Industry News

Exercise of Ordinary Intelligence Would’ve Revealed Merchant Cash Advance Contract Was Not a Loan, Court Says

May 9, 2017 In the New York Supreme Court, the Honorable Linda S. Jamieson was tasked with ruling on twelve causes of action in a merchant cash advance contract case. While the 18-page decision covers a lot of ground, one notable section was the plaintiffs’ request for rescission based on “misrepresentations or unilateral mistake” and “damages for fraudulent inducement.” According to the order, the plaintiffs, K9 Bytes, Inc., Epazz, Inc., Strantin, Inc., MS Health Inc., and Shaun Passley, “claim that the defendants misled them by representing that they were entering into “loans governed by usury laws,” but instead caused them “to enter into ‘merchant agreements.'” Exhibits on the docket attached by the plaintiffs purport to demonstrate the word loan being used in communications, though the judge noted that the plaintiffs failed to identify how the individuals in those communications specifically attributed to the defendants. Nevertheless, the judge was unmoved by plaintiffs given the overt language spelled out in the contract itself.

In the New York Supreme Court, the Honorable Linda S. Jamieson was tasked with ruling on twelve causes of action in a merchant cash advance contract case. While the 18-page decision covers a lot of ground, one notable section was the plaintiffs’ request for rescission based on “misrepresentations or unilateral mistake” and “damages for fraudulent inducement.” According to the order, the plaintiffs, K9 Bytes, Inc., Epazz, Inc., Strantin, Inc., MS Health Inc., and Shaun Passley, “claim that the defendants misled them by representing that they were entering into “loans governed by usury laws,” but instead caused them “to enter into ‘merchant agreements.'” Exhibits on the docket attached by the plaintiffs purport to demonstrate the word loan being used in communications, though the judge noted that the plaintiffs failed to identify how the individuals in those communications specifically attributed to the defendants. Nevertheless, the judge was unmoved by plaintiffs given the overt language spelled out in the contract itself.

[The plaintiffs] state that they would not have knowingly entered into merchant agreements, because what they really wanted were loans. Indeed, plaintiffs allege that “the word ‘purchase’ or ‘sale’ would have caused Passley to decline a transaction with [defendants] because a loan – the product Passley wanted to obtain – is not a purchase or sale.”

A review of the contracts in this action shows that not only do they all clearly state that they involve purchases or sales, but they all expressly state they are not loans. Even if someone were confused by the contracts, or did not understand the obligation or the process, by reading the documents, one would grasp immediately that they certainly were not straightforward loans. The very first heading on the page was “Merchant Agreement,” and the second heading says “Purchase and Sale of Future Receivables.”

[…] For plaintiffs to state that they would not have entered into a purchase or sale if they had known that that is what they were doing is utterly undermined by the documents themselves. As the Second Department has held, in Karsanow v. Kuehlewein, 232 A.D.2d 458, 459, 648 NY.S.2d 465, 466 (2d Dept. 1996), “the subject provision was clearly set out in the … agreements, and where a party has the means available to him of knowing by the exercise of ordinary intelligence the truth or real quality of the subject of the representation, he must make use of those means or he will not be heard to complain that he was induced to enter into the transaction by misrepresentations.” So too here, plaintiffs had the means to understand that the agreements set forth that they were not loans. As it has long been settled that a party is bound by that which it signs, the Court finds that the ninth cause of action, for recission based on misrepresentation or mistake, and the tenth cause of action, for fraudulent inducement based on misrepresentation, must be dismissed as a matter of law. Pimpinello v. Swift & Co., 253 N.Y. 159, 162-63 (1930) (“the signer of a deed or other instrument, expressive of a jural act, is conclusively bound thereby. That his mind never gave asset to the terms expressed is not material. If the signer could read the instrument, not to have read it was gross negligence; if he could not have read it, not to procure it to be read was equally negligent; in either case the writing binds him.”).

The plaintiffs are likely to be disappointed with the rest of the ruling as well. The decision can be found in the New York Supreme Court in the County of Westchester under Index Number 54755/2016 or can be downloaded in full here.

OnDeck On the Path to Profitability?

May 8, 2017 In their earnings announcement this morning, OnDeck predicted that GAAP profitability would be achieved in the second half of 2017. For now, the GAAP net loss in Q1 was only $11.1 million, down from $36.5 million in Q4. The company originated $573 million worth of loans for the quarter.

