small business owners

Is Print Media Dead? Why Small Business Owners Should Take a Second Look

November 11, 2012 Many small business owners may have thrown out the newspaper with the bath water when it comes to using print media as a marketing and promotion channel for their small business. Number one, most of us are pretty much convinced that print media is dead. Major newspapers that have been around for eons are dead or dying. Print magazines are failing or subscriptions are woefully down. On top of that there are literally hundreds of thousands of online social media specialists and bloggers out there tooting the digital horn not as “the way of the future” – but telling us that the future is now. Any small business owner out there not engaging in social media marketing isn’t only missing the boat, they’re on a sinking ship.

Many small business owners may have thrown out the newspaper with the bath water when it comes to using print media as a marketing and promotion channel for their small business. Number one, most of us are pretty much convinced that print media is dead. Major newspapers that have been around for eons are dead or dying. Print magazines are failing or subscriptions are woefully down. On top of that there are literally hundreds of thousands of online social media specialists and bloggers out there tooting the digital horn not as “the way of the future” – but telling us that the future is now. Any small business owner out there not engaging in social media marketing isn’t only missing the boat, they’re on a sinking ship.

However, small business owners might want to take a second, and much closer, look at whether or not investing in print media still represents an opportunity to achieve a high rate of return for their particular business.

Print Media Can Hit Your Target

The most obvious example is a small local business owner. A business owner who serves a local community with distinct boundaries is targeting consumers and clients within that local jurisdiction. That local community may be at the neighborhood, small town, or even large municipal area. What is common to all local businesses is that oftentimes print media exists that provides a relatively low cost vehicle to promote their small business.

For example, small business owners in small towns are likely to get a pretty big bang for their buck promoting their business in their local small town newspaper. Many of these small town papers provide what could be classified as “hard journalism” reporting on local political and other town issues such as city budget and the like. However, a major focus in small town newspapers tends to be human interest articles that attract local readers. In turn, those articles attract specific types of readers.

For instance, often there will be a column dedicated to subjects such as gardening, cooking, local events, the environmental, the arts, books, and so on. Because the paper is so small, many local newspapers provide a greater opportunity to locate your ad near copy that relates to your small business, or that is read by people you’ve targeted as your most optimal customers or clients. If you’re a local hardware store, an ad located near the gardening article can be very effective. If you’re a local podiatrist or retail store selling running shoes, an ad near an article about a local 10K is a great opportunity. Most neighborhood and municipal newspapers offer this type or similar opportunities for ad placement.

Loyalty and Numbers Matter

Regarding reach of your small businesses’ ad, local print media can be a better option than promoting your local small business online. For one, many of these publications already have a very loyal readership. Any small business owner with even a modicum of experience creating an online presence can appreciate just how much effort, time, and (yes) money goes into creating a strong, loyal, and large following online. While social media is low cost, it isn’t “no cost.” Even if you’re not outsourcing social media activities (i.e. content creation, posting, replying, etc.) – you are paying a huge premium in time.

Equally important is that print advertising in many ways isn’t as limited as social media. You can get a whole lot more information in an ad in your local newspaper than an online banner ad. Additionally, advertising in your printed local publication can actually create more credibility for your small business. Consumers understand that print advertising comes at a cost and tend to assign credibility to businesses using print advertising. Consumers are savvy and know online banner ads can come pretty cheap – a print ad can effectively communicate your small business is both established and reliable.

Ironically, we’re going to provide you with the best argument for taking a second look at promoting and marketing your small business using print media with an online example. On their “About” page here is how one community paper describes themselves:

The College Park Community Paper has been in circulation since 1989. We are a monthly, full color, family friendly newspaper delivering the good news happening in College Park each month. The paper is delivered free of charge by mail to over 7,000 homes and businesses in the 32804 zip code which includes College Park and the Country Club of Orlando. Additional distribution is provided throughout the community and commercial district through the use of newspaper stands and counter top display. Additional exposure is garnered through our website which includes additional material not shown in the print edition.

You’ll also want to take a look at their ad rates here, but we use them as an example for quite another reason: they provide an excellent example of a small business integrating both on and offline channels to promote their small business, which can be not only a balanced approach, but an approach that provides the biggest bang for your buck.

– Merchant Processing Resource

https://debanked.com

Forward?

