Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.

Articles by Sean Murray

Janene Machado Appointed Director of Programs for PCMA’s New York Chapter

November 4, 2019 DeBanked’s Director of Events, Janene Machado, has been appointed the Director of Programs for Professional Convention Management Association’s (PCMA) New York Chapter. Machado will oversee the Program Committee for a three-year term (January 2020 – December 2022). The Committee is responsible for deciding on the topics, programming, logistics, and speaker invitations for the New York Chapter events.

DeBanked’s Director of Events, Janene Machado, has been appointed the Director of Programs for Professional Convention Management Association’s (PCMA) New York Chapter. Machado will oversee the Program Committee for a three-year term (January 2020 – December 2022). The Committee is responsible for deciding on the topics, programming, logistics, and speaker invitations for the New York Chapter events.

PCMA, a volunteer driven organization, is the world’s largest, most respected and most recognized network of business events strategists with more than 7,000 members and activities in 30 countries.

Machado has overseen and directed deBanked’s exceptional events including CONNECT and Broker Fair since joining the company in July 2018. The volunteer position with PCMA will be in addition to her continuing to work for deBanked.

Federal Judge Rules New York’s “Win” Against OCC’s Fintech Charter Nullifies The Fintech Charter Concept Entirely

October 21, 2019 The Office of the Comptroller of The Currency took a gamble with a federal judge in a lawsuit brought by the New York Department of Financial Services (DFS) and lost. On Monday, Judge Victor Marrero ruled that the OCC must “set aside” its special purpose (fintech) national bank charters entirely, not just for those with a nexus to New York.

The Office of the Comptroller of The Currency took a gamble with a federal judge in a lawsuit brought by the New York Department of Financial Services (DFS) and lost. On Monday, Judge Victor Marrero ruled that the OCC must “set aside” its special purpose (fintech) national bank charters entirely, not just for those with a nexus to New York.

The outcome is a byproduct of a ruling issued on May 2nd where the OCC had sought to dismiss the challenge from the onset. DFS was somewhat victorious then in that the case was allowed to proceed, be litigated, and eventually tried. But the OCC felt the case was lost before it had begun because “the Court [had already] ruled on the issue of the law at the heart of the case: whether, under the National Bank Act, OCC has the authority to issue special purpose national bank charters to financial technology companies that do not accept deposits.”

The Court made it clear, that “OCC does not have the authority because the relevant language in the National Bank Act unambiguously defines ‘the business of banking to include deposit-taking.”

The Court made it clear, that “OCC does not have the authority because the relevant language in the National Bank Act unambiguously defines ‘the business of banking to include deposit-taking.”

As a result, OCC negotiated with DFS to reach an agreed upon final judgment in DFS’s favor. The only remaining question was to what level of defeat the OCC would concede. OCC argued a judgment should preclude only New York companies from applying for a fintech charter while the DFS argued it should apply beyond New York’s borders to all 50 states.

On Monday, the judge went with DFS’s version, pointing out that ordinarily prevailing on an Administrative Procedure Act claim, as OCC had indeed consented to judgment on, would mean that the agency’s order would be vacated, not that the plaintiff would win some special relief.

It is hereby ordered, adjudged and decreed that:

OCC’s regulation 5 C.F.R. 5.20(e)(1)(i), is set aside with respect to all fintech applicants seeking a national bank charter that do not accept deposits.

DFS Superintendent Linda A. Lacewell issued an official comment on the ruling:

This decision makes the financial well-being of consumers from New York and around the country a priority. It reflects the rational conclusion that DFS and other state banking regulators have the expertise to provide the strict supervisory oversight and enforcement of anti-money laundering and consumer protection statutes and regulations that non-depository financial service providers are required to follow. The decision stops OCC’s attempt to usurp state authority by establishing a federal fintech regulatory framework at the expense of consumers. Going forward, DFS will continue to be a fierce advocate for consumers in New York and nationwide.

