internet marketing

Google Will Ban Cryptocurrency Ads

March 14, 2018Today, Google updated its list of banned advertising content to include “cryptocurrencies and related content (including but not limited to initial coin offerings, cryptocurrency exchanges, cryptocurrency wallets, and cryptocurrency trading advice).”

This comes as Facebook made the same decision at the end of January. While Facebook’s prohibition of cryptocurrency-related ads came into effect immediately, the Google ban will not begin until this June.

The value of Bitcoin dropped by 9.1 percent in the wake of this news. Critics contend that this overarching ban may hurt the legitimate use of cryptocurrencies, while crypto detractors are pleased that cryptocurrency fraud will soon be significantly restricted.

In June, Google will also prohibit ads related to Binary options, a type of financial contract that promises either a fixed amount of compensation or nothing at all.

Google Restricts Ads for Merchant Cash Advances

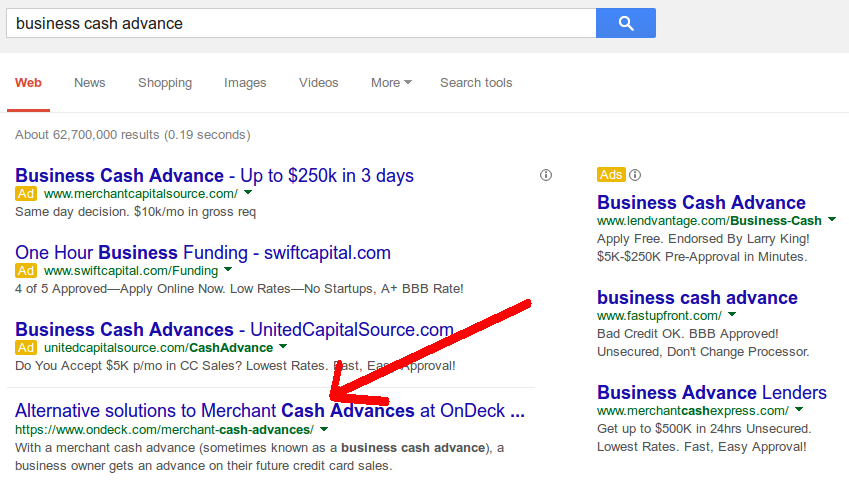

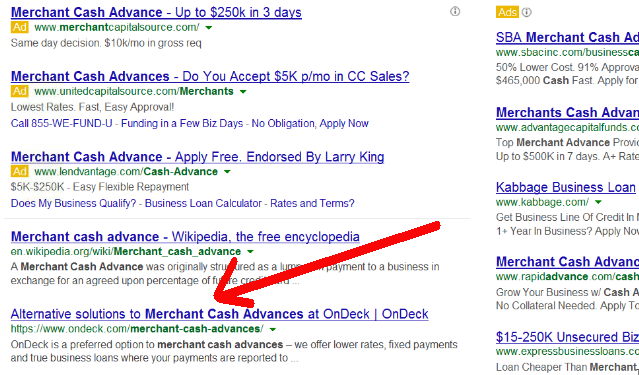

October 8, 2017Google’s quest to stamp out payday loan advertisements from its paid search results has caused collateral damage to merchant cash advances. That’s because the two-word term cash advance, often synonymous with payday loan, appears to now have a blanket restriction that blocks ads whenever that term is included in search, regardless of the words that come before it or after it.

Merchant cash advances, however, are commercial factoring transactions with no relation to payday or consumer finance.

A user on the deBanked forum first alerted me on October 5th and deBanked conducted tests from internet connections in two states to see if we could replicate the results. Below is a sample of our results:

| Keyword | Google Adwords Status |

| cash advance | BLOCKED |

| merchant cash advance | BLOCKED |

| business cash advance | BLOCKED |

| business loan | ACCEPTED |

| loans | ACCEPTED |

| get a business loan | ACCEPTED |

| loan for my business | ACCEPTED |

| cash advance for my business | BLOCKED |

| business loan companies | ACCEPTED |

| merchant cash advance companies | BLOCKED |

| factoring or business loans or credit cards | ACCEPTED |

| factoring or business loans or merchant cash advances | BLOCKED |

| loan from ondeck | ACCEPTED |

| cash advance from ondeck | BLOCKED |

| consolidate loans | ACCEPTED |

| consolidate cash advances | BLOCKED |

No such block exists on rival search engine Bing.

Though Google has not said this, the mass removal of payday lending ads, once a massive source of revenue for them, is likely the result of government pressure. Over the last two years, federal regulators have begun targeting lead generation sites that direct users to lenders in a misleading manner.

