technology

Amazon Says Browser Extension No Longer Secure, Just After PayPal Acquired It

January 13, 2020Last week Politico reporter Ryan Hutchins noted on Twitter that Amazon has been alerting its website users who had installed Honey that the browser extension is no longer safe. The extension, which searches the web for sales coupons for items in your checkout basket and automatically applies them, was recently acquired by PayPal for $4 billion. The deal was agreed upon in November and completed last week. According to Hutchins, such warnings have been viewed by Amazon customers since just before Christmas.

Amazon is telling shoppers that the browser extension Honey — it gives you coupon codes and other ways to save — is malware.

Paypal bought Honey in November for $4 billion. That’s one extensive piece of Malware. pic.twitter.com/Di6I8RAX2X

— Ryan Hutchins (@ryanhutchins) December 20, 2019

Having been compatible for years without any security warnings from Amazon, critics have now raised the question over whether this was intentionally done to level competition between the two tech giants. Honey makes a profit by charging retailers a percentage of the sales made with the coupons that it finds, and with this now under PayPal’s umbrella, Amazon may no longer be comfortable taking that hit. Especially when its own Amazon Assistant offers a similar experience.

Having been compatible for years without any security warnings from Amazon, critics have now raised the question over whether this was intentionally done to level competition between the two tech giants. Honey makes a profit by charging retailers a percentage of the sales made with the coupons that it finds, and with this now under PayPal’s umbrella, Amazon may no longer be comfortable taking that hit. Especially when its own Amazon Assistant offers a similar experience.

Speaking to The Verge, an Amazon spokesperson said that “Our goal is to warn customers about browser extensions that collect personal shopping data without their knowledge or consent.” A charge against Honey that did not seem to stick for Hutchins, who continued on Twitter with, “That’s how all browser extensions work – including Amazon’s own extension.”

During the summer, a security vulnerability was found in the browser extension only to be quickly patched. Following the coverage of this latest security warning, a Honey spokesperson stated to Wired that “We only use data in ways that directly benefit Honey members – helping people save money and time – and in ways they would expect … Our commitment is clearly spelled out in our privacy and security policy.”

Google to Begin Offering Checking Accounts in 2020

November 16, 2019 This week Google announced that it plans to offer checking accounts to customers in 2020. The news comes after the release of the Apple Card, Apple and Goldman Sach’s controversial joint project, in August; this week’s release of Facebook Pay; and the mass exodus by payments companies from Facebook’s Libra Association last month.

This week Google announced that it plans to offer checking accounts to customers in 2020. The news comes after the release of the Apple Card, Apple and Goldman Sach’s controversial joint project, in August; this week’s release of Facebook Pay; and the mass exodus by payments companies from Facebook’s Libra Association last month.

Titled as Google’s ‘Cache’ project, the accounts will be the result of a partnership between the tech giant and a selection of banks and credit unions. Thus far, Citigroup and a credit union based in Stanford University have been confirmed as partners, with more to be announced. Speaking on the venture, Citigroup spokesperson Liz Fogarty said the “agreement has the potential to expand the reach and breadth of our customer base.” Whereas Joan Opp, President and CEO of Stanford Federal Credit Union, remarked that the deal would be “critical to remaining relevant and meeting customer expectations.”

As of yet, not much is known beyond these partners and that the checking accounts will be in some way “smart” according to Google spokesperson Craig Ewer. Whether or not there will be fees attached to the accounts, or who will be the target audience remain unsure. The latter especially given Google Pay’s poor take up in America.

As well as all this, it is equally unclear what exactly Google will be bringing to banking that is new. In his statement, Ewer said that “we’re exploring how we can partner with banks and credit unions in the US to offer smart checking accounts through Google Pay, helping their customers benefit from useful insights and budgeting tools while keeping their money in an FDIC or NCUA-insured accounts.” Such “insights” and “tools” are yet to be expanded upon and may give cause to alarm, as the company has recently come under fire for its questionable use of data after it was revealed that Google has secretly gathered the personal medical data of 50 million Americans from healthcare providers; and has recently been accused of using both human contractors and algorithms to tweak search engine results, potentially exhibiting favoritism as well as a willingness to change results related to at least one major advertiser.

