Archive for 2021

Lenders, Funders Look to Expand as 2021 Heads Into Final Stretch

September 14, 2021 As the year ends, lenders and funders across the globe are looking to meet goals, help businesses, and close the books on some of the most unpredictable months the industry has ever seen. Whether it comes to improving technology, hiring more staff, or creating completely new concepts on how to do business, any company worth its salt isn’t just going to be content with just staying stagnant.

As the year ends, lenders and funders across the globe are looking to meet goals, help businesses, and close the books on some of the most unpredictable months the industry has ever seen. Whether it comes to improving technology, hiring more staff, or creating completely new concepts on how to do business, any company worth its salt isn’t just going to be content with just staying stagnant.

“Our main goal for this year’s end is to scale our small business loan and MCA deal flow in order to maximize our syndication opportunities, which we want to overtake commission as our primary revenue stream,” said Zack Fiddle, President of CapFront. “We’ve already built a robust CRM and marketing automation system over the past year, we have great people and a proven process and product, and we just moved to a much larger space.”

From a brand-new office in Garden City, Fiddle seems to be expanding his company on multiple fronts. “The next step for us is hiring more support staff and more account managers to handle more leads from increased media [spending] and more referrals from our various business development channels,” he said.

Other fintech brands are looking to come up with new ideas surrounding borrowing. “We are coming out with a special lawyer loan,” said Justin Leto, co-founder and CEO of Miami-based Idea Financial, whose recent announcement about LevelEsq will allow the firm to divi out loans to attorneys who wait to get paid until when —or if — their client wins. “We’ll have the only insurance product that is available on the market that will cover the downside risk that the case [the attorney] is borrowing on goes to trial and loses.”

“It’s a really exciting time here at Idea Financial because we are able to leverage a lot of our existing resources and expertise to enter an entirely new market, which is legal lending,” said Larry Bassuk, co-Founder and President of Idea Financial.

Other firms are taking the current political and social climates into consideration when it comes to their end-of-year plans. “[We’ll] be analyzing risk a little more in case there is another lockdown,” said Drew Matthew, CEO of Infusion Capital Group. The two-person firm doesn’t plan to expand their staff too much going into the new year, but Matthew did flirt with the idea of bringing on an ISO-rep as his business expands.

“I think we’re going to pick up dramatically,” said Matthew when asked about the number of his future clients. “Once there’s no more [covid restrictions], SBA money, or no more fear of another pandemic shutdown, no matter what [we charge], the small businesses in America need us.”

This risk and surrounding political climate have no influence on the location of Infusion Capital’s offices in the future. “I know everyone is going down to Florida, but not us,” said Matthew. “New York or nowhere, baby.”

As seasons change and the year ticks its final months, lenders, much like the businesses they support, are looking to find the next best way to edge out competitors while offering the best product and services for their customers.

Media, Market Duped Again in Fintech Fake News

September 13, 2021 Multiple media outlets fell victim to a major hoax Monday morning, after GlobeNewsWire claimed that Walmart was beginning to accept Litecoin as tender for purchases in its stores. The wire seemed legit — a formally structured release from a credible source that was packed with quotes form Walmart’s CEO Doug McMillon about the company’s apparent move.

Multiple media outlets fell victim to a major hoax Monday morning, after GlobeNewsWire claimed that Walmart was beginning to accept Litecoin as tender for purchases in its stores. The wire seemed legit — a formally structured release from a credible source that was packed with quotes form Walmart’s CEO Doug McMillon about the company’s apparent move.

With a bad link on the release alongside silence of the supposed partnership on Walmart’s end, skeptics quickly realized that no move was ever in the works. After denying the validity of the release, tons of major outlets began scurrying to announce the hoax.

The motive may have been to artificially inflate Litecoin, as it shot up 35% minutes after outlets ran with the story.

This is eerily like one of the industry’s most infamous hoaxes, when the news service known as Internet Wire made headlines for the wrong reasons back in 2000. Then 23-year old Mark Jakob was out almost $100,000 after shorting stock for the Emulex Corporation, which he attempted to recoup by writing a fake press release stating that the company was going to restate quarterly earnings as losses, and their CEO was quitting the company. Jakob was a former employee of Internet Wire and a community college student at the time.

His faux release resulted in Emulex losing over $2 billion in market cap, while Jakob netted almost a quarter of a million dollars to cover his shorts and then some.

Jakob later pled guilty to creating the fake release in order to cover his shorts. He earned himself over 40 months behind bars, forfeited all of his earnings, and was handed a 6-figure penalty for his actions.