Unless Google fixes the glitch that caused merchant cash advances to get wrapped up with consumer cash advances, the organic search results will experience a huge boost in value. Last month we reported that companies like OnDeck, Fundera, and Nerdwallet were winning the search engine optimization battle for several keywords including merchant cash advance. Absent any ads, those companies and several others will now benefit from a stream of free traffic and applicants for which their cost of acquisition will be zero dollars.

Perhaps little has been mentioned about this ban within the industry because the end result is FREE leads for those that rank well organically. Long live SEO!

Merchant Cash Advance Now In-Depth

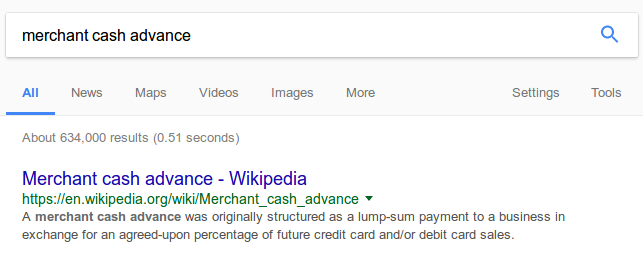

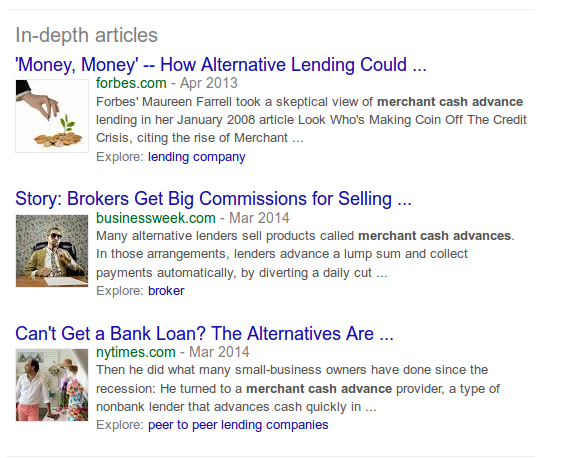

December 1, 2014For quite possibly the first time ever, Google has blessed merchant cash advance with its own array of In-depth articles. What are In-depth articles? Why, they’re featured stories at the bottom of the normal search results. The In-depth feature launched in 2013 and has only worked for certain keywords.

Today it appeared for the very first time for the keyword merchant cash advance

Since Google experiments constantly and shows different results to everyone, it’s possible that you’ve been seeing this for some time already.

I had this to say about the feature 16 months ago:

If you’re wondering how websites can prepare themselves to benefit from such rich snippets, I published Schema.org Markup and Rich Snippets for the Little Guy back in August 2013.

Businessweek, NY Times, and Forbes… I’m not surprised that they’re the chosen publications. Truth be told, there may not have been enough written about merchant cash advance to implement this feature until now. Consider this a milestone.

