Archive for 2021

Tune In Tuesday at 10:30 AM EST: deBanked TV Live – With Guests From the Business Funding Industry

March 22, 2021 deBanked is hosting a livestream broadcast tomorrow beginning at 10:30 AM from a venue in Midtown Manhattan with guest speakers from two broker shops and a business funding company. There is no need to register for anything. Anyone can tune in live at deBanked.com/tv to watch it. The broadcast will run for 2.5 hours and end at 1 PM. This is an-person event being broadcast with no Zoom or virtual conversation. The event will also be recorded and made available free.

deBanked is hosting a livestream broadcast tomorrow beginning at 10:30 AM from a venue in Midtown Manhattan with guest speakers from two broker shops and a business funding company. There is no need to register for anything. Anyone can tune in live at deBanked.com/tv to watch it. The broadcast will run for 2.5 hours and end at 1 PM. This is an-person event being broadcast with no Zoom or virtual conversation. The event will also be recorded and made available free.

deBanked’s massive in-person conference, Broker Fair, will return to NYC later in the year on December 6th at Convene at Brookfield Place in lower Manhattan.

Merchant Cash Advance is as Old as The Renaissance

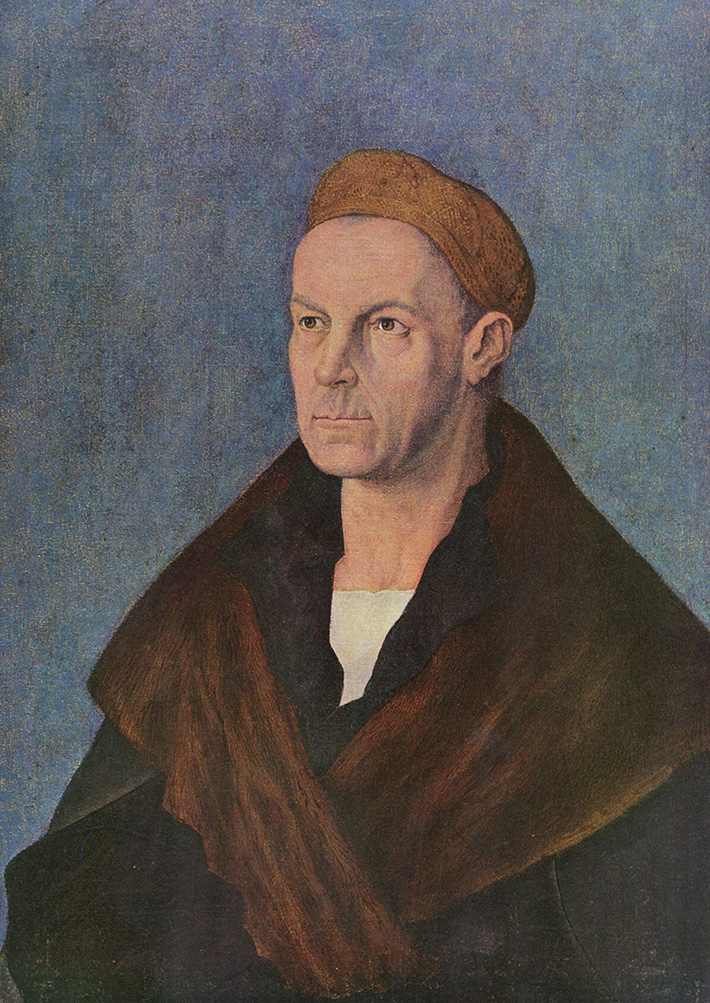

March 21, 2021 The first merchant cash advance enthusiast ended up the richest man in the history of the world. Jakob Fugger was the cash king of Europe 500 years ago, and his climb to wealth indirectly caused the Protestant Reformation. One of the pivotal events in western history, the Reformation led to the eventual “fad” of democratic representational government— all because some guy bought the future receivables of a silver mine.

