Business Lending

Fintech Startup BlueVine Raises $49 Million in Series D Funding

December 14, 2016- The company has provided more than $200M in financing to thousands of businesses

- In response to customer demand BlueVine is increasing credit lines to $2 million for invoice factoring and $100,000 for business lines of credit

- Company is expanding strategic relationships with partners like Intuit

REDWOOD CITY, Calif. (December 14, 2016) BlueVine, a leading online provider of everyday financing to small businesses, announced today it has closed $49 million in funding. The Series D funding round was led by existing investors, including Lightspeed Venture Partners, Menlo Ventures, 83North, Citi Ventures, Rakuten FinTech Fund and Silicon Valley Bank.

Since launching in March 2014, BlueVine’s cloud-based financing solutions have helped thousands of small businesses obtain quick, easy access to the funds they need to purchase inventory, cover expenses and expand operations.

We are very proud of all we’ve accomplished in 2016 and excited to continue on our incredible growth trajectory, said Eyal Lifshitz, CEO and founder of BlueVine. BlueVine is delivering unprecedented ease and convenience to meet SMB owners¹ financing needs and help them achieve their goals.

This financing will support BlueVine’s rapid growth as it expands its team and range of offerings. BlueVine has already funded more than $200 million in working capital for SMBs and is on track to fund more than $500 million in working capital during 2017.

This team continues to push the pace of innovation to deliver best-in-class everyday financing products, said Yoni Cheifetz of Lightspeed Venture Partners. We are delighted to have supported BlueVine’s journey to date and thrilled to enable them to bring their vision to thousands more SMBs across the country.

BlueVine’s business line of credit has proven to be very popular with QuickBooks users, said Rania Succar, business leader of QuickBooks Financing. It fills a critical part of the QuickBooks Financing portfolio and allows us to extend credit to younger businesses. We are excited about expanding our partnership to serve even more QuickBooks SMBs with BlueVine’s business line of credit.

BlueVine also announced it has once again increased its maximum credit lines based on client demand:

- For invoice factoring the maximum credit limit has been increased from $250,000 to $2,000,000

- For the business line of credit the maximum credit limit has been increased from $50,000 to $100,000

BlueVine offers credit lines starting at $5,000 for a business line of credit and $20,000 for invoice factoring.

About BlueVine

BlueVine offers small businesses financing solutions to access the funds they need to purchase inventory, cover expenses or expand operations. BlueVine was the first factoring company to develop a fully online, cloud-based platform for invoice factoring, enabling rapid advances on outstanding invoices due in 7-90 days and bringing a 4,000-year-old industry into the digital age. BlueVine also offers Flex Credit, an on-demand, revolving line of credit through the same online platform. With BlueVine, business owners can focus on growing their business instead of worrying about their bank account. BlueVine is funded by Lightspeed Venture Partners, Citi Ventures, 83North, Correlation Ventures, Menlo Ventures, Rakuten Fintech Fund and other private investors.

About Lightspeed Venture Partners

Lightspeed Venture Partners is an early stage venture capital firm focused on accelerating disruptive innovations and trends in the Enterprise and Consumer sectors. Over the past two decades, the Lightspeed team has backed hundreds of entrepreneurs and helped build more than 300 companies globally. The Firm currently manages over $4 billion of committed capital and invests in the U.S. and internationally, with investment professionals and advisors in Silicon Valley, Israel, India and China. www.lsvp.com

Press Contact

Amberly Asay

BlueVine Public Relations

801-461-9776

bluevine@methodcommunications.com

Fifth Third Bank/ApplePie Capital Deal Great, But Bank Deals For Many Other Business Lenders Still a Pie in the Sky

December 13, 2016 Fifth Third Bank is buying a stake in franchise marketplace lender ApplePie Capital as part of a $16.5 million venture round, the WSJ reported. The prediction that non-banks are evolving into banks is slowly coming true, but will the trend in the commercial space continue?

Fifth Third Bank is buying a stake in franchise marketplace lender ApplePie Capital as part of a $16.5 million venture round, the WSJ reported. The prediction that non-banks are evolving into banks is slowly coming true, but will the trend in the commercial space continue?

