Brendan Garrett was a Reporter at deBanked. Articles by Brendan Garrett

“A Bad Solution in Search of a Problem”: SBFA’s Response to the New York Disclosure Bill

August 6, 2020 “It’s actually shocking to me how tone deaf those who claim to represent our industry are when it comes to policy,” is how Steve Denis, Executive Director of the Small Business Finance Association, described the Innovative Lending Platform Association’s response to and influence over the drafting of bill A10118A/S5470B. Known as New York’s APR disclosure bill, S5470B has been passed by the state legislature, and if signed by Governor Cuomo, will require small business financing contracts to disclose the annual percentage rate as well as other uniform disclosures.

“It’s actually shocking to me how tone deaf those who claim to represent our industry are when it comes to policy,” is how Steve Denis, Executive Director of the Small Business Finance Association, described the Innovative Lending Platform Association’s response to and influence over the drafting of bill A10118A/S5470B. Known as New York’s APR disclosure bill, S5470B has been passed by the state legislature, and if signed by Governor Cuomo, will require small business financing contracts to disclose the annual percentage rate as well as other uniform disclosures.

Speaking to deBanked over the phone, Denis expressed disappointment with both the bill as well as comments made by ILPA’s CEO, Scott Stewart, in a recent article.

“Small businesses in New York are struggling right now,” the Director noted. “They’re waking up every single day wondering if they should even stay open or close permanently, and companies and organizations in our space are using their resources to push a disclosure bill that nobody has asked for. There’s no widespread issue with disclosure. There’s been no outpouring of complaints to regulators. No bad reviews on Trustpilot. This is a really bad solution in search of a problem. We have real problems right now, we should be coming together as an industry to help solve them. We want to make sure that capital is available to small businesses on the other side of this pandemic, and this group of tone deaf companies are spending resources trying to push a meaningless disclosure bill that’s just going to hurt the access to capital for real small businesses who are grinding and trying to figure out how to stay open. It’s unbelievable.”

The SBFA showed deBanked a list of issues and complaints made to the New York legislature regarding S5470B. According to the trade group, these were largely ignored and the bill was pushed through with the issues left in. Among these were problems relating to definitions and terms. No definition for the application process is included, nor is there one for a finance charge. As well as this, one senator was quoted using the term “double dipping” to refer to consumers refinancing debts that have prepayment penalties; which Denis said was “creating a whole new term that’s never been used or defined before, and applying it to commercial finance, something that’s never been done.”

Accompanying these complaints was one regarding how APR is calculated, as S5470B includes two different calculations for this, producing different results while not clearly defining when to use each.

When asked why he believes these issues were allowed to remain in the language of the bill, Denis was baffled.

When asked why he believes these issues were allowed to remain in the language of the bill, Denis was baffled.

“I think that the companies and organizations that support this legislation don’t fully understand what’s actually in the bill. […] They have no problem pounding the table and taking credit for its passage, but I guess they don’t realize it will subject them and the rest of the alternative finance industry to massive liability, massive fines—upwards of billions of dollars worth of fines.”

Denis’s fear going forward is that funders in New York will tighten up their channels going forward or cease funding entirely, given the increased riskiness of funding under the terms of S5470B if Cuomo signs it into law. Before that happens though, the Director mentioned that he believes there will be legal challenges to the bill in the future, saying that its wording is just too unclear and poorly drafted. Adding to this, Denis said that he believes many members of New York’s state government are aware that this bill is imperfect and were comfortable with the thought of it being edited once passed. Looking forward, Denis wants the SBFA to be deeply involved in those edits, saying that they’re willing to work with the Governor, the state assembly, and the New York Department of Financial Services.

“We’re for disclosure, we think there should be standard disclosure. … Our message to the Governor’s office is ‘Let’s take a step back.’ The Department of Financial Services needs to look at our industry, they need to get to know our industry. They are the experts that understand the space, they understand disclosure, and they understand what they need to do to bring responsible lending to New Yorkers. And we would like to work with the NYDFS and a broader industry to put forward a bill that’s led by the Governor and the Governor’s office that brings meaningful disclosure and meaningful safeguards to this industry.”

LendingPoint Partners with eBay to Fund Online Sellers

August 6, 2020 LendingPoint announced this week that it is partnering with the online marketplace eBay to provide funding to sellers on its platform. Titled eBay Seller Capital, the program will offer terms of up to 48 months, with no origination or early payback fees, and which will be capped at $25,000 during its pilot program.

