Articles by deBanked Staff

What’s Challenging in the Broker World

July 24, 2024Are you a small business finance broker? Here are some of the most common challenges that they report to deBanked.

The lender I was working with was not a lender

The lender I was working with was not a lender

This is a preventable mistake. Instead of falling for a cold call, check the appropriate state registries, ask for feedback from your peers online (or in person), and conduct extensive due diligence. If you’re not willing to conduct due diligence as a broker, you will inevitably be fooled.

The deal was intercepted by a third party

Whether it’s through backdooring, big data, or a customer lying about shopping around, brokers often report the sudden appearance of a mysterious competitor right as their deal was approaching the finish line. Since there seems to be virtually no remedy on the horizon for this, brokers should speak candidly with their clients upfront about what to expect and lock in their loyalty well in advance so that this mysterious competition is shut down.

The available lead quality in the public marketplace is low or good exclusive leads are non-existent

If the business was easy as buying the same leads as everyone else and using them to earn huge profits on the deals closed without much hassle, then every single person in the country would be a broker. Being a broker is hard work and a significant part of the gig is marketing. You’ll have to decide if you or someone you hire is up to the task of generating the deals for you or your closers to close. If you can’t figure out how to market, you will eventually fail.

I didn’t get paid on a funded deal

While relationships do count for a lot, broker agreements count for just as much. As much as smaller shops roll their eyes at the prospect of having to shell out funds for attorneys to review contracts, it is a necessary cost to operate. If a lending company believes it doesn’t have to pay you, it won’t. Don’t be surprised when it happens to you. Instead be ready with your agreement, the facts, and your attorney to remedy the issue. Brokers unable to afford legal representation are much more likely to be bullied by a lender than everyone else. So do all the boring but necessary due diligence before signing up and if they ultimately breach the agreement with you, be ready to stand up for yourself in a way they will have no choice but to respect.

Ponzi Schemer Continued to Run Ponzi Scheme From Prison Phone

July 22, 2024Don’t syndicate with New Beginning Global Funding LLC, New Beginning Capital Funding LLC, and Lion Heart Capital Group L.L.C.

That’s because these entities were just named in a federal plea agreement as belonging to Johanna Garcia, a now-convicted ponzi schemer currently serving time in Miami’s federal detention center. Readers might remember her as being the mastermind behind a fake MCA company known as MJ Capital Funding. Garcia raked in more than $190 million as part of a fake syndication/investment scheme from thousands of duped investors. The SEC shut the company down in 2021 and she was charged criminally last year.

She did not go down quietly. Apparently after the SEC shut down her entities she simply set up new entities and kept going. When she was finally arrested and jailed awaiting trial she continued the ponzi from the prison phone and email.

In a proffer signed by Garcia, it’s stated that “Garcia and her co-conspirators told investors that their money would be used to fund general contractors who worked on commercial and residential properties through merchant cash advance loans. In truth, bank records show that there was little to no merchant cash advance activity, and the money raised was used to pay off previous investors.”

Garcia, and those that participated in the scheme with her, used MCA as a cover for their scheme. She was not actually known to people in the industry nor actually worked in it.

Fake LOC Scam Results in Guilty Plea

July 17, 2024Yisroel (“Scott”) Heber pleaded guilty last month for his role in a fake business line of credit scam. In April, the US Attorney for the Southern District of NY and the US Secret Service alleged that Heber and a co-defendant posed as a lending company and induced victims to make payments related to loans that they promised they would get but never actually came through with. Heber pleaded guilty to Conspiracy to Commit Wire Fraud.

Prosecutors called it an “advance-fee merchant cash advance fraud scheme through which they agreed to defraud victims of a total of more than $1.5 million.”

The case against Heber’s co-defendant is still ongoing.

eBay Brings Back Revenue Based Financing Product

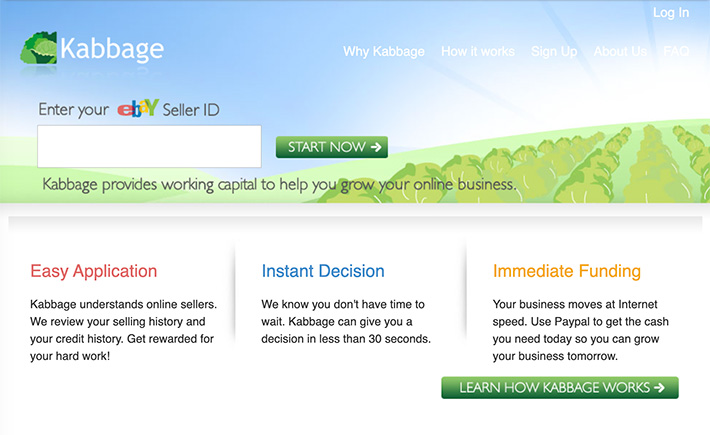

July 12, 2024eBay announced that Liberis had been onboarded as one of its “Seller Capital” partners this week, making it the second official partner after Funding Circle (which was recently acquired). Liberis, homegrown in the UK, expanded to the US in 2020 and offers a revenue based financing product described by eBay as a “Business Cash Advance.” While eBay has partnered with similar companies in the UK for years, eBay customers in the US have seen this before.

