Enova’s Small Business Division Garner’s Limelight in Q2

August 16, 2019 Late last month, Enova released its second quarter report for 2019. Generally bearing positive news, the report asserts that the company is in a good position due to increasing demand, growth in various areas, and reductions in financing costs.

Late last month, Enova released its second quarter report for 2019. Generally bearing positive news, the report asserts that the company is in a good position due to increasing demand, growth in various areas, and reductions in financing costs.

Total revenue is up from Q2 2018, rising 13% from $253 million to $286 million, just as net income has risen from $18 million to $25 million.

“We are pleased to report another quarter of solid financial results that exceeded our expectations on both the top and bottom line,” said Enova CEO David Fisher in the earnings call. “Our strong financial performance was driven by solid demand, stable credit, and efficient marketing spend. We continue to demonstrate our ability to produce sustainable and profitable growth and our second quarter results further validate this balanced approach.”

Speaking more specifically about which divisions of Enova have excelled, Fisher highlighted the small business sector, which is composed of Headway Capital and The Business Backer. “NetCredit and our small business financing products were the primary growth drivers during Q2, with domestic revenue up 19% year over year … Our products are clearly gaining traction with customers, resulting in originations increasing 140% year over year, and small business now represents 12% of our book at the end of Q2.”

Jim Granat, Enova’s Head of Small Business Financing, chalked such gains up to “having a great team, a good strategy, and a great company behind us that has the ability to invest in the analytics, tech, and people.” The strategy he speaks of is titled ‘Faster and Easier,’ a modus operandi began by him after his arrival to the company in 2018. It is data-driven and involves incorporating certain individual operations of Headway and Business Backer, and streamlining these processes so that the brands overlap for particular actions. Implemented with the belief that “doing it internally would lead to speed and ease externally,” ‘Faster and Easier’ appears to be working, if one takes Fisher’s comments and the report as affirmation.

“We’ve been working really hard and hopefully the results of that show in the fruits of these efforts,” said Granat. “We are just in the beginning of what we can accomplish, these projects take a while and we are incredibly excited about the second half of 2019, let alone 2020 and beyond.”

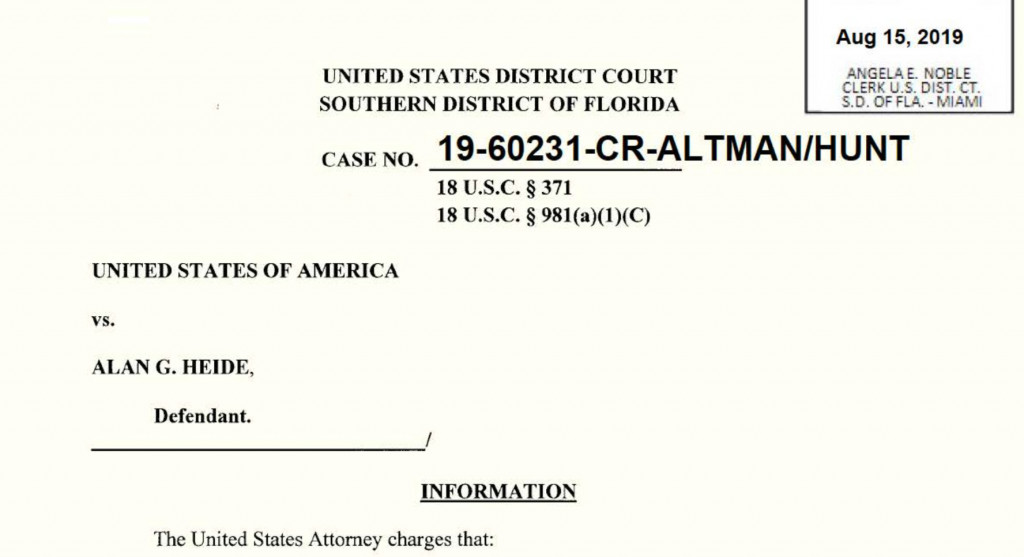

Alan Heide, CFO Of 1 Global Capital, Hit With Criminal Charge & SEC Violations

August 15, 2019

Update: Alan Heide has pleaded guilty to one count of conspiracy to commit securities fraud.