Then there was PRWeb’s publishing of a press release that falsely stated that Google had made a $400 million deal to purchase a Rhode Island- based wireless hotspot provider in 2012, which made the provider’s shares jump dramatically. Many major media outlets took PRWeb at their word and ran with the story. It was later discovered that the release was completely bogus and had come from a Gmail account that had originated in Aruba.

Reporting with one hundred percent accuracy is difficult. Information updates, numbers fluctuate, and deadlines loom. Vetting sources is an integral part of being a quality journalist, but even the best can get fooled, turning perceived truth into a manipulated consensus of reality.

In fintech news however, these hoaxes aren’t just blurring facts and changing narratives, they could result in the moving of billions of dollars around the market before the deception is revealed.

More TCPA Lawsuits Could be Inbound

September 12, 2021 Despite a significant drop in TCPA cases since 2018, a flurry of new TCPA cases could be on the horizon as TCPA plaintiff attorneys had been telling clients to hold off — pending the reaction of Facebook’s recent Supreme Court case, according to Michael O’Hare, Chairman of Colorado-based Cashyew and operator of the TCPA Litigator List. The Court ultimately narrowed the definition of an autodialer.

Despite a significant drop in TCPA cases since 2018, a flurry of new TCPA cases could be on the horizon as TCPA plaintiff attorneys had been telling clients to hold off — pending the reaction of Facebook’s recent Supreme Court case, according to Michael O’Hare, Chairman of Colorado-based Cashyew and operator of the TCPA Litigator List. The Court ultimately narrowed the definition of an autodialer.

O’Hare heads a service that provides names of individuals and their attorneys who have sued under the TCPA law, protecting his clients from what has become an industry in and of itself.

“It’s a fight between free speech and privacy,” said O’Hare, when asked what the hardest part about leading an organization that protects businesses from falling victim to these kinds of suits is. He worries that his clients will be preyed upon by serial litigators that go after businesses searching for some type of settlement. According to O’Hare, some of these cases can cost tens of thousands of dollars to fight in court.

“The government has empowered citizens to become the enforcer,” said O’Hare. The law allows citizens to privately sue unsolicited callers who disrupt their daily lives, subsequently creating an entire industry out of these kinds of suits alone.

“People are making a 6-figure living,” he said.

Since deBanked covered this minefield back in 2016, the TCPA has not changed. Some states like Florida and California have adopted their own versions of the law, but the federal law has gone unchanged for thirty years.

The robocallers have also adapted to the lack of upkeep of the TCPA, as the concept of “spoofing” has become a weird ethical gray area in the telemarketing industry. By showing the area code that’s identical to the number being dialed on that number’s caller ID, the user is believed to be more likely to answer. Not covered by the TCPA, organizations like the FCC have begun to step in and put a stop to the tactic.

This “decentralization of enforcement,” as O’Hare called it, may do more harm than good, giving these serial litigators and their clients more avenues of reason to sue.

The ambiguity of what defines a work phone versus a personal phone is much more prevalent now than it was in 1991. With cell phones, smart watches, and the elimination of the home phone for millions of Americans, the TCPA has become antiquated.

“Do they want us to go back to a rotary phone?” O’Hare sarcastically asked.

O’Hare stressed that lenders respect their clients and abide by basic ethics. “Always be scrubbing,” he said. “Prevention is not expensive, litigation is”.

Besides using services like his, O’Hare suggests using basic ethics and understanding to protect merchants that don’t want their calls. “If someone asks, take them off the list,” he said, “avoid trouble and respect the Do-Not-Call list.”

Brokers Say “Yes” to Commissions in Crypto

September 12, 2021 One month after Velocity Capital Group began offering broker commissions in crypto, CEO Jay Avigdor says it is taking off. It’s completely optional of course, but already seven of VCG’s ISOs have opted to get paid that way.

One month after Velocity Capital Group began offering broker commissions in crypto, CEO Jay Avigdor says it is taking off. It’s completely optional of course, but already seven of VCG’s ISOs have opted to get paid that way.

“The feedback has been fantastic!” Avigdor says.

In a previous interview with deBanked, Avigdor said that the initiative wasn’t about speculating on cryptocurrencies but instead about taking advantage of the transaction speed. Crypto can change hands faster than an ACH or a wire, for example, and VCG will send funds via a stablecoin so that there is no volatile exchange rate risk.

“Our goal since day 1 of VCG, was to give ISOs and merchants the ability to access capital as fast as possible,” Avigdor said. “With VCG’s proprietary technology, we have been able to change that mindset from ‘as fast as possible’ to ‘the FASTEST possible.’”

