Related Headlines

| 03/20/2024 | Can brokers split fees in CA? |

| 04/19/2021 | GOUNDFLOOR teams up with PadSplit |

| 02/05/2020 | Avant splits in two |

| 08/09/2018 | Industry split on CA disclosure bill |

| 09/21/2017 | Simply Funding announces new split provider |

Related Videos

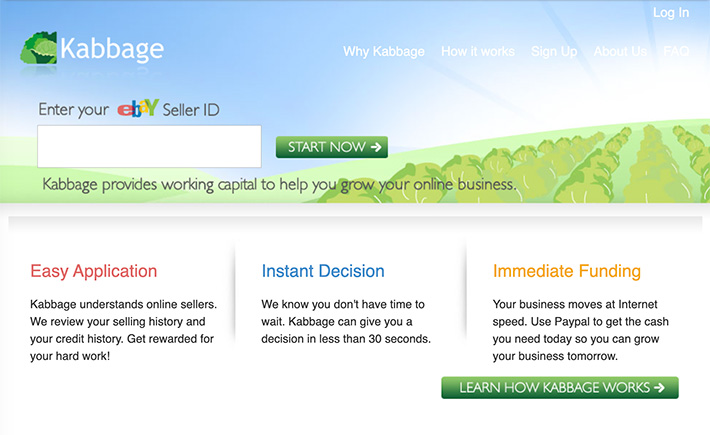

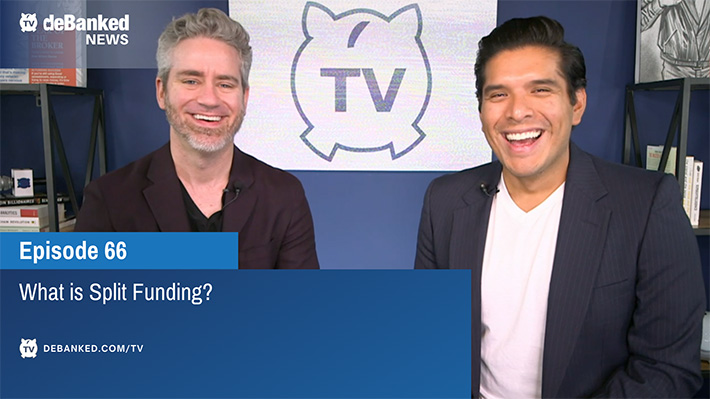

Split Funding & Split Deals - Ep. 66 | What is Split Funding? What's A Split Deal? |

Why Split Funding is Better Than ACH | |

Stories

Revisiting Splits and Payment Methods in the Funding World

March 31, 2024 As most people are aware, ACH debits are only one method used in the small business finance industry to facilitate performance of a deal. Here are some other common ways:

As most people are aware, ACH debits are only one method used in the small business finance industry to facilitate performance of a deal. Here are some other common ways:

Split Funding

This method has been in use since at least 1998 and is still used by many funding companies today.

See: CC Splits Still Make Profits, Payments Knowledgeable Funders Benefit

Lockbox

A lockbox gives you the protection and visibility of a split but may require additional setup steps. This method was very common in the 2008 – 2012 era and is still available.

Variable ACH

The variable ACH system, made famous by MCC starting circa 2009, is still in use around the industry.

See: Homegrown Software Enables FundKite to Reconcile MCAs Daily Rather Than Monthly

Não é bom: When Split-Payment Business Loans Fail

February 20, 2022 As tech companies like Square and Shopify capitalize on their respective abilities to collect loan payments from borrowers by withholding a percentage of their credit card sales, similar companies have replicated that model across the world. StoneCo, for example, which is traded on the Nasdaq but operates in Brazil, had a market cap last year of over $25 billion. More recently, however, it’s dropped to nearly $3 billion.