When asked by CNBC about Google’s plans to enter finance, Senator Mark Warner (D) was apprehensive, remarking that “large platform companies have not had a very good record of protecting the data or being transparent with consumers.” Warner, who was a tech entrepreneur before entering politics, believes more regulation should be in place as the number of tech companies looking to enter finances continues to increase, saying, “once they get in, the ability to extract them out is going to be virtually impossible.”

Such comments come in the wake of Facebook CEO Mark Zuckerburg’s testimony to Congress last month, in which he told the representatives: “I view the financial infrastructure in the United States as outdated.” Just how outdated Zuckerburg and his contemporaries believe it to be will become clearer as more of these Big Tech-Wall Street hybrids are released.

Is Your Firm Ready for Machine Learning?

October 15, 2018Artificial intelligence such as machine learning has the potential to dramatically shift the alternative lending and funding landscape. But humans still have a lot to learn about this budding field.

Across the industry, firms are at different points in terms of machine learning adoption. Some firms have begun to implement machine learning within underwriting in an attempt to curb fraud, get more complex insights into risk, make sounder funding decisions and achieve lower loss rates. Others are still in the R&D and planning stage, quietly laying the groundwork for future implementation across multiple areas of their business, including fraud prevention, underwriting, lead generation and collections.

“It’s entirely critical to the success of our business,” says Paul Gu, co-founder and head of product at Upstart, a consumer lending platform that uses machine learning extensively in its operations. “Done right, it completely changes the possibilities in terms of how accurate underwriting and verification are,” he says.

While there’s no absolute right way to implement machine learning within a lender’s or funder’s business, there are many data-related, regulatory and business-specific factors to consider. Because things can go very wrong from a business or regulatory perspective—or both—if machine learning is not implemented properly, firms need to be especially careful. Here are a few pointers that can help lead to a successful machine learning implementation:

Using machine learning, funders can predict better the likelihood of default versus a rule-based model that looks at factors such as the size of the business, the size of the loan and how old the business is, for example, says Eden Amirav, co-founder and chief executive of Lending Express, a firm that relies heavily on AI to match borrowers and funders.

Machine learning takes hundreds and hundreds of parameters into account which you would never look at with a rule-based model and searches for connections. “You can find much more complex insights using these multiple data points. It’s not something a person can do,” Amirav says.

He contends that machine learning will optimize the number of small businesses that will have access to funding because it allows funders to be more precise in their risk analyses. This will open doors for some merchants who were previously turned down based on less precise models, he predicts. To help in this effort, Lending Express recently launched a new dashboard that uses AI-driven technology to help convert business loan candidates that have been previously turned down into viable applicants. The new LendingScore™ algorithm gives businesses detailed information about how they can improve different funding factors to help them unlock new funding opportunities, Amirav says.

Lenders and funders always have to be thinking about what’s next when it comes to artificial intelligence, even if they aren’t quite ready to implement it. While using machine learning for underwriting is currently the primary focus for many firms, there are many other possible use cases for the alternative lenders and funders, according to industry participants.

Lead generation and renewals are two areas that are ripe for machine learning technology, according to Paul Sitruk, chief risk officer and chief technology officer at 6th Avenue Capital, a small business funder. He predicts that it is only a matter of time before firms are using machine learning in these areas and others. “It can be applied to several areas within our existing processes,” he says.

Collection is another area where machine learning could make the process more efficient for firms. Machines can work out, based on real-life patterns, which types of customers might benefit from call reminders and which will be a waste of time for lenders, says Sandeep Bhandari, chief strategy and chief risk officer at Affirm, which uses advanced analytics to make credit decisions.

“There are different business problems that can be solved through machine learning. Lenders sometimes get too fixated on just the approve/decline problem,” he says.

“Most underwriters don’t have enough data to effectively incorporate AI, deep learning, or machine learning tools,” says Taariq Lewis, chief executive of Aquila, a small business funder. He notes that effective research comes from the use of very large datasets that won’t fit in an excel spreadsheet for testing various hypotheses.