LendingPoint announced this week that it is partnering with the online marketplace eBay to provide funding to sellers on its platform. Titled eBay Seller Capital, the program will offer terms of up to 48 months, with no origination or early payback fees, and which will be capped at $25,000 during its pilot program.

“We’re committed to empowering entrepreneurs to make their dreams a reality, and we are continuing to partner with our sellers to provide them with the tools they need to thrive, eBay’s VP of Global Payments Alyssa Cutright said in a statement. “We’re excited to make flexible financing options available that are integrated with our new payments experience. The program with LendingPoint will enable critical funding opportunities for eBay sellers, especially during this time of economic uncertainty.”

In its early stages now, eBay Seller Capital will only be available for selected sellers, with the plan being for it to be made available to all eligible sellers in the US later this year. Beyond the program, LendingPoint has made clear in its statement that it aims to “expand their offering to provide eBay sellers with more tools to help run their businesses,” however, when asked, CEO and Co-Founder Tom Burnside did not give details of these future plans.

“I don’t want to leave the proverbial cat out of the bag yet with that,” Burnside commented in a call, “but what I will tell you is that I think when we are done eBay will be able to offer best-of-class seller financing.”

ZenBusiness Acquires Joust

August 3, 2020ZenBusiness, the Austin-based business formation services company, recently announced that it reached an agreement to acquire Joust for an undisclosed amount. Offering financing options to freelancers and entrepreneurs, Joust services, like PayArmour, will continue under its new ownership, rebranded as ZenBusiness Money when it relaunches in October.

“The acquisition of Joust and upcoming launch of ZenBusiness Money furthers our mission to provide the nation’s 57 million micro businesses with exceptional and friendly tools that simplify the process of forming and running their business,” ZenBusiness CEO and Co-founder Ross Buhrdorf noted in a statement. “We are excited to welcome the world-class fintech experience the entire Joust team brings to the ZenBusiness family as we continue to grow the features of our platform.”

With there still being an urge to work from home, all of ZenBusiness’s newly acquired employees will work remotely. Given the oddness of being bought in the middle of a global pandemic, Buhrdorf explained in a call how while covid-19’s economic impacts have led to an increased interest in their product, this uptick is not something new, but rather an inevitability.

“There’s no denying our businesses have accelerated as a result of covid-19. I don’t want to get carried away there because this was a growing trend before this. Lots of companies were turning employees into contractors, and so this was a growing trend. I think that the pandemic accelerated that, either out of necessity or it was, ‘hey, the world’s a changed place, I need to start up a side gig.’”

Joust CEO Lamine Zarrad followed up on this point by mentioning that this pattern is linked to why ZenBusiness is a B Corp, with the hope being that they will be able to provide support to Americans as they encounter new financial challenges.

“We are now a public benefit corporation, and Joust’s missions has always been oriented towards social good. And we’re excited to help these individuals who are now becoming entrepreneurs and wading into these waters that are completely uncharted.”

BlueVine Partners with DoorDash to Fund $6 Million in PPP

July 29, 2020 This week BlueVine announced that since partnering with the food delivery service DoorDash in late April, over 180 businesses have received funds from the Paycheck Protection Program via said partnership. Totaling over $6 million, the partnership exclusively served restaurants on DoorDash’s platform, offering them a PPP pathway through BlueVine in email correspondence as well as the DoorDash merchant portal.

This week BlueVine announced that since partnering with the food delivery service DoorDash in late April, over 180 businesses have received funds from the Paycheck Protection Program via said partnership. Totaling over $6 million, the partnership exclusively served restaurants on DoorDash’s platform, offering them a PPP pathway through BlueVine in email correspondence as well as the DoorDash merchant portal.

“DoorDash saw a need within their merchant partner base to be able to quickly apply for and receive a PPP loan – something many were not able to do through traditional banking services – and was looking to solve the accessibility factor with a partnership,” BlueVine CCO Brad Brodigan said in an email. “Small restaurants in particular were unable to access funds they needed to stay in business and navigate through this uncertain time, and the hope was that information from a trusted source like DoorDash would help them look for solutions if their bank was unable to help them.”

The $6 million funded is part of the larger $3.5 billion in PPP money that BlueVine claims to have funded to +100,000 businesses. According to Brodigan, the median loan size for the DoorDash deals was $16,000; with the median employees on payroll being five. DoorDash will be donating all referral fees from the program to the CRA Restaurants Care Covid-19 Grant as well as the Small Business Relief Fund.

