Marketplace Lending

Goldman Sachs Ramps Up Online Lending Unit, Makes Key Hires

February 24, 2016 Goldman Sachs is ramping up its online lending business and has hired a former Consumer Financial Protection Bureau attorney.

Goldman Sachs is ramping up its online lending business and has hired a former Consumer Financial Protection Bureau attorney.

Mitch Hochberg who was a senior counsel of the agency from 2011 to 2013 has been roped in to head compliance for the investment bank’s new online consumer lending business, Buzzfeed reported following Hochberg’s LinkedIn profile.

Goldman Sachs has hired a bunch of executives for this endeavor. Over the past year, it has hired executives from Discover, Lending Club and American Express. It’s not surprising that big banks like Goldman Sachs and JP Morgan Chase want a slice of the online lending market valued at trillion dollars. JP Morgan Chase partnered with online lender OnDeck last year to build a new lending product for small business merchants to be launched this year.

A Loan Bazaar Where You Can Literally Buy Loans for Pennies – FOLIOfn

February 22, 2016 Welcome to the true marketplace where you can trade debt on any level you like

Welcome to the true marketplace where you can trade debt on any level you like

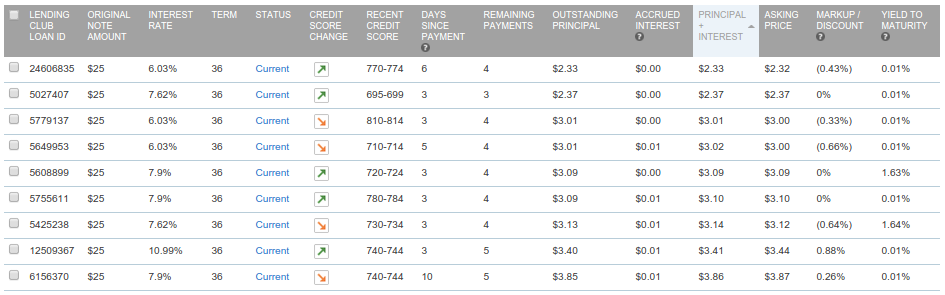

You haven’t experienced marketplace lending until you’ve entered the world of FOLIOfn. Operating as a secondary market for Lending Club and Prosper investors, the platform offers more than just liquidity for holders of 3-5 year consumer debt-backed notes. It’s a sort of anything-goes bazaar for loans, the kind of place where you can bet on a borrower making their last and final loan payment after having made 35 straight monthly payments with no problems.

For the price of 82 cents, an investor could literally buy the remaining 83 cent principal balance (their last payment) on a $25 3-year note.

Why invest in a borrower with no proven track record anyway? On FOLIOfn, you don’t have to. You can buy a note from someone else after the borrower has made their first few payments.

And what if you just want bigger? You can get that. Some investors are offering much larger loan pieces. You can even buy whole loans from them. Would you buy the entire remaining principal of a $6,000 loan paying 21% APR if you knew the buyer had already made all their payments in the first year on time? Somebody will make you that deal, but you’ll have to pay more than the outstanding principal balance to get it.

FOLIOfn has a bet for everyone. You can buy notes for example where the borrower’s FICO score has dropped by more than 200 points but is still surprisingly current on their loan. A drop by that much likely indicates that the borrower is delinquent on their other forms of credit, so you might want to get a discount on buying it. And yet, many investors list such loans at a premium, which could indicate that scarcity is a prevailing force.

The effects of scarcity are certainly evident on FOLIOfn, considering how many loans are up for sale on the platform in which no payments have been made yet because the loans are newly issued. With these, a different kind of loan speculator could hope to book a quick 5% gain in just 1 month by reselling a highly prized note to someone who seeks it. Do this over and over 12x a year and well… you could make a killing.

Millions of dollars worth of loans and loan pieces are being marketed at any one time. At the time this was written, there were more than 300,000 trades offered. Of course, they’re all ASKs. There’s no BIDs on FOLIOfn, which limits the efficiency of the marketplace and creates information asymmetry. Hence, a lot of the proposed trades are terrible and investors on industry forums are at times not shy about expressing their hope that a sucker buys them.

And just like one might expect at a bazaar, you don’t always know exactly what you’re going to get. Last year on the Lend Academy forum for example, investors pointed out that you could inadvertently buy notes that had already paid off. What was happening was that a note was being sold from one investor to another before Lending Club could process that the note had been paid off in full. If the investor paid a premium for it, they would immediately lose the premium and forfeit the future interest, causing a loss. The buyer would likewise take home a free premium.

