Related Headlines

| 09/28/2023 | Camino Financial, Fundation merge |

| 02/25/2021 | Fundation, ODX merge |

| 02/24/2020 | Fifth Third partners with Fundation |

| 11/23/2019 | Fundation collaborates with Fifth Third |

| 05/16/2018 | Fundation secures $120M credit facility |

Potential Match Found in deBanked UCC Filer list

| Company Name | Phone number | UCC Alias 1 | Alias 2 | Alias 3 | Alias 4 | Alias 5 |

| Fundation | 888-390-0064 | Fundation Group LLC |

Stories

ODX Merges with Fundation

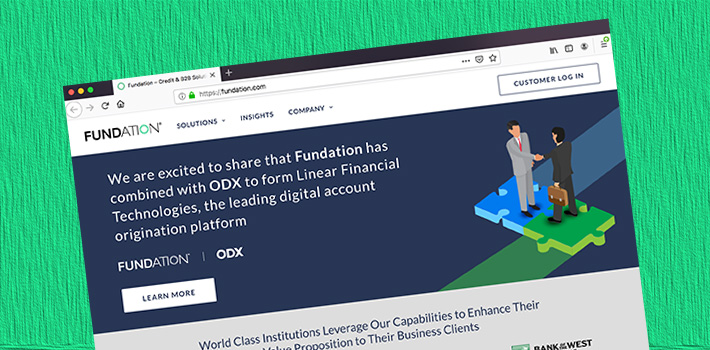

February 25, 2021 The ODX brand from OnDeck is splitting off to combine with Fundation, forming a new SMB digital banking company called Linear Financial Technologies.

The ODX brand from OnDeck is splitting off to combine with Fundation, forming a new SMB digital banking company called Linear Financial Technologies.

The news follows the recent disclosure from Enova that it was looking to divest ODX in addition to OnDeck Canada and OnDeck Australia.

The new firm, headed by the current CEO of Fundation, Sam Graziano, will be an online banking service provider. Linear will take on Fundation’s service of processing loans for big and small banks, reportedly processing a total of $13 billion.

“Over the years, our combined platforms have served hundreds of thousands of business customers through many of the leading business banking providers in the market, deploying modern banking experiences that their customers and front-line colleagues expect in the digital era,” said Graziano in the published announcement. “Together as Linear, we’ll have the resources to more rapidly expand the breadth of our solutions to bring more value to our clients.”

Enova will retain a minority stake in the new firm.

Citizens Bank to Use Fundation’s Tech and Services in 2017

December 21, 2016Fundation is back at it, this time announcing a deal with Citizens Bank to offer “digital lending capabilities to small business customers.”

According to a press release:

The added capability will enable small businesses to apply for loans and lines of credit through a simple online application at citizensbank.com. In most cases approval is provided within minutes, and loans are funded in as little as three business days. Additionally, Fundation will offer credit to some customers that do not meet Citizens’ credit guidelines, helping the bank to serve more of its small business customers’ credit needs.

Expected to go into effect in mid-2017, it should be a huge improvement to Citizen’s existing online loan application process, which doesn’t appear to even exist. A cursory review of their website indicates that business owners can at best, schedule a consultation with a banker over the phone.

