Story Series: The Broker

The Broker: Funding Businesses The Irish Way

October 10, 2019 I’m sitting in the lobby of The Marker Hotel, a 5-star 7-story property on the edge of Dublin’s Grand Canal Dock. Here in Ireland’s major tech hub, I’m waiting for a self-identified corporate finance broker by the name of Rupert Hogan, the managing director of BusinessLoans.ie. Outside of our email exchanges, I don’t really know what to expect. I’ve met brokers from the US, Canada, Mexico, UK, and Hong Kong, but never Ireland.

I’m sitting in the lobby of The Marker Hotel, a 5-star 7-story property on the edge of Dublin’s Grand Canal Dock. Here in Ireland’s major tech hub, I’m waiting for a self-identified corporate finance broker by the name of Rupert Hogan, the managing director of BusinessLoans.ie. Outside of our email exchanges, I don’t really know what to expect. I’ve met brokers from the US, Canada, Mexico, UK, and Hong Kong, but never Ireland.

When he arrives, he doesn’t disappoint. Hogan is full of energy and enthusiasm. He has a natural charisma and friendly manner that’s well-suited for a relationship-based business. It just so happens that SME finance in Ireland is still heavily reliant on person-to-person contact and Hogan is at the forefront of helping potential borrowers look beyond the bank for their financing needs.

SMEs are looking for speed and ease in the loan process, Hogan says. Historically, business owners would call on their bank for financing, invoking the sanctity and reliability of decades-old personal relationships, but Hogan explains that relationships between SMEs and banks just aren’t what they used to be. “[SMEs] feel like they’re going to get the runaround,” he says.

That’s where he comes in. And it could be any kind of business, he explains. Hogan jumps from a call with an import/export business to one in retail, followed by one with an agricultural equipment company. He has to understand a bit about them all no matter what it is, to figure out a proper financial solution. BusinessLoans.ie doesn’t charge for their service but they do receive a commission from the financial company if a deal closes.

That’s where he comes in. And it could be any kind of business, he explains. Hogan jumps from a call with an import/export business to one in retail, followed by one with an agricultural equipment company. He has to understand a bit about them all no matter what it is, to figure out a proper financial solution. BusinessLoans.ie doesn’t charge for their service but they do receive a commission from the financial company if a deal closes.

“Corporate” finance may evoke images of big city corporations engaged in international commerce but Hogan’s company can connect SMEs with as little as €5,000 through an unsecured business loan or merchant cash advance. Invoice Financing, leasing, and trade finance are also tools at his disposal. It’s not all small, however, as he hands me a rate sheet for one lender that will go up to €25M. Interest rates on these products when compared with their American and UK brethren are quite reasonable, and suggest also that the target clientele is not subprime.

As we sit there drinking coffee, Americano style in my honor, an executive for a local SME lender happens to spot him while passing by. After they exchange pleasantries, Hogan explains to me that he submits deals to that lender through their online broker portal. And so I ask him if doing everything online has become the standard in Ireland.

“It’s getting there,” he says, while acknowledging there’s still a ways to go with the population that’s conditioned to handling their financial dealings offline. The company’s domain name is perhaps perfectly positioned to capture that transitioning audience. When businesses decide to look for a loan online, he explains, “I hope they go to BusinessLoans.ie”

“Do It Better Than How You Learned It”: How Paul Pitcher Came To Be In Canada

June 27, 2019 Few kids who dream of running their own international business actually grow up to live that fantasy. Even fewer end up working alongside their childhood heroes. Paul Pitcher is doing both, and he’s loving every minute of it.

Few kids who dream of running their own international business actually grow up to live that fantasy. Even fewer end up working alongside their childhood heroes. Paul Pitcher is doing both, and he’s loving every minute of it.

Growing up in Annapolis, Maryland, the Managing Partner at First Down Funding and SharpShooter Funding studied at Severn School and immersed himself in sport. Under the eye of his father, Pitcher began playing basketball and baseball at the age of 4. Golf came later, and it followed him into his young adult life as he played at a collegiate level while enrolled at the University of Tampa, where he studied International Marketing and Finance. And upon graduation, Pitcher landed a job in Washington D.C., working in sales for the Washington Wizards and Capitals.

