Related Videos

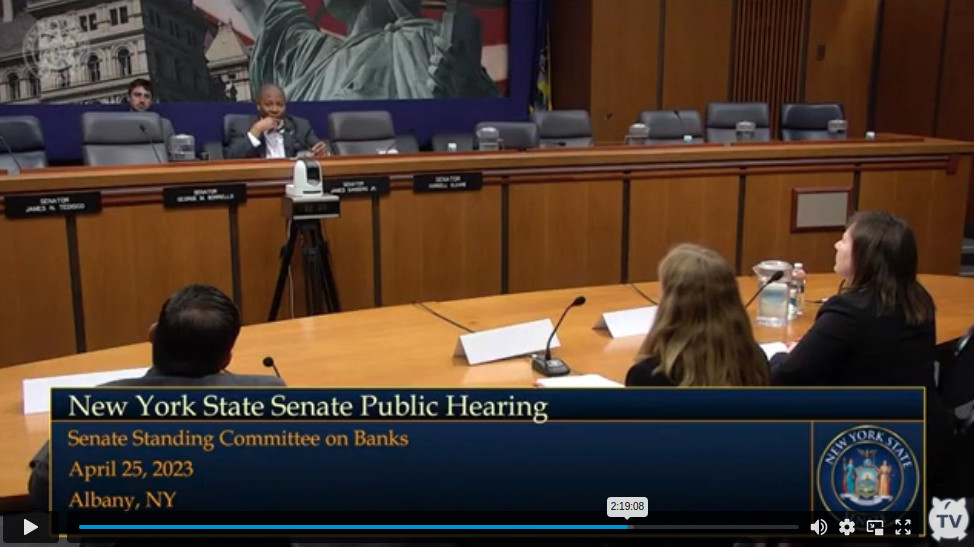

SMB Finance Industry Debates Licensing Bill in New York |

Stories

Innovative Lending Platform Association and Coalition for Responsible Business Finance Join Forces

March 5, 2017NEW YORK, Early Release — The Innovative Lending Platform Association (ILPA) and the Coalition for Responsible Business Finance (CRBF) today announced they are joining forces and will now operate as the ILPA – the leading trade organization representing a diverse group of online lending and service companies serving small businesses. Joining ILPA’s existing members, OnDeck® (NYSE: ONDK), Kabbage® and CAN Capital, are CRBF member companies Breakout Capital, Enova International’s (NYSE: ENVA) The Business Backer™, PayNet and Orion First Financial. United by a shared commitment to the health and success of small businesses in America, the newly expanded ILPA is dedicated to advancing best practices and standards that support responsible innovation and access to capital for small businesses.

In addition, leading national small business organizations that formerly served as the CRBF Advisory Board will now represent small business customers as formal advisors to the ILPA. The Advisory Board includes individuals from the National Federation of Independent Business (NFIB), the National Small Business Association (NSBA), the Small Business & Entrepreneurship Council (SBE Council), the U.S. Chamber of Commerce, and new representatives from the Association for Enterprise Opportunity (AEO). These small business organizations have provided key input into the collective group’s best practices and standards initiatives over the past year, ensuring that the needs of their small business constituents are addressed.

The expanded ILPA remains committed to advancing online small business lending education, advocacy and best practices. In October, the ILPA introduced the SMART Box™ (Straightforward Metrics Around Rate and Total cost), a first-of-its-kind model pricing disclosure and comparison tool launched in partnership with the AEO. The SMART Box is focused on empowering small businesses to better assess and compare finance options and is now available for broader adoption by lending platforms. More details can be found at: http://innovativelending.org/smart-box/

As a leading voice for responsible business funding, CRBF launched in January 2016 with the mission to create a concrete code of ethics for the industry and to educate policymakers on the value of non-bank small business financing. The organization outlined responsible and transparent business practices for both providers as well as customers, and the expanded ILPA has leveraged that work to formulate an updated industry Code of Ethics that will guide the ILPA moving forward.