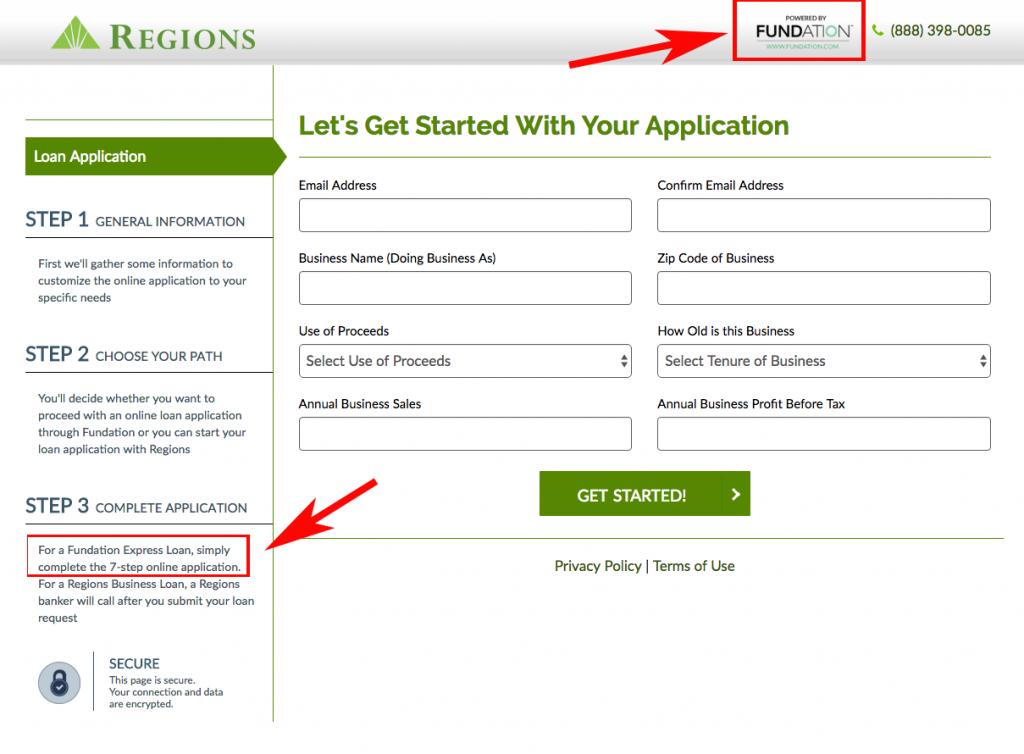

Fundation has transformed this process for other banks in the past, Regions Bank for example, as we showed in a prior post. The partnership should be valuable for both Fundation and Citizens.

Fundation’s $100 Million Credit Facility From Goldman Sachs Is A Return To Banking

August 23, 2016 The online lending party isn’t over yet. And neither is bank lending…

The online lending party isn’t over yet. And neither is bank lending…

Fundation, which company CEO Sam Graziano described to the WSJ as a credit solutions provider rather than a lender, has secured a $100 million credit facility from Goldman Sachs. But they are a lender, a direct small business lender in fact, that uses their own balance sheet to make loans.

Fundation is different in that they bolt their platform on top of the traditional banking system. Their partnership with Regions Bank for example, allows Regions Bank customers to apply for a Fundation loan right through the Regions.com website.

The sizable credit facility, the system it will help foster, and the name behind it further demonstrates the demise of peer-to-peer lending. “We decided to be an integrated partner of the banking system,” said Fundation’s Graziano to the WSJ in regards to the saturated environment of lending platforms.

The WSJ also reported that the firm will use the funds to make more loans to Regions bank customers as well as other community banks that they have partnered up with.

With Fraud on the Rise, AI Can Fill in the Gaps

October 19, 2023 In today’s dynamic world of fraud detection, technology, and artificial intelligence (AI) are allies. The insights of industry experts, Yinglian Xie, a technology veteran with a background at Microsoft Research and CEO at DataVisor, Sandip Nayak, President at Fundation, and Andrew Davies, Global Head of Regulatory Affairs at ComplyAdvantage, discuss the transformative role of AI in fraud prevention.

In today’s dynamic world of fraud detection, technology, and artificial intelligence (AI) are allies. The insights of industry experts, Yinglian Xie, a technology veteran with a background at Microsoft Research and CEO at DataVisor, Sandip Nayak, President at Fundation, and Andrew Davies, Global Head of Regulatory Affairs at ComplyAdvantage, discuss the transformative role of AI in fraud prevention.

When DataVisor started, it primarily offered advanced machine learning solutions, through an unsupervised approach. In other words, their programs can spot fraud without needing a loss or training labels; they can automatically identify suspicious activities. Xie explains that AI’s ability to make rapid decisions during real-time transactions depends on the amount of data available for this process. To achieve a proactive response, it must be synchronized with real-time data, as opposed to a manual or “supervised machine learning” approach.

“We need to kind of switch the traditional approach looking at fraud being very much kind of an isolated case, like a manual approach, and into something we need technology for, said Xie. “And we need to essentially be able to make decisions instantaneously as well.”

In addition to unsupervised learning algorithms, Xie explains that generative AI falls into another category of fraud detection. This method describes the data and communicates information back in human-like responses. Xie gives an example that as customers, some may not understand why a transaction was rejected and that’s where generative AI comes to rationalize the reason behind the rejection.

Echoing Xie, Nayak described solutions where traditional techniques fail, one of them being unsupervised learning algorithms. These algorithms can use techniques like anomaly detection to actually hone in on “the needle in a haystack problem.”

“Number two, the automated and advanced nature of AI can really solve the shortcomings of rules based and human based approaches in detecting fraud and can also self-calibrate itself as the nature of fraud evolves with time,” said Nayak.

