technology

Getting Your Reps to Perform at the Ultimate Level? This ISO is Using AI to Train Them

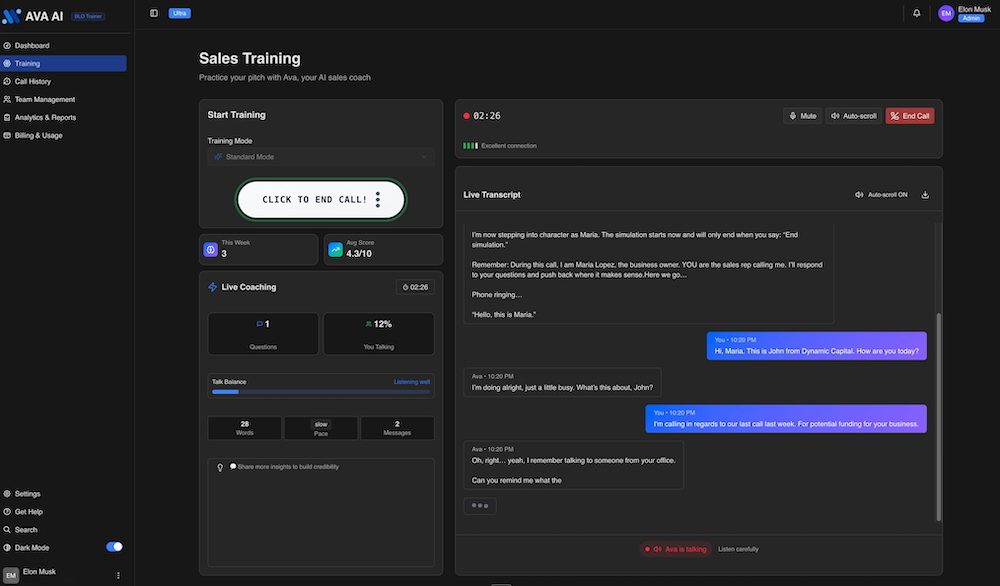

February 2, 2026“I‘m unable to get 80, 90 guys to work in the area that I am in so I have to actually max out the team that I have,” says Steven Edisis, CEO of Dynamic Capital. “So my whole thing is onboarding guys and getting them to perform at the ultimate level.”

Edisis says that training small business finance sales reps takes extreme discipline, hours and hours of manual training. Training in the morning. Training in the afternoon. Training at night. Training and then some more training. Some of that training involves roleplaying. Other times it’s live calls. In either case, he’s found there are weaknesses in those systems. For instance, in a roleplay, the trainer has to contend with maintaining rapport with the individual they’re training. Persistent unfavorable feedback, even if warranted, could actually be demoralizing and create tension in the relationship.

“When you’re roleplaying with your buddy, your buddy’s a human,” Edisis says. “After two or three or four times of them getting it wrong, do you just stop correcting it? And you let it go.”

The end result is that they’re not actually in top shape and ready for calls, but they could be deceived into thinking that they are. Meanwhile, live-call training presents another dilemma. If you give the trainee good leads and they mess up, are the good leads wasted? And if you give them really cheap leads and they don’t get anywhere with them, how are they supposed to be judged or learn from it?

For Dynamic Capital, the solution to all of the above has been AI. About a year ago, Edisis began using an AI agent called Ava, a product by Reech AI that’s led by CEO Liran Weissenberg. Ava does for Dynamic Capital what Edisis did for a long time, trains, but on steroids. Trainees, experienced reps, and even veteran pros at the game can roleplay with Ava, a voice AI, in any setup of circumstances they choose. It can be a straight-up cold call, a warm lead, or a follow-up, for example. It can be tuned to easy mode, regular mode, hard mode, or even impossible mode. The best part is that Ava knows how to play the role of a merchant, speaks in real time, and speaks with human-believable tones and emotions. Voice AI technology, once considered clunky or plagued by latency in years past, has finally become virtually indiscernible from a real person.

