Business Lending

THE ABCs OF SBDCs

December 16, 2018 An often-overlooked national network of nearly a thousand Small Business Development Centers has the potential to help alternative funders cement relationships with existing clients and locate new ones. The centers, known as SBDCs, offer free or low-cost training and consultation to established and aspiring merchants and manufacturers.

An often-overlooked national network of nearly a thousand Small Business Development Centers has the potential to help alternative funders cement relationships with existing clients and locate new ones. The centers, known as SBDCs, offer free or low-cost training and consultation to established and aspiring merchants and manufacturers.

The earliest SBDCs have been around for four decades. The centers operate in conjunction with the Small Business Administration as public-private partnerships and serve about 1.5 million clients annually.

Centers help small-business owners evaluate ideas, organize companies, find legal assistance and obtain operating capital.

But not everyone knows all that. “The network is underutilized,” says Donna Ettenson, vice president of operations for Washington-based America’s SBDCs, which functions much like a trade association for the centers scattered across the nation. “We’re one of the best-kept secrets in the United States federal government.”

That means alternative funders can assist customers by simply informing them that the centers exist and can offer potentially beneficial services. Providing basic information on the SBDCs could become part of a consultative approach to selling that brings repeat business, especially with merchants who lack business skills or experience, observers suggest.

What’s more, alt funders who want to increase their chances of benefitting from SBDCs can go beyond merely providing clients with a rundown on the centers. The funders can become actively involved with the work of carried out at the centers.

One way of taking part is to contact nearby centers and offer to make presentations at seminars or workshops, Ettenson says. Funders could provide information to fledgling business owners on the instruments available through the alternative-funding industry, such as cash advances, loans and factoring, she suggests.

To get started, alternative funders can visit the America’s SBDC website, where they’ll find a search tool that provides contact information for their nearest centers, Ettenson says. From there, they could discuss possible connections with officials at the local centers, she advises.

To get started, alternative funders can visit the America’s SBDC website, where they’ll find a search tool that provides contact information for their nearest centers, Ettenson says. From there, they could discuss possible connections with officials at the local centers, she advises.

That involvement would not only provide exposure to merchants in need of capital but also to center officials who point merchants toward capital sources. If enough members of the alt funding industry took part, their work could eventually give rise to something akin to the lists of attorneys that some centers maintain, Ettenson says.

Centers often tap attorneys—perhaps quarterly—to lecture on a rotating basis on what type of business to form. That could mean organizing as a corporation, limited-liability partnership or some other form. In much the same way, funders could share their knowledge of instruments for obtaining capital.

Funders could emulate the lawyers who use the centers as a forum for soft marketing, Ettenson says. The speaker becomes a familiar face and can leave business cards that students could use to contact them as questions arise. However, speakers must provide general information and are prohibited from using speaking opportunities as blatantly self-promotional unpaid advertisements, she cautions.

What’s more, the centers have to exercise caution to avoid recommending specific attorneys, accountants or sources of capital because they could incur liability if events go sour and a service provider absconds to Bogata, Columbia, Ettenson points out. That keeps the centers “ecumenical,” in that they provide a list of professionals for clients to interview and rather than pointing to a single source.

Alternative funders can explore other ways to become involved with SBDCs, too. The national organization presents an annual trade show and professional development conference for service-center directors and service-center staff members who teach or consult with clients. Alternative funders who have taken booth space on the exhibition floor or made presentations in the accompanying conference include RapidAdvance, Breakout Capital, Kabbage and Newtek Business Services.

When America’s SBDCs issues a call for presentations at the annual conference, it receives approximately 300 applications for about 140 speaking slots. Some of the speakers come from the rosters of presenters at past shows, while companies newer to the trade show can purchase an entry-level sponsorship that includes booth space and the right to conduct a workshop.

The attendees at those annual conferences can tell their clients about the funders they encounter there. Attendees can also find out more about the alternative- funding industry and then pass that information along to merchants.

Some regional centers in states with large populations—such as California—can also hold conventions for their officials, says Patrick Nye, executive director for small business and entrepreneurship at the Los Angeles Regional SBDC Network, which is based at Long Beach City College. His state was planning its second statewide gathering this year and intends to do it again every other year. Alternative funders could participate, he says.