“Our Model Disclosure Legislation”: ILPA’s CEO on New York’s APR disclosure bill

July 28, 2020 Late last week the New York State legislature voted to pass A10118A/S5470B, a bill that might lead to greater clarity and consumer knowledge according to Scott Stewart, CEO of the Innovative Lending Platform Association, a trade association of small business lenders.

Late last week the New York State legislature voted to pass A10118A/S5470B, a bill that might lead to greater clarity and consumer knowledge according to Scott Stewart, CEO of the Innovative Lending Platform Association, a trade association of small business lenders.

Referring to it as “our model disclosure legislation,” Stewart explained in a phone call the work that the ILPA put in to help the bill through as well as what sort of impacts can be expected from S5470B.

“The implications are that small businesses, certainly in New York to begin with, but we think throughout the country, will have the opportunity to really see, understand, and compare various different sources and products for financing their small businesses in terms of their expansion and success. That’s something we’re very proud of and I think that’s something the small business borrower really deserves to see. They deserve to see and understand exactly what they’re doing and when they’re taking out financing products for their businesses.”

What exactly these business owners will understand better relates to the details of the bill, which requires small business financing contracts to disclose the annual percentage rate as well as other uniform disclosures. If signed by New York Governor Cuomo, the bill could have ramifications on small business lenders, MCA, and factoring providers.

ILPA, founded in 2016 and comprised by the likes of Kabbage, OnDeck, and BlueVine; worked alongside legislators to help with the drafting of the bill, assisting with the wording so that it reflects their own SMART Box initiative. This being a form offered by ILPA which lists a number of metrics worth considering when seeking small business financing.

“In January 2019, our team came together and decided that it made sense in the wake of 1235 in California to take a proactive approach to codify SMART Box as legislation in a state, and we selected New York because we felt we had a favorable legislature there,” Stewart said. “I think it’s an incredible achievement. You see the big margins that it passed by in both the Assembly and the Senate and we’re very, very proud of that. I think it really speaks to our cooperative approach to building legislation. And now, as we move toward the implementation phase, we’re going to be in a place where, hopefully in the next six months or so, small businesses will begin receiving really clear disclosures on the capital and credit that they’re trying to take out.”

As noted though, the bill must be signed by Governor Cuomo before becoming law, and then it will affect New York only. Beyond the Empire State though, Stewart is hopeful that ILPA will be able to implement the terms of S5470B in other states.

“Now that we have hopefully harmonized the legislative landscape between California, with 1235, and New York; hopefully we’ll be able to export that to other states. We don’t have any accurate plans at this time to do that, but we feel like if two of the larger states in the nation have very similar disclosure regimes then we’re on the track toward seeing this nationwide.”

Kabbage Launches Checking Accounts for SMBs

July 22, 2020 Today Kabbage announced the launch of its latest service, business checking accounts. Targeting small-sized businesses and offering no monthly fees, 1.10% APY, and a Kabbage debit card; Kabbage Checking is available now and is part of an effort by Kabbage to transition from being a pure SMB-funding company into a cash-flow management company.

Today Kabbage announced the launch of its latest service, business checking accounts. Targeting small-sized businesses and offering no monthly fees, 1.10% APY, and a Kabbage debit card; Kabbage Checking is available now and is part of an effort by Kabbage to transition from being a pure SMB-funding company into a cash-flow management company.

“Kabbage is a full financial services platform that’s focused on solving on cash-flow management for small businesses.” President Kathryn Petralia explained in an email. “A business checking account is a core function of how they manage their money, and we saw an opportunity to build them a solution specifically designed for them – while simultaneously reducing their costs and increasing their yield.”

Launched in the wake of a study which reports that over 40% of small businesses are looking to change their bank following struggles with their Paycheck Protection Program applications, Kabbage is optimistic that fintechs an online lenders will benefit from a wave of interest following the failures of financial institutions in the face of the coronavirus.

“Amidst one of the largest financial crises in history, we helped over 225,000 small businesses access services many of their long-time bank partners would only provide to their largest customers,” the President said in a statement. “We believe in the businesses too often left out, overlooked, and underestimated. Kabbage Checking is a new banking service built to give those small businesses an upper hand to earn more, save more, and grow their business faster without sacrificing anything they expect from a bank.”