In a live demo performed for deBanked to show it in action, the AI answered the phone and Edisis went right into the normal flow of business.

“This is Steven with Dynamic Capital. Last week you went online, requested some information for some working capital for your business, how are you today?”

“I’m ok, just a little busy right now,” Ava responded somewhat suspiciously. “yeah, I remember poking around online. I put in my info but I never really got a clear idea what you guys actually do.”

From there, Edisis played it out to a conclusion. When it was over, Ava rated him on his performance, gave him a score, and shared what he did well, as well as things he could have done better. It seemed to understand the relevance of open balances a merchant might have with loans or MCAs, which is key to making it impactful. Ava’s an AI, so a trainee would not be able to attribute the constructive criticism it offered to being singled out or picked on. For instance, if the AI said the trainee needed to work on tone and pacing of speech, there’s no way for the trainee to attribute that to personal bias from a trainer.

“The cool thing is that we can model the AI to behave in very specific scenarios and to have very specific analysis,” said Weissenberg of Reech AI, who created Ava.

Meanwhile, no real leads were wasted in the process. This is especially valuable since Edisis says that he teaches a specific technique—or rather, an art—called the interruption, a very delicate tactic used to keep a call on track. But it only works if delivered correctly, because it involves literally interrupting the prospect while they’re speaking. Learning how to interrupt in the circumstances that call for it is a massive gamble that could not only lead to lost sales revenue but also negative customer feedback if executed poorly. This is a perfect example of where AI training comes into play.

“It’s really nice to [practice it] on Ava versus blowing up and getting negative reviews from a live person,” Edisis said. “So that’s a really cool way that I can train people.”

Weissenberg said that when Ava is being used across a whole sales floor, a sales manager can view transcripts of all the calls, along with feedback and analytics. One could literally have a full-on simulated call center where all the prospects are AI agents being used to train reps.

“The coolest thing about the app is the analytics,” Weissenberg said. “It’s only going to get better too because AI is getting smarter and it’s getting more human.”

“On top of [new trainees], my other guys over the years—some have been here up to ten years—every once in a while they get a little rusty, revert back to bad habits, etc.,” Edisis said. “This allows me to keep them honest. And when some new person comes to me and tells me my leads are bad, I say, “let’s go to Ava… you tell me your pitch, I’ll do the same pitch.”

If Edisis significantly outscores them, it becomes evident that lead quality isn’t the issue, but rather all the other factors that go into having a successful call.

“It keeps some honesty between the program and reality,” he said.