The expansion of the ILPA follows a period of broad stakeholder engagement and a demonstrated shared commitment to serving small businesses. With this unification, the cross-industry effort to bring innovative and responsible solutions to improve access to capital for Main Street small businesses continues to gain momentum.

“Fostering responsible innovation and empowering small businesses to better assess and compare finance options are priorities for the ILPA. We are delighted to join forces with the CRBF as we work together to advance small business online lending education, advocacy and best practices,” said Noah Breslow, Chief Executive Officer, OnDeck. “We are proud to be part of this growing cross-sector effort to help improve capital access on behalf of small businesses across the United States.”

“The combination of these leading organizations represents a landmark moment in the industry, signifying how major players in the small business lending space are increasingly aligned on values and best practices that benefit small businesses,” said Carl Fairbank, founder and chief executive officer, Breakout Capital. “Founded on the fundamental principles of responsible lending, education and transparency, Breakout Capital is thrilled to partner with other premier players in the industry who share our vision and believe that a unified industry voice can promote small business success more effectively. “As a founding member company of CRBF, The Business Backer is thrilled with the merger between the CRBF and the ILPA,” said Jim Salters, president of The Business Backer and CRBF Advisory Board member. “The move creates an even larger platform of industry leaders with a common voice to help ensure small businesses have access to honest and transparent funding sources.”

“The ILPA was launched as a self-regulatory exercise and is focused on empowering small businesses with clear and transparent ways to compare financing options,” said Rob Frohwein, co-founder and chief executive officer of Kabbage. “Kabbage and the ILPA are excited to join with the CRBF in order to advance ubiquitous industry standards. Together, we are eager to continue working with regulators and policymakers to expand small businesses’ ability to easily access technology-driven financing products.”

“Access to capital is a high priority for America’s small businesses. As our economy grows, small business owners need diverse sources of capital to hire new employees and expand their businesses. The U.S. Chamber of Commerce applauds the innovative capital providers in the ILPA for their dedication to fueling growth on Main Street,” said Tom Sullivan, vice president, small business, U.S. Chamber of Commerce.

“CAN Capital has been a supporter of transparency throughout our 19 year history, and we are excited to see the ILPA expand as it continues to support small business owners,” said Parris Sanz, chief executive officer of CAN Capital.

“Small business lending continues to be stubbornly elusive for many small firms and what we need is not just more lending, but better lending options,” said Todd McCracken, National Small Business Association president and chief executive officer. “This merger will expand on efforts to connect small business with a variety of fair and responsible lending resources.”

“We are excited to be part of an organization whose purpose is to create a vibrant, healthy, small business lending marketplace that serves the engine of the U.S. economy – small businesses,” said David Schaefer, chief executive officer of Orion First Financial. “As a loan servicer to small business lenders, we are particularly enthusiastic that the ILPA is embracing a diverse membership and participation from small business associations through its Advisory Board.”

“SBE Council looks forward to partnering with the expanded ILPA to continue advocating for the innovative and responsible sources of funding to which entrepreneurs and small businesses need access,” said Karen Kerrigan, president and chief executive officer of the Small Business & Entrepreneurship Council.

“It is critical that these and other responsible lenders come together to advance initiatives like SMART Box,” said Connie Evans, president/chief executive officer of the Association for Enterprise Opportunity. “The time is ripe for united voices and action to give more people the opportunity and the tools to realize a brighter future for their businesses.”

Together, the members of the expanded ILPA have provided access to more than $14 billion dollars in capital to small businesses to help drive growth and hiring.

Media and Trade Associations With Representation at B2B Finance Expo

August 21, 2024Coming to B2B Finance Expo on September 23-24 in Las Vegas? Here are some of the news publishers and trade associations that will have representatives there! (SEE AGENDA HERE)

Small Business Finance Association

National Private Lenders Association

Innovative Lending Platform Association

Registration is still open at: b2bfinexpo.com

Financial Service Associations Urge Legislation on IRS Income Verification

January 25, 2024 The IRS doesn’t want financial service companies to be able to verify the income of customers, at least not through official channels like the Income Verification Express Services (IVES) system. On January 2 and 3, the IRS announced it would only allow IVES transcripts to be made available “to mortgage lending firms for the sole purpose of obtaining a mortgage on residential or commercial real property (land and buildings).” Government agencies will also not be allowed to use IVES.

