internet marketing

Penguin 2.0 Epic Fails

May 23, 2013Just as the Merchant Cash Advance industry is beginning to enjoy positive publicity, Google has the potential to set the momentum backwards by pushing terrible results. I’m going to post some Penguin 2.0 epic fails over the next couple days. So check in every now and then to see what’s new. You can also send screenshots of any epic fails you find to webmaster@merchantprocessingresource.com

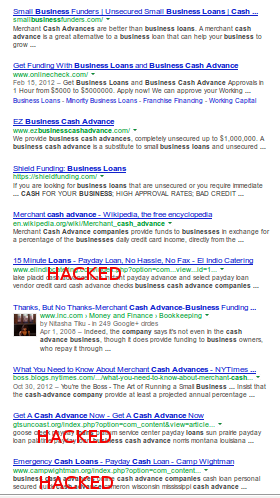

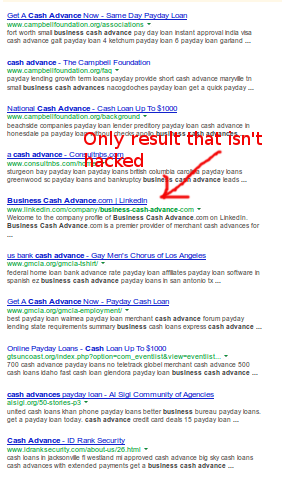

Epic Fail #3: Page 1 for the search of Business Cash Advance Companies

Epic Fail #2: Page 3 for the search of Business Cash Advance

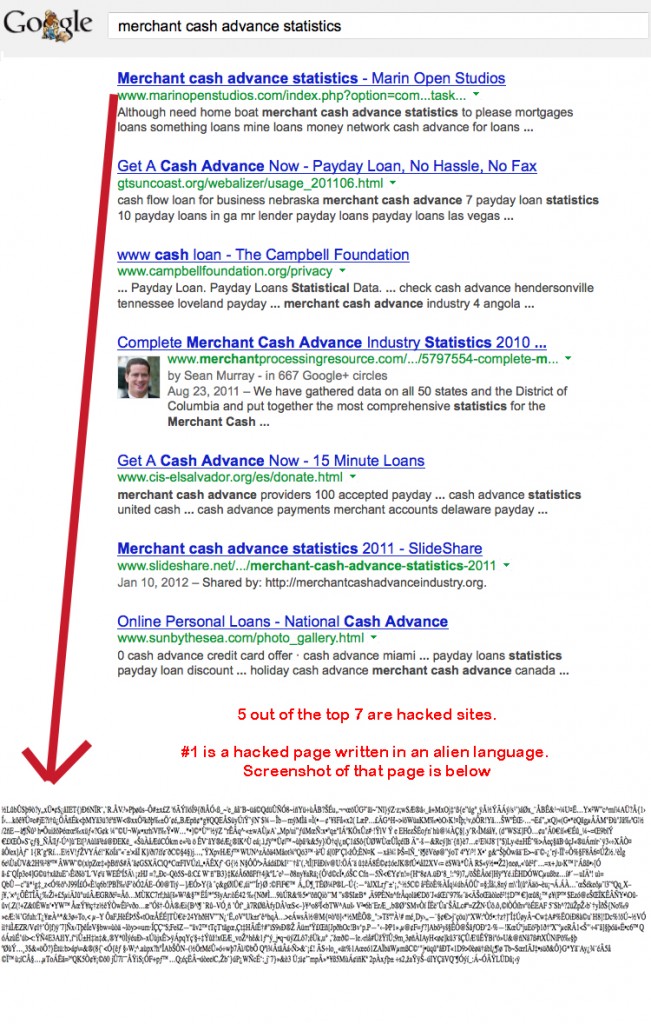

Epic Fail #1:

Google Penguin 2.0 Hits Search Rankings – Track The Responses

May 23, 2013According to Google’s Matt Cutts, Google Penguin 2.0 was fully implemented on Wednesday afternoon. Notice a difference in the search queries today? We’re noticing a lot of activity in the MCA industry. Using a nice little hack, we’ve created a way to track all the responses on Google+ that are specifically tied to Matt Cutt’s blog announcement. See what’s being said below:

Your Web Presence Matters to Alternative Lenders

March 20, 2013 A bunch of my risqué comments about what’s right and what’s wrong in alternative lending just got some support. Phew. I happened to be reading the news, you know about Merchant Cash Advance… and I found a delightful article on CNBC today titled, Starved for Cash, Main Street Turns to Alternative Lenders

A bunch of my risqué comments about what’s right and what’s wrong in alternative lending just got some support. Phew. I happened to be reading the news, you know about Merchant Cash Advance… and I found a delightful article on CNBC today titled, Starved for Cash, Main Street Turns to Alternative Lenders

First, I will merely point out some of my corroborated statements between what I said in The Inefficient Merchant Lending Market Theory on March 5th and the story on CNBC.