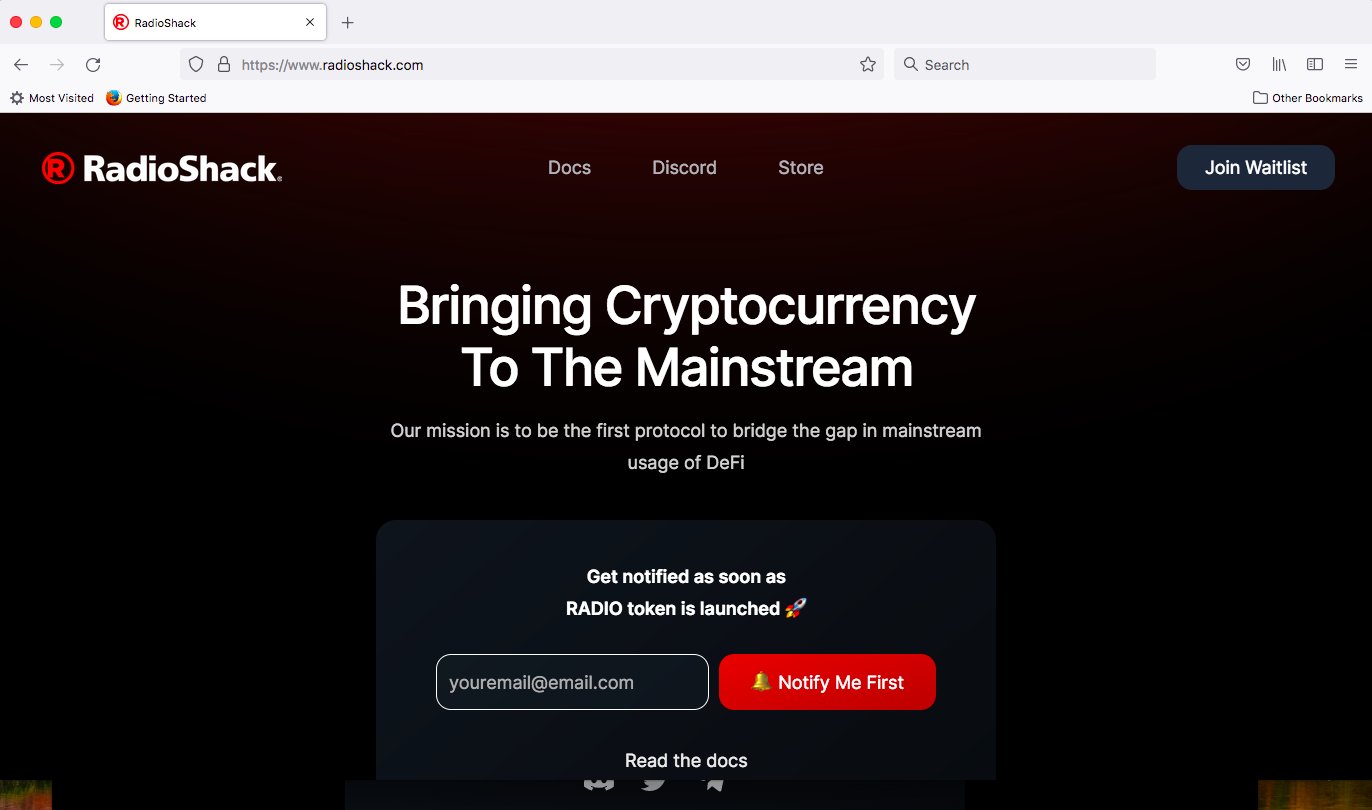

RadioShack is Launching a Crypto Swap

December 19, 2021 If you had RadioShack on your 2021 DeFi bingo card, congratulations, you’ve won. The company announced that its “mission is to be the first protocol to bridge the gap in mainstream usage of DeFi” and it plans to do this, apparently, by launching a swap.

If you had RadioShack on your 2021 DeFi bingo card, congratulations, you’ve won. The company announced that its “mission is to be the first protocol to bridge the gap in mainstream usage of DeFi” and it plans to do this, apparently, by launching a swap.

RadioShack wants to compete with the likes of Uniswap, a smart-contract-based crypto exchange where users can “swap” tokens without having to register on a formal exchange like Coinbase.

The business is a gold mine, according to RadioShack.

“The concept of a swap stands out first and foremost as the place of low-hanging fruit – fruit that is spinning off incredible levels of net profit,” the company said. “Profit not just from speculation like Bitcoin or other cryptocurrencies, but ones born out of trading fees. Some existing swaps like Uniswap or Sushiswap reportedly are doing $1-$7 million net profit per day! They are the current profitable forces of nature in the DeFi world.”

Use of a “swap” is how tokens issued by the ConstitutionDAO crowdfunding saga leaked out into the publicly tradeable marketplace, for example. What was supposed to be a “governance token” to vote on where a copy of the United States Constitution would be held, instead turned into a tradeable novelty asset (like pogs or baseball cards) with a soaring value, all because of decentralized swapping. More than $100 million worth of the novelty governance tokens stemming from the failed bid to buy the Constitution were traded just in the last 24 hours alone, according to Coinmarketcap.com.