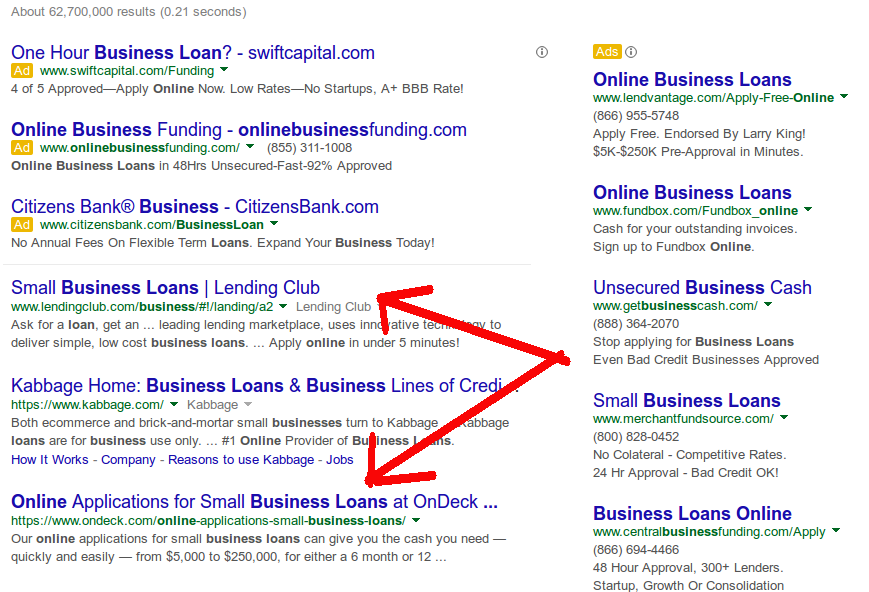

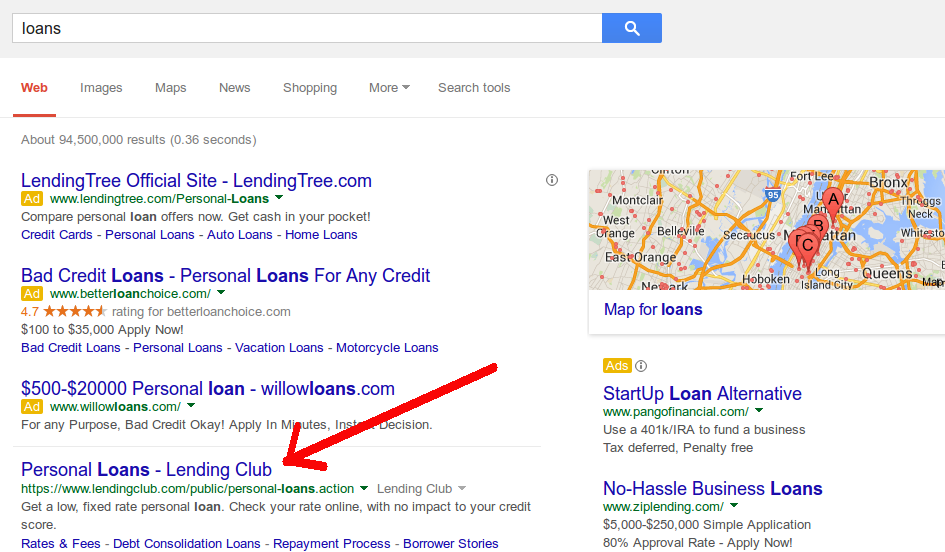

Six Signs Alternative Lending is Rigged

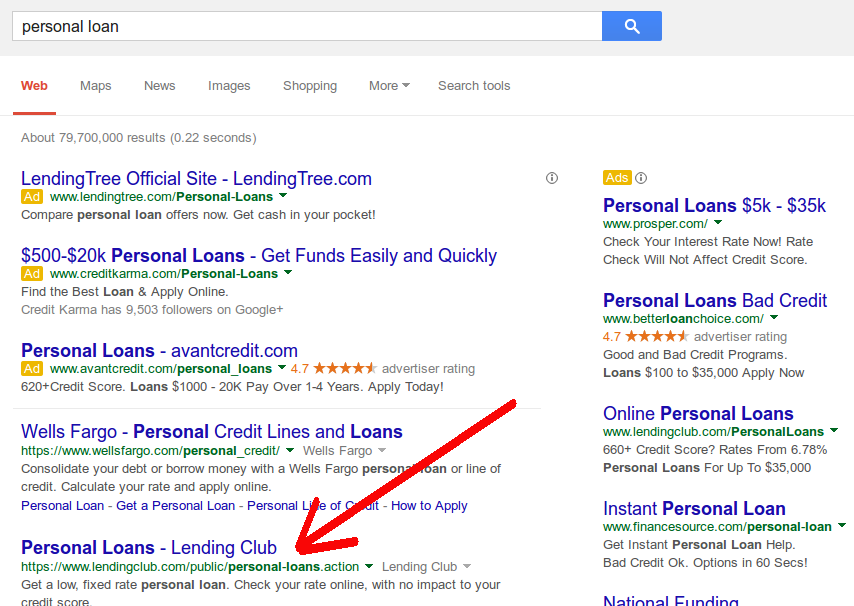

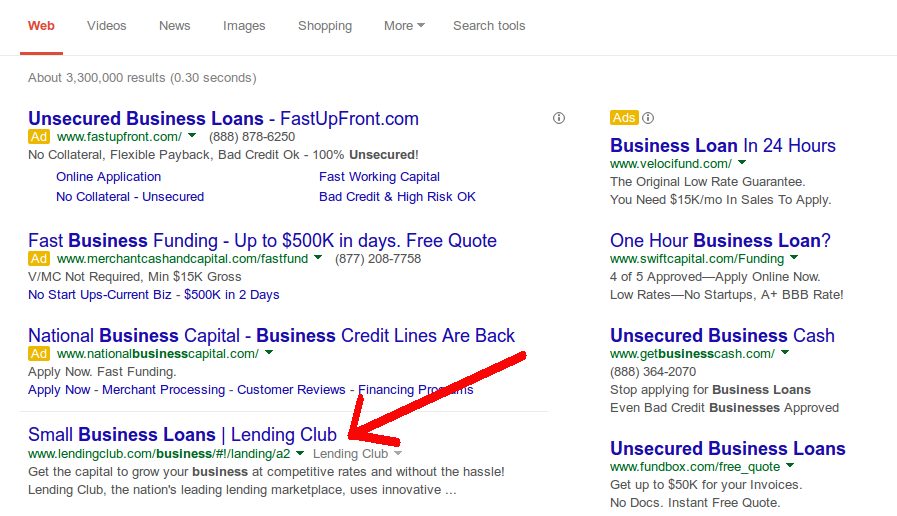

August 3, 2014There’s a lot of players at the alternative lending table but there are two that have won a string of lucky hands to put them on top. Neither were the first to draw cards, nor do either of them offer something that everybody else does not. These two lenders have something in common of course, special favor with the Internet gods. Is the game rigged?

