Archive for 2019

BFS Capital Eliminates Upfront Fees to Simplify Financing for Small Business Owners

October 1, 2019 CORAL SPRINGS, FLA. (Oct. 1, 2019)—BFS Capital, a leader in small business financing, today announced it has eliminated all upfront fees on its financing solutions, including loans and business advances, as it simplifies pricing for small business owners.

CORAL SPRINGS, FLA. (Oct. 1, 2019)—BFS Capital, a leader in small business financing, today announced it has eliminated all upfront fees on its financing solutions, including loans and business advances, as it simplifies pricing for small business owners.

With pricing that is transparent, flexible and easy to understand, BFS Capital is leading the evolution of small business financing. BFS Capital customers can now apply for and receive up to $500,000 in financing with no origination fees, no processing fees and no upfront costs. Customers are able to pay back a loan with a fixed daily or weekly payment, or as a flexible payment calculated as a percentage of credit card sales.

“There will be no hidden costs or unexpected surprises. What customers borrow is what gets funded into their accounts,” said BFS Capital CEO Mark Ruddock. “We are committed to empowering small businesses by meeting their needs with straightforward, cost-effective and timely online financing, whether it be to smooth cash flow, invest in adding staff, purchase equipment or upgrade a space.”

BFS Capital is also preparing to roll out a new, state-of-the-art digital lending platform. Over the next few weeks, the BFSCapital.com website will showcase a refreshed brand and exciting advances in automation across the entire loan application and approval process.

BFS Capital is also preparing to roll out a new, state-of-the-art digital lending platform. Over the next few weeks, the BFSCapital.com website will showcase a refreshed brand and exciting advances in automation across the entire loan application and approval process.

Partners, including Independent Sales Organizations (ISOs) that match small businesses to BFS Capital’s financing solutions, will also benefit from the company’s new no fee product proposition, evolving digital capabilities and dedication to transparency. ISOs and partners will soon have real-time visibility into the status of their leads across the entire customer relationship lifecycle, from the initial application through the life of the loan and beyond.

“As we embark on our mission of reimagining small business financial services, we are reinforcing support for our partners with API integration and faster, fully underwritten personalized offers, all complemented by market-leading pricing and commissions,” Ruddock added.

BFS Capital has over a decade long history of helping small business owners thrive and has provided more than $2 billion in financing. To qualify, businesses must be in operations for at least two years and generate at least $12,000 in monthly revenue. More than 23,000 businesses have been funded by BFS Capital across 400 industries.

To learn more, please visit BFSCapital.com.

About BFS Capital

BFS Capital champions the long-term growth and prosperity of small businesses by providing timely, flexible financing solutions. BFS Capital’s leading small business financing platform leverages customized underwriting and proprietary algorithms to fund businesses in the United States, Canada, and through its United Kingdom subsidiary, Boost Capital. Since 2002, BFS Capital has provided over $2 billion in total financing to over 23,000 small businesses across more than 400 industries. Headquartered in South Florida with offices in New York, California and the United Kingdom, BFS Capital is an accredited BBB company with an A+ rating.

Media Contact

Archie Group for BFS Capital

Gregory Papajohn

gregory@archiegroup.com

917.287.3626

NYC Taxi Industry Leads Charge to Ban Confessions of Judgment Nationwide

September 30, 2019 New York State may have outlawed entering confessions of judgments (COJs) against out-of-state debtors in their courts, but federal legislators want to see a ban on their use nationwide. On Thursday, the House Financial Services Committee convened for a hearing on predatory debt collection. Notably adding small businesses to the mix with consumers, COJs repeatedly came under attack.

New York State may have outlawed entering confessions of judgments (COJs) against out-of-state debtors in their courts, but federal legislators want to see a ban on their use nationwide. On Thursday, the House Financial Services Committee convened for a hearing on predatory debt collection. Notably adding small businesses to the mix with consumers, COJs repeatedly came under attack.