With so much going on at the centers, someone has to front the cash to keep the lights on. Local organizations are funded partly through federal appropriations administered by the SBA. “In order for the federal money to be pulled down, a matching non-federal dollar must be provided as well,” Ettenson says. The federal funds are apportioned based on the amount of matching funds the centers provide.

The matching funds usually flow from colleges, universities and state legislatures. “It’s a mix,” Ettenson says of the sources. Institutions of higher learning often meet part of their matching-fund goals by providing “in kind” resources—such as classrooms, services and instructors—instead of cash.

In the six states that administer the centers through their economic development departments, the state legislatures generally appropriate matching funds. In Texas, the representatives of the state’s four regional programs combine forces to lobby the legislature for matching funds, and that teamwork reduces the cost of their efforts in Austin.

The federal funds and matching funds support local and regional centers that belong to a network based on 62 host institutions. Of the 62, six operate through the economic development departments of state governments. They’re in Indiana, Illinois, Ohio, West Virginia, Minnesota and Colorado. The rest of the host institutions are mostly universities or community colleges. Some are based in economic development agencies.

One can think of the regional centers as something akin to corporate headquarters and the local centers as retailers, says Nye, who administers the Southern California regional center. The local centers under his regional’s jurisdiction are located in only three counties but pull in the sixth-largest share of funding because of Southern California’s huge population, he notes.

The local service centers provide training and consulting for entrepreneurs starting or expanding their enterprises. About 60 percent of the clients are already in business. Of the 40 percent who don’t own a business, about half launch one after receiving assistance from an SBDC, Ettenson says.

The centers don’t charge for consulting services, and the fees for training are just large enough to cover expenses. The training fees usually remain in the centers that provide the instruction where they’re used to cover expenses like buying computers.

In Southern California centers, the business advisors are usually under contract and have knowledge to share from their experience in business, marketing, banking, social media, consulting or other realms, says Nye. Not many college instructors work in the centers, he notes, adding that the centers are monitored to avoid conflicts of interest among advisors.

To track how well advisors are performing, the national organization produces economic impact statements by interviewing thousands of clients. Interviews generally take place two years after consulting sessions. That should provide enough time to get results, Ettenson says

Thus, America’s SBDCs this year surveyed clients who received services in 2016. Those long-term clients received $4.6 billion in financing, while last year the clients surveyed who got underway in 2015 had received $5.6 billion in financing. She could not break down that financing by categories like banks and non-banks.

Discussing those surveys, Ettenson offers some details. “If you talk to us for two minutes, we don’t consider you a client,” she emphasizes. The SBDC definition of what constitutes a client calls for at least one hour of one-to-one consulting or at least one two- hour training session, she says. The organization defines “touches” as people with less exposure, such as those who call on the phone with a question.

When an SBDC client needs funding, officials at the centers have no qualms about including alternative funders in their recommendations to clients who are seeking funds, says Ettenson. “We don’t exclude anybody in any way, shape or form unless there’s some reason to think they’re fraudulent,” she notes.

But malfeasance isn’t the worry it once was, Ettenson asserts, noting that alternative funders have gained credibility in the last five or so years as they began policing their own industry. “They’ve learned to keep track of who’s in their space and how they’re operating,” she says.

Alternative financing has established a niche that benefits small-business people who know how to use it, Ettenson maintains. “They understand that they’re borrowing money for a short period of time and it’s going to cost you a fair amount,” she says. “It’s a short-term bridge to get to whatever your goal is.” Merchants seeking funders should learn the differences among alternative funders—whom she says all operate a little differently from each other—to choose their best option.

And opportunity for alternative funders may abound at the centers in the near future. Nye cites the two biggest goals for his centers as new business starts and capital infusion. Center advisors help develop business plans that aid clients in obtaining financing, he says. Last year, his region received a little over $4 million from the SBA and used it to help start 365 new businesses and raise $148 million in capital infusions. Those efforts created 1,700 jobs, he says.

OnDeck Expands Canadian Business with Merger

December 5, 2018 OnDeck announced today that it has entered into an agreement to merge its Toronto-based Canadian business with Evolocity Financial Group (Evolocity), an online small business funder headquartered in Montreal. OnDeck will have majority ownership of Evolocity and the combined entity will be rebranded as OnDeck Canada.