November 8, 2012The election is over and now it seems we will be “Moving forward, not back.” The republicans that have already come to accept Romney’s defeat are sounding a lot like Sookie Stackhouse:

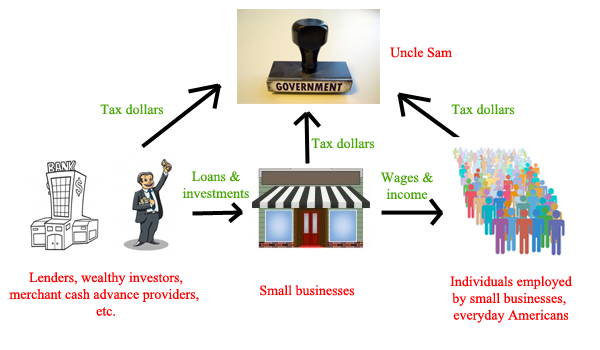

Onwards we go to help the little guy, a process many feel can’t happen until we end trickle-down economics. It’s the trickle part that doesn’t sound good. Money should flow freely gosh darn it, not trickle! We couldn’t agree more. Here’s a broad diagram of the economy at work:

It’s popular to hate Wall Street, but Wall Street provides small businesses with financing to expand, who in turn employ more people in the process. Wall Street is not just banks and Merchant Cash Advance companies. It is any party that has enough money to invest in others while being able to absorb potential losses. A private investor is Wall Street. Wealthy friends or family members are Wall Street.

Tax these parties more and there is less money to invest in small businesses which means fewer businesses will receive capital to expand and hire. Wall Street will make less money as a result of less money being invested and therefore tax revenue will decrease. With fewer businesses hiring, less people will be employed and therefore less people will be paying taxes. Taxing Wall Street more does not necessarily mean more net tax dollars.

This Darn Trickle

One can dislike the economic chain since the flow of money between parties may not happen perfectly or because it allows Wall Street to get richer. There is nothing wrong with the rich getting richer, so long as the middle class and poor get richer too. If small businesses use the money invested by Wall Street wisely, they too will eventually become Wall Street. The amount of new jobs created as a result of a small business’s success means more wage earners will have a shot at becoming small businesses. In economics, a wide divide between rich and poor can be positive, for it creates a ladder that anyone can climb with no cap.

Empower the Little Guy

There is a competing theory and that is to believe that the economic chain starts with middle class wage earners. One could argue to significantly lower taxes on the middle class and the poor and impose much higher taxes on the rich. By doing so, consumers would have more money to spend at small businesses, prompting those small businesses to draw up plans to expand. That expansion capital still needs to come from somewhere and less of it will be there if Wall Street has been further taxed. Perhaps a small business could save money for a few years and use their savings to self-finance their own expansion. Under this theory, everyone becomes part of a very broad middle class. The extremes disappear.

Whoops

When the extremes disappear, there will be few investors with the capability to make large investments or investments that are particularly risky. A small business owner could save up for several years and open a 2nd location without an investment, but could he open 200 nationwide? Not without Wall Street. How many jobs will be created by the opening of 1 store? How many would be created by the opening of 200?

Now calculate how much new tax revenue is generated in each scenario, as well as the number of people that move up from being poor and unemployed to middle class and employed.

When the rich aren’t getting richer, the other classes can’t really move up either. Everyone stays in a broad middle class and innovation and advancements decline. The consumer or small business owner with a potential $100 million innovative idea won’t be able to raise the capital to see it through. How can they when the rich have been prevented from becoming really rich? What if they had a $10 billion idea?

One could argue as a single class society, that a $100 million idea or $10 billion idea could be financed by the government. This is true. It is also textbook state socialism. A one class society is also the premise of Marxism, where everyone is getting their needs met through cooperative work.

Marxism ignores the realities of a global economy. Ultimately, Americans need to obtain resources from other nations, and stay ahead technologically so as not to be conquered by outside forces. A classless society is a stale society, with no economic movement, social movement, or technological advancements.

How will the Merchant Cash Advance Market be Affected?

Merchant Cash Advance companies typically invest in businesses with less than 50 employees. Under Obamacare, any business with less than 50 employees does NOT HAVE to provide health insurance. This program may not affect the business as a whole, but the law mandates that all individuals purchase health insurance for themselves if they don’t have coverage already. Small business owners in the MCA market may be incrementally stressed by having to purchase health insurance. Their employees will be further stressed by having to buy it as well. As a result, wages may need to go up to help workers pay for their own insurance and less money will be available to grow and hire.