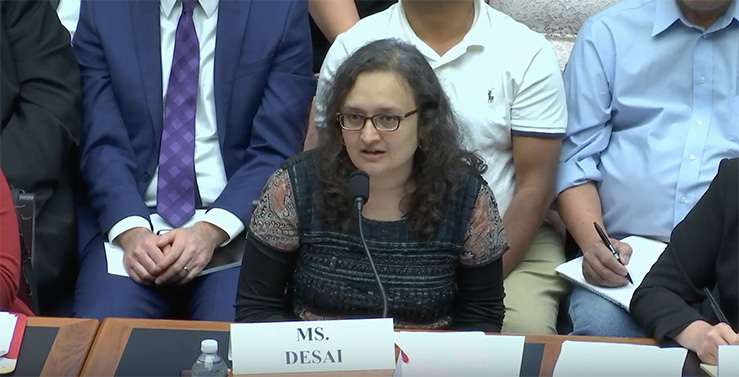

Testimony presented by Bhairavi Desai, executive Director of the 22,000 member New York Taxi Workers Alliance, claimed that predatory lenders are aggressively relying on COJs to “intimidate borrowers into making large sum payments towards outstanding loan balances.” Desai provided one such COJ affidavit to the Committee in which allegedly victimized defendants had confessed to judgment for nearly $600,000. The plaintiff was 160-year-old New York Community Bank, not an alternative finance company.

The NYC taxi business has moved front and center after the New York Times published a bombshell story in May that alleged lenders unfairly trapped Taxi medallion owners into loans they could not repay. The occasional reliance on COJs was vaguely mentioned but struck a nerve with critics already frothing to make them illegal.

Desai explained that unusually high suicide rates in the taxi business are rooted in part by predatory lending practices. “The real stories are the tens of thousands of drivers we see today that are really dying a slow death from despair, from stress from the crisis of this debt,” she told the Committee on Thursday. “Confessions of judgment have basically meant that when [the taxi medallion market] started to fall, drivers were told that they had to pay up the total sum of what was owed on that debt, had to produce $350,000, $400,000 overnight.”

Desai explained that unusually high suicide rates in the taxi business are rooted in part by predatory lending practices. “The real stories are the tens of thousands of drivers we see today that are really dying a slow death from despair, from stress from the crisis of this debt,” she told the Committee on Thursday. “Confessions of judgment have basically meant that when [the taxi medallion market] started to fall, drivers were told that they had to pay up the total sum of what was owed on that debt, had to produce $350,000, $400,000 overnight.”

FTC Commissioner Rohit Chopra voiced his support for a COJ ban when called upon to testify. “The FTC has unique jurisdiction to attack debt collection and discrimination issues in the small business lending market and we should look to restrict terms like confessions of judgment that the FTC banned in consumer loans ages ago.”

The Bloomberg stories that led to new legislation in New York were only mentioned during the hearing once and only in passing.

A slew of bills have been introduced to pursue the Committee’s initiatives. In addition to the Small Business Fairness Lending Act that would outlaw COJs from small business finance transactions nationwide, the Small Business Fair Debt Collection Protection Act seeks to apply the existing Fair Debt Collections Practices Act to small businesses and effectively put small business lenders under the regulatory purview of the CFPB.

You can watch the hearing below:

No Fees, Ever – Is Goldman Sachs Winning Or Losing The Online Lending Battle?

September 30, 2019 Peer-to-Peer lending in the United States died the day Goldman Sachs launched a rival online lending company in 2016. Armed with a low cost of capital and the trust of a household name, Marcus, as Goldman Sachs referred to themselves, sought to further disrupt consumer lending by eliminating every type of fee including late fees. Its pitch was simple, “No fees. Ever.” Three years later, the company still hasn’t caught up to competitors like Lending Club in origination volume (Marcus’ loan book is $5B vs. Lending Club’s $15B). Its fee-less model may also be backfiring.

Peer-to-Peer lending in the United States died the day Goldman Sachs launched a rival online lending company in 2016. Armed with a low cost of capital and the trust of a household name, Marcus, as Goldman Sachs referred to themselves, sought to further disrupt consumer lending by eliminating every type of fee including late fees. Its pitch was simple, “No fees. Ever.” Three years later, the company still hasn’t caught up to competitors like Lending Club in origination volume (Marcus’ loan book is $5B vs. Lending Club’s $15B). Its fee-less model may also be backfiring.