Sports accompanied him in each phase of his life, so it comes as no surprise that it is entwined with his current business ventures.

After leaving the Regional Sales Manager position he held with the Wizards and Capitals, Pitcher became a broker, eventually establishing First Down in 2012 – seeing it as a solution to a problem many business owners across the country face: acquiring capital. Offering funds via merchant cash advances, First Down provides financial aid to small and medium-sized businesses.

And after enjoying success in the United States, lightning struck on June 6th, 2015. Out of the blue, over 25 Canadian business owners applied for funding from First Down. Chalking it up to ads First Down had placed across social media, Pitcher decided to dive into the new, northern market, but only after consulting with the only Canadian he knew, WWE Hall of Famer Bret ‘Hitman’ Hart.

Having met the wrestler in 1993, Pitcher gambled on Hart remembering the 10-years-old kid in the Looney Toons t-shirt that he took a photo with two decades ago. And it paid off. Following discussions of what First Down did and how it met the needs of the Canadian market, Hart partnered with the company and now serves as commissioner to SharpShooter, the Canadian arm of First Down.

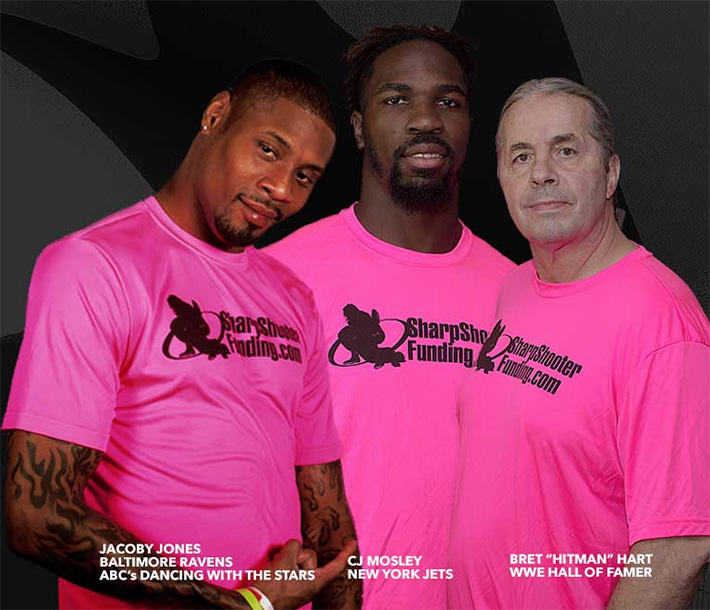

With the backing of a hero from his youth behind him, Pitcher expanded beyond the borders of the US, and with this came further support from sports stars. Recent years have seen CJ Mosley of the New York Jets, Jacoby Jones of the Baltimore Ravens, and the Shogun Welterweight Champion Micah Terill partnering with Pitcher.

With the backing of a hero from his youth behind him, Pitcher expanded beyond the borders of the US, and with this came further support from sports stars. Recent years have seen CJ Mosley of the New York Jets, Jacoby Jones of the Baltimore Ravens, and the Shogun Welterweight Champion Micah Terill partnering with Pitcher.

Noting that the spirit and culture of sport has definitely bled into First Down and SharpShooter from both his own personal life as well as the lives of those athletes that are partnered to it, Pitcher affirms that healthy competition is integral to both sport and business.

Believing that it’s just as important to win as it is to develop the environment you are in, Pitcher is in the funding market for the long-run. And it is exactly this that attracts him to Canada. Comparing it to Baltimore in his home state, he sees the Great White North as a region that is less saturated with funding firms like you would find in New York or Chicago, in other words, he sees it as a place of opportunity, where there is room to grow.

Of course, with such opportunity there are growing pains, like the populace’s level of product knowledge as well as the building of trust between business owners and SharpShooter, but Pitcher welcomes it. Emphasizing his love for competition, he calls for more firms like his to enter the market, be they big or small, as according to him, it could only help build upon the culture of non-bank funding that has taken root in Canada.