In 2010, for example, Kabbage was arguably the first company to offer revenue based financing to eBay customers, which deBanked first covered 13 years ago. And they had it all to themselves until PayPal began to muscle its way in with a similar product starting in 2013. Given that eBay owned PayPal, PayPal held a distinct advantage until the two companies split in 2015. Still, PayPal continued to be the default payment service for eBay until 2018.

Kabbage continued to thrive anyway, evolving beyond the platform at least until covid when Kabbage suddenly imploded and was sold to American Express. PayPal’s working capital product also continued to thrive at least until 2023 when it announced a dramatic pullback after elevated charge-offs.

The result is that in 2024, eBay sellers can now look toward getting funding via Liberis.

“As a pioneer in ecommerce and the home to small businesses in more than 190 markets, eBay understands the challenges small businesses encounter in securing fast, flexible and transparent financing,” said Avritti Khandurie Mittal, VP & General Manager of Global Payments and Financial Services at eBay in the official announcement. “eBay Seller Capital is aimed at fueling our sellers’ growth by providing them with tailored financing solutions that meet the unique needs of their businesses. The addition of Business Cash Advance to our suite of offerings in partnership with Liberis enables us to expand capital availability for our sellers on flexible terms – when they need it the most.”

“We understand the unique challenges eBay sellers face when securing financing through traditional means,” adds Rob Straathof, CEO of Liberis. “Through eBay Seller Capital, Liberis will empower sellers with access to fast and responsible financing. We’re thrilled to partner with eBay to support eBay sellers to operate and grow their businesses.”

B2B Financing Industry Poker Tournament

July 11, 2024The pre-show gathering for B2B Finance Expo taking place at Wynn Las Vegas this September will include a poker tournament for those interested in participating. It will not be cash stakes and all registration fees will go toward an appropriate cause (to be named). Players must also be registered to attend the conference. If you ever wanted the opportunity to play cards against your peers, potential partners, or competitors, this is an opportunity that can’t be missed.

B2B Finance Expo

Poker tournament: September 22 (7-10pm)

Conference: September 23-24

REGISTER FOR THE CONFERENCE HERE

READ MORE ABOUT THE CONFERENCE HERE

Anyone attending the conference who doesn’t want to play is free to watch the tournament and enjoy a networking atmosphere.

B2B Finance Expo is a collaborative effort between deBanked and the SBFA.

OIG Report Shows SBA Forgot to Report Many Charged Off PPP Loans

July 9, 2024 For many underwriters the era of PPP loans is now a distant memory. The loans were either forgiven long ago or are for some reason now tied up in collections. It’s the latter that should be cause for concern. According to the Office of the Inspector General, the SBA was required to report charged-off PPP loans to three major commercial credit reporting agencies but for the sample the OIG reviewed, the SBA failed to report 37% of charge-offs to any credit agency. Further, it failed to keep the credit agencies updated on its charge-offs on a regular basis, missing its required reporting deadlines 97% of the time.

For many underwriters the era of PPP loans is now a distant memory. The loans were either forgiven long ago or are for some reason now tied up in collections. It’s the latter that should be cause for concern. According to the Office of the Inspector General, the SBA was required to report charged-off PPP loans to three major commercial credit reporting agencies but for the sample the OIG reviewed, the SBA failed to report 37% of charge-offs to any credit agency. Further, it failed to keep the credit agencies updated on its charge-offs on a regular basis, missing its required reporting deadlines 97% of the time.

“SBA did not report these charged-off PPP loans to commercial credit reporting agencies because it relied on its automated process used to report loans to credit reporting agencies and did not periodically monitor or conduct reviews to ensure loans were reported, as required,” the OIG report said. “When we asked SBA officials why they did not report all loans to credit reporting agencies, they stated that all charged-off PPP loans should be reported, and that SBA’s Office of Capital Access was in the process of reviewing and updating its system to correctly identify PPP loans eligible for reporting.”