“RadioShack DeFi is focused on the early majority,” the company said. “It will become the first to market with a 100 year old brand name that’s recognized in virtually all 190+ countries in the world.”

Study Finds Fintech Puts Customer Rentention on the Clock with Biometrics

October 21, 2021 Onfido and Okta, a verification authenticity company and an independent identity provider, respectively, found that consumer-based businesses —regardless of industry—need to earn their customer’s trust in no longer than ten minutes or risk losing their business altogether.

Onfido and Okta, a verification authenticity company and an independent identity provider, respectively, found that consumer-based businesses —regardless of industry—need to earn their customer’s trust in no longer than ten minutes or risk losing their business altogether.

According to the report, 65% of customers who want to open a bank account want the process to be less than ten minutes, 69% when booking a car rental, 72% when opening a telemedicine account, and 77% when registering a gaming account, among other industries.

“From the moment a consumer visits a service provider’s website or downloads an app, they’re evaluating whether the business can deliver a trusted digital service, providing security and keeping their data private,” says Mike Tuchen, CEO of Onfido. “Businesses have just minutes to establish the confidence that consumers expect in the digital world. Those that can offer low or zero friction during verification and authentication will positively differentiate themselves in a market where digital services have become the norm and consumer trust breeds brand loyalty.”

After surveying 5,000 consumers from across the United States and Europe, the companies found that the moment the onboarding process begins in a virtual space, customers aren’t looking to spend much time putting information into a database to complete their transaction. The study found that customers felt that brands should know and trust them, while also having a strong desire for a seamless verification process rather than a fraud-preventing rigorous one.

Half of consumers expect that it should take less than three minutes to approve a banking transaction (49%) or place a bet (48%), and approximately 1 in 3 (35%) consumers believe it should take the same time to fill prescriptions.

Those consumers that were evaluated also desired to have companies recognize them on multiple devices, which just a third of responses claimed businesses currently do. 70% of customers claimed they “suffered” from a lack of an efficient digital process in a business transaction. Biometrics, according to the study, will be a way to solve these inefficiencies in the authentication and transactional software space.

In a blog post that accompanied the release, Onfido broke down the confidence that consumers have in Biometrics in the marketplace. According to them, 80% of customers have confidence in both the convenience and security of Biometrics.

“Let’s say you’ve verified an identity document. You need Onfido’s biometric technology to verify that the document truly belongs to the person making the transaction. So biometrics adds a layer of protection against stolen IDs and impersonation attacks,” the blog reads.

“Ensuring that digital account onboarding and access meets users’ expectations for speed, experience and security will require many businesses to reassess their identity platform requirements,” says Ben King, Regional Chief Security Officer, Okta. With biometric recognition putting identity at the heart of the authentication process to offer a robust yet seamless experience across any and every device, it is little surprise that consumers worldwide are increasingly opting for it in place of traditional passwords or in-branch verification checks.”

Google to Purchase Manhattan Building in Mega Deal

September 21, 2021 In the footsteps of other giant companies like Facebook and Amazon, it seems that Google has joined in on buying a tremendous piece of New York City office space, as Google’s parent company Alphabet has announced a tentative $2.1 billion deal Tuesday to purchase the building they already lease.

In the footsteps of other giant companies like Facebook and Amazon, it seems that Google has joined in on buying a tremendous piece of New York City office space, as Google’s parent company Alphabet has announced a tentative $2.1 billion deal Tuesday to purchase the building they already lease.

Under extensive renovations, Google plans on making a 1.7 million square foot community of office space by adding the former freight terminal to their New York offices— competing with some of the biggest names and workspaces in the city.

Google will remain in complete control of two other office spaces in Soho and Greenwich Village in conjunction with the new acquisition on the Hudson. The combination of these three offices will create a campus-esque environment for the tech giant. All the offices are within about a mile radius of one another.