“Whatever you do, do it better than how you learned it,” are among the final words Pitcher leaves me with, and with the other closing remarks hinting at further expansion beyond Canada, the Managing Partner seems to be living by this maxim. Be it the education he picked up in Tampa, the lessons learnt in sales, or even a chance encounter with a childhood hero, Pitcher appears to be aiming to continually build and expand upon what he has experienced.

Paul Pitcher is also speaking on a sales and marketing strategies panel at deBanked CONNECT Toronto on July 25th alongside Smarter Loans President Vlad Sherbatov and SEO Consultant Paul Teitelman.

How To Scale Your Broker Shop

May 15, 2019

When it comes to hiring, it’s quality over quantity. That’s what the co-founders of Everlasting Capital Josh Feinberg and Will Murphy told a packed room at deBanked’s Broker Fair last week. They presented a panel called “How to Scale Your Broker Shop,” where they shared tips on how to do just that.

“We wanted to scale so badly and throw bodies in seats,” Murphy said.

And that’s what they did until they realized that they were doing just as much volume when they had fewer people.

CEO of National Funding Dave Gilbert, who spoke on a different panel at Broker Fair, said that he’s a fan of small brokers. He later explained to deBanked that when brokers get too big, they can get stuck with legacy staff. Instead, he said that when they stay lean and spend money on high quality salespeople, they can be much more effective with five or fewer people than with 10.

“It’s not the amount of bodies in the office, it’s the processes you have in place,” Murphy said.

Processes like hiring, training employees and organizing data, which they said should be as simple as possible. Bigger isn’t better and perfect isn’t realistic, they conveyed.

“Don’t worry about trying to create the perfect website or business card,” Feinberg said.

Instead, he said to think about five elements when trying to scale a brokerage shop:

- Focus on cash flow.

- Know that you will fail.

- Don’t quit before the miracle happens.

- Be different than your competition.

- Think bigger.

Meanwhile, Murphy presented concrete actions to take to grow a broker shop:

- Get customers.

- Build relationships.

- Be transparent.

- Find a mentor.

- Ask questions.

- Specialize in two programs (products)

- Brand yourself / your company

Everlasting Capital, which now has 19 people on staff and is based in New Hampshire, facilitates MCA funding and equipment financing.

On Diversification: Acknowledging that MCAs have an uncertain future, Feinberg said it’s important to diversify. He said that three years ago they were doing exclusively MCA deals and now they do 50% MCA and 50% equipment financing.

On social media marketing: “Be consistent. It’s not about the likes. It’s about [good] content and consistency,” Murphy said.

On broker performance: Brokers are given a six month training program at Everlasting Capital. After the six month period, they’re expected to fund four deals a month.

They also said it’s important to make friends with people in the industry.

True Story: I Cold Called a Merchant

February 25, 2019 While visiting the office of Excel Capital in Manhattan on a reporting assignment, I saw a few open desks. They weren’t exactly empty, just available. There were phones, headsets, and computers all set up, just waiting for a salesperson to sit down and plug in. I pictured the salespeople I’ve previously profiled, smiling & dialing, as they say, contacting small businesses and delivering their best pitch. And for a moment, I imagined it was myself in one of those chairs. A funny thought perhaps if you’ve gotten to know me, but it’s not an uncommon curiosity for a reporter to try and channel a source’s mindset.

While visiting the office of Excel Capital in Manhattan on a reporting assignment, I saw a few open desks. They weren’t exactly empty, just available. There were phones, headsets, and computers all set up, just waiting for a salesperson to sit down and plug in. I pictured the salespeople I’ve previously profiled, smiling & dialing, as they say, contacting small businesses and delivering their best pitch. And for a moment, I imagined it was myself in one of those chairs. A funny thought perhaps if you’ve gotten to know me, but it’s not an uncommon curiosity for a reporter to try and channel a source’s mindset.

