What’s Lending Got to do With Cryptocurrency?

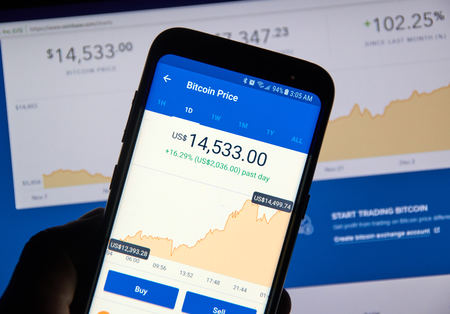

January 10, 2018 Facebook and Snapchat might be the last things that employees are being distracted by these days. Instead it’s Coinbase and Blockfolio, two cryptocurrency apps, that are quickly stealing the attention of young finance professionals. And the interest in Bitcoin, Ethereum and alt coins is causing some in the industry to wonder if the phenomenon can somehow be connected to online lending and merchant cash advance.

Facebook and Snapchat might be the last things that employees are being distracted by these days. Instead it’s Coinbase and Blockfolio, two cryptocurrency apps, that are quickly stealing the attention of young finance professionals. And the interest in Bitcoin, Ethereum and alt coins is causing some in the industry to wonder if the phenomenon can somehow be connected to online lending and merchant cash advance.

A meetup hosted by partners of Central Diligence Group (CDG) on Tuesday night in NYC, for example, was geared towards cryptocurrency enthusiasts. CDG is a merchant cash advance and business lending consulting firm. Those that attended, talked candidly about Ripple, Bitcoin, Ethereum, and the hot topic of Initial Coin Offerings (ICOs). And it did seem all connected. Companies successfully raised more than $3 billion through ICOs in 2017, for example, some of them online lending companies.

ETHLend and SALT, blockchain-based p2p lenders, each raised $16.2 million and $48.5 million respectively through ICOs. What’s more, their crypto market caps currently stand at $325 million and $754 million respectively. The latter is nearly twice as valuable as online lender OnDeck. The founder of Ripple, meanwhile, briefly became one of the richest men in the entire world.

ETHLend and SALT, blockchain-based p2p lenders, each raised $16.2 million and $48.5 million respectively through ICOs. What’s more, their crypto market caps currently stand at $325 million and $754 million respectively. The latter is nearly twice as valuable as online lender OnDeck. The founder of Ripple, meanwhile, briefly became one of the richest men in the entire world.

Whether these valuations are overdone is besides the point. A smart phone is all that’s required to get in on the action and trade thousands of cryptocurrencies online, many of which move up and down by astronomical percentages over the course of a day. Becoming a millionaire overnight by hitting on the right one is a dream sought after by many. And young people, especially millennials, are become unconsciously comfortable transacting in non-government-backed currencies through technology that completely shuts out banks.

And that may be the shift in all of this to pay attention to. It isn’t that a local restaurant is going to collateralize their Bitcoin to get a loan and outcompete an MCA company, but that a portion of the monetary system eventually starts to sidestep banks.

Trying to collect on that judgment? Good luck tracing the money in cryptos.

Need to freeze funds? You can’t freeze someone’s Bitcoins if they’ve got them stored on their own hardware.

Evaluating a business’s bank statements? The transactions can only be verified on a blockchain.

You might not believe me, but it’s incredibly likely that you’ve encountered a client that has defaulted on an MCA or loan whose stash of money has been obscured in cryptos all the while their bank statements appear to show insolvency.

It’s also likely that you’ve encountered a client that has used the proceeds of their MCA or loan to buy a crypto. Maybe not the whole amount, but with some of it. One study, for example, revealed that 18% of people have purchased Bitcoin using credit. Bloomberg reported that the phrase “buy bitcoin with credit card,” just recently spiked to an all-time high.

People are even taking out mortgages to buy Bitcoin, according to CNBC.

If you think cryptocurrency is an industry completely independent of your business, consider that the market cap of cryptocurrencies is currently valued at more than $700 billion. That’s nearly twice the market cap of Goldman Sachs and JPMorgan, COMBINED. The #3 cryptocurrency by market cap, Ripple, is being pitched almost entirely to traditional financial institutions.

