July 24, 2013

Below is a look back at some of the contract language used in the industry.

Below is a look back at some of the contract language used in the industry.

2009 First Funds Contract

Purchaser agrees to purchase from Seller and the Seller agrees to sell to Purchaser, in consideration of the purchase price specified below (the “Purchase Price”), Seller’s interest in the percentage specified below (the “Specified Percentage”) of each of its future credit card receivables (the “Future Receivables”) due to Seller from the credit card processor identified below (“Processor”) until the amount specified below (the “Specified Amount”) of Future Receivables has been collected by Purchaser according to the additional terms and conditions set forth in this Purchase and Sale Agreement (“Agreement”).

The undersigned principal(s) of Seller (such principals, whether shareholders, partners or other owners are referred to herein as the “Guarantor’) hereby unconditionally, jointly and severally, guarantee Seller’s performance and satisfaction of all the covenants, representations and warranties set forth in Section 3 of the Agreement. This guarantee is continuing and shall bind Guarantor’s heirs, successors and assigns, and may be enforced by or for the benefit of any assignee or successor of Purchaser. Purchaser shall not be obligated to take any action against the Seller prior to taking any action against the Guarantor. Guarantor shall pay Purchaser for all its overhead and expenses incurred in enforcing this guarantee and underlying Agreement, including all Purchaser’s reasonable attorney’s fees. The release and/or compromise of any obligation of Seller or any other obligors and guarantors shall not in any way release Guarantor from his or her obligations under this guarantee. This guarantee shall be governed and construed according to the laws of the State of New York. ALL ACTIONS, PROCEEDINGS OR LITIGATION RELATING TO OR ARISING FROM THIS GUARANTEE OR UNDERLYING AGREEMENT SHALL BE INSTITUTED AND PROSECUTED EXCLUSIVELY IN THE FEDERAL OR STATE COURTS LOCATED IN THE STATE AND COUNTY OF NEW YORK NOTWITHSTANDING THAT OTHER COURTS MAY HAVE JURISDICTION OVER THE PARTIES AND THE SUBJECT MATTER, AND GUARANTOR FREELY CONSENTS TO THE JURISDICTION OF THE FEDERAL OR STATE COURTS LOCATED IN THE STATE AND COUNTY OF NEW YORK. Service of process by certified mail to Guarantor’s address listed below or such other address that Guarantor may provide Purchaser in writing from time to time will be sufficient for jurisdictional purposes. GUARANTOR FREELY WAIVES, INSOFAR AS PERMITTED BY LAW, TRIAL BY JURY IN ANY ACTION, PROCEEDING OR LITIGATION ARISING FROM OR IN ANY WAY RELATING TO THIS GUARANTEE. GUARANTOR WAIVES, TO THE EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT TO PURSUE A CLAIM AGAINST PURCHASER OR ITS ASSIGNS AS PART OF A CLASS ACTION, PRIVATE ATTORNEY GENERAL ACTION OR OTHER REPRESENTATIVE ACTION. Guarantor grants continued authority to Purchaser and its agents and representatives and any credit reporting agency employed by Purchaser to obtain Guarantor’s credit report and/or other investigative reports, and to investigate any references given or any other statements or data obtained from or about Guarantor or Seller or any of Seller’s principals for the purpose of this guarantee, Agreement or renewal thereof.

1. Methods of Collection; Use of Approved Processor.

Purchaser shall collect the cash attributable to the Specified Percentage in one of the following ways: (i) directly from Seller’s credit card processor; (ii) by debiting the Seller’s credit card processing deposit account or another of Seller’s accounts that has been approved by Purchaser; or (iii) by debiting an account established by the Seller with Purchaser’s approval specifically to hold funds that are due to Purchaser (“Dedicated Account”). Purchaser may decide in its sole discretion which of the three methods it will accept for the remittance of the Specified Percentage. If Purchaser elects to use method (i) or (ii), then Seller agrees to enter into an agreement with a credit card processor acceptable to Purchaser (“Approved Processor”). Purchaser reserves the right to change the collection method at any time, with five (5) days notice to Seller, if it is unable to collect funds on a consistent basis through the collection method initially selected.

1.1 Collection Directly from Processor.

If Purchaser agrees to accept the remittance of the Specified Percentage directly from the Seller’s Approved Processor, then Seller authorizes the Approved Processor to pay the Specified Percentage directly to Purchaser rather than to Seller until the Specified Amount has been received by the Purchaser from the Approved Processor. This authorization is irrevocable, absolute and unconditional. Seller further acknowledges and agrees that the Approved Processor will be acting on behalf of Purchaser to collect the Specified Percentage. Seller hereby irrevocably grants Approved Processor the right to hold the Specified Percentage and to pay Purchaser directly (at, before or after the time Approved Processor credits or remits to Seller the balance of the Future Receivables not sold by Seller to Purchaser) until the entire Specified Amount has been received by Purchaser. Seller acknowledges and agrees that the Approved Processor may provide Purchaser with Seller’s credit card, debit card and other payment card and instrument processing history, including without limitation Seller’s chargeback experience and any communications about Seller received by Approved Processor from a card processing system, as well as any other information Purchaser deems pertinent. Seller understands that Purchaser does not have any power or authority to control the Approved Processor’s actions with respect to the authorization, clearing, settlement and other processing of transactions and that Purchaser is not responsible for the Approved Processor’s actions. Seller agrees to hold Purchaser harmless for the Approved Processor’s actions or omissions.

1.2 Collection via ACH Withdrawals.

If Purchaser agrees to accept the remittance of the Specified Percentage by debiting the Seller’s credit card processing deposit account, then Seller (i) irrevocably authorizes the Approved Processor or their representative to provide daily reports to Purchaser regarding Seller’s credit card processing batch amounts, and (ii) irrevocably authorizes Purchaser, or its designated successor or assign to withdraw the Specified Percentages of the Future Receivables and any other amounts now due, hereinafter imposed, or otherwise owed in conjunction with this Agreement by initiating via the Automatic Clearing House (ACH) system debit entries to Seller’s account at the bank listed above or such other bank or financial institution that Seller may provide Purchaser with from time to time (“Bank Account”). In the event that Purchaser withdraws erroneously from the Bank Account, Seller authorizes Purchaser to credit the Bank Account for the amount erroneously withdrawn via ACH. Purchaser shall not be required to credit the Bank Account for amounts withdrawn related to credit card transactions which are subsequently reversed for any reason. Purchaser, in its sole discretion, may elect to offset any such amount from collections from Future Receivables. Seller represents that the Bank Account is established for business purposes only and not for personal, family, or household purposes. Seller understands that the foregoing ACH authorization is a fundamental condition to induce Purchaser to enter into this Agreement.