The former CFO of 1 Global Capital, Alan Heide, was stacked with bad news on Thursday. The US Attorney’s Office for the Southern District of Florida lodged criminal charges against him at the same time the Securities & Exchange Commission announced a civil suit for defrauding retail investors.

Heide was criminally charged with conspiracy to commit securities fraud.

According to the criminal complaint:

It was a purpose of the conspiracy for the defendant and his conspirators to use false and fraudulent statements to investors concerning the operation and profitability of 1 Global, so that investors would provide funds to 1 Global, and continue to make false statements to investors thereafter so that investors would not seek to withdraw funds from 1 Global, all so that the conspirators could misappropriate investors’ funds for their personal use and enjoyment.

He is facing a maximum of 5 years in prison.

1 Global Capital CEO Carl Ruderman, who recently consented to judgment with the SEC, has not been charged criminally to-date. However, he is mentioned throughout the pleading against Heide as “Individual #1 who acted as the CEO of 1 Global.”

Civil charges were simultaneously lodged by the SEC.

According to the SEC’s complaint:

Although 1 Global promised investors profits from its short-term merchant cash advances to businesses, the company used substantial investor funds for other purposes, including paying operating expenses and funding Ruderman’s lavish lifestyle. The SEC alleges that Heide, a certified public accountant, for nine months regularly signed investors’ monthly account statements that he knew overstated the value of their accounts and falsely represented that 1 Global had an independent auditor that had endorsed the company’s method of calculating investor returns.

According to an SEC statement, Heide agreed to settle the SEC’s charges as to liability, without admitting or denying the allegations, and agreed to be subject to an injunction, with the court to determine the penalty amount at a later date.

1 Global Capital filed for bankruptcy last year after investigations by the SEC and US Attorney’s Office hampered their ability to raise capital. Ruderman’s recent settlement with the SEC put him on the hook for $50 million to repay investors.

The 2019 Top Small Business Funders By Revenue

August 14, 2019The below chart ranks several companies in the non-bank small business financing space by revenue over the last 5 years. The data is primarily drawn from reports submitted to the Inc. 5000 list, public earnings statements, or published media reports. It is not comprehensive. Companies for which no data is publicly available are excluded. Want to add your figures? Email Sean@debanked.com

| Company | 2018 | 2017 | 2016 | 2015 | 2014 |

| Square | $3,298,177,000 | $2,214,253,000 | $1,708,721,000 | $1,267,118,000 | $850,192,000 |

| OnDeck | $398,376,000 | $350,950,000 | $291,300,000 | $254,700,000 | $158,100,000 |

| Kabbage | $200,000,000+* | $171,784,000 | $97,461,712 | $40,193,000 | |

| Global Lending Services | $232,200,000 | $125,700,000 | |||

| Bankers Healthcare Group | $220,300,000 | $160,300,000 | $93,825,129 | ||

| National Funding | $121,300,000 | $94,500,000 | $75,693,096 | $59,075,878 | $39,048,959 |

| Forward Financing | $75,500,000 | $42,100,000 | $28,305,078 | ||

| ApplePie Capital | $69,700,000 | ||||

| Fora Financial | $68,600,000 | $50,800,000 | $41,590,720 | $33,974,000 | $26,932,581 |

| Reliant Funding | $64,800,000 | $55,400,000 | $51,946,000 | $11,294,044 | $9,723,924 |

| Envision Capital Group | $32,700,000 | ||||

| Expansion Capital Group | $31,300,300 | $23,400,000 | |||

| SmartBiz Loans | $23,600,000 | ||||

| 1 Global Capital | bankruptcy | $22,600,000 | |||

| IOU Financial | $19,200,000 | $17,415,096 | $17,400,527 | $11,971,148 | $6,160,017 |