Problems, however, can occur when there’s too much complexity in the models and the results become too hard to understand in actionable business terms. For example, firms may use models that analyze seasonal lender performance without understanding the input assumptions, like weather impact, on certain geographies. This may lead to final results that do not make sense or are unexpected, he says.

“There’s a lot of noise in the data. There are spurious correlations. They make meaningful conclusions hard to get and hard to use,” he says.

The more precise firms can be with the data, the more predictive a machine learning model can be, says Bhandari of Affirm. So, for example, instead of looking at credit utilization ratios generally, the model might be more predictive if it includes the utilization rate over recent months in conjunction with debt balance. It’s critical to include as targeted and complete data as possible. “That’s where some of our competitive advantages come in,” Bhandari says.

Underwriters also have to pay particularly close attention that overfitting doesn’t occur. This happens when machines can perfectly predict data in your data set, but they don’t necessarily reflect real world patterns, says Gu of Upstart.

Keeping close tabs on the computer-driven models over time is also important. The model isn’t going to perform the same all along because the competitive environment changes, as do consumer preferences and behaviors. “You have to monitor what’s going well and what’s not going well all the time,” Bhandari says.

Certainly, as AI is integrated into financial services, state and federal regulators that oversee financial services are taking more of an interest. As such, firms dabbling with new technology have to be very careful that any models they are using don’t run afoul of federal Fair Lending Laws or state regulations.

“If you don’t address it early and you have a model that’s treating customers unfairly or differently, it could result in serious consequences,” says Tim Wieher, chief compliance officer and general counsel of CAN Capital, which is in the early stages of determining how to use AI within its business.

“AI will be transformative for the financial services industry,” he predicts, but says that doing it right takes significant advance planning. For instance, Wieher says it’s very important for firms to involve legal and compliance teams early in the process to review potential models, understand how the technology will impact the lending or funding process and identify the challenges and mitigate the risk.

“AI will be transformative for the financial services industry,” he predicts, but says that doing it right takes significant advance planning. For instance, Wieher says it’s very important for firms to involve legal and compliance teams early in the process to review potential models, understand how the technology will impact the lending or funding process and identify the challenges and mitigate the risk.

To be sure, regulation around AI is still a very gray area since the technology is so new and it’s constantly evolving. Banking regulators in particular have been looking closely at the issues pertaining to AI such as its possible applications, short-comings, challenges and supervision. Because the waters are so untested, there can be validity in asking for regulatory and compliance advice before moving ahead full steam, some industry watchers say.

Upstart, for example, which uses AI extensively to price credit and automate the borrowing process, wanted buy-in from the Consumer Financial Protection Bureau to help ease the concern of its backers as well as to satisfy its own concerns about the legality of its efforts. So the firm submitted a no-action request to CFPB. The CFPB responded by issuing a no-action letter to Upstart in September 2017, allowing the company to use its model. In return, Upstart shares certain information with the CFPB regarding the loan applications it receives, how it decides which loans to approve, and how it will mitigate risk to consumers, as well as information on how its model expands access to credit for traditionally underserved populations.

The No-Action Letter is in force for three years and Upstart can seek to renew it if it chooses.

Theoretically firms could have a computer underwriting model constantly updating itself without having a human oversee what the model is doing—but it’s a bad idea, industry participants say. “I believe there are companies doing that, and it’s a risky thing to do,” says Scott M. Pearson, a partner with the law firm Ballard Spahr LLP in Los Angeles.

During review of the models—and before implementing them—people should carefully review the models and the output to make sure there’s nothing that causes intrinsic bias, says Kathryn Petralia, co-founder and president of Kabbage, which is one of the front-runners in using machine learning models to understand and predict business performance.

“If you’re not watching the machine, you don’t know how the machine is complying with regulatory requirements,” she says.

Kabbage has teams of data scientists regularly developing models that the company then reviews internally before deploying. The company is also in frequent contact with regulators about its processes. Petralia says it’s very important that firms be able to explain to regulators how their models work. “Machines aren’t very good at explaining things,” she quips.

As a best practice, Pearson of Ballard Spahr says lenders and funders shouldn’t use any machine learning model until it’s been signed off on by compliance. “That strikes a pretty good balance between getting the benefits of AI and making sure it doesn’t create a compliance problem for you,” he says.

