Story Series: The Broker

The Broker: How Copelon Kirklin Became a Dealmaker

September 3, 2018 Title: President of KPC Group, one man broker shop.

Title: President of KPC Group, one man broker shop.

Location: Kenner, Louisiana. Fifteen minutes outside of New Orleans.

What’s your morning routine?

I wake up at 6. I get a quick breakfast. I check my emails and then on to phone calls.

What keeps you going throughout the day?

My gasoline is my family. They’re my coffee, my 5-hour energy. They’re my motivation because I know what I want to give them. I’ve been able to accomplish some things in this business and [be able to] provide some of things for them… So no coffee here. Just the family. That’s my fuel.

Biggest deal?

$2.5 million deal. It was an SBA loan and I had 1 point in it. So I made a $25,000 commission.

What are a few of your biggest challenges as a broker?

If I’m dealing directly with a merchant, at the beginning, the way they represent themselves on paper regarding their revenue – everything looks good. And then when the actual bank statements come through, it doesn’t match up. I mostly work with construction contractors. It’s a niche and it’s pretty simple. But it’s only simple if [merchants] don’t misrepresent their financials, if they’re telling the true story.

Also, I don’t mind working with brokers…it doesn’t matter if you’re in the deal 50-50 or you’re just passing me a deal of a friend…I pay 50% every time, because I want to foster more relationships and get more deals that way. The challenge is when the co-broker can’t let go of the client to let me deal with them. It’s when they want to be the go-between. When they want to communicate through me to the client and it just doesn’t work that way. I haven’t closed any deals when another broker tries to work that way.

Could you tell me about your first deal?

Could you tell me about your first deal?

2014 was the first time I closed a deal in finance…and I only made $500. But I tell you, it was the best thing that happened to me because it let me know that it was possible. There was this one moment when I was really questioning “am I supposed to be doing this?” And I’ll never forget that day. I was sitting in my bed and I just had this look on my face and my wife asked me what was wrong and I told her “I don’t know if this is for me because I’ve been doing this for [a few] years and nothing’s happened yet.”

And to my surprise, she said “pick up that laptop, open it back up and you get back to work. It’s going to work out. You’re not doing this in vain.” And lo and behold, two weeks later, I closed that first deal at $500 [in commission], and the next week I closed two deals, one for $1,100 and one for $1,400. And I was just on my way from that point.

How did you learn to be a broker?

I learned from the internet. I found leads organically because I didn’t have any money for leads. LinkedIn was my best friend at the time and it’s still my go-to. It was where I learned that people are willing to do business with you without meeting you. I got hooked on it – developing my profile, adding to it, learning, making mistakes, chasing pipe dreams. [Those many months] before closing my first deal were just a lot of growing pains.

How do know when something isn’t real on LinkedIn?

It’s really about learning to do due diligence and not taking people at their word, even though you would love to. You check out their background. Do they just have a personal email address? That’s not always a killer, but it does help if they have a corporate email address if they’re telling you that they’re a lender. Learning that someone is actually a broker when they’re saying that they’re a lender. Checking Ripoff Report, seeing if [someone] has a website, learning to tighten my filter. In the beginning, you want it to be easy. You want to take people at their word. And I fell for [tricks]. But you have to do your homework.

Grooming The Best Sales Reps

August 22, 2018The best sales reps have a lot in common – they’re smart, honest, likable, well-organized, thick-skinned and hungry for success. They navigate the difficult early days of their careers in the alternative small-business funding community by persevering despite long hours, countless outbound telephone calls and meager commissions.

“Persistency is really, really the key – putting in the time,” says Evan Marmott, CEO of Montreal-based CanaCap and CEO of New York-based CapCall LLC. “It’s not always easy, but you’ve got to stay late, make the phone calls, send the emails and do the follow-ups. It’s a numbers game.”

Being relentless counts not only when pursuing merchants but also when matching merchants with funders, Marmott emphasizes. “If they can’t get an approval one place, they’re going to shop it out until they get approval someplace else so they can monetize everything that comes in,” he says.

“It’s all mindset and work ethic,” in sales, according to Joe Camberato, president at Bohemia, N.Y.-based National Business Capital. His company works to create a culture that supports the right mindset by working with a firm called “Delivering Happiness.” Together, they forge to a set of core values based on integrity, innovation, teamwork, empathy, and respect for fellow employees, clients and clients’ businesses.

National Business Capital employees learn to live those ideals by working and playing together on the company volleyball team, through work with local and national charities, and at company mixers and staff picnics, Camberato maintains. “We adapt and change, and we’re committed to helping small businesses grow,” he says of the company culture, “and we have fun while doing all that.”

Likeability helps build relationships with customers, says Justin Thompson, vice president of sales for San Diego-based National Funding. “People will do business with people they like and trust,” says Thompson. “It’s really about establishing a relationship first and then establishing quality discovery.” From there, presentation and execution become paramount, he says.

Methodology can make the difference between success and failure in sales, observes Justin Bakes, co-founder and CEO of Boston-based Forward Financing LLC. “Have a defined process and stick to it,” he advises. A well-organized approach inspires trust among clients, establishes and maintains a great reputation; and fosters understanding of the customers’ needs, wants and business operations that help the rep choose the right financing option and appropriate funder. Using technology to wrangle multiple leads and high volume counts for a lot, too, he says.

It’s all part of the consultative approach to sales, says Jared Weitz, CEO of Great Neck, N.Y.-based United Capital Source. Long ago, sales reps may have succeeded by mimicking carnival barkers, sideshow pitchman and arm-twisting medicine-show peddlers. Thankfully, those days have ended – if they ever really existed. Most of today’s successful salespeople earn clients’ respect by becoming knowledgeable, trusted business consultants, says Weitz.

THE CONSULTATIVE SALE

“Someone calls, and there are two ways of handling a deal, right?” Weitz asks rhetorically. Using one method, a salesperson can say, “We’ll fund you this much at this rate today – are we good?” he says. The other way calls for understanding the client’s business – how long has it been open, does it make more cash deposits or credit card deposits, would it be best-served by an advance, a loan, an equipment lease or a line of credit, how much can it afford in monthly payments?