The total public debt outstanding has exceeded $16 trillion. That debt has to be paid for somehow and it is more likely than ever that Wall Street is going to have to pay up. This will not stimulate growth and as such, the economy is not likely to pick up any time soon.

Traditional lenders are going to remain quiet while the alternative lenders are going to power through it. A business could save up for three years and open a 2nd location or it could open it today with a Merchant Cash Advance. In three years, the location they want may no longer be available and that individual looking for a job will have run out of unemployment benefits long ago.

A Merchant Cash Advance helps small businesses expand today, hire today, generate more tax revenue for the government today, and helps everyone move up the economic ladder. Baby steps are better than none at all. What starts with a 2nd location may lead to a dream of owning 200 locations nationwide. They’ll need a bigger fish than MCA to get there. Let’s make sure we don’t tax those fish to death.

What do you think Michael?

Forward!

– Merchant Processing Resource

https://debanked.com

Is There a Majority of Small Business Owners Ready to Vote for One Presidential Candidate?

November 3, 2012 For the “everyday” small business owner, trying to figure out which presidential candidate most small business owners support, or even if one candidate has more support from the business community over the other, can be a fruitless endeavor.

For the “everyday” small business owner, trying to figure out which presidential candidate most small business owners support, or even if one candidate has more support from the business community over the other, can be a fruitless endeavor.

While we may not be able to come up with an inarguable percentage, going on a Google safari does provide us with food for thought.

While their statistics may not completely represent the small business as a whole due to the fact that they’re a membership organization and therefore might be “preaching to the choir”, the National Federation posts some interesting statistics on their home page. For instance:

- According to a November 2010 member ballot, 93% of NFIB members supported repealing the healthcare law.

- 78% of NFIB members supported a moratorium on new regulations that cost more than $100 million.

- According to the latest NFIB member ballot, 90% of small business owners support a balanced budget amendment to the Constitution.

- The cost of fuel ranks as the third-most important problem facing small business owners. Electricity costs rank 12th.

- 91% of NFIB members said that Congress should permanently increase the dollar amount of equipment purchases a small business can expense.

- According to a recent NFIB ballot, unreasonable government regulations rank as the fifth-most important concern facing small business.

The page is formatted in three columns, with the statistics in the middle and a description of Romney’s and Obama’s positions on either side. Follow this link to NFIB where you can draw your own conclusions.

On the other hand, we’ve got the Small Business Majority another membership organization, who report the following statistics based on their research and surveys:

- Only a third of small business owners want the Supreme Court to overturn the Affordable Care Act; a plurality of 50% would like it upheld, with minor or no changes.

- 50% of small business owners support clean energy and climate legislation.

- Small business owners see regulations as a necessary part of a modern economy and believe they can live with them if they’re fair and reasonable: 86% of small business owners agree some regulation of business is necessary for a modern economy, and 93% of them agree their business can live with some regulation if it is fair, manageable and reasonable.

- The majority of small businesses support raising taxes on high-income earners; nearly 9 in 10 oppose raising taxes on the middle class: Small business owners recognize the gravity of our budget crisis: 52% agree that while no one likes to raise taxes, we should raise taxes on the wealthiest 2%.

The above statistics are pulled from a variety of reports that can be easily located on the Small Business Majority website. However, it’s likely you can see where we’re going with this comparison of statistics provided by these two organizations, it is difficult, if not impossible, to accurately assess who the majority of American small business owners are likely to vote for. The NFIB endorses candidates in both federal and state elections, but does not provide an endorsement for either Obama or Romney. The Small Business Majority does not appear to provide endorsements of political candidates. However, it is worth a visit to both sites to make your own personal determination as to whether any potential bias exists.

Guest Authored

– Merchant Processing Resource

https://debanked.com

Can a Broken Window Be a Good Thing?

November 2, 2012 There’s a ton of controversy right now as to whether or not the devastation caused by Hurricane Sandy will, or will not, serve to stimulate the economy.

There’s a ton of controversy right now as to whether or not the devastation caused by Hurricane Sandy will, or will not, serve to stimulate the economy.

Obviously there are two camps: one says Sandy is stimulating and the other days it isn’t. It would appear that the only thing we can be sure Sandy is stimulating is controversy over whether or not it will serve as a boon to what many see as our nation’s less-than stellar economic recovery (at least in the areas devastated by the storm.)