Bet all you want on the prediction that this bubble will burst. Maybe it will. But the underlying technology, transacting without banks in non-government backed currencies that may be difficult to trace and recover, is a genie that’s not returning to its bottle anytime soon.

In the meantime, now might be a good time to poll your employees or colleagues about their knowledge or use of cryptocurrency. You may be surprised by what you find, especially among the younger crowd.

——–

Disclaimer: I currently hold a material amount of Ether, the currency of the Ethereum blockchain.

How I Failed to Become a Bitcoin Millionaire

December 18, 2017 This past Fall, an industry colleague congratulated me on my newfound wealth. “What newfound wealth?” I reply. “What are you talking about?”

This past Fall, an industry colleague congratulated me on my newfound wealth. “What newfound wealth?” I reply. “What are you talking about?”

“Aren’t you a bitcoin millionaire now?” he says, smiling brightly, with a look in my direction that suggests he can see through my deceptively coy demeanor. “You were talking about it for years. You were right about it!”

“Oh, yeah… Bitcoin,” I say back while looking at the ground, embarrassed by what I am about to tell him. “I spent nearly all my Bitcoins well before the price jump,” I reveal.

He didn’t believe me, but it didn’t matter. I had no regrets up until that moment when I decided to look back and see how much my Bitcoins would’ve been worth had I just held on to them. Doing the math ultimately turned out to be a bad idea.

$500,000.

That’s the rise in value I missed out on by spending the Bitcoins I had been acquiring in 2014-2016. It’s not a million dollars, but it’s enough to sit back and think, what if. [Editor’s note. The market value of those Bitcoins since the time this issue went to print reached about a million dollars after all. DAMN.]

Bummer

But why spend or sell them if I was a supposed true believer? I never cared much for speculating. I liked and still like Bitcoin because it’s a payment methodology that exists outside the purview and control of banks and government. It is the ultimate way to de-bank. And hey, that’s what all the fuss of this publication is about.

I started reporting on Bitcoin here in deBanked as early as 2014, mainly to an audience that didn’t know what they were and didn’t care to know. I couldn’t blame you all. Talk of digital currency, mining, and block sizes doesn’t exactly go hand-in-hand with things like online lending, merchant cash advance, and brokering deals.

A handful of diehard Bitcoin fans at the time told me they were happy to see Bitcoin legitimized through our coverage. Others told me it was complete garbage, a ponzi scheme even, that didn’t deserve any attention whatsoever.

In those days, I took a tour through the whole ecosystem by mining Bitcoin, buying it, selling it, paying people with it, and accepting payment with it. I read books about it, attended seminars on it, and watched documentaries about it. I even experimented with turning my computer into a node in the Bitcoin network to keep the ecosystem itself running smooth. I repeatedly heard critics argue that it was all a scam and I walked away every time remaining unconvinced.

Bitcoin allows users to carry their money across borders without hassle and to retain possession of their funds even if a bank or government agency wants to seize it. Perhaps these benefits appeal to criminals, but surely they also do to law-abiding citizens.

I didn’t like the volatility of it so much back when I was acquiring them. It wasn’t a very good store of value and it still isn’t. The fact that a Bitcoin I acquired for $300 is now worth $10,000 [market value at the time it went to print] is amusing but also terribly unnerving. What good is Bitcoin to legitimately use as money if the value can swing massively in an hour? And what to do if I bought 1 Bitcoin now at $10,000 and it retreated back to $300?

In a way, I may have been more excited to have held all those Bitcoins for another year without them experiencing any increase in value, rather than to have accidentally profited handsomely thanks to speculators who do not care about the underlying utility of Bitcoin.

Maybe I’m an idealist. Or maybe I’m just rationalizing why I shouldn’t cry myself to sleep over having missed out on 500k in profit. I personally believe Bitcoin will be at its most valuable when its price is stable. If we can get to that point and the world economy becomes more accepting of it as a form of payment, well then I’d be very interested in holding on to Bitcoin indeed.