Consider this conundrum. The note selling for 82 cents has a remaining principal balance of 83 cents that is coming due in less than a month, a bet that supposedly promises 1 cent profit (before the 1% Lending Club fee) if it works out. According to the borrower’s payment schedule however, they’re apparently only supposed to make one last payment of 76 cents, 7 cents less than the remaining principal officially stated on the account. If that’s correct, then a buyer’s best outcome is a loss of 6 cents (7 cents after the 1% Lending Club fee) and a worst case loss of 82 cents. It’s not uncommon for investors to notice and complain about these weird discrepancies (sometimes chalked up as rounding errors), but that’s the nature of the market. Confusing information is part of the trade.

To FOLIOfn’s credit, there is one cardinal rule, CAVEAT EMPTOR. The following is prominently displayed on top of the platform:

Notes are highly risky and only limited information is available about them. They are suitable only for investors whose investment objective is speculation. You could lose most or all of the money you invest in them. Folio Investing has no role in the original issuance of the Notes and is not responsible for and does not approve, endorse, review, recommend or guarantee the Notes or the accuracy, reliability, or completeness of any data or information about the Notes. See the Important Disclosures page for additional important information.

In the FOLIOfn loan bazaar, the numbers don’t always add up and the borrowers and traders are anonymous. Welcome to lending’s real marketplace, where it’s really hard to know much of anything.

Luckily, beginners only need bring pennies to start trading.

—

There’s actually something called The Penny Note Strategy (AKA The Toilet Note Strategy). You can read about it on Peter Renton’s blog.

Without Scalia, Media Outlets Reporting Marketplace Lenders Supposedly Doomed With Supreme Court Case (They’re Wrong)

February 18, 2016 Without Antonin Scalia, marketplace lending is apparently doomed, according to news outlets reporting on the matter. A high profile case (in the banking world anyway) known as Madden v Midland, is pending before the U.S. Supreme Court. Midland Funding seeks to reverse an appellate court ruling that said that interest rate preemption under the National Bank Act did not apply to them and thus they were subject to New York State’s usury laws.

Without Antonin Scalia, marketplace lending is apparently doomed, according to news outlets reporting on the matter. A high profile case (in the banking world anyway) known as Madden v Midland, is pending before the U.S. Supreme Court. Midland Funding seeks to reverse an appellate court ruling that said that interest rate preemption under the National Bank Act did not apply to them and thus they were subject to New York State’s usury laws.

According to BankRate.com’s reporting on the Scalia angle, “The U.S. Supreme Court has been asked to review a lower court decision that prevents marketplace lenders from getting around state usury laws by hooking up with banks headquartered in states that don’t have those rules.” But that’s not true at all. The case isn’t about marketplace lenders and the appellate court’s ruling isn’t currently preventing marketplace lenders from doing anything.

Midland Funding is a debt collector. Saliha Madden, a New York resident, obtained a bank issued credit card with an interest rate of 27% APR, racked up charges and didn’t pay them. The debt got written off and the bank sold the debt to Midland Funding. Midland continued to assess interest on the credit card debt while it attempted to collect. Saliha Madden sued on the basis that Midland was violating New York State usury laws. Midland Funding won and Madden appealed. Then a weird thing happened. The United States Court of Appeals for the Second Circuit held that in order “[t]o apply NBA preemption to an action taken by a non-national bank entity, application of state law to that action must significantly interfere with a national bank’s ability to exercise its power under the NBA.”

And from there began the somewhat justifiable panic in the marketplace lending industry. If a collector buying a charged-off debt from a bank can’t continue to enforce the terms as originally contracted, then could you make the same argument for loan platforms that buy newly issued loans? The answer is simply that you could make the argument. It’s not definitive. It’s one of those things that would likely have to be challenged in court by a borrower confident that a case involving a debt collector and a bank issued credit card somehow related to the matter between a marketplace lender and a borrower.

But there’s another problem in trying to make that link.

The Madden v Midland case involved a national bank and preemption under the National Bank Act. Many marketplace lenders such as Lending Club are not even conducting their business with national banks but with state-chartered banks. Their preemption ability falls under the Federal Deposit Insurance Act.

Lending Club did not shut their business down after the appellate court ruling and they didn’t stop lending in the states in which the Second Circuit has jurisdiction (New York, Connecticut and Vermont). Lending Club’s CEO Renaud Laplanche even expressed little worry about how it would impact their business when asked about it during their 2015 Q2 earnings call.

