Archive for 2017

What Will it Take to Grow OnDeck’s Stock Price?

September 20, 2017OnDeck closed at the exact same price on September 14th as it did on July 20th, $4.58. In between, OnDeck reported one of their best quarters ever (they released their 2nd quarter earnings on August 7th) and experienced a temporary boost to $5. Even then, the stock was 75% down from the IPO price and more than 80% down from their all-time high, yet that too couldn’t be sustained.

In Q2, OnDeck only had a GAAP net loss of $1.5 million and announced that they had expanded their collaboration with JPMorgan Chase for up to four years to provide the underlying technology supporting Chase’s online lending solution to its small business customers.

In the rest of the lending world, optimism is in style. Square is up 121% year-to-date, according to the deBanked Online Lender Tracker and even Lending Club is up 14%.

More traditional finance companies like American Express and Intuit are meanwhile hovering near their 52-week highs, according to the Specialty Business Lending Tracker.

Some of OnDeck’s former employees at least appear to be doing well. Just recently, the former Chief Sales Officer was named COO of CoverWallet, the former Director of External Sales was named Chief Revenue Officer of Pearl Capital and the former Director of Portfolio Management and Credit Operations was named SVP at Breakout Capital.

CFPB’s Small Business Lending RFI is Now Closed

September 18, 2017The window to share your two cents on the CFPB’s quest to collect data on small business lending has closed. The extended deadline to respond to the RFI was September 14th.

The agency received 2,668 comments, 650 of which you can read online. Most responses that deBanked reviewed asked the CFPB to exempt certain businesses such as community banks from the law. Others denounced the CFPB’s objective as misguided or poorly thought-out from the get-go.

Nevertheless, Section 1071 of the 2009 Wall Street Reform and Consumer Protection Act directed the CFPB to collect data on small business lending presumably to determine if women and minorities are treated differently.

Some observers expected this initiative to be derailed when Richard Cordray, the Director of the CFPB, resigned to campaign for Governor of Ohio. However, the governor’s race is now in full swing and he has yet to resign, and could now possibly remain in his position until it expires next year.

The implementation of any resulting rule from the RFI would likely not take place until some time in the 2020s, sources contend.

New CTO at Breakout Capital is Former CTO of Capital One Labs

September 18, 2017 Firoze Lafeer, the former Capital One Head of Tech Fellows Program and CTO, Capital One Labs, is now the CTO of Breakout Capital, a Breakout representative confirmed. Lafeer was with Capital One for five years, most recently running the company’s experimental product & technology incubator and accelerator.

Firoze Lafeer, the former Capital One Head of Tech Fellows Program and CTO, Capital One Labs, is now the CTO of Breakout Capital, a Breakout representative confirmed. Lafeer was with Capital One for five years, most recently running the company’s experimental product & technology incubator and accelerator.

Breakout Capital is a fintech small business lender based in Mclean, VA where Lafeer will lead technology, including scaling their tech platform.

Last month, Breakout hired Robert Fleischmann as Senior Vice President, Strategic Partnerships and Tom McCammon as Senior Vice President, Business Operations. Fleischmann was previously Director of Strategic Partnerships at RapidAdvance. McCammon was previously the Director of Portfolio Management and Credit Operations at OnDeck.

The Top Small Business Funders By Revenue

September 14, 2017Thanks to the Inc 5000 list on private companies and earnings statements from public companies, we’ve been able to compile rankings of alternative small business financing companies by revenue. Companies that haven’t published their figures are not ranked.

| SMB Funding Company | 2016 Revenue | 2015 Revenue | Notes |

| Square | $1,700,000,000 | $1,267,000,000 | Went public November 2015 |

| OnDeck | $291,300,000 | $254,700,000 | Went public December 2014 |

| Kabbage | $171,800,000 | $97,500,000 | Received $1.25B+ valuation in Aug 2017 |

| Swift Capital | $88,600,000 | $51,400,000 | Acquired by PayPal in Aug 2017 |

| National Funding | $75,700,000 | $59,100,000 | |

| Reliant Funding | $51,900,000 | $11,300,000 | Acquired by PE firm in 2014 |

| Fora Financial | $41,600,000 | $34,000,000 | Acquired by PE firm in October 2015 |

| Forward Financing | $28,300,000 | ||

| IOU Financial | $17,400,000 | $12,000,000 | Went public through reverse merger in 2011 |