Excel CEO Chad Otar obviously caught that flashing glimmer in my eyes, because the next thing I knew he invited me to sit down and make a call myself, a completely cold one… to a merchant.

My instinct was to just observe, but the journalist in me unconsciously accepted the invitation. Before I knew what I was getting myself into, I was sitting at Chad’s desk in the CEO chair, reviewing sales scripts that were handed to me. I read two of them and realized that they were fairly different in tone. The first said something like “I’m calling from the back office and it appears that you once had an interest in funding. I’m checking to see if you still do.” The other one was far more direct. It explained a special offer to prospective clients and it finished with a question, “What are you seeking capital for?”

Chad recommended the more direct route, the one I liked more as well. I didn’t like the idea of being in a “back office.” It sounds so distant, so non-urgent. And from my understanding, a sales call should sound urgent, without being too aggressive either. I knew I had to strike the right balance. I looked at the bolder script and practiced reading it a few times out loud. The script started with “Hello, my name is [John Doe.]” But I thought, “I think ‘hello’ is too formal. ‘Hi’ works better for me.” And I also thought that using just my first name might be more familiar and less intimidating than my full name. So I decided to just use my first name. Note that when introducing myself on the phone at deBanked, I always use my full name because I aim to be very intimidating. I’m totally kidding!

Back to my first EVER cold call. After rehearsing the script a few times and letting everyone around me know that this was my first cold call and a really big deal for me, I picked up the phone and I started to dial. “Hello, this is Kathy” a voice beamed from the other end of the phone. I said “Hi Kathy” and I started to read the script. Then I stopped. For a moment, it was just silent. She didn’t hang up! YES! She also didn’t curse at me or ask that I not call her back again. She didn’t even politely excuse herself. Instead, she asked a few clarifying questions.

“Where are you calling from?”

I could answer that! Except that I made a slight mistake. I called the company Excel Credit, instead of the correct Excel Capital. A subtle enough error, I thought, so I chose not to acknowledge it. And since I’ve been writing about companies like Excel Capital for a little while now, I felt comfortable enough to provide a brief sentence to this woman about what Excel Capital does. “We offer funding to small businesses throughout the US,” I said. I thought this would be a good opportunity to correct my earlier error, so I slipped in “we’re also known as Excel Capital.” That could have sounded shady. But I don’t think she heard it that way.

“How did you find us?” she asked.

“Wow,” I thought. “This is turning into a real conversation!” I didn’t know how her info had been obtained, so I just said “I get lists from my boss and I don’t know exactly how this list was obtained.”

Chad said something to me about previous funding, so I then added: “We got this list of businesses that have previously been funded.”

At this point, I thought to myself “Why don’t you ask a question now?” So I went down to the next question on the script sheet and I asked in a “just happen to be curious” way: “Is there a certain amount that you need?”

“That would be the owner who would know about that,” Kathy said.

Uh-oh. I wasn’t even on the phone with the owner. I wasn’t speaking to the decision maker. But for my first cold call ever, I felt pretty good about it. I gave Kathy Excel’s number and yes, my full name, and I feel like I helped warm up this potential client. They could call back and say that they (Me!) spoke with Kathy. My first cold call wasn’t so bad, and honestly, I’m kind of ready to make 200 more! Just kidding.

The Broker: How Industry Veteran Joe Cohen Closes Deals and Dodges Backdooring

November 11, 2018Role: I’m the manager of Business Finance Advance in Brooklyn. I manage a team of about 20.

Years in the business: Since the beginning. 2005/2006.

How he closes a deal:

How he closes a deal:

You have to really know the customer. You have to have a feel for what his needs are. Is his hot button the amount of money? Is it the term? Is it the rate? Is it all of the above? You have to know what the customer is looking for and try to hit a bullseye…I make sure that I know exactly what the customer wants before I make an offer.

What were your first deals like?

In those days, when we first started doing it, the hard part was just convincing the client that we were for real – actually willing to give him money – and not some fraudster trying to get a hold of his bank statements. And it was only based on credit card revenues at the time. We used to call them up, “Hi, Mr. Smith, do you accept credit cards?” “No.” We’d hang up the phone [because] we couldn’t do anything. There was no ACH program in those days.