The first merchant cash advance enthusiast ended up the richest man in the history of the world. Jakob Fugger was the cash king of Europe 500 years ago, and his climb to wealth indirectly caused the Protestant Reformation. One of the pivotal events in western history, the Reformation led to the eventual “fad” of democratic representational government— all because some guy bought the future receivables of a silver mine.

In Jakob Fugger the Rich, historian Jakob Strieder writes the Fugger enterprise began as one of the upstart merchant families of the Renaissance. The Fuggers were traders and cloth merchants from Augsburg, Germany. They created a network of aristocratic clients, furnishing weddings and parties through trading warehouses in modern-day Venice, Florence, and Austria. Jakob Fugger I lent some money around, but when Jakob Fugger II joined the family shipping warehouse in Venice, he looked for a better return on capital.

According to International Business History: A Contextual and Case Approach, Fugger entered an agreement to supply some cash- 23,627 Florins to a silver mine owned by Archduke Siegmund in 1487.

Siegmund had plenty of silver laying around for collateral; he just needed cash for the day-to-day. It was a collateral-backed loan, common today: if he couldn’t pay it back, the Fuggers would get paid in silver. The transaction worked so well that a year later, Siegmund reapplied, this time in a revolutionary way. Siegmund would get 150,000 florins, and the Fuggers would get paid the future receivables of the silver mine: unrefined and cheap future silver for cash now.

The problem, written by historian Greg Steinmetz in The Richest Man Who Ever Lived, was the Church. Any interest-based transaction was specifically outlawed, though there were hundreds of lenders during this era. The line from Luke 6:35, “Lend and expect nothing in return,” was taken by the Church to mean an outright ban on usury, defined as the demand for any interest at all.

Even savings accounts were considered sinful, but Venetians ignored these rules as they preferred making money to pleasing God, entombed in the motto “First Venetians, then Christians.” Fugger began accepting deposits like a bank to his clients, with a 5% return to investors.

But convicted usurers could be excommunicated and denied a Christian burial, a nightmare for a capitalist who relied on a Christian network. Fugger did not worry about punishment or the apparent sin of money lending, but as he became a fixture in European society, his reputation became increasingly vulnerable.

Fugger needed the laws to be changed, or at least relaxed, or his lending business was in trouble. In 1515, he wrote a letter to Pope Leo X and funded a debate in the St. Petronius Basilica in Bologna. The debate ran for five hours, a back and forth of philosophy, scripture, and rampant crowd heckling. In the end, it was declared a tie, but Pope Leo X that year signed a papal “bull” reforming the concept of usury.

Originally, the Church pointed to the philosopher Aristotle’s model for determining what was okay to charge for and what wasn’t. Aristotle had said that charging someone for a cow because it produced milk was fine, but money was a dead thing and unfair to profit from.

A silver mine produced silver and as such paying cash for the future proceeds of the mine had allowed Fugger to more or less carry on his business. It wasn’t called merchant cash advance back then but he applied that model wherever he could. Not everyone in need of money had a business, however, and it was critical that he be allowed to charge interest when circumstances called for it.

More than a millennium after Aristotle, Pope Leo X found that risk and labor involved with safeguarding capital made money lending a living thing. As long as a loan involved labor, cost, or risk, it was in the clear. This opened a flood of church-legal lending: Fugger’s lobbying paid off with a fortune.

Jakob Fugger was off to the races and he greatly expanded his financial services business. Historian Dennis McCarthy found that the Fugger family grew their war chest nine times over in the next seventeen years, a gain of 927%. Their funding efforts bought a trading empire, and they entered into agreements with nobles that placed entire countries as collateral.

Jakob Fugger was off to the races and he greatly expanded his financial services business. Historian Dennis McCarthy found that the Fugger family grew their war chest nine times over in the next seventeen years, a gain of 927%. Their funding efforts bought a trading empire, and they entered into agreements with nobles that placed entire countries as collateral.

McCarthy wrote: That was one of the problems with the Fugger model- “how does one take possession of Austria or France or Spain when its rulers default or lag behind debt repayment schedules?”