First reported by the Wall Street Journal, the purchase is New York’s largest single office building sale since pre-pandemic days, while also being one of the biggest purchases in New York City commercial real estate history.

As smaller fintech companies are seemingly leaving the city in droves, it is the big players in the industry who are looking to stick around and ride out Manhattan’s post-pandemic and remote work woes.

It seems that Google, along with the other tech giants, are expecting a large in-person working environment to return to New York. According to CEO Sundar Pichai in an announcement on Google’s blog from August 31, the company plans on keeping remote work an option for all employees until January 10. After that, they are leaving it up to local officials to dictate if employees can be asked to return in person.

“To make sure everyone has ample time to plan, [employees will] have a 30-day heads-up before [they’re] expected back in the office,” Pichai wrote.

With Facebook’s acquisition of office space at Penn Station and Amazon’s purchase of Lord and Taylor’s former 5th Avenue landmark building, Google is late to the Manhattan real estate grab. These giants are paying top dollar for these spaces, as eight-figure real estate deals are status quo for a city that is littered with empty storefronts and a questionable future for many of its longtime tenants.

Google has a track record of building a presence in New York. An east coast presence is nothing new for the company. “Our investment in New York is a huge part of our commitment to grow and invest in U.S. facilities, offices and jobs,” wrote SVP and CFO Ruth Porat on a Google Blog back in 2018 when the lease agreement for the building was made.

Earlier this year, the company committed to a $150 million investment in New York workspaces.

Google’s new offices will serve as the main hub of their New York City offices. As the new year arrives, Google expects to see 1/5 its workforce still remote. With their new offices already functioning, the new office should complete the Google campus in 2023.

It seems that Silicon Valley’s presence may be creeping East as the finance industry continues to head South. With the price of commercial real estate sky high, the reputation for the city at a low, and a political climate that is creeping its way into business, it seems as if New York may be evolving into the East Coast Silicon Valley hub.

Snapchat Acquired Mobile Shopping App Founded By Former MCA Execs

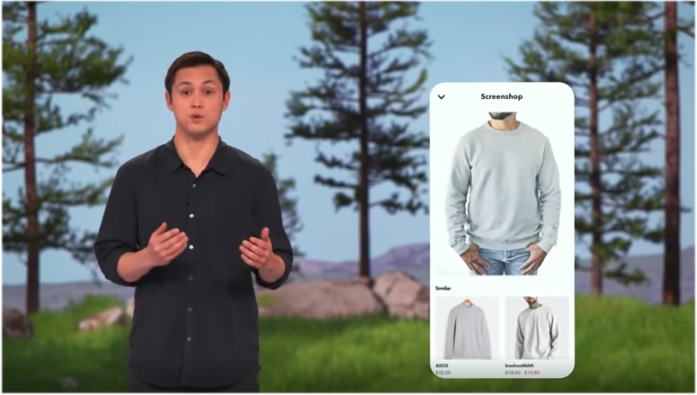

July 2, 2021 A brother and sister team formerly known throughout the merchant cash advance industry have achieved major success in another market altogether, mobile shopping.

A brother and sister team formerly known throughout the merchant cash advance industry have achieved major success in another market altogether, mobile shopping.

Recently, their app was acquired by Snapchat, according to various news outlets, and the tech has since been integrated into the Snapchat app.

Molly and Meir Hurwitz, both original stalwarts of the old Pearl Capital in New York, co-founded Screenshop in 2017, an app that integrated shopping with fashion and social media. Its initial launch received added buzz thanks to Kim Kardashian’s early involvement as an advisor. Notably, Screenshop CEO Mark Fishman was previously a Risk Manager at Pearl Capital, rounding out the former MCA crew.

“We’re No. 5 on the app store category of fashion,” Meir Hurwitz told deBanked in November 2017. “We’re just getting started.”

The success continued.

“Screenshop gives shopping recommendations from hundreds of brands when you Scan a friend’s outfit,” Snapchat wrote in a published announcement this past May.