Consider that ApplePie has only made 120 loans over the last two years, a small piece of pie compared to a company like CAN Capital which has made nearly 200,000 loans and advances since inception. But ApplePie and CAN are not competitors, nor is ApplePie really like the rest of the industry that has long proclaimed that banks can’t profitably make small business loans under $250,000 or lend to borrowers with poor credit history. Instead, ApplePie’s model, terms and customers have always had a common synergy with banks, $420k loans (on average) for up to 7 years to franchise owners at 8.62% APR (on average) and 750 FICO (on average). It’s a borrower profile that has literally resulted in zero defaults for ApplePie so far, though it’s still early days. Business owners can get term-sheets in 5 days and funding in approximately 30 days. Sounds mighty bankish to me.

ApplePie’s loans are even issued by a New Jersey State chartered commercial bank, Cross River Bank. But ApplePie is the platform, using technology to draw attention to franchise owners in need of financing, streamlining the process and providing a way for investors to participate in the deals. Denise Thomas, the company’s CEO and co-founder told the WSJ that banks’ costs are now too high to make $420,000 loans. That might be true but one wonders if such loans should be done over such a long period of time and at such low rates, especially considering that their borrowers are not asked to put up any personal collateral.

Another lender that tried their hand at prime small business borrowers closed their doors last month. In an op-ed penned by Candace Klein of the now defunct Dealstruck, she said of moving away from the mid-prime borrower to prime, “yields began to tighten. Lenders stopped making a profit and backend capital began to question whether there was a ‘there’ there after all.”

But whereas Dealstruck was constrained by their cost of capital, a bank could potentially make it work. One pitfall that ApplePie has however is limited time in business. It’s easy to claim no defaults on loans with 70 month terms (on average) when you have only been business for two years. Even still, it’s not hard to see why a bank would be interested in their particular model. The vast majority of non-bank small business funding companies operate in a totally different universe, with smaller loans, poorer credit, shorter terms and faster service. These are the ones typically associated with fintech, seeing as they have been able to make tens of thousands or hundreds of thousands of loans in a short amount of time. If that market was as easy as pie though, banks probably would’ve forged more partnerships by now.

Alternative Funders Bid Adieu to 2016, Show Renewed Optimism for 2017

December 12, 2016

After getting pummeled in 2016, many alternative funders have licked their wounds and are flexing their muscles to go another round in 2017.

“The industry didn’t implode or go away after some fairly negative headlines earlier in the year,” says Bill Ullman, chief commercial officer of Orchard Platform, a New York-based provider of technology and data to the online lending industry. “While there were definitely some industry and company-specific challenges in the first half of the year, I believe the online lending industry as a whole is wiser and stronger as a result,” he says.

Certainly, 2016 saw a slowdown in the rapid rate of growth of online lenders. The year began with slight upticks in delinquency rates at some of the larger consumer originators. This was followed by the highly publicized Lending Club scandal over questionable lending practices and the ouster of its CEO. Consumers got spooked as share prices of industry bellwethers tumbled and institutional investors such as VCs, private equity firms and hedge funds curbed their enthusiasm. Originations slowed and job cuts at several prominent firms followed.

Despite the turmoil, most players managed to stay afloat, with limited exceptions, and brighter times seemed on the horizon toward the end of 2016. Institutional investors began to dip their toes back into the market with a handful of publicly announced capital-raising ventures. Loan volumes also began to tick up, giving rise to renewed optimism for 2017.

Notably, in the year ahead, market watchers say they anticipate modest growth, a shift in business models, consolidation, possible regulation and additional consumer-focused initiatives, among other things.

MARKETPLACE LENDERS REDEFINING THEMSELVES

Several industry participants expect to see marketplace lenders continue to refocus after a particularly rough 2016. Some had gone into other businesses, geographies and products that they thought would be profitable but didn’t turn out as expected. They got overextended and began getting back to their core in 2016. Others realized, the hard way, that having only one source of funding was a recipe for disaster.

“Business models are going to evolve quite substantially,” says Sam Graziano, chief executive officer and co-founder of Fundation Group, a New York-based company that makes online business loans through banks and other partners.

For instance, he predicts that marketplace lenders will move toward using their balance sheet or some kind of permanent capital to fund their loan originations. “I think that there will be a lot fewer pure play marketplace lenders,” he says.