OnDeck Capital is the most celebrated alternative business lender of our time. Their daily repayment loans and fast approval times are a hit with customers. In fact, as told in their recent securitization prospectus, OnDeck has been eroding its reliance on brokers and third parties to accommodate growth through their direct channel. Direct has been good for OnDeck, very good.

LendingClub on the other hand is the big dog in consumer lending, having funded more than $5 billion since inception. Every month they shatter the previous record for volume of loans funded and they’re expected to go public within the next year. LendingClub continues to pound their distant rival Prosper in monthly loan production. Are they just better at marketing?

Curiously I can’t help but notice they have something in common, they’re both owned by Google. Google Ventures led OnDeck Capital’s series D round and Google Ventures’ Karim Faris sits on OnDeck’s board of directors. Similarly, Google owns a minority stake in LendingClub.

While neither is outright owned or controlled, It’d be surprising if Google didn’t do something to foster the success of their investments. What could a billion dollar Internet giant possibly do to give them a little push?

Stop backlinking and SEO. The game is rigged

If you reproduce a search for the same keywords, you should know that results vary depending on what kind of device you’re using (mobile vs. desktop), what zip code you’re in, what time of the day it is, whether or not you’re logged into Gmail/Google+/Youtube, and whether you’ve searched for related topics before. I performed my searches with a fresh desktop browser on a Sunday evening in NYC with all cookies, cache, and Google account sessions wiped clean.

You might not get exactly what I get and I realize that obfuscates the conspiracy I’m trying to establish here. If you do witness peculiar keyword domination though, keep an open mind that there might be more going on than good SEO and strong natural backlinking brought on by mainstream media publicity. Plenty of big businesses that dominate offline fail to rank well in the top ten results online.

You might not get exactly what I get and I realize that obfuscates the conspiracy I’m trying to establish here. If you do witness peculiar keyword domination though, keep an open mind that there might be more going on than good SEO and strong natural backlinking brought on by mainstream media publicity. Plenty of big businesses that dominate offline fail to rank well in the top ten results online.

Search engines say that if you’re popular, you’ll rank well. But there are plenty of cases where ranking well has made businesses popular.

Maybe, just maybe the game is rigged…

Lending Club Threatens The Status Quo

March 20, 2014 In late 2013, consumer peer-to-peer lender Lending Club announced their plans to start offering small business loans. That caused a stir in the merchant cash advance world for a few weeks, but the hype died down. The general consensus was that there would be little to no overlap between the applicants each target.

In late 2013, consumer peer-to-peer lender Lending Club announced their plans to start offering small business loans. That caused a stir in the merchant cash advance world for a few weeks, but the hype died down. The general consensus was that there would be little to no overlap between the applicants each target.

To this day, I continue to doubt that the overlap will be anything less than substantial. Nik Milanovic of Funding Circle would probably disagree with me. The main argument has been that Lending Club will only target small business owners with good credit, which assumes that businesses with anything less are the only users of merchant cash advances. Not to give anyone’s figures away, but I have seen data to suggest that a large segment of merchant cash advance users have FICO scores in excess of 660. Somewhere along the line we convinced ourselves that merchant cash advances were for businesses with really bad credit. That was never the purpose it was intended for, though it’s true that many applicants have low scores.

Historically, merchant cash advances were for businesses that posed a cash flow risk to banks. Split-processing eliminated that risk by withholding a percentage of card sales automatically through the payment company processing the business’s transactions. Funders today that rely on bank debits for repayment don’t have that safeguard, but they make up for the risk they take by doing something banks don’t do, require payments to be made daily instead of monthly. This allows businesses to manage their cash flow throughout the month and enables the funder to compound their earnings daily. It’s a phenomenon I wrote about in the March/April issue of DailyFunder (Razzle Dazzle Debits & Splits: Daily is the Secret Sauce)

According to the Wall Street Journal, Lending Club will require a minimum of 2 years in business and participation will initially only be open to institutional investors.

Lending Club’s website states that they will recoup funds on a monthly basis via ACH and that interest rates range from 5.9% APR to 29.9% APR + an origination fee. Terms range from 1 to 5 years and there are no early payment penalties.

TechCrunch openly pegs CAN Capital and OnDeck Capital as chief rivals for Lending Club in the space. CAN has enjoyed frontrunner status in the industry since 1998 and while they have been tested in the last 2 years, they haven’t come up against something like this.

In the same Wall Street Journal story, Lending Club’s CEO, Renaud Laplanche lays out who his competitors are with his quote, “The rates provide an alternative to short-term lenders and cash-advance companies that sometimes charge more than the equivalent of 50% annually.”