Goldman’s consumer lending business has racked up major losses, according to the WSJ. “It spent heavily to buy startups and cloud-storage space, hire hundreds of techies, and build call centers in Utah and Texas. Loans have gone bad at a higher rate than that of rivals.”

For all of the bank’s early bluster, they were so afraid of negative PR, that they launched without a collections department, leading to significantly high bad debt, the WSJ reports. That has since changed. But where Goldman Sachs appears to have lost, they may still be on track to win. As a consumer “bank” Marcus can also accept deposits. It had collected $36 billion as of year-end 2018 and added another $14 billion this year so far. Goldman also scored a valuable partnership with Apple on a branded credit card. The pitch is a familiar one, “No fees. Not even hidden ones.”

Apple promotes its card as “Created by Apple, not a bank,” yet The WSJ ironically reports that Goldman spent $300 million creating the card for Apple.

Apple promotes its card as “Created by Apple, not a bank,” yet The WSJ ironically reports that Goldman spent $300 million creating the card for Apple.

In a Q2 earnings call, Goldman CFO Stephen Scherr said that the bank was shifting its consumer lending focus from Marcus to the Apple Card. “I’d also say that if you look at the level and rate of growth in the Marcus loan business, while it continues to grow and perform well, we have slowed the increasing growth in that in contemplation of taking on increasing consumer credit through the card business,” he said. “What’s important for us is that we look at this on a risk-adjusted return basis not simply on a return on asset construct.”

Competitively, however, Scherr couldn’t answer if the consumer lending business’s costs will ultimately look more like a fintech lender or a bank as they scale. “What I can tell you is that what we have built jointly with Apple both on the front end and on the back end is intended to be operationally resilient, but equally is intended to be efficient both in terms of the application all through the delivery and on the back-end and so my expectation is that the efficiency will be reflected in that, but again premature to sort of put numbers around it.”

Of note is that Goldman acquired or acqui-hired from Clarity Money, Bond Street, and Final.

deBanked Around The World

September 28, 2019 Members of the deBanked editorial team returned from Ireland this week. The Republic of Ireland will be the latest in our international series on nonbank finance. Stay tuned for our stories on that.

Members of the deBanked editorial team returned from Ireland this week. The Republic of Ireland will be the latest in our international series on nonbank finance. Stay tuned for our stories on that.

In the meantime, be sure to check out our international coverage of:

Canada

- Canada story series

- Magazine Feature: Canada’s Alternative Financing Market Is Taking Off

- Canadian Funder Directory

Australia

- Australia story series

- Magazine Feature: Snapshot on Australia: Growth in the making

- Australia Funder Directory

Hong Kong

Mexico

Head of MyPayrollHR Charged in Massive Nine-Year Bank Fraud

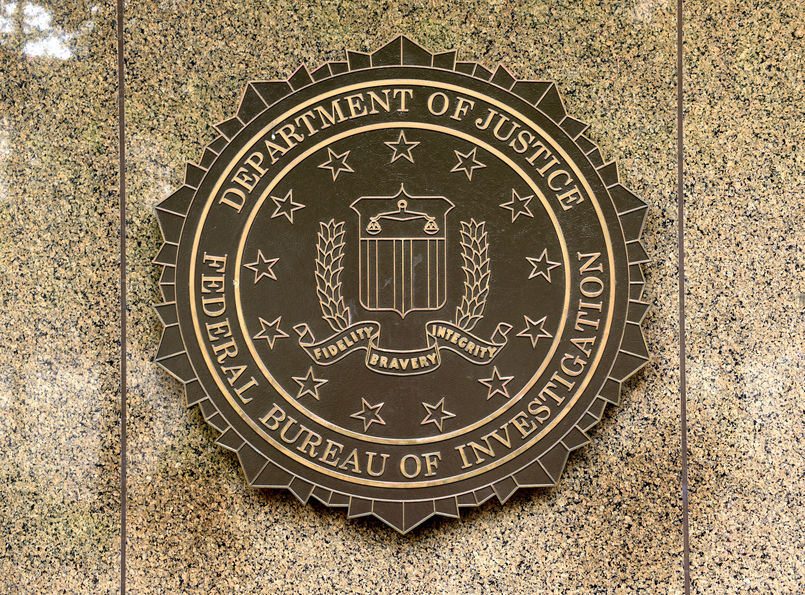

September 23, 2019 When MyPayrollHR left thousands of companies and their employees high and dry without their paychecks earlier this month, suspicion grew that the company’s rather mysterious owner, Michael Mann, may have been involved in some unsavory business. New information has emerged that around that time, Mann voluntarily checked in to the US Attorney’s office in Albany and admitted to a fraud he’d been running for 9 long years.

When MyPayrollHR left thousands of companies and their employees high and dry without their paychecks earlier this month, suspicion grew that the company’s rather mysterious owner, Michael Mann, may have been involved in some unsavory business. New information has emerged that around that time, Mann voluntarily checked in to the US Attorney’s office in Albany and admitted to a fraud he’d been running for 9 long years.

Since then, according to the Department of Justice, “Mann fraudulently obtained at least $70 million in loans from banks and other financial institutions. He created companies that had no purpose other than to be used in the fraud; fraudulently represented to banks and financing companies that his fake businesses had certain receivables that they did not have; and obtained loans and lines of credit by borrowing against these non-existent receivables.”

He has not paid them back. By the end, Mann resorted to kiting checks, the DOJ claims, in that he wrote checks back and forth to himself at different backs to inflate the balance of one or more accounts.

His largest creditor, Pioneer Bank, is owed tens of millions. Earlier this month, Mann attempted to route funds meant for his customers’ payrolls to an account at Pioneer Bank. Pioneer Bank responded by freezing all of the funds, causing all of MyPayrollHR’s clients to get caught in the crossfire.

Mann is charged with Bank fraud. If convicted, he faces up to 30 years in prison and a maximum $1 million fine.

Avi Wernick and Boris Kalendarev Move to RDM Capital Funding

September 23, 2019 Avi Wernick and Boris Kalendarev are joining RDM Capital Funding as the new Director of Partnerships and Strategy and CFO/COO, respectively.

Avi Wernick and Boris Kalendarev are joining RDM Capital Funding as the new Director of Partnerships and Strategy and CFO/COO, respectively.

The move comes after a fruitful year for the company, with it securing a $7.5 million credit facility from Charleston Capital, an amount that it has since extended; upping its funding originations from $300-500,000 per month at the beginning of 2018 to over $2.5 million currently; and witnessing 300% growth over the previous 12 months.

Wernick is moving from BlueVine, where he was a Business Development Manager. Seeking to develop and create new opportunities for RDM, as well as ensure the stability of these prospects, Wernick says that he’s bringing with him the skills and lessons learned at the New Jersey-based funding company, believing that how he will operate in RDM will serve as a “nod to his time and the guys at BlueVine.”

Prior to this, Wernick had done consulting work for Morgan Stanley in the early 2010s. Saying that he “wasn’t enthralled by” the world of institutional finance, he moved to RDM during its launch year, 2015, before starting at BlueVine in February 2018. Speaking of his homecoming to RDM, Wernick notes that he is excited to return to the “blend of ideas” that he says is integral to RDM’s approach towards operations and culture.

Kalendarev echoes this, saying that himself, Wernick, and Reuven Mirlis, RDM’s CEO, have been friends outside of business for years and that he enjoys the overlap of his personal and professional connections. “It’s something we arrived at gradually, it wasn’t like, ‘hey, we’re all working in finance, let’s pool our efforts.’”

Coming from Santander, where he was a Vice President, Kalendarev will be focusing on the operations of RDM. Having been a Financial Advisor for Wachovia Securities during the early years of college, as well as beginning his time at Santander during the days of his senior year, Kalendarev has been in finance for over ten years. On his departure from the Spanish bank he said that it “was a very hard role to leave,” but that he savored the risk which came with building a less established financial entity, saying that “you’re more aligned with it, you’ve got skin in the game.”