Establishing how the merchant intends to use the funding plays a crucial role in the consultative sale, Marmott agrees. Objections can arise when a merchant learns that receiving $100,000 this week will require paying back $150,000 in four or five months, he notes. So it’s essential to demonstrate that using the money productively will more than pay for the deal. A trucking company can realize more income if it deploys two more trucks, or a restaurant can increase revenue by placing another bar outside for the summer, he says by way of example.

“A lot of salespeople ask a business owner what they need the money for,” observes Thompson. “The merchant says, ‘Inventory,’ and the rep stops right there. I train my reps at National Funding to go two or three clicks deeper.” Examples abound. When does the merchant need the inventory? From whom do they order it? How long does it take to ship? How long does it take to turn it over? What are the shipping terms?

The consultative approach can require salespeople to pose a lot of open-ended questions that can’t be answered yes or no, according to Thompson. Ideally, the conversation should adhere to the 80-20 rule, with the client talking 80 percent of the time and the sales rep speaking 20 percent, he asserts, adding that “a lot of times it’s reversed in this industry.”

Sometimes, however, salespeople should set aside the time-consuming consultative approach and instead find funding for a merchant as soon as possible. That’s true when the business owner can make an opportune purchase of inventory or when it’s time to acquire a competitor quickly. More often, however, it pays to take the time to understand the merchant’s needs and search out the best type of funding for that particular case, top sales people maintain.

Much of the alternative small-business finance industry has caught on to the importance of the consultative approach to sales as the array of available alternative financial products has grown beyond the industry’s initial offerings of merchant cash advances, according to Weitz. The days of scripted pitches and preplanned rebuttals to objections have ended, he says. Today, management trains reps for success.

THE RIGHT TRAINING

Are top salespeople born that way? “Some people hit the ground running, but sales can be taught – that’s for sure,” Weitz says. “The tougher thing to teach is integrity.” Much of the training process focuses on learning the products to enable a rep to make a consultative sale and shoulder financial responsibility, he maintains.

Believing that some people are born to sell provides a crutch to avoid learning what really works, according to Bakes. Training can teach a smart, motivated person how to succeed, he maintains. They don’t have to be born that way.

However, some people do seem born to exert influence, which can translate into sales prowess, says Thompson. Still, those born with a strong work-ethic can overcome other deficiencies, he notes. The work ethic drives them to “come in every day,” he notes. “They’re organized and disciplined. They follow the National Funding philosophy, and they make a ton of money.”

National Funding trains salespeople to view their craft as being defined by two broad elements – art and science, Thompson continues. The science proves easier to master and includes asking the right questions to learn about the customer and the deal. The hard part, the art of the sale, consists of getting to know the business owner, building a relationship and demonstrating expertise. In one example, that’s based on learning how many trucks are in the fleet, whether they’re long-haul or short haul and whether they use dumpsters versus box trailers, he says.

Beyond those important basics, training should be ongoing because selling techniques change slightly as new products and systems emerge, according to Weitz. “One of the things I like about being a broker is the ability to pivot and add another arrow to your quiver,” he says.

Salespeople at United Capital Source talk sales among themselves almost nonstop, which amounts to daily sales training, Weitz observes. That can take the form of describing a challenge and explaining how to overcome it, he notes. A particularly good idea merits an email to the group to share the new piece of wisdom. It’s a matter of constantly refining the approach.

Training can help sales reps understand the businesses their clients run, according to Marmott. Knowing the margins in a restaurant, for example, can help the salesperson explain that the increase in revenue from an expansion will quickly pay the cost of capital, he notes.

Training should teach new employees how business works because common elements arise in enterprises ranging from dog grooming to asphalt paving, Thompson notes. There’s inventory, marketing, employee expense, payroll taxes, insurance and 401k’s in almost any business. “We teach all that to the reps,” he says. Then after conversations with thousands of merchants, reps have a solid foundation in the workings of businesses.

National Business Capital’s formal two-week classroom training usually lasts three hours a day, focusing on systems, guidelines, product, general business principles and the company’s processes, says Camberato. Teachers include the sales management team, company culture leaders and the managers of IT and Tech, Marketing, Processing, and Human Resources.

National Business Capital’s formal two-week classroom training usually lasts three hours a day, focusing on systems, guidelines, product, general business principles and the company’s processes, says Camberato. Teachers include the sales management team, company culture leaders and the managers of IT and Tech, Marketing, Processing, and Human Resources.

New hires spend much of their time working with mentors for the first six months and a team leader who works with them indefinitely, Camberto continues. The company sometimes hires in groups and sometimes hires individually, he notes.

National Funding provides three eight-hour days of regimented classroom training on the fundamentals to each of the four groups of 12 to 17 hired each year, says Thompson. The classes cover processes, sales strategy, marketing and the lender matrix. Next comes three months of working with a sales manager dedicated to working with the class. After a total of nine to 12 months, management knows which reps will succeed.

Some shops operate on the opener-closer model, with less experienced salespeople qualifying the merchant by asking questions like how long they’re been in business and how much revenue they bring in monthly, Marmott says. If the merchant qualifies, the newer salesperson who’s working as an opener then hands off the call to an experienced closer to complete the deal. Good openers become closers, but opening isn’t easy because it requires lots of calls, he notes.

National Funding doesn’t use the opener-closer approach because the company believes reps should Participate “from cradle to grave,” Thompson says. “They hunt the business down, build the relationship and handle the transaction from A to Z.” East Coast shops often focus on cold calling and use the opener-closer model, while West Coast shops tend to invest more in marketing and reject the opener-closer method, he noted.

But where do these top salespeople come from?

THE RIGHT BACKGROUND

Prospective sales reps who have just finished college should have a grounding in communications or business, Weitz believes. Experience in sales and a familiarity with dealing with merchants helps prepare reps, he notes. Job history doesn’t have to be in the finance industry. Someone who’s sold business services in a Verizon store or worked for a payroll company, for instance, has been dealing with small-business owners and may succeed more quickly than those without that background.

Sales experience in other industries counts, Bakes agrees, especially in businesses that require dealing with a large number of leads. “Organization and process is just as important as being born with the traits of a salesperson,” he opines.

Life experience that breeds a positive attitude can prove vital, says Marmott. That’s especially important in the beginning when a new rep might take home a paltry $300 in the first month. Later, when the rep has a $50,000 month, he or she will see that their optimism wasn’t misplaced, he declares.