| Gibraltar Business Capital | $16,000,000 | ||

| United Capital Source | $8,500,000 | ||

| SnapCap | $7,700,000 | ||

| Lighter Capital | $6,400,000 | $4,400,000 | |

| Fast Capital 360 | $6,300,000 | ||

| US Business Funding | $5,800,000 | ||

| Cashbloom | $5,400,000 | $4,800,000 | |

| Fund&Grow | $4,100,000 | ||

| Priority Funding Solutions | $2,600,000 | ||

| StreetShares | $647,119 | $239,593 |

Companies who were published in the 2016 Inc 5000 list but not the 2017 list:

| Company | 2015 Revenue | Notes |

| CAN Capital | $213,400,000 | Ceased funding operations in December 2016, resumed July 2017 |

| Bizfi | $79,000,000 | Wound down |

| Quick Bridge Funding | $48,900,000 | |

| Capify | $37,900,000 | Wound down |

The Google Battle for Lending and SMB Finance Keywords

September 14, 2017The online lending battle is at least in part being fought online. Below is a chart of organic page 1 rankings in Google for some of the industry’s biggest players, banks, and the SBA. (Hat tip to Fundera and NerdWallet):

| Keywords | OnDeck | Kabbage | Fundera | Lending Club | NerdWallet | National Funding | Traditional Banks | SBA.gov |

| business loan | 1 | 9 | 3 | 5 | 4,7 | 6 | ||

| merchant cash advance | 2 | 3 | 4 | 8 | ||||

| working capital | 9 | 4 | ||||||

| commercial loan | 3 | 2,7 | ||||||

| small business loans | 2 | 3 | 5 | 7 | 1 | |||

| business line of credit | 3 | 2 | 11 | 1,4 | 6,7,8,9,10 | 5 | ||

| fast business loan | 1 | 4 | 2 | 5,6 | ||||

| business loan with bad credit | 7 | 1 | 2 | 3 |

The Top 10 Google Search Results for Merchant Cash Advance in February 2012 compared to now:

| February 2012 | September 2017 |

| MerchantCashinAdvance.com | Wikipedia |

| Yellowstone Capital | OnDeck |

| Entrust Cash Advance | Fundera |

| Merchants Capital Access | NerdWallet |

| Merchant Resources International | Businessloans.com |

| American Finance Solutions | Bond Street |

| Nations Advance | Capify |

| Bankcard Funding | National Funding |

| Rapid Capital Funding | CNN |

| Paramount Merchant Funding | CAN Capital |

The top result in 2012 is a great example of how much easier it was to game Google’s system back then. After achieving rank #1 for MCA and 300 other related keywords, MerchantCashInAdvance.com, which was just a lead generation site, sold for $75,000 in December 2011. The site was later clobbered by Google Penguin for black hat SEO and banished from visibility.

A major shift has obviously taken place over the last 5 and a half years. Is the search results game rigged to advance Google’s own interests? Three years ago I put forth my theory on that.

One thing that’s different between then and now is that Google now has 4 paid links above the organic search results as opposed to 3 and the paid links blend in more with the organic results. With the organic results pushed further down the page, they’re not as visible as they were five years ago.

Read my previous analyses on the industry’s search war over the years:

December 2015 Google Serves Low Blow to Merchant Cash Advance Seekers

March 2015 Google Culls Online Lenders – Pay or Else?

October 2014 Merchant Cash Advance SEO War Still Raging

August 2014 Six Signs Alternative Lending is Rigged: Do Lending Club and OnDeck have a helping hand?

October 2013 Google Penguin 2.1 takes swing at the MCA industry

August 2013 Your merchant cash advance press release may be hurting you

December 2012 Is Google your only web strategy?

July 2012 The other 93% [of leads]

April 2012 The SEO war continues

February 2012 The SEO War for Merchant Cash Advance: The first story on this topic

PayPal’s Global Head of Product Comm Joins Lending Club

September 14, 2017Anuj Nayar, PayPal’s global head of product communications, has moved on to Lending Club as VP and head of communications, according to published reports. Nayar was also previously Head of Mac Public Relations at Apple from 2003 to 2008.

At PayPal, Nayar was the primary spokesperson on a range of proactive and reactive issues, according to his LinkedIn profile.

Lending Club has struggled in the PR department since May 2016 when the company’s founder resigned.