Meanwhile, Andrew Davies pointed out that one of the biggest challenges faced by banks and financial institutions is “they are constantly playing catch-up.” With the accelerated pace of money movement and real-time settlement, he emphasized that fraudsters capitalize on this by being swift and innovative, continuously seeking out new vulnerabilities to exploit.

“Banks must update their legacy technology which leaves too many weak points in the control environment,” said Davies. “Additionally, as money moves more quickly and is subject to finality, fraud detection must be done in real time.”

And as the digital landscape continues to evolve, Nayak envisions the adoption of these technologies will be beneficial to the lending industry. Embracing different strategies not only reduces fraud losses but also enhances capital efficiency, paving the way for increased profitability and security in lending, according to Nayak.

“I do expect the lending industry, especially the ones who adopt the latest technologies of fraud detection, will have a competitive advantage compared to those who don’t,” said Nayak. “And what that will do is it will help them preserve more of their capital in the current tough macro environment by helping the overall unit economics…”

Unsupervised machine learning and generative AI are strategies reshaping fraud prevention. The ability to make rapid, data-driven decisions, adapt to evolving fraud tactics, and provide human explanations behind alerts has become a cornerstone in modern fraud detection.

Linear CEO on New Merger

March 1, 2021 Fundation and ODX were in talks to merge for over a year, Linear and past Fundation CEO Sam Graziano said. Then covid changed plans, but by mid-summer talks were back on.

Fundation and ODX were in talks to merge for over a year, Linear and past Fundation CEO Sam Graziano said. Then covid changed plans, but by mid-summer talks were back on.

There was recognition by the leadership team at Fundation and CEO of OnDeck Noah Breslow that ODX and Fundation were competitors in the same banking-as-a-service space and could merge to serve the entire market, Graziano said.

Launching with the press release last week, Linear is majority-owned by Fundation, but Graziano said it was looked at as a “cashless transaction” and merger between two companies. This upcoming year, Linear plans “To merge the two businesses more structurally,” Graziano said, “continue to merge the two businesses, deepen industry relationships, and continue to expand the scope of clients.”

Fundation’s minor business funding branch will continue under the Fundation brand, Graziano said.

CFPB Initially Proposed to Exclude MCAs, Factoring, and Equipment Leasing From Section 1071

December 17, 2020 After ten years of debate over when and how to roll out the CFPB’s mandate to collect data from small business lenders, the Bureau has initially proposed to exclude merchant cash advance providers, factors, and equipment leasing companies from the requirement, according to a recently published report.

After ten years of debate over when and how to roll out the CFPB’s mandate to collect data from small business lenders, the Bureau has initially proposed to exclude merchant cash advance providers, factors, and equipment leasing companies from the requirement, according to a recently published report.

The decision is not final. A panel of Small Entity Representatives (SERS) that consulted with the CFPB on the proposed rollout recommended that the “Bureau continue to explore the extent to which covering MCAs or other products, such as factoring, would further the statutory purposes of Section 1071, along with the benefits and costs of covering such products.”

The SERS included individuals from:

- AP Equipment Financing

- Artisans’ Bank

- Bippus State Bank

- CDC Small Business Finance

- City First Bank

- Floorplan Xpress LLC

- Fundation Group LLC

- Funding Circle

- Greenbox Capital

- Hope Credit Union

- InRoads Credit Union

- Kore Capital Corporation

- Lakota Funds

- MariSol Federal Credit Union

- Opportunity Fund

- Reading Co-Operative bank

- River City Federal Credit Union

- Security First Bank of North Dakota

- UT Federal Credit Union

- Virginia Community Capital

The panel discussed many issues including how elements of Section 1071 could inadvertently embarrass or deter borrowers from applying for business loans. That would run counter to the spirit of the law which aims to measure if there are disparities in the small business loan market for both women-owned and minority-owned businesses.

One potential snag that could complicate this endeavor is that the concept of gender has evolved since Dodd-Frank was passed in 2010. “One SER stated that the Bureau should consider revisiting the use of male and female as categories for sex because gender is not binary,” the CFPB report says.

But in any case, there was broad support for the applicants to self-report their own sex, race, and ethnicity, rather than to force loan underwriters to try and make those determinations on their own. The ironic twist, however, according to one SER, is that when applicants are asked to self-report this information on a business loan application, a high percentage refuse to answer the questions at all.