Before 2:00 P.M. EST of the day following each day that Seller conducts business, Seller shall cause Approved Processor or Approved Processor’s agent to deliver to Purchaser, in a format acceptable to Purchaser, a record from Approved Processor reflecting the total gross dollar amount of the preceding day’s credit card transactions processed by Approved Processor for Seller, irrespective of whether such amount consists of sales, taxes or other amounts collected by Seller from its customers (“Daily Batch Amount”). In the event that Seller is unable to procure Approved Processor’s compliance in a timely manner or as otherwise required under this section, within two (2) business days’ written notice by Purchaser to Seller of the same via facsimile to Seller at the fax number listed herein, Seller shall at its sole expense terminate its relationship with Approved Processor and exclusively engage the services of an alternative credit card processor that Purchaser approves in writing and enter into any merchant credit card processing agreement as the alternative credit card processor may require, which credit card processor shall thereafter be referred to and included within the meaning of “Approved Processor” herein. Alternatively, in the event of Approved Processor’s noncompliance, Purchaser is hereby authorized to estimate the Daily Batch Amount based upon Purchaser’s analysis of Seller’s historical experience and to collect the Specified Percentage of the Future Receivables as provided in Section 2 of this Agreement based upon such estimate. Purchaser will make appropriate adjustments upon the submission by Seller of statements with respect to the period of Approved Processor’s non-compliance. Further, Seller hereby irrevocably authorizes Purchaser to obtain information regarding its other bank account(s) from Approved Processor and/or from the sales agent, and to debit such bank account(s) in the event that Purchaser is unable to debit the Specified Percentage from Seller’s credit card processing account.

1.3 Collection from a Dedicated Account.

If Purchaser agrees to accept the remittance of the Daily Percentage by debiting a Dedicated Account, Seller agrees to complete all necessary forms to establish the Dedicated Account. Seller (i) irrevocably authorizes and will require Seller’s processor to deposit directly into the Dedicated Account a daily amount corresponding to Seller’s Daily Batch Amount multiplied by the Specified Percentage; and (ii) acknowledges and agrees that any funds deposited into the Dedicated Account by Seller’s processor will remain in the Dedicated Account until the Specified Percentage is withdrawn by Purchaser and then the remaining funds, minus any amount required to maintain the minimum balance for the account, will be forwarded to Seller’s Bank Account. If the Dedicated Account requires a minimum account balance, Purchaser may, in its sole discretion, fund the required minimum balance for the Dedicated Account out of the Purchase Price. Seller acknowledges and agrees that it shall not have the right to directly withdraw funds from the Dedicated Account.

2. Processing Trial; Commencement of Agreement. After this Agreement has been signed by Seller but prior to Purchaser’s acceptance, the parties shall conduct a processing trial of four or fewer business days in order to ensure that the Seller’s credit card transactions are being correctly processed through Approved Processor and that Purchaser timely receives the Daily Batch Amount in a satisfactory manner and format. Nothing herein shall create an obligation upon Purchaser to enter into this Agreement. The Agreement shall commence upon Purchaser’s payment to Seller of the Purchase Price.

3. Seller’s Covenants, Representations and Warranties. Seller and Guarantor represent, warrant and covenant the following as of this date and during the term of this Agreement:

a) Seller represents that it is not contemplating closing its business.

b) Seller represents that it has not commenced any case or proceeding seeking protection under any bankruptcy

or insolvency law, or had any such case or proceeding commenced against it, and it is not contemplating

commencing any such case or proceeding.

c) Seller represents that the Future Receivables are free and clear of all claims, liens or encumbrances of any

kind whatsoever.

d) Seller represents that it does not intend to temporarily close its business for renovations or other reasons

during the next twelve months.

e) Seller shall not take any action to discourage the use of credit cards which are settled through its processor or

to permit any event to occur which could have an adverse effect on the use, acceptance or authorization of credit cards for the purchase of Seller’s services and products;

f) Seller shall not change its arrangements with its credit card processor in any way which is adverse to Purchaser;

g) Seller shall not change the credit card processor through which the major credit cards are settled from Approved Processor to another credit card processor or to permit any event to occur that could cause a diversion of any of Seller’s credit card transactions to another processor without Purchaser’s prior written consent;

h) Seller represents that as of this date, all Seller’s credit card sales and transactions are being processed exclusively with Approved Processor or are being deposited exclusively into a Dedicated Account;

i) Seller shall not sell, dispose, convey or otherwise transfer its business or assets without the express prior written consent of Purchaser; Seller shall not enter into a concurrent agreement for the purchase and sale of future receivables with any purchaser aside from First Funds.

j) Seller shall furnish Purchaser with the bank statements for its Bank Account and any and all other accounts to which proceeds from Seller’s sales are deposited within seven (7) days’ of any such request by Purchaser;

k) Seller shall unconditionally ensure that the cash Seller receives from Approved Processor attributable to the

Specified Percentage of the Future Receivables is immediately thereafter available to Purchaser for collection

via ACH from Seller’s Bank Account;

l) Seller shall not attempt to revoke its ACH authorization to Purchaser set forth in this Agreement or otherwise

take any measure to interfere with Purchaser’s ability to collect the cash that Seller receives (i) from Approved Processor attributable to the Specified Percentage of the Future Receivables or (ii) from the Dedicated Account;

m) Seller shall not close its Dedicated Account, or close or change the bank account into which Approved Processor deposits the Future Receivables to another account without Purchaser’s prior written consent;

n) Seller shall not conduct its businesses under any name other than as disclosed to Purchaser or change any of its places of business without Purchaser’s prior written consent; and

o) Seller represents that the information it furnished Purchaser in this Agreement and preceding application, including without limitation, Seller’s processing statements, is true and accurate in all respects and fairly represents the financial condition, result of operations and cash flows of Seller at such dates, and since the dates therein, there has been no material adverse change in the business or its prospects or in the financial condition, results of operations, or cash flows of Seller.