In their earnings announcement this morning, OnDeck predicted that GAAP profitability would be achieved in the second half of 2017. For now, the GAAP net loss in Q1 was only $11.1 million, down from $36.5 million in Q4. The company originated $573 million worth of loans for the quarter.

OnDeck has been under pressure from at least one major shareholder to make changes. “We’re talking about a stock that is down 75 percent to 80 percent from its IPO price. You’re not going to find a lot of happy campers in that situation. Shareholders are going to ask tough questions,” Mario Cibelli, Marathon Partners managing member, told deBanked last month.

OnDeck has been underperforming just about all of its peers year-to-date according to the deBanked Tracker. The company’s stock price has been flat on the year, whereas Square, which does payments in addition to business loans, is up 45%.

The Marketplace, once a defining part of the tech-based lender’s strategy, is being almost completely phased out. “Loans sold or designated as held for sale through OnDeck Marketplace represented 9.0% of term loan originations in the first quarter of 2017 compared to 25.9% of term loan originations in the comparable prior year period,” their report said. OnDeck plans to reduce the amount of loans sold through their marketplace to less than 5% for the remainder of 2017.

“The Provision Rate in the first quarter of 2017 was 8.7% compared to 5.8% in the prior year period.”

“The 15+ Day Delinquency Ratio increased to 7.8% in the first quarter of 2017 from 5.7% in the prior year period and from 6.6% in the fourth quarter of 2016 due primarily to the continued seasoning of the portfolio.”

“The Cost of Funds Rate during the first quarter of 2017 increased to 5.9% from 5.5% in the prior year period primarily due to the increase in short-term rates.”

“The Net Charge-off rate increased to 14.9% in the first quarter of 2017 from 11.2% in the prior year period and increased sequentially from 14.2%.”

“Combined with the company’s prior workforce reduction, total headcount at the end of the second quarter of 2017 is expected to be approximately 27% lower than December 31, 2016 levels, due to both involuntary terminations and actual and scheduled attrition.”

MCA Company Wins Case After Judge Actually Reads the Contract

May 5, 2017 An explosive New York Supreme Court decision in December against a merchant cash advance company just lost some of its bite, thanks to a decision handed down by the Honorable Catherine M. Bartlett in Orange County.

An explosive New York Supreme Court decision in December against a merchant cash advance company just lost some of its bite, thanks to a decision handed down by the Honorable Catherine M. Bartlett in Orange County.

By all accounts, plaintiff Merchant Funding Services, LLC (“MFS”) had reason to be worried when Long Island attorney Amos Weinberg appeared on behalf of defendants Micromanos Corporation and Atsumassa Tochisako. MFS and Weinberg squared off last year in an almost identical case when Weinberg represented a company named Volunteer Pharmacy, Inc. There, a Westchester County judge decided the agreement in question to be criminally usurious on its face, leaving no question of fact for a trier of fact to resolve. According to court records, Weinberg has been relying on that decision to bolster his legal arguments against other MCA agreements ever since.

But up in Orange County, less than an hour northwest of Westchester, the court there sided in favor of MFS on Thursday, even after being briefed on the Volunteer Pharmacy decision.

Defendants, citing Merchant Funding Services, LLC v. Volunteer Pharmacy Inc., 44 NYS3d 876 (Sup. Ct. Westchester. 2016), assert that a plenary action is not required in the circumstances of this case because the Secured Merchant Agreement is, on its face and as a matter of law, a criminally usurious loan. However, Defendants’ position is grounded on a dubious misreading of the Agreement.

Micromanos, like Volunteer Pharmacy, was seeking to vacate the confession of judgment entered against them by way of a motion rather than by filing an entirely new lawsuit.

Here, the judge not only rejected that the confession of judgment be vacated but she also admonished Micromanos for misleading the court over the actual wording of the contract in order to serve their argument.