Once we got the statements back, we’d just have to figure out how much we could give him based on his credit card sales…We never knew what a decline was in the early days. Everybody that sent in paperwork was approved, it was just a matter of how much money he was going to get approved for.

Biggest challenge as a broker:

The most challenging part of my job is the silent thief. When we send out deals to funders, not only do we have to worry about closing the deal…but when we send a file to some of the funders, either there’s someone at the funder that’s backdooring the deal or there’s a whole syndicate taking the deal and calling the merchant behind our back. That is the biggest challenge to [brokering] today…You’re going to make some deals and you’re going to lose some, but the biggest issue we have is the drama that’s been set up by the backdoor channels that are rampant throughout the industry.

Advice for newcomers:

You have to [understand] that it will take you a year, at least, before you start making any money because a) there’s a lot of people doing it, and b) you have a lot of [backdooring] and if you don’t understand the business, you’re going to get caught up with the wrong funders.

What are some funders you work with, who you trust?

Quarterspot. And CAN Capital and OnDeck. These are the ones that will not backdoor us.

What do you look for in a good broker?

A guy that basically is hardworking and tenacious. You can’t give up. It’s not an easy business. You’ve got to work very, very hard and you have to deal with the successes and compartmentalize the losses.

The Broker: How Andy Savarese Changes Collars and Closes Deals

October 12, 2018 Title:

Title:

I’m the Managing Partner at JustiFi Capital, a brokerage in Farmingdale, Long Island. I started it September 2017 with my cousin, who’s the owner and my best friend. We do mostly MCA, but also some term loans.

His schedule:

I have a part-time/full-time job in the mornings. I work in sanitation for the town of Oyster Bay on Long Island. I typically wake up at around 3:37 a.m. I get into my yard at 4:15 a.m. and I go right into my route. My job is task completion. So the faster you work, the faster you get to go home. You get paid the same. I was fortunate to get on a fast truck, so I’m usually done between 7:45 a.m. and 9:30 a.m.

I go home, I take a quick shower, and I change my outfit. I go from blue collar to white collar. I get into the office around 10:30 a.m. and I start doing more of a mental hustle compared to a physical hustle.

At around 12:45 p.m., I take my lunch and I go to the gym for about 45 minutes. I get back to the office and I keep up the closing, the pitching, the selling, the prospecting. At around 5:30 p.m., I leave the office, I pick up my son from daycare, and since my wife works evenings, I take care of him at night until around 7:30 p.m., and get him ready for bed. The second he hits his crib, I hit my bed and I call it a day.

His background in the business:

About three years ago, I was driving oil trucks after sanitation, and my cousin, who is also my best friend, gave me a call. He knew I was breaking my butt all day. He had a friend that was starting his own ISO. So I did that for a year and I learned the industry. It didn’t really work out there, so I convinced my cousin to open up our own shop, which is JustiFi.

His process:

At JustiFi, we’ve been growing. We’re just grinding it out and things are going really well. We have four brokers and we keep it tight. We keep it small so that everybody is inundated with files and everybody’s making money and everybody’s happy. We don’t have any processors or chasers. We do it all on our own. We’re working the deal from beginning to end. My cousin has devised a pretty strategic marketing plan that inundates us with leads all day. I disperse them and I follow up with my guys and see how I can help. I overlook all of the closings and make sure that everything than can get worked is getting worked.

His biggest challenge as a broker:

A lot of people will say getting good leads and keeping your brokers happy. What I found is the most challenging part of being a broker in this industry is keeping a really level head and keeping your emotions out of the game. It’s a very tumultuous industry. One day, you could have 12 deals in the funding chute, the next day, your pipe could be dry. You could have a deal you think is going close and something happens on the funding call and it gets derailed. The point is that you’ve got to stay positive, you’ve got to stay confident, and you’ve got to roll with the punches. If not, you’re going to lose it and you’re going to get eaten alive. Because it’s a battlefield out there. You’ve got to keep your composure, no matter what the size of the deal. You’ve got to just keep pushing through. Because if not, you’re not going to make it.