4. Agency; Modifications & Amendments; Entire and Final Agreement. Purchaser does not have any power or authority or control over Approved Processor’s actions with respect to the processing of Seller’s credit card transactions. Purchaser is an entirely separate and independent entity from the Processor and ISO (if any) and their respective agents. Neither Approved Processor nor ISO (if any) is Purchaser’s agent and neither is authorized to waive or alter any term or condition of this Agreement and their representations shall in no way affect Seller’s or Purchaser’s rights and obligations set forth herein. This Agreement contains the entire and final expression of the agreement between the parties, and may not be waived, altered, modified, revoked or rescinded except by a writing signed by one of Purchaser’s executive officers. All prior and/or contemporaneous oral and written representations are merged herein. No attempt at oral modification or rescission of this Agreement or any term thereof will be binding upon the parties.

5. Governmental Approvals. Seller possesses and is in compliance with all permits, licenses, approvals, consents and other authorizations necessary to own, operate and lease its properties and to conduct the business in which it is presently engaged. Seller is in compliance with any and all applicable federal, state, and local laws and regulations, including, without limitation, all laws and regulations relating to the prosecution of the confidentiality of information received from credit card users.

6. Exclusive Use of Processor. Seller understands that services of Approved Processor are the exclusive means by which Seller may process its credit card transactions, unless it has set up a Dedicated Account, in which case all of Seller’s credit card processing must be subject to daily withholding of the Specified Percentage in the Dedicated Account.

7. Sale of Future Receivables; Non-Consumer Transaction. Seller and Purchaser agree that the Purchase Price paid by Purchaser in exchange for the Specified Amount of Future Receivables is for the purchase and sale of the Specified Amount of Future Receivables and is not intended to be, nor shall it be construed as, a loan or an assignment for security from Purchaser to the Seller. Seller and Guarantor hereby acknowledge and agree that neither party is a “consumer” with respect to this Agreement and underlying transaction, and neither this Agreement nor any guarantee thereof shall be construed as a consumer transaction.

8. No Right to Repurchase. Seller acknowledges that it has no right to repurchase the Specified Amount of Future Receivables from Purchaser.

9. Sale of Additional Future Receivables; Schedules; Right of First Refusal. Nothing herein shall obligate either party to sell and purchase future credit card receivables; however, Seller grants Purchaser the right of first refusal to purchase any such additional future credit card receivables that Seller may wish to sell during the term of this Agreement and during the period ending ninety (90) days after termination of this Agreement. Under such right of first refusal, if Seller desires to sell additional future credit card receivables, Seller agrees to sell such receivables to Purchaser only, and not to any other prospective purchaser, so long as Purchaser purchases such future credit card receivables on terms that are no less favorable to Seller as the terms and conditions of this Agreement.

10. Default. A “Default” shall include, but not be limited to, any of the following events: (a) The breach by Seller of any covenants contained in this Agreement; (b) Any representation or warranty made by the Seller in this Agreement, proving to have been incorrect, false or misleading in any material respect.

11. Remedies. In the event of a Default, Purchaser shall be entitled to all remedies available under law. Without limiting the generality of the foregoing, in the event of Seller’s default under Section 10 herein, Purchaser will be entitled to require Seller to purchase the remaining Future Receivables for an amount equal to the amount by which the Specified Amount of Future Receivables exceeds the amount of cash received from Future Receivables that Purchaser had previously collected under this Agreement, which amount Purchaser may automatically debit from Seller’s Bank Account via ACH without notice to Seller. No failure on the part of Purchaser to exercise, nor any delay in exercising any right under this Agreement shall operate as a waiver thereof, nor shall any single or partial exercise of any right under this Agreement preclude any other or further exercise of any other right. The remedies provided hereunder are cumulative and not exclusive of any remedies provided by law or equity.

12. UCC-1 Financing Statements. Seller authorizes Purchaser to file one or more UCC-1 Financing Statements prior to each sale of Future Receivables for purposes of providing public notice of the purchase by Purchaser from Seller of the Specified Amount of Future Receivables. The UCC-1 Financing Statements will state that the sale of the Future Receivables is an outright sale and not an assignment for security.

13. Notices. All notices, requests, demands and other communications hereunder, including disputes or inaccuracies concerning information furnished to credit reporting agencies shall be, unless otherwise provided herein, in writing and shall be delivered by mail, overnight delivery or hand delivery to the respective parties to this Agreement at their respective addresses listed on the face of this Agreement or at such other address that either may provide to the other in writing from time to time.

14. Binding Effect; Assignment. This Agreement shall be binding upon and inure to the benefit of Seller, Purchaser and their respective successors and assigns, except that Seller shall not have the right to assign its rights hereunder or any interest herein without the prior written consent of Purchaser which consent may be withheld at Purchaser’s sole discretion. Purchaser may assign this Agreement without notice to Seller.

15. Governing Law and Jurisdiction. This Agreement shall be governed by and construed in accordance with the laws of the State of New York. Seller consents to the jurisdiction of the federal and state courts located in the State and County of New York and agrees that such courts shall be the exclusive forum for all actions, proceedings or litigation arising out of or relating to this Agreement or subject matter thereof, notwithstanding that other courts may have jurisdiction over the parties and the subject matter thereof. Service of process by certified mail to Seller’s address listed on the face of this Agreement will be sufficient for jurisdictional purposes.

16. Purchaser’s Costs of Enforcement; Attorney’s Fees. Purchaser shall be entitled to receive from Seller and Seller shall pay to Purchaser, all Purchaser’s costs and expenses, including Purchaser’s collections overhead and Purchaser’s reasonable attorney’s fees, in enforcing any of the terms of this Agreement, regardless of whether or not a legal action has been commenced. If Seller files action against Purchaser and the matter is dismissed or Purchaser prevails in the matter, Seller agrees to pay all of Purchaser’s attorney fees and costs incurred whether in court or arbitration.