American Banker reported that “Scalia’s Death Is a Setback for Online Lenders in Key Court Fight.” But it’s really only a setback in the sense that a loss would peel away just one layer of the onion. Marketplace lenders weren’t going to suspend their operations regardless of whether or not the Supreme Court heard the case and regardless of whether or not Scalia was there to dissent.

Consider also that exporting home state interest rates using national and state chartered banks is only one system available to marketplace lenders. Square’s working capital program for example, is actually structured as a purchase of future receivables. There is no bank, no loan, and no preemption. An unfavorable Madden v Midland ruling would have no impact on that model or the dozens of merchant cash advance companies that offer similar products.

There’s also state by state licensing, which while costly and time consuming to set up, would at least allow marketplace lenders to lend in many states without relying on a bank or preemption. “I think the stronger business model is the state licensing model, as opposed to partnering up with a bank,” said Richard Eckman, a lawyer at Pepper Hamilton, to American Banker.

Even further distanced from this case are commercial marketplace lenders since state lending laws are generally less burdensome for business-to-business transactions.

And even if all else failed, a choice-of-law provision in a loan agreement can potentially decide which state’s law applies. Lending Club’s Laplanche said as much last year. “We continue to operate in the Second Circuit district where that decision was rendered, exactly as we did before and are relying on our choice of law provisions,” he said during an earnings call.

Scalia’s absence is at most a bummer for marketplace lenders. A win would only serve to tie up loose ends and finally put an end to bank charter model naysayers. Madden v Midland became so famous because the ruling was just so shocking. It practically begged the industry to take a look and wonder, what if? If this, then why not that? And if that, then who’s to say not this then? Even on deBanked, we’ve explored the nightmare scenario in which a well established system totally unravels and the world ends. The real world holds much more promise.

The real losers in an unfavorable Supreme Court ruling would be national banks and credit card companies. And that’s because if debt collectors can’t enforce their loan agreements, then they’re not going to buy that debt to begin with. And if debt collectors won’t buy that debt, then banks are going to have to figure out a better way to collect on their own, else they make even less risky lending decisions.

Something tells me though that banks would find a creative work-around for that anyway. Because if they didn’t, Madden v Midland would end up being a massive boon for marketplace lenders.

Imagine that.

DBRS Gives Marketplace Lenders High Marks

February 17, 2016After it was announced that new-age student lender Earnest had securitized $112 million worth of notes, another name returned to the forefront, DBRS. Founded in 1976 as Dominion Bond Rating Service, DBRS is a smaller ratings agency than Standard & Poor’s, Moody’s Investors Service and Fitch. Nonetheless, they rated Earnest’s senior notes an “A” which indicates they are of a “good” credit quality.

DBRS is a big name in the marketplace lending industry’s securitizations and they’ve historically doled out optimistic reports. In the case of SoFi for example, several tranches received AAA ratings in 2015, putting them on par with the United States Government in terms of safety.

Below is a list of some of the ratings stamped on new securitizations:

| Date | Company | Amount | DBRS Rating |

| 5/28/14 | OnDeck | $156,680,000 | BBB |

| 5/28/14 | OnDeck | $18,320,000 | BB |

| 10/20/14 | CAN Capital | $171,000,000 | A |

| 10/20/14 | CAN Capital | $20,000,000 | BBB |

| 2/10/16 | Earnest | $34,710,000 | A |

| 2/10/16 | Earnest | $70,240,000 | A |

| 2/10/16 | Earnest | $7,050,000 | BBB |

| 11/19/15 | SoFi | $154,903,000 | AAA |

| 11/19/15 | SoFi | $334,778,000 | AAA |

| 11/19/15 | SoFi | $46,691,000 | BBB |

| 8/4/15 | SoFi | $136,500,000 | AAA |

| 8/4/15 | SoFi | $250,800,000 | AAA |

| 8/4/15 | SoFi | $30,300,000 | BBB |

| 6/9/15 | SoFi | $146,676,000 | AA |

| 6/9/15 | SoFi | $235,445,000 | AA |

| 6/9/15 | SoFi | $29,780,000 | BBB |

| 2/3/15 | SoFi | $151,500,000 | AA |

| 2/3/15 | SoFi | $162,300,000 | AA |

| 11/10/14 | SoFi | $105,700,000 | AA |

| 11/10/14 | SoFi | $197,500,000 | AA |

| 7/15/14 | SoFi | $125,500,000 | A |

| 7/15/14 | SoFi | $125,500,000 | A |

| 12/24/13 | SoFi | $151,800,000 | A |

In the case of Earnest, the securitized loans represent borrowers with an average FICO score of 775 and an average annual income of $143,535. The average borrower is 32-years old. 81% of them have a graduate level degree.