The CFPB will eventually roll the law out in some final fashion regardless. The full report can be viewed here.

Where Fintech Ranks on the Inc 5000 List for 2020

August 12, 2020Here’s where fintech and online lending rank on the Inc 5000 list for 2020:

| Ranking | Company Name | Growth |

| 30 | Ocrolus | 7,919% |

| 46 | Yieldstreet | 6,103% |

| 351 | Direct Funding Now | 1,297% |

| 402 | GROUNDFLOOR | 1,141% |

| 486 | LoanPaymentPro | 946% |

| 534 | LendingPoint | 862% |

| 539 | OppLoans | 860% |

| 566 | dv01 | 830% |

| 647 | Fund That Flip | 724% |

| 1031 | Fundera | 449% |

| 1035 | Nav | 447% |

| 1053 | Fundrise | 442% |

| 1103 | Bitcoin Depot | 409% |

| 1229 | Smart Business Funding | 365% |

| 1282 | Global Lending Services | 349% |

| 1360 | CommonBond | 327% |

| 1392 | Forward Financing | 319% |

| 1398 | Fundation Group | 318% |

| 1502 | Fountainhead Commercial Capital | 293% |

| 1736 | Seek Capital | 246% |

| 1746 | PIRS Capital | 244% |

| 1776 | Braviant Holdings | 240% |

| 1933 | Choice Merchant Solutions | 218% |

| 2001 | Fundomate | 212% |

| 2257 | Lighter Capital | 185% |

| 2466 | Bankers Healthcare Group | 167% |

| 2501 | Fund&Grow | 165% |

| 2537 | Central Diligence Group | 162% |

| 2761 | Lendtek | 145% |

| 3062 | Shore Funding Solutions | 127% |

| 3400 | Biz2Credit | 110% |

| 3575 | National Funding | 103% |

| 4344 | Yalber & Got Capital | 76% |

| 4509 | Expansion Capital Group | 70% |

Online Small Business Borrowing Decisions Not Driven By Costs or Disclosures, Fed Study Finds

December 23, 2019 A new study on transparency conducted by the Federal Reserve on non-bank small business finance providers indicates that borrowers are not driven by costs or disclosures. The #1 reason for a business to apply with an online lender was the speed of the process, the study showed. #2 was the likelihood of being funded. Cost ranked near the bottom of the list.

A new study on transparency conducted by the Federal Reserve on non-bank small business finance providers indicates that borrowers are not driven by costs or disclosures. The #1 reason for a business to apply with an online lender was the speed of the process, the study showed. #2 was the likelihood of being funded. Cost ranked near the bottom of the list.

While a focus group pointed out many areas that are ripe for improvement, the Fed was left to conclude that “clearer information—in the form of standardized disclosures—will not necessarily alter the decisions of some small business borrowers about whether and where to obtain financing.”

The Fed further commented that some loan applicants revealed that they had already “committed the expected loan proceeds” before a lender could even present rates and terms. Others borrowers wished they could know their approved rate and terms before even providing a lender with any data. These findings seem to undermine the potential value of enhanced uniformity in disclosures.

The report, which attempts to paint a bleak picture of online lending in spite of the data, seems to validate what online lenders have been saying all along, that speed is supreme. Even where transparency is lacking, it cannot be overstated that big banks scored lower on transparency than online lenders did.

Uncertain Terms: What Small Business Borrowers Find When Browsing Online Lender Websites evaluated BFS Capital, CAN Capital, Credibly, Fundation, Funding Circle, Kabbage, Lending Club, National Funding, OnDeck, Rapid Finance, PayPal Working Capital, and Square Capital.

Who does monthly payments and has an iso program?... looking for some new lenders to submit deals through that offer monthly payments besides loanme, bluevine and fundation that have an iso program. shoo... |

See Post... fundation but i am going to get a lower rate which happens to be what that deal specifically needs to close. this kind of falls back on whoever is allocating the deals, they should know where to place deals to maximize the approval + allow for the biggest commission as a result. successful retail shops are organized and notate these things to be able to ferry subs over quickly with the right guidelines. also helps tremendously if you have someone with at least a mediocre underwriting ability to scrub the docs once you get a full package to better appropriate the deals. the better they're placed the more likely you are to get an offer that makes sense,.. fund, and be skipping all the way to the bank hoping they don't clawback your ish. lol, i'm just kidding.... |

See Post... fundation were setup to process sba throughout the covid shutdown.... |

Term Loans... fundation.. they closed for now, , anyone else... |