More than 170 million Snapchatters use scan features every month, the company revealed.

“Screenshop is now a part of ‘Scan’ said Snapchat CTO Bobby Murphy during the company’s annual Partner Summit broadcast on May 20. The above screenshot is of Murphy demonstrating the Screenshop technology.

Ocrolus Named #1 Fastest Growing Fintech By Inc.

September 1, 2020 Ocrolus, a document analytics company, was recently named Inc.’s #1 fastest growing fintech company in the US and #1 fastest growing software company in NYC. The rating is based on percentage revenue growth between 2016 and 2019. Ocrolus placed as the #30 fastest-growing private company in America overall.

Ocrolus, a document analytics company, was recently named Inc.’s #1 fastest growing fintech company in the US and #1 fastest growing software company in NYC. The rating is based on percentage revenue growth between 2016 and 2019. Ocrolus placed as the #30 fastest-growing private company in America overall.

Ocrolus was founded in 2014 and has grown by 8,000% to become an industry-leading document scanning platform. Automating document applications for partners like BlueVine, Cross River, and Square, Ocrolus recently facilitated 761,455 small business applications for PPP loans.

So what sets Ocrolus apart? CEO and Co-Founder Sam Bobley credits the growth factor on just how fast and accurate the Ocrous API is.

“Lenders who were not using Ocrolus were not able to get to underwriting decisions as fast as lenders that were using Ocrolus- we saw a domino effect,” Bobley said. “Once we got a few big consumers on the platform, we were able to quickly onboard more and more funders and help them increase speed in their underwriting process.”

Bobley also said that while competitor document applications struggle with the accuracy at which they can read documents, landing somewhere in the 70-85% accuracy area, Ocrolus boasts more than 99% accuracy.

Success snowballed, and Ocrolus was helping grow businesses. The API directly addresses many financial institutions’ problems with scale- typically, more applications require more manpower to sift through paperwork.

“Typically, when a customer starts using our platform, within one year of using our platform, they double their volume, and within two years they quadruple,” Bobley said. “One of the reasons for that is they no longer have to staff up and deal with the operational complexities of handling the fluctuating volume of loans.”

With Ocrolus plugged in, customers were free from a major operating cost, and could go all out taking on new clients- which would mean more paperwork to process with Ocrolus.

Today, the company employs more than 900 team members across four offices but was founded in New York City. And like Seinfeld, Bobley loves the city, especially as a thriving hub for fintech activity.

“There’s no better place to do it than in the heart of the financial center of the US here in New York City,” Bobley said. “We’re right near where a lot of our lender customers are operating.”

On the news of recent acquisitions and reports that companies like PayPal and Intuit are ramping up their involvement in small business lending, Bobley said he sees larger entities in fintech as an opportunity for pricing transparency and better access to capital.

“I think the headline here is that financial services firms are recognizing that there’s a significant amount of businesses that used to be underserved,” Bobley said. “The bigger players are raising their eyebrows and want to get more involved, which in my opinion will be ultimately good for small business.”

And when it came time for Ocrolus to do its part for small business, Bobley said that more than 430,000 PPP applications of the 761,455 that were made using their partner network got approved, saving an estimated 1.5 million jobs.

“It’s always great when you know you can connect your work to a greater purpose for the community, so it’s really just a cool rewarding experience,” Bobley said. “It’s been fantastic, but we think we’re still in the early innings in terms of what we can do as a company- not just in small business lending but also in consumer mortgage and auto.”

Open Banking: Canada Might Not Be Able to Make Up for Lost Time

January 22, 2020

Over the last two years, open banking has become a matter of public conversation in Canada. Most would agree there is overwhelming support for the implementation of an open banking regime. So why has nothing concrete happened yet?