17. Severability. In case any one or more of the provisions contained in this Agreement should be invalid, illegal or unenforceable in any respect, the validity legality and enforceability of the remaining provisions contained herein and therein shall not in any way be affected or impaired thereby.

18. Limitation of Liability. In no event will Purchaser be liable for any claims asserted by Seller under any theory of law, including any tort or contract theory for lost profits, lost revenues, lost business opportunities, exemplary, punitive, special, incidental, indirect or consequential damages, each of which is hereby expressly waived to the fullest extent permitted by law by Seller.

19. Waiver Of Jury Trial; Limitation On Action. PURCHASER AND SELLER KNOWINGLY, WILLINGLY AND VOLUNTARILY WAIVE, INSOFAR AS PERMITTED BY LAW, TRIAL BY JURY IN ANY ACTION, PROCEEDING OR LITIGATION BROUGHT BY PURCHASER, SELLER OR GUARANTOR HERETO ARISING FROM OR IN ANY WAY RELATING TO THIS AGREEMENT OR THE UNDERLYING TRANSACTION. SELLER SHALL COMMENCE ANY ACTION OR COUNTERCLAIM BASED IN CONTRACT, TORT OR OTHERWISE ARISING FROM OR IN ANY WAY RELATING TO THIS AGREEMENT OR THE UNDERLYING TRANSACTION WITHIN ONE YEAR OF THE ACCRUAL OF THAT CAUSE OF ACTION AND NO SUCH ACTION MAY BE MAINTAINED WHICH IS NOT COMMENCED WITHIN THAT PERIOD. SELLER KNOWINGLY, WILLINGLY AND VOLUNTARILY WAIVES, TO THE EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT TO PURSUE A CLAIM AGAINST PURCHASER AS PART OF A CLASS ACTION, PRIVATE ATTORNEY GENERAL ACTION OR OTHER REPRESENTATIVE ACTION.

—————–

2006 AdvanceMe Contract

In exchange for payment by Company to Merchant of the purchase price specified below (“Purchase Price”), Company hereby purchases from Merchant and Merchant hereby sells to Company all of Merchant’s right, title and interest in and to the amount specified below (“Specified Amount”) of Merchant’s future receivables (“Future Receivables”) arising from payments by Merchant’s customers with cards (“Cards”) of a type settled, directly or indirectly, by Processor (as defined below). Merchant will remit the Specified Amount of Future Receivables to Company by causing a processor acceptable to Company (“Processor”) to pay Company each day an amount of cash equal to the percentage specified below (“Specified Percentage”) of all Card receivables due to Merchant on the day in question (“Receivables”). Company will continue to receive the Specified Percentage of Receivables until Merchant has remitted to Company the entire Specified Amount of Future Receivables.

Company will not increase the Specified Percentage without Merchant’s prior written consent. Merchant (i) will enter into an agreement acceptable to Company with Processor to obtain processing services (“Processing Agreement”) and (ii) hereby authorizes Processor and/or Operator (as defined below) to pay daily the cash attributable to the Specified Percentage of Receivables to Company rather than to Merchant and to debit the Account (as defined below) in such amounts until Company receives the cash attributable to the entire Specified Amount of Future Receivables.

Merchant agrees (i) to conduct its business consistent with past practice; (ii) to exclusively use Processor for the processing of all of its Card transactions, to not change its arrangements with Processor in any way that is adverse to Company and to not take any action that has the effect of causing the processor through which Cards are settled to be changed from Processor to another processor; (iii) to not take any action to discourage the use of Cards and to not permit any event to occur that could have an adverse effect on the use, acceptance or authorization of Cards for the purchase of Merchant’s services and/or products; (iv) to not open a new account other than the Account to which Card settlement proceeds will be deposited and to not take any action to cause Future Receivables or Receivables to be settled or delivered to any account other than the Account; (v) not to sell, dispose, convey or otherwise transfer its business or assets without the express prior written consent of Company and the assumption of all of Merchant’s obligations under this Agreement pursuant to documentation reasonably satisfactory to Company; and (vi) to maintain a Minimum Balance (as defined below) in the Account (collectively, the “Merchant Contractual Covenants”).

The owners of Merchant (such owners, whether shareholders, partners, members or other owners are referred to herein as “Owners”) hereby guarantee the performance of all of the covenants made by Merchant in this Agreement, including the Merchant Contractual Covenants.

To the extent set forth herein, each of the parties is obligated upon his, her or its execution of the Agreement to all terms of the Agreement, including the Additional Terms set forth below. Each of above-signed Merchant and Owner(s) represents that he or she is authorized to sign this Agreement for Merchant and that the information provided herein and in all of Company’s forms is true, accurate and complete in all respects. If any such information is false or misleading, Merchant shall be deemed in material breach of all agreements between Merchant and Company and Company shall be entitled to all remedies available under law. Company may produce a monthly statement reflecting the delivery of the Specified Percentage of Receivables from Merchant via Processor and/or Operator. Merchant hereby agrees to a $___ administrative fee per month for the production of the monthly statement and further agrees that Company and its designees may debit such administrative fee from Merchant’s bank account each month via the automated clearing house (“ACH”) system. An investigative or consumer report may be made in connection with the Agreement. Merchant and each of the above- signed Owners authorizes Company, its agents and representatives and any credit reporting agency engaged by Company, to (i) investigate any references given or any other statements or data obtained from or about Merchant or any of its Owners for the purpose of this Agreement, and (ii) pull credit reports at any time now or for so long as Merchant and/or Owner(s) continue to have any obligation owed to Company as a consequence of this Agreement or for Company’s ability to determine Merchant’s eligibility to enter into any future agreement with Company.