The agreement on its face provided for MFS’s purchase of 15% of Micromanos’ future receipts until such time as the sum of $224,250 has been paid. Paragraph 1.8 of the Agreement recited the parties’ understanding – directly contrary to Defendants’ claims herein – that (1) MFS’ purchase price was being tendered in exchange for the specified amount of Micromanos’ future receipts, (2) that such purchase price “is not intended to be, nor shall it be construed as a loan from MFS to Merchant”, and (3) that payment by Micromanos to MFS “shall be conditioned upon Merchant’s sale of products and services and the payment therefore by Merchant’s customers…”

These provisions not withstanding, Defendants contend that the Addendum altered the essential nature of the Agreement by requiring a Daily Payment of $2,995.00 on pain of default, thereby eliminating any element of risk or contingency in the amount or timing of payment to MFS, and converting the Agreement into a criminally usurious loan bearing interest at the rate of 167% per annum. Not so. The Addendum expressly provided that the $2,995.00 Daily Payment was only “a good-faith approximation of the Specified Percentage” of 15% of Micromanos’ receipts, and that Micromanos was entitled to request a month-end reconciliation to ensure that the cumulative monthly payment did not exceed 15% of Micromanos’ receipts. Defendants’ contention that MFS was entitled under the Addendum to the $2,995.00 Daily Payment without being obliged to offer Micromanos a month-end reconciliation is founded on an incomplete and palpably misleading quotation of paragraph “d” of the Addendum.

According to Defendants, paragraph “d” states:

“The Merchant specifically acknowledges that ***the potential reconciliation*** [is] being provided to the Merchant as a courtesy, and MFS is under no obligation to provide same”.

As noted above, paragraph “d” actually states:

“The Merchant specifically acknowledges that: (I) the Daily Payment and the potential reconciliation discussed above are being provided to the Merchant as a courtesy, and that MFS is under no obligation to provide same, and (ii) if the Merchant fails to furnish the requested documentation within five (5) business days following the end of a calendar month, then MFS shall not effectuate the reconciliation discussed above.”

The Defendants’ omission fundamentally alters the meaning of paragraph “d”. Contrary to Defendants’ assertion, the gist of paragraph “d” is that the institution of the fixed Daily Payment plus month-end reconciliation mechanism as a substitute for Micromanos’ daily payment of 15% of its actual receipts was a non-obligatory courtesy. Paragraph “d” plainly does not enable MFS to require a $2,995.00 Daily Payment while concomitantly refusing Micromanos’ request for a reconciliation.

Defendants further contention that the Agreement as a matter of law eliminated all risk of hazard of nonpayment by placing Micromanos in default upon any material adverse change in its financial condition is not borne out by the language of the Agreement. Under Paragraphs 2.1 and 3.1 of the Agreement, Micromanos’ failure to report a material adverse change in its financial condition, not the adverse change itself, was defined as an event of default.

Therefore, the Secured Merchant Agreement is not on its face and as a matter of law a criminally usurious loan. Consequently, Defendants have failed to establish an exception to the general requirement that relief from a judgment entered against them upon the filing of an affidavit of confession of judgment must be sought by way of a separate plenary action.

It is therefore ORDERED, that Defendants’ motion is denied.

Alarmingly, court documents show that Micromanos attorney Amos Weinberg is relying on the same “incomplete and palpably misleading quotation” in other cases involving other merchant cash advance contracts to serve his arguments. Fortunately, in this case, the Honorable Catherine M. Bartlett compared his quotation of the contract to the actual language of the contract and saw they didn’t match up. While a decision from the Supreme Court in Orange County doesn’t mean that the matter is settled for good in New York State, it does potentially put the decision that arose from Volunteer Pharmacy on very shaky ground.

Merchant Funding Services, LLC v. Micromanos Corporation d/b/a Micromanos and Astsumassa Tochisako can be found in the New York Supreme Court under index number: EF000598-2017

System Error: Prosper Showed Incorrect Returns to Investors

May 3, 2017Investor returns weren’t what they claimed for at least seven quarters, according to a notice Prosper issued on Wednesday.

It recently came to our attention that the annualized net return numbers displayed on your account overview page were inaccurate due to a system error. This error affected the Annualized Net Return and Seasoned Net Annualized Return numbers and has now been fixed.

This error did not impact any other part of your account, including payments, deposits, monthly statements, tax documents and note and loan level information – including estimated returns.

We sincerely apologize for this error. If you have any questions, please email us at investorquestions@prosper.com.

And this was no small adjustment. On LendAcademy, Ryan Lichtenwald said his returns were adjusted from 13.55% down to 9.27%. One user on the LendAcademy forum said his returns were adjusted down from 10% to 8% and another from 14% to 7%. Yet another individual who interacted with me on twitter claims his return dropped from 10% to 1.2%. While we can’t confirm some of these accounts, Prosper’s admission and Lichtenwald’s post on LendAcademy are pretty alarming.