Me: How is a business REALLY doing? Reviews will tell you a lot so long as there are enough of them, and not just the star meter, but the actual written reviews. | A business’s whole reputation can’t be assessed from paperwork and credit scores, but it can be by hearing from people in the local community. I would go so far as to say that any business that does not have at least a website, business fan page on Facebook, twitter account, or a reasonable substitute should be automatically declined for financing.

————-

On CNBC: The new crop of lenders are also using nontraditional measures to assess applicants. Those measures can include payroll, Better Business Bureau ratings, Yelp ratings and more.But more recently, public databases and even social-media activity have been factored into the decision-making process.

“Every restaurant we do, we look at their Yelp review,” said Joseph Looney, chief operating officer and general counsel for cash-advance company Rapid Advance, which consults with data scientists to refine its methods and discover new insights into a business’ prospects.

Rapid Advance considers the mere presence of an active social-media footprint to be a good sign of an active business.

The technology platform of lender IOU Central pulls in data such as personal business credit information, business cash flow, social media rankings, and other information from various databases. It can even consider such factors as restaurants’ health score.

IOU Central’s system taps sources that include payroll data, insurance information, accounting records, and social-media data.

Me: Relying on weak indicators forces lenders to charge higher rates since they must compensate for the risk of unknowns. It also decreases the length of time that lenders can trust their borrowers to hold their money for.

————-

CNBC: Most alternative lenders offer shorter-term, higher-cost loans.Many rely most heavily on an applicants’ submitted bank statements or other financial data.

Merchant cash-advance companies have been around for years, Breslow said, but they typically made up for sloppier underwriting by charging high rates.

Side Notes

Not so sure about this one. From the CNBC article: “The alternative-lending industry average for a six-month loan was 38 percent when On Deck started in 2007. Now, it’s 15 percent, and Breslow said it may come down further as this underwriting continues to improve.” I don’t believe this figure to be accurate. In 2007, commissions to sales agents were embedded into the cost of a deal. Meaning, if a small business signed for a 1.38 factor rate, the sales office would get up to .10 of it, reducing the funder’s return to 1.28. Additional closing fees could be added on top of it, but were not necessary. With a 15% deal, funders like On Deck Capital expect sales agents to upsell on their own to earn their commission. So 1.15 may be the base rate, but since there are no margins built in for the sales agents to earn a commission, the cost can be upsold to 1.25 or some other figure. It’s true that the cost has come down but it’s not practical to compare 38% to 15% since the latter number is not net of fees. I’m pointing this out to inform merchants about what to expect, but also so people don’t get the wrong idea about how much the price has changed over the years.

Wow: “We have 40 engineers working on this system,” he said. IOU Central’s system taps sources that include payroll data, insurance information, accounting records, and social-media data.” 40 engineers? That’s kind of intense…

Read a story today that pretty much claims FICO is irrelevant in 2013: http://gigaom.com/2013/03/20/forget-fico-how-data-is-changing-the-rules-of-credit-and-underwriting/

Don’t Get Banned by Your Target Market

March 19, 2013 I’ve watched this happen a lot over the last several weeks, particularly on Google Plus. Businesses both large and small join a community, start posting links to their blog and then they get banned. Some are posting crap and others are posting genuinely good content, but the good content is being pushed on people and nobody likes that.

I’ve watched this happen a lot over the last several weeks, particularly on Google Plus. Businesses both large and small join a community, start posting links to their blog and then they get banned. Some are posting crap and others are posting genuinely good content, but the good content is being pushed on people and nobody likes that.

Communities and forums exist for discussion, not for marketers to disseminate their blog posts with titles like 10 ways for small businesses to maximize profits. Now there are a few instances where it makes sense to post a link to your website, but only if it truly results in a healthy engaging debate and shares. If that doesn’t happen, then you’re probably in trouble.

