Tips

What Kind of Deals are Good / Not So Good

August 27, 2023 “Industries with stable, recurring revenue models, like healthcare and essential services, often show strong repayment history due to consistent demand,” said Michelle Melo, Chief Revenue Officer at Westwood Funding. Melo, who’s been at Westwood for more than four years has seen a lot of deals come through the door and has gotten a feel for numerous industries. Over time, experiences like hers, have led to a general consensus about what business types make for good funding customers and why.

“Industries with stable, recurring revenue models, like healthcare and essential services, often show strong repayment history due to consistent demand,” said Michelle Melo, Chief Revenue Officer at Westwood Funding. Melo, who’s been at Westwood for more than four years has seen a lot of deals come through the door and has gotten a feel for numerous industries. Over time, experiences like hers, have led to a general consensus about what business types make for good funding customers and why.

For Ken Peng, Director of Business Development & Marketing at Elevate Funding, he said of medical and healthcare related businesses that “I think the combination of being an essential service and traditionally having higher profit margins has allowed this industry to perform well from a repayment standpoint.”

Melo at Westwood said the technology industry has also performed well, while Michael Gaura, who works alongside Peng at Elevate, named an industry that’s challenging, trucking. Gaura, a Director of Financial Planning and Analysis, said that when it comes to trucking, “historically they have had challenges such as driver shortages, driver retention, and equipment maintenance making them a higher risk of repayment.”

“As of recently, [the trucking industry has] seen an increase in challenges of operational costs increases (fuel and insurance premiums), Economic & Supply Chain Issues, and increased competition, which has placed a further strain on their industry,” Gaura added.

Abe Klugmann, the COO and Head of Sales at YM Ventures, also had feelings about the state of the trucking industry, saying that it’s a “disaster.” “Construction is also very very challenging right now because of the economy,” he added. Unsurprisingly, like the others, he saw strength in the healthcare industry, saying that home healthcare businesses were among the most resilient. “It’s a pretty good industry, it works out pretty well when you find those types of companies,” he said.

Get Ahead in 2023 with These Best Accounting Practices for MCA Companies

January 6, 2023

As we draw the curtain on 2022 with the festive holiday season and prepare to kick off 2023 with a bang- with ambitious goals and the highly anticipated industry meetup at deBanked Connect in Miami on January 19-, your company accountant is gearing up for a busy quarter. Depending on the level of financial organization in your MCA business, filing your annual taxes can be a breeze or a nightmare.

Better Accounting Solutions has been the premier accounting partner in the MCA space for over a decade, and we’ve compiled some of the best accounting practices you can implement now to make your taxes easier next year:

1. Determine your income recognition method and be consistent with it:

This is important for three reasons:

a) Accurate financial reporting: Consistently applying a single income recognition method ensures that the financial statements accurately reflect the income earned by the business. This is important for internal decision-making and stakeholders such as investors and creditors who rely on these statements to assess the business’s financial health.

b) Tax compliance: Proper income recognition is important for tax compliance purposes. The method used to recognize income can affect the amount of tax that a business owes. By consistently applying a single method, the business can ensure that its tax returns are accurate and avoid potential issues with the tax authorities.

c) Simplicity: Consistently applying a single income recognition method can also make it easier for the business to prepare and file its tax returns, as well as to manage its overall financial record keeping. This can save time and reduce the risk of errors or discrepancies.

2. Understand Writeoffs:

As a business owner, it is important to understand how to maximize write-offs in order to reduce your company’s tax liability, and one way to do this is by taking advantage of deductions and credits that are available to the company. For example, businesses can write off typical expenses such as employee salaries, office rent, and supplies. On top of that, you may be able to write off meals, trips, and events if they are being done for the business, so consult your accountant to see what counts.

It is also important to ensure that these expenses are properly documented in the company’s financial records, and that they are being paid for using company cards accounts rather than personal accounts for business expenses. This is because personal expenses are not tax deductible, whereas (many) business expenses generally are. By using clearly delineated company accounts, businesses can ensure that they are able to properly document and claim these expenses as deductions on their tax returns.

