Related Videos

CA Disclosure Lawsuit Decision |

Stories

Small Business Finance Association Releases Best Practices Just in Time

April 13, 2016

The Small Business Finance Association (SBFA) has finally released their long awaited best practices guide. The four overarching principles are transparency, responsibility, fairness and security.

Unlike other organizations that have called for APR disclosures, the SBFA believes that the total dollar cost of the transaction is the most important way to achieve that goal. It’s also because the organization’s core members are engaged in a form of factoring most often referred to as merchant cash advances. Those transactions don’t have interest or interest rates and thus no way to ascribe an APR.

As part of the announcement, SBFA VP and RapidAdvance Chairman Jeremy Brown said, “Small business owners are a powerful constituency and we want to give them the utmost confidence in the alternative finance industry. These best practices are our way to prove to small businesses that our industry will consistently offer transparent, fair, and responsible choices to meet their needs.”

The timing could not be better. Earlier this morning, Stephen Denis, the executive director of the SBFA, testified in an Illinois State Senate hearing to protest a controversial bill that would effectively outlaw nonbank business lending under $250,000.

Among the bill’s strangest rules, is the restriction on monthly loan payments to being no more than 50% of a business’s net income, which would cause all businesses breaking even or reporting a loss to be prohibited from obtaining a loan from a nonbank or nonprofit source by law.

Small Business Finance Association To Unveil White Paper

March 29, 2016 The Small Business Finance Association (“SBFA”) will soon publicly unveil a set of guiding industry principles, deBanked has learned, and they’ll fall under four broad categories that espouse transparency, responsibility, fair dealings and security.

The Small Business Finance Association (“SBFA”) will soon publicly unveil a set of guiding industry principles, deBanked has learned, and they’ll fall under four broad categories that espouse transparency, responsibility, fair dealings and security.

Transparency will not just be about the disclosure of fees but also likely about the disclosure of process, methodology, and application rejection, among others.

The principles of fair dealings are unlikely to touch on pricing or costs. Instead they will be about a commitment to being truthful and fair in dealings with small businesses. That is sure to include marketing materials that are clear and understandable, an area that will undoubtedly extend out to the brokers they work with, if any.

While responsibility will speak to the notion of being a legally compliant good citizen when it comes to dealing with customers, security will be more than just the use of an SSL Certificate to access the website. Verifying the business’s legitimacy and confirming the owner’s identity are high on the list of a secure process, deBanked has learned.

SBFA members already adhere to a set of standards and have since the group was formed eight years ago. Their new white paper will serve to codify them in a way that others can adopt and conduct themselves to accordingly.

The white paper will be the first major achievement of the organization since Stephen Denis came on as the executive director in mid-December. Denis is the former deputy staff director of the U.S. House Committee on Small Business.

“The goal is to start from scratch and take a look at everything the association is doing,” Denis said in deBanked’s previous magazine issue, “and to really build this out to a robust group that represents the interests of small businesses.”

In another interview conducted for that story, SBFA president and founder David Goldin explained that he had been troubled by misconceptions over the industry’s prices. “Most people don’t understand the economics of our business,” he said.

The SBFA also plans to revamp their website in the near future.

Small Business Finance Association Accelerates Repositioning With Hiring of New Executive Director

December 14, 2015WASHINGTON–(BUSINESS WIRE)–The Small Business Finance Association (SFBA) announced today the hiring of Stephen Denis as its executive director. Denis was formerly the Deputy Staff Director of the House Committee on Small Business and brings over 12 years of public policy experience to the SBFA.

“The innovative companies that are disrupting the way small businesses access capital are creating opportunities for economic growth,” said Denis. “Traditional finance is changing out of necessity for small businesses and SBFA’s mission is to be the voice of the alternative financing industry for small businesses and establishing industry best practices and education.”

The Small Business Finance Association represents companies that offer alternative financing options to small businesses and provides guidance through establishing industry best practices, education and risk monitoring tools. The alternative finance industry has experienced dramatic change and explosive growth in recent years, prompting the need for a strong presence in Washington to protect a vital lending resource for small businesses.

“We felt it was time to bring on an experienced Capitol Hill veteran to make SBFA the leading voice for alternative small business finance in Washington,” said incoming President of SBFA and Chief Executive Officer of Capify, David Goldin. “It is time to come together as an industry to ensure we have a strong and unified voice on behalf of the small businesses we serve.”