I. PROCESSING TERMS AND ARRANGEMENTS.

Section 1.1. Processing Agreement. Merchant understands and agrees that the Processing Agreement and the authorizations to debit set forth above irrevocably authorize Processor and Operator to pay the cash attributable to the Specified Percentage of Receivables to Company rather than to Merchant until Company receives the cash attributable to the entire Specified Amount of Future Receivables from Processor and/or Operator. These authorizations may be revoked only with the prior written consent of Company. Merchant agrees that Processor and Operator may rely upon the instructions of Company, without any independent verification, in making the cash payments described above. Merchant waives any claim for damages it may have against Processor or Operator in connection with actions taken based on instructions from Company, unless such damages were due to such Processor’s or Operator’s failure to follow Company’s instructions. Merchant acknowledges and agrees that (a) Processor and Operator will be acting on behalf of Company with respect to the Specified Percentage of Receivables until the cash attributable to the entire Specified Amount of Future Receivables has been remitted by Processor and/or Operator to Company, (b) Processor and Operator may or may not be affiliates of Company, (c) Company does not have any power or authority to control Processor’s or Operator’s actions with respect to the processing of Card transactions or remittance of cash to Company, and (d) Company is not responsible for, and Merchant agrees to hold Company harmless for, the actions of Processor and Operator. For purposes of this Agreement, the term “Operator” shall mean any party Company designates to debit any amounts from Merchant’s or Owners’ accounts as authorized or permitted by this Agreement.

Section 1.2. Instructions to Processor. Merchant will irrevocably instruct Processor to hold the Specified Percentage of Receivables on behalf of Company and to remit directly to Company the cash attributable thereto at the same time it remits to Merchant the cash attributable to the balance of the Receivables. Merchant acknowledges and agrees that Processor shall provide Company with Merchant’s Card transaction history.

Section 1.3. Indemnification. Merchant indemnifies and holds each of Processor and Operator, their respective officers, directors, affiliates, employees, agents and representatives harmless from and against all losses, damages, claims, liabilities and expenses (including reasonable attorneys’ fees) suffered or incurred by Processor or Operator resulting from actions taken by Processor or Operator in reliance upon information or instructions provided to Processor or Operator by Company.

Section 1.4. Limitation of Liability. In no event will Processor, Operator or Company be liable for any claims asserted by Merchant under any theory of law, including any tort or contract theory for lost profits, lost revenues, lost business opportunities, exemplary, punitive, special, incidental, indirect or consequential damages, each of which is hereby expressly waived by Merchant.

Section 1.5. Processor Commissions. Merchant understands and agrees that Processor will charge a fee or commission for processing receipts of Receivables (the “Processor’s Fee”) as set forth in the Processing Agreement and that the Processor’s Fee will be deducted from the portion of the Receivables payable to Merchant and not from the cash attributable to the Specified Percentage of Receivables payable to Company.

Section 1.6. No Modifications. Merchant will comply with the Processing Agreement and will not modify the Processing Agreement in any manner that could have an adverse effect upon Company’s interests, without Company’s prior written consent.

Section 1.7. Account. Merchant represents and warrants that Merchant’s sole bank account (“Account”) into which all settlement proceeds of Receivables will be deposited is that account identified by account name, account number and bank name and address that is shown on the face of the voided check that Merchant shall provide to Company along with this Agreement, the delivery of which voided check is a condition precedent to Company’s obligations under this Agreement. If Processor transfers to the Account or any other account of Merchant or Owner(s) any funds that should have been transferred to Company pursuant to Sections 1.1 and 1.2 hereof, or if Merchant otherwise has monies deposited in its or Owner(s)’s account(s) that otherwise should have been transferred to Company pursuant to Sections 1.1 and 1.2 hereof, Merchant shall immediately segregate and hold all such funds in express trust for Company’s sole and exclusive benefit. In any such circumstance, Merchant shall maintain in the Account a minimum balance equal to Company’s undivided interest in such funds or the Specified Percentage multiplied by the Merchant’s average daily Card volume based on the processing records provided to Company prior to the execution of this Agreement (assuming twenty-one days of processing per month) multiplied by three (3), whichever is greater (“Minimum Balance”), until such funds are paid to Company. Merchant and each Owner authorizes Company, Processor and Operator to debit such funds directly from all such accounts, including the Account, and agrees to not revoke or cancel such authorizations until such time as Company has received the entire Specified Amount of Future Receivables. Merchant acknowledges and agrees that Company, Processor and Operator may issue a pre-notification to Merchant’s and/or Owner(s)’s bank(s) with respect to such debit transactions. Within twenty-four (24) hours of any request by Company, Merchant shall provide, or cause Processor or Operator to provide, Company with records and other information regarding Merchant’s Card sales, the Account and any other accounts of Merchant or Owner(s).

Section 1.8. Processing Trial. After this Agreement has been signed by both Merchant and Company but prior to Company’s determination as to whether to pay the Purchase Price, Merchant agrees to permit Company to instruct Processor and/or Operator to conduct a short processing trial (the “Processing Trial”) to ensure that Merchant’s Card transactions are being correctly processed through Processor and that the cash attributable to the Specified Percentage of Receivables will be appropriately remitted to Company. Company agrees to make a determination as to whether to purchase the Specified Amount of Future Receivables promptly after the commencement of the Processing Trial. If Company elects to purchase the Specified Amount of Future Receivables, then all of the cash received by Company in connection with the Processing Trial prior to the payment of the Purchase Price shall be applied to reduce the Specified Amount. Nothing herein shall create an obligation on behalf of Company to purchase any Future Receivables, and Company expressly reserves the right to not purchase the Specified Amount of Future Receivables and not pay the Purchase Price to Merchant. If Company decides to not purchase the Specified Amount of Future Receivables and not pay the Purchase Price, this Agreement shall have no further effect and Company shall, promptly after receipt from Processor or Operator, return to Merchant any cash received by Company in connection with the Processing Trial.

Section 1.9. Excess Cash. In the event that the amount of cash remitted to Company pursuant to this Agreement exceeds the Specified Amount (such excess being the “Excess Cash”) by at least $20.00, Company agrees to pay such Excess Cash to Merchant within thirty (30) days after receipt thereof by Company. In the event the Excess Cash is less than $20.00, Company agrees to pay such Excess Cash to Merchant within thirty (30) days after its receipt of a written request from Merchant, provided such request is made within six months of Company’s receipt of such Excess Cash. Merchant acknowledges and agrees that Company has no obligation to take any action (including against Processor or Operator) with respect to any cash being held by Processor or Operator, which will become Excess Cash once it is paid by Processor or Operator to Company, prior to the receipt of such Excess Cash by Company.