3. Documentation, Documentation, Documentation!

Businesses and governments are run on the back of paperwork, and ensuring you are on top of your documentation and records is the best way to ensure smooth operations and compliance. This includes making sure:

All your business licenses and registrations are in order.

Your W-2’s are filed by the end of January.

Determine who you need to get W-4’s and W-9’s from:

It’s important to know how to categorize your partners to establish clean and complete records. Filing inconsistent records, internally or compared to their paperwork, can cause issues and complications down the road when you file your taxes.

For example, an ISO is typically classified as an independent contractor rather than an employee. As such, an ISO would typically need to fill out a W-9 when working for you, rather than a Form W-4.

Form 1099 is a tax document used to report various types of income other than wages, salaries, and tips that are reported on a Form W-2. Form 1099s are typically issued by businesses or other organizations to contractors or other independent workers for services rendered or income received.

Independent contractors, including ISOs, are responsible for paying their own taxes and are not entitled to the same employment benefits as employees, so you’d need to get a W-9 form from them and then give them a 1099 based on the information they gave you.

Better Accounting Solutions recommends not giving syndicators 1099s from you because we’ve found that many syndicators have different methods of reporting their recognized income to the IRS, and we do not want to report differing numbers to the IRS, which can lead to obvious complications.

It is important for businesses to correctly classify workers as either employees or independent contractors to ensure that the proper tax forms are used and that the correct amount of taxes are withheld or paid.

Speak to an experienced financial expert to determine how to classify your partners, vendors and employees.

Get a W-9 from all of your partners (ISO’s, etc.) before you pay them, otherwise, you’ll have to chase them for paperwork when they’ll have no incentive to get it to you in a timely manner.

4. Ensure You Are Getting The Best Financial and Accounting Advice:

If there is a major theme in this piece, it is the importance of having access to expert financial and accounting advice and guidance, particularly in an industry as complicated as merchant cash advance.

Whether you work with an in-house CPA or work with a large accounting firm, do consistent check-ins and self-audits to make sure your business is getting the premier service it deserves, which will certainly save you a significant amount of stress, time and money.

A Q&A With Viceland’s Host Of ‘Hustle’ John Henry

March 5, 2020 Entrepreneur and investor John Henry, who also hosted TV show ‘Hustle‘ on Viceland, recently spoke with deBanked Chief Editor Sean Murray about his experience as a young successful entrepreneur (Q&A is below). Henry will be a special guest speaker at Broker Fair 2020 on May 18th in New York City. YOU WON’T WANT TO MISS IT!!!

Entrepreneur and investor John Henry, who also hosted TV show ‘Hustle‘ on Viceland, recently spoke with deBanked Chief Editor Sean Murray about his experience as a young successful entrepreneur (Q&A is below). Henry will be a special guest speaker at Broker Fair 2020 on May 18th in New York City. YOU WON’T WANT TO MISS IT!!!

—–

About John Henry

Voted to Forbes’ 30 Under 30 and Ebony’s Power 100 lists – John Henry is a Dominican-American entrepreneur and investor. Henry started his first business at 18, an on-demand dry cleaning service for the Film and TV industry in New York City, with clients such as The Wolf of Wall Street, Boardwalk Empire, Power, and more. Henry led the company through its acquisition in 2014 — founding and selling his first business by the age of 21. On the heels of his first win, Henry launched Cofound Harlem — a non-profit incubator that aims to foster a robust tech ecosystem North of 96th street in New York City. Cofound Harlem has launched numerous high-growth companies in Harlem, gaining recognition from Fast Company, TechCrunch, Business Insider, and more. He is a former Partner at Harlem Capital, a diversity-focused early stage venture capital firm on a mission to change the face of entrepreneurship. Henry is also the host of VICELAND’s latest show, HUSTLE, which is Executive Produced by Alicia Keys and focused on helping scrappy entrepreneurs grow their business to the next level.

—–

Q (Sean Murray): You started your first business at 18 but what made you want to start one?