| Quicksilver Capital | $16,500,000 | ||||

| Channel Partners Capital | $23,000,000 | $14,500,000 | $2,207,927 | $4,013,608 | |

| Lendr | $16,500,000 | $11,800,000 | |||

| Lighter Capital | $16,000,000 | $11,900,000 | $6,364,417 | $4,364,907 | |

| United Capital Source | $9,735,350 | $8,465,260 | $3,917,193 | ||

| Fundera | $15,600,000 | $8,800,000 | |||

| US Business Funding | $14,800,000 | $9,100,000 | $5,794,936 | ||

| Wellen Capital | $12,200,000 | $13,200,000 | $15,984,688 | ||

| PIRS Capital | $11,900,000 | ||||

| Nav | $10,300,000 | $5,900,000 | $2,663,344 | ||

| P2Binvestor | $10,000,000 | ||||

| Seek Business Capital | $8,800,000 | ||||

| Fund&Grow | $7,500,000 | $5,700,000 | $4,082,130 | ||

| Funding Merchant Source | $7,500,000 | ||||

| Shore Funding Solutions | $5,000,000 | $4,300,000 | |||

| StreetShares | $4,967,426 | $3,701,210 | $647,119 | $239,593 | |

| FitSmallBusiness.com | $3,000,000 | ||||

| Eagle Business Credit | $3,600,000 | $2,600,000 | |||

| Everlasting Capital | $2,500,000 | $2,100,000 | |||

| Swift Capital | acquired by PayPal | $88,600,000 | $51,400,000 | $27,540,900 | |

| Blue Bridge Financial | $6,569,714 | $5,470,564 | |||

| Fast Capital 360 | $6,264,924 | ||||

| Cashbloom | $5,404,123 | $4,804,112 | $3,941,819 | ||

| Priority Funding Solutions | $2,599,931 |

Michele Romanow on Clearbanc’s Recent $300M Series B

August 7, 2019 Last week Clearbanc announced it had secured $300 million in a Series B. Specializing in the provision of capital to business owners for the purchasing of ads on digital platforms such as Facebook and Instagram, the company operates in an untapped niche. Alternative financing for the acquirement of a highly specific product, this product being the form of advertising that is currently most wide-spread.

Last week Clearbanc announced it had secured $300 million in a Series B. Specializing in the provision of capital to business owners for the purchasing of ads on digital platforms such as Facebook and Instagram, the company operates in an untapped niche. Alternative financing for the acquirement of a highly specific product, this product being the form of advertising that is currently most wide-spread.

And perhaps this is why the Toronto-based company received an investment of such magnitude for their second round of funding. The signs of success are there: high demand; low supply; and as well as this, there’s a celebrity profile attached to Clearbanc, Dragons’ Den’s Michele Romanow.

Having co-founded the company in 2015, Romanow now acts as its President. Speaking to deBanked recently, the celebrity investor explained how Clearbanc works as well as the what it does differently.

Ultimately, it comes down to two intertwined strategies: focusing on unit economics and having good tech.

“Our core is really understanding what your customer acquiring cost and your product costs are, as well as if you’re making money on each transaction,” explains Romanow. Speaking in straight forward calculations, the dragon states that, at a basic level, Clearbanc will check and find that if it takes $10 to make a product, $10 to buy Facebook ads, and that this leads to $50 in sales, then you have positive unit economics. And that this sort of calculation is what their tech does, just on a much more complex scale.

“We built a machine learning model on a fundamental understanding of what the unit economics of a business were.” A range of financial information is plugged in, “thousands of factors” are accounted for, and an algorithmically approved recommendation is prepared for underwriters.

Such reliance on tech and number-crunching has produced an unexpected side-effect for Clearbanc. Strict adherence to positive and negative numerical values has steamrolled two potential biases encountered in the finance raising process: location and gender. Romanow jokes about a report showing that just four states received 80% of venture capital in 2018, and nine raised nothing at all, saying that “it’s impossible that there’d be no good entrepreneurs in nine states of America.” Which is partly why Clearbanc has invested in 43 out of 50 so far, each business being greenlighted by their tech. As well as this, the company has funded eight times more women-led businesses than the industry average for venture capital.