Section 1.10. Reliance on Terms. The provisions of this Agreement are agreed to for the benefit of Merchant, Owner(s), Company, Processor and Operator and, notwithstanding the fact that Processor and Operator are not parties to this Agreement, they may rely upon the terms of this Agreement and raise them as defenses in any action.

II. REPRESENTATIONS, WARRANTIES AND COVENANTS.

Merchant and Owner(s) represent, warrant and covenant the following as of the date hereof and during the term of this Agreement:

Section 2.1. Merchant Contractual Covenants. Merchant shall comply with each of the Merchant Contractual Covenants as set forth herein.

Section 2.2. Business Information. All information (financial and other) provided by or on behalf of Merchant to Company in connection with the execution of or pursuant to this Agreement is true, accurate and complete in all respects. Merchant shall furnish Company, Processor and Operator such information as Company may request from time to time.

Section 2.3. Reliance on Information. Merchant acknowledges and agrees that all information (financial and other) provided by or on behalf of Merchant has been relied upon by Company in connection with its decision to purchase the Specified Amount of Future Receivables.

Section 2.4. Compliance. Merchant is in compliance with any and all applicable federal, state and local laws and regulations and rules and regulations of card associations and payment networks. Merchant possesses and is in compliance with all permits, licenses, approvals, consents, registrations and other authorizations necessary to own, operate and lease its properties and to conduct the business in which it is presently engaged.

Section 2.5. Authorization. Merchant and the person(s) signing this Agreement on behalf of Merchant have full power and authority to enter into and perform the obligations under this Agreement and the Processing Agreement, all of which have been duly authorized by all necessary and proper actions.

Section 2.6. Insurance. Merchant shall maintain insurance in such amounts and against such risks as are consistent with past practice and shall show proof of such insurance upon the request of Company. Section 2.7. Change Name or Location. Merchant does not and shall not conduct Merchant’s business under any name other than as disclosed to Company and Processor and shall not change its place of business.

Section 2.8. Merchant Not Indebted to Company. Merchant is not a debtor of Company as of the date of this Agreement.

Section 2.9. Exclusive Use of Processor. Merchant understands and agrees that the services of Processor are the exclusive means by which Merchant can and shall process its Card transactions.

Section 2.10. Working Capital Funding. Merchant shall not enter into any arrangement, agreement or commitment that relates to or involves Future Receivables, whether in the form of a purchase of, a loan against, or the sale or purchase of credits against, Future Receivables or future Card sales with any party other than Company.

Section 2.11. Unencumbered Future Receivables. Merchant has good, complete and marketable title to all Future Receivables, free and clear of any and all liabilities, liens, claims, charges, restrictions, conditions, options, rights, mortgages, security interests, equities, pledges and encumbrances of any kind or nature whatsoever or any other rights or interests that may be inconsistent with the transactions contemplated with, or adverse to the interests of, Company.

Section 2.12. Business Purpose. Merchant is a valid business in good standing under the laws of the jurisdictions in which it is organized and/or operates, and Merchant is entering into this Agreement for business purposes and not as a consumer for personal, family or household purposes.

III. ADDITIONAL TERMS.

Section 3.1. Sale of Future Receivables. Merchant and Company agree that the Purchase Price paid by Company in exchange for the Specified Amount of Future Receivables is a purchase of the Specified Amount of Future Receivables and is not intended to be, nor shall it be construed as, a loan or financial accommodation from Company to Merchant.

Section 3.2. No Right Merchant acknowledges and agrees that it has no right to repurchase the Specified Amount of Future Receivables from Company and Company may not force Merchant to repurchase the Specified Amount of Future Receivables.

Section 3.3. Remedies. In the event that any of the representations or warranties contained in this Agreement is not true, accurate and complete, or in the event of a breach of any of the covenants contained in this Agreement, including the Merchant Contractual Covenants, Company shall be entitled to all remedies available under law, including the right to non-judicial foreclosure. In the event that Merchant breaches any of the Merchant Contractual Covenants specified in clauses (ii) or (iv) on the first page of this Agreement, Merchant agrees that Company shall be entitled to, but not limited to, damages equal to the amount by which the cash attributable to the Specified Amount of Future Receivables exceeds the amount of cash received from Receivables that have previously been delivered by Merchant to Company pursuant to this Agreement. Merchant hereby agrees that Company and Operator may automatically debit such damages from Merchant’s bank accounts via the ACH system or wire transfers. The obligations of Owners, including the guarantee on the first page of this Agreement are primary and unconditional and each Owner waives any rights to require Company to first proceed against Merchant.

Section 3.4. Financing Statements. To secure performance of the Merchant Contractual Covenants and all of the other obligations of Merchant to Company under this Agreement or any other agreement between Merchant and Company, Merchant grants to Company a continuing priority security interest, subject only to the security interest of Processor, if any, in the following property of Merchant wherever found: (a) All personal property of Merchant, including, all accounts, chattel paper, documents, equipment, general intangibles, instruments, inventory (as those terms are defined in Article 9 of the Uniform Commercial Code (“UCC”) in effect from time- to-time in the State of New York), and liquor licenses, wherever located, now or hereafter owned or acquired by Merchant; (b) all trademarks, trade names, service marks, logos and other sources of business identifiers, and all registrations, recordings and applications with the U.S. Patent and Trademark Office (“USPTO”) and all renewals, reissues and extensions thereof (collectively “IP”) whether now owned or hereafter acquired, together with any written agreement granting any right to use any IP; and (c) all proceeds with respect to the items described in (a) and (b) above, as the term “proceeds” is defined in Article 9 of the UCC. Merchant understands and agrees that Company may file one or more (i) UCC-1 financing statements at anytime to perfect the interest created under the UCC upon the sale, and (ii) assignments with USPTO to perfect the security interest in IP described above. The UCC-1 financing statements may state that the sale of the Specified Amount of Future Receivables is intended to be a sale and not an assignment for security.