A (John Henry): It was driven by necessity more than a desire to be an entrepreneur, but I did exhibit some of the traits that pushed me towards that path. Entrepreneurs tend to have a history of non-conformity where there’s no pre-chartered path and in an environment that demands conformity, anyone that likes to express their own views comes up against a lot of friction. So, for me it was necessity but also part of my character to do things differently.

Q: What kind of lessons did you learn from running a business at such a young age?

A: It’s a serious game and it’s full of responsibility. I was telling myself at one point that I was just 18 and so the struggles I faced running a business could be overlooked because of my age, but the world doesn’t care how old you are. If you’re running a business, there’s no way around the responsibilities it demands.

The other thing is, when you come up against really tough situations, you need to be brave and have courage to go through those moments. I’m glad I had the courage in them. Once you take them head-on, you come out feeling better on the other side.

Q: As a former partner of a Venture Capital firm, what’s the #1 mistake you saw entrepreneurs and business owners make?

A: You’ve got to have macro understanding and micro-chops. Everything is connected, it’s not just knowing your business but knowing where you’re situated in the economic or market cycle and understanding what customer sentiment is. That’s what a lot of entrepreneurs miss. Like if your idea is to make a mobile app, that’s great, but how many apps are already out there? How long have apps been part of the market already? What’s going to make your app stand out from every other app? And this doesn’t apply just to startups, but also existing companies. Every 3 months, you should be asking yourself the business question and evolve if necessary. The hardest part though is when your gut is telling you you’re right but every other person out there is telling you you’re wrong. And that’s something you’ll really have to figure out.

Q: Why has helping minority entrepreneurs and businesses been so important to you?

A: I’m not usually asked why, but I was seeing less and less minority representation among entrepreneurs that were receiving capital. There are some systemic factors that make it harder to get ahead but at the same time people can become inclusive to the point where they’re becoming exclusive. So, I think it’s about helping those that are on their way to overcoming tremendous odds to get far.

Q: Real estate, what can you tell me about your foray into that market?

A: I can say it’s the best business that I have been in so far. Real estate is the #1 fundamental building block of wealth. When I first got into it, I was shocked that you could put down 20% and the bank would put in the other 80%. This is a game of physical assets and I’m glad I came across it when I did. I’m currently building a bedrock of business around real estate, my preference being residential multi-family apartments.

How to Respond to Negative Press

January 3, 2019 Wondering what to do about negative press? deBanked spoke to some Public Relations professionals about helpful techniques to manage the situation.

Wondering what to do about negative press? deBanked spoke to some Public Relations professionals about helpful techniques to manage the situation.

“When it comes to a negative story, we advise our clients to bridge back to something they are comfortable talking about,” said Bill McCue, Executive Consultant at Indicate Media.

Bill McCue, Indicate media

Bill McCue, Indicate mediaMcCue said this is known as “bridging.”

“If you’re asked a question about something you don’t want to talk about for whatever reason, you can use transitional phrases like ‘You know that’s an interesting point, but what the real story here is…’ or ‘What we believe is truly the most important thing to talk about is…’ And just keep bridging from a topic you’re not comfortable addressing to a topic you are comfortable addressing.”

McCue noted that politicians and professional athletes are excellent at this. His favorite example is hockey players, who never talk about themselves. When they get a question about their own performance, they always “bridge” to something like the strength of another player or the coach or the entire team.

McCue also advises all clients, whether they’re overcoming negative press or not, to speak in simple terms, and avoid jargon or acronyms.

“Never assume that the reporter is an expert on your industry,” McCue said. “He or she might be writing about [multiple] topics throughout a given business day. Or they may have been writing about real estate last week and now they’re writing about small business lending…So never assume a certain level of expertise.”

Jason Geller, JMediaHouse

Jason Geller, JMediaHouseIf your industry has gotten negative press, but your company in particular has not been targeted, Jason Geller, Founder of New York-based public relations firm JMediaHouse, said that no response is often the best response.

“Unless you have established clear goals and a message you must put out, or if the allegation is serious, the best response in most cases is nothing. Ignore it,” Geller said. “Don’t give the story life. By opting out you’ve robbed it of the oxygen it needs to continue on.”