OnDeck announced today that it has entered into an agreement to merge its Toronto-based Canadian business with Evolocity Financial Group (Evolocity), an online small business funder headquartered in Montreal. OnDeck will have majority ownership of Evolocity and the combined entity will be rebranded as OnDeck Canada.

“The combination of OnDeck’s Canadian operations with Evolocity will create a leading online platform for small business financing throughout Canada and represents a significant investment in the Canadian market,” said Noah Breslow, Chairman and CEO of OnDeck. “There is an enormous need among underserved Canadian small businesses to access capital quickly and easily online.“

According to the announcement, “the transaction will combine the direct sales, operations, and local underwriting expertise of the Evolocity team with the marketing and business development capabilities of the OnDeck team.”

As part of the merger, Neil Wechsler, who is the CEO of Evolocity, will become the CEO of OnDeck Canada. And the management team will include Evolocity co-founders David Souaid as Chief Revenue Officer and Harley Greenspoon as Chief Operating Officer. OnDeck Canada will be governed by a Board of Directors chaired by Breslow and composed of existing OnDeck and Evolocity management.

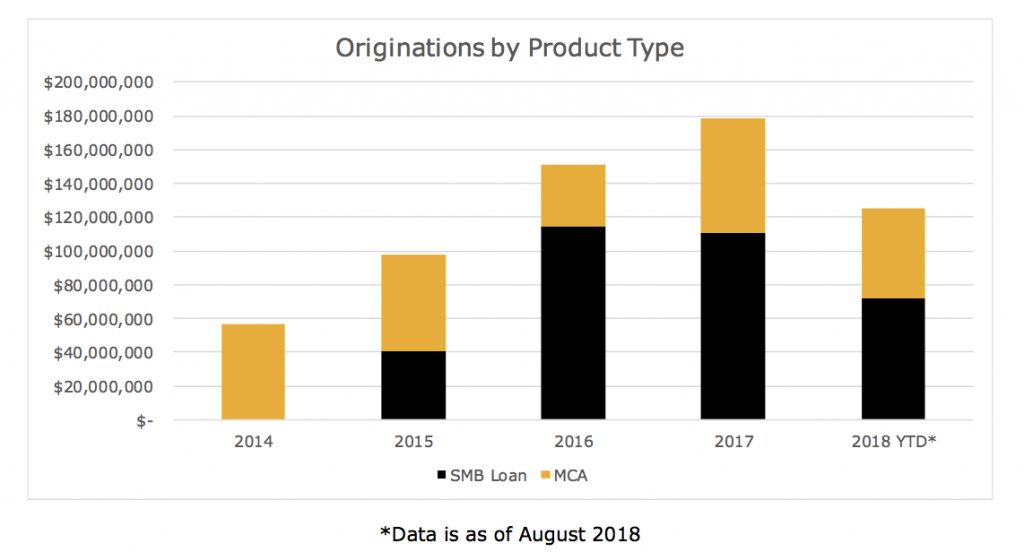

Currently, OnDeck offers a variety of loans up to $500,000 and lines of credit up to $100,000. Evolocity offers small business loans and an MCA product, from $10,000 to $300,000. deBanked inquired with OnDeck to see if OnDeck Canada will retain the MCA product from Evolocity, but has yet to hear back. Since OnDeck entered the Canadian market in 2014, it has originated over CAD $200 million in online small business loans there. Evolocity has provided over CAD $240 million of financing to Canadian small businesses since 2010.

Currently, OnDeck offers a variety of loans up to $500,000 and lines of credit up to $100,000. Evolocity offers small business loans and an MCA product, from $10,000 to $300,000. deBanked inquired with OnDeck to see if OnDeck Canada will retain the MCA product from Evolocity, but has yet to hear back. Since OnDeck entered the Canadian market in 2014, it has originated over CAD $200 million in online small business loans there. Evolocity has provided over CAD $240 million of financing to Canadian small businesses since 2010.

Investment in online small business lending in Canada is growing. IOU Financial, a Montreal-based small business funder that primarily funds American small businesses, told deBanked last month that they made a concerted marketing effort in the third quarter to reach Canadian small business owners. Meanwhile, Thinking Capital, a Canadian online small business funder, announced in July the launch of BillMarket, a service that provides Canadian small businesses with a credit grade (A through E), making it easier for them to get funded.