After gaining the good faith to lend in the Church’s eyes, the papacy itself became a Fugger customer. Positions in the Church were inseparable from social and political power, and the only way to get a place on the totem pole was by paying for a title. Just as the richest silver mine owners didn’t have the cash to pay for lunch- so did wealthy aristocrats need capital to afford positions in the cloth.

By the time Martin Luther “nailed” his 95 theses to the door of a church in 1517, he was rallying against the Fugger funding family and its stranglehold on the Roman Catholic Church.

It all came down to an in-house promotion. Albert Brandenburg brought a whole new meaning to the concept of “moneychangers in the temple.” A German Archbishop of Magdeburg, Brandenburg was promoted to Elector of Mainz: the second in command of the Holy Roman Empire. Unfortunately, he had to pony up 21,000 ducats to pay the Roman Curia (the Church’s admin)- for the title. Naturally, he didn’t have the cash, and the Fuggers stepped in.

Brandenburg got a loan on interest. To pay it back, he also paid Pope Leo X for the right to sell indulgences. Indulgences were contracts the church sold to forgive sins, allowing believers to purchase their way out of purgatory and into heaven. A fresh round of indulgences was printed to fund the construction of St. Peter’s Basilica, and Brandenburg was entrusted to sell them in 1517. (Their sale was later banned by the Church in 1567).

The sale of indulgences  interlinked the Church with Fugger, and solidified Luther’s desire to maintain the Faith through an alternate system. Luther’s complaints spawned the Reformation, and his followers and independent revolutionaries like John Calvin would bring the rise of Protestantism, the Church of England, and ultimately what historian Alec Ryrie wrote as the foundation of modern mercantilism.

interlinked the Church with Fugger, and solidified Luther’s desire to maintain the Faith through an alternate system. Luther’s complaints spawned the Reformation, and his followers and independent revolutionaries like John Calvin would bring the rise of Protestantism, the Church of England, and ultimately what historian Alec Ryrie wrote as the foundation of modern mercantilism.

“I’m saying that there are some specific parts of modern life that derive directly from the Protestant Reformation. We couldn’t have these features if it hadn’t happened.” Ryrie said. “That combination of free inquiry, democracy, and limited government is pretty much what makes up liberal, market democracies. It runs the modern world.”

To this day, no one is sure of the extent of the Fugger fortune. Historian Mark Häberlein found that Fugger struck a deal with Augsburg Tax authorities in 1516: he agreed to pay an annual lump sum on the condition that his family’s true wealth would never be revealed. He died in 1525.

To get an idea of the extent of his wealth, we can base calculations on the cost of butchering a pig in 1522 (yes, that’s a real metric.) It cost one Gulden, a new coin minted in 1500 to butcher a hog. The German coin contained about the same amount of gold as a Florin.

Based on those ham prices, Jim Ulvog from Ancient Finances estimated that in 2017 a single florin would be worth ~$900, and other writers have put the florin in the same range. Though the true wealth of the Fuggers may never be known, when Charles V aimed to take control of the Holy Roman Empire in 1519, the Fuggers were lending Charles 543,000 guldens to buy votes: approximately $448 million. That’s just in a single deal.

It’s been said that merchant cash advances or sales-based financing is relatively new, but it could be argued that such transactions are so old that life as we know it in the modern world only exists because a guy 500 years ago was engaged in non-loan transactions to fund businesses in a manner that was Church-compliant and wanted to expand.

Connecticut Introduces Commercial Financing Disclosure and Double Dipping Bill

March 20, 2021 Ever since New York State Senator George Borrello famously questioned the meaning of “double dipping” in a commercial financing transaction, states have rushed to include the term in proposed laws despite no one knowing exactly what it means.

Ever since New York State Senator George Borrello famously questioned the meaning of “double dipping” in a commercial financing transaction, states have rushed to include the term in proposed laws despite no one knowing exactly what it means.

The latest state is Connecticut, which introduced SB 745 in February, an “Act Requiring Certain Financing Disclosures.” It is essentially a copy & paste of New York’s recent law which is slated to go into effect in June.