Geller also said that if the reporting contained inaccurate information, then the company must first provide the correct information to the reporter or blogger. This, he said, “opens up a great opportunity to leverage the situation and strengthen your relationship with the journalist, and to allow him or her to get to know your company and clients better.”

If a given negative story is so bad that it truly warrants a response, Geller said that it’s critical first to research the writer or blogger before responding.

“What have they written about in the past? Do they have a history of putting out negative commentary? Have they had a bad experience with your product or brand? Once you have the answers to these questions, you’ll be able put together a much more concise and educated response,” Geller said.

What’s a Broker To Do? Industry Execs Offer Their Insight

March 12, 2018

Below are excerpts from separate interviews with four industry executives when asked for tips or advice for brokers:

“I would just say to be in it for the long haul. Play the long game. Be the kind of quality partner that you would want in return. There are some brokers and referral sources in this space who see merchants only as a commission check, not as the going concern and business entities that they are. Some brokers are playing the short game, which is unfortunate, because brokers can be in a very powerful position with their clients (merchants) – they need to use that power wisely. If one were to carefully look at a business and its working capital challenges, and then tried to do what was in the best interest of that business in the long run, a broker could be creating a revenue stream for a longer period of time – on a healthier business – and in return creating a more sustainable brokerage platform for themselves. Be open and transparent – sometimes losing a deal due to full transparency can lead to many multiples of that volume with a loyal funding partner.”

– Bill Gallagher, President and Managing Partner, CFG Merchant Solutions | Read full interview

“Choose industries that you excel in—and own them.

Concentrate your marketing efforts on your core customers and target those that meet a lender’s criteria. It’s not the quantity of leads you deliver, it’s the quality—and that will save you time and money. Look for customers in growth stages, not those that are desperate for funds to stay afloat. This will also result in more renewals.

And find a lending partner with a strong brand, as this opens doors to new customers.”

– Michael Marrache, CEO, BFS Capital | Read full interview

“It is not an easy business and not for everyone. It takes quite some time – years – to either build an organization or to become a seasoned pro that truly understands the space. It is also very fast paced and ever changing, so you have to really commit and take the space seriously if you want to be successful.”

– James Webster, CEO, National Business Capital | Read full interview

“Brokering is a tough marketplace right now. I don’t want to say [it’s] saturated, but it’s getting pretty close…Everyone’s getting a million phone calls and mailings and the marketing is going crazy, and the expense is going up. So you really have to find a way to differentiate yourself.

That’s really the biggest thing about being a broker, besides quality service. It’s more: What kind of niche can I get into? How can I break into the market without having to spend like a million dollars a month on marketing? The biggest thing is: What can you do differently?”

– Evan Marmott, CEO, CanaCap | Read full interview

If you noticed a shuffle in search rankings for industry keywords last night, it’s because Google unleashed Penguin 2.1.

If you noticed a shuffle in search rankings for industry keywords last night, it’s because Google unleashed Penguin 2.1.

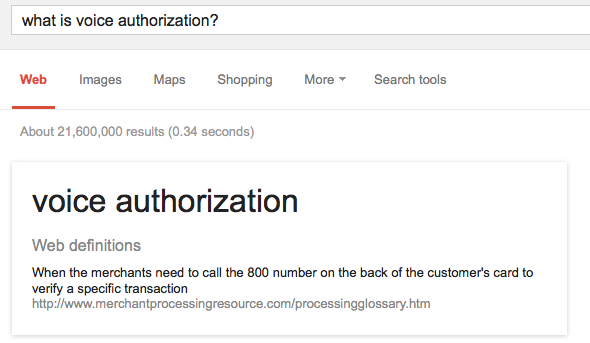

I’ll say it for the hundredth¹ time, the advantage of

I’ll say it for the hundredth¹ time, the advantage of  “I know you do a million in gross sales monthly but since you process only $5,000 in credit cards, we can only approve you for $7,000.”

“I know you do a million in gross sales monthly but since you process only $5,000 in credit cards, we can only approve you for $7,000.”