Regulation

More TCPA Lawsuits Could be Inbound

September 12, 2021 Despite a significant drop in TCPA cases since 2018, a flurry of new TCPA cases could be on the horizon as TCPA plaintiff attorneys had been telling clients to hold off — pending the reaction of Facebook’s recent Supreme Court case, according to Michael O’Hare, Chairman of Colorado-based Cashyew and operator of the TCPA Litigator List. The Court ultimately narrowed the definition of an autodialer.

Despite a significant drop in TCPA cases since 2018, a flurry of new TCPA cases could be on the horizon as TCPA plaintiff attorneys had been telling clients to hold off — pending the reaction of Facebook’s recent Supreme Court case, according to Michael O’Hare, Chairman of Colorado-based Cashyew and operator of the TCPA Litigator List. The Court ultimately narrowed the definition of an autodialer.

O’Hare heads a service that provides names of individuals and their attorneys who have sued under the TCPA law, protecting his clients from what has become an industry in and of itself.

“It’s a fight between free speech and privacy,” said O’Hare, when asked what the hardest part about leading an organization that protects businesses from falling victim to these kinds of suits is. He worries that his clients will be preyed upon by serial litigators that go after businesses searching for some type of settlement. According to O’Hare, some of these cases can cost tens of thousands of dollars to fight in court.

“The government has empowered citizens to become the enforcer,” said O’Hare. The law allows citizens to privately sue unsolicited callers who disrupt their daily lives, subsequently creating an entire industry out of these kinds of suits alone.

“People are making a 6-figure living,” he said.

Since deBanked covered this minefield back in 2016, the TCPA has not changed. Some states like Florida and California have adopted their own versions of the law, but the federal law has gone unchanged for thirty years.

The robocallers have also adapted to the lack of upkeep of the TCPA, as the concept of “spoofing” has become a weird ethical gray area in the telemarketing industry. By showing the area code that’s identical to the number being dialed on that number’s caller ID, the user is believed to be more likely to answer. Not covered by the TCPA, organizations like the FCC have begun to step in and put a stop to the tactic.

This “decentralization of enforcement,” as O’Hare called it, may do more harm than good, giving these serial litigators and their clients more avenues of reason to sue.

The ambiguity of what defines a work phone versus a personal phone is much more prevalent now than it was in 1991. With cell phones, smart watches, and the elimination of the home phone for millions of Americans, the TCPA has become antiquated.

“Do they want us to go back to a rotary phone?” O’Hare sarcastically asked.

O’Hare stressed that lenders respect their clients and abide by basic ethics. “Always be scrubbing,” he said. “Prevention is not expensive, litigation is”.

Besides using services like his, O’Hare suggests using basic ethics and understanding to protect merchants that don’t want their calls. “If someone asks, take them off the list,” he said, “avoid trouble and respect the Do-Not-Call list.”

CFPB Publishes Long Awaited Proposed Rule on Small Business Loan Data Collection

September 1, 2021 A 918-page proposed rule published by the Consumer Financial Protection Bureau (if you don’t know what this bureau is, now is a good time to read up), is finally out.

A 918-page proposed rule published by the Consumer Financial Protection Bureau (if you don’t know what this bureau is, now is a good time to read up), is finally out.

Its application is broad, extending to “loans, lines of credit, credit cards, and merchant cash advances,” the CFPB said today. Initially, the Bureau’s intent was to exclude merchant cash advances, but that has apparently changed. (side note: I predicted this could happen as early as 2014.) Meanwhile, “factoring, leases, consumer-designated credit used for business purposes, and credit secured by certain investment properties” are exempt from the rule.

The rule is designed to assess whether there are disparities in sex, race, and ethnicity, when it comes to small businesses being able to access credit.

Covered financing providers would have to request that applicants disclose these things, which applicants can refuse to answer if they so choose. It could get a bit awkward from there because “if an applicant does not provide any ethnicity, race, or sex information for at least one principal owner, the Bureau is proposing that the financial institution must collect at least one principal owner’s race and ethnicity (but not sex) via visual observation and/or surname if the financial institution meets in person with any principal owners (including meeting via electronic media with an enabled video component).

BUT “minority-owned business status and women-owned business status would only be reported on the basis of information the applicant provides specifically for Section 1071 purposes, and financial institutions would not be permitted or required to report these data points based on visual observation, surname, or any other basis.”