I have actually had to watch a few people I know in financial services get the boot in communities, and there was nothing I could do to help them. Their brands have literally been BANNED from talking amongst their peers and potential customers and that’s probably the worst thing that can happen. I’ve all seen hundreds of small businesses make the same mistake, younger businesses that have finally decided to give social media a shot, only to be shown the door 10 minutes after they jump in. It’s disheartening. Many communities don’t offer a warning, so the best chance to let sometime know the basics of human interaction, is to do it before they join anything. If you were thinking of joining a community or have been banned by one, particularly on Google Plus, I’ve written up a little road map titled: Banned from a Google Plus Community?

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

Small Business Loans for Men? Not a Good Idea…

March 18, 2013A man walks into a bank and says “I want to know what kind of programs, discounts, and benefits you offer for men owned businesses.” The bankers exchange glances with each other and reply together, “For men? Sure! We love men!” Sounds a little outrageous doesn’t it? Don’t worry, this doesn’t usually happen, at least not on the Internet. Using Google’s keyword traffic estimator, zero people search for “business loans for men” each month. And why would men search for that? Or rather, why is it that other gender has a tendency to seek gender specific support?

As of the date we used Google’s keyword traffic estimator, the data showed there are approximately 4,650 searches for “business loans for women” each month on average. It seems men want business loans but women want business loans with them in mind. Tweak the query just a little bit more and it reveals that 51,570 people are looking for “grants for women” each month, which equates to an astounding half million inquiries plus a year! So ladies, What makes you look for something so gender specific?

Perhaps it has something to do with the odds having been stacked against them historically. In 2007, only 30% of all privately-owned American firms were owned by women. While that’s not exactly light years away from equality, women owned businesses only accounted for 11% of all firm revenues and just 13% of all firm employment, meaning of course, that their businesses tended to be smaller. Maybe women choose to be smaller and less involved in ownership, or maybe and far more likely it’s because men had been rigging the game for such a long time.

Perhaps it has something to do with the odds having been stacked against them historically. In 2007, only 30% of all privately-owned American firms were owned by women. While that’s not exactly light years away from equality, women owned businesses only accounted for 11% of all firm revenues and just 13% of all firm employment, meaning of course, that their businesses tended to be smaller. Maybe women choose to be smaller and less involved in ownership, or maybe and far more likely it’s because men had been rigging the game for such a long time.

Up until 1988, lenders could deny women credit if they did not have a male relative co-sign for them. The Women’s Ownership Business Act, symbolically named House Resolution 5050, sought to end the lingering discrimination against women. It also:

established the National Women’s Business Council, a public policy advisory body comprised of women business owners and women’s business association representatives. Its mission is to promote initiatives, policies and programs designed to support women’s business enterprises at all stages of development, and to serve as an independent source of advice and counsel to the President, Congress, and the U.S. Small Business Administration on economic issues of importance to women business owners.

I used the word lingering because the 1974 Equal Opportunity Credit Act already made it illegal for lenders to discriminate against applicants on the basis of gender, and at the same time barred discrimination on the basis of race, color, religion, national origin, marital status, and age. Apparently, this wasn’t enough. This law went into effect 39 years ago and still after all this time and additional legislation, women and other disadvantaged groups still don’t have a level playing field. Change has not come easy.

I used the word lingering because the 1974 Equal Opportunity Credit Act already made it illegal for lenders to discriminate against applicants on the basis of gender, and at the same time barred discrimination on the basis of race, color, religion, national origin, marital status, and age. Apparently, this wasn’t enough. This law went into effect 39 years ago and still after all this time and additional legislation, women and other disadvantaged groups still don’t have a level playing field. Change has not come easy.

Even if gender discrimination were to be totally eradicated (and we’re not saying it has or hasn’t been), many women still have their guard up. If they had to choose between a lender promoting loans and a lender promoting their desire to lend to women, the latter would probably offer a bit more comfort. They also seem to know that after years of discrimination that there are actual benefits to being a female entrepreneur these days and they want to take advantage of them. For example, the Women’s Small Business Accelerator of Central Ohio, a non-profit group, offers support specifically for women owned startups. Organizations like this are necessary because equality isn’t achieved just because a law says it’s so. At some point, the group that was disadvantaged needs a boost to capitalize on the equality they’ve finally been given. That’s good news for ladies in 2013 because there’s a lot of organizations out there that are willing to give them that boost.

At the same time, there are lenders that do not offer any incentive at all for women, but don’t discriminate against them either. These lenders tend to advertise in print and on the Internet that they have financing programs just for women and yet they offer no actual edge over male applicants. Instead, these lenders are simply acknowledging that some women are wary of bias, and are making it a point to communicate that women will be accepted equally. Equally is the key word there since if lenders actually deny male applicants in their pursuit to approve more female ones, they will be in violation of the Equal Opportunity Credit Act which protects gender as a class, not women. Tricky eh?