Section 3.5. Protection of Information. Merchant and each person signing this Agreement on behalf of Merchant and/or as Owner, in respect of himself or herself personally, authorizes Company to disclose to any third party information concerning Merchant’s and each Owner’s credit standing (including credit bureau reports that Company obtains) and business conduct. Merchant and each Owner hereby waives to the maximum extent permitted by law any claim for damages against Company or any of its affiliates relating to any (i) investigation undertaken by or on behalf of Company as permitted by this Agreement or (ii) disclosure of information as permitted by this Agreement.

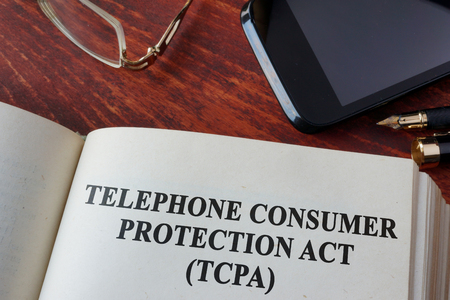

Section 3.6. Solicitations. Merchant and each Owner authorizes Company and its affiliates to communicate with, solicit and/or market to Merchant and each Owner via regular mail, telephone, email and facsimile in connection with the provision of goods or services by Company, its affiliates or any third party that Company shares, transfers, exchanges, discloses or provides information with or to pursuant to Section 3.5 and will hold Company, its affiliates and such third parties harmless against any and all claims pursuant to the federal CAN-SPAM ACT of 2003 (Controlling the Assault of Non-Solicited Pornography and Marketing Act of 2003), the Telephone Consumer Protection Act (TCPA), and any and all other state or federal laws relating to transmissions or solicitations by any of the methods described above.

Section 3.7. Confidentiality. Merchant understands and agrees that the terms and conditions of the products and services offered by Company, including this Agreement and any other Company documentation (collectively, “Confidential Information”) are proprietary and confidential information of Company. Accordingly, unless disclosure is required by law or court order, Merchant shall not disclose Confidential Information to any person other than an attorney, accountant, financial advisor or employee of Merchant who needs to know such information for the purpose of advising Merchant (“Advisor”), provided such Advisor uses such information solely for the purpose of advising Merchant and first agrees in writing to be bound by the terms of this Section 3.7).

Section 3.8. Publicity. Merchant and each Owner authorizes Company to use its, his or her name in a listing of clients and in advertising and marketing materials.

IV. MISCELLANEOUS.

Section 4.1. Modifications; Amendments; Construction. No modification, amendment or waiver of any provision of this Agreement shall be effective unless the same shall be in writing and signed by the parties affected. The headings of the sections and subsections herein are inserted for convenience only and under no circumstances shall they affect in any way the meaning or interpretation of this Agreement. For purposes of this Agreement, “including” shall mean “including, without limitation”.

Section 4.2. Notices. All notices, requests, demands and other communications hereunder shall be in writing and shall be delivered by mail, overnight delivery or hand delivery to the respective parties to this Agreement. Notices to Company shall be sent to the following address:

Advanceme, Inc.

c/o General Counsel

2 Overhill Road, Suite 410 Scarsdale, NY10583-5323

Section 4.3. Waiver; Remedies. No failure on the part of Company to exercise, and no delay in exercising, any right under this Agreement shall operate as a waiver thereof, nor shall any single or partial exercise of any right under this Agreement preclude any other or further exercise of any other right. The remedies provided hereunder are cumulative and not exclusive of any remedies provided by law or equity.

Section 4.4. D/B/A’s. Merchant hereby acknowledges and agrees that Company may be using “doing business as” or “d/b/a” names in connection with various matters relating to the transaction between Company and Merchant, including the filing of UCC-1 financing statements and other notices or filings.

Section 4.5. Binding Effect. This Agreement shall be binding upon and inure to the benefit of Merchant, Owner(s), Company and their respective successors and assigns, except that Merchant and Owner(s) shall not have the right to assign its rights or obligations hereunder or any interest herein without the prior written consent of Company, which consent may be withheld in Company’s sole discretion. Company reserves the right to assign this Agreement or its rights or obligations hereunder with or without prior notice to Merchant.

Section 4.6. Governing Law. This Agreement shall be governed by, and construed in accordance with, the internal laws of the State of New York without regard to principles of conflicts of law. Merchant hereby submits to the jurisdiction of any New York state or federal court sitting in the Borough of Manhattan of the City of New York or any Georgia state or federal court sitting in Cobb County. Merchant hereby waives any claim that the action is brought in an inconvenient forum, that the venue of the action is improper, or that this Agreement or the transactions of which this Agreement is a part may not be enforced in or by any of the above-named courts.

Section 4.7. Costs. Company shall be entitled to receive from Merchant and/or Owner, and Merchant and/or Owner shall pay, all reasonable costs associated with a breach by Merchant of any of the Merchant Contractual Covenants or other obligations or any of the representations and warranties of Merchant and the enforcement thereof, including court costs and attorney’s fees.

Section 4.8. Term and Survival. This Agreement shall continue in full force and effect until all obligations hereunder have been satisfied in full; provided, however, that Sections 1.3, 1.4, 3.3, 3.6, 3.7, 3.8, 4.7, 4.12 and 4.13 shall survive indefinitely.

Section 4.9. Severability. In case any one or more of the provisions contained in this Agreement should be invalid, illegal or unenforceable in any respect, the validity, legality and enforceability of the remaining provisions contained herein and therein shall not in any way be affected or impaired thereby.

Section 4.10. Counterparts and Facsimile Signatures. This Agreement may be signed in one or more counterparts, each of which shall constitute an original and all of which when taken together shall constitute one and the same agreement. Facsimile signatures shall be deemed to be original signatures and each party hereto may rely on a facsimile signature as an original for purposes of enforcing this Agreement.

Section 4.11. Entire Agreement. This Agreement contains the entire agreement and understanding between Merchant, Owners and Company and supersedes all prior agreements and understandings, whether oral or in writing, relating to the subject matter hereof unless otherwise specifically reaffirmed or restated herein.