Indeed, some marketplace lenders are starting to take note that it’s a bad idea to rely on a single source of financing and are shifting course. Some companies have set up 1940-Act funds for an ongoing capital source. Others have considered taking assets on balance sheet or securitizing assets.

“The trend will accelerate in 2017 as platforms and investors realize that it’s absolutely necessary for long-term viability,” says Glenn Goldman, chief executive of Credibly, an online lender that caters to small-and medium-sized businesses and is based in Troy, Michigan and New York.

BJ Lackland, chief executive of Lighter Capital, a Seattle-based alternative lender that provides revenue-based start-up funding for tech companies, believes that more online lenders will start to specialize in 2017. This will allow them to better understand and serve their customers, and it means they won’t have to rely so heavily on speed and volume—a combination that can lead to shady deals. “I don’t think that the big generalist online lenders will go away, just like payday lending is not going to go away. There’s still going to be a need, therefore there will be providers. But I think we’ll see the rise of online lending 2.0,” he says.

Despite the hiccups in 2016, Peter Renton, an avid P2P investor who founded Lend Academy to teach others about the sector, says he is expecting to see steady and predictable growth patterns from the major players in 2017. It won’t be the triple-digit growth of years past, but he predicts investors will set aside their concerns from 2016 and re-enter the market with renewed vigor. “I think 2017 we’ll go back to seeing more sustainable growth,” he says.

THE CONSOLIDATION EQUATION

Ron Suber, president of Prosper Marketplace, a privately held online lender in San Francisco, says victory will go to the platforms that were able to pivot in 2016 and make hard decisions about their businesses.

Prosper, for example, had a challenging year and has now started to refocus on hiring and growth in core areas. This rebound comes after the company said in May that it was trimming about a third of its workforce, and in October it closed down its secondary market for retail investors. Suber says business started to pick up again after a low point in July. “Business has grown in each of the subsequent months, so we are back to focused growth and quality loan production,” he says.

Not long after he said this, Prosper’s CEO, Aaron Vermut, stepped down. His father, Stephan Vermut, also relinquished his executive chairman post, a sign that attempts to recover have come at a cost.

Other platforms, meanwhile, that haven’t made necessary adjustments are likely to find that they don’t have enough equity and debt capital to support themselves, industry watchers say. This could lead to more firms consolidating or going out of business.

The industry has already seen some evidence of trouble brewing. For instance, online marketplace lender Vouch, a three-year-old company, said in June that it was permanently shuttering operations. In October, CircleBack Lending, a marketplace lending platform, disclosed that they were no longer originating loans and would transfer existing loans to another company if they couldn’t promptly find funding. And just before this story went to print, Peerform announced that they had been acquired by Versara Lending, a sign that consolidation in the industry has come.

The industry has already seen some evidence of trouble brewing. For instance, online marketplace lender Vouch, a three-year-old company, said in June that it was permanently shuttering operations. In October, CircleBack Lending, a marketplace lending platform, disclosed that they were no longer originating loans and would transfer existing loans to another company if they couldn’t promptly find funding. And just before this story went to print, Peerform announced that they had been acquired by Versara Lending, a sign that consolidation in the industry has come.

“I think you will see the real start of consolidation in the space in 2017,” says Stephen Sheinbaum, founder of New York-based Bizfi, an online marketplace. While some deals will be able to breathe life into troubled companies, others will merge to produce stronger, more nimble industry players, he says. “With good operations, one plus one should at least equal three because of the benefits of the economies of scale,” he says.

Market participants will also be paying close attention in 2017 to new online lending entrants such as Goldman Sachs’ with its lending platform Marcus. Ullman of Orchard Platform says he also expects to see more partnerships and licensing deals. “For smaller, regional and community banks and credit unions—organizations that tend not to have large IT or development budgets—these kinds of arrangements can make a lot of sense,” he says.

A BLEAKER MCA OUTLOOK

Meanwhile, MCA funders are ripe for a pullback, industry participants say. MCA companies are now a dime a dozen, according to industry veteran Chad Otar, managing partner of Excel Capital Management in New York, who believes new entrants won’t be able to make as much money as they think they will.