While AI has many benefits, industry participants say alternative lenders and funders need to be mindful of how it can be applied practically and effectively within their particular business model.

Craig Focardi, senior analyst with consulting firm Celent in San Francisco, contends that the classic FICO score continues to be the gold standard for credit decisions in the U.S. He warns firms not to get overly distracted trying to find the next best thing.

“Many fintech lenders have immature risk management and operations functions. They’re better off improving those than dabbling in alternative scoring,” he says, noting that data modeling is an entirely separate core competency.

Indeed, Lewis of Aquila cautions underwriters not to view AI as a silver bullet. “AI is just one tool out of many in the lenders’ toolbox, and our industry should use it and respect its limitations,” he says.

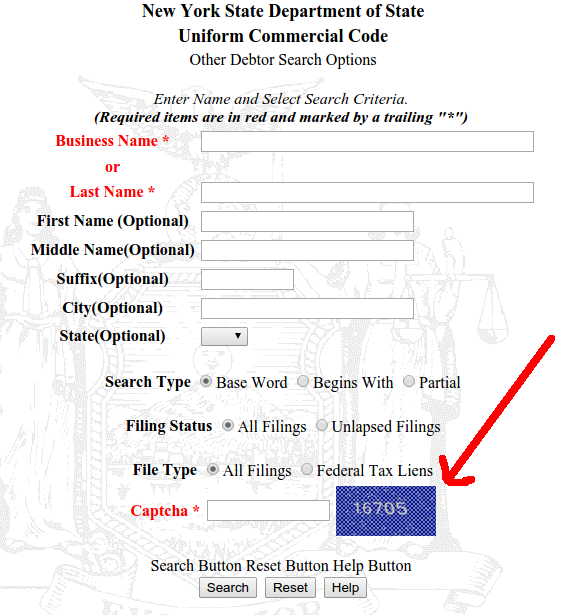

Did UCC Lead Generators Overload NY State’s System?

April 4, 2017 In the small business finance industry, New York State is known as one of the friendliest places to conduct a UCC search. You can not only search by debtor, but also by secured party, and get just about everything you need to create a list of prospects for free.

In the small business finance industry, New York State is known as one of the friendliest places to conduct a UCC search. You can not only search by debtor, but also by secured party, and get just about everything you need to create a list of prospects for free.

But the State’s website isn’t exactly a pillar of technological achievement. Indeed, the UCC Lien Search welcome page makes clear that searchers will need to be using Netscape Navigator 4.0 or higher and that version 3.0 of Internet Explorer or lower is not supported. Those browser iterations were released in 1997 and 1996 respectively, before some in the business finance industry were even born.

And the online system built for Windows 3.1 users didn’t seem to be doing so well over the last few months. Routine manual searches that I occasionally conduct were leading to error messages and crash pages instead of results. Were UCC lead generators querying the system to death?

Last week, New York took the entire UCC system down for “maintenance” and when it finally came back up, a tool to combat automated queries had been installed.

Curiously, this has only been implemented for secured party searches and other debtor search options. Standard debtor search options remains unchanged.

As Captchas are designed to thwart automated queries, could this be a sign that lead generators were crashing the system?

To check it out yourself, it’s best to be using Windows 95 or higher. Typewriters and Etch-A-Sketch users may experience performance issues.

OnDeck CEO Noah Breslow Talked Tech Worker Shortage in Canada on BloombergTV

March 22, 2017On BloobergTV Canada, OnDeck CEO Noah Breslow explained what he thought the country could do to boost innovation. The discussion stemmed from Canada’s decision to set aside C$800 million over the next four years to carry out that objective.

Breslow said that since Canada has excellent schools, those graduates can be nurtured into forming businesses and creating business investment opportunities. He also said that vocational training towards today’s new working-style job would be beneficial as well, whether it’s jobs for people who can design the latest algorithm or people who can build systems and data centers or can rack servers together.

When asked if perhaps government intervention was not the answer to achieve this, Breslow said that there are two ends of that spectrum, and where he believed intervention could be helpful was in the formation and talent development and formation incubation stage of companies. For later-stage companies, it was probably not appropriate, he said.