2019 turned out to be an exciting, yet painfully underwhelming year for open banking in Canada. The news media finally caught on to the movement and started publishing stories on the rise of robo-advisor apps, or how small and medium-sized businesses would be impacted, and so forth. Experts and industry leaders pitched in with a massive volume of op-eds, most of which were in support of open banking, and with many deploring Canada’s slowness. Some came to our podcast to discuss their perspective (spoiler: customer-centricity is a very big theme.)

Another telling sign of the importance of open banking is the fact that at the federal level, both the legislative and executive arms of the government have become actively engaged in the public conversation. The Senate of Canada’s committee on Banking, Trade and Commerce produced a well-researched report — perhaps the most valuable contribution to the conversation. This report calls for swift action on the part of the federal government to advance a regulatory framework for open banking. In parallel, the Department of Finance’s appointed advisory committee on open banking held a consultation with key stakeholders and should publish its own report in the near future.

Even to a casual observer, there was an obvious sense that Canada is ready to embrace open banking.

But here’s the thing: despite all this work and evidence of widespread support, Canada didn’t move the needle on open banking in any concrete way.

Who’s leading?

The UK has already implemented a comprehensive open banking regime, and continental Europe is close behind. Dozens more countries are working toward their own versions. Among the various geographies moving in this direction, some are opting for a government-led approach, the UK probably being the best example. Others, like the US, tend to be more market-driven. In Canada, the main stakeholders are still largely hesitant about where to strike the balance between the two approaches — and the result is that so far, both have failed to provide the leadership that would allow open banking to move forward.

The Department of Finance’s advisory committee was tasked to study the “merits of open banking”. This line of inquiry feels very old, and for good reason: to question whether we should have open banking or not is a false debate, and a time-wasting rabbit hole. The real question Canada should be asking itself when it comes to open banking is, “what is the objective we want to achieve here?”

Let’s take a few steps back to realize just how important this question is.

The UK had a very clear vision for their open banking regime. The Competition and Markets Authority had assessed that the oligopolistic dynamics of the banking sector were putting consumers at a disadvantage. Thus, the UK set on their open banking journey with a very precise objective in mind: make it easier for consumers to switch providers. While some take great pride in criticizing the UK’s implementation — stating that its objective was either wrong, too narrow, or poorly executed — the fact remains that they are ahead of the pack. And the UK’s leadership in this area still persists, with the Financial Conduct Authority now studying the question of extending the current open banking regime into a holistic open finance regime.

Meanwhile, in Canada, the government is trying to wrap its head around the big questions, such as the liability framework that should be put in place for an open banking regime to be viable. (In other words, in a system where financial services are decentralized, how do we go about making the consumer whole when something goes wrong?) However, without a decision on what end state we are looking to achieve with open banking, these conversations are doomed to keep looking exactly like they’re looking now: a bunch of market actors with conflicting interests pretending they know what’s best for consumers. Conversations happening in industry groups aren’t much more productive, with the “trench war” dynamics being the trend there as well.

Meanwhile, in Canada, the government is trying to wrap its head around the big questions, such as the liability framework that should be put in place for an open banking regime to be viable. (In other words, in a system where financial services are decentralized, how do we go about making the consumer whole when something goes wrong?) However, without a decision on what end state we are looking to achieve with open banking, these conversations are doomed to keep looking exactly like they’re looking now: a bunch of market actors with conflicting interests pretending they know what’s best for consumers. Conversations happening in industry groups aren’t much more productive, with the “trench war” dynamics being the trend there as well.

The irony is that the technical aspects of open banking can be dealt with easily. From a technical standpoint, financial data-sharing APIs have proven their effectiveness, and coming up with a shared technical standard should not be too difficult. The real challenge is coming up with a framework everyone — incumbents and new entrants alike — can rally behind, something industry groups have largely been ineffective at.

Canada’s highly concentrated financial services sector is a stable one, but incumbents are not likely to open themselves up to disruption. This is the part where bold political leadership is required.