But will the impact be felt right away? In Laplanche’s interview with Fortune, he claims that it’s very likely they’ll focus on the 750+ FICO segment first, where institutional investors will be comfortable. But make no mistake about it, that will change quick, especially with a probable IPO in the next 8 months.

Is Lending Club really all that big? To draw a comparison, RapidAdvance got a $100 million enterprise valuation when they got bought out by Rockbridge Growth Equity about 6 months ago. Lending Club on the other hand was valued at around $2.3 billion at that time. It took OnDeck Capital 7 years to fund $1 Billion in loans. Lending Club is funding a billion dollars in loans every 3 and a half months. Granted, they’ve all been consumer loans, but let’s not kid ourselves about their capabilities.

Lending Club is funding more consumer loans than the entire merchant cash advance industry is doing combined. Thanks to the peer-to-peer model, they have infinity capital at their disposal. We can pretend that no one with good credit ever applied for a merchant cash advance or we can acknowledge the 3 billion pound gorilla in the room.

Lending Club and other peer-to-peer lenders that follow them will disrupt the alternative business lending status quo.

—

Previous articles on this subject:

Will Peer-to-Peer Lending Burn the Alternative Lending Market?

Lending Club Business Loans are Here

Peer-to-Peer Lending will Meet MCA Financing

Google Penguin 2.1 Takes Swing at Merchant Cash Advance Industry

October 5, 2013 If you noticed a shuffle in search rankings for industry keywords last night, it’s because Google unleashed Penguin 2.1.

If you noticed a shuffle in search rankings for industry keywords last night, it’s because Google unleashed Penguin 2.1.

Penguin 2.1 launching today. Affects ~1% of searches to a noticeable degree. More info on Penguin: http://t.co/4YSh4sfZQj

— Matt Cutts (@mattcutts) October 4, 2013

Penguin focuses on spammy or purchased backlinks so if you did one or the other, you probably got harmed. Given the high cost of traditional marketing and Pay-Per-Click Internet Marketing, many funders, ISOs, and lead generators have turned to SEO to boost their visibility in organic search. Whether undertaken by inside employees or outside contractors to do the job, there is no doubt that building links has been part of the strategy. Some have had major success in rising up through Google’s search results but most haven’t. It’s not easy getting to page 1, but if you get there, don’t celebrate. You won’t be there forever.

Less than two weeks ago on DailyFunder, someone took to the board to pat themselves on the back for ranking #2 for the keyword: merchant cash advance. Wikipedia is #1. They admitted it took a lot of hard work over the course of 8 months. Last night they were thrust back to position #65. That’s on page 7 where they will never be found. 8 months of work for 2 weeks of ranking. You might be saying, “Well my SEO guy will just roll with the punches and get us right back.” Unfortunately with Penguin, it doesn’t work that way. Penguin is basically a permanent penalty, an algorithmic barricade to prevent you from ever ranking for your keywords again. According to a poll on Search Engine Roundtable, only 7% of respondents claimed to have made a full recovery after Penguin 2.0. Most SEOs would advise that you torch your domain, buy a new one and start a whole new website. That’s not exactly an easy thing for a big brand or company to do.

There’s a flaw in all the SEO being done in the merchant cash advance industry anyway and that’s the notion of being on page 1 to begin with. If you read David Amerland’s Google Semantic Search, he explains that “there is no longer a first page of Google”. The results you see on the first page of Google depend completely on whether or not you’re using a desktop or mobile device, what zip code you’re accessing the internet from, what you’ve searched for in the past, and whether you’re logged into your gmail account. And if you use Google+, then forget it! The first page results for someone that uses Google+ are ultra personalized. To rank on their first page, they’ll pretty much need to follow you socially first.

So if you’re thinking about ranking higher in search as a means to generate more leads, you sure as heck better understand how the results work these days. What you see on your screen is not what I see on mine. A site that’s #65 for me, may be #4 for you.

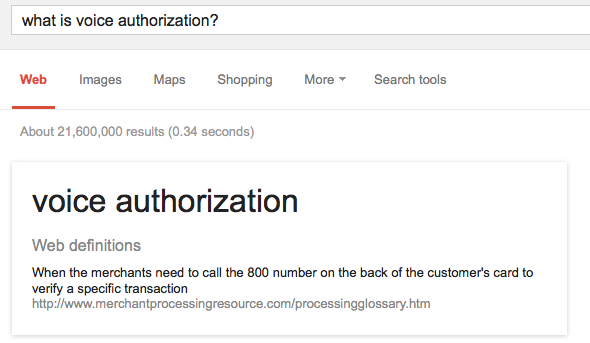

The other angle of Google’s foray into Semantic Search is their desire to be an answer engine, not a search engine. Google wants to answer questions for searchers without them having to click a link. Here’s an example of Merchant Processing Resource acting in that role:

What is voice authorization you ask? Boom! Answered! No need to click anything. That’s where search is going. What this means for companies that are trying to get customers is that they either need to become the absolute authority within their industry or they need to throw in the towel and do Pay-Per-Click.