One broker attested on facebook that he received his commission from VCG within 5 minutes from the moment the deal funded via the DAI stablecoin.

Even a merchant requested that they be funded with crypto, according to Avigdor, which they accommodated. Payments back to VCG are still done via ACH debit, however.

The market cap of the cryptocurrency industry is currently at more than $2 trillion.

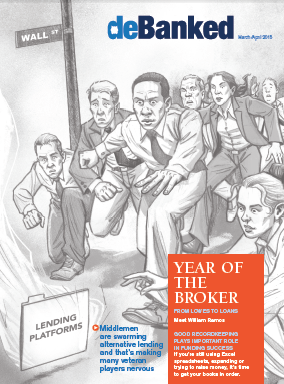

deBanked Mints NFTs, Puts First Magazine Cover on the Ethereum Blockchain

September 12, 2021 deBanked has been forever etched into the Ethereum blockchain.

deBanked has been forever etched into the Ethereum blockchain.

The first print magazine cover ever published by deBanked has been turned into an NFT. Over the weekend, deBanked deployed its own NFT smart contract on to Ethereum and minted several NFTs including the deBanked logo and the Broker Fair 2021 logo. The exercise was prompted by a deBanked TV discussion about athletes selling “digitally-signed” memorabilia.

“I think it’s important that as we talk about this technology, that we fundamentally understand how it all works,” said deBanked President Sean Murray. “There are some drag-and-drop style NFT ‘makers’ online, but I thought that would defeat the purpose, so I did it all through the Terminal. Once I got our NFT smart contract on the Ethereum mainnet, I minted a handful of NFTs with it.”

Murray, who started using and mining crypto in 2014, has offered Bitcoin as a deBanked customer payment option for more than 6 years.

Although the NFT contract and token IDs are visible on etherscan.io, images themselves are not. Users need a particular wallet or app that is equipped to display NFTs.

“It’s a somewhat strange system in which these tokens basically contain metadata with a URL to where the images are hosted somewhere else online. So you need something that’s interpreting the metadata,” Murray said.

“It’s a somewhat strange system in which these tokens basically contain metadata with a URL to where the images are hosted somewhere else online. So you need something that’s interpreting the metadata,” Murray said.

Using a mobile wallet like MetaMask can accomplish this, but so can a quick web tool like deBanked’s NFT Viewer.

Murray added that there’s actual costs involved too.

“A lot of people are joking about how someone paid $1.3 million for a picture of a rock,” he said, “but it does cost money by way of eth to mint an NFT. It could cost someone more than $100 just to put a single NFT on Ethereum so selling an NFT, even if it’s something silly, could fetch a significant price by virtue of the high transaction fees on the network.”

Network fees are a known obstacle. NFTs on the sports star operated Autograph.io are minted on the Polygon blockchain where costs are lower, for example. Autograph boasts that anyone can buy “digitally signed autographs” from celebrities like Tom Brady, Derek Jeter, and Wayne Gretzky.

Network fees are a known obstacle. NFTs on the sports star operated Autograph.io are minted on the Polygon blockchain where costs are lower, for example. Autograph boasts that anyone can buy “digitally signed autographs” from celebrities like Tom Brady, Derek Jeter, and Wayne Gretzky.

Minting an NFT or two or three, or as many as one wants, is as simple as pressing a button once a proper script is written. Interested collectors would have to establish just how genuinely or intimately signed an autograph is and how rare it is. Is it an agent executing a script? Is it the celebrity pressing a button? Or could it be that the image itself is unique and that the seller drew or signed it with their own hand in Adobe Photoshop or something similar? As the mysteriousness of the technology becomes more understood, the market may become more cost normalized.

Murray says that the smart contract is still accessible so that there is the potential to mint more deBanked-originated NFTs in the future and that deBanked NFTs can also be sent to others that have Ethereum-equipped wallets.

“I think 2021 is as good a year as ever for Broker Fair in particular to be memorialized into Ethereum,” Murray said. “What better way than to be on the forefront of technology in the commercial finance space?”

Facebook Enters the Invoice Factoring Arena and More

September 11, 2021 Facebook is the latest tech company to enter the small business financing space. Starting October 1st, Facebook will begin offering eligible American businesses the opportunity to sell their invoice receivables for cash upfront. The only cost is a 1% fee of the A/R and invoices can be as small as $1,000.

Facebook is the latest tech company to enter the small business financing space. Starting October 1st, Facebook will begin offering eligible American businesses the opportunity to sell their invoice receivables for cash upfront. The only cost is a 1% fee of the A/R and invoices can be as small as $1,000.