Paul A. Rianda, whose Irvine, California-based law firm focuses on MCA companies, likens the situation to the Internet boom and subsequent bust. “There’s a lot of money flying around and fin-tech is the hot thing this time around. Sooner or later it always ends.”

In particular, Rianda is concerned about rising levels of stacking in the industry. According to TransUnion data, stacked loans are four times more likely to be the result of fraudulent activity. Moreover, a 2015 study of fintech lenders found that stacked loans represented $39 million of $497 million in charge-offs.

Although Rianda does not see the situation having far-reaching implications as say the Internet bubble or the mortgage crisis, he does predict a gradual drop off in business among MCA players and a wave of consolidation for these companies.

“I do not believe that the current state of some MCA companies taking stacked positions where there are multiple cash advances on a single merchant is sustainable. Sooner or later the losses will catch up with them,” he says.

Rianda also predicts that the decrease of outside funding to related industries could have a spillover effect on MCA companies, causing some to cut back operations or go out of business. “Some companies have already seen decreased funding in the lending space and subsequent lay off of employees that likely will also occur in the merchant cash advance industry,” he says.

THE REGULATORY QUESTION MARK

One major unknown for the broader funding industry is what regulation will come down the pike and from which entity. The Office of the Comptroller of the Currency that regulates and supervises banks has raised the issue of fintech companies possibly getting a limited purpose charter for non-banks. The OCC also recently announced plans to set up a dedicated “fintech innovation office” early in 2017, with branches in New York, San Francisco and Washington.

There’s also a question of the CFPB’s future role in the alternative funding space. Some industry participants expect the regulator to continue bringing enforcement actions against companies. In September, for instance, it ordered San Francisco-based LendUp to pay $3.63 million for failing to deliver the promised benefits of its loan products. Ullman of Orchard Platform says he expects the agency to continue to play a role in the future of online lending, particularly for lenders targeting sub-prime borrowers.

Meanwhile, some states like California and New York are focusing more efforts on reining in online small business lenders, and it remains to be seen where this trend takes us in 2017.

MORE CONSUMER-FOCUSED INITIATIVES ON HORIZON

As the question of increased regulation looms, some industry watchers expect to see more industry led consumer-focused initiatives, an effort which gained momentum in 2016. A prime example of this is the agreement between OnDeck Capital Inc., Kabbage Inc. and CAN Capital Inc. on a new disclosure box that will display a small-business loan’s pricing in terms of total cost of capital, annual percentage rates, average monthly payment and other metrics. The initiative marked the first collaborative effort of the Innovative Lending Platform Association, a trade group the three firms formed to increase the transparency of the online lending process for small business owners.

Katherine C. Fisher, a partner with Hudson Cook LLP, a law firm based in Hanover, Maryland, that focuses on alternative funding, predicts that more financers will focus on transparency in 2017 for competitive and anticipated regulatory reasons. Particularly with MCA, many merchants don’t understand what it means, yet they are still interested in the product, resulting in a great deal of confusion. Clearing this up will benefit merchants and the providers themselves, Fisher notes. “It can be a competitive advantage to do a better job explaining what the product is,” she says.

CAPITAL-RAISING WILL CONTINUE TO POSE CHALLENGES

CAPITAL-RAISING WILL CONTINUE TO POSE CHALLENGES

Although there have been notable examples of funders getting the financing they need to operate and expand, it’s decidedly harder than it once was. Renton of Lend Academy says that some institutional investors will remain hesitant to fund the industry, given its recent troubles. “It’s a valuation story. While valuations were increasing, it was relatively easy to get funding,” he says. However, industry bellwethers Lending Club and OnDeck are both down dramatically from their highs and concerns about their long-term viability remain.

“Until you get sustained increases in the valuation of those two companies, I think it’s going to be hard for others to raise money,” Renton says.

Several years ago, alternative funders were new to the game and gained a lot of traction, but it remains to be seen whether they can continue to grow profits amid greater competition and the high cost of obtaining capital to fund receivables, according to William Keenan, chief executive of Pango Financial LLC, an alternative funding company for entrepreneurs and small businesses in Wilmington, Delaware.