An old LendAcademy forum post shows users mulling over Prosper’s return calculation more than a year ago, but were unsure what to make of it.

In December 2016, the subject came up again.

That same month, Prosper hired a new CFO, Usama Ashraf.

Update: According to Bloomberg, “some of the investors that were affected saw their annual returns fall in half, but in most cases returns fell less than 2 percentage points.” A Prosper spokesperson said that the issue has been going on for several quarters.

Update 2: According to Financial Times, “The miscalculations affected a majority of Prosper’s customers and date back as far as seven quarters.”

Links to additional websites that show investors were growing suspicious of Prosper’s calculations:

Oct 2016: Prosper showing return of 8% – “What I don’t understand, is that when I look at my statements and compare account balances, I’m seeing a return of closer to 4%.”

Reactions from Prosper investors on the Internet:

“My displayed returns are now 1/2 of what they used to be.”

“I was at 16.81%. Today my account shows 9.42% – so not exactly half, but a lot.”

“Prior to the update I was somewhere close to 11%. After the correction…6.65% HAHA”

Fintech Sandbox? States, OCC Mull Regulatory Options

May 2, 2017It’s called the “New England Regulatory FinTech Sandbox.”

State banking regulators across the six New England states are exploring the creation of a regional compact that would allow financial technology companies to experiment with new and expanded products in “a safe, collaborative environment,” says Cynthia Stuart, deputy commissioner of the banking division at the Vermont Department of Financial Regulation.

Stuart asserts that she and her New England cohorts are adroitly positioned and uniquely qualified to oversee laboratories of finance. In Vermont, for example, she heads an agency that oversees regulation and examination of banks, trust companies, and credit unions as well as such nonbank financial providers as mortgage brokers, money transmitters, payday lenders and debt adjusters.

Financial watchdogs at the state level, Stuart observes, “are already witnesses to a wide breadth of financial services offerings and understand how they impact communities and consumers. As technology intersects with financial regulation,” she adds, “state regulators also appreciate the need to be open to technological innovation while balancing risk and return.”

The regional fintech sandbox is the brainchild of David Cotney, the former Massachusetts Commissioner of Banks, and Cornelius Hurley, director of Boston University’s Center for Finance, Law and Policy. The sandbox stitches together elements of Project Innovate, a development program for fintechs inaugurated by the U.K.’s banking regulator, and the European Union’s “passport” model for cross-border banking operations.

In the U.K., the Financial Conduct Authority is supporting both small and large businesses “that are developing products and services that could genuinely improve consumers’ experience and outcomes,” according to a 2015 report by the London agency. In harmonizing the regulatory regime for the sandbox across state lines of Maine, New Hampshire, Vermont, Massachusetts, Rhode Island and Connecticut, the program emulates the EU’s “passport.” Since 1989, a bank licensed in one EU country has been able to set up shop there while – thanks to the “passport” –operating seamlessly throughout the 28 states of the EU (soon to be 27 after “Brexit”).

“It’s still preliminary,” Cotney says of the proposed New England sandbox-cum-passport, “but we’ve talked to the financial regulators in all six states and there’s universal openness. Nobody want to be seen as being a barrier to innovation.”

(Barred by law from lobbying in Massachusetts, Cotney hands off the Bay State duties to Hurley while he meets with regulators and other officials in the five remaining New England states. In March, Cotney was named a director at Cross River Bank, a Fort Lee, N.J.-based, $600 million-asset community bank known for its partnerships with peer-to-peer lenders including Lending Club, Rocket Loans and Loan Depot.)

This nascent effort of financial Transcendentalism in New England is, meanwhile, taking place against the backdrop of an increasingly acrimonious battle between the Office of the Comptroller of the Currency and state banking authorities over the licensing and regulation of fintech companies. At issue is the OCC’s plan announced in a December, 2016 “whitepaper” to issue a “special purpose national bank” charter to nonbank fintechs.

Siding with the OCC are the fintechs themselves, including Lending Club, Kabbage, Funding Circle, ParityPay, WingCash. “A special purpose national bank charter for fintechs creates an opportunity for greater access to banking products, empowers a diverse and often underserved customer base, promotes efficiency in financial services, and encourages industry competition,” Kabbage wrote to the OCC in a sample industry comment to its whitepaper (which is on the agency’s website).