Such reliance on tech and number-crunching has produced an unexpected side-effect for Clearbanc. Strict adherence to positive and negative numerical values has steamrolled two potential biases encountered in the finance raising process: location and gender. Romanow jokes about a report showing that just four states received 80% of venture capital in 2018, and nine raised nothing at all, saying that “it’s impossible that there’d be no good entrepreneurs in nine states of America.” Which is partly why Clearbanc has invested in 43 out of 50 so far, each business being greenlighted by their tech. As well as this, the company has funded eight times more women-led businesses than the industry average for venture capital.

Surprising results aside, Romanow claims that much of her recent ventures are inspired by her time with Dragons’ Den, with the concept for Clearbanc partially stemming from her reflections on the format of the show.

Specifically, the idea struck her after seeing a number of business owners pitch themselves for funding in exchange for equity, when what they were receiving was not worth pawning off part of their company. Believing that a better deal existed, Clearbanc was created with the plan to operate via revenue share agreements, taking a percentage of revenue over an undetermined amount of time until a fixed cost is paid.

As well as this, Clearbanc offers business owners access to its Venture Partner Network, a team of successful investors and high profile entrepreneurs that will offer guidance. Included are the likes of Jason Finger of Seamless, Jack Abraham of Hims, Gary Vaynerchuck, and Romanow herself. Sharing similarities with the setup of Dragons’ Den, in which celebrity investors offer funding and guidance, it seems like Romanow is carrying her experiences along with her.

As to where else she might carry them, Clearbanc is looking to eventually expand. “We’re experimenting in a couple of international territories right now, but we’ll have some announcement about that probably later this year,” she explains tightlippedly. For now she’ll continue to work with tech in North America with the belief that it’s the way forward, “when we use data better, we can drive down prices for everyone. And I think that’s an important part of what the equation is.”

Shopify Issued $93M in MCAs and Loans in Q2, Has Begun Offering Funding to Non-Shopify Payment Customers

August 4, 2019 Shopify, a publicly traded e-commerce platform, is quickly growing its merchant cash advance and loan originations through its Shopify Capital brand. The company issued $93M in Q2, up 36% year-over-year and an increase from the prior quarter of $5.2M. Shopify’s loan product is only available in Arizona, Idaho, Illinois, Indiana, Iowa, Kansas, Louisiana, Maine, North Carolina, South Carolina, Utah, Washington, Wisconsin, and Wyoming.

Shopify, a publicly traded e-commerce platform, is quickly growing its merchant cash advance and loan originations through its Shopify Capital brand. The company issued $93M in Q2, up 36% year-over-year and an increase from the prior quarter of $5.2M. Shopify’s loan product is only available in Arizona, Idaho, Illinois, Indiana, Iowa, Kansas, Louisiana, Maine, North Carolina, South Carolina, Utah, Washington, Wisconsin, and Wyoming.

The company also recently began offering funding to merchants who don’t use Shopify Payments but still use the Shopify platform.

On the quarterly earnings call, Shopify CFO Amy Shapero said in doing so “we still have significant visibility into their operations, we see their orders, we see the engagement with the platform. And so, we are very comfortable moving in that direction.” The move provides an opportunity to expand their eligible market by 10%, she added.

Furthermore, Shopify’s deals are performing well, the company claims. Shapero said “we’ve actually managed our loss ratio in a very, very tight range. In fact, it’s lower than the top of the range where we think we could go with this, which says the power of our algorithms are working.”

Shopify Capital has originated more than $180M in 2019 so far, indicating they may be surpass many competitors in the rankings this year. The company originated $277.1M in 2018.

Clearbanc Raises $300M in a Series B

July 31, 2019

Toronto-based Clearbanc, a company founded on the idea of providing business owners with capital to purchase facebook and instagram ads in exchange for a percentage of their future sales, has raised $300M in a Series B. $50M of it is an equity investment led by Highland Capital. The other $250M will go into a fund that Clearbanc uses to fund small businesses, according to Fortune.