The IRS doesn’t want financial service companies to be able to verify the income of customers, at least not through official channels like the Income Verification Express Services (IVES) system. On January 2 and 3, the IRS announced it would only allow IVES transcripts to be made available “to mortgage lending firms for the sole purpose of obtaining a mortgage on residential or commercial real property (land and buildings).” Government agencies will also not be allowed to use IVES.

“The IRS is implementing the provisions of the Taxpayer First Act (P. Law 116-25) with increased privacy and security requirements for access to confidential tax information,” it announced. “If tax transcript information is required by your firm for other than securing a mortgage, we recommend requesting it directly from the taxpayer.”

But relying on getting the information directly from the taxpayer defeats the whole purpose in more ways than one, many financial service trade associations say. On Wednesday, a letter jointly signed by the American Bankers Association, America’s Credit Unions, American Fintech Council, Consumer Data Industry Association, Electronic Transactions Association, Financial Technology Association, Innovative Lending Platform Association, Independent Community Bankers Association, Mortgage Bankers Association, Responsible Business Lending Coalition, and Small Business Finance Association urged senior ranking members of Congress to pass H.R. 3335. Dubbed the IRS eIVES Modernization and Anti-Fraud Act, it would “ensure the IRS follows the original intent of Congress to modernize the system and prevent disruptions to the consumer and commercial lending industries.”

Ho Ho… Hold Up. NY Governor Signs Industry-Altering Small Business Lending Law

December 24, 2020 Merrrrry Christmas. New York Governor Andrew Cuomo reportedly signed SB 5470 into law late last night, a bill that forever changes and complicates nearly all forms of small business financing in the state.

Merrrrry Christmas. New York Governor Andrew Cuomo reportedly signed SB 5470 into law late last night, a bill that forever changes and complicates nearly all forms of small business financing in the state.

The law gives regulatory enforcement authority to New York’s Department of Financial Services, requires APR disclosures on contracts where one can’t be mathematically calculated, and mandates that customers be told if there is any “double dipping” going on. And that’s just the beginning of what it contains.

A coalition of small business capital providers fiercely opposed the language of the bill. Steve Denis, executive director of the Small Business Finance Association, wrote in an op-ed that “the lack of cogency and lazy approach to this legislation is a disservice to the hard-working entrepreneurs who continue to open their businesses while facing daily economic uncertainty.”

The bill was also opposed by fintech lenders like PayPal.

Proponents of the bill celebrated the news on social media in the early morning hours of Christmas Eve.

Ryan Metcalf at Funding Circle, a company not even based in New York that moved all of its tech jobs out of the US to the UK this summer, wrote on LinkedIn that the bill will “save New York #smallbiz between $369 million and $1.75 billion annually.” Funding Circle, as a member of the Responsible Business Lending Coalition (RBLC), was heavily engaged in the advocacy process.

Several of RBLC’s members have already ceased small business lending in the US, some permanently.

Unique circumstances also exist at an ally of the RBLC, the Innovative Lending Platform Association (ILPA), which Funding Circle is also a member of. Two out of the 11 members were acquired before the bill could even be signed, Kabbage and OnDeck.

NY State Assemblyman Ken Zebrowski and State Senator Kevin Thomas, who sponsored the bill, cheered the signing of it.

“Thanks to Governor Cuomo for signing our Small Business Truth in Lending Act,” Zebrowski tweeted. “Extremely proud to have worked with many to establish the most comprehensive small business disclosure law in the nation. With the pandemic surging on, small biz owners need these critical protections now.”

“The signing of the New York State Small Business Truth in Lending Act is a victory for New York’s small business owners,” Thomas wrote on twitter. “Thank you for signing New York’s first-ever small business lending transparency bill into law.”

