p2p lending

Moody’s Position on Marketplace Lending

January 21, 2016You can’t slap a FICO score on to an entire industry but you can still assess its short term and long term risks. That’s precisely what ratings agency Moody’s has done in a report they published last month titled, 2016 Outlook – Marketplace Lending Platforms Will Continue to Evolve, Expand Loan Types.

In their report, Moody’s defines “marketplace lending” as “the growing industry of Internet-based, alternative lending platforms for consumers and small businesses.” And there’s good news, they predict it will further expand globally in 2016. The US is not even the biggest game in town, according to Moody’s, China is. “China will remain by far the largest market for marketplace lending and similar online lending platforms,” they wrote.

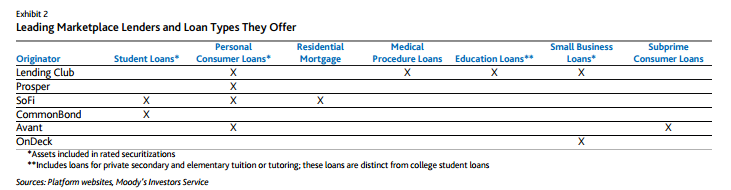

OnDeck was labeled as the leading player in the small business loan market, SoFi and CommonBond for student loans, and Lending Club, Prosper, SoFi, and Avant for personal consumer loans.

Listed among the industry’s risks is the Madden v. Midland decision. Ironically, merchant cash advance companies who gave up doing purchases of future receivables in exchange for becoming a “true lender” have found themselves wondering if merchant cash advance was perhaps the safer model all along. “Questions remain about the viability of the loan origination model many marketplace lenders currently use, in which a partner bank originates the loans, then promptly sells them to the marketplace lender,” the Moody’s report states. “This model allows marketplace lenders to take advantage of federal “rate exportation” laws and offer loans with interest rates that exceed the maximum rate otherwise allowed.”

Below are some of the other highlights:

- An increase in interest rates will not have an impact on performance but defaults will rise moderately

- Defaults on student loans will continue to be low

- Unemployment is not expected to rise in the near term

Most people probably can’t name more than 5 peer-to-peer lending platforms in the US. Meanwhile in China, there are so many that 800 of them have already failed or were recently facing major liquidity issues. There are more than 2,600 platforms there nationwide.

Lending Club Stock Curiously Clobbered

January 20, 2016When Lending Club’s share price was nearing its all-time lows late last year, one might think that company executives would be eager to buy, if for no other reason than to signal long-term confidence. That’s precisely what company CEO Renaud Laplanche did when he bought 60,000 shares on November 30th. And from that date until December 10th, the stock rose from $12.02 to $14.16. That put them within a dollar of their $15 IPO price, a reassuring sign even if they were still down 50% from their all-time high a year earlier.

Here’s what happened next:

- December 14th: The company’s Chief Financial Officer sold 13,950 shares

- December 15th: Board member and former US Treasury Secretary Larry Summers sold 23,421 shares.

- December 16th: The Fed raised interest rates

- December 18th: The company’s Chief Risk Officer sold 75,000 shares. (stock closed at a new all-time low of $11.48)

- January 6th: The company’s Chief Marketing/Operating Officer sold 35,000 shares. (stock closed at a new all-time low of $10.12

- January 11th: The company’s Chief Technology Officer sold 12,500 shares. (stock closed at a new all-time low of $9.24)

- January 12th: The company’s Chief Technology Officer sold 12,500 shares.

- January 13th: The company’s Chief Technology Officer sold 12,500 shares. (stock closed at a new all-time low of $8.86)

- January 14th: The company’s Chief Technology Officer sold 12,500 shares. (stock closed at a new all-time low of $8.02)

While company insiders were selling relatively small blocks of shares and likely doing it to bank just a little bit of their paper wealth, the trades coincided with the company’s plunge to oblivion and perhaps contributed to the drop in the first place. On January 14th, the date of the last insider sale, trading volume spiked to nearly 5x the daily average and the share price hit a record intraday low of $7.76.