On the pair joining, Mirlis had to say, “We’re very, very excited for both Avi and Boris. They have an immense amount of value and they’re going to be an integral part of our group going forward. We’re extremely excited to have them on board and to see what’s to come going forward.”

When asked about what exactly may come in the future for RDM, Mirlis noted he plans to reach 300% growth for a second year in a row.

On the topic of the recent COJ bill, the new hires were optimistic, with Kalendarev remarking that RDM stopped using the contracts over eight months ago and that he thinks “it’s good for the space.” “It’ll be a challenge for these companies who tried to get rich quick and take short cuts and not build a sustainable operation,” said Wernick. “You know regulation is a scary thing.”

Last Call To Book Rooms & Sponsor deBanked CONNECT San Diego

September 21, 2019deBanked CONNECT San Diego, which kicks off on October 24th at the Hard Rock Hotel, is fast approaching. Discounted hotel rooms through deBanked’s special link will only remain available until Monday at 5pm. Even if you were planning to book later and pay full price, the hotel has informed us that they are almost entirely sold out of rooms.

Monday is also the last day to become a sponsor of the event. Don’t miss out on this incredible west coast opportunity and call 917-722-0808 or email events@debanked.com to register.

Tickets to the event can be purchased HERE. Commercial finance brokers benefit from a reduced entry fee.

Nationwide Management Services Adds New Features To Its Virtual Site Inspections

September 20, 2019 MARICOPA, Arizona, September 20, 2019— Nationwide Management Services Inc. (NMSI) announced two new features have been added to its Virtual Site Inspection Software that will change the merchant cash advance and small business lending industries. NMSI’s new features are Pinch to Zoom/Remote Synchronized Zoom and Text Extract using OCR (Optical Character Recognition).

MARICOPA, Arizona, September 20, 2019— Nationwide Management Services Inc. (NMSI) announced two new features have been added to its Virtual Site Inspection Software that will change the merchant cash advance and small business lending industries. NMSI’s new features are Pinch to Zoom/Remote Synchronized Zoom and Text Extract using OCR (Optical Character Recognition).

With Pinch to Zoom you can touch the screen with two fingers and expand/collapse the distance between your fingers and the image zooms in and out. Also, you can move the image right, left, up, or down to focus exactly where you want to focus. Remote Synchronized Zoom allows participants to be simultaneously zoomed based on the mobile device, the user can choose zoom 2x or 3x.

Text Extract using OCR allows the use of optical character recognition to capture alphanumeric sequences to help eliminate typos. For example, a user can capture the MAC address or serial number of a device by copying it to their device/systems clipboard and then paste it wherever needed.

Millions of dollars are lost every year due to merchant fraud. NMSI is at the forefront of this technology and provide its clients with Virtual Site Inspection services that are easy, fast, and secure. In fact, this service can save time and allow Merchant Cash Advance Providers and their underwriters to fund deals quickly.

Important features that set the virtual site inspections apart from other competing services are online chat, SMS messaging, sharing of images, videos and documents, the ability to add single and group participants, screen share to multiple devices, private notes, capture still frame, collaborate markup of images, high-resolution photos, GPS tag location every 10 seconds, recording of the video session, and OCR to capture Serial numbers, Model numbers, and VIN numbers.

“Our proactive approach exemplifies our commitment in providing the small business lending industry the best in class virtual software in the marketplace,” said John Marsh, Chief Executive Officer for NMSI. “Our Virtual Site Inspections provide our clients with the risk management they desire. NMSI continues to lead the way in providing outstanding services to our clients.”

For more information about our Free Virtual Site Inspections, you may visit: https://debanked.com/nationwidemsi/

About Nationwide Management Services Inc.

Nationwide Management Services Inc. is a Veteran owned business established in 2005. NMSI is based in Arizona and specializes in Virtual Site Inspection and Face to Face contact (Door knocks).

SOURCE Nationwide Management Services Inc.

Media Contact:

John Marsh

President

Nationwide Management Services, Inc.

520.840.4583

info@nationwidemsi.com

www.nationwidemsi.com

class=”aligncenter size-large wp-image-182322″ />

class=”aligncenter size-large wp-image-182322″ />