The clock is ticking

Data sharing is nevertheless picking up, as 4 million Canadians (and counting) have made fintech apps a part of their financial lives. Consumers and businesses who want the benefits of on-demand data sharing must rely on the current generation of financial aggregators, like Flinks. This system may work as a de facto connectivity layer, but the lack of standards results in a clumsy patchwork of bilateral deals between aggregators and banks. It just isn’t a viable way to achieve an open banking regime that levels the playing field when it comes to data portability.

In its report, the Senate’s Committee on Banking, Trade and Commerce states that Canada “risks falling behind” if it fails to implement open banking, and that “without swift action, Canada may become an importer of financial technology rather than an exporter.” It is true that if we keep delaying open banking, our slowness will prove to be a very stingy and lasting price to pay for the Canadian society; this is why we need bold action now. We can’t afford the comfort of waiting until we’ve figured out the 100% perfect solution.

There’s nothing like a real-world example: 2020 opened with a seismic shift when financial giant Visa acquired Plaid, one of the largest US financial aggregators, for over five billion USD. This is hinting at a new phase where markets will consolidate around a few large players; Canada can either ride the tide or get towed under.

It’s time to be bold

In the end, what needs to happen for Canada to move forward with open banking?

Our financial services sector can be compared to those of the UK and Australia, where a few powerful banks control a very large portion of the market. In those two countries, open banking was designed to stimulate competition, and government action was necessary to get things moving.

Right now, the question politicians ought to ask shouldn’t be if — or even how — but why. A why will pave the way and provide a natural direction to sort out the how. In 2019, discussions around open banking lacked this fundamental feature: political leadership centered on a bold, ambitious, consumer-centric mission statement. A why.

So here’s one for 2020: open banking will increase consumers’ choice when it comes to financial services. That would be a good start — and while good is not perfect, it still beats nothing by a landslide.

Amazon Says Browser Extension No Longer Secure, Just After PayPal Acquired It

January 13, 2020Last week Politico reporter Ryan Hutchins noted on Twitter that Amazon has been alerting its website users who had installed Honey that the browser extension is no longer safe. The extension, which searches the web for sales coupons for items in your checkout basket and automatically applies them, was recently acquired by PayPal for $4 billion. The deal was agreed upon in November and completed last week. According to Hutchins, such warnings have been viewed by Amazon customers since just before Christmas.

Amazon is telling shoppers that the browser extension Honey — it gives you coupon codes and other ways to save — is malware.

Paypal bought Honey in November for $4 billion. That’s one extensive piece of Malware. pic.twitter.com/Di6I8RAX2X

— Ryan Hutchins (@ryanhutchins) December 20, 2019

Having been compatible for years without any security warnings from Amazon, critics have now raised the question over whether this was intentionally done to level competition between the two tech giants. Honey makes a profit by charging retailers a percentage of the sales made with the coupons that it finds, and with this now under PayPal’s umbrella, Amazon may no longer be comfortable taking that hit. Especially when its own Amazon Assistant offers a similar experience.

Having been compatible for years without any security warnings from Amazon, critics have now raised the question over whether this was intentionally done to level competition between the two tech giants. Honey makes a profit by charging retailers a percentage of the sales made with the coupons that it finds, and with this now under PayPal’s umbrella, Amazon may no longer be comfortable taking that hit. Especially when its own Amazon Assistant offers a similar experience.

Speaking to The Verge, an Amazon spokesperson said that “Our goal is to warn customers about browser extensions that collect personal shopping data without their knowledge or consent.” A charge against Honey that did not seem to stick for Hutchins, who continued on Twitter with, “That’s how all browser extensions work – including Amazon’s own extension.”

During the summer, a security vulnerability was found in the browser extension only to be quickly patched. Following the coverage of this latest security warning, a Honey spokesperson stated to Wired that “We only use data in ways that directly benefit Honey members – helping people save money and time – and in ways they would expect … Our commitment is clearly spelled out in our privacy and security policy.”