“It’s no secret that access to capital is a top challenge for small businesses. SBFA is working to ensure that there are options available to these businesses that contribute to the vibrancy and health of the American economy,” said Vice-President of SBFA and Chairman of Rapid Advance, Jeremy Brown.

The Small Business Finance Association (SBFA) is a not-for-profit 501(c)(6) trade association representing organizations that provide alternative financing solutions to small businesses. SBFA (formerly known as NAMAA) provides guidance and helps to influence and shape the small business alternative financing industry through leadership, education and risk monitoring tools. For more information, visit http://www.sbfassociation.org

Contacts

Small Business Finance Association

Steve Denis, 202-213-9506

sdenis@sbfassociation.org

North American Merchant Advance Association (NAMAA) Announces New Name – Small Business Finance Association (SBFA)

April 14, 2015New York, NY, (April 14, 2015) – The North American Merchant Advance Association (NAMAA), a 501c non-profit industry association that provides guidance and helps influence and shape the small business alternative financing industry through best practices, leadership, education and risk monitoring tools, announced today the changing of its name to Small Business Finance Association (“SBFA”).

“With the alternative financing industry growing exponentially into a multi-billion dollar industry, we felt it was time for the trade association to evolve with it and open itself up to all types of small business alternative financing providers hence the name change to Small Business Finance Association. This industry trade association has been the voice of small business alternative lenders for over eight years and we look forward to evolving as the alternative financing industry rapidly expands each year. We look forward to opening up our membership base to even more members that share the same best practice principals of our current membership base.”, says David Goldin, President of the SBFA

The SBFA plans on releasing an updated version of its best practices and as the largest trade association for small business alternative finance providers, the association welcomes opportunities from the press and organizations looking for information on the industry.

“NAMAA started primarily as an association of merchant cash advance providers and has evolved into an association for all types of small business alternative financing – particularly those providers of business loans. SBFA will continue to be the leading voice for this industry and we look forward to the association evolving with our industry.”says Jeremy Brown, Vice-President of the SBFA.

For companies that provide alternative financing solutions to small businesses looking for more information about becoming a member of SBFA, please visit http://www.sbfassociation.org.

About Small Business Finance Association (SBFA)

The Small Business Finance Association (SBFA) is a not-for-profit 501c trade association representing organizations that provide alternative financing solutions to small businesses. SBFA (formerly known as NAMAA) provides guidance and helps to influence and shape the small business alternative financing industry through leadership, education and risk monitoring tools. For more information, visit http://www.sbfassociation.org.

Is NAMAA Reborn? Meet the Small Business Finance Association

April 14, 2015Almost seven years ago exactly, the North American Merchant Advance Association announced their presence. As of today, they are now officially the Small Business Finance Association (SBFA). Back then, a release dated April 15, 2008 stated:

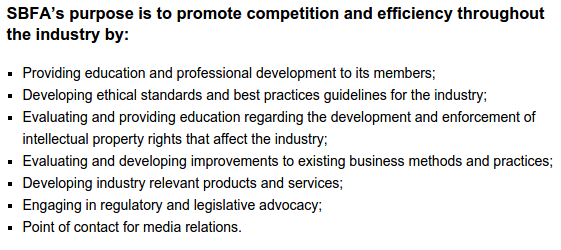

The North American Merchant Advance Association, Inc. (NAMAA) has recently been created to represent merchant cash advance providers and to promote competition and efficiency throughout the merchant advance industry. NAMAA’s members will have the opportunity to share industry education and professional development, ethical standards and best practices guidelines, the development of industry relevant products and services, and the engagement in regulatory and legislative advocacy.

Of the ten original members, a handful are no longer operating. NAMAA’s membership in 2008 arguably encompassed the entirety of the merchant cash advance industry sans AdvanceMe (now named CAN Capital). Today, the SBFA website currently lists seventeen members. The organization has clearly grown but it pales in comparison to the size of the industry in 2015.

Internal data indicates that there are well over one hundred direct providers of merchant cash advance. Several hundred more are ISOs/brokers that co-invest in merchant cash advance transactions (Strategic Funding Source has had more than 200). And there are more than one thousand ISO/brokers that resell the product nationwide.