While company insiders were selling relatively small blocks of shares and likely doing it to bank just a little bit of their paper wealth, the trades coincided with the company’s plunge to oblivion and perhaps contributed to the drop in the first place. On January 14th, the date of the last insider sale, trading volume spiked to nearly 5x the daily average and the share price hit a record intraday low of $7.76.

Lending Club finished at $7.34 on January 19th, a new all-time record low, with dips as low as $7.05 intraday. That means the stock has dropped nearly 40% since the CEO bought shares less than two months ago. By comparison, the S&P 500 is down 9.5% over that time period.

The share price death spiral has arguably made it easier to spread fear. In the Lending Club subforum on the LendAcademy website for example, a user claiming to manage a hedge fund urged members who use Lending Club’s marketplace to sell everything now and prepare for an armageddon of loan defaults. That thread was suspiciously created around the market open of January 14th, the date with the most trading volume since the IPO.

Meanwhile investors in Lending Club’s notes have remain largely unperturbed. And why wouldn’t they? They’re still enjoying very attractive returns and despite all the doom and gloom, everything is pretty much business as usual.

In a note to shareholders, Compass Point Research and Trading, LLC set a price target of $12 for Lending Club back in December on the risk of the Madden v. Midland case, Congressional investigations into terrorism finance, and the California Department of Business Oversight inquiry into marketplace lenders. While all are perhaps concerning, none seem to present an immediate threat. The most likely reason for the run on Lending Club is that general market fear is stoking reminders of the 2008 crash in which anything related to lending was toxic. As of Tuesday’s close, OnDeck, a business lender often compared to Lending Club, was down 61% from their IPO price. Lending Tree, an online consumer lending portal was down 51% from its 52 week high.

Meanwhile, Lending Club posted positive results in the 3rd quarter. Compared to the same period last year, revenue more than doubled, adjusted EBITDA tripled, and loan originations doubled. They also posted a profit. Overall, these results should not have caused the stock to drop by 50% over the next few months.

As a marketplace, Lending Club does not keep the loans it makes on its balance sheet. That’s something a lot of investors might be overlooking. They may have been clobbered these last few months but the fears might be somewhat unfounded. ..

FICO-Free Zone

January 15, 2016 Many lenders and alternative funders over the last several years have stressed a reduced dependence on FICO scores, but SoFi might be the first lender to declare their turf a “FICO-Free Zone.”

Many lenders and alternative funders over the last several years have stressed a reduced dependence on FICO scores, but SoFi might be the first lender to declare their turf a “FICO-Free Zone.”

In a blog post, SoFi co-founder Daniel Macklin vented that his 15 years of credit history in the UK prior to moving to the US counted for nothing at all. To fix that, he felt pressured to obtain and use credit just to build his score, which he referred to as counterintuitive. For those that have been in this country all along though, his gripe was that things that should matter in a credit score for some reason don’t. “The FICO score calculation doesn’t consider things like your savings, your cash flow, your ability to pay non-credit bills like water and electric or your future earnings,” he wrote.

That’s the opposite of how other marketplace lenders are thinking.

In an online discussion I had six months ago with some members of the Lend Academy forum regarding a borrower’s ability to repay as evidenced by their bank statements, the feedback was resoundingly negative. “I have a feeling if you ask to crawl someone’s bank account, they’ll just go elsewhere,” one user said. “Seems that’d only work on subprime borrowers who have limited bargaining power,” he added.

The logic behind the defense of a continued FICO-oriented approach was steeped in competitive advantage, basically that no sane borrower would ever consider disclosing additional information about their financial situation to one lender when another would just give them a loan on FICO score alone. Ironically that translated to, anyone who wants their creditworthiness to be judged on their ability to pay probably can’t afford to pay, at least that was my takeaway from it.