Also on board for the OCC’s fintech charter are powerful Washington trade associations such as Financial Innovation Now, the membership of which comprises Amazon, Apple, Google, Intuit and PayPal, and industry research organizations like the Center for Financial Services Innovation. The U.S. banking establishment also appears largely supportive of the OCC. While qualifying its imprimatur somewhat, the American Bankers Association declared that it “views the OCC’s intent to issue charters as an opportunity to further bring financial technology into the banking system…”

But an irate army of detractors is condemning the fintech charter outright. Consumer groups, small-business organizations, community banks, and state attorneys general number among the furious opposition. No cohort, however, has been more hostile to the OCC’s fintech charter than state banking regulators.

Maria T. Vullo, superintendent of New York State’s Department of Financial Services, has emerged as a firebrand. “The imposition of an entirely new federal regulatory scheme on an already fully functional and deeply rooted state regulatory landscape,” she wrote to the OCC earlier this year, “will invite serious risk of regulatory confusion and uncertainty, stifle small business innovation, create institutions that are too big to fail, imperil crucially important state-based consumer protection laws, and increase the risks presented by nonbank entities.”

Although big-state regulators from New York, California and Illinois have been in the vanguard of opposition, their unhappiness with the OCC is widely shared. Vermont regulator Stuart, who emphasizes the need for regulators “to embrace change,” nonetheless disparages the OCC’s endeavor.

“Of particular concern is the creation of an un-level playing field for traditional, full-service Vermont institutions to the advantage of the proposed nonbank charter,” she told deBanked. “The special purpose national nonbank charter would not be subject to most federal banking laws and would be regulated with a confidential OCC agreement. The disparity in regulatory approaches is concerning.”

What had been confined to a war of words – rounds of angry denunciations packed into letters and press releases directed at the OCC — reached fever-pitch last week when, on April 26, the Conference of State Banking Supervisors filed suit against the OCC in federal court. The lawsuit seeks to prevent the agency “from moving forward with an unlawful attempt to create a national nonbank charter that will harm markets, innovation and consumers,” according to a CSBS statement.

Among other things, the conference’s complaint charges that by creating a national bank charter for nonbank companies, the OCC has “gone far beyond the limited authority granted to it by Congress under the National Bank Act and other federal banking laws. Those laws,” the conference’s statement continues, “authorize the OCC to only charter institutions that engage in the ‘business of banking.’”

Under the National Bank Act, the conference’s complaint asserts, a financial institution must “at a minimum” accept deposits to qualify as a bank. By “attempting to create a new special purpose charter for nonbank companies that do not take deposits,” the complaint adds, the OCC is acting outside its legal authority.

Christopher Cole, senior regulatory counsel at the Independent Community Bankers Association – a Washington, D.C. trade association of Main Street bankers known for punching above its weight — asserts that the state banking regulators are on solid ground. “The whole question comes down to what should a bank be for purposes of a national bank charter,” he says in a telephone interview. “The Bank Holding Company Act (of 1956), federal bankruptcy laws, and tax laws – all three – define banks as insured depository institutions. It’s right there in the statutes. So our recommendation,” he says, “is for the OCC to go back to Congress” and ask for the explicit authority to create a fintech charter.

Because the OCC has “short-circuited rule-making” protocol required by another law – known as the Administrative Procedures Act — “the process hasn’t been kosher,” Cole adds.

Many members of Congress are also expressing outrage at the OCC. Not only have Democratic Senators Sherrod Brown of Ohio and Jeff Merkley of Oregon strenuously objected to the OCC’s fintech charter, but on March 10, 2017, Jeb Hensarling, the chairman of the House Financial Services Committee, fired off a “hold-your-horses” letter to Comptroller Thomas J. Curry. Signed by 34 House Republicans, the March 10 letter reminded Curry that his term of office would officially be up at the end of April, 2017, and urged him not to “rush this decision” regarding the fintech charters.

Many members of Congress are also expressing outrage at the OCC. Not only have Democratic Senators Sherrod Brown of Ohio and Jeff Merkley of Oregon strenuously objected to the OCC’s fintech charter, but on March 10, 2017, Jeb Hensarling, the chairman of the House Financial Services Committee, fired off a “hold-your-horses” letter to Comptroller Thomas J. Curry. Signed by 34 House Republicans, the March 10 letter reminded Curry that his term of office would officially be up at the end of April, 2017, and urged him not to “rush this decision” regarding the fintech charters.