The Broker: Funding Businesses The Irish Way

October 10, 2019 I’m sitting in the lobby of The Marker Hotel, a 5-star 7-story property on the edge of Dublin’s Grand Canal Dock. Here in Ireland’s major tech hub, I’m waiting for a self-identified corporate finance broker by the name of Rupert Hogan, the managing director of BusinessLoans.ie. Outside of our email exchanges, I don’t really know what to expect. I’ve met brokers from the US, Canada, Mexico, UK, and Hong Kong, but never Ireland.

I’m sitting in the lobby of The Marker Hotel, a 5-star 7-story property on the edge of Dublin’s Grand Canal Dock. Here in Ireland’s major tech hub, I’m waiting for a self-identified corporate finance broker by the name of Rupert Hogan, the managing director of BusinessLoans.ie. Outside of our email exchanges, I don’t really know what to expect. I’ve met brokers from the US, Canada, Mexico, UK, and Hong Kong, but never Ireland.

When he arrives, he doesn’t disappoint. Hogan is full of energy and enthusiasm. He has a natural charisma and friendly manner that’s well-suited for a relationship-based business. It just so happens that SME finance in Ireland is still heavily reliant on person-to-person contact and Hogan is at the forefront of helping potential borrowers look beyond the bank for their financing needs.

SMEs are looking for speed and ease in the loan process, Hogan says. Historically, business owners would call on their bank for financing, invoking the sanctity and reliability of decades-old personal relationships, but Hogan explains that relationships between SMEs and banks just aren’t what they used to be. “[SMEs] feel like they’re going to get the runaround,” he says.

That’s where he comes in. And it could be any kind of business, he explains. Hogan jumps from a call with an import/export business to one in retail, followed by one with an agricultural equipment company. He has to understand a bit about them all no matter what it is, to figure out a proper financial solution. BusinessLoans.ie doesn’t charge for their service but they do receive a commission from the financial company if a deal closes.

That’s where he comes in. And it could be any kind of business, he explains. Hogan jumps from a call with an import/export business to one in retail, followed by one with an agricultural equipment company. He has to understand a bit about them all no matter what it is, to figure out a proper financial solution. BusinessLoans.ie doesn’t charge for their service but they do receive a commission from the financial company if a deal closes.

“Corporate” finance may evoke images of big city corporations engaged in international commerce but Hogan’s company can connect SMEs with as little as €5,000 through an unsecured business loan or merchant cash advance. Invoice Financing, leasing, and trade finance are also tools at his disposal. It’s not all small, however, as he hands me a rate sheet for one lender that will go up to €25M. Interest rates on these products when compared with their American and UK brethren are quite reasonable, and suggest also that the target clientele is not subprime.

As we sit there drinking coffee, Americano style in my honor, an executive for a local SME lender happens to spot him while passing by. After they exchange pleasantries, Hogan explains to me that he submits deals to that lender through their online broker portal. And so I ask him if doing everything online has become the standard in Ireland.

“It’s getting there,” he says, while acknowledging there’s still a ways to go with the population that’s conditioned to handling their financial dealings offline. The company’s domain name is perhaps perfectly positioned to capture that transitioning audience. When businesses decide to look for a loan online, he explains, “I hope they go to BusinessLoans.ie”

What Happened to Borro?

October 6, 2019Borro has since relaunched. Story is HERE

In 2013, Borro, an innovative online lending company that was poised to disrupt pawn shop lending forever, invited me to their stylish offices at 767 Third Avenue in Manhattan. It wasn’t for a story per se, but rather to learn more about each other’s place in the world of online lending. deBanked was still called Merchant Processing Resource and Borro, well they were beginning to take a shine to the idea that business owners could be a good source of potential customers. Framed as a “luxury asset-backed lender,” deBanked would eventually cover the concept two years later as Borro and other lenders like them took off.

In 2013, Borro, an innovative online lending company that was poised to disrupt pawn shop lending forever, invited me to their stylish offices at 767 Third Avenue in Manhattan. It wasn’t for a story per se, but rather to learn more about each other’s place in the world of online lending. deBanked was still called Merchant Processing Resource and Borro, well they were beginning to take a shine to the idea that business owners could be a good source of potential customers. Framed as a “luxury asset-backed lender,” deBanked would eventually cover the concept two years later as Borro and other lenders like them took off.