I wondered, of course, if the me of three years ago would’ve agreed with my philosophy now. A blog post I wrote in November 2014 answers that question.

Below are some of the points I made then:

“Bitcoin is more than a currency. It’s not the Euro, the Yen, or the Peso. It’s a detachment from governments and banking. It’s self-control. Without the private key, your bitcoins can’t be seized.”

“I’m not necessarily speculating though. I spent almost half my bitcoins shopping on Overstock on Black Friday.”

“A 5% swing might be acceptable for an investment but it’s quite ugly for a currency.”

“Your money is not really yours. You have rights to it, but only to an extent. It can be garnished, frozen or confiscated. That’s the price of liquidity and relative stability. If you can afford to color outside the lines, where you can remove [bankers] and their control, why not experiment? There’s something pure about [Bitcoin], liberating. And when you add in the fact that it’s governed by math, it’s more than that, it’s beautiful.”

“There are indeed those holding [Bitcoin] and not spending. Rampant speculation is both a cause of volatility and an argument for its long term unsustainability. Speculators are hoping the digital currency will appreciate and make them filthy rich. If that day never comes, a big sell off will cause its value to drop.”

And so it was in 2014, I was interested in the utility of Bitcoin while concerned about the volatility of it. The value has since shot up to the moon, largely due to speculation. Along the way my views caused me to miss out on becoming a Bitcoin millionaire.

And I couldn’t care less. Wake me up when the price stabilizes.

Editor’s Note: Between the time this story was sent off to print and now (when it’s being published online), the market value of those Bitcoins had increased from $500,000 to nearly $1 million. Incredibly, I legitimately would’ve been a Bitcoin millionaire.

Editor’s Note 2: It’s been a long time since I have played around with being a Bitcoin node. More recently, I have become a node on Ethereum, a blockchain for decentralized applications that also serves as the backbone platform for things like Initial Coin Offerings.

Get $10 Worth of Bitcoin FREE

November 28, 2017 Ok, so this is a shameless affiliate marketing offer. If you buy $100 worth of Bitcoin from Coinbase using this link, you’ll not only get an extra $10 worth of Bitcoin free, but I’ll get $10 worth of free Bitcoins as well.

Ok, so this is a shameless affiliate marketing offer. If you buy $100 worth of Bitcoin from Coinbase using this link, you’ll not only get an extra $10 worth of Bitcoin free, but I’ll get $10 worth of free Bitcoins as well.

While it’s awesome that a single Bitcoin is worth $10,000 these days, I personally fell in love with the utility of the currency 3 years ago. I mined it, bought it, sold it, became a node on the network, donated it, spent it, accepted it as payment, went to meetups dedicated to it, and read books on it. The ironic part about it all is that few, if any, people cared about my coverage of it. Now that’s it up nearly 900% YTD, readers have been asking about it.

Before you get get caught up in the hype aspect, maybe take a minute to read through some of my very old blog posts about Bitcoin and decide for yourself if the currency makes sense.

- 12/3/14 – My Satoshi Monday – My trip to the Bitcoin Center

- 12/8/14 – How to Use Bitcoin – I bought a computer monitor on Overstock with Bitcoin

- 12/18/14 – Confessions of a Bitcoin Miner – My tale of mining Bitcoins

- 3/10/15 – deBanked Inks Deal With Lenders Marketing in Bitcoin – deBanked priced an advertising deal in Bitcoins

- 4/20/15 – Rand Paul Speaks at Bitcoin Event – A forward thinking Senator latched on to Bitcoin years ago

After Fork, Coinbase Has Change of Heart on Bitcoin Cash

August 6, 2017 Now that Bitcoin Cash has forked off of Bitcoin, Coinbase is no longer taking a hard line stance against the alt currency. In a new email they sent to account holders, they cite security of the network, customer demand, trading volumes, and regulatory considerations as the reasons they have decided to support Bitcoin Cash by January 1, 2018. Not mentioned are the rumored threats of class action lawsuits for withholding Bitcoin Cash from their account holders.