GUYS WHO ARE HUNGRY”

“The biggest thing I look for is guys who are hungry,” Marmott maintains. I don’t need somebody with a doctorate or a master’s degree or even a degree,” he says. “I need somebody who is going to put the work in.” Of a roomful of 25 new reps, two or three will succeed and stay on the job, he calculates. “You get to eat what you kill. If you’re not killing anything, you don’t get to eat.”

“We look for potential candidates who come from backgrounds of rejection,” says Thompson. Their previous sales experience has taught them not to take the answer “no” personally. “It’s part of the business and you continue to move on.”

Although most regard the financial services industry as a white-collar pursuit, “it has blue collar written all over it,” Thompson says, referring to the work ethic required for success. But it’s not just the volume of work. Sixty good phone calls generate more business than 300 mediocre calls, he emphasizes.

GETTING UP TO SPEED

Succeeding at sales requires taking the time to form relationships, understand guidelines, become familiar with lenders and acquire a working knowledge of how clients’ businesses operate, Camberato says. How long does it take? “It’s a solid year,” he contends while conceding that most who succeed operate at a fairly high level before then.

Others disagree about what constitutes being up to speed and how much time’s necessary to achieve it. “I’ve seen it take 30 days, and I’ve seen it up to 120 days,” says Weitz. “The hope is that it’s within 60.”

A salesperson should start feeling better after 30 days and should start feeling good after 60 days, Marmott says. Management can usually identify the strong and the week reps within two to three weeks, he says. “You get the lazy ones that drop out, the guys who aren’t making any money, the ones who aren’t putting the effort in,” he says. “The first two weeks are the toughest because you’re learning the product and how to sell it.”

“It depends on the person,” Bakes says of the time needed to begin selling successfully. “It takes time. It is not something that will just happen overnight.” About six months should suffice to become confident as a closer, he estimates.

Even when sales reps hit their stride, some outsell others, Marmott notes, citing the 80-20 rule that 80 percent of the business comes from 20 percent of the salesforce. Outbound sales to merchants who may feel beleaguered by offers of funding requires more effort than when a merchant makes an inbound call to seek funding, he adds.

And even the best salespeople need great marketing and tech support from the their companies, sources agree.

INVESTING IN SALES

A shop just starting out might have a marketing budget as low as $2,500 a month, which won’t do much more than pay for direct mail pieces that might prompt a few potential clients to pick up the phone, Weitz says. With a little more money to spend, a shop can begin buying leads, he notes. “Don’t break the bank before you understand what formula works for you,” he advises.

“The key to sales is marketing,” says Marmott. “You can be the best sales guy but if you don’t have anything qualified to call or follow up with, it’s a waste of time.” Social media doesn’t work as well for business-to-business contact as it does for business-to-consumer marketing, he says. Pay per click and key words have become more expensive and isn’t as cost-effective as it once was, especially for smaller shops, he contends. Mailers can work but require heavy volume and repetition, he says, adding that could mean at least 25,000 pieces and at least three mailings.

Besides allocating marketing dollars, companies can invest in sales by paying new sales staffers a salary instead of forcing them to rely on commissions to eke out subsistence during the tough early days. National Business Capital pays a salary at first and later switches reps to commissions and draw, Camberato says. “An energetic person interested in sales can plug into our platform, get trained and do very well,” he continues. “We believe in you, as long as you believe in us.”

National Funding provides recruits with a salary and commissions so that they have enough income to get by and still reap rewards when they help close a deal, Thompson says.

Investment in technology can help salespeople set priorities, eliminate some of the drudge work in the sale process, measure the sales staff member’s success or lack of success, and provide a consistent experience for customers, notes Bakes. “Because of the way our technology is set up we can hold people accountable,” he adds.

Every salesperson and every shop should organize the workflow by using a lead-management system or customer relationship management tool (CRM) – such as Zoho or Salesforce –instead of operating with just a spreadsheet, Weitz says.

Brokers can invest in sales through syndication, which means putting up some of the funds involved in a deal. Forward Financing favors syndication in some cases because it aligns the salesperson and the funder, thus demonstrating the sales rep’s belief in the validity of the deal and ensuring a willingness to continue servicing that customer, Bakes says.

Some shops offer monthly bonuses for outstanding sales results, but Weitz believes awarding incentives weekly makes more sense. With a monthly cycle, some reps tend to slack off for the first week or so because they believe they can make up for lost time later. With weekly rewards, there’s not much room for downtime, he notes.

Whatever form investment takes, it can help build a sterling reputation and a free-flowing “pipeline.”

THE RIGHT REPUTATION

“Reputation is huge,” especially for repeat business and referrals, Marmott says. Once a merchant has received funding, a blizzard of sales call can follow. Treating customers right by maintaining ethical standards and helping them during hard times can guard against defection to a competitor touing low prices, he says.

Reputation requires differentiation, which usually occurs online, by email or over the phone, notes Bakes. Factors that enhance reputation include referrals by satisfied customers and real-world testimonials from actual customers and good ratings on social media sites, he says.

While it’s still uncertain what role social media plays in the industry’s reputation-building efforts, it appears that text messages elicit quick responses if the client has agreed to communicate with the company via that format, Bakes says. He notes that unwanted text messages won’t work. Email messages provide more information than text messages but seem less likely to prompt response, he says.

THE RIGHT GOAL

So, where does the effort to succeed at sales lead? It’s the foundation for building “the pipeline” – the name given to the flow of renewals, referrals and leads that makes every day not just busy, but busy in a productive and profitable way. As a rep’s pipeline takes shape, the cost of acquiring new business also goes down, Marmott says. “It just grows from there,” he says of the successful salesperson’s endeavors at building a pipeline of business. It’s what successful salespeople seek.

The Broker: How Zach Ramirez Makes Deals Happen

August 17, 2018 deBanked interviewed Zachary Ramirez to find out what makes a successful broker like him tick, how he does it, and what kinds of things he’s encountered along the way.

deBanked interviewed Zachary Ramirez to find out what makes a successful broker like him tick, how he does it, and what kinds of things he’s encountered along the way.

Title: Founder and Managing Director of ZR Consulting, LLC, a brokerage of 10 people in Orange County, California.

Years in the industry: 6

Age: 29

Number of brokerage shops he’s started: Three. The first one he created failed after only about three deals, the second one, called Core Financial (that he got in early on with 2 other partners), grew to 27 brokers before it was acquired, and this one is only two months old and has already funded $1 million.