But over in SoFi land, the student lender “has chosen to not use FICO scores when evaluating the financial wherewithal of applicants.” They alternatively examine your more complete financial situation and well-being, things marketplace lending investors on other platforms (at least for consumer loans) seemed to argue couldn’t and shouldn’t be done.

SoFi is no small fish. To date they have issued around $7 billion in loans.

Hedge Fund Manager Tells P2P Lending Enthusiasts That He’s Shorting Them

January 14, 2016 On the Lend Academy forum, a user claiming to be a hedge fund manager lectured enthusiasts about their naiveté. “I manage a hedge fund and I’m short pretty much everything in the realm of P2P lending. Everything. I hope you don’t take it personally,” he opened with.

On the Lend Academy forum, a user claiming to be a hedge fund manager lectured enthusiasts about their naiveté. “I manage a hedge fund and I’m short pretty much everything in the realm of P2P lending. Everything. I hope you don’t take it personally,” he opened with.

Then with the kind of abrasive charm one might expect from a hedge fund manager, he went on to accuse Lending Club of engaging in “brazenly negligent lending.” “You can’t listen to what they tell you about a FICO score. The same thing happened in 2007,” he argued.

When users pushed back with math, he ranted that consumers were basically all on the verge of default, the system is being gamed, fraud is rampant, and the underwriting is worse than ever. “My honest advice is to get out now, if you can,” he added.

As Lending Club’s share price ($8.02) sank to another all-time low today, one has to wonder if fear mongering like this could be having an effect out there or if there really is something to worry about.

What do you think? You can catch up on the thread here.

A Recession Could Turn Marketplace Lending Into The Hunger Games

January 13, 2016 When you don’t have the upper hand, one strategy is to partner up with opponents whose skills complement yours in order to compete with everyone else. But partnerships, while essential to self-preservation in an ultra competitive environment, are fleeting on the road to victory. When the field starts to narrow, it’s only a matter of time before truces are cancelled. The enemy of your enemy is your friend until they eventually become your enemy as well. Katniss Everdeen was not a lender last I checked, but her story is not so different.

When you don’t have the upper hand, one strategy is to partner up with opponents whose skills complement yours in order to compete with everyone else. But partnerships, while essential to self-preservation in an ultra competitive environment, are fleeting on the road to victory. When the field starts to narrow, it’s only a matter of time before truces are cancelled. The enemy of your enemy is your friend until they eventually become your enemy as well. Katniss Everdeen was not a lender last I checked, but her story is not so different.

Just last year, OnDeck partnered up with Chase while Fundation partnered up with Regions bank. Dozens of other “lenders” have partnered up in a different way with WebBank, Bank of Internet and Celtic Bank. Marketplace lending platforms that serve as centralized matchmakers have partnered up with hundreds of lenders and merchant cash advance companies. And Wells Fargo has had an arrangement with CAN Capital for what seems like forever.

Bank of America however, has vowed to fight on alone. According to the Wall Street Journal, BoA CEO Brian Moynihan “has no plans to partner with online or alternative lenders in part because of potential dings to its reputation.” Is that decision at their own peril?

While 2015 became the year of alternative lenders gushing about partnerships with banks (and that supposedly being the plan all along), Broadmoor Consulting Managing Principal Todd Baker relegated these alleged disruptors to a lesser status he refers to as “enablers.” Baker posits that OnDeck’s future for example, “may be brighter as a technology provider to banks than as a freestanding finance company subject to the vagaries of economic, credit, liquidity and regulatory cycles.” While perhaps not intentional, he seems to suggest that overtaking banks through technological innovation was unlikely and that alternative lenders are destined to a life of impotence, one that merely “enables” the competitors they were never going to beat.

