies show that traditional banks cannot meet the overwhelming demand for small business capital in the United States and we be believe that CFC members help thousands of entrepreneurs grow and sustain their businesses,” Gans explained. “We believe it is critical to educate policy makers in Washington and in state capitals like Albany and Sacramento about the vital role our industry plays in helping small businesses achieve success.”

The CFC is not the only trade association in the industry, but they have made political engagement a focal point of their mission since they were founded 18 months ago.

Gans elaborated on this. “Since its establishment in January of 2016, the CFC has been educating Members of Congress and state legislators about MCA and non-bank small business finance. We give our members a needed voice with elected officials and regulators. I would encourage anyone in the MCA space that is not a CFC member to inquire about membership. The industry is facing many threats and it is important that groups like the CFC stand in the gap to educate government leaders about the thousands of jobs advances from our members create across the country.”

To inquire about CFC membership, they advise to please contact Mary Donohue at mdonohue@polariswdc.com or call (202) 368-9758.

Full disclosure: I have accompanied the CFC on their DC fly-ins and the engagement is every bit as real and consequential as it sounds.

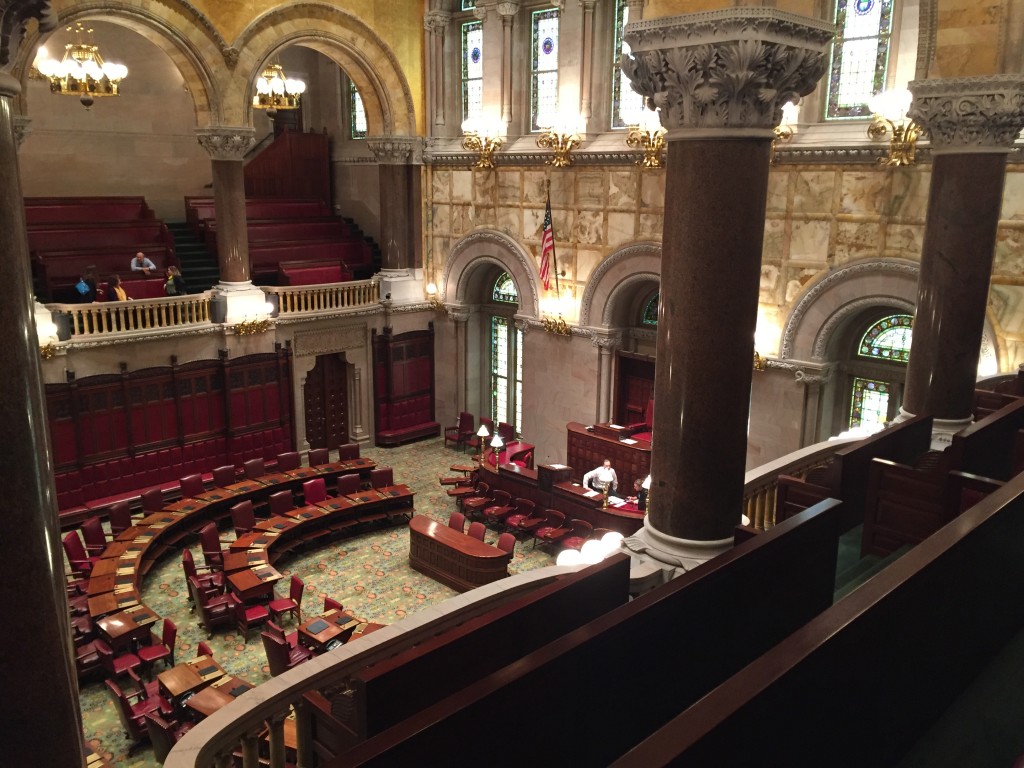

With Clock Ticking, Members of the Commercial Finance Coalition Journeyed to the New York State Capitol

March 5, 2017 With less than a month to go until New York State’s budget deadline, members of the Commercial Finance Coalition (CFC) traveled to Albany, NY last week to address a vague and confusing licensure proposal put forth by Governor Cuomo. According to the CFC, nobody from the New York Department of Financial Services, the governor’s office or the state legislature had contacted any of their members prior to putting the language in the budget that they suspect could lead to catastrophic consequences. So on very short notice, they packed their bags and went up to Albany to tell their story to as many legislators as they could.