These companies continue to need investors or retained earnings and for some companies this is going to be increasingly difficult. “How they sustain growth going forward could be a challenge,” he says. Even so, Renton remains bullish on the industry—P2P players especially. “The industry’s confidence has been shaken. There have been a lot of challenges this year. I think many people in the industry are going to be glad to put 2016 to bed and will look with renewed optimism on 2017,” he says.

Prior to this story going to print, small business lender Dealstruck was reportedly not funding new loans and CAN Capital announced that three of the company’s most senior executives had stepped down.

OnDeck Announces New $200 Million Revolving Credit Facility with Credit Suisse

December 9, 2016

NEW YORK, Dec. 9, 2016 /PRNewswire/ — OnDeck® (NYSE: ONDK), the leader in online lending for small business, announced today the closing of a $200 million asset-backed revolving debt facility with Credit Suisse.

In addition to its other funding sources, OnDeck may now obtain funding under the new credit facility with Credit Suisse, subject to customary borrowing conditions, by accessing $125 million of committed capacity and an additional $75 million of capacity available at the discretion of the lenders.

“OnDeck has emerged as a leading provider of growth capital to small businesses around the country,” said Jon-Claude Zucconi, Managing Director, Credit Suisse. “The team’s innovative vision and commitment to financing is vital to expansion and growth in the small business community.”

Under the facility, loans will be made to Prime OnDeck Receivable Trust II, LLC, or PORT II, a wholly-owned subsidiary of OnDeck, to finance PORT II’s purchase of small business loans from OnDeck. The revolving pool of small business loans purchased by PORT II serves as collateral under the facility. OnDeck is acting as the servicer for such small business loans. The Class A Loans under the facility were rated by DBRS, Inc.

OnDeck intends to initially use a portion of this facility, together with other available funds, to optionally prepay in full without penalty or premium, the existing $100 million Prime OnDeck Receivable Trust, LLC facility which was scheduled to expire in June 2017. As a result, OnDeck will benefit from obtaining additional funding capacity through December 2018.

OnDeck intends to initially use a portion of this facility, together with other available funds, to optionally prepay in full without penalty or premium, the existing $100 million Prime OnDeck Receivable Trust, LLC facility which was scheduled to expire in June 2017. As a result, OnDeck will benefit from obtaining additional funding capacity through December 2018.

“This transaction marks a continuation of our financing strategy to diversify funding sources, extend debt maturities, and create additional funding capacity to pave the way for future loan growth,” said Howard Katzenberg, Chief Financial Officer, OnDeck. “We are pleased to have Credit Suisse, a leading global financial institution, support OnDeck in our mission to power the growth of small business through lending technology and innovation.”

About OnDeck

OnDeck (NYSE: ONDK) is the leader in online small business lending. Since 2007, the company has powered Main Street’s growth through advanced lending technology and a constant dedication to customer service. OnDeck’s proprietary credit scoring system – the OnDeck Score® – leverages advanced analytics, enabling OnDeck to make real-time lending decisions and deliver capital to small businesses in as little as 24 hours. OnDeck offers business owners a complete financing solution, including the online lending industry’s widest range of term loans and lines of credit. To date, the company has deployed over $5 billion to more than 60,000 customers in 700 different industries across the United States, Canada, and Australia. OnDeck has an A+ rating with the Better Business Bureau and operates the educational small business financing website BusinessLoans.com.

For more information, please visit www.ondeck.com.

About Credit Ratings

Credit ratings are opinions of the relevant rating agency. They are not facts and are not opinions of OnDeck. They are not recommendations to purchase, sell or hold any securities and can be changed or withdrawn at any time.

Safe Harbor Statement

This press release contains “forward-looking statements” within the meaning of the private Securities Litigation Reform Act of 1995 and other legal authority. Forward-looking statements include statements about the intended use of proceeds from the new facility and expected optional repayment in full of the existing facility, the extension of debt maturities and the availability of additional funding capacity, all of which are dependent upon compliance with the borrowing and other conditions of the new facility, as well as information concerning OnDeck’s business plans and objectives and financing plans including future loan growth. Forward-looking statements can also be identified by words such as “will,” “enables,” “expects”, “may,” “allows,” “continues,” “believes,” “intends,” “anticipates,” “estimates” or similar expressions. Forward-looking statements are neither historical facts nor assurances of future performance. They are based only on OnDeck’s current beliefs, expectations and assumptions regarding the future of its business, anticipated events and trends, the economy and other future conditions. Moreover, OnDeck does not assume responsibility for the accuracy and completeness of forward-looking statements. As such, they are subject to inherent uncertainties, changes in circumstances, known and unknown risks and other factors that are difficult to predict and in many cases outside OnDeck’s control.