His largest deal funded:

$250,000. And I made $38,000.

His advice for brokers:

When I go to close a good sized deal, or a tough deal, I don’t like to come off as a salesman. I’ll never do that. I’m going to come off as an advisor. I’m going to come off as a partner with you where I’m going to explain the ins and outs of the deal. I’m going to explain how it benefits you. I’ll never put on pressure or talk slang. I’m going to be a professional. You’ve got to kind of put yourself in [the merchant’s] shoes and you’ve got to see that it really makes sense for them. Because when it makes sense to you and it makes sense to them, you’re going to close the deal and you’re going to move forward.

But there are always deals that will never close, deals that you can’t sell. So you can’t be too hard on yourself. You’ve got to stay positive. You can’t beat yourself up if you don’t sell something. You’ve got to just do your best, stay neutral, and just talk to clients how you want to be talked to.

What he does to pump himself up for a deal:

If I know my day is bringing a big deal that I have to sell and I’m a little uneasy about it, I have an advantage. I’m on the back of a garbage truck all morning and I focus on what’s in store for me that day. If I have a big deal, I recite in my head [from the truck] how I’m going to report to my client. So when I get into the office, I dial up and I already know how the conversation is going to go. I have my rebuttals in my head, I have the direction, I have everything ready to go so that when I get on the call, I’m fully prepared.

Will you quit your morning job?

No. When my pension kicks in, I’ll leave. But I told myself the day I started this and the day I started seeing the return, “I’m never leaving sanitation. I won’t.” I made that promise to myself. There’s been days when I’ll have a five figure commission day and the next morning it’ll be pouring rain out, and I’ll say to myself, “Man, I just want to take the day off.” But no, I made a promise. I go in.

Why?

It keeps me grounded, it’s a stress relief. It’s what I am. It’s what I do.

The Broker: How Elana Kemp Turns Values into Value

September 26, 2018 Title: Broker at Fundomate, a commercial finance brokerage in Los Angeles.

Title: Broker at Fundomate, a commercial finance brokerage in Los Angeles.

Background in business:

I started four years ago when I was living in Israel and I was working American hours. It was tough because I have four kids…A [non business] opportunity brought me to LA where my dad lives and where I’m from originally. So I jumped on that and continued doing brokerage part-time as a one man show for about a year. I met some people in the industry here in LA and started working with them. From there I went to Fundomate, then somewhere else. And then I came back to Fundomate.

What’s the difference between working for yourself and for a brokerage company?

Generating leads is so challenging to do on your own. If it wasn’t for that, I’d be a one man show all day long. I have to admit, though, that after a year, I did miss the infrastructure of working with people and the energy.

Why is it so hard to find leads?

It’s hard to find an honest lead generator. They promise you a lot, but at the end of the day, you don’t get much. I tried many different avenues [when I was working alone.] And I had one lead guy who I was really happy with and then he ended up in the hospital. So there went that. But otherwise, most of them didn’t perform the way they promised.

What’s your morning like with four kids?

Well, I’m not the first in the office. I work for someone who’s very understanding of my situation. I have a kind of cart blanche in terms of my hours. Of course, though, I’m awake at 6 / 6:30, and the second I’m awake, I’m on my phone, checking my emails. So [while] I’m not physically in the office, the second I’m awake, my workday starts. So I don’t make it to the office until 8:15 / 8:30.

Is there any ritual you have to close a deal?

If I have a big deal pending, like a $250,000 deal, I definitely take the time to envision the funding email and kind of manifest that. I definitely believe in the power of energy. If I don’t make a deal, I try not to take it home with me. I believe it’s meant to be and I’ll get the next one. I do believe there’s enough out there for everyone.

I recently read a fun fact – that elephants eat 400 lbs of food a day. It blew me away. And I thought “if an elephant can find 400 lbs of food to eat a day, then I can find enough deals to fund and support my family.”

Largest deal funded:

$325,000. Commission was $26,000.