Number of brokerage shops he’s started: Three. The first one he created failed after only about three deals, the second one, called Core Financial (that he got in early on with 2 other partners), grew to 27 brokers before it was acquired, and this one is only two months old and has already funded $1 million.

His morning routine:

I get up at about 5:45.

I have my protein shake – banana, protein, coconut oil and whatever else I can find that seems healthy to me.

I get a cup of coffee.

I sit down at my desk and the first thing I do is look at all the leads that came in that night. Sometimes there’s as many as 80. Sometimes there’s as few as 20 or 25. I then distribute the leads to my sales team, so that as soon as they wake up, they have all their leads. After that, I focus on marketing and closing some of the bigger deals.

Ritual before he closes a deal:

Ritual before he closes a deal:

It’s a funny habit that makes me laugh but before I try to close a deal, I visualize myself closing the deal and I beat my chest. I walk around the office beating my chest like an ape, and it’s just hysterical. I get this big adrenaline rush right before I call the merchant. And when I call them, I’m just on fire. Whatever happens, I’m ready for it. And when I’m in that mode, I can’t lose a deal. It’s like impossible.

His first deal:

It was an auto repair shop that needed $75,000 in order to add three new bays for their repair shop. I think I funded it with OnDeck. It was a very smooth deal. My buddy brought it to me. He said the customer needs the money today. And we ended up funding it the same day. It was great.

I was 23 years old and that was the first time I had seen my business capture any revenue. Finally, after a month or two months of straight working, and not finding a single deal, I finally figured out the marketing a little bit and ended up funding that one. I remember we had 10 points in it, so we had $7,500. I was a single guy renting a room, and for me that was a good chunk of money.

What it taught him:

It helped me learn about expense management because that first broker shop I started failed. I lost everything on that shop. I only funded two or three deals and I ended up spending more money than I made. I was very humbled by this. I realized that being a broker isn’t as easy as people think.

What his best merchants have in common:

My favorite merchants understand why they qualify for what they qualify for. We have a deep rapport. I don’t just talk about business. I’ll talk about their family. I’ll talk about trends I see in their industry. I’ll help them understand their financial situation. And my best merchants are the ones that understand that I’m a source of information for them and I can provide them with valuable insights that they might not be aware of. Things that can help them. I’ll help them with marketing a lot…I say, ‘Look, if you talk to these people, they can do this marketing for you.’ And I do stuff like that because it’s increasing their revenue which helps their business. And that can help me do bigger loans for them.

Largest deal:

Largest deal:

It was a $2 million deal. We had three points in it, so we made $60,000.

Favorite funders:

OnDeck. Also, I really like Fundworks, Quickbridge and Kalamata Capital Group. If someone doesn’t say OnDeck, then they’ve got a problem because OnDeck is amazing.

Why?

Because the consistency of their approvals, their competitive rates, the fast and seamless funding process. And especially, the online checkout. The online checkout is godly.

An ISO Brokers Main Street Deals – on Main Street

June 25, 2018 Envision a giant office filled with rows of commercial finance brokers on the phone, aggressively selling deals to faceless small town merchants. Then step into the office of Horizon Financial Group and meet brothers and business partners James and John Celifarco. The contrast could not be more striking.

Envision a giant office filled with rows of commercial finance brokers on the phone, aggressively selling deals to faceless small town merchants. Then step into the office of Horizon Financial Group and meet brothers and business partners James and John Celifarco. The contrast could not be more striking.

The most dramatic difference between their office and that of almost every other broker, or ISO, is that you enter the office from the sidewalk. There’s no lobby and no elevator. It’s just the two brothers (plus one salesperson and one assistant) working on the other side of a glass storefront window.

The store isn’t on Madison Avenue or Rodeo Drive. It’s on a modest, roughly three-block commercial strip on Avenue S in a working class section of Brooklyn called Marine Park. There’s a deli, a pizzeria, a barbershop, a pet grooming store and a bunch of other stores that you’re likely to find on Main Street, U.S.A. In other words, Horizon Financial Group’s neighbors are the exact kind of small business owners they seek as customers. And since they opened up shop on this quaint stretch at the end of October, many of their store owner neighbors have already become customers.

The store isn’t on Madison Avenue or Rodeo Drive. It’s on a modest, roughly three-block commercial strip on Avenue S in a working class section of Brooklyn called Marine Park. There’s a deli, a pizzeria, a barbershop, a pet grooming store and a bunch of other stores that you’re likely to find on Main Street, U.S.A. In other words, Horizon Financial Group’s neighbors are the exact kind of small business owners they seek as customers. And since they opened up shop on this quaint stretch at the end of October, many of their store owner neighbors have already become customers.

“It’s a different relationship with the customer,” James said of their neighborhood clients. “You’re not on the phone. You’re face to face with these people. You’re meeting them, you’re shaking their hands, you’re getting to know them personally, which helps with the longevity of the relationship itself.”

Sitting at the glass conference table by their storefront window, James, 34, and John, 37, counted up to six clients by simply pointing out the window at other small stores across the street. Horizon Financial Group is an ISO that brokers working capital deals and does credit card processing, equipment leasing, ATM machines and commercial mortgages. (James has his New York real estate license, so he can also help local store owners buy or sell a house.) The brothers said that about 40 percent of their business is facilitating deals brought to them by other ISOs, another 40 percent comes from merchants that they find directly, and about 20 percent comes from these local customers they’ve developed from having a physical presence in the neighborhood.

“Obviously you can’t build an entire business on just these two streets,” John said, “but it’s extra business that we wouldn’t have had if we weren’t here. And when we came here, we stopped thinking ‘Who are we going to buy leads from?’ and started thinking more outside of the box.”

An example of this was their decision to approach the Brooklyn Chamber of Commerce where they are now one of the chamber’s preferred vendors, which brings them business from the entire borough.

James said they’ve made contributions to the local little league and kids football, and whenever a new store opens in the area, they introduce themselves and explain what they do. It also doesn’t hurt that they grew up in Marine Park, so they already know the town pretty well. James recognized someone on the sidewalk and ran outside to say hi. It was someone who used to be a next door neighbor. There is a truly old-fashion sense of community on Avenue S.