Somewhere out there in the arena, Baker’s best friend Mike Cagney of SoFi is gearing up to win the 2016 Hunger Games. By openly admitting that banks like Wells Fargo and First Republic are the enemy, Cagney exhibits the ferocity one would expect of a tribute from District 2. SoFi has made nearly $7 billion in loans and wants their borrowers to leave their banks.

Behind the scenes, the Head Gamemaker is threatening to shower the arena with regulations and rising interest rates. While the alternative lending contestants partner up to ensure survival at least until the later rounds, there is potential trouble brewing in and around Panem, another recession. To hear most companies tell it, they would welcome a recession because they believe their models are built to withstand boom and bust cycles. Indeed, the atmosphere at Money2020 was exactly that, that it would be really convenient if the weak could hurry up and die already.

We should however consider that the consequences of a recession may go one step further and tip the scales of lending in a way that the “enablers” almost unwittingly become the new masters few now believe they’re destined to be. The Royal Bank of Scotland chief credit officer for example has already gone on record and told the public to sell bloody everything and prepare for the impending end of the world. 2016 will be a “cataclysmic year,” Andrew Roberts said. Fortune and Forbes have run less harrowing stories in recent days but warned that China, declining oil prices, and market signals indicate a recession could happen this year or the next. Reuters says we’re just facing a little thing called a “profit recession.” But whether these issues are false flags or indications of something more, an environment where credit once again becomes frozen in the traditional banking system could mean a suspension of partnerships between banks and alternative lenders. For alternative lenders that rely entirely on traditional banks for capital to begin with, the end for them will be swift and painful.

For those that don’t, let’s just say there’s a certain long-term advantage to being open for business when everyone else is closed. The merchant cash advance industry for example, which operated in an abyss between 1998 and 2008, suddenly awoke like a sleeping dragon during the Great Recession. In what is now a $7 billion/year industry or a $20 billion/year industry depending on how you define a merchant cash advance, the concept is now widely accepted as an alternative to traditional financing, even if at times criticized.

Foundation Capital’s Charles Moldow believes that “marketplace lending” will be a trillion dollar industry by 2025. “Consumers are fed up,” writes Moldow in his white paper. “Banks are no longer part of their communities. Rates are high for borrowers and not even keeping up with inflation for depositors. During the Great Recession of 2008-2009, when consumers and small businesses needed access to credit more than ever, many banks stopped offering loans and lines of credit.”

71% of Millenials would rather go to their dentist than listen to what banks are saying, according to Viacom’s Scratch. 33% believe they won’t need a bank at all in 5 years.

The presumption is often that banks will prevail in the lending tug-of-war anyway because they are more or less tasked by the federal government to be the arbiters of all lending activity. An economy where consumers and businesses regularly conducted their finances outside the purview of the banking system would be a nightmare scenario for a government that relies on the ability to monitor and control everything. Ergo alternative lenders should partner up with these banks, “enable them” and surrender to a future of impotence in which their only purpose is to serve their masters until perhaps one day the banks replace them with something else.

With alternative lenders still operating unfettered for now, today’s developing regulatory pressure would in all likelihood be traded for support in a recession, even if that support came in the form of willful ignorance.

If Millenials would already rather get a root canal than talk to their bank, then it’s probably not a good time for banks to become even less friendly, as would happen in a recession. The timing of one in the near future is almost to be expected considering how long it’s been since the last one, but the next one could be one of those transformative moments in history in which the world actually comes out looking a little bit different. Make no mistake, today’s alternative lenders are disruptive, they’ve just been playing the game rather safely. Partner up, work together, “enable” if they must, whatever it takes to ensure their survival into the later rounds. From student loans to consumer loans to business loans, 2016’s tributes are a force to be reckoned with.

There was only supposed to be one victor of the 74th hunger games, the banks. And there was always one until one year there were two. They surprisingly weren’t there to serve and enable their master either. The system that always was, was irreversibly disrupted.