On this basis alone, less than two percent of industry providers and resellers are members of the trade organization. Granted, the seventeen member companies likely make up at least 15% of the industry’s funding volume. Member company Merchant Cash and Capital for example, announced just last month that they had funded $1 billion since inception.

Some have viewed the organization’s membership as overly exclusive and resistant to change. A seasoned veteran of an ISO that wished to remain anonymous said prior to the organization’s announced changes that, “NAMAA served a purpose for a long time but as the industry has changed, they have not.”

Ironically, Goldin’s statement in today’s release couldn’t be any more well timed. “With the alternative financing industry growing exponentially into a multi-billion dollar industry, we felt it was time for the trade association to evolve with it and open itself up to all types of small business alternative financing providers hence the name change to Small Business Finance Association,” he said.

The shift clearly acknowledges the true dynamic of the industry’s growth, that it’s not all merchant cash advance anymore.

SBFA Vice President Jeremy Brown is quoted in the release as saying, “NAMAA started primarily as an association of merchant cash advance providers and has evolved into an association for all types of small business alternative financing – particularly those providers of business loans.”

SBFA Vice President Jeremy Brown is quoted in the release as saying, “NAMAA started primarily as an association of merchant cash advance providers and has evolved into an association for all types of small business alternative financing – particularly those providers of business loans.”

But with lenders added to the mix of potential constitutents, is the SBFA a little light? The SBFA will now represent less than 1% of the companies selling or reselling merchant cash advances and business loans. In growing membership however, patience may perhaps be a virtue.

Jared Weitz, CEO of United Capital Source, said, “NAMAA is a beneficial association in the industry and should be choosy with who they let in.” As a broker, his company has historically not been eligible for membership.

Similarly, Chad Otar, Managing Partner of Excel Capital Management, whose company has also not been historically eligible for membership, said, “The aim of NAMAA is to help out our audience to understand and remember the information we stand for as funders and ISOs.”

Otar’s point belies a troubling trend, that many players in this industry disagree about what it is they stand for.

In a deBanked Magazine article, titled, Stacking: Is it Tortious Interference?, Robert Cook, Cathy Brennan, and Kate Fisher of Hudson Cook, LLP delved into the industry’s most polarizing debate, the practice of entering into a cash advance transaction or loan knowing that the merchant has one or more open cash advances or loans with a competitor. They wrote:

On one side are companies that only originate first-position deals. These companies generally include a clause in their contracts prohibiting the merchant from obtaining another merchant cash advance or loan until the company receives all of the future receivables it has purchased or is fully repaid. First-position companies view stacking as a threat to recovery of money advanced or loaned to merchants. On the other side are companies that routinely offer second or third-position deals. These companies argue that merchants with adequate cash flow to support additional advances should be free to obtain them.

Though I did not ask the SBFA directly if the practice of stacking is an immediate disqualifier for membership, the organization has long been known to advocate against it. In Year of the Broker, Goldin commented that stacking litigation is underway.

Though I did not ask the SBFA directly if the practice of stacking is an immediate disqualifier for membership, the organization has long been known to advocate against it. In Year of the Broker, Goldin commented that stacking litigation is underway.

Lawyers at Hudson Cook, LLP echoed the same. “In the last several months, at least two first position companies have sued their stacking competitors, claiming that stacking constitutes tortious interference with contractual relations,” they wrote.

The lawsuits come on the heels of the International Factoring Association (IFA) ban on merchant cash advance companies, citing tortious interference as the main driver.

After meeting with board members from both associations, the decision was made to deny membership to merchant cash advance businesses. This decision was based on numerous complaints and increased scrutiny that could negatively impact the factoring industry. By distancing ourselves from the merchant cash advance industry, we hope to diminish the chance of potential legislation.

-Commercial Factor July/August 2014

With several merchant cash advance companies left high and dry by the IFA, a potential leadership void has been created.

“As every industry evolves and shapes itself, some sort of governance and guidance is always needed,” said Otar. “This guidance is something that NAMAA holds itself responsible for,” he argued.

“The question is, can they reestablish themselves as a powerful voice that demands respect?” asked an industry veteran on the condition of anonymity.

Goldin assured me that the updated version of the organization’s best practices guide will be a public document.

Industry brokers like Otar are eager to comply with an established code of conduct and play any role they can in its creation. “Most of the business driven industry-wide is brought in through various ISO channels, which are the ones responsible in presenting the product offered by the funders to the end client,” he said.