As tech companies like Square and Shopify capitalize on their respective abilities to collect loan payments from borrowers by withholding a percentage of their credit card sales, similar companies have replicated that model across the world. StoneCo, for example, which is traded on the Nasdaq but operates in Brazil, had a market cap last year of over $25 billion. More recently, however, it’s dropped to nearly $3 billion.

In Brazil, StoneCo used its wide reaching payment business to start originating small business loans that were paid back through their customers’ credit card sales. That business seemed to hold up quite well early on in the pandemic but then took a turn for the worse. According to Bloomberg, distressed businesses came up with ways to circumvent their payments. “…[B]usinesses started jumping to other payments firms, meaning Stone no longer had access to their card purchases,” it said.

“Lockdowns pressured businesses’ cash flows and several sought ways to not pay back their loans,” StoneCo CEO Thiago Piau said.

Historically, diverting sales through another payment processor to avoid this type of obligation was known as “splitting.” It’s an inherent risk to finance companies that make underwriting decisions based on the assumption that the customer is unable to exit the relationship without seriously disrupting its business.

StoneCo was hit so bad that it stopped lending altogether and a significant percentage of its customers went into default. In the company’s Q3 2021 earnings call, Chief Strategy Officer Lia Matos said that they intend to get back into lending again but with some adjustments.

“So, those improvements are, for example, the inclusion of personal guarantees from the business owners and potentially other business they may have, improve risk scoring through additional data,” said Matos.

Covid may have been less damaging to similar companies in the US like Square, for example, because Square was able to repurpose itself to a PPP lender. The incentive to move to another payments platform may have been diminished by the allure of leveraging a pre-existing relationship to secure PPP funds.

StoneCo in Brazil is an example of what can happen to a fintech lender reliant on recouping credit card sales when that relationship doesn’t stick.

To help ensure the team gets things right in the future, StoneCo recently acquired Gyra+. Described as “a data-driven SME lender, which operates under a fee-based, asset-light approach,” the company plans to gently ease back into lending.

“I think that we are not ready to provide a specific guidance in terms of scaling the credit,” said CEO Thiago Piau in November. “We are really focused toward engineering and getting the feedback of clients and all the clients’ experience that we have learned throughout this.”

Brazil has a population of 212 million people.

CC Splits Still Make Profits, Payments Knowledgeable Funders Benefit

June 15, 2021 Back in its heyday, the MCA industry began as credit card factoring. The original product was simple- purchase future credit card receivables, and collect a percentage of them every day: easy peasy. Then, the industry broadened into ACH, funding businesses that did not have credit card purchases and credit card receivables became less common.

Back in its heyday, the MCA industry began as credit card factoring. The original product was simple- purchase future credit card receivables, and collect a percentage of them every day: easy peasy. Then, the industry broadened into ACH, funding businesses that did not have credit card purchases and credit card receivables became less common.

But some funders still work with credit card payments through long-standing payment processor relationships. Cash Buoy is a Chicago-based MCA firm that uses a network of twelve major credit card processors and thousands of representatives from payments ISOs to fund old-fashioned MCAs. Co-Founder and president Sean Feighan would tell you that having connections in payments pays off for both merchants and ISOs.

“The whole point is to add value to their business. By doing split funding remittance,” Feighan said. “It’s a much more comfortable way for the merchant to pay back the advance, it gives them some breathing room on the ebbs and flows of their volume, as opposed to having that hard fixed daily ACH that doesn’t care if they were closed on Monday, are slow on Tuesday, or we’re in a global pandemic.”

Feighan attests that the CC model still works great. He said alongside co-founder Brian Batt, they started Cash Buoy to give ISOs a better option. He boasts a renewal rate of 90% on his CC products, and his default rates for standard MCAs are a “night and day difference” with CC splits.

But operating heavily within the payments realm requires some expertise, something that long-time veterans of the MCA space are fortunate to have accumulated from the era of the product’s origin.