The Aftermath: What Industry Experts Had to Say About The Future Alignment of People and Data

July 20, 2020

Like never before, the ways in which people and data are employed are overlapping more in a post-covid economy. Nearly three months of slow-down and, in some cases, complete economic shutdown have forced brokers and funders alike to view businesses differently than before. New documents, metrics, and terms are being incorporated into underwriting with the belief that it will provide a much more comprehensive picture of each business applying for funding.

Broker Fair Virtual took the chance to explore these new perspectives in The Aftermath, a panel featuring Moshe Kazimirsky, VP of Strategic Partnerships and Business Development at Become; Heather Francis, CEO of Elevate Funding; and David Snitkof, Head of Analytics at Ocrolus. Here, the industry experts discussed what the future of data and people may look like, what the new things that funders are looking out for are, and how the coronavirus has changed consumer and merchant behavior.

First up was Heather Francis, who gave a run down of how Elevate has adapted to the constantly shifting environment created by covid-19. “There were slim pickings on what we could fund,” Francis noted of the early lockdown period. Explaining that many businesses didn’t fit their criteria in the early days of lockdown, Elevate began the process of including new metrics and lenses through which to ascertain if businesses were financially viable.

National, state, and local restrictions became a daily check-in, rather than monthly; with one person being assigned to cover changes in local and even county regulations. As well as this, Francis explained that the company shifted its focus from underwriting the business owner’s activity to underwriting the consumers’ activity. This meant that foot traffic was constantly reviewed via FourSquare, trends that showed which industries were seeing upticks and downturns were monitored, and what customers in varying geographies were comfortable with was gauged.

“There are some areas in our country that were not heavily impacted,” Francis explained, commenting on the discrepancies between locations, particularly for bars and restaurants. “I know some of us have our optics on what’s going on in our daily lives, and a lot of people in our space are located in New York or California, and these were the very heavily regulated areas where everything was shut down and there was not much to do. Here in Florida, it was easier, with open-seating dining.”

“There are some areas in our country that were not heavily impacted,” Francis explained, commenting on the discrepancies between locations, particularly for bars and restaurants. “I know some of us have our optics on what’s going on in our daily lives, and a lot of people in our space are located in New York or California, and these were the very heavily regulated areas where everything was shut down and there was not much to do. Here in Florida, it was easier, with open-seating dining.”

David Snitkof echoed Francis’s points, saying that “the old way of businesses underwriting credit is no longer sufficient … If you were to only look at people’s repayment histories, their credit profiles, and things like that, you wouldn’t get all the data you need to make the right decision. Generally there’s this idea that the past is prologue and the greatest predictor of future results is past behavior, and this type of pandemic makes that no longer the case … we need to think beyond the traditional data sets that people have used to underwrite credit.”

According to Snitkof, the old models for underwriting and funding have been overturned, with funders adhering to three principals going forward as they chart new methods: more data, more time, more detail. This means incorporating more data and analytics than before, pushing for more data-driven strategies; requesting information and data from merchants that cover longer periods of time, with the hope of gaining further insight into the pattern of the business; and upping the thoroughness with which each merchant is scrutinized, recording more information that is unique to their industry, location, and business management.

“Lenders will realize that in order to make a credit decision, we need to have access to very deep, detailed, and wide time-framed data of our customers; and we need to be able to process it in an automated and efficient way,” Snitkof asserted.

Still, while it looks like data is due to play a larger role in the future, Heather Francis took care to mention that important data is currently missing from their metrics. Credit and delinquency reporting are on hold, just as rent is paused for many tenants; meaning that in two or three months, many funders could be in for a surprise when they realize their merchant is having trouble.

Speaking on the Paycheck Protection Program as well as the Economic Injury Disaster Loan, both Snitkof and Francis expressed that while it is good to see deposits for the government programs, questions must be asked regarding them. They can’t be viewed as revenue, since they do not reflect a business’s ability to generate revenue, said Snitkof, but rather they offer a chance to view how a company manages its cash-flow, with how they spread out PPP and EIDL funds being a key insight.

Speaking on the Paycheck Protection Program as well as the Economic Injury Disaster Loan, both Snitkof and Francis expressed that while it is good to see deposits for the government programs, questions must be asked regarding them. They can’t be viewed as revenue, since they do not reflect a business’s ability to generate revenue, said Snitkof, but rather they offer a chance to view how a company manages its cash-flow, with how they spread out PPP and EIDL funds being a key insight.

Looking forward, the panelists noted that the experiences of economic shutdown; PPP; EIDL; and how many business owners’ banks supported, or did not support, them could lead to a shift in how non-banks are viewed.