A then-executive of Borro explained the model as follows, “People don’t want to put their house at risk when they need capital. They’d rather lose the Maserati or a lovely piece of art than the house.” Ferraris, fine wine, rolexes, whatever, they would take it and make loans as low as $20,000 to as high as $10 million. Borro made $50 million worth of such loans in 2013 and doubled that number in 2014. Founded in the UK, the company’s expansion into the US was indicative of untapped demand and sky high potential. Big name investors got behind it including Victory Park Capital, Canaan Partners, Eden Ventures, and Augmentum Capital, eventually tallying up to more than $200 million raised.

But less than two years after deBanked ran its story, Borro went into administration, the UK’s version of bankruptcy.

But less than two years after deBanked ran its story, Borro went into administration, the UK’s version of bankruptcy.

What happened?

Zelf Hussain, Partner at PwC, had to answer that question in his position as joint administrator of BGH Realisations (2017) Limited, a Borro holding company. Hussain retells the tale in a 2018 Companies House report. It is as follows:

In February 2014, Victory Park Management LLC (VPM) entered into a £67 million credit facility with a number of Borro companies which was guaranteed, inter alia, by the Company. The VPM loan was intended to allow Borro to expand its portfolio and make larger value loans to clients.

Following the VPM loan, Borro’s loan book increased in size and it moved into property lending. This was not a successful move and several loans went into default. In addition, Borro was unsuccessful in selling the underlying properties of defaulted loans in a timely manner. These issues exacerbated its cash flow issues due to carrying costs and the cost of interest due to VPM.

Following a review of the Borro business, it was decided that the property lending side of the business would be closed down. In addition, VPM became aware of other customer loans that were in arrears and these lead to further cash flow issues and a depletion of Borro’s working capital.

In an effort to raise additional capital, Borro instructed investment advisors to run a sales proces. No bids were received which would serve to fully repay VPM or provide any equity value beyond the debt obligations to VPM.

In light of the failed sales process, PwC was engaged by the Company to assess its options. Following discussions, VPM offered to purchase the business and assets of the Company, including its share in Borro Limited (BL) and therefore indirectly the shares in other Borro group companies.

On 15 November 2017 the Company directors resolved that placing the Company into administration to facilitate the transfer of ownership of BL to VPM was in the best interests of all stakeholders and, in particular, the Company’s creditors. VPM would be a well-capitalised and supportive owner, with a long term plan for the business.

We were appointed as administrators on 15 November 2017, and effected the sale of the business and assets to VPM in a pre-packaged transaction on the same day.

Since then, Borro trudged along, but earlier this year the company stopped making new loans.

The news was cheered by one of the same pawn shop lenders that Borro was supposed to disrupt. Jordan Tabach-Bank, a board member of the National Pawnbrokers Association and CEO of a family owned pawn shop business, used the company’s downfall to promote the benefits of doing business offline. “Our clients like the personal touch of a face-to-face loan, particularly when entrusting us to safeguard their most precious and expensive personal possessions,” he wrote in a release.

How Linked Finance is Linking Irish SMEs With Quick Loans

October 1, 2019 Google Maps was convinced that I was already at my destination, but that didn’t make sense because I was still sitting in my cramped Airbnb rental apartment in Dublin and hadn’t left to go anywhere yet. “Oh man please tell me Google works in Ireland,” I said to myself while glancing at the time and counting how many minutes I’d be late to my first meeting.

Google Maps was convinced that I was already at my destination, but that didn’t make sense because I was still sitting in my cramped Airbnb rental apartment in Dublin and hadn’t left to go anywhere yet. “Oh man please tell me Google works in Ireland,” I said to myself while glancing at the time and counting how many minutes I’d be late to my first meeting.

I was on my way to Linked Finance, a peer-to-peer SME lender based in Dublin. Their office was uncannily close to where I was staying on Liffey Street Lower, just steps away from the Ha’penny Bridge. So close in fact, that Google Maps believed that I was going to and from the same location. I breathed a sigh of relief at the realization and ventured the short distance to the elevator that promised to deliver me to the inner universe of Irish fintech.