Clearbanc’s payment methodology is reminiscent of merchant cash advances and their factor rates range between 6% and 12.5%. Funding amounts range from $10,000 to $10M and the company is reportedly on track to fund $1 billion to small businesses.

Clearbanc President and co-founder Michele Romanow is a serial entrepreneur that is also a celebrity investor on the TV show series Dragon’s Den. She attributes the idea for Clearbanc to her experience on the show in which entrepreneurs were inappropriately seeking venture capital when it was really a specific type of working capital they needed, funds to advertise on facebook or instagram, for example.

The company was founded in 2015 in Toronto.

Spotlight on deBanked CONNECT Toronto

July 30, 2019 As the heat of the Toronto sun split the stones outside, the crowd inside the Omni King Edward’s seventeenth-floor Crystal Ballroom mingled and munched as part of deBanked’s most recent CONNECT event.

As the heat of the Toronto sun split the stones outside, the crowd inside the Omni King Edward’s seventeenth-floor Crystal Ballroom mingled and munched as part of deBanked’s most recent CONNECT event.

The first of its kind to be held in Toronto, the CONNECT series are half-day events that take place in both San Diego and Miami as well. Despite not being as established as the latter two, Toronto proved just as eventful, with a variety of speakers and topics broached, as well as a host of attendees from differing backgrounds making an appearance. It was par for the course for an inaugural deBanked show with the attendance figures being reminiscent of deBanked’s first ever event in the USA, a market that’s 10x the size.

The day was kicked off by entrepreneur, a dragon on the Canadian Dragons’ Den series, and co-founder of Clearbanc, Michele Romanow, whose anecdotes detailed the adventures that accompany the beginning of a startup. Regaling the audience with the story of Evandale Caviar, Romanow began with telling the room of a post-college venture that saw her working tooth and nail to secure a fishing license, studying YouTube fish gutting tutorials that were exclusively in Russian, and getting her hands dirty with the other co-founders when the time came to put their time spent online to use.

But it wasn’t all blood and glory for Romanow, as the tale shifted from one of youthful expansion to one of reflection and acceptance of the unknown. Speaking on the effect of tech giants in various fields, Romanow explained that “we have no idea of how these industries will shape out.” The likes of Uber and AirBnb never planned change the world, just to change a product and thus solve a problem, and their meteoric rises are unpredictable as a result. Iteration, rather than innovation, is what drives a company forward according to Romanow.

But it wasn’t all blood and glory for Romanow, as the tale shifted from one of youthful expansion to one of reflection and acceptance of the unknown. Speaking on the effect of tech giants in various fields, Romanow explained that “we have no idea of how these industries will shape out.” The likes of Uber and AirBnb never planned change the world, just to change a product and thus solve a problem, and their meteoric rises are unpredictable as a result. Iteration, rather than innovation, is what drives a company forward according to Romanow.

And this sentiment was brought further along with the following panel, which featured Vlad Sherbatov of Smarter Loans, Paul Pitcher of SharpShooter Funding, and SEO expert Paul Teitelman, speaking on the trials and novelties of the sales and marketing scene. Offering wisdom on various aspects of the field, the three men covered the need to go beyond the traditional forms of advertising, instead looking outward towards unorthodox methods of marketing; the hardships that come with the grind of a sales job; and the role that SEO can play when raising public awareness of your company; respectively.

“It’s a matter of spreading the word,” one conference goer noted when asked about the sales panel afterwards. “Businesses have to know who we are, and we’re working on that.”

“It’s a matter of spreading the word,” one conference goer noted when asked about the sales panel afterwards. “Businesses have to know who we are, and we’re working on that.”

Similarly, Martin Fingerhut and Adam Atlas discussed the existing legal topics of note to Canadian alternative financing companies, as well as those incoming rulings that may be worth knowing about. Covering both the English-speaking provinces and Quebec, the duo gave a comprehensive crash course on the legal landscape of the industry, highlighting laws unique to the regions. Aaron Iannello of Top Funding considered the talk to be particularly engaging, commending it for relaying information that might otherwise be unknown to American companies.