“BillMarket represents a cash flow revolution for the Canadian small business market,” said Jeff Mitelman, CEO of Thinking Capital, which has roughly 200 employees between its Toronto and Montreal offices.

According to a recent Canadian government report cited by OnDeck in its announcement today, there are 1.14 million small businesses in Canada that represent 97.9 percent of all businesses in the country. Also, small businesses employed over 8.2 million people in Canada, or 70.5 percent of the total private workforce.

According to a recent Canadian government report cited by OnDeck in its announcement today, there are 1.14 million small businesses in Canada that represent 97.9 percent of all businesses in the country. Also, small businesses employed over 8.2 million people in Canada, or 70.5 percent of the total private workforce.

Evan Marmott, founder of Canadian small business funder, Canacap, told deBanked earlier this year that unlike the saturated small business market in the U.S., the Canadian small business market is still ripe for growth. Not only this, he said that while the market is smaller in Canada, the default rates are generally lower and he found that Canadian merchants do less shopping around. He also said he has seen less fraud in Canada than in the U.S.

“For brokers, while commissions are lower, you could actually speak to business owners who are not being bombarded with calls [as they are in the U.S.] and have a much higher closing rate,” Marmott said.

Evolocity has 70 full-time employees and offices in Montreal, Vancouver and Marham, in the Toronto area. OnDeck has funded over $10 billion to small businesses and became a public company (NYSE: ONDK) in 2014. OnDeck is headquartered in New York.

“We are excited to join forces with OnDeck…to enhance our best in class digital financing solutions to small businesses across Canada,” said Wechsler, Evolocity CEO. “Additionally, this transaction will augment our data science and analytics capabilities to help deliver an unparalleled merchant experience.”

Popular Business-Lending Marketplace Dealstruck Restructures

December 3, 2018VALLEY STREAM, N.Y., Dec. 3, 2018 — Innovative online business-lending marketplace Dealstruck.com (which has been featured in CNBC, The New York Times, Forbes and many other publications) has reorganized. A private investment group of fintech experts acquired the company. “This acquisition represents a significant strategic opportunity for our client base,” said Dealstruck CEO Anthony Porrata.

Dealstruck is a leader in the alternative lending space. The company provides small and medium-sized business owners with seamless access to capital. Advances in technology make the process quick and efficient with minimal paperwork.

During the restructuring process, the company paused providing loans. “Recently, many people have asked, ‘What happened to Dealstruck?’ There were rumors that Dealstruck shut down but that was not true,” noted Porrata. “We’re happy to announce the Dealstruck news that a group of private investors has created a new ownership coalition that is leading a bold evolution for the company.” The new investment group combines a portfolio of existing small business capital providers with the highest technological advances in the field of online business loans.

Company leaders expect the change will help small businesses immensely. “Clients will see quicker approval turnarounds and a more streamlined process,” said Porrata. “This will also help clients who would not otherwise have equal access to growth opportunities.”

Vice President Chris Jones expects small business owners will be excited about the Dealstruck news. “This restructuring will allow us to approve more clients than ever before,” he smiled. “I’m looking forward to joining many new business ribbon-cutting ceremonies. Nothing gives us more pride than a grand opening.”

The reorganization allows Dealstruck to expand its mission while maintaining the personalized service that makes it so well known. The new management team has access to more capital and creative financing terms for Dealstruck clients.

About Dealstruck: As a leading online capital facilitator, Dealstruck connects small and medium-sized businesses with access to a variety of working capital options. These options help business owners find custom-tailored loans, so they can better manage their time and achieve their goals. For more information, visit dealstruck.com.

Contact:

Anthony Porrata – CEO

855-610-5626

info@dealstruck.com

What We Learned About Credibly From Credibly’s Securitization

November 29, 2018Today, Credibly CEO Ryan Rosett told deBanked that the company’s October securitization will be used, in part, to roll out its new Market Expansion Product (MXP), which will allow Credibly to service merchants with FICO scores as low as 500 and those that have been in business for less time.

“We believe the MXP will open up the funnel by allowing us to serve business owners that we previously couldn’t,” Rosett said.

Kroll Bond Rating Agency assigned preliminary ratings to three classes of notes as part of Credibly’s first securitization. Rosett said this securitization follows a large warehouse line of credit from SunTrust Bank which is also the primary underwriter, of the securitization.