Alan Fagan, the company’s head of marketing, greeted me at the door. Fagan joined the company in 2015, two years after its founding. As we walk in, I notice the prominent display of the Linked Finance logo amid an ocean of eye-popping orange. The look, the feel, suddenly I feel transported to the tech scene in San Francisco. The accents overheard in the background, however, suggest I am most definitely in Ireland.

Alan Fagan, the company’s head of marketing, greeted me at the door. Fagan joined the company in 2015, two years after its founding. As we walk in, I notice the prominent display of the Linked Finance logo amid an ocean of eye-popping orange. The look, the feel, suddenly I feel transported to the tech scene in San Francisco. The accents overheard in the background, however, suggest I am most definitely in Ireland.

We sit down. Tea is offered. I decline. Fagan gets right into it and he sings a familiar song, that it can take a very long time for a business to get a bank loan.

It can take up 8 weeks to get funded, he says. “SMEs are the biggest employer in the country,” he explains, while hinting that facilitating loans to this demographic is as much a patriotic endeavor as it is a business one.

The nation’s Central Statistics Office puts the number of active enterprises in the private business economy at over 250,000. As of June, Linked Finance had made more than 2,100 loans for a grand total of more than €100 million.

Fagan gives me a demonstration of the platform, where individual investors (or peers) can see the name and location of the businesses whose loans are available to fund. An investor can even sort the listings by county, of which there are 26 in the Republic. Linked Finance does the underwriting, something they can do within 1 day, Fagan says.

The underwriting is tight. “We’re not a lender of last resort,” Fagan explains. They put themselves on the same (or better) credit risk footing as banks and claim that they’re able to assess risk and provide funds in a much more efficient manner. “We feel we do it better than banks,” Fagan says.

Most loans close quickly, thanks in part to their Autobid tool. Investors can be from anywhere so long as they’re over 18 and have a European Union bank account. Annual interest rates on the loans range from 6% to 17.5%.

Fagan says that although they are an online lender, many borrowers in Ireland still appreciate personal relationships. They can accommodate applicants that prefer a personal walk-through by a real person and that it can actually leave a memorable impression on their customers.

Marketing is done via a variety of direct methods but also through channel partners like accountants and financial advisors. A big name asset manager, Paris-based Eiffel Investment Group, with €1.5B under management, is among the loan investors on the Linked Finance platform.

I keep waiting for the caveat, an obstacle or twist in the model so inherently Irish, that somebody like me from half a world away would never truly grasp. But there isn’t one. The market is overtly familiar, yet more reminiscent of the UK than the States. Ireland lacks the robust regulatory framework of both countries, however. Despite that, the government does not appear to be holding the industry back. In June, Paschal Donohoe, the Minister for Finance, the government official responsible for all financial and monetary matters of the state, said “availability of credit is a key consideration for all businesses, and I am aware of the role peer to peer lending is playing in broadening competition in the SME finance market.”

Indeed, such competition has made credit more available in markets abroad.

As our time together winds down, I mindlessly attempt to plot my trip back. “Siri, take me home,” I speak into my phone. The Maps app opens and then loads to reveal a double entendre. It seems I am already very much there.

NYC Taxi Industry Leads Charge to Ban Confessions of Judgment Nationwide

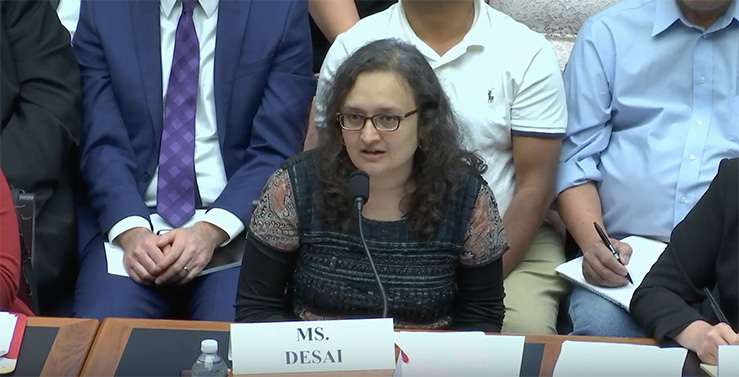

September 30, 2019 New York State may have outlawed entering confessions of judgments (COJs) against out-of-state debtors in their courts, but federal legislators want to see a ban on their use nationwide. On Thursday, the House Financial Services Committee convened for a hearing on predatory debt collection. Notably adding small businesses to the mix with consumers, COJs repeatedly came under attack.