Now that Bitcoin Cash has forked off of Bitcoin, Coinbase is no longer taking a hard line stance against the alt currency. In a new email they sent to account holders, they cite security of the network, customer demand, trading volumes, and regulatory considerations as the reasons they have decided to support Bitcoin Cash by January 1, 2018. Not mentioned are the rumored threats of class action lawsuits for withholding Bitcoin Cash from their account holders.

On Twitter, Columbia University Professor Tim Wu had likened Coinbase’s original refusal to turn over Bitcoin Cash to account holders to a hijacked stock split. “Imagine a stock split where the broker declined to issue the new stock to its owners,” he wrote on July 31st. He also wrote that Coinbase was “courting serious, maybe ruinous legal trouble if it doesn’t give the users the full value of the Bitcoin fork.”

There is little doubt that Coinbase would’ve been exposed to lawsuits because they have access to Bitcoin Cash through their users’ Bitcoin deposits but were keeping the Bitcoin Cash for themselves. And Bitcoin Cash is not exactly valueless. As of the time I’m writing this, 1 Bitcoin is equal to $3,226, according to Coinmarketcap.com. 1 Bitcoin Cash is equal to $204. Bitcoin is hovering around its all-time high while Bitcoin Cash is already the 4th most valuable alt coin.

A letter from Coinbase on their change of heart is below:

Dear Coinbase customer,

We wanted to give our customers an update on the recent Bitcoin hard fork. You can read more about what a digital currency fork is here:

https://blog.coinbase.com/what-is-a-bitcoin-fork-cba07fe73ef1

Forks enable innovation and improvements to digital currency and we believe that we will see an increasing number of forks in the future. We expect this to be a vibrant and innovative community.

When a digital currency forks, it creates a new digital asset. Adding new digital assets to Coinbase must be approached with caution. Not every asset is immediately safe to add to Coinbase from a technical stability, security, or compliance point of view.

Our top priority is the safety of customer funds and we spend extensive time designing, building, testing and auditing our systems to ensure that the digital asset we support remains safe and secure. We may not always be first in adding an asset, but if we do, you can be sure that we’ve invested significant time and care into supporting it securely. We believe this is the best approach for us to maintain customer trust.

In the case of bitcoin cash, we made clear to our customers that we did not feel we could safely support it on the day it was launched. For customers who wanted immediate access to their bitcoin cash, we advised them to withdraw their bitcoin from the Coinbase platform. However, there are several points we want to make clear for our customers:

Both bitcoin and bitcoin cash remain safely stored on Coinbase.

Customers with balances of bitcoin at the time of the fork now have an equal quantity of bitcoin cash stored by Coinbase.

We operate by the general principle that our customers should benefit to the greatest extent possible from hard forks or other unexpected events.

Over the last several days, we’ve examined all of the relevant issues and have decided to work on adding support for bitcoin cash for Coinbase customers. We made this decision based on factors such as the security of the network, customer demand, trading volumes, and regulatory considerations.

We are planning to have support for bitcoin cash by January 1, 2018, assuming no additional risks emerge during that time.

Once supported, customers will be able to withdraw bitcoin cash. We’ll make a determination at a later date about adding trading support. In the meantime, customer bitcoin cash will remain safely stored on Coinbase.

Thank you,

Coinbase Team

A Bitcoin Hard Fork is Coming and Creating New Money With It

July 30, 2017On August 1st, Bitcoin will fork into two different currencies. That’s because a significant group of developers and miners believe that the Bitcoin protocol needs an upgrade in order to scale. Not everyone agrees so the chain is splitting in two. Since a split chain will share the same history, anyone who owns Bitcoin on one chain will automatically own the same amount of Bitcoin on the other chain. To avoid confusion, Bitcoins on the new chain will be called Bitcoin Cash.

You can think of this fork as a stock split except that Bitcoin & the new Bitcoin Cash will have a different value and future. An original Bitcoin at present has a value of about $2,700 per coin. Bitcoin Cash will likely be worth less.