With less than a month to go until New York State’s budget deadline, members of the Commercial Finance Coalition (CFC) traveled to Albany, NY last week to address a vague and confusing licensure proposal put forth by Governor Cuomo. According to the CFC, nobody from the New York Department of Financial Services, the governor’s office or the state legislature had contacted any of their members prior to putting the language in the budget that they suspect could lead to catastrophic consequences. So on very short notice, they packed their bags and went up to Albany to tell their story to as many legislators as they could.

“It could destroy the industry if the worst comes to fruition,” declared Robert Cook, a partner at Hudson Cook LLP, who was speaking in reference to the proposal. The industry not only employs thousands of people in New York State but also provides much-needed capital to small businesses there. The CFC says that their members injected more than $50 million into New York businesses just last year alone.

Several law firms who have written about the proposal have used words like could, may and likely to explain what will happen, in part because it seems as though no one’s really sure. CFC members worry that the proper research hasn’t been done, especially when there hasn’t been any engagement with them. “They should allow all the stakeholders to have their voices heard,” said Dan Gans, CFC’s executive director.

As the clock ticked down, the CFC’s two-day effort in the capitol building played out like a scene from a movie.

Are you aware of Part EE of the TED Bill?

This is what we do…

No, nobody from the Department of Financial Services has even talked to us

No, we’re not kidding

And on it went…

Gans says the CFC is looking for additional companies in the small business financing industry to support their efforts. He’ll be at the LendIt Conference. “I would be happy to meet with anyone interested in joining the CFC and helping us fight this misguided policy that is also attending,” he said. He can be contacted at dgans@polariswdc.com.

The budget deadline in New York State is March 31st.

Commercial Finance Coalition Tells MCA Industry Story on Capitol Hill

September 23, 2016

Earlier this week, executives and representatives from the merchant cash advance industry met with dozens of policymakers on Capitol Hill. The Fly-In was hosted by the Commercial Finance Coalition, whose members make up a sizable chunk of the industry’s overall transaction volume. It was their second such event this year.

The opportunity allowed industry representatives to get face time with Republicans and Democrats from both the House and the Senate. One message of great importance was in communicating the challenges that small businesses face in trying to access less than $250,000 in working capital. Another was in distinguishing purchase transactions from loans.

“Our members are engaged and committed to educating and advocating the interests of the merchant cash advance industry in Washington DC and state capitals around the country,” said Isaac Stern, President of the CFC and Fundry. “I would strongly encourage my industry colleagues and competitors to get involved in the organization and help us grow the CFC.”

While banks have been accused of being too big to fail, the CFC noted that many businesses have become too small to survive as a consequence of banks moving upstream. Regulations have made it too burdensome and expensive for a bank to underwrite a $25,000 loan, plus they may not be able to stomach the risk or be properly incentivized to approve or decline a loan in the first place. The CFC’s members do not securitize their transactions or sell them off, lending credence to the position that their livelihood depends on small businesses succeeding and performing.

“In less than 9 months the CFC has become the gold standard of alternative small business finance trade groups in Washington,” said Dan Gans, Executive Director of the CFC. “In a short time we have been able to conduct over 50 meetings with key policymakers and assemble a world class regulatory and lobbying team. I would encourage anyone involved in the merchant cash advance or alternative small business finance space to join the CFC and help us advocate for the thousands of small businesses across the country who benefit from the access to needed capital provided by the industry.”

The CFC has not been the only coalition from the broad genre of fintech to host a Fly-In, making it all the more imperative for the MCA industry to educate policymakers on the specifics of what they do and how they do it. For instance, a lot of the regulatory discussion as of late has focused on the partnerships between online lenders and chartered banks, the legitimacy of those partnerships and the sustainability of the algorithms being employed to make quick decisions. While there are several MCA-like products that rely on that model, there is also an entirely different methodology that relies on helping small businesses by purchasing their future receivables. The CFC is one major coalition communicating that distinction.

The CFC is also currently accepting new members to join their cause and participate in future events.

Commercial Finance Coalition Emerges – An All Inclusive MCA Industry Trade Group

March 16, 2016 A new trade association hopes to bring together every type of company in the alternative-finance industry to form a united front capable of managing state and federal regulation.

A new trade association hopes to bring together every type of company in the alternative-finance industry to form a united front capable of managing state and federal regulation.

The fledgling Commercial Finance Coalition (CFC) welcomes potential members that include funders, brokers, payments processors, data providers and collection agencies, said Matt Patterson, CEO of Sioux Falls, SD-based Expansion Capital Group LLC and a board member and organizer of the new trade group.

Patterson began thinking about forming an association early last year when he learned that the established Small Business Finance Association (SBFA), formerly the North American Merchant Advance Association, wasn’t communicating with legislators and regulators on behalf of the industry. “When I talked to them six or nine months ago, they had no road map for affecting legislation or regulation,” he said.