The Connecticut bill similarly applies to factoring, merchant cash advance, business lending and more. It was introduced by State Senator Saud Anwar (D).

A hearing held on March 2nd, drew testimony from the Commercial Finance Coalition, Small Business Finance Association, Electronic Transactions Association, Innovative Lending Platform Association, and Secured Finance Network.

If the bill passes, it is designed to go into effect in October of this year.

Maryland’s Latest Merchant Cash Advance Prohibition Bill Failed to Advance

March 18, 2021 Despite the rapid advancement of the newest merchant cash advance prohibition bill in the Maryland state legislature, the bill failed to jump over the final hurdle in a House Committee hearing on Thursday. Delegate Seth Howard (R), who introduced the bill, vigorously advocated for it to move forward so that it could proceed to the Floor, going so far as to say he was willing to make some concessions to at least get “the regulatory structure” of the bill into law.

Despite the rapid advancement of the newest merchant cash advance prohibition bill in the Maryland state legislature, the bill failed to jump over the final hurdle in a House Committee hearing on Thursday. Delegate Seth Howard (R), who introduced the bill, vigorously advocated for it to move forward so that it could proceed to the Floor, going so far as to say he was willing to make some concessions to at least get “the regulatory structure” of the bill into law.

“I don’t want to snatch defeat from the jaws of victory,” he maintained.

There were several amendments up for consideration, including the inclusion or removal of a 24% APR rate cap on MCA transactions. The subject of APR dominated the light Q&A that took place, but one delegate voiced concern that creating restrictions on capital providers to businesses that might not be able to obtain funding elsewhere would probably be counterproductive. And when a roll call of votes was taken to determine if the Bill should advance to the Floor, he voted no, as did nineteen of his colleagues. Only three voted yes, so the bill did not advance, ending its prospects for the 2021 legislative session. However, it could be reintroduced again in 2022.

Committee Vice-Chair Kathleen Dumais (D) said that she thought the bill “was not ready” despite Delegate Howard “having worked hard on it.” This was Howard’s second try in two years to move it forward. His first attempt, introduced on February 7, 2020, was called the Merchant Cash Advance Prohibition Bill. The more recent one dropped the “prohibition” label but used language that would have effectively prohibited them in the state of Maryland.

Back in Person: Southeast Acquirers Association Going Full Speed Ahead With May 24th Event

March 18, 2021 While positive vaccine predictions began slowly peeking their head out of the media mess that was the fall of ’20, John McCormick and members of the Southeast Acquirers Association (SEAA) had a difficult choice to make: When could they begin planning for an in-person conference?

While positive vaccine predictions began slowly peeking their head out of the media mess that was the fall of ’20, John McCormick and members of the Southeast Acquirers Association (SEAA) had a difficult choice to make: When could they begin planning for an in-person conference?

“It was probably October, November: we thought, okay, are we nuts, or should we do it,” McCormick said. “We just kept saying, well, it seems like we keep hearing good news about vaccines.”

With optimism, McCormick and the team slated a late May reopening. Their bet paid off. With vaccine success and viral loads down so far, things look clear for a return to normal this spring, especially for a payments conference in Bonita Springs, Florida. McCormick said the Hyatt Regency, also eager to reopen business, helped with the planning.

“They said ‘we really want you guys to have the show, we need the business,'” He said. “The location itself is beautiful. Tons of outdoor space, and it’s incorporated into the conference facility so people will really be able to break away and give a little more distance, have a one-on-one and not feel like they’re in a crowd.”

Watching a hackneyed, fazed reopening across the US, SEAA had to plan how to make people feel comfortable meeting, doing business no matter where they were from. Along with picking a venue with 26 acres of property to spread out, they decided to use a color-coated sticker system. Red for “keep your distance,” Yellow for “proceed with caution”, Green for “let’s chat,” and purple for “vaccinated.” Hotel staff will also, of course, be tested and carefully managing the food and distancing.