Breslow also expressed his belief that a permissive immigration policy is important and that there should be less friction to bring in skilled workers to Canada.

You can watch the full video below to hear the rest:

AI Sales Assistant Penetrating Alternative Finance Raises $34 Million in Series B Round

December 15, 2016 Wondering how your competition always seems to be so on top of their game? They might be using an artificially intelligent sales assistant. Such technology was reported on last month when deBanked learned that it had penetrated the alternative business financing industry through at least one company named AI Assist. AI Assist is powered by Conversica, a Foster City, CA-based technology firm that announced it had raised $34 million in a Series B round on Wednesday led by Providence Strategic Growth Capital Partners L.L.C. More than 1,000 companies across technology, automotive, higher education, finance, insurance, real estate and hospitality are using Conversica.

Wondering how your competition always seems to be so on top of their game? They might be using an artificially intelligent sales assistant. Such technology was reported on last month when deBanked learned that it had penetrated the alternative business financing industry through at least one company named AI Assist. AI Assist is powered by Conversica, a Foster City, CA-based technology firm that announced it had raised $34 million in a Series B round on Wednesday led by Providence Strategic Growth Capital Partners L.L.C. More than 1,000 companies across technology, automotive, higher education, finance, insurance, real estate and hospitality are using Conversica.

“Conversica’s AI technology has helped IBM be smarter about engaging our prospective customers and maximizing their value as they move through our sales funnel,” Kevin Pollack, head of IBM’s Global Email Marketing Practice, is quoted as saying in a press release. “Not only have we freed up resources within the marketing team and gained immediate value in the form of qualified sales opportunities, we are also seeing how AI can help transform our entire business moving forward.”

For Roman Vinfield, who launched a merchant cash advance ISO in 2015, it changed his life. “I hadn’t heard anything like an artificial-intelligence sales assistant,” said Vinfield. “The results we got within a month of using it were unbelievable.” Within the first month, Vinfield made $35,000 in revenues by spending just $4,000 and he eventually reduced his staff of 24 to 4 people. He’s since launched AI Assist, the exclusive reseller of Conversica to the alternative finance industry.

“We’ve gone way beyond the theoretical,” Conversica CEO Alex Terry told Fortune. A demo given by Vinfield of AI Assist, demonstrated that its artificial intelligence can communicate with merchants over emails in a way that is indistinguishable from a human. According to Fortune, Terry said the sales assistant software has proven so effective for some customers that recruiters have even mistaken the software for a human and tried to make a hire. Other contacts have sent in thank-you notes and flowers, he added.

Conversica has raised more than $56 million since inception. Providence, who led the Series B round, also owns stakes in Hulu and the Yankees Entertainment & Sports Network (YES Network). Conversica’s technology is only available to this industry via AI Assist.

Google To Shut Down Financial Products Comparison Site

February 23, 2016 Another Google product bites the dust.

Another Google product bites the dust.

The tech giant plans to shut down Google Compare on March 23rd 2016, a tool which let users compare financial products like credit cards, mortgages and insurance.

The service which has been active in the UK since 2012, was launched in the US as Google Advisor last year and allowed customers to get quotes on financial products. Despite having launched with partners like Zillow and Lending Tree for mortgage products, the service didn’t do much for the company in terms of revenue.

In its letter to partners, the company noted, “Despite people turning to Google for financial services information, the Google Compare service itself hasn’t driven the success we hoped for.”

Last week, DailyFunder was a media sponsor of Exponential Finance presented by Singularity University & CNBC. It was a totally different atmosphere from some of the other events I’ve been to this year already (Transact 14, LendIt, etc.). In the upcoming July/August issue of DailyFunder magazine, I’ve got a column that summarizes the event that I think you’ll like.

Last week, DailyFunder was a media sponsor of Exponential Finance presented by Singularity University & CNBC. It was a totally different atmosphere from some of the other events I’ve been to this year already (Transact 14, LendIt, etc.). In the upcoming July/August issue of DailyFunder magazine, I’ve got a column that summarizes the event that I think you’ll like.