New York State may have outlawed entering confessions of judgments (COJs) against out-of-state debtors in their courts, but federal legislators want to see a ban on their use nationwide. On Thursday, the House Financial Services Committee convened for a hearing on predatory debt collection. Notably adding small businesses to the mix with consumers, COJs repeatedly came under attack.

Testimony presented by Bhairavi Desai, executive Director of the 22,000 member New York Taxi Workers Alliance, claimed that predatory lenders are aggressively relying on COJs to “intimidate borrowers into making large sum payments towards outstanding loan balances.” Desai provided one such COJ affidavit to the Committee in which allegedly victimized defendants had confessed to judgment for nearly $600,000. The plaintiff was 160-year-old New York Community Bank, not an alternative finance company.

The NYC taxi business has moved front and center after the New York Times published a bombshell story in May that alleged lenders unfairly trapped Taxi medallion owners into loans they could not repay. The occasional reliance on COJs was vaguely mentioned but struck a nerve with critics already frothing to make them illegal.

Desai explained that unusually high suicide rates in the taxi business are rooted in part by predatory lending practices. “The real stories are the tens of thousands of drivers we see today that are really dying a slow death from despair, from stress from the crisis of this debt,” she told the Committee on Thursday. “Confessions of judgment have basically meant that when [the taxi medallion market] started to fall, drivers were told that they had to pay up the total sum of what was owed on that debt, had to produce $350,000, $400,000 overnight.”

Desai explained that unusually high suicide rates in the taxi business are rooted in part by predatory lending practices. “The real stories are the tens of thousands of drivers we see today that are really dying a slow death from despair, from stress from the crisis of this debt,” she told the Committee on Thursday. “Confessions of judgment have basically meant that when [the taxi medallion market] started to fall, drivers were told that they had to pay up the total sum of what was owed on that debt, had to produce $350,000, $400,000 overnight.”

FTC Commissioner Rohit Chopra voiced his support for a COJ ban when called upon to testify. “The FTC has unique jurisdiction to attack debt collection and discrimination issues in the small business lending market and we should look to restrict terms like confessions of judgment that the FTC banned in consumer loans ages ago.”

The Bloomberg stories that led to new legislation in New York were only mentioned during the hearing once and only in passing.

A slew of bills have been introduced to pursue the Committee’s initiatives. In addition to the Small Business Fairness Lending Act that would outlaw COJs from small business finance transactions nationwide, the Small Business Fair Debt Collection Protection Act seeks to apply the existing Fair Debt Collections Practices Act to small businesses and effectively put small business lenders under the regulatory purview of the CFPB.

You can watch the hearing below:

No Fees, Ever – Is Goldman Sachs Winning Or Losing The Online Lending Battle?

September 30, 2019 Peer-to-Peer lending in the United States died the day Goldman Sachs launched a rival online lending company in 2016. Armed with a low cost of capital and the trust of a household name, Marcus, as Goldman Sachs referred to themselves, sought to further disrupt consumer lending by eliminating every type of fee including late fees. Its pitch was simple, “No fees. Ever.” Three years later, the company still hasn’t caught up to competitors like Lending Club in origination volume (Marcus’ loan book is $5B vs. Lending Club’s $15B). Its fee-less model may also be backfiring.

Peer-to-Peer lending in the United States died the day Goldman Sachs launched a rival online lending company in 2016. Armed with a low cost of capital and the trust of a household name, Marcus, as Goldman Sachs referred to themselves, sought to further disrupt consumer lending by eliminating every type of fee including late fees. Its pitch was simple, “No fees. Ever.” Three years later, the company still hasn’t caught up to competitors like Lending Club in origination volume (Marcus’ loan book is $5B vs. Lending Club’s $15B). Its fee-less model may also be backfiring.

Goldman’s consumer lending business has racked up major losses, according to the WSJ. “It spent heavily to buy startups and cloud-storage space, hire hundreds of techies, and build call centers in Utah and Texas. Loans have gone bad at a higher rate than that of rivals.”