Since Earnest launched two years ago, they’ve never had a loan go more than 60 days delinquent. That’s out of 5,580 borrowers which represents about $400 million in loans.

“100% of the pool contains refinancings of existing student loan debt,” the DBRS report says. “Loans are used to prepay a borrower’s existing eligible educational loan debt.”

While similar to SoFi’s prime customer base, DBRS explains that among Earnest’s weaknesses are their limited operational history and lack of data to gauge how their loans would perform during a recession.

The Dual Aura of Fora – How Two College Friends Built Fora Financial and Became the “Marketplace” of Marketplace Lending

February 16, 2016A recent Bloomberg article documented the hard-partying lifestyle of two young entrepreneurs who struck it rich when they sold their alternative funding business. The story of their beer-soaked early retirement in a Puerto Rico tax haven came complete with photos of the duo astride horses on the beach and perched atop a circular bed.

But two other members of the alternative-finance community have chosen a different path despite somewhat similar circumstances. Jared Feldman and Dan B. Smith, the founders of New York-based Fora Financial, are about the same age as the pair in that Bloomberg article and they, too, recently sold an equity stake in their company. Yet Smith and Feldman have no intention of cutting back on the hours they dedicate to their business or the time they devote to their families.

They retained a share of Fora Financial that they characterized as “significant” and will remain at the head of the company after selling part of it to Palladium Equity Partners LLC in October for an undisclosed sum. Palladium bought into a company that has placed more than $400 million in funding through 14,000 deals with 8,500 small businesses. It expects revenue and staff size to grow by 25 percent to 35 percent this year.

The deal marks Palladium’s first foray into alternative finance, although it has invested in the specialty-finance industry since 2007, said Justin R. Green, a principal at the firm. His company is appointing two members to the Fora Financial board.

Palladium, which describes itself as a middle-market investment firm, decided to make the deal partly because it was impressed by Smith and Feldman, according to Green. “Jared and Dan have a passion for supporting small businesses and built the company from the ground up with that mission,” he said. “We place great importance on the company’s management team.”

Negotiations got underway after Raymond James & Associates, a St. Petersburg, Fla.-based investment banking advisor, approached Palladium on behalf of Fora Financial, Green said. RJ&A made the overture based on other Palladium investments, he said.

The potential partnership looked good from the other point of view, too. “We wanted to make sure it was the right partner,” Feldman said of the process. “We wanted someone who shared the same vision and knew how to maximize growth and shareholder value over time and help us execute on our plans.”

It took about a year to work out the details of the deal Feldman said. “It was a grueling process, to say the least,” he admitted, “but we wanted to make sure we were capitalized for the future.”

It took about a year to work out the details of the deal Feldman said. “It was a grueling process, to say the least,” he admitted, “but we wanted to make sure we were capitalized for the future.”

The Palladium deal marked a milestone in the development of Fora Financial, a company with roots that date back to when Smith and Feldman met while studying business management at Indiana University.

After graduation, Feldman landed a job in alternative funding in New York at Merchant Cash & Capital (today named Bizfi), and he recruited Smith to join him there. “That was basically our first job out of college,” Feldman said.

It struck Smith as a great place to start. “It was the easiest way for me to get to New York out of college,” he said. “I saw a lot of opportunity there.”

The pair stayed with the company a year and a half before striking out on their own to start a funding company in April 2008. “We were young and ambitious,” Feldman said. “We thought it was the right time in our lives to take that chance.”

They had enough confidence in the future of alternative funding that they didn’t worry unduly about the rocky state of the economy at the time. Still, the timing proved scary.

Lehman Brothers crashed just as Smith and Feldman were opening the doors to their business, and all around them they saw competitors losing their credit facilities, Smith said. It taught them frugality and the importance of being well-capitalized instead of boot-strapped.

Their first office, a 150-square-foot space in Midtown Manhattan, could have used a few more windows, but there was no shortage of heavy metal doors crisscrossed with ominous-looking interlocking steel bars. The space seemed cramped and sparse at the same time, with hand-me-down furniture, outdated landline phones and a dearth of computers. Job seekers wondered if they were applying to a real company.

“It was Dan and I sitting in a small room, pounding the phones,” Feldman recalled. “That’s how we started the business.”

At first, Smith and Feldman paid the rent and kept the lights on with their own money. Nearly every penny they earned went right back into the business, Feldman said. The company functioned as a brokerage, placing deals with other funders. From the beginning, they concentrated on building relationships in the industry, Smith said. “Those were the hands that fed us,” he noted.