“I buy my pizza from [the pizza store owner] and he does his credit card processing with us,” James said. “When the dry cleaner needed equipment, we got them capital, and I actually got to see the piece of equipment I helped finance. That almost never happens.”

Because there is no building guard or front desk person, customers can stop by whenever they like. As if in a sitcom, a man walked into the store saying to the brothers, “Don’t be mad at me.” It was a customer, the owner of a local paint store. “It’s not completely my fault, but I broke the phone swiper on the job.”

Because there is no building guard or front desk person, customers can stop by whenever they like. As if in a sitcom, a man walked into the store saying to the brothers, “Don’t be mad at me.” It was a customer, the owner of a local paint store. “It’s not completely my fault, but I broke the phone swiper on the job.”

Reassuringly, John told him to come to his desk and he helped the customer with a replacement for a piece of credit card processing equipment.

The brothers have each been working in the small business financing industry independently for more than a decade. James established Horizon Financial Group by himself in 2009 while John was working for a different company in the credit card processing and MCA space. John joined James at Horizon Financial Group in September 2017.

John said he prefers co-leading Horizon Financial Group, itself a small business, to running a larger operation in Manhattan.

“Compared to somebody in the city with a huge rent and a huge payroll, I don’t need to do the same numbers he’s doing to end up making the same amount of money.”

John also noted that he doesn’t have to sit on a train for an hour and a half because he lives just six blocks away from the storefront office.

“A lot of people don’t like to say they’re a small company,” John said. “I couldn’t be happier that we’re a small company.”

Running a small business is familiar to the Celifarcos. Horizon Financial Group gets its name from Horizons Dance Center, a successful Brooklyn dance school founded by James and John’s mother. It has been in business for 46 years and is still going strong.

“The name is good luck,” James said.

James lives a short drive away in Rockaway with his wife and daughter. On running a small business like Horizon Financial Group, James said: “It’s also about quality of life. You don’t need to work 7 to 7. I can be on the beach with my daughter. It’s really a different approach.”

What’s a Broker To Do? Industry Execs Offer Their Insight

March 12, 2018

Below are excerpts from separate interviews with four industry executives when asked for tips or advice for brokers:

“I would just say to be in it for the long haul. Play the long game. Be the kind of quality partner that you would want in return. There are some brokers and referral sources in this space who see merchants only as a commission check, not as the going concern and business entities that they are. Some brokers are playing the short game, which is unfortunate, because brokers can be in a very powerful position with their clients (merchants) – they need to use that power wisely. If one were to carefully look at a business and its working capital challenges, and then tried to do what was in the best interest of that business in the long run, a broker could be creating a revenue stream for a longer period of time – on a healthier business – and in return creating a more sustainable brokerage platform for themselves. Be open and transparent – sometimes losing a deal due to full transparency can lead to many multiples of that volume with a loyal funding partner.”

– Bill Gallagher, President and Managing Partner, CFG Merchant Solutions | Read full interview

“Choose industries that you excel in—and own them.

Concentrate your marketing efforts on your core customers and target those that meet a lender’s criteria. It’s not the quantity of leads you deliver, it’s the quality—and that will save you time and money. Look for customers in growth stages, not those that are desperate for funds to stay afloat. This will also result in more renewals.

And find a lending partner with a strong brand, as this opens doors to new customers.”

– Michael Marrache, CEO, BFS Capital | Read full interview

“It is not an easy business and not for everyone. It takes quite some time – years – to either build an organization or to become a seasoned pro that truly understands the space. It is also very fast paced and ever changing, so you have to really commit and take the space seriously if you want to be successful.”

– James Webster, CEO, National Business Capital | Read full interview

“Brokering is a tough marketplace right now. I don’t want to say [it’s] saturated, but it’s getting pretty close…Everyone’s getting a million phone calls and mailings and the marketing is going crazy, and the expense is going up. So you really have to find a way to differentiate yourself.

That’s really the biggest thing about being a broker, besides quality service. It’s more: What kind of niche can I get into? How can I break into the market without having to spend like a million dollars a month on marketing? The biggest thing is: What can you do differently?”

– Evan Marmott, CEO, CanaCap | Read full interview

Nest Planner: The Story Of A Startup MCA Broker

March 4, 2018deBanked interviewed Anthony Frisone, the founder of Nest Planner, a young ISO on Long Island, on how he got his start.

What were you doing before becoming an MCA broker?

I was doing real estate and then I got sick. I was having a hard time walking. And you can’t sell real estate when you can’t walk. I was bedridden for a long time [before I got better.] I was in a bad place, mentally and physically, and a friend of mine just said to me “you should try this out.” I knew nothing about it. So I went to his office and I actually grabbed a deBanked magazine off of one of the desks in his office.

What’s the greatest challenge of being an MCA broker?

Being sick was easier than starting out in this business. It was rough. The first three or four months was an uphill battle. It was brutal. We did zero. No business at all. But I didn’t give up. We just kept dialing the phone. I couldn’t even get funders to send deals to. I was calling quite a few of them. And they were like “Who are you sending deals to now?” And I said, “No one. I’m brand new in the business.” And they were basically like “Come back to me when you have something under your belt.”

I had a whole list of people I was calling and I called up a place called Cardinal Equity, which came from the deBanked website or magazine. The owner answered the phone and we were just talking, for a half hour, maybe an hour. I remember it was late at night and right before Thanksgiving, and he said “Call me next week and I’ll send you the application.” I was like “Oh wow, thanks.” [..] Finally he sent it to me and I sent it back to him. And he let me send him deals.

What about getting deals made?

Getting deals was a whole different story because I didn’t have anyone to tell me “Don’t take $5,000 a month accounts.” We were surrounded by no one that knew the business. So it made it even harder by not knowing what I was doing. But I had no choice. So I just came in everyday and worked. And something, little by little, started panning out.

After Cardinal Equity, I didn’t get another funder until after I took the deBanked “Merchant Cash Advance Basics” [online course] in January 2017. It was eye opening for me. Everything started making sense. I was able to have a conversation with funders and actually understand them. I started sending over my MCA Basics Certificate of Completion to every funder I could think of, and within a month’s time, I had over 30 different funders waiting for me to send them deals. However, [at the time] I had no merchants to send them.