Steven Hunter, a multi-decade industry vet explained where the MCA concept came from. Hunter worked at CAN Capital back in 2000 when it was still was called AdvanceMe when he and the data team developed one of the first credit card factoring products.

Steven Hunter, a multi-decade industry vet explained where the MCA concept came from. Hunter worked at CAN Capital back in 2000 when it was still was called AdvanceMe when he and the data team developed one of the first credit card factoring products.

“The idea came across to build a credit card-based product, because a lot of the original development team other than myself, were the First Data guys,” Hunter said. “And they said ‘okay well what if we could factor future sales, instead of three invoices or accounts receivable or inventory’, which we all know how to factor those things, that’s been in place since biblical times.”

So they built a model, aiming to fund merchants and take out a small amount of money from their credit card splits. Merchants would never see the money hit their bank, and the product just felt like free investing money paid for off of the increase in future sales.

When restaurants and other merchants shut down during the pandemic or rolled back to 25% capacity, many ACH funders found out their customers could not keep up with the pre-set debits. While defaults were on the rise, Cash Buoy was getting paid back, Feighan said, at an admittedly slower rate but still seeing returns.

Feighan has intentionally shied away from ACH. Cash Buoy is modeled on his and Batts’ connections in the payments space. They founded Cash Buoy after five or six years of experience in on-boarding merchant accounts. Feighan said he tried brokering but became disappointed with the process of working with an outside funder.

“[Other firms] may not have the relationships to get split funding at national processors,” Feighan said. “Maybe they didn’t have enough business or money in the bank when they went through the application process with different processors to get true split funding accommodations.”

Hunter agreed that without payment connections it is hard to factor CCs these days. Shortly after AdvanceMe began CC splits, other firms caught up and began developing similar products, with slightly changed terms like automatic set ACH draws. Eventually, he said this made MCAs more loan-like as opposed to a real variable product.

In 2021, there are many reasons that firms adopt ACH right off the bat, he said.

“Well, several reasons one, not every company takes credit cards,” Hunter said. “The thing is that some credit card processors, I’m not going to name any names, are very hostile to the product and they will not actually help people. They won’t help you manage the remittance, they won’t split for you, because they consider you to be a competitor, afraid you will take a portion away.”

The final reason Hunter said is a lot less elegant. He said in order to make this work, as a direct funder, you have to exchange files with every credit card processor you work with every night on every deal you have.

The final reason Hunter said is a lot less elegant. He said in order to make this work, as a direct funder, you have to exchange files with every credit card processor you work with every night on every deal you have.

“So you got to send them something out and say, populate this for us. ‘Joe’s Bait Shop, What did they do today? Today they did this much money, your split is 11%, here’s what’s coming to you,'” Hunter said. “Then you import that back into your system and Joe’s Bait Shop’s balance drops by this amount. Right, that’s hard. I mean it’s a pain in the ass to manage, and I have people who do nothing but exchange, you’ve got to have processors who work with you and you’ve got to have the expertise.”

Hunter now works as a consultant, known in the industry as a go-to for MCA funding help. As for Cash Buoy, after the pandemic year, things are only on the up and up. Covid could not have happened at a worse time right after a three-year bull run, Feighan said, but now that things are back, there are “high water funding amounts each month.”

“The biggest thing here in Cash Buoy are our partners, our ISO partners, and processors,” Feighan said. “And if anybody were to say, ‘tell me, what’s the most important thing to you, Cash Buoy,’ it is 100% Our agent partner program. That is number one. The whole point of the company was to be able to provide a ton of value to national processors and ISOs.”

Split-Funding MCA and Daily Debit Loans Are Spreading Across the World

July 4, 2016

When banks say no, merchants all over the world are getting funded via non-bank alternatives that resemble products here in the USA. In Hong Kong for example, a special administrative region of China, there are non-bank businesses that offer merchant cash advances and/or daily debit loans.