“I think that the companies and organizations that support this legislation don’t fully understand what’s actually in the bill,” SBFA’s Steve Denis said to deBanked in August. “[…] They have no problem pounding the table and taking credit for its passage, but I guess they don’t realize it will subject them and the rest of the alternative finance industry to massive liability, massive fines—upwards of billions of dollars worth of fines.”

And yet Senator Thomas tweeted, “This will help a lot of small businesses trying to get back on their feet during this pandemic.”

It is unclear, of course, who they expect to provide such capital now to do this.

Fed Lowers Minimum Main Street Lending Program Loan to $100,000: Too Little, Too Late?

November 8, 2020 “$100,000, we can make that work,” said Ryan Metcalf, head of Public Policy Affairs at Funding Circle. “But we can help a lot more small business if it was $50,000.”

“$100,000, we can make that work,” said Ryan Metcalf, head of Public Policy Affairs at Funding Circle. “But we can help a lot more small business if it was $50,000.”

Metcalf was referring to a recent change in the minimum loan amount in the Main Street Lending Program (MSLP.) Just recently, the Federal Reserve lowered the minimum loan amount for the MSLP for a third time, to $100,000. The change was intended to broaden the underused Cares Act aid facility but it might not be enough.

Though changing the program days before, at a press briefing Thursday Fed chair Jerome Powell said SMB aid projects like PPP and the MSLP were up to the gridlocked House and Senate.

“The Fed cannot grant money to particular beneficiaries; we can only create programs or facilities to make loans that will be repaid,” Powell said. “Elected officials have the power to tax and spend, and to make decisions about where we as the society should direct our collective resources.”

Despite Powell’s talk of inaction in the face of an undecided congress, Metcalf said the Fed’s actions have proved that changes can be made to existing programs. Metcalf has been fighting for changes to MSLP for months on behalf of the small business lending community, he says.

In July, Metcalf, in partnership with the Innovative Lending Platform Association and Marketplace Lending Association, wrote a letter to the fed to argue for changes to the MSLP.

The letter argued that the Cares Act made non-depository finech lenders eligible to participate in PPP lending. Though these lenders saved millions of jobs, they were not allowed to lend through the MSLP facility.

Even if they could, the minimum loan size was still too large for “main street” American businesses that needed capital. The letter advocated for a lower minimum of $50,000, allow lenders that were approved for PPP to lend in the MSLP, and create a Special Purpose Vehicle for fintechs.

Metcalf said the Fed has only responded, “that is not under consideration.”

So far, 400 borrowers have taken out $3.7 billion in loans, of the $600 billion allocated. The program offers Fed backed five-year loans with differed principal and interest payments and minimal rates. With the facility’s deadline approaching Dec 31 and no changes in sight, Metcalf said the program’s vultures are circling.

If new aid, revisions, or at least an extension is not passed by when the government is funded Dec 11, Metcalf said the program might be finished.

Back in September, Powell testified before Congress that lowering the minimum any further wouldn’t change the adoption rate.

“We have very little demand below a million, as I told the chair a while back,” Powell said. “We’re not seeing demand for very small loans. And that’s really because the nature of the facility and the things you’ve got to do to qualify, it tends to be larger sized businesses.”

Mnuchin has consistently argued that grant programs like PPP would most benefit smaller firms. Metcalf said this was only the case because the MSLP facility has left out smaller firms and alternative lenders that need the capital.

“My response to that was no, there’s been no uptick in your program because the requirements of the program are not attractive enough to make it workable,” Metcalf said. “Don’t scrap the entire program altogether; look at the proposal that we sent you back in July and work with us on amending the facility.”

2019 Top 25 Executive Leaders in Lending – Canadian Lenders Association – Presented By BMO

November 11, 2019 The Canadian Lenders Assocation (CLA) received 124 nominations for these awards from leaders in lending across the country. The CLA’s goal is to support access to credit in the Canadian marketplace and champion the companies and entrepreneurs who are leading innovations in this industry.