When I search for merchant cash advance from my desktop in NYC, 7 out of the top 10 results are not company pages, which is astounding considering how much effort companies are putting in to rank high for this keyword. I see:

- 1 Wikipedia

- 4 News articles

- 1 Press release

- 1 Youtube video

Did you get hit by Penguin 2.1? Are you optimized for Semantic Search?

Previous merchant cash advance SEO articles:

- Your Merchant Cash Advance Press Release May be Hurting You 8/8/13

- Is Google Your Only Web Strategy? 12/31/12

- The Other 93% 7/13/12

- Google Penguin Kills Survivors 5/6/12

- The SEO War Continues 4/4/12

- The SEO War for Merchant Cash Advance 2/12/12

Loans for Likes

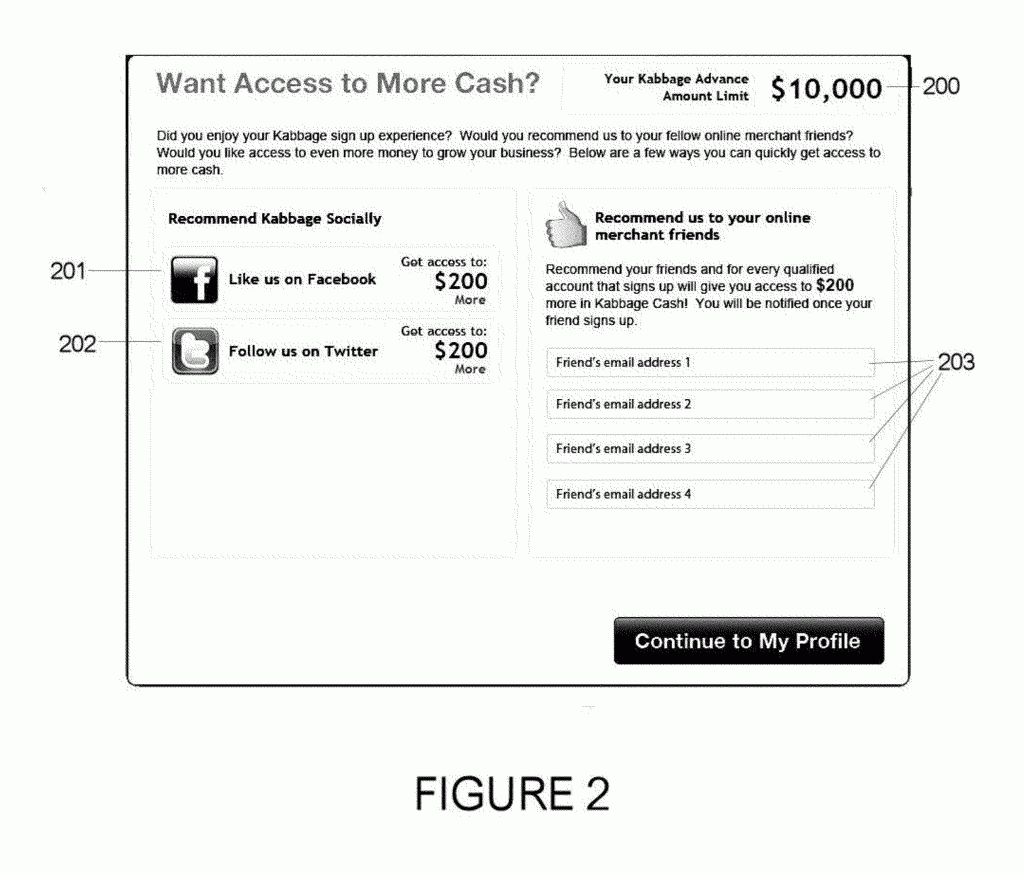

September 17, 2013How Kabbage is building a social media marketing empire

Take a look at what Kabbage has cooked up:

Like Kabbage on twitter or Facebook and your approval amount gets extended automatically. This helps Kabbage accomplish two goals:

1. Spread awareness about their brand to the followers of the people Liking and following them.

2. Identify the public social media accounts the business is using so it can monitor what they’re doing.

You can learn about how Kabbage feels about businesses that aren’t using social media in the patent’s summary. Under Description, Section 2:

You can learn about how Kabbage feels about businesses that aren’t using social media in the patent’s summary. Under Description, Section 2:

Social networking is growing at an exponential rate and businesses that are not exploiting social networking sites such as FACEBOOK and LINKEDIN are considered falling behind the times.