Their sister events company, the NEAA, had to postpone the planned April show in Philadelphia, but as we know, Florida is open for business.

McCormick is a Founder and board member of (SEAA) and has been active in the payments industry since 1995. Like many events companies, he said, SEAA held a virtual conference last year. While the presentations and education sessions were great, the in-person networking and POS demonstrations a vendor could expect from the conference hall experience were just not up to par.

This year, he said his team is focusing everything toward putting on a safe, “back-to-business with caution” show that is seeing unprecedented interest from firms and industry members excited to, well, shake hands again. If guests are still not ready to meet in person, the big presentations will be streamed to the SEAA site and built into a catalog.

So how many people are attending? McCormick said he’s not sure how many will show up to the Hyatt on May 24th but that the registration numbers ten weeks out are already better than in previous years.

“When we first started, we thought we normally get between 800 and 1,000 people, and we thought you if we can get 600, that would be a success,” McCormick said. “I’d feel great about that, and I think we’re going to hit that number. The interest is there.”

He said the interesting part is that larger firms generally involved in conferences were more cautious this year. A smaller firm with one to 20 people is more likely to say, “Okay, whoever feels comfortable, if you’ve been vaccinated, go ahead and go.” But it’s the larger companies that have called and said, look, we’d love to be there, but we have to wade through legal and manage to approve it.

Still, larger partners this year are excited to sponsor the event, happy to send support for a conference-leading the way back open. McCormick said he’d seen some innovative ways firms are trying to bring their products to the conference platform, like scannable QR codes for video demonstrations. The pandemic has brought virtual innovation, but many people, McCormick said, are excited to return to normal.

“You know, we’re getting awfully close. I really feel like we’re getting there,” McCormick said. “This is the hardest time because you feel it, you can see the light at the end of the tunnel, but if we can just hang on and be responsible for a couple more months, we’ll get there. That’s gonna be sort of the challenge: to remind people, ‘man, we’re all excited, let’s still grab a drink and keep six feet apart.'”

SAFE Banking for Cannabis Businesses Do-Over

March 18, 2021 A bi-partisan group of congress members plans to reintroduced the Secure and Fair Enforcement (SAFE) Banking Act to the House floor, legislation that would protect financial institutions from sanctions for working with marijuana companies.

A bi-partisan group of congress members plans to reintroduced the Secure and Fair Enforcement (SAFE) Banking Act to the House floor, legislation that would protect financial institutions from sanctions for working with marijuana companies.

Representatives Ed Perlmutter (D-CO), Steve Stivers (R-OH), Nydia Velazquez (D-NY), and Warren Davidson (R-OH) joined together supporting the bill, aiming to better align federal and state laws.

“Thousands of employees and businesses across this country have been forced to deal in piles of cash for far too long,” said Rep. Perlmutter. “The SAFE Banking Act is an important first step to treating cannabis businesses like legal, legitimate businesses and beginning to reform our federal cannabis laws.”

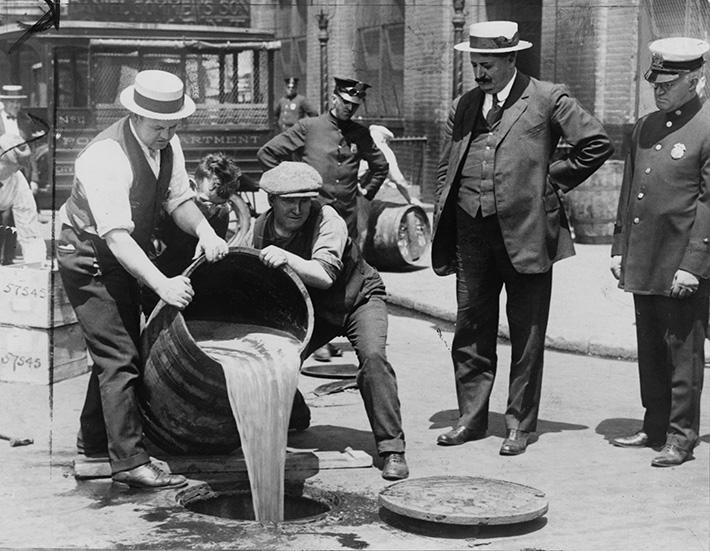

Though legal in a growing number of states and available for recreational use for over a third of Americans, weed is still a class one drug under federal law. Based on that label, federal regulations have kept firms from providing capital, banking, and other financial products to weed companies: it’s hard to scale a business when it’s cash-only.