By early 2009, Smith and Feldman started raising capital from friends and family members so that they could fund deals themselves. About that time, they developed a computer platform to track the payments they received from funding companies where they placed deals.

Smith and Feldman’s first credit facility came from Entrepreneur Growth Capital. The stake enabled them to begin handling deals on their own instead of passing them along to funders. At the same time, they expanded their computing platform to handle entire deals.

From there, Smith and Feldman expanded their computing capability to help with accounting, underwriting and other functions. A combination of staff and outside developers guided the platform’s evolution. Today, three full-time in-house tech people handle programming.

Smith and Feldman emphasize that they don’t consider Fora Financial a tech company, but Green said the company’s platform helped cinch the deal. “We view Fora Financial as a technology-enabled financial services company,” he maintained.

While building the platform and expanding the business, Fora Financial secured mezzanine financing from Hamilton Investment Partners LLC, a company that bases its investments on the strength of management teams. “I am industry-agnostic,” said Douglas Hamilton, managing partner and and cofounder. “Dan and Jared are one of the best young teams I have encountered in my 35 years of doing private investing.”

Meanwhile, Fora Financial moved six times to larger accommodations. The company’s 116 employees now occupy 26,000 square feet in Midtown, with half of the staff working in direct sales and the other half devoted to back office, underwriting, finance, IT, customer service, collections and legal duties.

Meanwhile, Fora Financial moved six times to larger accommodations. The company’s 116 employees now occupy 26,000 square feet in Midtown, with half of the staff working in direct sales and the other half devoted to back office, underwriting, finance, IT, customer service, collections and legal duties.

Seventy percent of the company’s business flows from its inside sales staff and the rest comes from ISOs, brokers and strategic partners, Feldman said. “Most of the industry is the opposite,” he noted.

Finding salespeople presents a challenge in New York, where they’re in great demand. “We’ve invested a lot of money in finding the right salespeople,” Feldman said. “We also have to make sure that we’re right for them.” The sales staff includes recent graduates and experienced people from other sectors of financial-services or other businesses, Feldman noted.

“We don’t hire from within the industry,” Smith added. “From Day One, we’ve been training our staff our way and not bringing in tainted brokers.” That way, the company can make sure salespeople hew to the company’s ethical approach to business, he maintained. It’s part of creating a company culture, he said.

The Fora Financial culture also includes strict compliance with state and federal regulation because until recently Smith and Feldman owned the entire company, Feldman said. “Regulatory compliance is a core value with us and has been for some time,” he noted, adding that it’s also resulted in conservatism and due diligence.

Those traits have not gone unnoticed, according to Robert Cook, a partner at Hudson Cook, LLC, a Hanover, Md.-based financial-services law firm that has worked extensively with the company. “Fora was one of the first clients in this small-business funding area that took compliance to heart,” Cook said. “As time has gone on, we’re seeing more and more companies make compliance part of their culture, but Fora was one of the early adapters in this area.”

Those traits have not gone unnoticed, according to Robert Cook, a partner at Hudson Cook, LLC, a Hanover, Md.-based financial-services law firm that has worked extensively with the company. “Fora was one of the first clients in this small-business funding area that took compliance to heart,” Cook said. “As time has gone on, we’re seeing more and more companies make compliance part of their culture, but Fora was one of the early adapters in this area.”

Top management at alternative finance companies often talk about compliance, and the discussion too often ends there and doesn’t filter down through the ranks, Cook said. But that’s not the case at Fora Financial, he maintained. “It’s throughout the organization,” he said of the company Smith and Feldman founded. “From a compliance attorney’s standpoint, that’s always a great sign.”

Nurturing a penchant for compliance and dedicating a company legal and compliance department to pursuing it became a factor in Palladium’s decision to become involved with the company, Feldman said.

The focus on compliance also spread to the way Fora Financial brings brokers on board, Smith said. The company scrutinizes potential partners carefully before taking them on, he maintained.

“We probably missed out on some business as the industry grew because we were more cognizant of doing things the right way, but that paid off in the long run and some of our competitors have followed suit,” Smith said.

Compliance first became particularly important when Fora Financial added small-business loans to their initial business of providing merchant cash advances. They began making loans because lots of businesses don’t accept cards, which serve as the basis for cash advances.

On a cash basis, the current portfolio is 75 percent to 80 percent small-business loans. Loans started to surpass advances during the fourth quarter of 2014. The shift gained momentum after the company began funding through its bank sponsor, Bank of Lake Mills, in the third quarter of 2014.