Her style:

I get really close to my merchants. Some people think I get too close to them. Everybody has a different [style]. Sometimes [getting very close to a merchant] will make me win a deal. Sometimes it will make me lose a deal. Everybody has a different vibe that they feel comfortable with.

I get close to people very quickly. It’s just who I am. And in my opinion it works to my advantage because I have merchants that renew with me multiple times a year. And I know, no matter how many calls they get [from other brokers], they’re going to turn to me. I know that they trust me. I’ve had one merchant come over for dinner at my house. I have some merchants I check in with every few months and sometimes we don’t talk about money at all. We just talk about life.

On honesty:

I try to imagine that the merchant is like my dad. I want to treat them properly. And I believe in karma. I also say that if I get a deal funded but it was not 100% honestly done, then I like don’t want to feed my kids with that money.

Advice for brokers:

Don’t give up on your values for a deal. Values are more valuable than one deal funded. You can always fund another deal…a [reputation] can be broken down in like 2 minutes.

The Broker: How Kunal Bhasin and His Team of Closers Make Deals in NYC

September 25, 2018 Kunal Bhasin, President, 1 West Finance

Kunal Bhasin, President, 1 West FinanceHis title:

President and owner of 1 West Finance in New York City. He founded it in May of 2017 in New York City. The company is a team of seven.

His background:

I was at World Business Lenders for 6 years. That’s where I learned this business and figured out how things worked. Then I left WBL and started 1 West Finance. At WBL, I worked in business development…And I think I was in a good space there to get experience to start my own shop.

His morning:

I get up around 7:00, usually will take my kids to school. I’ll have one cup of coffee, then pick up a cup of coffee for my train ride. On the train, I answer any overnight emails and follow up on whatever outstanding deals I’m working on. So usually I’ll be pinging funders to say “What’s going on with this? What’s going on with that? What’s next, what’s next, what’s next?” Then I buy another coffee when I get to Penn Station. I get to the office by 9:15 / 9:30.

Two times a week at a minimum, will bring in all the guys into the conference room. We will go through the pipeline…Who needs my help? Or who needs the sales manager’s help on a certain deal?…Things tend to move really well after that meeting.

Biggest challenge:

Biggest challenge:

Because of the nature of our relationships, we get a lot of clients that haven’t done this type of financing before. And there’s always some level of sticker shock that the client experiences when you tell them, “I’m going to give you $100,000 and you’re going to pay me $130,000 or $135,000.” And they’re like “Oh my goodness. How is that possible?” “And by the way,” we say, “I’m going to take the payments daily or weekly.”

For clients who haven’t experienced this before, getting over this initial sticker shock is a challenge.

How do you respond to this shock?

I usually say “Hey, listen, we are not a bank.” I say “we fund clients everyday and clients fall into two buckets.” Either they have already gone to the banks and have been told “No.” Or, they can get the money from the bank but they just don’t have the time, because the bank is going to take 40 days or 60 days. And they need the money today or tomorrow.

So I say “If you think you have the 60 days and you can go to the bank, you should go to the bank. Don’t take this money. But if the bank says ‘No’ or you can’t wait, then I’m the next stop.”

Some of his favorite funders:

OnDeck – “by far, my favorite”

Green Peak Capital

InAdvance

Wall Funding

Average monthly volume funded:

$2.7 million.

Largest deal:

$1 million. We made $50,000. That was this year.

The Team

The TeamHis funding process:

A deal first goes to two processors [we have]. They make sure everything is there. No pages missing. They’ll make a decision – is this a good deal for OnDeck or is this a better deal for InAdvance or Fundworks? They’ll actually make the submission, update the CRM, and once the approvals come back, if it meets what the client needs, then the deal goes round robin around the sales team…We try to keep it very fair. And all my guys can close. They’ve all been in business for at least 5 years.

His weekends:

I’m a husband and the father of three and a half year-old identical twin boys. I work a lot and my kids are generally asleep before I get home. So weekends are dedicated to my wife and kids. I try to put the phone away and spend some quality time with them.