The OIG added that as a result there was an increased risk that delinquent borrowers could inappropriately obtain other loans.

“We compared our list of charged-off PPP loans to the loans identified in our COVID19 Pandemic EIDL and PPP Loan Fraud Landscape report and found that 169,589 loans [out of 203,101] totaling $5.8 billion were also reported in the fraud landscape report as potentially fraudulent,” the report said. That’s 83% of all charge-offs in the sample.

The takeaway is that most of the early PPP charge-offs were actually a result of fraud and if the SBA was forgetting to report most of these to the credit agencies, then this useful information may not be known by any subsequent lender or funder down the road.

Law Firm Sued Over “Debt Relief” Practices

July 9, 2024Another alleged “debt relief” law firm is under fire by a small business lender. This time the lender is National Funding and their latest lawsuit names not only a borrower that breached a loan agreement as a defendant but also a New York based law firm named J.S. Fritzon Law Firm, P.C.

According to the Complaint filed in San Diego County of California’s Superior Court, after the defendant law firm identifies National Funding’s customers, they contact them, offer to provide debt relief services, and attempt to persuade them to breach their obligations.

“As part of this effort, Non-Borrower Defendants routinely make misleading representations to National Funding’s customers, including by promising to save them money by settling their obligations to National Funding for a discounted amount when Non-Borrower Defendants have no legitimate basis for making such a promise and no reasonable expectation of being able to fulfill such a promise,” it says.

Among the causes of action against that defendant in particular are Intentional Interference with Contractual Relations, Unfair Competition, Conducting Business as a Prorater Without a License, Unauthorized Practice of Law, and Violation of Uniform Voidable Transfer Act.

The case number is 37-2024-00021246-CU-BC-CTL.

B2B Finance at deBanked

July 5, 2024 When Broker Fair first debuted in 2018, the keynote speaker was none other than Ryan Serhant, then a fast rising New York City real estate broker and star of Bravo’s Million Dollar Listing. Today he’s got his own Netflix Series called Owning Manhattan.

When Broker Fair first debuted in 2018, the keynote speaker was none other than Ryan Serhant, then a fast rising New York City real estate broker and star of Bravo’s Million Dollar Listing. Today he’s got his own Netflix Series called Owning Manhattan.

“After selling real estate for 12 years, I decided to start my own company,” Serhant says in the trailer for the first episode, “and if you can’t sell, you can’t be here.”

That New York hustle attitude was the connecting link for why Broker Fair chose him despite the broker audience being largely engaged in small business financial services at the time. But since then the small business finance broker community has become increasingly diversified in its product offerings and real estate is frequently one of the assets on the menu.

“People will be surprised how many clients have real estate, not just a [primary home], but they own just a small multifamily down the road that they never touched or tapped into,” said Julio Sencion, Principal at Alta Financial, in a recent interview with deBanked.

Companies like World Business Lenders figured that out a long time ago while still more discovered the business during the covid recovery, leading deBanked to produce a video miniseries about real estate investing in the summer of 2021. The guests ranged from real estate influencer Ralph DiBugnara to NestSeekers International’s Chief Economist Erin Sykes to a couple of old fashioned guys named Danny and Bruce who started investing in real estate across New Jersey long ago.

deBanked also interviewed house-flipper turned real estate tech CEO Andrew Luong of Doorvest, did a deep dive as to why real estate was becoming the side hustle of choice in the industry, and even bought real land using the blockchain for the purpose of a story.

Equipment financing has also taken off, leading deBanked to produce the first ever sales reality series named Equipping The Dream in 2022.

That’s been complemented by regular coverage and even sitdown interviews from Andrew Carman, Steve Geller, and George A. Parker.

deBanked’s Sean Murray has previously presented at the International Factoring Association’s (IFA) Fintech educational event, been a guest on the Coleman Report run by renowned SBA expert Bob Coleman, and moderated panels separately for the New York Institute of Credit and the Alternative Finance Bar Association.

Murray was also the host and producer of the industry’s first ever Broker Battle which took placed in Miami Beach this past January.

deBanked is also affiliated with the largest online small business finance community in the US, DailyFunder, and has produced nearly two dozen events since 2017.

“Back in 2018, there was a question that Serhant posed on stage to the Broker Fair audience to make sure he understood where they were coming from,” Murray said. “‘You guys are all B2B right?’ he said, and I think his characterization was spot on, because B2B is pretty much what we’ve been all along.”

deBanked is collaborating with the Small Business Finance Association on the B2B Finance Expo that’s taking place in Las Vegas on September 23-24. For info, visit: https://www.b2bfinexpo.com