The next recession could produce a similar outcome. Partnering with banks now seems like a great idea, but absent an actual merger or acquisition, they should be considered temporary alliances. You know what that means…

To the marketplace lenders and the technologies that power them, happy 2016! And may the odds be ever in your favor.

Online Lending IPOs Off to a Bad Start

January 12, 2016All the major stock indexes have tanked so far in 2016 but the new online lending stocks have really taken a beating.

OnDeck closed at $8.57 yesterday, near its all-time low. Investors, who originally appeared to have renewed interest after the JPMorgan Chase partnership announcement, have disappeared, even before details of the announcement emerged.

Lending Club and Yirendai have also plummeted. Meanwhile loanDepot cancelled their IPO altogether after concerns about the pricing environment in the public markets.

Hopefully the Elevate IPO is more elevated than the other disastrous online lending IPOs $YRD $ONDK $LC $ELVT #IPO pic.twitter.com/ffyrS9Dn54

— Renaissance Capital (@IPOtweet) January 11, 2016

Yirendai, a Chinese Peer-to-Peer lender that was spun off from CreditEase has gone nowhere but down in its first month. They had originally hoped to get a public valuation of $2 billion but instead came in at around $625 million.

Here is what some day traders are saying out there:

$ONDK Ondeck will probably double this year. While $LC is going to be highly challenged. Their market cap still too high.

— WingPuppy (@WingPuppy) Dec. 26 at 01:11 PM

$LC $ONDK These stocks have been left for dead, but fundamentals are great! Excellent sales, profit growth, and cheap. Like both for 2016

— Stanky Pigano (@StankyPigano) Dec. 23 at 01:23 PM

$ONDK Awful Business Model, lend at insanely high interest rate to "subprime" businesses, they cant pay because the rate is so high #deault

— Alex Baker (@abaker) Jan. 5 at 10:19 PM

How is $LC not a massive buy right now? It is trading at a 52 week low and at 50% of IPO.

— Kaz Nejatian (@CanadaKaz) January 7, 2016

Will online lenders change the mind of the public markets later this year?

Invest in Marketplace Lending in 2016 (New Year’s Resolution)

January 4, 2016 The story of 2015, at least according to CNN, was that 70% of investors lost money. The big winners were apparently people that didn’t invest at all or those that took humongous risks. Millennials are notorious for being perpetually pessimistic about the stock market and headlines like these probably don’t raise their spirits. And while there’s nothing wrong with caution and skepticism, there’s really no reason that 2015 should’ve been a losing year, especially for such a large percentage of people.

The story of 2015, at least according to CNN, was that 70% of investors lost money. The big winners were apparently people that didn’t invest at all or those that took humongous risks. Millennials are notorious for being perpetually pessimistic about the stock market and headlines like these probably don’t raise their spirits. And while there’s nothing wrong with caution and skepticism, there’s really no reason that 2015 should’ve been a losing year, especially for such a large percentage of people.

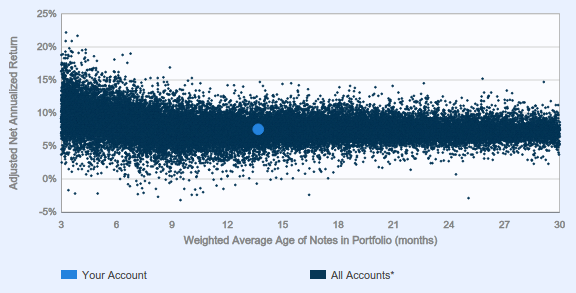

Peer-to-peer lending evangelist Peter Renton is earning more than 10% a year through his Lending Club and Prosper investments. And he’s not an anomaly. The majority of Lending Club investors are earning above 5%, including myself as shown below as the dot compared to everyone else:

After splurging on very high risk notes in 2014, I’ve since settled on a strategy of only A & B-rated notes for individuals making more than $85,000 a year. Since July of 2015, my notes have been purchased automatically by LendingRobot based upon the filters I’ve programmed in. Thus, marketplace lending has become a rather passive investment for me that runs in the background and it should for you too, especially if you work in the alternative lending industry.