But this debate isn’t limited to people duking it out on Facebook using terms such as “jerk” and “idiot” to prove their point (otherwise known as an ad hominem, or “against the man” argument that confuses name calling with intelligent debate.) We’ve got some serious academic economic theory out on the table.

On one hand you’ve got your Keynesians (20th century economist John Maynard Keynes gave us the theory.) Keynesians were/are considered “revolutionary” in that they deny the ability of a free economy to “fix” or stabilize itself and instead feel that, in order for an economy to consistently support full employment and stable prices government must implement policies that stabilize prices and create full employment scenarios.

On the other hand you’ve got economists who support a “laissez-faire” economy. (18th century economist Adam Smith provided us with this theory.) Adams and his adherents felt that since human beings are guided by self-interest as long as you leave the economy alone (i.e. no government intervention) the result will be a balanced, self-regulating economy because that is the state of economy that best serves self interest.

And then we’ve got Frédéric Bastiat. Ironically he happens to be a great defender of laissez-faire economics. We say ironic as it is his “Parable of the Broken Window” that tells us that, in fact, destruction, whether it be caused by natural forces (such as Hurricane Sandy) or man (such as wars) do not stimulate the economy by creating more business (and therefore more jobs.) Bastiat included the story in an essay entitled “The Seen and the Unseen.” Here’s the short version of the parable:

The Seen: A boy breaks a store window. The owner now pays for a new window, which creates income for the glazier.

The Unseen: Because the store owner has to fix his (or her) window, he (or she) now doesn’t have money to invest in the growth of their business – or for anything else they might have spent it on.

In other words, Bastiat’s theory is that destruction doesn’t create more income, it simply reallocates income. Obviously, if this is true, disasters that cause mass destruction don’t stimulate the economy.

As far as the battle between laissez-faire and Keynesian economists are concerned, for our purposes let’s just say the jury is still out, especially after suffering through this last (or current depending on who you listen to) economic debacle. On the one hand, Keynesians can gloat over seemingly infinite corporate greed that resulted in lost homes as well as lost jobs – on the other hand, those who live on the laissez-faire side of the street can gleefully cite how President Obama’s stimulus package perhaps did nothing more than (as Bastiat might say) help us see that the economy was “worse than we realized.”

Back to Bastiat

Whether or not laissez-faire or Keynesian policy should be pursued in the effort to cure the economy really isn’t the point as related to the impact of Hurricane Sandy – at least for the purpose of this article. What is at hand is whether or not Bastiat was right. However, perhaps we’ve left out an important economic theory. And that would be Darwinian, or “evolutionary economics.”

There is no getting around the fact that evolutionary economics is pretty darn complex. Evolutionary economists like to use a lot of math – especially something called game theory which uses math to explain/describe what might appear to be “irrational” economic choices or events.

However, one thing we can all understand is that evolutionary economics uses methods and ideas similar to those used to study biological evolution. And most of us are very familiar with the evolutionary concept of “survival of the fittest.”

Just for a minute let’s suppose that two store owners find that someone broke their window (destruction.)

The Seen: Both hire a glazier to fix their window (and we see the glazier benefit.)

The Unseen Store Owner #1: Poor guy (or gal) is forced to use money previously identified to be used to pay for an ad in the local newspaper to promote an upcoming sale. Now that the cash is gone, the store owner responds by throwing up their hands in despair.

The Unseen Store Owner #2: Decides to take President Theodore “Teddy” Roosevelt’s advice and “Do the best I can, with what I’ve got, where I’m at.” Knowing the ad is now out of the question, and without any funds left to promote the upcoming sale, she (or he) decides to use the new window to showcase the sale.

The store owner pulls out every old decoration from every holiday or special event sale from the back room and decorates the new, clear as a bell storefront window. She (or he) then gets on Facebook and Twitter and announces a contest to come up with a name for a sale that encompasses every holiday and special event known to man. The contest winner will receive $200 to donate to their favorite community charity. She (or he) contacts every existing customer via email to inform them of the upcoming sale and contest and asks them to spread the word.

The local community newspaper (ironically the one that the paid ad would have run in) picks up the story. The sale is a huge success. Too many people assume that “fittest” always means strongest. Wrong. “Fit” means the organism that is best able to adapt when the environment changes.

Obviously Store Owner #2 fits that bill. The moral is that, no matter what the “disaster”, be it hurricane or recession, crossing your fingers and hoping for the best or hoping the government will save you are not your only two choices. One choice will always be yours to make, and that is choosing to do the best you can, with what you’ve got, where you’re at.