Representatives hope to give safe harbor to firms to transact with the weed industry if they follow state regulations. The bill first went through the house in September 2019 and passing with flying colors in a 321-103 vote. Then the pandemic hit and muddled up the Senate vote, but after pro cannabis language landed in two stimulus bills, supporters are even more confident this time around.

“At a time when small businesses need all the support they can get, and after cannabis businesses specifically have been providing essential services and generating significant tax revenues for states and the federal government with little to no financial relief, it is more imperative than ever to get the SAFE Banking Act passed into law,” Aaron Smith, the CEO of the National Cannabis Industry Association said. “These businesses are contributing billions of dollars to the national economy every year and need to be treated like any other legal, regulated industry.”

Upstart Says Covid Had No Material Impact on Loan Performance, Believes All Loan Underwriting Will be Powered by AI in the Future

March 17, 2021 Yet another online consumer lender has reported that the Covid-era was good for business. Upstart, which went public in December, recorded $1M in profit in Q4 and $6M in profit for the year. Prosper Marketplace, an Upstart competitor, reported an $18.5M profit for 2020 just days earlier.

Yet another online consumer lender has reported that the Covid-era was good for business. Upstart, which went public in December, recorded $1M in profit in Q4 and $6M in profit for the year. Prosper Marketplace, an Upstart competitor, reported an $18.5M profit for 2020 just days earlier.

“Despite the COVID-19 pandemic, we delivered strong growth and profits in Q4 and for the full year 2020,” Upstart CEO Dave Girouard said in the company earnings announcement. “This combination is rare among FinTechs and demonstrates the growing advantages of AI-based lending.”

Upstart actually grew its revenue in 2020 by 42% over the previous year while keeping loan performance steady.

“We’re happy to report that the COVID-19 pandemic had no material impact on the returns that our bank partners and loan investors experienced this past year.”

The company is going full speed ahead on AI-based lending. “We believe virtually all lending will be powered by AI in the future, and we’re in the earliest stages of helping our bank partners successfully navigate that transformation.”

Keenly aware that AI is an overly used buzzword, the company reminded investors about what its AI can actually do.

Our AI models, like all AI systems, are fueled by incredible amounts of data and sophisticated software to interpret that data, while most lenders consider only a handful of variables as part of a lending decision, Upstart’s model considers more than 1,000 variables about each applicant. You can think of these as the columns in a spreadsheet. And as of December 31, 2020, our model was trained on more than 10.5 million unique repayment events.

These are like the rows in the spreadsheet. And we continually upgrade the machine learning software that interprets this data, enabling us to price the next loan on our platform just a bit more accurately. Upstart goes far beyond a singular AI model predicting default risk. We have discrete AI model that improve the entire lending process, including identity fraud, income misrepresentation, loan stacking, prepayment risk, fee optimization, and more.

But of course, our model that targets default risk is the centerpiece of our system. It predicts not just the likelihood that a loan will default, but when that default can be expected to happen.

Upstart also intends to bring that technology to auto lending. The company simultaneously announced that it had acquired Prodigy Software, Inc, a tech that’s been used to assist with selling more than $6B worth of cars.

“…2021, from our perspective with auto, is really a building year,” said Girouard, “And the acquisition of Prodigy, we certainly view as an accelerator toward the point of sale, the majority of the market that happens at the dealership.”

Ireland’s Fintech Industry May Be Coming to North America

March 16, 2021 Americans asked to name an Irish fintech company often say Stripe, the company founded by two Ireland-born brothers that is dual headquartered in San Francisco and Dublin. Recently valued at $95 billion, its financial backers include Sequoia Capital and the Irish government via the National Treasury Management Agency.