Having had the opportunity to visit with some of those funders there last week, I was surprised to learn that we spoke the same language. By that I mean that they price deals with factor rates, work with local finance brokers, underwrite files using recent bank statements, do site inspections and more. They even a have decision issued by the highest court in the land that declared merchant cash advances to be purchases, not loans.

Even the pitch is basically the same. “Banks aren’t lending to small businesses,” I heard time and time again in Hong Kong. And that’s probably not going to change any time soon. While the non-bank business financing scene is starting to take off, merchant cash advances in particular have been around there for about seven years already.

Hong Kong’s population is a little less than a third of the size of Australia, where many US-based funders have been expanding to over the last couple years.

Splits Glitz or Fritz? – Transact 16 highlighted strange chapter in merchant cash advance history

April 21, 2016

It’s Opposite Day in the alternative business funding industry. Lenders are splitting card payments and merchant cash advance companies are doing ACH debits.

Jacqueline Reses was not an odd choice for Transact 16’s Wednesday morning keynote. Square, the company she works for, has continued to be a hot topic in the payments world for years. But what was striking is that Reses heads the lending division, the group that allows merchants to pay back loans through their future card sales. If that sounds very merchant-cash-advance-like, it’s because that’s exactly the product they used to offer before changing the legal structure behind them.

Split-payments, not ACH payments, have literally propelled Square and PayPal to the top of the charts of the alternative business funding industry. One individual on the exhibit hall floor posited that Square’s ability to originate loans through their payments ecosystem was the company’s real value; Payments itself was secondary. It’s a testament to the opportunities that split-payments affords to (as I argued 3 years ago on the ETA’s blog) a company well positioned to benefit from it.

Meanwhile, the companies at Transact that one would have historically described as merchant cash advance companies have mostly transitioned away from split-payments to ACH. Essentially, Square and PayPal embraced splits as an incredible strength while yesterday’s merchant cash advance companies viewed splits as a handcuff that limited scalability. The payment companies became merchant cash advance companies and the merchant cash advance companies became something else entirely, a diverse breed of loan and future receivable originators operating under a label people are now calling “marketplace lenders.” But even Square and PayPal, arguably the two companies at Transact doing the most split-payment transactions, claim to make loans, not advances.

Merchant Cash Advance as anyone knew it previously is dead

Ten years. That’s the average age of the small business funding companies that exhibited at Transact this week. They are but the last remaining players that probably considered the debit card interchange cap imposed by the Durbin Amendment of Dodd-Frank as being among the most significant legislation that affected their businesses.

A senior representative for one credit card processor told me at the conference that their biggest gripe with new merchant cash advance ISOs today is that they know almost absolutely nothing about merchant accounts. It’s not that they know less, they know nothing, he said.

One company was notably absent from the floor this year, OnDeck. They’ve since embraced the marketplace lending community as their home, just as many others have.

Nine years ago, I overheard a very influential person say that the first company to be able to split payments across the Global, First Data and Paymentech platforms would be crowned the “winner” of the merchant cash advance industry and by extension the wider nonbank small business financing space.

If one were to define the winner as the first company from that era to go public, well then those 3 platforms played no role. OnDeck was the first and they relied on ACH payments the entire way. They also refer to themselves these days as a nonbank commercial lender. If that doesn’t sound very payments-like, it’s because it’s not.

What cause is being Advanced?

At least four coalitions are currently advocating on the marketplace lending industry’s behalf, the Coalition for Responsible Business Finance, the Marketplace Lending Association, the Small Business Finance Association, and the Commercial Finance Coalition. The Transact conference is put on by the Electronic Transactions Association whose tagline is “Advancing Payments Technology.” In an age where new merchant cash advance ISOs know nothing about payments, it’s no wonder there’s a growing disconnect.

Could Transact now be one of the best kept secrets?

A few people from companies exhibiting say that they believed they stood a better chance to land referral relationships from payment companies by being there and that there was still a lot of value in landing those deals. Partnerships like these may be why the average exhibitor has been in business for 10 years while today’s new companies relying solely on pay-per-click, cold calling, or handshakes are falling on hard times.