Guest Author

– Merchant Processing Resource

https://debanked.com

It’s a Mad, Mad World

October 18, 2012 You aren’t going to find too many people who would disagree that things have gotten a bit crazy lately. We’ve got a crazy economy going, so why not employ a bit of crazy when it comes to promoting your small business in a crazy economy?

You aren’t going to find too many people who would disagree that things have gotten a bit crazy lately. We’ve got a crazy economy going, so why not employ a bit of crazy when it comes to promoting your small business in a crazy economy?

Think that be a bit of a naïve approach to attracting business? Maybe not.

Recently Old Navy added a little bit of crazy to the tried and true idea of a coupon when it created a “human coupon” to celebrate reaching 5 million fans on Facebook. Liberty Tax Service, while a big company, knew it couldn’t compete with H&R Block’s intensive television ad campaign, so they added their own little bit of crazy and instead dressed people up like the Statue of Liberty to direct traffic going by to their storefront. And let’s not forget all the hoopla Macy has been able to tweek out of their Thanksgiving parade for the last 80 years?

Still not convinced? How about a little case study on Sir Richard Branson? The man built a business empire using “crazy stunts” to bring attention to the “Virgin” brand. These stunts were perhaps a bit “larger” than most small business owners are capable of pulling off (you most likely can’t fund crossing the Atlantic ocean in a hot air balloon, or build an “aquaticar” and make history traveling from London to Paris in literally record time.) But you can’t deny that Brandon’s billions make a credible case for crazy.

OK, so maybe you’re not ready to dress like a chicken (or hire someone to dress like a chicken. Here are few approaches to crazy you might want to consider for your small business:

Organize a protest. Most everyone has either driven by or watched a “protest” on the evening news. How about staging a protest at your small business? What might you protest? How about carrying signs protesting “This business puts the customer first!” Or, “They actually helped me find something.” Or, “I called and a human being answered!”

Sponsor a crazy contest. This is a cool one because it can be conducted online as well as offline. For example, if you’re an office supply company or a professional organizer how about a “Messiest Desk” contest? The winner receives organizational products or a half hour consultation.

Crazy Customer of the Month. No, the customer doesn’t win if they’re crazy – in this case it is the award that’s crazy. For instance, a “Crazy Happy Customer of the Month.” Or, “Techie Customer of the Month.” Or, “Best Dressed Customer of the Month.” Take pictures and hang plaques.

Crazy Building Decorations. If you own the building, or it is OK in your lease, how about using your building to help your business stand out? A company in South Africa hung multi-colored sandals on a tree outside their building making it “bloom.” If you’re a financial planner it might be pretty effective to do the same to the tree in front of your office with fake 100 dollar bills.

Some businesses might find the above doesn’t mirror their brand. But you can still get a little crazy. Even the stodgiest consultancy can promote themselves by asking people to post pics of “crazy ties” on their Facebook page. Or hand out coffee cups that say something along the lines of “I got this for staying awake the longest at our last staff meeting.”

Sometimes crazy makes crazy good business sense.

– Guest Author

Merchant Processing Resource

https://debanked.com

Silicon Valley’s One Punch Knockout

October 4, 2012“This morning I woke up, brushed my teeth, and hopped in my hovercraft to go to the office. As soon as I arrived, I began my routine of playing ping-pong against my co-workers while computers performed the automated tasks I had set for them. Then I went to the gym, came back, and learned that our web portal had generated 12,000 leads, closed 7,000 deals, and funded 5,000 merchants. It was an exhausting day…” — A Senior Account Executive from the year 2013.

We’ve been offering insight on the 2012 invasion of Silicon Valley into the Merchant Cash Advance (MCA) industry. Excuse us, it’s called the “merchant financing industry” now. California technology companies are bringing money, yes, but most importantly, bringing their treasure trove of technologies to companies that were mostly satisfied with the status quo. But are America’s small businesses ready to do business Silicon Valley style or have MCA companies had it right all along, to operate in the way that small business is most comfortable with?

We’ve been offering insight on the 2012 invasion of Silicon Valley into the Merchant Cash Advance (MCA) industry. Excuse us, it’s called the “merchant financing industry” now. California technology companies are bringing money, yes, but most importantly, bringing their treasure trove of technologies to companies that were mostly satisfied with the status quo. But are America’s small businesses ready to do business Silicon Valley style or have MCA companies had it right all along, to operate in the way that small business is most comfortable with?