Further, no one involved in the underwriting of the loan or advance would be allowed to know or access the ethnicity, race, or sex of the applicant. However, this would not apply if it isn’t “feasible” to do so.

All of the nuances, which seem to contradict themselves on the surface level, are specified in greater detail in the 918 page document.

When the proposed rule becomes final, lenders and MCA providers would have 18 months before they would be required by law to not only collect this data in the properly established manner, but also be prepared to submit it annually to the CFPB.

This rule will become a standard operating part of the business for companies both large and small whether one agrees with it or not. This law was passed in 2010 and it has taken this long to get to this point. This is a link to the CFPB’s official summary.

NJ Resurrects Small Business Finance Disclosure Bill

July 28, 2021New Jersey’s legislature has revived its small business finance disclosure bill. Having languished since last January, the Senate Commerce Committee quietly gave it a favorable report this past June.

New Jersey’s bill is similar to the law that New York is putting into effect on January 1st. As part of it, non-loan products will be required to calculate an APR even if one cannot be mathematically calculated by “estimating” one.

Brokers would be impacted too:

A broker who charges any fees or commission that would be paid by the recipient of the financing shall provide, at the time of extending a specific offer for a commercial financing transaction and in a form and manner prescribed by the commissioner, a written disclosure, in a document separate from the provider’s contract with the recipient, stating the following, if the information is not contained within the disclosure offered by the provider directly to the recipient:

(1) a list of all fees or commissions that would be paid to the broker by the recipient in connection with the commercial financing;

(2) the total dollar amount of charges listed pursuant to the bill;

and

(3) any increase to the annual percentage rate due to the charges listed above and the resulting dollar cost.

You can read the Senate Commerce Committee’s report here.

North Carolina Joins States Proposing Commercial Financing Disclosures

May 12, 2021 North Carolina is the latest in a series of states to introduce a commercial financing disclosure bill.

North Carolina is the latest in a series of states to introduce a commercial financing disclosure bill.

The “Small Business Truth in Financing Act” introduced on May 11th, would cover business loans, factoring, and merchant cash advances.

The language was copy and pasted from bills elsewhere, like the recent one in Connecticut. The “double dipping” term is noticeably absent from this one, however.

The North Carolina bill was introduced by Rep James D. Gailliard (D). If it succeeds in moving forward, it’s written to go into effect on May 1, 2022.

Yellowstone Capital, FTC Lawsuit Results in Settlement

April 22, 2021 The lawsuit filed by the FTC against Yellowstone Capital et al has resulted in a settlement. The defendants agreed to pay $9,837,000 for the matter to be resolved.

The lawsuit filed by the FTC against Yellowstone Capital et al has resulted in a settlement. The defendants agreed to pay $9,837,000 for the matter to be resolved.

As part of it, the defendants did not admit or deny the allegations of the complaint. They also agreed to have the FTC monitor their compliance with the agreement for varying but long periods of time.

Aside from the cost, the FTC made its point in two areas, the requirement that the defendants comply with a specific system of customer disclosure and that they not debit or cause withdrawals to be made from any customer’s bank account without the customer’s express informed consent. On the former, they must (roughly speaking) disclose clearly and conspicuously the amount and timing of any fees, the specific amount a customer will receive at the time of funding, and the total amount customers will repay.

The announcement coincides with the Supreme Court decision that revoked the agency’s presumed authority to obtain restitution or disgorgement under Section 13(b), the basis that the FTC brought against Yellowstone Capital in August 2020.

The FTC signed and filed the agreement less than 24 hours before the SCOTUS decision.

Senators Marco Rubio, Sherrod Brown Renew Campaign to Ban COJs Nationwide

April 15, 2021 The Small Business Lending Fairness Act is back. Senators Marco Rubio and Sherrod Brown reintroduced a bill this week that failed to advance the two previous times it was introduced.

The Small Business Lending Fairness Act is back. Senators Marco Rubio and Sherrod Brown reintroduced a bill this week that failed to advance the two previous times it was introduced.

One of cornerstone objectives is to outlaw confessions of judgment from being used in business loan transactions nationwide.