Americans asked to name an Irish fintech company often say Stripe, the company founded by two Ireland-born brothers that is dual headquartered in San Francisco and Dublin. Recently valued at $95 billion, its financial backers include Sequoia Capital and the Irish government via the National Treasury Management Agency.

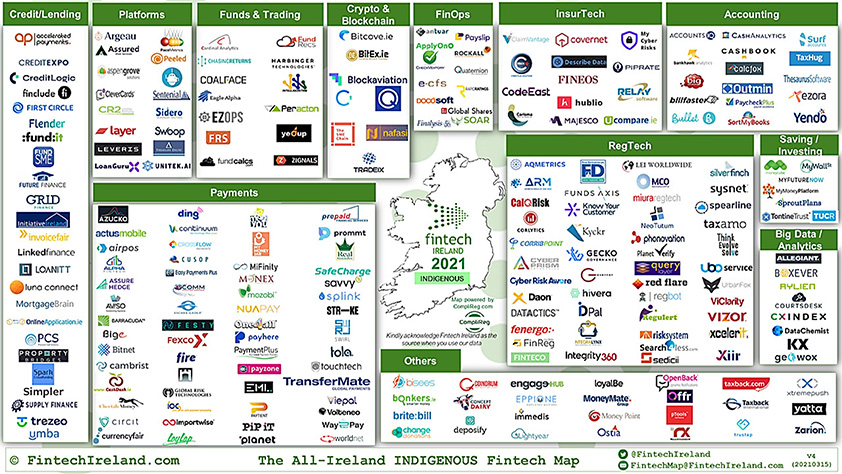

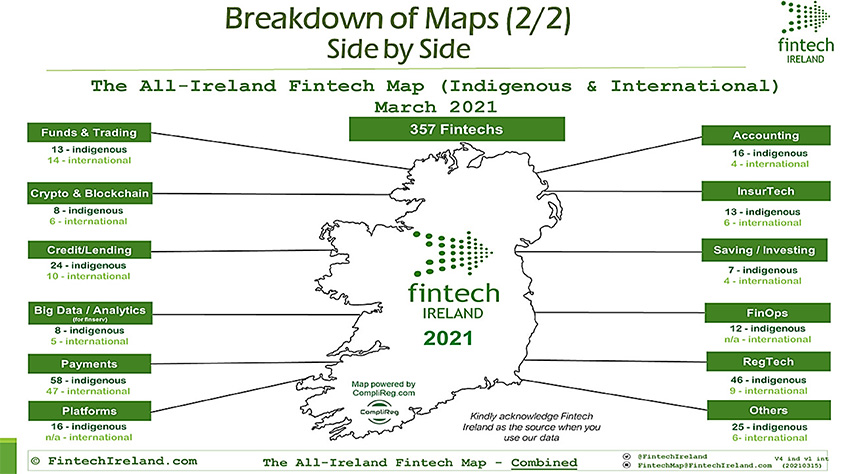

Stripe’s Irish roots may not be a one-off. Though the Republic’s entire population (4.9M) is less than that of New York City (8.7M), it is home to nearly 250 indigenous fintech companies, dozens of which offer lending and payment products, according to the latest Fintech Ireland map. And many have expansion plans in the works.

Despite the close proximity to the UK, the United States and Canada tied for the #1 priority region that homegrown Irish fintech companies said they want to expand to, according to Fintech Ireland’s industry survey. The UK came in 2nd. The majority of Irish fintech companies actually said they prioritized expansion plans for the US and Canada even over expansion in their home country.

A flight from New York to Dublin can be shorter than a flight from New York to San Francisco and Ireland’s primary language is English. 7,000 people work in fintech in Ireland, the bulk of which are based in Dublin.

deBanked evaluated the market in-person during the Fall of 2019 and determined that there are many cultural and operational similarities to the US. A follow-up piece in May 2020 captured how the industry there was faring through the Covid pandemic.