That enthusiasm may be resonating with the SBFA. Goldin communicated that they are working towards different types of memberships, hinting at the possibility that brokers might one day be extended an invitation to join.

“We are exploring different levels of membership / pricing,” Goldin wrote in an email.

For the right price, they will likely find a lot of eager applicants.

Photos From B2B Finance Expo and More

September 30, 2024

Photos from B2B Finance Expo can be FOUND HERE. The order of them arranges at random. We’re still adding a few to the gallery. If you want a higher res version of a photo or to inquire if there are any of you that may not be here, email events@debanked.com. Video interviews from the red carpet or from the trade show floor will start being added over the next couple days and should take up to 2 weeks to get them all up. There is a ton of video content!

Congratulations to Cesar Valero (pictured at right), Business Development Exec of Spartan Capital on his victory at the event’s official poker tournament! Story on this to follow! Second place went to Erica Bell, Business Development Exec at Tax Guard. The final table of the match was HIGH PRESSURE so if you want to know how they got so good at the game, make sure to give them a buzz.

Congratulations to Cesar Valero (pictured at right), Business Development Exec of Spartan Capital on his victory at the event’s official poker tournament! Story on this to follow! Second place went to Erica Bell, Business Development Exec at Tax Guard. The final table of the match was HIGH PRESSURE so if you want to know how they got so good at the game, make sure to give them a buzz.

B2B Finance Expo was a two-day event in Las Vegas that brought folks together from across the fintech and commercial finance industries.

Special thanks goes out to Greg Smith and Steve McLaughlin of FT Partners for their incredible insights on Day 1. Proceeds from the event will benefit the Small Business Finance Association (SBFA). A thank you to all the sponsors and attendees.

Anticipated Attendance to B2B Finance Expo Surges

September 12, 2024 Registrations for the inaugural B2B Finance Expo taking place Sept 23-24 at Wynn, Las Vegas have already exceeded attendance to deBanked CONNECT MIAMI 2024 and may well surpass Broker Fair 2024’s turnout in New York City. Due to this overwhelming interest the opportunity to buy tickets may end soon. Make sure your ticket is secured here.

Registrations for the inaugural B2B Finance Expo taking place Sept 23-24 at Wynn, Las Vegas have already exceeded attendance to deBanked CONNECT MIAMI 2024 and may well surpass Broker Fair 2024’s turnout in New York City. Due to this overwhelming interest the opportunity to buy tickets may end soon. Make sure your ticket is secured here.

Interest in the event, which will encompass commercial finance folks from across across SBA, CRE, MCA, Equipment Financing, term loans, LOCs, factoring, investment banking, and more, is quickly propelling B2B Finance Expo to be the largest commercial finance event of the year. Brokers, lenders, funders, vendors, tech, data, legal, leads, and more are among those registered to attend. The featured guest speaker is Steve McLaughlin, CEO of FT Partners.

Brokers will benefit from the wide array of relationship partners available at the show. The event has the backing of the Small Business Finance Association (SBFA) and deBanked.

Media and Trade Associations With Representation at B2B Finance Expo

August 21, 2024Coming to B2B Finance Expo on September 23-24 in Las Vegas? Here are some of the news publishers and trade associations that will have representatives there! (SEE AGENDA HERE)

Small Business Finance Association

National Private Lenders Association

Innovative Lending Platform Association

Registration is still open at: b2bfinexpo.com

See Post... small business finance association, supports the legislation as drafted but would prefer a total ban on confessions, said stephen denis, the organization’s executive director. “any company that is counting on cojs as a collection practice, they are just practicing bad underwriting,” he said. “they should be leaving the industry anyway.”, , --with assistance from david ingold and demetrios pogkas., , to contact the reporters on this story: zachary r. mider in new york at zmider1@bloomberg.net;zeke faux in new york at zfaux@bloomberg.net, , to contact the editors responsible for this story: robert friedman at rfriedman5@bloomberg.net, david s. joachim, , 2019 bloomberg l.p.... |

See Post... small business finance association)? , , funny how the sbfa wants to institute best practices for brokers, while they have places like credibly that is potentially stacking other members. , , ma... |

See Post... small business finance association supports these bills. so, if you live off commissions for seconds+ and coj's, smal... |