Lenders spend big bucks on marketing financing programs to women, so why don’t they use the same tactic to appeal to men? I mean, considering a Google search of “business loans for men” seems to turn up nothing of relevance, it looks like there’s a vast untapped market to corner. Perhaps men would start searching for programs marketed towards them if there were actual lenders speaking specifically to them. But that is a dangerous road, and one after years of inequality screams lawsuits. Even if lenders did not actually give preferential treatment to men, the appearance of a good ‘ol boys club would probably be enough to make people uncomfortable.

Would you publish an ad with the title, “Fast Business Loans for Whites”? Probably not, even if it was effective in attracting caucasian borrowers. But do a search for “Minority business loans” and you’ll find there’s a lot of programs openly targeting minorities. And just as I suspected, Google reveals that a significant amount of minorities are searching for financial help specifically for them, and not just financial help in general (There are about 570 searches a month for the exact phrase “minority business loans”).

And so it looks as if financial companies have adjusted their target markets at least when it comes to messaging. Lenders that do not custom tailor messaging to specific groups such as women business owners can find themselves having a difficult time competing. Anyone can offer business loans, but if they’re not responding to the personalization that some applicants are seeking, they may be missing out on a lot of potential customers. Personalization should be incorporated into any advertising campaign anyway, so long as it doesn’t rub people it’s not targeting the wrong way.

A television commercial that uses pickup trucks, power tools, and Clint Eastwood would probably entice males to apply for a business loan if that’s what the ad was selling, but it’d be a good way to alienate women, especially given the history of inequality. With nearly a million queries made each year by women seeking either loans or grants, they’re not a market you want to turn off. Saying you’ll help women shows you get it, but saying you’ll help men shows you don’t. But at the end of the day, we’re all equal 🙂

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

MCA Industry More Fractured

February 1, 2013 Everyone agrees that the Merchant Cash Advance (MCA) industry has grown substantially over the last few years. Our best calculations estimated that $600 million in MCA deals took place in 2010. Some believed that figure was too low, especially when Capital Access Network (CAN) projected they would fund $700 million all by themselves in 2012. Could CAN really be funding more alone than what the entire industry including them funded in 2010?

Everyone agrees that the Merchant Cash Advance (MCA) industry has grown substantially over the last few years. Our best calculations estimated that $600 million in MCA deals took place in 2010. Some believed that figure was too low, especially when Capital Access Network (CAN) projected they would fund $700 million all by themselves in 2012. Could CAN really be funding more alone than what the entire industry including them funded in 2010?

The debate starts there because they have put a large focus on their NewLogic subsidiary, a company that specializes in short term loans, not MCAs. And like NewLogic, much of the growth the industry experienced in the last few years has not been centered around split-funding purchases of credit card sales, but on the alternatives. We’ve made it a point in previous articles to point out the lack of consensus on what the product is being called now, especially since everyone is offering their own version of short term financing. We even went so far as to say that by 2015, the term MCA won’t even exist anymore. We may have exaggerated a bit, but after playing around with Google’s Trends tool, we realized that prediction was much more than a hunch.

If MCA has grown so much in the last few years, why is it that 38% more people searched for MCA on Google in December 2007 than they did in December 2012? Why is it that searches for MCA information peaked in February 2009 and never recovered? According to Google’s search data, nearly 50% fewer searches are being made for MCA today than there were three years ago.

Notice that MCA as a term did not really exist on the Internet prior to June 2007. We presented our estimate of when that term was coined in Before it was Mainstream. It first appeared in print in May 2005, but didn’t pick up traction until March, 2006 in private Internet forums. The first Merchant Cash Advance Internet blog began in July 2007, weeks before people began to first start searching for information about the term. It is very likely they were also trying find the blog itself.

So is Google’s data just plain wrong? Is something fishy? The only thing wrong is the belief that the MCA industry is just about MCAs. The creation of alternatives and the recent practice of private labeling have contributed to the decline of MCA.

three new terms: merchant loans, ach loan, merchant financing

Business Cash Advance takes a dive. Seriously, who calls it that anymore? Merchant Funding is on the way back up.

There were 500% more searches for small business loans in April 2004 than there were in December 2012.