If you store your Bitcoins on an exchange, you could actually miss out on getting your Bitcoin Cash. Coinbase, for example, an exchange based in San Francisco, said that its users will not be able to access Bitcoin Cash. In a letter they sent out to customers last week, they advised customers withdraw funds before the fork if they hope to benefit from Bitcoin Cash.

Dear Coinbase Customer,

We wanted to provide an update on proposed changes to the Bitcoin network and what that means for bitcoin stored on Coinbase. You can read more about what a digital currency fork is https://blog.coinbase.com/what-is-a-bitcoin-fork-cba07fe73ef1.

Our first priority is the safety of customer funds. In the event of a fork, customer fiat currency (USD, EUR and GBP) and digital currencies (bitcoin, ether and litecoin) are safe.

On August 1st, 2017 there is a proposal to make changes to the bitcoin software. This proposal, known as Bitcoin Cash, is likely to create a fork in the Bitcoin network. This means that after August 1st, 2017 there are likely to be two versions of the Bitcoin blockchain and two separate digital currencies.

In the event of two separate blockchains after August 1, 2017 we will only support one version. We have no plans to support the Bitcoin Cash fork. We have made this decision because it is hard to predict how long the alternative version of bitcoin will survive and if Bitcoin Cash will have future market value.

This means if there are two separate digital currencies – bitcoin (BTC) and bitcoin cash (BCC) – customers with Bitcoin stored on Coinbase will only have access to the current version of bitcoin we support (BTC). Customers will not have access to, or be able to withdraw, bitcoin cash (BCC).

Customers who wish to access both bitcoin (BTC) and bitcoin cash (BCC) need to withdraw bitcoin stored on Coinbase before 11.59 pm PT July 31, 2017. If you do not wish to access bitcoin cash (BCC) then no action is required.

We plan to temporarily suspend bitcoin buy / sells, deposits and withdrawals on August 1, 2017 as the fork is likely to cause disruption to the bitcoin network. This means your funds will be safe but you will be unable to access your bitcoin (BTC) for a short period of time.

We will keep you updated on this event through our blog, status page and Twitter.

Thank you,

Coinbase Team

If you are one of the few people in the alternative finance community who has still never owned, bought, or sold something with Bitcoin, Coinbase is a good place to start. They are fully licensed in New York State. Sign up here.

deBanked has accepted Bitcoin as a form of payment since 2014.

The value of a Bitcoin is up 63% year-to-date, according to the deBanked Tracker, while the S&P 500 is only up 10%.

Bitcoin: The Sky’s the Limit?

May 26, 2017 Investors, merchants and miners all watched as bitcoin’s price ran up knocking on the door of the $2,800 level. The digital currency has climbed nearly 50 percent in the past week and by triple digits in 2017, evoking emotions ranging from euphoria to fear that a bubble is among us.

Investors, merchants and miners all watched as bitcoin’s price ran up knocking on the door of the $2,800 level. The digital currency has climbed nearly 50 percent in the past week and by triple digits in 2017, evoking emotions ranging from euphoria to fear that a bubble is among us.

And while the price has pulled back some, underscoring the volatility that’s attached to the digital currency, bitcoin continues to attract the spotlight.

“The sense I’m getting generally is excitement, the sky’s the limit kind of feeling. I think there’s also some nervousness. Personally, this looks like a bubble. Whenever you see something go up this quickly, the fear is that what goes up must come down,” said Joshua Rosenblatt, an attorney at Frost Brown Todd.

The stratospheric rise in the bitcoin price has been attributed to several factors, not the least of which includes increased demand from a wider audience.

“I think people are starting to realize that these digital assets like bitcoin are good for several different purposes, they’re versatile. There’s a whole industry built on top of them and to gain access to the industry you need to have access to cryptocurrencies like bitcoin,” said Rosenblatt, who also personally invests in cryptocurrency.

Meanwhile DoubleLine Capital chief executive Jeffrey Gundlach hints toward a flight to safety in Asia as the catalyst for the spike in bitcoin. He recently tweeted:

“Bitcoin up 100% in under 2 months. Shanghai down almost 10% same timeframe, compared to most global stocks up. Probably not a coincidence!” – Jeffrey Gundlach on Twitter.