The Canadian Lenders Assocation (CLA) received 124 nominations for these awards from leaders in lending across the country. The CLA’s goal is to support access to credit in the Canadian marketplace and champion the companies and entrepreneurs who are leading innovations in this industry.

The Top 25 finalists in this report represent various innovations in the borrower’s journey from innovations in artificial intelligence powered credit modelling to breakthroughs in consumer identity management using blockchain technologies. These finalists also represent solutions for a wide spectrum of borrower maturity and needs, ranging from consumer credit rebuilding all the way to senior debt placements for global technology ventures.

See The Leading Companies Report Here

See The Leading Executives Report Here

|

Mark Cashin

CEO of myBrokerBee | Ontario After a career in commercial finance and being CEO of Transpor, Mark Co-founded myBrokerBee a mortgage broker platform that provides transparency to private lenders and their clients. |

|

Avinash Chidambaram

CEO of Ario Platform | Ontario Through his experience as Product lead at Interac and Blackberry, Avinash has helped bring together an accomplished and talented group of experts in Data Science, Machine Learning, Security, Software Development to successfully develop this banking services software platform Ario. |

|

Evan Chrapko

CEO of Trust Science | Alberta Evan is the founder and CEO of Trust Science, a leader in organizing alternative credit data. As a saas founder and CEO, Evan has done over 500mm in startup exits. |

|

Kevin Clark

President of Lendified | Ontario Kevin is a recognized leader in the financial services industry with over 30 years of experience. Kevin has helped create the voice of Canada’s SME lending ecosystem through his leadership of Lendified and the CLA. |

|

Jerome Dwight

VP of Cox Automotive | Ontario Jerome established Nextgear Capital in Canada to become the largest specialty finance company in the automotive sector. Jerome is a Globe & Mail 40 under 40 winner and previously lead RBC’s international wealth management, private banking and asset servicing business. |

|

Saul Fine

CEO of Innovative Assessmer | Israel Saul is a licensed organizational psychologist and psychometrician, and a former lecturer in psychology at the University of Haifa. Saul is a global leader in the use of psychometric data for credit scoring and financial inclusion. |

|

David Gens

CEO of Merchant Growth | BC David is the Founder and CEO of Merchant Growth, which grew from its humble beginnings in his apartment to offices in both Toronto and Vancouver. David now leads one of Canada’s largest online small business finance companies. |

|

Bryan Jaskolka

COO of CMI | Ontario Nominated for the 2018 Mortgage Broker of the Year, Bryan Jaskolka is an expert in Canadian mortgage financing with a particular focus on the alternative lending space and mortgage investing. |

|

Peter Kalen

CEO of Flexiti | Ontario Peter is a leader in Canada’s retail financing market. Before founding Flexiti, Peter was in senior leadership positions at Citi, PC Financial, and Sears Canada. Flexiti was recently named #7 on the Deloitte Fast50. |

|

Yves-Gabriel Leboeuf

CEO of Flinks | Quebec Yves-Gabriel Leboeuf is the co-founder and CEO of Flinks. Under his leadership, Flinks has become a Canadian leader in banking data enablement. |

|

Derek Manuge

CEO of Corl | Ontario Derek, also known as the “the quant from Canada” is the founder of the data-driven venture firm, Corl. Corl is one of Canada’s leaders in the use revenue-share financing models. |

|

Keren Moynihan

CEO of Boss Insights | Ontario Keren Moynihan is co-founder and CEO of Boss Insights, a company that uses big data and AI to accelerate lending from months to minutes. With a Joint JD/MBA, Keren has a diverse background as a commercial banker, wealth manager and former founder of an impact startup. |

|

Jason Mullins

CEO of Goeasy | Ontario Jason is President and CEO of goeasy, a publicly listed consumer lender. Jason has lead the company to become one of the largest and most innovative lenders in the country. |

|

Paul Pitcher

CEO of SharpShooter Funding | Ontario After founding First Down Funding, an alternative lending firm for SMEs in Baltimore, Paul expanded his business to Canada through the subsidiary Sharpshooter Funding. |