In May and June of last year, we told you to break out of your bubble. If you didn’t heed those words, maybe the new year will give you the excuse you need to give marketplace lending some consideration.

Over the last two years, I’ve personally invested nearly $75,000 in consumer debt through Lending Club and Prosper, entirely in $25 increments. Suffice to say, I didn’t lose money on these in 2015. The monthly principal and interest payments from them are constantly reinvested into new loans on a daily basis, compounding my earnings. It definitely beats not investing at all, which is apparently what a lot of people did last year.

Even if marketplace lending isn’t for you, you can earn a few hundred basis points less per year with an FDIC guaranty. 5-year CDs are paying up to 2.42% right now. Back in June I wondered whether or not the risk undertaken with consumer debt was worth a few extra percent a year, especially considering how these notes are taxed (you may only be able to deduct up to $3,000 in losses per year).

I guess you could say that I decided it was worth it. My new investing strategy takes the $3,000 loss cap in stride because the number of A and B-rated notes (which are all I buy now) that default are very low. In fact, I’ve never even had an A-rated note default in the two years I’ve been investing.

The one disclaimer I will add is that I did indeed invest more money in mutual funds (stocks) in 2015 than I did in marketplace lending. While I enjoy the reprieve from daily volatility that Lending Club and Prosper notes bring, it’s important to never lose sight of the fact that those investments are ultimately in Lending Club and Prosper themselves. Originally envisioned as peer-to-peer, both companies actually just issue bonds to investors that are backed by nothing other than the performance of chosen loans. So if Lending Club and Prosper blew up tomorrow (or worse), it might not matter how all those loans were performing. If the secret to investing is to diversify, then you should treat your total investment on a marketplace lending platform as if it were a single stock. That’s precisely why I won’t open an IRA with Lending Club or Prosper, even if the tax advantages would be better.

Nevertheless, as my mutual funds were flat for the year, my marketplace lending portfolio pushed me forward. At the very least I plan to reinvest all the payments from my portfolio this year into new notes on a daily basis. If you were discouraged by the headlines that 70% of investors lost money last year, you should consider complementing your stock portfolio with marketplace lending this year.

Consumer debt might seem like an odd choice for an individual to invest in, but once you get the hang of it, you’ll eventually consider it to be an integral part of diversification.

Lending Club Gets More Aggressive With Direct Pay

December 28, 2015 Lending Club’s maximum debt-to-income ratio eligibility level until now had been 30%. But under a new pilot program called Direct Pay Loans, borrowers whose DTI is as high as 50% can now get approved. But there’s a catch…

Lending Club’s maximum debt-to-income ratio eligibility level until now had been 30%. But under a new pilot program called Direct Pay Loans, borrowers whose DTI is as high as 50% can now get approved. But there’s a catch…

The Direct Pay Loan program “requires a borrower to use up to 80% of their loan proceeds to pay off outstanding debt,” according to a notice published by the company. They’re not trusting the borrower in these cases to do that on their own either. Lending Club will actually be the ones making the payments on the borrower’s behalf.

The move is reminiscent of a fairly common practice in the commercial financing industry where liabilities such as past due rent and tax liens are payed by the funding company directly.

It’s unclear if the ultimate goal is to be able to lend to more risky borrowers or if this is an experiment to determine if paying directly reduces the odds that a borrower will lie about how they intend to use the proceeds.

As of September 30th, 2015, Lending Club reported that 67.7% of their borrowers used their loans to refinance existing loans or pay off their credit cards. Since that’s based entirely on what box applicants select on the online application and isn’t actually verified, it’s possible that no borrowers actually refinance or pay off anything. With this being the case, Direct Pay may help Lending Club force their borrowers to hold up their end of the bargain.