“It’s definitely a time and place for us to really highlight how our industry is placed to assist small businesses,” Francis stated. “We should really take this opportunity to expand on what we can do and how we can help. I think it’s our moment to shine because a lot of banks have pulled back on what they’re able to do in this time.”

This pulling back by banks became clear during the peak of the PPP application period, when many business owners complained of a lack of or poor communication between themselves and the bank they applied to. Highlighting the importance of the customer experience, Snitkof pointed out that this aspect of alternative finance may only become more important as time goes on.

“We have this golden age of customer service. Customers are going to demand good funding, on the right terms, with full transparency, with good speed of decisioning, with a good relationship, and if they can get that from someone who is not a bank, but is an alternative finance provider, then that’s a great funding scenario for them.”

More generally though, the panel ended on a note of ambiguity over the future, with the speakers agreeing that what comes next will be uncertain and challenging, as Francis reminded the audience of what 2020 has in store: a presidential election and a possible second wave of the novel coronavirus.

But there may also be opportunity for those who are there to take it, according to Snitkof, who finished off by saying that “the silver lining of what we’ve just been through as a country, as a world, as an industry, is that all those things that were good enough, they were on pause. So it’s given people the time and space to reimagine what they could do and actually look at the capabilities that we’ve available to us and say ‘maybe we can provide a great personalized customer experience to every small business and customer out there. Maybe we can be more automated and data-driven in our decisions. Maybe we can actually extend better terms on financing to people because we’re able to determine risk better, and optimize our market spend and cost of capital better.’ One of the good things about a disruption is it takes away a lot of the stuff that was good enough; a lot of those sacred cows are now ready to be disrupted and maybe in a few years we’ll see rapid innovation along those lines.”

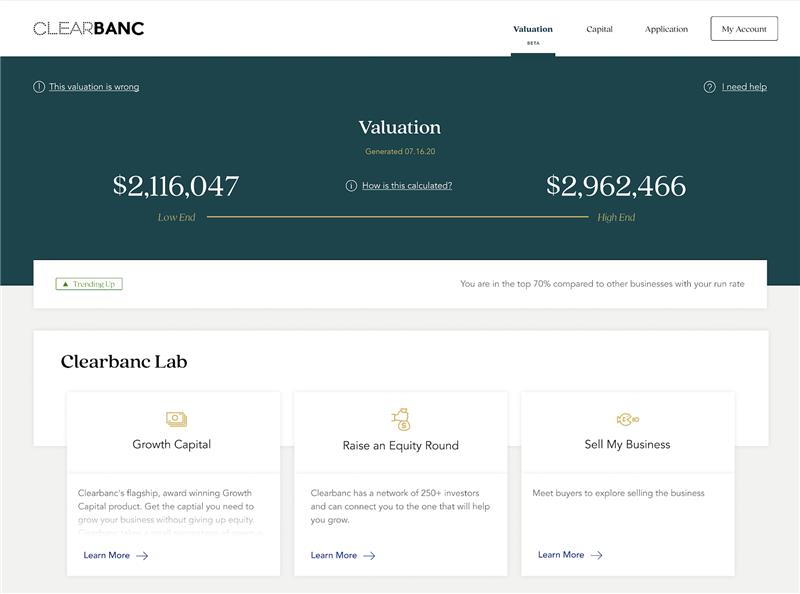

Clearbanc Launches Valuation Service for Founders

July 16, 2020

Today Clearbanc, the Toronto-based alternative finance company, has launched its latest service, Valuation, allowing founders to gauge their company’s value. Being an extension to Clearbanc’s platform, the service will be free to everyone and promises an estimation within 24 hours that can be checked weekly.

Valuation also offers three options to founders upon receiving their company’s value: the chance to access capital via Clearbanc’s funding channels, connect with investors in order to raise an equity round, and investigate possible acquisition opportunities. For the last two of these options, Clearbanc makes introductions to a selection of venture capital investors that have connected with the program.

As per the requirements, founders will have to connect a selection of private data points. Their business accounts, payment processor, accounting platform, and their admin account will all be required. As well as this, public data is also used to arrive at a valuation, basing the estimations on information specific to the company as well as the industry it is in.

“We think this could be as revolutionary as what Credit Karma did when they launched free credit scores for everyone and gave consumers access to their own information,” explained Clearbanc CEO Michele Romanow. “We’re really excited about this as it represents our first non-capital launch, and we think that it’s part of a much bigger vision of how we help founders win in this environment.”