Where Alternative Finance Ranks on the Inc 5000 List

September 14, 2017Here’s where your peers rank on the Inc 5000 list for 2017:

| Ranking | Company Name | Growth | Revenue | Type |

| 15 | Forward Financing | 12,893.16% | $28.3M | MCA |

| 47 | Avant | 6,332.56% | $437.9M | Online Consumer Lender |

| 219 | OppLoans | 1,970.22% | $27.9M | Online Consumer Lender |

| 260 | US Business Funding | 1,657.42% | $5.8M | Business Lender |

| 361 | nCino | 1,217.53% | $2.4M | Software |

| 449 | Kabbage | 979.31% | $171.8M | Online Consumer Lender |

| 634 | Lighter Capital | 712.03% | $6.4M | Online Business Lender |

| 694 | Swift Capital | 652.08% | $88.6M | Business Lender |

| 789 | CloudMyBiz | 575.46% | $2.1M | IT Services |

| 1418 | loanDepot | 286.11% | $1.3B | Online Consumer Lender |

| 1439 | Nav | 281.98% | $2.7M | Online Lending Services |

| 1731 | United Capital Source | 224.85% | $8.5M | MCA |

| 1101 | ZestFinance | 165.99% | $77.4M | Online Lending Services |

| 2050 | National Funding | 184.74% | $75.7M | Online Business Lender |

| 2572 | Blue Bridge Financial | 136.73% | $6.6M | Online Business Lender |

| 2708 | Bankers Healthcare Group | 127.51% | $149.3M | Financial Services |

| 2714 | Tax Guard | 127.02% | $9.9M | Financial Services |

| 2728 | Fora Financial | 125.81% | $41.6M | Online Business Lender |

| 2890 | Reliant Funding | 121.61% | $51.9M | Online Business Lender |

| 4005 | Cashbloom | 70.47% | $5.4M | MCA |

| 4945 | Gibraltar Business Capital | 42.08% | $16M | MCA |

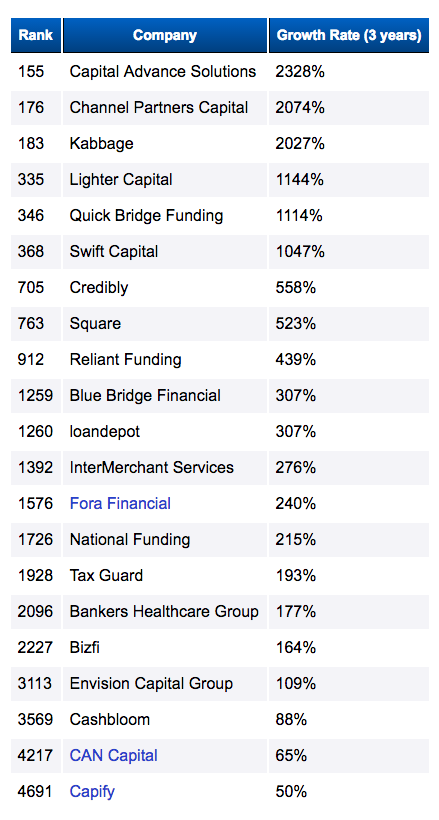

Compare that to last year’s list below:

Of the companies on the 2016 list, Capify and Bizfi were wound down while CAN Capital ceased operations but then later resumed them more than half a year later.

Bond Street Has Stopped Lending

September 13, 2017 NYC-based small business lender Bond Street has stopped making new loans, according to sources who worked with them. The Wall Street Journal published a similar report earlier today. In addition, the WSJ reported that Goldman Sachs is hiring 20 of Bond Street’s employees.

NYC-based small business lender Bond Street has stopped making new loans, according to sources who worked with them. The Wall Street Journal published a similar report earlier today. In addition, the WSJ reported that Goldman Sachs is hiring 20 of Bond Street’s employees.

Just seven months ago, Bond Street announced that they had closed a $300 million loan purchase agreement with Jefferies. The WSJ reported that an inability to raise additional equity is what threw a wrench in their future. The same situation happened to Bizfi just a few short months ago, who wound down after 10 years and shipped their portfolio off to rival Credibly to service.

Bond Street’s 1-3 year loans with APRs ranging from 8% – 25% were terms that many in the alternative business lending universe say is a fundamentally unprofitable model. The company now appears to be joining the ever growing purgatory of alternative small business finance companies. They join Dealstruck, Herio Capital, Bizfi, and Nulook Capital. CAN Capital was previously on that list but was recently restructured and revived.

Able Lending, another small business lender, denied that they were going out of business but admitted they were looking to be acquired.

Square is also reportedly in talks to hire Bond Street employees, the WSJ claims. When Bizfi closed, their employees were mainly picked up by rivals World Business Lenders, Strategic Funding, iPayment, 6th Avenue Capital, and others.