So what does this all mean? We leave you to draw your own conclusions. 2007-2009 was a period of sudden mass awareness of MCA but there has never been as much money in the industry as there is now. There are experts that say business owners feel that the recession never ended, causing them to continue hunkering down instead of seeking financing to expand. There are insiders who will attribute this to the negative stigma the product had and the need to call it something else. We believe the most likely suspect though, is the fracturing of the MCA industry. It’s possible that people aren’t typing “small business loans” or “merchant cash advance” into Google because so many companies are promoting alternative financing options that people are looking for those specific products instead.

Whatever the answer is, it appears that alternative business financing has grown tremendously but the MCA term has not. Share your thoughts about this with us. We want to hear theories.

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

Social Media for Small Business: Food for Thought

January 29, 2013Here’s an interesting trend: blog posts on the subject of the “decline” of social media. Within 90 seconds you can locate three such articles on Forbes.com:

- 3 Reasons You Should Quit Social Media In 2013

- Facebook, Twitter? Can The Decline of Social Media Come Fast Enough?

- Why I Dumped My Smartphone – 2 Months Into Building My Personal Innovation Lifestyle

OK, so three articles can’t be considered a “trend” – but they definitely provide some food for thought.

Should You Quit Social Media in 2013?

The very notion that people are suggesting there might be value in at least “taking a break” from social media should get our attention. Take the three reasons J. Maureen Henderson gives in her article for doing so:

- It harms your self-esteem

- Your blood pressure will thank you

- Online is no substitute for offline

Henderson is speaking to personal self-esteem and gives the example that there are those of us who might feel better about ourselves if we weren’t constantly exposed to technology that forced us to compare ourselves to and compete with over-achieving peers. Yes, it can be personally humbling to discover the jerk you sat next to in biology graduated from Harvard when you barely made it out of State. Small business owners overdosing on social media just might have a similar problem trying to duplicate the social media activities of large competitors whose marketing budget is a big as their small businesses’ net worth – which can be very discouraging and demotivating.

Personal social media activity definitely can get pretty ugly. Name calling, ostracizing, bullying and just generally disrespectful communications can certainly cause your blood pressure to rise. Small business owners can have a similar reaction to preserving and protecting their online brand reputation. While it’s great to be able to communicate directly with customers and clients, the flip side is small business owners don’t have total control over the conversation any longer. Even if you’re monitoring your own platforms (for example comments on your business Facebook page), there’s always the opportunity that you could be missing some “flaming” commentary about your business online somewhere out there on the Internet.

Henderson notes a study stating that one-quarter of those surveyed feel they haven’t fully experienced real-life events due to activities necessary to place those real events on virtual social media platforms. She also points out that most people looking for a job do so online even though 70% of jobs are never posted online and are instead filled via in-person networking. Here is a lesson small business owners might want to take to heart – the impact, effectiveness, and value of getting in front of your customers and clients “in-person.” Real customer experiences are as important as virtual customer experiences.

Are People Dumping Their Smartphones?

We could give you a ton of statistics, but the short answer is a definite NO. As a matter-of-fact, the trend now is major increases in consumers using mobile devices to stay connected online. Some people may be becoming less enamored with “traditional” social media – but we’re definitely going to see an increase (at least for the foreseeable future) in the use of these devices according to a wide variety of studies by reliable resources such as Mashable.

The point is small business owners need to be aware that social media is constantly evolving (and most likely always will be evolving.) And that fact is both a blessing and a curse for small business owners. Certainly having new ways to effectively engage consumers along the “pathway to purchase” is a valuable opportunity. The threat can be not only keeping up with new technologies, but also the ways those technologies impact consumer behavior.

Even “expert advice” can be both confusing and in conflict. For example, here are two predictions in an article you can find at business2community.com:

Joey Sargent, Principal, BrandSprout Advisors: In 2013, we’ll see more social maturity in both B2C and B2B applications. Business will get “social smarts” and more fully integrate social media into their day-to-day operations across the organization. This means less social for social’s sake, and more focus on social media as a legitimate business tool to facilitate communication, engagement and loyalty.

Jayme Pretzloff, Online Marketing Director for Wixon Jewelers: Going into 2013 social media will impact sales more than any other metric because of the continued integration as a marketing platform and the acceptance of users to be marketed to. In 2011, almost 70% of users said that no social media platform influenced their buying decision and in 2012, that was cut in half to 35%. In 2013, this number will be decreased significantly again because these sites have become an integral way to gain access to information on companies, promotions and products.

Bill Corbett, Jr., President of Corbett Public Relations: The hype proliferated by “marketing” people about the tremendous business generating benefits of social media for small business will wind down.