Following this, Kevin Clark, President of Lendified, took to the stage to talk about the importance of the Canadian Lenders Association (CLA). Saying that in the absence of a regulatory body, the CLA seeks to offer guidance to those companies who are looking for it. Clark asserted that “it’s a good thing for our industry to have oversight from a regularly body,” and that he looks forward to the day when one is established.

Following this, Kevin Clark, President of Lendified, took to the stage to talk about the importance of the Canadian Lenders Association (CLA). Saying that in the absence of a regulatory body, the CLA seeks to offer guidance to those companies who are looking for it. Clark asserted that “it’s a good thing for our industry to have oversight from a regularly body,” and that he looks forward to the day when one is established.

And before wrapping up the speakers for the day, Clark was joined by IOU Financial’s President, Robert Gloer, to discuss contemporary risk management. Covering everything from the next recession to the emergence of AI, the pair, which accumulatively have been in the industry for decades, offered knowledge learnt from years of experience in both the pre- and post-crash eras.

And the prophesizing of what will be the next big episode to shake the industry continued beyond the day’s scheduled agenda as many attendees continued on well into the evening at smaller networking functions offsite.

As the sun started to touchdown on the tips of Toronto’s skyscrapers, the salvo of excited conversation briefly harmonized to produce a singular axiom, that there was an abundance of opportunity in Canada.

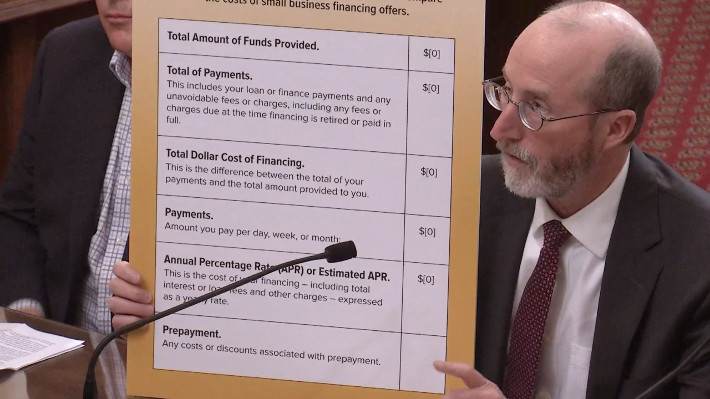

California DBO Making Progress On Finalizing Rules Required By The New Disclosure Law

July 29, 2019 Last October, California Governor Jerry Brown signed a new commercial finance disclosure bill into law. The bill, SB 1235, was a major source of debate in 2018 because of its tricky language to pressure factors and merchant cash advance providers into stating an Annual Percentage Rate on contracts with California businesses. The final version of the bill, however, delegated the final disclosure format requirements to the State’s primary financial regulator, the Department of Business Oversight (DBO).

Last October, California Governor Jerry Brown signed a new commercial finance disclosure bill into law. The bill, SB 1235, was a major source of debate in 2018 because of its tricky language to pressure factors and merchant cash advance providers into stating an Annual Percentage Rate on contracts with California businesses. The final version of the bill, however, delegated the final disclosure format requirements to the State’s primary financial regulator, the Department of Business Oversight (DBO).

The DBO then issued a public invitation to comment on how that format should work. They got 34 responses. Among them were Affirm, ApplePie Capital, Electronic Transactions Association, Commercial Finance Coalition, Fora Financial, Equipment Leasing and Finance Association, Innovative Lending Platform Association, International Factoring Association, Kapitus, OnDeck, PayPal, Rapid Finance, Small Business Finance Association, and Square Capital.

On Friday, the DBO published a draft of its rules along with a public invitation to comment further. The 32-page draft can be downloaded here. The opportunity to comment on this version of the rules ends on Sept 9th.

You can review the comments that companies submitted previously here.