In addition to the new MXP product, Rosett said that Credibly intends to launch a line of credit product in 2019. Currently, Credibly provides merchant cash advances up to $150,000, business expansion loans up to $250,000, with terms up to 24 months, and working capital loans up to $250,000 with terms up to 17 months. Rosett said that the company’s working capital loan is its most popular product.

In an interview yesterday with Benzinga, Rosett said that he has seen a strong increase in demand for Credibly’s products and that they are currently evaluating over 10,000 applications per month.

2017 net revenue before provisions: $33 million

2017 earnings: $1.4 million

Total shareholder equity: $18.7 million

Lifetime funding volume: $700+ million

Raw # of fundings: 17,000+

Majority owned by: Flexpoint Ford

# of employees: 140

Notable deal: Acquired the rights to service BizFi’s $250 million MCA portfolio in August 2017

Provides: Small business loans (in 37 states and D.C.) and merchant cash advances

Founded: 2010 by co-CEOs Edan King and Ryan Rosett

Generates deals via: Brokers and inside sales

Patriot Bank Expands SBA Lending

November 28, 2018 Connecticut-based Patriot Bank announced today the overall expansion of its small business lending operation. At the beginning of the month, it added to it board of directors Brent Ciurlino, a former SBA official who served as Director of the Office of Credit Risk Management for the SBA. There, he supervised the $105 billion SBA 7(a) and 504 loan debenture and portfolio programs.

Connecticut-based Patriot Bank announced today the overall expansion of its small business lending operation. At the beginning of the month, it added to it board of directors Brent Ciurlino, a former SBA official who served as Director of the Office of Credit Risk Management for the SBA. There, he supervised the $105 billion SBA 7(a) and 504 loan debenture and portfolio programs.

“As a banking executive and former federal regulator overseeing small business loan programs, Brent brings substantial expertise and value that will benefit Patriot Bank, its customers and its shareholders,” said Michael Carrazza, chairman and CEO of the bank. “As we build our small-business lending portfolio and look ahead to the goals we have set, Brent’s active involvement will bring a heightened dimension of operational, regulatory and risk management oversight.”

Patriot Bank became an approved SBA lender at the end of 2017, obtained “preferred lender” status with the SBA in September, and is currently opening SBA Business Development offices in the southeast, according to a story on the bank’s website. Additionally, according to the story, the bank signed a definitive purchase agreement in February of this year with Hana Small Business Lending Inc. for its $490 million SBA portfolio. Carrazza said at the time that this would help the bank become one of the country’s leading SBA 7(a) lenders.

Patriot Bank’s Director of SBA Lending Kevin Ferryman, himself a new hire this year, said that the bank’s goal is to enhance its traditional lending programs.

“We’re in a position now where we can approve loans for a lot more customers than we could do with our own internal policies,” he said.

Ferryman also acknowledged that having “preferred lender” status with the SBA allows the bank to process, close and service most SBA-guaranteed loans without prior SBA review.

“As a result, entrepreneurs and small community businesses can obtain their loans more quickly and efficiently,” Ferryman said.

Founded in 1994, Patriot Bank is a consumer and commercial bank with branches in affluent communities in Connecticut and one in Scarsdale, NY.

IOU Partners with FINSYNC to Fuel Growth

November 27, 2018 Montreal-based IOU Financial announced yesterday that it is partnering with FINSYNC in an effort to improve their customers’ experience and broaden access to new customers. FINSYNC is a cash flow management software and platform that allows businesses to collect income, pay bills, process payroll, automate accounting, and access financing through FINSYNC’s Lending Network.

Montreal-based IOU Financial announced yesterday that it is partnering with FINSYNC in an effort to improve their customers’ experience and broaden access to new customers. FINSYNC is a cash flow management software and platform that allows businesses to collect income, pay bills, process payroll, automate accounting, and access financing through FINSYNC’s Lending Network.

“FINSYNC’s innovative cash flow management solution helps business owners better assess the opportunity to access working capital based on past and projected cash flow,” said Christophe Choquart, VP of Strategic Partnerships at IOU Financial. “This is a totally new way to [support] growing businesses.”