“If the OCC proceeds in haste to create a new policy for fintech charters without providing the details for additional comment, or rushing to finalize the charter prior to the confirmation of a new Comptroller,” the letter from Hensarling et alia declares, “please be aware that we will work with our colleagues to ensure that Congress will examine the OCC’s actions and, if appropriate, will overturn them.”

Never mind the stern letter from Chairman Hensarling, or the fact that an impressive array of Congressmembers on both sides of the aisle are bipartisanly unhappy, or that state banking regulators’ have filed suit, or that Curry’s replacement as Comptroller is overdue: the OCC is pushing ahead. The agency will play host to a bevy of financial technology companies and other financial institutions on May 16 for two days of get-acquainted sessions in its San Francisco office.

Billed as “office hours,” the West Coast meetings will consist of one-on-one, hour-long informational meetings “to discuss the OCC’s perspective on responsible innovation,” Beth Knickerbocker, the OCC’s acting chief innovation officer, says in a press release.

The office hours, Knickerbocker adds, “are an opportunity to have candid discussions with OCC staff regarding financial technology, new products or services, partnering with a bank or fintech company, or other matters related to financial innovation.”

Back in New England, Hurley, the Boston University law professor advocating the regional sandbox, says: “No one knows where fintech is going. But one place it’s not going is away.”

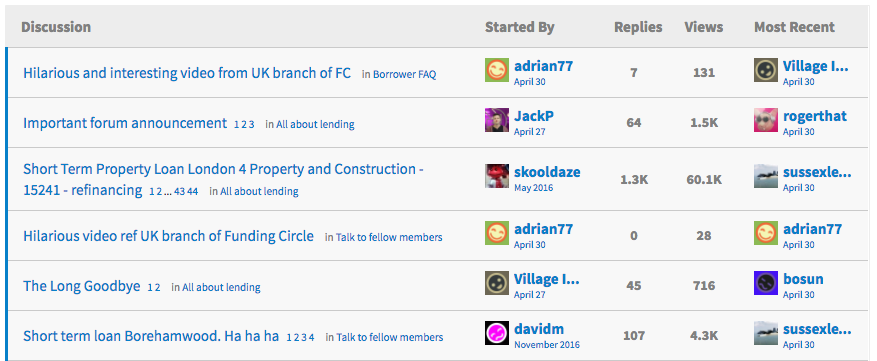

Funding Circle is Closing its Forum

May 1, 2017 One notable remaining aspect of Funding Circle’s peer-to-peer roots has been its own online forum. If you haven’t been part of that community, you’re too late, since it’s shutting down on Tuesday.

One notable remaining aspect of Funding Circle’s peer-to-peer roots has been its own online forum. If you haven’t been part of that community, you’re too late, since it’s shutting down on Tuesday.

According to a forum admin, “there has been a developing trend towards a small number of investors asking questions about a narrow range of technical topics – most of which are better dealt with through our Investor Support team. Therefore we have taken the decision to close the forum at 6pm [UK time] on Tuesday 2nd May. We hope you will all continue sharing your views on Funding Circle over on the P2P Independent Forum, which we will continue to monitor.”

One forum user jokingly theorized that the move was really about silencing investors who use the forum to complain about delinquent borrowers, going so far as to create a humorously custom-captioned movie clip.

According to P2P Finance News, a Funding Circle spokesperson said, “The closure has nothing to do with the performance of Funding Circle property development loans over the last three years which continue to outperform expectations. Investors have earned an average of seven per cent since launch and more than £22m in interest on property loans alone.”

Update 5/2: The Funding Circle Forum has officially been taken down. The URL now just redirects to a general FAQ page

Nulook Capital Bankruptcy Envelops PSC

April 27, 2017Nulook Capital was not the only casualty of its April 4th Chapter 11 bankruptcy filing. On Wednesday, April 26th, a federal judge in a separate action issued an order aimed at one of Nulook’s alleged creditors, PSC. PSC is also a Long Island-based company engaged in the merchant cash advance business.

In the order, the Honorable Arthur D. Spatt appointed a receiver for International Professional Services Inc. dba PSC and PSC Financial, granting him exclusive dominion and control over all of their assets, books, records and business affairs.

PSC was originally listed as a creditor in the Nulook bankruptcy with $400,000 owed. Another creditor however, GWG MCA Capital, Inc., argued that PSC had interfered with its first position lien and taken possession of its collateral. Alas, in the suit that GWG brought, the court found the full extent of their arguments compelling enough to appoint a receiver over PSC.