Some payment processors acknowledged that merchant cash advance companies were still a good source to acquire merchant accounts, though the process by which that happens is not the same as it used to be. A lot of it is referral based now, according to one senior respresentative for a card processor. The funding company funds a deal via ACH and then refers them to the payment guy to try and convert that as an add-on. The residual earnings may not be as good as they used to be but that’s because they don’t have to do any work in this circumstance. In a sense, funders are still leading with cash but instead of the boarding process being mandatory, it’s an entirely separate sale that sometimes works and sometimes doesn’t. In that way, small business funding companies can be a good lead source for payments companies.

When I asked the senior representative if they really had success closing merchant accounts just off of a referral from a funding company, he looked at me incredulously, and said, “you used to do this, of course we do. that’s how this whole industry started.”

“What industry?” I asked.

What industry indeed…

WTF, From Credit Card Processing to Funding Deals

August 6, 2024“My first name is William, my son’s name is Torre and he’s my partner, and our last name is Failla, so WTF was the name of the acronym that we came up with.”

WTF Merchant Services, a real name and double entendre that makes it instantly unforgettable to any client that hears it, has an unusual story. Its CEO Will Failla is a veteran professional poker player that has won more than $6.6 million from tournaments over the course of his career according to a site that tracks players. It’s through friends he made at the card tables that he began to learn about a unique business that some of them were involved in, funding merchants based on their credit card processing sales. After a lot of encouragement and advice over the years, Failla was intrigued enough to look into doing it himself.

WTF Merchant Services, a real name and double entendre that makes it instantly unforgettable to any client that hears it, has an unusual story. Its CEO Will Failla is a veteran professional poker player that has won more than $6.6 million from tournaments over the course of his career according to a site that tracks players. It’s through friends he made at the card tables that he began to learn about a unique business that some of them were involved in, funding merchants based on their credit card processing sales. After a lot of encouragement and advice over the years, Failla was intrigued enough to look into doing it himself.

“I approached my son who was a business major and a finance major out of Hofstra and I said to him, ‘you’re graduating any day now so why don’t we do some diligence, look into this business and see what you think.'”

His son, Torre, who is now the company’s CFO, signaled his approval so long as they paced themselves and mastered the most fundamental component of it first, the credit card processing side of the business. Thus 2021 kickstarted WTF Merchant Services as a shop on Long Island that focused entirely on boarding merchant accounts. They started by approaching their friends, family, and contacts and then expanded it to where they had a referral incentive program and continued to acquire more and more accounts.

The most attractive part of the business to them is the residual revenue component to it. “That’s the greatest. That’s what made us get into it because now we get paid every month. As long as you keep that customer, you get paid every month,” Failla explained.

And keeping those clients means providing great customer service, which he said they’ve placed a strong emphasis on. They’ve also gotten a firsthand look at the financial trends of the various businesses they’ve worked with, something they figured would come in handy for when they were ready to take the next step.

“We didn’t do an MCA deal until the beginning of this year,” Failla said. “We really wanted to learn the business in and out, and then we were just an ISO.”

The evolution from credit card processing to funding is straight out of the old MCA playbook of the mid-2000s, but with a notable difference here, they haven’t abandoned their roots. Unlike many modern funding ISOs who focus entirely on commissions paid out on funding, WTF is requiring their funding clients to switch their merchant accounts to them, assuming it’s a business that processes cards. And if they can do the funding deal on a split of the processing, all the better.

The evolution from credit card processing to funding is straight out of the old MCA playbook of the mid-2000s, but with a notable difference here, they haven’t abandoned their roots. Unlike many modern funding ISOs who focus entirely on commissions paid out on funding, WTF is requiring their funding clients to switch their merchant accounts to them, assuming it’s a business that processes cards. And if they can do the funding deal on a split of the processing, all the better.