Section 4.12. Jury Trial Waiver. THE PARTIES HERETO WAIVE TRIAL BY JURY IN ANY COURT IN ANY SUIT, ACTION OR PROCEEDING ON ANY MATTER ARISING IN CONNECTION WITH OR IN ANY WAY RELATED TO THE TRANSACTIONS OF WHICH THIS AGREEMENT IS A PART OR THE ENFORCEMENT HEREOF, EXCEPT WHERE SUCH WAIVER IS PROHIBITED BY LAW OR DEEMED BY A COURT OF LAW TO BE AGAINST PUBLIC POLICY . THE PARTIES HERETO ACKNOWLEDGE THAT EACH MAKES THIS WAIVER KNOWINGLY, WILLINGLY AND VOLUNTARILY AND WITHOUT DURESS, AND ONLY AFTER EXTENSIVE CONSIDERATION OF THE RAMIFICATIONS OF THIS WAIVER WITH THEIR ATTORNEYS.

Section 4.13. Class Action Waiver. THE PARTIES HERETO WAIVE ANY RIGHT TO ASSERT ANY CLAIMS AGAINST THE OTHER PARTY AS A REPRESENTATIVE OR MEMBER IN ANY CLASS OR REPRESENTATIVE ACTION, EXCEPT WHERE SUCH WAIVER IS PROHIBITED BY LAW AGAINST PUBLIC POLICY. TO THE EXTENT EITHER PARTY IS PERMITTED BY LAW OR COURT OF LAW TO PROCEED WITH A CLASS OR REPRESENTATIVE ACTION AGAINST THE OTHER, THE PARTIES HEREBY AGREE THAT: (1) THE PREVAILING PARTY SHALL NOT BE ENTITLED TO RECOVER ATTORNEYS’ FEES OR COSTS ASSOCIATED WITH PURSUING THE CLASS OR REPRESENTATIVE ACTION (NOT WITHSTANDING ANY OTHER PROVISION IN THIS AGREEMENT); AND (2) THE PARTY WHO INITIATES OR PARTICIPATES AS A MEMBER OF THE CLASS WILL NOT SUBMIT A CLAIM OR OTHERWISE PARTICIPATE IN ANY RECOVERY SECURED THROUGH THE CLASS OR REPRESENTATIVE ACTION.

——————–

Many sections of these contracts have been used, reused, rewritten, distributed, and redistributed by 3rd parties and are considered to be in the public domain. Sections are reproduced here for educational purposes. If you believe any section violates a copyright, e-mail webmaster@merchantprocessingresource.com

Lead generators for alternative funders are facing stronger headwinds these days. The business has gotten tougher for a whole host of reasons. A pullback in alternative lending necessitates fewer leads. On top of that, funders, ISOs and brokers have gotten pickier about the types of leads they’ll accept. What’s more, stricter application of the Telephone Consumer Protection Act (TCPA) is hampering lead generators’ ability to solicit business owners. As a result, some lead generators have faded away, while others have been developing additional business lines or are broadening their reach to other areas within financial services to buoy earnings.

Lead generators for alternative funders are facing stronger headwinds these days. The business has gotten tougher for a whole host of reasons. A pullback in alternative lending necessitates fewer leads. On top of that, funders, ISOs and brokers have gotten pickier about the types of leads they’ll accept. What’s more, stricter application of the Telephone Consumer Protection Act (TCPA) is hampering lead generators’ ability to solicit business owners. As a result, some lead generators have faded away, while others have been developing additional business lines or are broadening their reach to other areas within financial services to buoy earnings. At the same time, however, TCPA regulations have gotten more stringent, making it dangerous to solicit businesses, says O’Hare of Blindbid. “Any phone call you make, you can get sued,” he says.

At the same time, however, TCPA regulations have gotten more stringent, making it dangerous to solicit businesses, says O’Hare of Blindbid. “Any phone call you make, you can get sued,” he says. Rob Buchanan, senior sales executive at Infogroup in Papillion, Nebraska, who focuses on lead-generation for the fintech space, notes that within the past 18 months or so, clients have been going after “low-hanging fruit” when it comes to leads. They are looking for leads where business owners are actively looking for financing as opposed to relying primarily on UCC data. They are still using UCC data, but to a lesser extent than they were in the past, he says.

Rob Buchanan, senior sales executive at Infogroup in Papillion, Nebraska, who focuses on lead-generation for the fintech space, notes that within the past 18 months or so, clients have been going after “low-hanging fruit” when it comes to leads. They are looking for leads where business owners are actively looking for financing as opposed to relying primarily on UCC data. They are still using UCC data, but to a lesser extent than they were in the past, he says.

Meanwhile, the problems plaguing the lead business should prompt funders to become creative in their approach to finding prospects. That’s why even vendors who make their living selling leads encourage funders to search for prospects on their own. “We always advise generating your own leads,” says Benton. “The only leads you can truly count on are the ones you generate yourself.”

Meanwhile, the problems plaguing the lead business should prompt funders to become creative in their approach to finding prospects. That’s why even vendors who make their living selling leads encourage funders to search for prospects on their own. “We always advise generating your own leads,” says Benton. “The only leads you can truly count on are the ones you generate yourself.”

Back in April, I presented the idea of trigger leads coming to the alternative lending industry. In subsequent discussions about that blog post, many folks particularly in merchant cash advance questioned whether such a concept could possibly exist or would even be legal.

Back in April, I presented the idea of trigger leads coming to the alternative lending industry. In subsequent discussions about that blog post, many folks particularly in merchant cash advance questioned whether such a concept could possibly exist or would even be legal. And while backdooring does seem to happen out there from time to time, another culprit may very well be trigger leads. Credit bureaus and big data aggregators are selling credit pull data in real time. UCC-1 leads are leads after the funding has taken place. Trigger leads are leads before the funding has taken place. But do they really exist?

And while backdooring does seem to happen out there from time to time, another culprit may very well be trigger leads. Credit bureaus and big data aggregators are selling credit pull data in real time. UCC-1 leads are leads after the funding has taken place. Trigger leads are leads before the funding has taken place. But do they really exist?

If you noticed a shuffle in search rankings for industry keywords last night, it’s because Google unleashed Penguin 2.1.

If you noticed a shuffle in search rankings for industry keywords last night, it’s because Google unleashed Penguin 2.1.

Below is a look back at some of the contract language used in the industry.

Below is a look back at some of the contract language used in the industry.