As a result, you should not rely on any forward-looking statements. OnDeck’s expected results may not be achieved, and actual results may differ materially from OnDeck’s expectations. Important factors that could cause actual results to differ from OnDeck’s forward-looking statements are the risks that OnDeck may not be able to manage its anticipated or actual growth effectively, that its credit models do not adequately identify potential risks, and other risks, including those under the heading “Risk Factors” in OnDeck’s Annual Report on Form 10-K for the year ended December 31, 2015, Quarterly Report on Form 10-Q for the quarter ended September 30, 2016 and in other documents that OnDeck files with the Securities and Exchange Commission, or SEC, from time to time which are available on the SEC website at www.sec.gov. OnDeck undertakes no obligation to publicly update any forward-looking statements for any reason after the date of this press release to conform these statements to actual results or to changes in OnDeck’s expectations, except as required by law.

OnDeck, the OnDeck logo and OnDeck Score are trademarks of On Deck Capital, Inc.

Logo – http://photos.prnewswire.com/prnh/20150812/257781LOGO

SOURCE On Deck Capital, Inc.

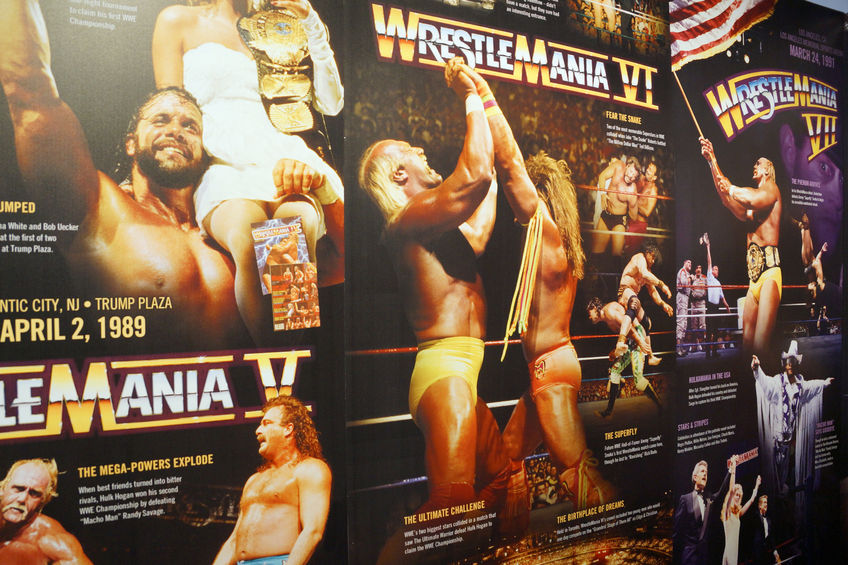

SBA ‘SmackDown’ In Linda McMahon, As Pick for Administrator Brings More WWE to Small Business Funding

December 8, 2016

President-Elect Trump’s pick to head the Small Business Administration is Linda McMahon, the former CEO of World Wrestling Entertainment (WWE). The publicly-traded company has produced many household names over the years, from The Undertaker to Bret “The Hitman” Hart to The Rock.

In a public announcement, Trump said “Linda has a tremendous background and is widely recognized as one of the country’s top female executives advising businesses around the globe. She helped grow WWE from a modest 13-person operation to a publicly traded global enterprise with more than 800 employees in offices worldwide.”

If confirmed by the Senate, McMahon will succeed Maria Contreras-Sweet, who has held the position since 2014 and has had a pretty open attitude about online lenders. The former WWE exec taking her place might find even more common ground with the non-bank finance community given that Bret the Hitman Hart is the official spokesperson for a merchant cash advance company.

Sharpshooter Funding in Canada, which heavily features Hart in their marketing campaigns, is affiliated with First Down Funding, a US-company that also does small business funding. A joint-company press release from earlier this year quotes Hart as saying, “When you sit down and listen to the whole format and how it provides money to much needed businesses and small business owners that need financial support and extra funding. It’s a worthwhile endeavor, and I’m actually very grateful that Paul Pitcher involved me with it so far.”