So why is this a patentable invention? A merchant’s approval amount is increased automatically by an algorithm that checks to see if a merchant performed the action of Liking or Following. So if you think that’s a great idea and want to do something similar, you’re a bit late. Better Call Saul… I mean Kabbage to license the use of such technology. It works as such:

The above aspects can be obtained by a system that includes (a) approving, by a cash provider, a user for a cash line wherein the user is permitted to receive cash up to the cash line; (b) causing an offer to be displayed on an electronic output device associated with a user’s computer, the offer being to increase the cash line when the user takes a particular action comprising associating the user’s social networking account with the cash provider; (c) determining that the user has taken the particular action; and (d) automatically increasing the cash line.

The term merchant cash advance is explicitly used twice in the patent but it also goes to cover any kind credit line or loan being program. This is actually an incredible patent to be in possession of because it’s such a great idea. Imagine telling a merchant approved for 5k, that they will get an extra $200 just for following you on twitter and another $200 just for liking you on facebook. It may not seem like much on a $250,000 deal but Kabbage does a lot of smaller sized advances where the $400 combined approval bump is a sweet incentive for merchants.

Marketing in this industry is expensive and this is one of the more innovative models I’ve seen.

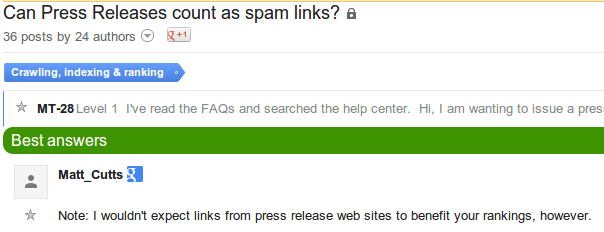

Your Merchant Cash Advance Press Release May be Hurting You

August 8, 2013Part of keeping up with the merchant cash advance industry means reading up on the press releases published online, but it’s not such an easy job. Legions of funders, ISOs, and lead generators are competing for valuable real-estate in search results and they’ll use every trick in the book to get it. It almost always comes with a price and these tricks don’t always work. By tricks here, I’m referring to using optimized anchor text in press releases as a way to build backlinks.

Have you ever seen a press release with thin information but lots of embedded links that say something like “best small business loan companies”? There’s a reason for that. These companies are trying to manipulate PageRank, a Google search ranking factor that calculates the value of the page the link is on, calculates the value of the website it’s on, uses the anchor text as a signal of what the page is about, and then passes that value onto the destination page. PRWeb has a solid PageRank of 7 out of 10 and last I checked, they don’t nofollow the links. That means a webpage can gain some serious ranking points by using optimized anchor text in a press release. But that’s just on PRWeb’s domain. Consider the fact that press releases are usually syndicated to tens, hundreds, or even thousands of other websites, most of which will keep the links intact, and multiplying the value being passed to the destination site.

Have you ever seen a press release with thin information but lots of embedded links that say something like “best small business loan companies”? There’s a reason for that. These companies are trying to manipulate PageRank, a Google search ranking factor that calculates the value of the page the link is on, calculates the value of the website it’s on, uses the anchor text as a signal of what the page is about, and then passes that value onto the destination page. PRWeb has a solid PageRank of 7 out of 10 and last I checked, they don’t nofollow the links. That means a webpage can gain some serious ranking points by using optimized anchor text in a press release. But that’s just on PRWeb’s domain. Consider the fact that press releases are usually syndicated to tens, hundreds, or even thousands of other websites, most of which will keep the links intact, and multiplying the value being passed to the destination site.

One press release could result in hundreds of powerful ranking signals for the keyword, “best small business loan companies.” Now if there were on-page signals for that keyword and additional external factors at work, then there’d be no reason for that page not to rank high in search results for best small business loan companies. And so anyone not totally asleep at the wheel has been using that method for months, if not for years.

There’s only one problem. Google’s Director of web spam (yes, this is a real title) had said back in December of 2012 that links in press releases shouldn’t count.

The Internet went wild over this statement especially since his choice of words implied that there is a chance they did count, he just wouldn’t expect them too. Search Engine Optimization (SEO) diehards decided this was a battle worth fighting and optimized anchor text in press releases became more used than ever before, that is until Google decided to take action.

Wouldn’t expect was apparently proven to mean definitely does. The fact is that links in press releases were passing PageRank and the sites on the other end of them were getting valuable ranking signals. That’s why to this day we see merchant cash advance releases read like an itemized list of keywords on PRWeb…

The best merchant cash advance company has announced a new program to help provide bad credit business financing to restaurants in need of a fast cash loan.