Dubbed Facebook Invoice Fast Track, a promotional video touts it as a solution to cash flow challenges.

The caveat is that it will only be open to businesses owned by minorities, females, veterans, LGBTQ+ or someone with a certified disability. Also, the invoices must be issued to a corporation or government entity with an investment-grade rating. An outstanding invoice from something like “Joe’s corner t-shirt shop” for example, would not be eligible.

Facebook COO Sheryl Sandberg predicts the company will be funding $100 million in invoices on an ongoing basis.

That’s not all, however. The company is also introducing a new small business loan resource through an arrangement with Connect2Capital. Facebook claims that in doing so, it is not “brokering” loans.

The developments may not be all that unsurprising given Facebook’s recent foray into India’s small business loan market.

MJ Capital Funding CEO Consents to Asset Freeze

September 9, 2021The primary defendant in the MJ Capital Funding case agreed to an extended asset freeze, court records show. Her consent is not an admission of guilt to the civil charges. The SEC has already sufficiently demonstrated its strength of prevailing in the case, which is why the judge ordered the companies be placed into receivership from the outset.

The consent order, entered on the 8th, covers 9 bank accounts held at both Wells Fargo and JPMorgan Chase, in addition to ten credit cards. MJ Capital’s CEO agreed to live off of income derived from two unrelated businesses known as MJ Remodeling and MJ Realty to the tune of $72,800 a year combined. That could change, however, if the SEC determines those businesses are also connected with the alleged scheme. $100,000 that was paid to her lawyer in advance will stand and can be used for her legal defense.

The only unusual bank record disclosed in the papers is a purported account at a small cryptocurrency hedge fund.

Nearly 2,900 people have signed an online petition voicing support for MJ Capital accused’s CEO.

The Receiver is providing regular court filing updates at: https://kttlaw.com/mjcapital/

America’s Football Fans Are About to Meet SoFi

September 9, 2021 When fans of the Los Angeles Rams return to the team’s new stadium for a Week-1 matchup with the Chicago Bears on Sunday, a large fintech brand will be there to welcome them. SoFi, the non-bank that shunned banks until it became a bank itself, secured the naming rights to the football stadium last season in Inglewood where both the Rams and Los Angeles Chargers play home games. (Covid prevented fans from actually attending in 2020.)

When fans of the Los Angeles Rams return to the team’s new stadium for a Week-1 matchup with the Chicago Bears on Sunday, a large fintech brand will be there to welcome them. SoFi, the non-bank that shunned banks until it became a bank itself, secured the naming rights to the football stadium last season in Inglewood where both the Rams and Los Angeles Chargers play home games. (Covid prevented fans from actually attending in 2020.)

It’s one of the boldest marketing campaigns ever taken on by a fintech player, a $400 million gamble of a deal that attempts to bring the legitimacy of the brand to a new level. Whether SoFi’s ambitions will bring millions of new customers into their fold or if the group has been overcome by vanity will be played out over the course of the 20-year deal between the stadium and SoFi.

A big thank you to @lapublichealth, the medical community and first responders + everyone doing their part.

WE’LL SEE YOU AT @SOFISTADIUM THIS FALL!

— Los Angeles Rams (@RamsNFL) May 25, 2021

Sofi’s logo is not just exclusive to the rafters of the 70,000+ seat stadium. It’s on the tickets, television broadcasts, repeatedly said on radio broadcasts, and will be mentioned on millions of social media posts throughout the upcoming seasons. Superbowl 56 will be played this February at SoFi Stadium, and the venue will be a major contributor to Los Angeles’ hosting of the Summer Olympics in 2028.

The stadium can also reach potential customers outside of the sports world. The Rolling Stones, Kenny Chesney, Motley Crue, and Def Leppard are scheduled to hold concerts at SoFi over the next few years, bringing hundreds of thousands of people to the stadium — all of whom will be exposed to the SoFi brand.

Rams owner Stan Kroenke, who used $5 billion dollars of his own money to build SoFi stadium, resonated with the company’s goals when announcing the stadium’s name last year. “It would be impossible to build a stadium and entertainment district of this magnitude without incredible and innovative partners who share our ambitions for Los Angeles, our fans worldwide and the National Football League” said Kroenke. “Since breaking ground at Hollywood Park, more than 12,000 people have worked side-by-side on this project, and we are proud to now have SoFi join us on this journey”.

Much like big banks that have name recognition, SoFi is just one of many who have their name on a stadium. Chase Field in Arizona, TD Garden in Boston, and Citi Field in New York are some of the costliest stadium naming rights in the industry.

It seems that if you want to be a big bank, having your name on a stadium is a rite of passage.