|

Brendan Playford & Cate Rung

Co-Founders of Pngme | USA Cate, ex-Uber and Brendan, a blockchain and agro-finance entrepreneur are the co-founders of Pngme, an alternative lending platform for financial institutions in emerging markets who serve Micro, Small, and Medium-sized Enterprises. |

|

Wayne Pommen

CEO of Paybright | Ontario Wayne is the President and CEO of PayBright. Wayne is also a director of IOU Financial Inc and of HBC. Previously, Wayne was a Principal at TorQuest Partners, one of Canada’s leading private equity firms, and a management consultant with Bain & Company in the UK, the US, and Canada. |

|

Adam Reeds

CEO of Ledn | Ontario Adam is a pioneer and thought leader in the digital asset backed lending space. Ledn is focused on building innovative financial products in the emerging digital asset space, with a focused mission to help people save more in bitcoin. |

|

Adam Rice

CEO of LoanConnect | Ontario Adam has played a pivotal role in building one of the largest online markets in Canada for unsecured loans. |

|

Mark Ruddock

CEO of BFS Capital | Ontario Mark is an experienced international CEO with two successful exits and over 20 years of experience at the helm of VC backed technology and fintech startups. In 2019 Mark announced BFS Capital’s expansion to Canada with a new 50 engineer data science hub in the heart of Toronto. |

|

Vlad Sherbatov

President of Smarter Loans | Ontario Vlad Co-founded Smarter Loans in 2016 with the goal of helping Canadians make smarter financial decisions. Since then, Vlad has grown the platform into one of the go-to resources for Canadian borrowers. |

|

Steven Uster

CEO of FundThrough | Ontario Steven is the Co-Founder & CEO of FundThrough, an invoice funding service that helps business owners eliminate “the wait” associated with payment terms by giving them the power and flexibility to get their invoices paid when they want, with one click, and in as little as 24 hours. |

|

Dmitry Voronenko

CEO of Turnkey Lender| Singapore Dmitry, CEO and Co-founder of TurnKey Lender, holds a PhD in Artificial Intelligence. Dmitry was recently named SFA’s Fintech Leader of the year. |

|

Neil Wechsler

CEO of Ondeck Canada | Quebec Neil briefly practiced law before becoming President and CEO of Optimal Group Inc. where he grew the company from a start-up to a leading NASDAQ-listed self-checkout and payments company. Neil later co-founded Evolocity, which in 2019 became OnDeck Canada. |

|

Michael Wendland

CEO of Refresh | BC Michael has led Refresh Financial’s rapid growth since its founding in 2013, including a recent ranking of number 40 on Deloitte’s Fast 500. |

Online Small Business Lending Provides Benefits to Small Business Owners, Finds New Survey

October 23, 2017

Washington, D.C., October, 23, 2017 – Four leading trade associations – Electronic Transactions Association, Innovative Lending Platform Association, the Marketplace Lending Association, and the Small Business Finance Association – commissioned a comprehensive survey of U.S. small business owners from Edelman Intelligence. The survey conducted by Edelman Intelligence found that a large majority (70%) of small business owners believe there are more credit options today when compared to five years ago, and 97% of those feel that the growing number of financing options is a good thing.

Small businesses owners need quick and streamlined access to credit to grow their businesses and the American economy. Online small business lenders are financial firms that provide credit to small business owners through automated, technology-enabled platforms. They regularly work with traditional lenders to deliver loans. By leveraging the ubiquity, speed and convenience of the Internet, online small business lenders use sophisticated software platforms to provide American small business owners with fast, easy and affordable credit.

Key findings of the study include:

- An overwhelming majority of small business owners reported more lending options available now than five years ago. 70 percent of small- and medium-sized business owners say there are more lending options now, and 97 percent of those believe that the increase in options is a positive thing for their businesses.

- Most small business owners reported using online small business lenders to help them expand their locations, make necessary hiring and equipment purchases, and help manage cash flow.