Indeed Rosenblatt agrees that in markets where access to capital or movement of capital is difficult, cryptocurrencies are a great alternative.

“A lot of people who missed the 2013 bitcoin bubble want in on this one. Also there is a lot of institutional money moving in for the first time. Interest in cryptocurrencies as an alternative to government issued currencies is [advancing] especially in Asia, South America and Africa, places where banking is hard or government intervention is high. Bitcoin at its core is excellent for the unbanked,” Rosenblatt told deBanked.

“A lot of people who missed the 2013 bitcoin bubble want in on this one. Also there is a lot of institutional money moving in for the first time. Interest in cryptocurrencies as an alternative to government issued currencies is [advancing] especially in Asia, South America and Africa, places where banking is hard or government intervention is high. Bitcoin at its core is excellent for the unbanked,” Rosenblatt told deBanked.

Rosenblatt’s clients are comprised of startups with products in the cryptocurrency space and funds that invest in this segment. He and the firm’s 15-person cryptocurrency team are devoting an increasing amount of time to clients in this space. “It’s most of what I do at this point,” he said.

Meanwhile, Frost Brown Todd, the firm at which Rosenblatt is employed, is similarly lifting its profile in the cryptocurrency space, evidenced by the firm’s recent launch of a smart-contract app for software escrow agreements.

“We believe smart contracts are going to change the way the law is practiced and we want to be on the bleeding edge of that. In our part of America there are not a lot of people focusing on it. We’re in a unique spot,” said Rosenblatt of the Midwestern-based law firm.

What Next?

The question on everybody’s minds is the same – where does bitcoin go from here? The expectations appear different depending on who you ask.

Kevin O’Leary, O’Shares ETF chairman, recently told CNBC he wished the SEC had approved a bitcoin ETF so he could take a short position in the fund.

And while Rosenblatt acknowledges signs of a bubble forming, he’s not going anywhere. “I’m still very excited about what the space has to offer over the medium and long term. The way I look at it, I’m in it for the long run,” he said, he said, adding that he is hopeful in the next year there will be companies starting to mature into revenue generating businesses with scale.

Bitcoin-based P2P Lending Platform BitLendingClub Shuts Down

December 2, 2016BitLendingClub (not to be confused with Lending Club) has shut down their bitcoin-based p2p lending platform, citing regulatory pressure. A message posted on their website says, “over the last year or so, the regulatory pressures has been increasing to the point that it is no longer feasible to maintain the operation of the platform. We are regretfully announcing that we will have to begin terminating the services effective immediately.”

BitLendingClub received a $200,000 seed investment from European VC fund LAUNCHub just two years ago. The company changed its name to LoanBase in September 2015 but then changed it back only a few months ago.

This was no small experiment either. Kiril Gantchev, BitLendingClub’s CEO, claims on his LinkedIn profile that the company made more than 10,000 loans worth more than $8 million dollars, originating from 90 countries. The company’s website claims an average APR of 192% and a default rate of nearly 12%.

In March however, the company stopped lending to people in several countries including Iran, Ireland and Nigeria due to elevated fraudulent activity.

It’s unclear what “regulatory pressures” caused them to shut down but the company appears to have been operating from San Francisco despite originally incorporating in Bulgaria. A search for a California lending license connected to them yielded no results. After the US, the country with the 2nd most borrowers on the platform was Venezuela followed by Brazil, the UK and India.

“Investors should understand the risks involved when making bitcoin loans,” their website warned. “The main risks are default and failure to collect.” they added.

“Bitcoin Lending As a Concept Has Problems”

March 4, 2016 As the trillion dollar alternative lending market expands, it is bringing into its fold newfangled and unproven investing practices like bitcoin lending. While bitcoin lending upstarts like LoanBase, BTCJam, Bitbond woo investors with attractive returns and push its cause for a diversified portfolio, researcher Brett Scott who studies economic systems is less convinced that bitcoin as an alternative currency will save the day. In his paper for the United Nations, Scott argues that it will still be a while until it brings about actual change in terms of financial inclusion and development.