After Cardinal Equity, I didn’t get another funder until after I took the deBanked “Merchant Cash Advance Basics” [online course] in January 2017. It was eye opening for me. Everything started making sense. I was able to have a conversation with funders and actually understand them. I started sending over my MCA Basics Certificate of Completion to every funder I could think of, and within a month’s time, I had over 30 different funders waiting for me to send them deals. However, [at the time] I had no merchants to send them.

So where have you found your best leads?

We tried out so many different places and spent so much money. But we had no one to guide us in the right direction. So we would look online and probably at deBanked also. We called up a bunch of different places. None of them were fantastic, but none of them were terrible. So we knew it was a numbers game and we had to stay on the phone. So there was no set place. I bought a little bit from everywhere and a little bit worked from everywhere.

When did you start making money?

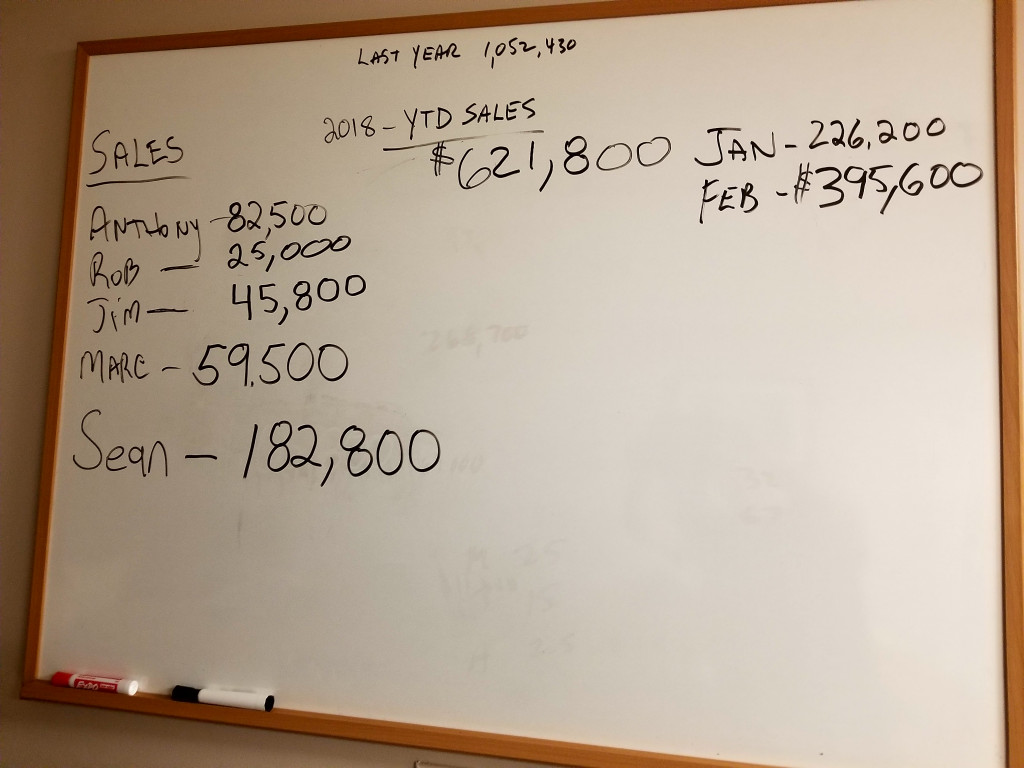

I started the business, called Nest Planner, in October 2016 all by myself. Just me and a desk and a laptop. And I didn’t start making money until March 2017. From October to March was a long 5 months. And in March I made close to $10,000 in advances. But by the end of last year, we hit the $1 million mark in advances. It’s not a lot, but it’s something that showed that we’re doing something right. And this year, it’s just February, and we have over $600,000 in [advances]. That’s huge for us and it’s just from us not giving up and pounding the phones.

How many people work for you?

Six.

How do you personally define success as a broker?

I guess the obvious part is the funds. If you make sales or close deals, it does feel good to make money. I have a wife and two kids and not taking home a paycheck is brutal. But what’s nice, also, is to see the people we hire make money. It’s nice to see them go home with a check.

How many applications do you typically send out?

So far, for January and February of this year, five of us sent in just under a 100 applications. And we funded 20 of them so far.

What resources do you wish you had that could have helped you made more deals in the beginning?

A CRM. I just had paper leads everywhere. We would just write it up on a piece of paper. No CRM and it’s rough. But it costs money. So we weren’t able to do it.

Apart from approving your applications, what do you look for in a funder?

Someone I could trust. Someone that returns calls. At the very beginning, it was hard. couldn’t get the time of day [from funders]. No one would call me back, except for Cardinal Equity. Now they’re actually calling me.

Want to become a better closer in this industry? Join your peers for training and networking at Broker Fair on May 14 in Brooklyn, NY! You can register here.

MCA’s Top Social Media Voice

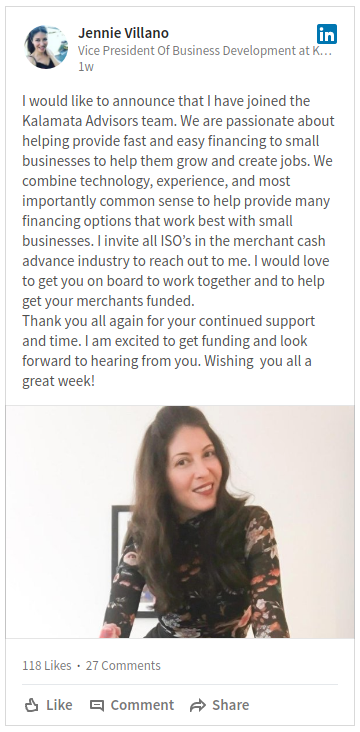

December 18, 2017 LinkedIn has unveiled its top 10 voices for marketing and social media. Fintech did not make the list, but perhaps the social networking site didn’t look hard enough. If they had been following Jennie Villano, who on Dec. 1 joined Kalamata Advisors as vice president of business relationships, that list might have included a nod to the MCA industry.

LinkedIn has unveiled its top 10 voices for marketing and social media. Fintech did not make the list, but perhaps the social networking site didn’t look hard enough. If they had been following Jennie Villano, who on Dec. 1 joined Kalamata Advisors as vice president of business relationships, that list might have included a nod to the MCA industry.