- Of the small business owners considering taking out a loan in the next 12 months, close to 40 percent say they will consider borrowing from an online lender.

- Online small business lenders have high levels of satisfaction and scored high marks for ease of use and business growth enablement. According to the study, 98 percent of small business owners who have used online lenders say they are likely to take out another loan with an online lender.

- For many small business owners, online small business lending platforms are a popular alternative to asking friends and family for a loan.

Media inquiries should be directed to:

ETA PRESS CONTACT:

Laura Hubbard, lhubbard@electran.org

ILPA PRESS CONTACT:

Jim Larkin, jlarkin@ondeck.com

203-526-7457

MLA PRESS CONTACT:

Nat Hoopes, nat.hoopes@marketplacelendingassociation.org

SBFA PRESS CONTACT:

Steve Denis, sdenis@sbfassociation.org

Catching Up With Marketplace Lending – A Timeline

April 20, 20172/17

- Prospa, an online small business lender based in Australia, was valued at $235M (AUD) in a $25M capital raise

- Square announced funding $248 million worth of business loans in Q4 2016

2/21 A Massachusetts state court vacated a merchant cash advance COJ

2/24 SoFi raised $500M in a financing round led by Silver Lake Partners that reportedly gave SoFi a $4.3B valuation

2/27 Prosper Marketplace closed a loan purchase agreement with a consortium of lenders for up to $5 billion of loans that has a provision that also enables the lenders to buy up to 35% of the company

2/28 BlueVine secured a warehouse line of up to $75M from Fortress

3/1 Lendio launched a new franchise program, allowing local offices around the country to become Lendio franchisees

3/3 Citing Madden v Midland, Colorado regulator brought a federal lawsuit against Marlette Funding for violating the state’s usury cap

3/5 Two trade associations, the Innovative Lending Platform Association (ILPA) and the Coalition for Responsible Business Finance (CRBF), joined forces. The merged company will continue to be known as ILPA

3/6 Upstart raised $32.5M

3/7

- It’s reported that former CAN Capital CFO Aman Verjee is now the COO of 500 Startups

- Kabbage priced a $525M securitization. It was oversubscribed

3/9 Citing Madden v Midland, Colorado regulator brought a federal lawsuit against Avant for violating the state’s usury cap

3/13

- Melvin Chasen, the founder of Rewards Network (originally Transmedia Network, Inc.) passed away. He was 88.

- The New York State Assembly rejected the Governor’s proposal to grant the Department of Financial Services (DFS) regulatory authority over any online lender doing business in the state

3/15

- The New York State Senate also rejected the proposal to further regulate lending

- The OCC published a manual on how it will evaluate charter applications from fintech companies

- The New York DFS published a statement rejecting the OCC’s plans

- The WSJ reported that Marlette Funding was cutting nearly 1/5th of its workforce

3/16 WebBank announced that it had a net income of $29.2M for 2016 and that it had a market valuation of $319.4M

3/20 Prosper Marketplace announced that it had originated $2.2B in loans in 2016, down from $3.7B in 2015, and had a net loss of $119M.

3/21 It’s reported that Kabbage will set up its European headquarters in Ireland

3/22 OnDeck expanded its credit facility with Deutsche Bank by $52M to a total of up to $214M

3/27 IOU Financial wins Gold Stevie Award for Best Use of Technology in Customer Service

3/30 In Advance Capital announced that they had secured access to an additional $50M

4/5

- Budget passes in New York. Proposed lending legislation was not included in it.

- Kabbage surpasses $3 billion funded to small businesses

See previous timelines:

12/16/16 – 2/16/17

9/27/16 – 12/16/16

See Post... innovative lending platform association, in partnership with the association for enterprise opportunity, is launching a pricing comparison tools initiative predicated on creating a model small business lending... |

SMART Box Initiative... innovative lending platform association, in partnership with the association for enterprise opportunity, is launching a pricing comparison tools initiative predicated on creating a model small business lending... |