FINSYNC provides almost all financing-related services except for the actual financing. According to its website, FINSYNC has partnerships with a number of other alternative funders, including OnDeck, Breakout Capital, BFS Capital and The Business Backer.

“This partnership greatly enhances the convenience of applying for working capital,” said Robert Gloer, President and COO of IOU Financial. “It gives merchants insight into what a cash infusion would look like [before they take out a loan.”

Through this partnership, IOU Financial’s marketing efforts will introduce potential merchants to FINSYNC’s payment, payroll and accounting services, while FINSYNC will offer IOU Financial an enhanced user experience, according to IOU Financial CEO Philip Marleau. He said that, for now, neither company is exchanging money with one another. It is purely a mutually beneficial partnership.

IOU Financial offers business loans of up to $300,000 to small business merchants in the U.S. and Canada. The company, which is traded publicly on the Toronto Stock Exchange, had a strong third quarter, with $36.1 million in originations, an 85% increase from the prior year. The lender’s average loan is $100,000 with a 12 month term, although they do offer terms up to 18 months.

Founded in 2009 by Gloer and CEO Phil Marleau, the company also has an office in Atlanta and has a total of about 40 employees.

SBA Loans Increase Slightly in 2018

November 26, 2018SBA total loan volume exceeded $30 billion with more than 72,000 approved loans for FY18 (October 1, 2017 through September 30, 2018), according to the SBA. The total volume is about the same as last year and there were approximately 4,000 more SBA loans issued this year compared to FY17.

Of the 72,000 SBA loans approved this year, 60,353 of them were 7(a) loans, totaling $25.37 billion. And 5,874 of the loans were 504 loans, totaling over $4.75 billion. This year, the SBA launched the 25-year Debenture, which offers an additional 60 months of financing at a fixed rate for small businesses. Since its introduction in April, over 1,000 debentures had been sold in FY18.

“The 25-year Debenture is designed to help free up cash flow and offer fixed rates in a rising interest rate environment for 504 borrowers and we are pleased to see over $1 billion has been disbursed in less than six months,” Associate Administrator for SBA’s Office of Capital Access William Manger said.

In FY18, there was notable growth in the SBA’s Microloan and Community Advantage Programs. In particular, over 5,000 loans were approved for over $72 million in the Microloan program and over 1,000 loans were approved for over $150 million in the SBA Community Advantage program.

Study Shows Small Business Loan Demand Highest Since 2012

November 26, 2018 A study released today reveals that American small businesses are eager to take business loans, with 48% planning to take out a loan in the next year, the highest level of demand since 2012. The study, called “Gimme Credit: Faster, Simpler, Safer Credit Main Street America,” was conducted by PayNet, which provides small business credit data, and Raddon, a research provider to financial institutions.

A study released today reveals that American small businesses are eager to take business loans, with 48% planning to take out a loan in the next year, the highest level of demand since 2012. The study, called “Gimme Credit: Faster, Simpler, Safer Credit Main Street America,” was conducted by PayNet, which provides small business credit data, and Raddon, a research provider to financial institutions.

According to the study, almost 65% of small businesses anticipate an increase in sales, the highest percentage in over 14 years. And 43% of small businesses have overall confidence in the economy.

“Small businesses are in full-on growth mode,” said PayNet President William Phelan. “They’re looking to banking partners for reasonable capital infusions, but are discouraged by slow reviews, impersonal processes and denials. This creates a huge opportunity for nimble community banks, credit unions, and alternative lenders to fill the void.”

Already, some larger banks like Chase and PNC have partnered with OnDeck’s ODX to enhance speed and fill this void.

Still, small business loan demand is often met with uncertainty from banks that remain wary of lending to small businesses in the wake of the financial crisis, according to the study. But Bill Handel, Chief Economist at Raddon, believes that lenders can change their ways, while still being fiscally responsible.

“It’s a recurring cycle,” Handel said. “Cumbersome underwriting practices increase the likelihood that lenders are either unwilling or unable to extend favorable terms to small businesses, which in turn discourages applications. Fortunately, lenders can take steps to improve their efficiency and profitability in this area.”

What are some of these steps? The study recommends the following:

- Segment applications by loan request size and reviews by loan risk profile.

- Deploy technology to assist in preparing applications, collecting data, and analyzing the business/loan.

- Optimize procedures by leveraging industry intelligence to improve their “decision engines.”