Growth of loans will continue to outstrip growth of cash advances because manufacturers, construction companies and other businesses usually don’t accept cards, Smith said. If a customer qualifies for both, Fora Financial helps decide which makes the most sense in a specific case, Feldman added.

“We don’t sell our loans – we carry everything on the balance sheet and assume the risk,” Feldman said. “If it’s not good for the customer, it’s going to come back and hurt the performance of our portfolio over time,” he noted.

That thinking helped the company recognize the importance of adding loans to the mix. “We were one of the first companies (in the alternative-finance industry) to get our California lending license,” Feldman said. The company obtained the license in 2011 and got to work on lending. Offering loans required some retooling because the underwriting criteria differ so much from those in the cash advance business, Feldman said.

With the help of several law firms, they made sense of regulation from state to state and began offering the loans one state at a time, Smith said. “We wanted to make sure we rolled it out the right way,” Feldman noted.

As the company was changing, Smith and Feldman saw a need to rebrand. Initially, they called their company Paramount Merchant Funding to reflect their merchant cash advance offerings. When they added small-business loans to the mix, they used several additional names. Now, they’ve brought both functions and all of the names together under the Fora Financial brand. Fora means marketplace in Latin and seems broad enough to cover products the company might add in the future, Feldman said.

Smith and Feldman are contemplating what form those future products might take, but they declined to mention specifics. “We’re constantly getting feedback from customers on what they need that we’re not currently delivering,” Feldman said. “We have ideas in the pipeline.”

Despite changes in the business, Smith and Feldman have managed to remain true to timeless values in their personal lives. Smith grew up near Philadelphia in Fort Washington, Pa., and Feldman is a native of Roslyn, N.Y. Both now reside in Livingston, N.J. and occasionally ride the train together to work in New York. Smith is married and has two children, while Feldman and his wife recently had their first child.

“We’re at it everyday,” Feldman said of their work-oriented lifestyle. “When we’re out of the office, we’re traveling for work. So is the rest of the team. We’re only going to go as far as our people.”

And what about that other pair luxuriating in the Caribbean? As Feldman put it: “New Jersey is a long way from Puerto Rico.”

—

Learn more about Fora Financial at www.forafinancial.com

SoFi Dating App Will Take On “Loanly-ness” (Here’s How That Might Look)

February 16, 2016SoFi is apparently serious about creating a dating app for their members. That might seem a little weird considering they’re a company known for refinancing student loans. But according to Inc, Claire Arthurs, SoFi’s Director of Community and Member Success, is planning events in the nation’s big cities to bring singles together. And it’s all because their borrowers are demanding it. Eighty-six percent of attendees at an initial small event said they wanted to meet someone from the event again, Arthurs said to Inc.

Meanwhile, most listeners to SoFi’s CEO Mike Cagney on the re/code decode podcast undoubtedly assumed he was joking about a dating app. But now, rumor has it that they may actually release such an app later this year.

Naturally, deBanked saw this as an opportunity to offer our thoughts on how the SoFi dating experience might play out:

When literally nothing else has worked for your love life

For late night liaisons

If you’re old fashioned

When it’s more than just looks

When you’re trying to be romantic

—–

We hope you enjoyed them.