As the trillion dollar alternative lending market expands, it is bringing into its fold newfangled and unproven investing practices like bitcoin lending. While bitcoin lending upstarts like LoanBase, BTCJam, Bitbond woo investors with attractive returns and push its cause for a diversified portfolio, researcher Brett Scott who studies economic systems is less convinced that bitcoin as an alternative currency will save the day. In his paper for the United Nations, Scott argues that it will still be a while until it brings about actual change in terms of financial inclusion and development.

deBanked spoke to Scott about bitcoin lending and its deficiencies as a loan product. Here are the excerpts from the email interview.

On Bitcoin lending

Bitcoin lending could be very positive in principle but in practice, though, the concept still has many problems. Firstly, Bitcoin is not anchored into any national economy. A currency like the Pound is legal tender in a particular geographical area and is widely accepted by everyone within that geographical area. Indeed, if a person in Britain wants to take part in the economy they pretty much have to use the Pound, and if they don’t they will face exclusion. Bitcoin is not like this. It might be accepted but it is not required to be accepted, and a person who doesn’t accept it doesn’t face exclusion from the economy. Thus, while I can buy certain types of goods with Bitcoin – like Pizza at the Pembury Tavern in London – it is not guaranteed to command goods and services anywhere.

On Bitcoin for business needs

This is a problem if you’re borrowing Bitcoin to start a business. If you’re borrowing money, you ideally want the money to be useful for buying a wide range of goods and services that will then enable you to start the business, and you then use your business to earn money with which to pay the loan back. If I get a Bitcoin loan, I’m probably going to struggle to use it to buy all the things I need to start a business – can I buy a computer, for example, or a scooter for delivering goods?

On unstable purchasing power

Also, Bitcoin is unstable in its purchasing power. If you are borrowing money, you want to have some degree of certainty as to what amount of goods and services that money will be able to purchase. I don’t want to get the loan thinking it will be enough to cover three months of business operations, and then discover than it can only cover two months of operations.

On Bitcoin and currency conversion

While businesses might borrow in Bitcoin, it will normally be earning income in a normal national currency. This poses a currency conversion risk in which your assets produce income that is in a different currency to the one required to pay off your liabilities. One response to this is just to accept the risk that the value of the currency your income is in doesn’t depreciate relative to Bitcoin. This basically means that you’re doing currency trading in addition to trying to focus on your core business though. Your business success really should be based on how well you run your operations, rather than how lucky you are about changes in currency values.

Big corporations that operate in multiple countries using multiple currencies deal with this by entering into currency derivative contracts with big investment banks, in which they hedge their currency risk, but right now there is not a well-developed market in Bitcoin currency derivatives. This doesn’t mean such a market won’t develop, but it will take some time still.

One alternative to this is to structure the Bitcoin loan in such a way that it is tied or pegged to a national currency, such that the amount of Bitcoin you have to pay back adjusts depending on how the value of Bitcoin changes. You’re going to have to convince the person that is giving the loan that this is a good arrangement though.

On pegging bitcoin to another currency

Both the lender and the borrower might think of the Bitcoin system as more of payments system instead of a currency in itself. Thus, someone in Britain might want to lend £10 000 to someone in India, so they take £10 000 and use it to buy Bitcoin on a Bitcoin exchange, then they send that Bitcoin to the person in India, who immediately sells it on an exchange for 945000 Rupees.

Furthermore, the person who is lending prices the loan in Pounds rather than Bitcoin. What has essentially happened here is that the loan is really in Pounds but the Bitcoin system was used as a way to transfer it into Rupees, rather than using the normal bank payments system to do that. Then, when the person wants to send interest payments back, they use Rupees to buy Bitcoin and send the Bitcoin to the UK person, who immediately uses it to buy Pounds. It’s possible that this – somewhat elaborate – process might end up being cheaper than using the normal international payments system, but you’d need to investigate that further.