Meanwhile, McMahon says she is up to the task. “Our small businesses are the largest source of job creation in our country,” she said in an announcement. “I am honored to join the incredibly impressive economic team that President-elect Trump has assembled to ensure that we promote our country’s small businesses and help them grow and thrive.”

LendingMania might be just around the corner in 2017.

New deBanked Magazine Issue is On The Way

December 7, 2016

The Nov/Dec issue of deBanked magazine is on the way! Can you guess who is on the cover? Hint: his face is blurred out in this image so you can’t cheat!

This edition closes the end of 2016, celebrates the journey of an industry veteran, recaps late fall conferences, and reveals new clues and details into a former industry player’s devilish fall from grace.

Stay on top of the industry and finish out the year with our latest major stories that are released in print well before they’re online. If you’re not already subscribed to deBanked Magazine, register now for FREE!

Barbara Corcoran, OnDeck Contest Final Aired on Rachael Ray Show

December 6, 2016The OnDeck “Seal of Approval” contest led by company spokesperson Barbara Corcoran recently came down to one final challenge and the results were aired on the Rachael Ray Show on Tuesday.

Three small businesses were featured and each won $10,000 paid for by OnDeck. Corcoran couldn’t mention the company enough times. This kind of collaboration and publicity is probably the best kind of marketing an alternative lender can get, not to mention a great opportunity for small businesses. Watch the TV segment of it below:

Not loading? Click here

SmartBiz Loans Ranked Number One Provider of Traditional SBA 7(a) Loans Under $350,000

December 5, 2016SAN FRANCISCO, CA – December 5, 2016 – SmartBiz Loans, the first SBA marketplace and bank-enabling technology platform, has ranked as the number one provider of non-Express, SBA 7(a) loans under $350,000 for the 2016 government fiscal year. SmartBiz also ranked number five among providers of under $350,000 traditional SBA 7(a) and Express 7(a) loans combined.

“SmartBiz’s success in this year’s SBA 7(a) ranking demonstrates how technology can support banks in meeting the needs of small businesses,” said Evan Singer, CEO of SmartBiz Loans. “SmartBiz is committed to creating the leading marketplace for both banks and small business owners, by matching small business owners with the bank best suited to their needs and enabling a higher percentage of SBA loans to be approved.”

SmartBiz generated $200 million in funded SBA 7(a) loans through its bank lending partners, which helped them earn the top spot. The data used is based on SBA lending data released in November, reflecting its 2016 fiscal year which ended on Sept. 30. Wells Fargo Bank, which was ranked just below SmartBiz, generated $155 million in funded non-Express SBA 7(a) loans under $350,000. This is the first time a technology platform and marketplace has achieved the number one position in SBA’s ranking of 7(a) loans.

“Small businesses are the driving force of the economy,” said Ann Marie Mehlum, retired Associate Administrator, Office of Capital Access, U.S. Small Business Administration. “By supporting them, the SBA and lending partners like SmartBiz are investing in the economy as a whole.”

SmartBiz is revolutionizing SBA lending. Its marketplace helps increase approval rates by automatically directing businesses to the right lender, while its advanced software streamlines the SBA loan application, underwriting and origination process. In this way, SmartBiz fills a critical gap in the small business loan market and enables small businesses nationwide to grow without settling for the sky-high rates of alternative online lenders or undergoing the typically slow and tedious traditional bank process.

About SmartBiz Loans

SmartBiz Loans is a unique combination of an online SBA loan marketplace and a bank enabling technology platform. The company’s online software provides SBA preferred lenders customized and automated origination, underwriting and documentation, making approval and funding fast and easy. Sophisticated algorithmic sorting in the SmartBiz marketplace also enables higher approval rates for small businesses because the right applications are automatically directed to the right bank. SmartBiz is based in San Francisco and was founded in 2009 by a team of experienced financial services entrepreneurs with backing from leading venture capital firms including Investor Growth Capital, Venrock, First Round Capital, Baseline Ventures, and SoftTech VC. Learn more at www.smartbizloans.com.