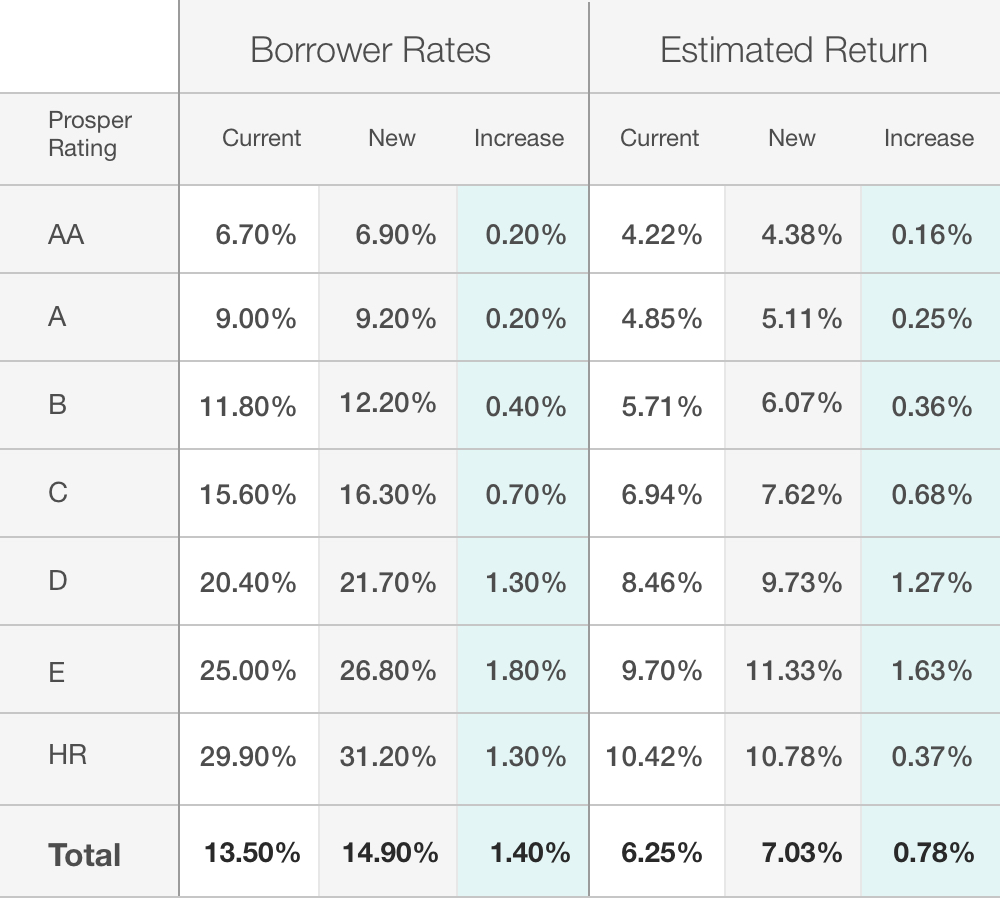

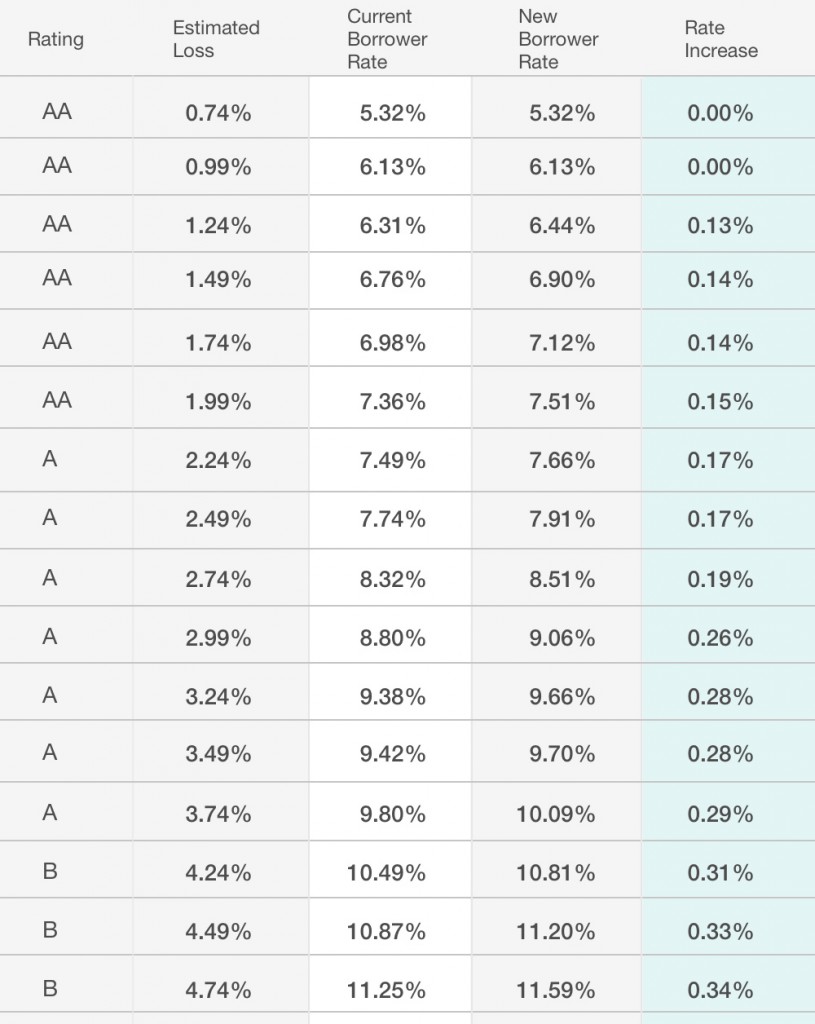

Prosper Has Increased Its Estimated Loss Rates

February 15, 2016“Effective today, Prosper has increased its estimated loss rates and the price charged for risk on the loans originated through the platform,” said an email to investors on Monday. “We believe this move ensures that our borrower payment dependent note and whole loan products remain competitive for our investors in the current turbulent market environment that we have witnessed since the beginning of 2016.”