“When you do the split, it’s so much easier because you take, let’s say 15 or 20% or whatever the merchant can handle at the time,” Failla said. “It’s just so much better of a direction to get paid because it doesn’t hit their bank, it doesn’t hurt them as much. When they see it coming out daily like that, it’s a little different. When it comes out of the credit cards it’s just early and it helps a lot. Mindset changes.”

The company’s traditional approach has already attracted the attention of some of their peers in the industry who like the idea of residual income but don’t have the time or the patience to worry about merchant accouts.

“We have different MCA offices that we actually do this with already,” Failla said. “We do all their credit card processing. We handle all the back-end. We handle all the front-end. All they do is give us the referral and they become what we call a referral partner, and they get paid every single month as long as we keep the account.”

Will was sure to give credit to those that have helped shorten his learning curve along the way. He has since discovered that others in the poker scene are also in the same business as he and it’s created a valuable community. WTF even has a poker table in its office as a sort of tribute to his background which he has not actually retired from. The Hendon Mob poker tracker states that Will recently placed 259th out of 10,112 players in the World Series of Poker in Las Vegas earlier this month. Meanwhile, the company name itself, a bold strategy, seems to be working out so far.

“If you look under our logo, it says our names right underneath it. William, Torre Failla, and listen there’s going to be some pushback, but the amount of pushback we’ve had is so minimal that I think it’s worth it, and we’re going to stick with it as long as we can.”

eBay Brings Back Revenue Based Financing Product

July 12, 2024eBay announced that Liberis had been onboarded as one of its “Seller Capital” partners this week, making it the second official partner after Funding Circle (which was recently acquired). Liberis, homegrown in the UK, expanded to the US in 2020 and offers a revenue based financing product described by eBay as a “Business Cash Advance.” While eBay has partnered with similar companies in the UK for years, eBay customers in the US have seen this before.

In 2010, for example, Kabbage was arguably the first company to offer revenue based financing to eBay customers, which deBanked first covered 13 years ago. And they had it all to themselves until PayPal began to muscle its way in with a similar product starting in 2013. Given that eBay owned PayPal, PayPal held a distinct advantage until the two companies split in 2015. Still, PayPal continued to be the default payment service for eBay until 2018.

Kabbage continued to thrive anyway, evolving beyond the platform at least until covid when Kabbage suddenly imploded and was sold to American Express. PayPal’s working capital product also continued to thrive at least until 2023 when it announced a dramatic pullback after elevated charge-offs.

The result is that in 2024, eBay sellers can now look toward getting funding via Liberis.

“As a pioneer in ecommerce and the home to small businesses in more than 190 markets, eBay understands the challenges small businesses encounter in securing fast, flexible and transparent financing,” said Avritti Khandurie Mittal, VP & General Manager of Global Payments and Financial Services at eBay in the official announcement. “eBay Seller Capital is aimed at fueling our sellers’ growth by providing them with tailored financing solutions that meet the unique needs of their businesses. The addition of Business Cash Advance to our suite of offerings in partnership with Liberis enables us to expand capital availability for our sellers on flexible terms – when they need it the most.”

“We understand the unique challenges eBay sellers face when securing financing through traditional means,” adds Rob Straathof, CEO of Liberis. “Through eBay Seller Capital, Liberis will empower sellers with access to fast and responsible financing. We’re thrilled to partner with eBay to support eBay sellers to operate and grow their businesses.”

Looking for Startup Funder and Micro Loans Funders to send leads to...... hey guys, i am working with a partner who wants to send leads with monthly revenues lower than 5k per month to a startup funder (like seek capital bu... |

See Post... splits exclusively.... |

See Post... split/lockbox., , i wish. mostly cash. but found a home so thank you all for responding.... |

See Post... split/lockbox.... |

I’ll say it for the hundredth¹ time, the advantage of

I’ll say it for the hundredth¹ time, the advantage of