Since then, the SBFA has hired an executive director with legislative and association experience to tell the industry’s story on Capitol Hill. (See here.) So, two industry groups now plan to begin contacting government officials to educate them on the cause of small-business alternative finance.

The decision to create the CFC came at a dinner meeting convened Dec. 3 in New York. That gathering came together after several months of conference calls and videoconferences, Patterson said.

The CFC is working with two well-established lobbying groups, Patterson noted. Both organizations advised the CFC during its formation, he said.

The CFC is working with two well-established lobbying groups, Patterson noted. Both organizations advised the CFC during its formation, he said.

Law firm WilmerHale was selected to represent the CFC. The combination of Polaris and WilmerHale will give the association an immediate Washington presence, he noted.

The group intends to write best practices for its members but doesn’t contemplate starting a trade show, trade publication or merchant watch list, Patterson said.

The CFC is beginning its journey with nearly 20 member companies, according to Patterson. Recruitment of additional members is scheduled to intensify after the association has been operating for a while.

Inviting members from all facets of the industry indicates a philosophy that differs from that of the SBFA, which includes only funders on its roster, Patterson said. “We want to be inclusive,” he said. “We’re interested in building a broad base of constituents that all have an incentive to see that the industry survives and thrives.”

The coalition’s trusted service providers include:

- Arena Strategies

- Catalyst Group

- Polaris Consulting

- Wilmer Cutler Pickering Hale and Dorr

Update on Connecticut Commercial Financing Disclosure Bill

March 28, 2022The Connecticut commercial financing disclosure bill first reported by deBanked on March 3rd is still in play. SB272, written similarly to the first draft of the recently passed New York legislation, has been met with both support and opposition.

Supportive

- Connecticut Bankers Association (but with amendments)

- Responsible Business Lending Coalition

- Innovative Lending Platform Association

Opposed

- Electronic Transactions Association

- Revenue Based Finance Coalition

- Small Business Finance Association

Connecticut Introduces Commercial Financing Disclosure and Double Dipping Bill

March 20, 2021 Ever since New York State Senator George Borrello famously questioned the meaning of “double dipping” in a commercial financing transaction, states have rushed to include the term in proposed laws despite no one knowing exactly what it means.

Ever since New York State Senator George Borrello famously questioned the meaning of “double dipping” in a commercial financing transaction, states have rushed to include the term in proposed laws despite no one knowing exactly what it means.

The latest state is Connecticut, which introduced SB 745 in February, an “Act Requiring Certain Financing Disclosures.” It is essentially a copy & paste of New York’s recent law which is slated to go into effect in June.

The Connecticut bill similarly applies to factoring, merchant cash advance, business lending and more. It was introduced by State Senator Saud Anwar (D).

A hearing held on March 2nd, drew testimony from the Commercial Finance Coalition, Small Business Finance Association, Electronic Transactions Association, Innovative Lending Platform Association, and Secured Finance Network.

If the bill passes, it is designed to go into effect in October of this year.

See Post... commercial finance coalition, a trade group whose members include some of the biggest users of confessions of judgment, has been lobbying for a different approach. the group recommends prohibiting confessions entirely on the smallest deals, but allowing them to continue to be filed against out-of-state debtors on transactions of more than $100,000, according to dan gans, the group’s executive director., , another industry group, the small business finance association, supports the legislation as drafted but would prefer a total ban on confessions, said stephen denis, the organization’s executive director. “any company that is counting on cojs as a collection practice, they are just practicing bad underwriting,” he said. “they should be leaving the industry anyway.”, , --with assistance from david ingold and demetrios pogkas., , to contact the reporters on this story: zachary r. mider in new york at zmider1@bloomberg.net;zeke faux in new york at zfaux@bloomberg.net, , to contact the editors responsible for this story: robert friedman at rfriedman5@bloomberg.net, david s. joachim, , 2019 bloomberg l.p.... |

NJ Regulation Hearing Testimony... commercial finance coalition, a group of responsible finance companies that provide capital to small and medium-sized businesses through innovative methods. i also am an attorney who helps providers of commercial financing comply with state and federal law., , the commercial finance coalition supports efforts to make business financing more transparent., , the problem is the proposed amendment would define a merchant cash advance as a loan. a merchant cash advance is not a loan... |

See Post... commercial finance coalition., , haha i think he is trying to say that yellowstone is the most aggressive subprime funding house in america.... |