Prosper is one of only two marketplace lending platforms in the US that is open to retail investors. Founded in 2005, the company has made over $5 billion in loans. They were surpassed by Lending Club in the race to dominate the market after being nearly destroyed by both the Great Recession and a class action lawsuit that claimed they sold unqualified and unregistered securities in violation of the California and federal securities laws. The suit was settled in 2013.

The going forward rate increase affects one category of high risk borrowers by as much as 199 basis points. Meanwhile, even prime borrowers will experience increases of up to 29 basis points.

These are the changes according to Prosper:

Estimated Aggregate Impact to Prosper Portfolio of Loss and Price Changes

Proposed Pricing Modifications for the Week of 2/15

Last week, the company also refaced their entire site. As a Prosper investor, the new user interface greatly improves the user experience.

California Lending License Process Isn’t Easy, State Painfully Slow on Paperwork

February 15, 2016 Quarterspot recently became a licensed lender in California. And it wasn’t quick, according to Quarterspot’s EVP Mike Green. It took much longer than a year, he says. Their CFLL license # is “603-K646”, but you can’t confirm that with California’s registry because the database hasn’t been updated in 42 days.

Quarterspot recently became a licensed lender in California. And it wasn’t quick, according to Quarterspot’s EVP Mike Green. It took much longer than a year, he says. Their CFLL license # is “603-K646”, but you can’t confirm that with California’s registry because the database hasn’t been updated in 42 days.

Welcome to the State that apparently has an abundance of resources to launch inquiries into marketplace lenders, but little time to work with the ones eager to operate in full compliance.

California attorney Paul Rianda told deBanked back in December that it can take months just to get a reply on a lending license application. And when they do reply, they’re sticklers over details. “I have experienced a situation where the examiner rejected an application because the name of the company was incorrectly spelled on the application,” Rianda wrote. “The name of the company was submitted on the application with ‘Inc’ instead of the complete ‘Inc.’ at the end of the company’s name.”

Yellowstone Capital’s Isaac Stern said it took them 15 or 16 months to get their license and required a lot of legal help from law firm Hudson Cook LLP. The cost, including lawyers’ fees came to about $60,000. “Man, it was like pulling teeth to get that license,” Stern told deBanked last year.

Tom McCurnin, an attorney for Barton, Klugman & Oetting LLP, disagrees. In an op-ed he wrote for Leasing News to counter a story published by deBanked, McCurnin wrote, “I would point out that the process of obtaining a California license is awfully easy, and involves a small filing fee and a bond.”

But for those not from the leasing industry, “easy” is not a word that comes to mind. “They’ll take away your license if you even sneeze the wrong way,” Stern previously told deBanked.

Worse, a change in the law regarding the payment of referral fees has led to a flurry of questions from lenders and commercial finance brokers alike. Law firm Hudson Cook LLP and Patrick Siegfried of the Usury Law Blog, both even had to weigh in on the issue. (See: Can California Lenders Pay Referral Fees to Unlicensed Brokers? | California Finance Lenders Push Legislative Agenda in Response to Growth of Alternative Small Business Finance Industry)

And even more confusing, is whether or not a license can be transferred. In February of 2015 for example, LoanMe Inc was ordered by the Department of Business Oversight to stop using what they claimed was another company’s lending license. But then a month later, the order was paused upon receiving “additional information” and then withdrawn.

As it stands with the State’s marketplace lending inquiry, 14 lenders have to respond by March. Among them is Kabbage Inc., Prosper Marketplace Inc., Avant Inc., On Deck Capital Inc. and Social Finance Inc., according to the Wall Street Journal.

Neither Kabbage or OnDeck are licensed California lenders from what deBanked could ascertain. But both would be legally eligible to make loans in the State through their chartered bank relationships.

“These online lenders are filling a need in today’s economy, and we have no desire to squelch the industry or innovation,” said DBO Commissioner Jan Lynn Owen in a December announcement.

In the meantime, being a licensed lender in the state is being perceived as a competitive advantage. Quarterspot for example, wants brokers to know that they can do loans in California now. Of course, after having waited painfully long to become licensed, it’s disheartening for them to see that the state hasn’t even updated their records since January 4th.

deBanked attempted to reach out to the California Department of Business Oversight a week ago to find out why their data was so slow to be updated. Nobody responded.