SmartBiz Loans Expands Its Footprint With a NorCal Bank

April 25, 2017Technology-based lending platform SmartBiz Loans, which is dedicated to facilitating SBA loans, has expanded its bank roster. SmartBiz announced today a new partnership with Sacramento-based Five Star Bank, bringing the tally of the number of banks on the startup’s platform to five and thrusting marketplace lending into the spotlight once again.

Five Star already delivers SBA loans to customers but through the SmartBiz platform will slash both the time and costs in the underwriting process while reaching new small business customers in the process.

Evan Singer, CEO of SmartBiz Loans, told deBanked that the mindset of the executive team at the Silicon Valley startup has always been to bring banks back into the fold and to incentivize them to fill a void in the market left by the financial crisis by originating smaller loans, in particular SBA loans.

“What we’ve seen in the market is that good businesses cannot get access to low-priced capital if they want to borrow $250,000. So sure, if they want to borrow $5 million they can get access. That’s why we came up with the idea to bring the banks back through fintech,” he said.

Five Star Bank, a privately held bank with $850 million in total assets, is pleased to be among those ranks. James Beckwith, president and CEO of Five Star Bank, was introduced to the SmartBiz technology about a year ago after which time the bank execs began the due diligence process.

“I was intrigued,” Beckwith told deBanked. “We felt the need to somehow play in the space. But we also knew it wasn’t practical for us to develop our own platform. So this was really right in our sweet spot of how we like to partner with people.”

As a result of the partnership Five Star Bank, which makes loans from its own balance sheet, is reaching small business clients the bank did not have access to before.

“Our market presence didn’t allow us to touch a lot of these businesses before, whether from Los Angeles, or Arizona, or San Jose. It’s really people we were unable to touch now being touched through the SmartBiz partnership,” said Beckwith, adding that the small businesses span industry verticals.

“At this point we’re looking at deals in the Western United States and we hope to expand that. The small businesses are really all types – construction companies, PR firms, consulting firms, — there’s no concentration in terms of industry type,” he noted.

The bank’s target customer is seeking a loan for $350,000 or less and the average loan size is $250,000 to $270,000. Terms of an SBA loan on this platform are comprised of a rate of Prime plus 2.75 over a 10-year period.

“The term is much longer and the rate is much lower than traditional loans. Small businesses can save thousands of dollars per month by getting an SBA loan through the SmartBiz and Five Star partnership,” said Singer. In fact, Five Star bank spends about one-tenth of the time on a file or customer originating from SmartBiz than it would on a customer coming from the traditional retail side of their business.

Industry Shakeout

Much of the fallout in the marketplace lending market segment has been tied to the stigma of subprime lending. Beckwith is quick to point out, however, that the underwriting standards for the loans on this platform, which are agreed upon by both Five Star and SmartBiz, are high.

“If you look at some of the average FICO scores we are doing, they are actually good deals. They’re SBA, they’re not subprime deals. I would not characterize them as subprime deals at all,” Beckwith said.

Meanwhile the marketplace lending segment has undoubtedly become more crowded in recent years, attracting the likes of lenders and non-lenders alike, evidenced by the participation of Amazon and Square Capital in this space, for instance.

According to Singer some industry shakeout can be expected in the near term. He expects over the next couple of years that those marketplace lenders and other alternative lenders unable to meet customer demands will either experience a wave of consolidation or they simply won’t be around any longer.

“We are already starting to see a number of our loan proceeds being used to refinance expensive shorter-term debt where they save thousands per month. Businesses are getting smarter with available options and folks that are able to best meet and deliver with small businesses on their minds first are going to come out on top,” said Singer.

SBA 7(a) Cap

As a technology platform dedicated to SBA loans, the issue of the program’s annual allotted cap is something that gets revisited on an ongoing basis. Nonetheless even when the SBA program has come close to suspension, Congress has stepped in to keep it afloat.

“The great thing about SBA is that it has support from both sides of the aisle in D.C. We’ll see what happens this year,” said Singer.

James agrees. “Every year that this becomes an issue the cap has been increased. I feel comfortable that what has happened in the past will happen again in the future because these programs are very viable. The small business space has very strong economic development activity.”

If they’re right this bodes well not only for the Smart Biz and Five Star partnership but also the new banks that the tech-based lender has in its pipeline.

“We are adding banks into the marketplace. And we’re selective about who we add,” Singer said.