By most standards she’s a newbie to fintech, having joined her previous employer Pearl Capital only two years ago. But that hasn’t prevented her from making her social media presence known. And while she reserves Facebook for her personal life, if you know Villano then you wouldn’t be surprised at her success on LinkedIn, as she seems to have a knack for social media.

“I felt like I needed a very strong presence in this industry to get anywhere,” Villano told deBanked. “It’s funny, I think a lot of people associate sales with a type A personality and being pushy. I’m not an aggressive, pit-bull woman. You don’t have to be that type of woman to get ahead. I thought about how am I going to show this to the industry? Social media was my answer. My Facebook and LinkedIn attract a lot of views.”

Indeed, it was because of her Facebook profile that Villano was featured by a famous painting by David Uhl. The painting, dubbed Steampunk Seduction, is the first in Uhl’s Steampunk series. “I got that through Facebook,” Villano explained. “Someone saw my profile on Facebook, reached out and said, ‘you should contact the artist.’ I told them they were crazy. They insisted, and he chose me. It’s been a blessing.”

Meanwhile, her LinkedIn posts designed for MCA ISOs have similarly caught on like wildfire, and she only “amped up” her activity on the site in July. Villano has been posting on LinkedIn once per week, and the proof is in the pudding. “Since then, in September, October, and November, we broke funding records every month. It works,” said Villano of her previous employer Pearl Capital.

Underpinning that deal flow has been a flow of new relationships she’s forming, evidenced by more than 500 ISOs having contacted Villano on LinkedIn via her previous employer’s Salesforce network.

“That was from posting one time per month and just educating; not posting pictures of me on a beach sipping a Pina Colada,” said Villano. Instead, she was educating them about Pearl’s funding options, the types of deals they wanted, their bonus structure, etc. “So, it’s very basic information. I was just letting them know what they can expect from Pearl, what kind of fundings we were doing, just being a constant reminder,” she added.

While Villano is no longer employed by Pearl Capital, her posts from her tenure there have had a lasting impact. “[Last month] I put up a post announcing that I was leaving Pearl Capital,” Villano said. “The post generated more than 35,000 views.” Meanwhile, since she’s been posting, she’s seen the number of LinkedIn connections skyrocket.

Villano is continuing her social media push at her new employer, Kalamata Advisors.

“Kalamata has a partnership-culture mentality. It’s an amazing opportunity to be elected a partner, like a partner at Goldman Sachs or McKinsey, here after a couple of years. Then you have a real stake in the company and work at a firm where everyone wants to pitch in,” she explained. “Second is their great reputation. The partners put their mission and values first. They’ve grown so fast; but they’ve grown with the purpose to genuinely help people. And lastly, they’re very respected in the industry. Everyone here is very responsive, honest and professional.”

And while she’s no longer employed by Pearl Capital, she has nothing but respect for her former employer as well. The feeling is mutual, evidenced by a going away party that they threw for her on her way to Kalamata.

Gender Gap

So why isn’t social media more pervasive among MCA market participants? According to Villano, the reasons are two pronged, the first of which is compliance. “It’s very important to make sure we convey ourselves properly,” she said.

So why isn’t social media more pervasive among MCA market participants? According to Villano, the reasons are two pronged, the first of which is compliance. “It’s very important to make sure we convey ourselves properly,” she said.

The other has to do with the fact that MCA is a male-dominated industry. “Women are more conversationalists through texting or social media. I find women are more intimate with it on a professional level. I have to say that I have the most active social media in our industry,” said Villano, who again only joined fintech two years ago. She’s inspired by the many women who are behind the scenes at ISO shops, many of whom she explained work as processors.

We asked Villano about whether sharing her trade secrets with competitors in the industry made her uncomfortable. “Not at all. I’m not made like that,” she said. “And Kalamata believes trust is the importance of every brand. With transparency, there is trust. Everyone is authentic and unique. Everyone should have the opportunity to share his/her own self in any industry.”

Hard Work, Big Success – The True Story of an MCA Broker

December 15, 2017Sales is a tough field for anyone to break into even if they come from the most ideal of circumstances. At some point, the rubber meets the road for every MCA broker, at which time they must decide whether they’ve got what it takes to make it in this business.

This is what makes Lerry Dore’s story so remarkable, as it seems that the more he got knocked down in life, the higher he was destined to rise. Today he’s employed as an MCA broker at Cresthill Capital. And while education has been paramount to getting him here, evidenced by the fact that during his entire employment he has been in college and he is still one of the funding company’s most successful brokers, Dore more than anything else was trained at the school of hard knocks.

Coming to America

Dore was born in South Florida, but he wouldn’t stay in the United States for long. After his parents split up, his mom was having a tough time making ends meet and made the impossible decision to send him to Haiti to live with extended family.

“My mom had a very hard time supporting us right out of the gate. Soon after I was born, I was sent to Haiti to live with my aunt and cousins,” he said, adding that this gave his mom a chance to get on her feet. “She needed to get a job so that she could provide for us at a basic level.”

Dore would remain in Haiti for the first three years of his life, where his first language would become Haitian Creole. But you wouldn’t detect a hint of an accent talking to him today at the age of 23.

Dore’s mom eventually found a job. She was only earning minimum wage at a hospital, but it was enough to get the wheels in motion to bring her son home.

“She was in a position to provide food, electricity and shelter for us. That’s why I came back,” said Dore, adding that he doesn’t remember much of Haiti with the exception of the plane ride home. “That’s where my memories start,” he said. Perhaps it was somewhere over the Caribbean that young Dore’s dreams began to form.

When he got back to Florida, Dore was able to meet his mom for what felt like the first time for him. He also met his brothers and sisters for the first time ever. He explained how at this point, his mom was still getting adjusted to life in America as an adult immigrant.

“There were a lot of things that I went through as a kid to this point that she couldn’t give me guidance on. She simply didn’t have that experience. That brought a challenge,” he said. Little did he know that these obstacles would help shape him into the resilient person and successful MCA broker he is today.

“There were a lot of things that I went through as a kid to this point that she couldn’t give me guidance on. She simply didn’t have that experience. That brought a challenge,” he said. Little did he know that these obstacles would help shape him into the resilient person and successful MCA broker he is today.