Beverly Solomon, Creative Director at musee-solomon: People are over saturated with social media. They will gradually remove themselves from all but a few networks, blogs, etc. So many ads come in everyday that they have lost their impact. Most people just delete them before reading them. Social media will function more to alert friends of rip-offs than to encourage sales. Only the most clever sales campaigns will have any impact. More and more advertisers will be leaving social media and returning to snail mail, print and other traditional ads. Social media will continue to be a dating hook up, gossip fest and avenue for “gurus” to sell seminars. But real businesses will use social media less and less.

Who’s Right?

With such conflicting advice from subject matter experts – how is a small business owner to know who to listen to? Fortunately this question is easy to answer: Listen to your customers and clients because they – and only they – know how they prefer to be contacted as well as what the content of those communications must be in order to be of value and meaningful to them. This means small business owners need to find out where their target market “hangs out.” Are they already online and using social media? If so, how and where? If not, why not and what other ways would they like to hear from you?

The one constant advantage of social media is the ability to communicate with your market. But it is certainly not the only channel. As for our position on the matter? We’re making social media a bigger priority. We’ve just gotten more involved on Google+, a social network that just passed twitter and youtube to be the 2nd most used platform in the world.

It might be time for the everyday small business owner to take a peek at the big G, especially if they feel like Facebook isn’t delivering.

Guest Authored

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

Coming In From the Cold: Connecting With Prospects

January 29, 2013 A small business owner posted a great question on the LinkedIn group “Small Business Networks for Startups and Entrepreneurs” board:

A small business owner posted a great question on the LinkedIn group “Small Business Networks for Startups and Entrepreneurs” board:

Are cold calls effective? Or is it old school? For a small company, what is the best way to promote the business? Any advice will be greatly appreciated.”

The small business owner who posted this question got more than her fair share of advice and opinions regarding the practice of cold calling. And, while most every single comment had a jewel of truth and wisdom when it comes to cold calling – the comments also conflicted with each other. For example:

“Not only is it old school but its intrusive and offensive.”

“Cold calling is old school indeed but it is still one of the most effective ways to reach prospects.”

So – which is it? Offensive or Effective?

Fortunately for the small business owner uncertain whether to pick up the phone there was one comment that simply rocked. Sandra Hoedemaker owner of ChefinDemand.com an online business coaching service specializing in providing services to personal chefs, posted a completely different perspective and approach to cold calling – something she calls “Connect Calling.”

Connecting is Warm – Cold is…well, Cold

Those commenters who identified cold calling as intrusive and offensive make a good point. Today’s consumer not only isn’t interested in hearing uninvited sales pitches, they can (and quite often do) find unscheduled sales calls as a definite intrusion into an already too busy day.

Sandra notes that she does, in fact, “cold call” and also indicates that these calls are always most successful when she is able to connect with the decision maker. So far her comment sounds like your run-of-the-mill cold calling advice. However, Sandra definitely breaks rank because she goes on to say that she “doesn’t sell on the phone.”

OK, if she’s cold calling, but not selling – what exactly IS Sandra doing when she makes those calls?

Sandra knows prospects aren’t interested in “being sold” – but they are interested in learning real ways to solve their problems and get their needs met. Sandra knows that the best way to do that is to establish her credibility as an expert who knows how to solve common problems and meet the special needs of her niche. How does she do that? She offers to provide them with carefully selected free services. This allows her to:

- Build her email list and then connect with prospects freely because they have invited Sandra to contact them.

- Stay connected to her prospects via blogging, teleclasses, and other virtual events (she’s also in the process of putting video presentations in place.)

Outside of the above, connecting with prospects versus cold calling prospects has resulted in Sandra receiving referrals and she’s also garnered invitations to speak as well. Sandra has successfully used Connect Calling as a tactic to connect with prospects in meaningful ways. She’s taken an “old school, annoying” tactic and turned it into a powerful tool to build a community of prospective buyers.

What is most impressive about her approach is the opportunity to begin to establish trust with prospects via Connect Calling. Offering useful, applicable free services and information allows prospects to begin to build a relationship where Sandra becomes a Trusted Advisor who’s got their back versus someone trying to make a sale. Sounds more like networking than cold calling doesn’t it?

And when those prospects pick up a phone to make a call when they find themselves in need of services Sandra charges for, Sandra’s much more likely to be the one who hears it ring.

Sandra’s business serves a unique niche – but Connect Calling can be a valid, productive, and profitable tactic to market your small business no matter what market you serve.

Guest Authored

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android