If you’ve stopped reading the article at this point, you’re in trouble. The gravy train is no longer running express. Less than two weeks ago, Google conceded that optimized anchor text in press releases works and are a form of cheating the system. That means that overuse or quite possibly any usage of a keyword rich anchor in a release means your website is at risk of a rankings penalty. Google advises that in order to be safe, webmasters should nofollow the links. There’s just one problem with that; Credible wire and release services do not under any circumstances allow companies to code in HTML attributes in their releases, rendering this feat impossible.

That means the burden of nofollowing the links is on the release services and syndicating websites, something that isn’t likely to happen anytime soon. Release services have not been shy about the potential SEO benefits they can provide, with some going so far as to offer paid consulting services to clients on how to optimize their anchor text for search engines. To them, a crackdown on links in releases means a crackdown on a very profitable portion of their business model.

Watch Matt Cutt’s explanation of links in advertorials:

Google offers the following guidance on link schemes:

The following are examples of link schemes which can negatively impact a site’s ranking in search results:

- Buying or selling links that pass PageRank. This includes exchanging money for links, or posts that contain links; exchanging goods or services for links; or sending someone a “free” product in exchange for them writing about it and including a link

- Excessive link exchanges (“Link to me and I’ll link to you”) or partner pages exclusively for the sake of cross-linking

- Large-scale article marketing or guest posting campaigns with keyword-rich anchor text links

- Using automated programs or services to create links to your site

Additionally, creating links that weren’t editorially placed or vouched for by the site’s owner on a page, otherwise known as unnatural links, can be considered a violation of our guidelines. Here are a few common examples of unnatural links that violate our guidelines:

- Text advertisements that pass PageRank

- Advertorials or native advertising where payment is received for articles that include links that pass PageRank

- Links with optimized anchor text in articles or press releases distributed on other sites. For example:

There are many wedding rings on the market. If you want to have a wedding, you will have to pick the best ring. You will also need to buy flowers and a wedding dress.- Low-quality directory or bookmark site links

- Links embedded in widgets that are distributed across various sites, for example:

Visitors to this page: 1,472

car insurance- Widely distributed links in the footers of various sites

- Forum comments with optimized links in the post or signature, for example:

Thanks, that’s great info!

– Paul

paul’s pizza san diego pizza best pizza san diegoNote that PPC (pay-per-click) advertising links that don’t pass PageRank to the buyer of the ad do not violate our guidelines. You can prevent PageRank from passing in several ways, such as:

- Adding a rel=”nofollow” attribute to the < a > tag

- Redirecting the links to an intermediate page that is blocked from search engines with a robots.txt file

You can watch John Mueller, one of Google’s lead Webmaster Trends Analyst answer questions to Google’s new link policies in the hangout below:

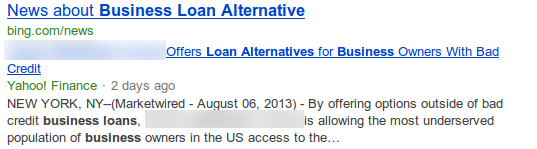

There are other purposes for publishing thin releases as both Google and Bing can decide to display a snippet of the release on the first page of the results for the keywords used in the announcement. So no, it’s not just about links, at least that isnt’t all of the SEO benefit to be gained.

These news snippets can last up to a week, helping companies that might not be ranking well jump to the front of the line for exposure.

Link Removal

We’re not going to call anyone out by name but ever since Google Penguin 1.0 was released, many merchant cash advance companies and payment companies have hired link removal experts to identify bad links for them and are paying them to have them taken down. The only way to take down a link is to ask the webmaster hosting the site to take it down. Unfortunately, this has led to some companies finding the cheapest link removal service they can find, resulting in a poorly qualified consultant setting off to remove 100% of a site’s links instead of just the bad ones. We know this firsthand because we have had no shortage of e-mails from people claiming to be the hired link removal representative of a merchant cash advance related company.

The e-mails usually look like this:

Hello sir,

I am contacting you on behalf of Cash Advance Funder ABC and recently we have been instructed by Google to remove all of our links to have a penalty removed. Therefore we are asking that you remove our spam link from your website. We appreciate your immediate assistance in this matter.Sincerely

sfahfdspfu547@spamlinkremovalservicecompanyseobest.com

A great way to make sure your website never ranks ever again is to remove all your good links too. We can assure you that links on this website are not bad.

So…

In conclusion, if your hired SEO consultant is still banging away on optimized anchor text in press releases, there’s a good chance now that they’ll be causing damage over the long term. Press releases are for the purpose of making important company announcements and Google is on to anyone using them for any other reasons.

Your press releases might be hurting you with Google. Bing on the other hand…

Other SEO related articles on Merchant Processing Resource:

- Is Google Your Only Web Strategy?

- Google Penguin Kills Survivors

- The SEO War for Merchant Cash Advance Continues

- The SEO War for Merchant Cash Advance

https://debanked.com