While getting used to the American culture was a challenge, something that his mother never lost sight of was the importance of education. “She was very big into education,” he said. Dore’s mom discovered Head Start, a government subsidized program that provided a pre-school education for families who couldn’t otherwise afford it. That was where it would all begin for Dore, and come hell or high water his mother was going to enroll him. Without the luxury of an air-conditioned vehicle to drive in the hot Florida heat, the pair set off on foot to sign up. Some 12-15 blocks later they arrived.

“Both of us were sweating bullets. She didn’t know it, but there was a small registration fee. At the time, she didn’t have it,” Dore explained. It was then that fate seems to have stepped in in the form of the woman who was handling registration. She pulled the pair aside and told them that after witnessing the dedication that this mother had toward her son, she was going to waive the fee. In return she only asked that they keep it on the down low.

“That small gesture made a dramatic difference in my life,” Dore said. “If I was not able to attend, I wouldn’t start school until I was seven or 10 years’ old. That was a very important moment in my life.”

Indeed, it was, as it would set in motion a series of events that would lead Dore to where he is today, a successful MCA broker at Cresthill Capital. But before he would join the firm, there were still more hardships waiting for him, not the least of which was the death of a friend in his teenage years. “That could have been me,” Dore exclaimed.

For the average person, life’s setbacks could have held them down forever. For Dore, they seem only to have propelled him further. “The reason why I stayed out of trouble was I was in school and my mother kept us grounded,” he said.

During his teenage years, Dore and his family lived in an apartment complex in a neighborhood of immigrant Haitians where he said the median income was $25,000 to $30,000 per year. He shared a room with his brothers and sisters.

“I focused on athletics,” he said, adding: “That’s where I got my competitive nature. Also, my thick skin,” both of which, incidentally, are characteristics that would serve him well as a broker later in life.

While he excelled at basketball at his Boca Raton high school, Dore wouldn’t be able to pursue those dreams for long. He and his family would be uprooted from their home time and time again amid landlord trouble. This series of setbacks, which involved him sleeping on his brother’s couch for a time, instilled a sense of maturity in Dore at a very young age.

He had a few Division II and Division III offers to play basketball in other states, but he turned them down. Instead of chasing his own dreams, Dore decided to focus on business and find a way to sustain and support his family “Once I graduated, I was not interested in basketball. I wanted to finish college,” said Dore, and lucky for the MCA industry he had his sights set on the field of finance.

Funding Merchants

After High School, the first thing that Dore did was to go online and look for a job. As it so happens, the first ad he saw was at a stock brokerage in Boca Raton. “That’s where I started, in phone sales. I didn’t have a Series 7 license at the time. I was just calling from the Yellow Pages. Once I got someone on the phone, I would transfer the call to someone who had a license,” he explained.

This went on for a couple of months until he heard about a startup company in nearby Delray Beach. “At the time, they were prospecting merchants. That’s how I got into the industry,” he said.

His first job in the MCA niche was with a very small ISO shop. But it was there that he would make a connection to change the course of his career. He was working on a deal that was hard to place and was only getting rejections. That is until he came across Mike Daniels, Cresthill’s No. 1 producer.

His first job in the MCA niche was with a very small ISO shop. But it was there that he would make a connection to change the course of his career. He was working on a deal that was hard to place and was only getting rejections. That is until he came across Mike Daniels, Cresthill’s No. 1 producer.

“I couldn’t get the deal done anywhere else. The merchant was getting frustrated with the process. I heard of a company that takes chances on merchants with imperfect credit,” he said. That funder was Cresthill Capital. Little did he know at the time, but they would eventually become his employer.

He sent the merchant file over to Daniels, who then reached out to the merchant and got the deal funded. It was at that point, Dore said, that he started to fall in love with Cresthill “because of how [Daniels] was able to treat the merchant with respect and get the deal done.”

For the next six months, Dore would proceed to trust all of his business with Cresthill. He was still employed by the small ISO shop, but he began to outgrow his environment and long for a platform that allowed him to explore his talent and excel. But his pursuit only left him frustrated and thinking about leaving the MCA industry, something he confided in Cresthill Capital’s Daniels, who was turning into a mentor, about.

It was at this point in his life and career that instead of being the rock, Dore needed to lean on someone else. Daniels and Cresthill Capital were there for him. He was invited in for an interview, and as they say the rest is history.

“I was shocked at how diverse the workforce is. There were different types of people with different backgrounds. I liked it right off the bat. And then everyone was very friendly to me from the moment I walked in,” he said. He was greeted at the front door by Cresthill Capital’s Mike Marano, who then proceeded to interview him.

“I’ve actually interviewed and sat with every single person at my company and hired them personally. What I can say about Lerry is that from the moment I looked at his face and saw his eyes, I knew intuitively that he was a good person. And responsible. I had no idea how deep of a person he was, how much humanity he would show. He was a willing student, and we were happy to teach him. And he continues to soak it up like a sponge,” Marano told deBanked.

“I’ve actually interviewed and sat with every single person at my company and hired them personally. What I can say about Lerry is that from the moment I looked at his face and saw his eyes, I knew intuitively that he was a good person. And responsible. I had no idea how deep of a person he was, how much humanity he would show. He was a willing student, and we were happy to teach him. And he continues to soak it up like a sponge,” Marano told deBanked.

Dore was convinced Cresthill Capital was the right place for him when Marano insisted that Dore stay in school and continue his education. “They said, ‘we will work around your schedule,’ and that really drew me in,” he said, adding that the dog-friendly environment was a bonus.

Dore has been employed by Cresthill Capital for the past 18 months and is graduating from college this week. He is not only supporting himself, but he’s the highest earner in his family, which has allowed him to help support them.

Paying it Forward

As if on cue from the mystery lady that paid his school tuition when he was just a child, Dore is now interested in paying it forward in life. He said that similar to how Cresthill Capital is involved with philanthropy, he’d like to give back to the community. But his vision goes beyond his neighborhood.

“I want to help kids that are similar to me, who are in programs that try to help them excel in this country. I want at some point to work with immigrants that come in from Haiti and work with them to give them a platform, like the lady who gave us a chance,” said Dore.

Since the Haiti earthquake, his extended family has relocated north to Canada. “But I still feel to some degree a responsibility to try and help out the people in that country and the ones who come here through immigration,” he said.

As for Marano, he said all Dore needs to do is exactly what he’s been doing. “When he leaves me, he won’t have to work again. But knowing this kid, he probably will anyway,” Marano said.