“With this bill, we are taking another step toward protecting America’s small businesses—the foundation of our economy—by preserving the right of a business to be heard in a court of law before a potential credit default,” Rubio said. “I remain committed to protecting our small businesses from predatory, out-of-state lenders, and I urge my colleagues to join me in this effort.”

“When we let financial predators harm hardworking Americans through scams like confessions of judgment, we undermine the dignity of work,” Brown said. “This bipartisan bill would protect consumers and small business owners from predatory lenders that use legal tricks to strip away their hard earned money.”

This is not the first swipe at COJs. In 2019, New York passed a law that made it illegal to file a confession of judgment against a non-New York debtor in the New York state court system. However, this does not prevent a party from using another state’s COJ and filing the COJ in that respective state.

The federal bill was previously introduced in 2018 and 2019 and failed to advance both times. The text of the bill can be found here.

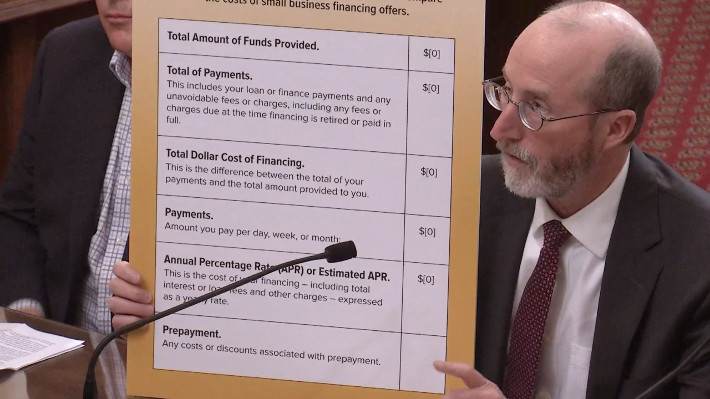

California’s Business Loan & MCA Disclosure Law Is Nearing Finality

April 13, 2021 Nearly three years after California became the first state to pass a business loan and merchant cash advance disclosure law (SB 1235), the actual disclosure rules themselves are finally nearing completion. The public has until April 26th to submit any comments on the amended portions of the proposed rules.

Nearly three years after California became the first state to pass a business loan and merchant cash advance disclosure law (SB 1235), the actual disclosure rules themselves are finally nearing completion. The public has until April 26th to submit any comments on the amended portions of the proposed rules.

The 52-page document is the result of years of negotiations between various parties that all have a stake in its implementation. Among the finer details are the characteristics of the fonts permitted in the disclosures, what column a certain disclosure can be placed in, and the aspect ratio of the columns themselves.

But that’s the easy part. Here’s the hard part, according to a brief published in Manatt’s newsletter yesterday.

“The modified regulations continue to require use of the annual percentage rate (APR) metric, rather than annualized cost of capital (ACC), to disclose the total cost of financing as an annualized rate. This appears to be a final decision, which will make it difficult if not impossible for many commercial finance companies to comply given the significant challenges of calculating APR on products with substantial variance in the amounts and timing of payments or remittances.”

Manatt highlights other issues, including that all the necessary disclosures be provided “whenever a payment amount, rate, or price is quoted based on information provided by the proposed recipient of financing…”

This requirement, the firm says, is not even required under Federal Regulation Z for consumer loans.

“Many companies will not be able to comply with this requirement absent radical changes to their California application and underwriting procedures, as it is common today for companies to have preliminary discussions with applicants about potentially available financing terms before full underwriting has been completed.”

Manatt’s newsletter on the issue can be found here.

Any interested person may submit written comments regarding SB 1235’s modifications by written communication addressed as follows:

Commissioner of Financial Protection and Innovation

Attn: Sandra Sandoval, Regulations Coordinator

300 South Spring Street, 15th Floor

Los Angeles, CA 90013

Written comments may also be sent by electronic mail to regulations@dfpi.ca.gov with a copy to jesse.mattson@dfpi.ca.gov and charles.carriere@dfpi.ca.gov.

The last day to submit comments is April 26, 2021

Implementation of New York’s Commercial Financing Disclosure Law Delayed

April 6, 2021The implementation of New York’s commercial financing disclosure law has been pushed back. Originally scheduled to go into effect in June of 2021, an amending bill changed the date to January 1, 2022.

The only other material change of note is that the exemption from the law for transactions greater than $500,000 has been increased to $2.5 million.