For all of the bank’s early bluster, they were so afraid of negative PR, that they launched without a collections department, leading to significantly high bad debt, the WSJ reports. That has since changed. But where Goldman Sachs appears to have lost, they may still be on track to win. As a consumer “bank” Marcus can also accept deposits. It had collected $36 billion as of year-end 2018 and added another $14 billion this year so far. Goldman also scored a valuable partnership with Apple on a branded credit card. The pitch is a familiar one, “No fees. Not even hidden ones.”

Apple promotes its card as “Created by Apple, not a bank,” yet The WSJ ironically reports that Goldman spent $300 million creating the card for Apple.

Apple promotes its card as “Created by Apple, not a bank,” yet The WSJ ironically reports that Goldman spent $300 million creating the card for Apple.

In a Q2 earnings call, Goldman CFO Stephen Scherr said that the bank was shifting its consumer lending focus from Marcus to the Apple Card. “I’d also say that if you look at the level and rate of growth in the Marcus loan business, while it continues to grow and perform well, we have slowed the increasing growth in that in contemplation of taking on increasing consumer credit through the card business,” he said. “What’s important for us is that we look at this on a risk-adjusted return basis not simply on a return on asset construct.”

Competitively, however, Scherr couldn’t answer if the consumer lending business’s costs will ultimately look more like a fintech lender or a bank as they scale. “What I can tell you is that what we have built jointly with Apple both on the front end and on the back end is intended to be operationally resilient, but equally is intended to be efficient both in terms of the application all through the delivery and on the back-end and so my expectation is that the efficiency will be reflected in that, but again premature to sort of put numbers around it.”

Of note is that Goldman acquired or acqui-hired from Clarity Money, Bond Street, and Final.

Could Peer-to-Peer Lending Be Resurrected By Falling Interest Rates? At Least For Now?

September 19, 2019 As interest rates rose and yields for investors at peer-to-peer (p2p) lenders collapsed, the allure of p2p lending, at least from my perspective, was gone.

As interest rates rose and yields for investors at peer-to-peer (p2p) lenders collapsed, the allure of p2p lending, at least from my perspective, was gone.

Rates on FDIC-insured CDs hit 2.5% while annual returns at some popular p2p lenders had declined to less than 5%. That’s a very narrow spread between an investment that has no risk of loss versus one that has a risk of losing everything, is rather unpredictable, and is marred by a history of misleading investors and overstating returns.

I compared the options and made the obvious decision and started withdrawing my personally invested funds out of p2p lenders 3 years ago in favor of more traditional investments like stock index funds.

But now interest rates are falling and it’s possible that retail investors once wooed by modestly generous savings account rates could begin to consider alternative options to generate returns. Enter P2P lending, again.

At Lending Club, the percentage of individual investors has trended downward consistently. In Q1 2015 these investors accounted for 19% of all platform originations with a total of $308 million. In the most recent quarter, that group has shrunk down to 5% of originations and only $155 million.

But at StreetShares, an online small business lender that offers individual retail investors a fixed 5% annualized return, the trend is the opposite. In a recent statement the company filed with the SEC, they claimed they had actually shifted away from funds from institutional capital providers and towards funds from retail investors. It doesn’t get into the specifics about why that is but it’s certainly unusual. StreetShares’ investment offering carries a total risk of loss much like other p2p lenders.

But interest rates aren’t supposed to fall in a void where nothing else in the outside world is happening. Assuming the economy is cooling, or worse, eventually heading towards a recession, the somewhat attractive looking p2p loan yields will fall as well since defaults on the underlying loans will rise.

So what does this mean? It means that online lenders, to the extent they’re still interested, have a potentially short window to entice retail investors back. To do so, they’ll have to convince the world that past transgressions are behind them and that low savings account rates can be supplanted by people helping their peers in return for a slightly better yield. That’s how the entire concept took off to begin with. I say the window is short because once we’re actually in a recession, it will become incredibly hard to convince fearful investors to participate in making risky online loans especially if the average returns drop into the negative. Don’t be surprised when that happens.