Two weeks ago, California enacted a law that will allow computerized driverless cars to drive on the road. Cars that drive themselves… this is business as usual in parts of California where everyday things such as gasoline, wires, and paper money don’t exist anymore. There, it is believed that clipping coupons from newspapers is something that the Pilgrims did on the Mayflower. There, applying for a small business loan should be as easy as using your brain waves to telepathically connect with a bank’s computer and having the funds instantly transferred to your bank account. There, is a sense that the rest of the country is just like them…. except it’s not.

If you’ve ever had the pleasure of being an MCA underwriter, you know why antiquated funding companies aren’t going to go quietly into the night. We got to speak with one veteran on condition of anonymity. His words:

We had a guy with good credit, processing $15,000 a month in credit card sales, looking for $20,000. He’d been in business for fourteen years and it seemed like a home run but it took seven weeks to close. He didn’t have a printer or a scanner and he had to drive twenty miles to the nearest Fedex/Kinkos every time he wanted to send us something. On his third trip, his ’94 Corolla broke down and we had to wait a few days until he could find a friend’s car to borrow to send the documents.

These situations do not occur every day, but it is evidence that automation will not singlehandedly knock everyone else out with one punch. There is a technology gap in America. Statisticians point out that 78% of Americans use the Internet, but there is a whole generation that doesn’t trust it with their most sensitive information or have the capabilities to use it to its fullest extent. Would a Silicon Valley takeover of the MCA industry alienate them and leave many of America’s small businesses once again without a shoulder to lean on?

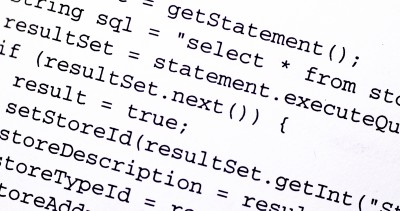

Program or be Programmed

The title of this segment here is the title of a book written by Douglas Rushkoff. An article on CNN commented at length about it and its revelations about the digital age. Americans need to learn all the basics when they’re young. Your PHPs are just as important as your ABCs and 123s. CNN interestingly states:

It’s time Americans begin treating computer code the way we do the alphabet or arithmetic. Code is the stuff that makes computer programs work — the list of commands that tells a word processor, a website, a video game, or an airplane navigation system what to do. That’s all software is: lines of code, written by people.

—Just a couple of years ago, I was getting blank stares or worse when I would suggest to colleagues and audiences that they learn code, or else. “Program or be programmed,” became my mantra: If you are not a true user of digital technology, then you are likely being used by digital technology. My suggestion that people learn to program was meant more as a starting point in a bigger argument.

—According to Calacanis, each employee who understands how to code is valued at about $500,000 to $1 million toward the total acquisition price. One million dollars just to get someone who learns code.

Read those last two lines? Each employee that understands how to code is worth up to $1 million. Are they seriously teaching people in school that Microsoft Office proficiency is a leg up in the business world?

College graduates that know more than one language have an edge over people that don’t. But speaking Chinese, Spanish, or Arabic won’t get you as far as JavaScript. According to IT World, JavaScript is the most highly ranked programming language in the world as measured by its use and popularity. Learn French and you’ll really enjoy a vacation in Paris. Learn PHP, Python, or Ruby and you just might become the King of France.

Am I Already a Dinosaur?

No! Don’t let those 10 year olds with a software empire get you down. Anyone can learn and you need not spend $30,000 a year on college tuition to do it. Codecademy can help complete beginners learn code for free. Get real good at it and you may earn yourself a $50,000 salary increase.

One Punch

Silicon Valley with their exotic computer languages and cars that drive themselves may present a challenge to the MCA industry, but many firms will be able to hang on for a long, long time. Some people still pay by check at the grocery store and yes, many business owners would rather not use online banking, no matter how safe they’re told it is. But there will come a time when being bilingual means being able to write Java and Perl. Oh there will come a time when driving twenty miles to Kinkos in a car that one must drive themselves to fax a document that will never again exist on paper, will be an experience we confuse with the Pilgrims trip on the Mayflower.

Everyone should at least take some basic lessons on self-defense. Silicon Valley is coming out fighting. They might not knock you out, but it couldn’t hurt to have a white belt in JavaScript. Anything to keep you in the ring just a little bit longer.

< ?php echo "- Merchant Processing Resource"; ? > 😉

https://debanked.com

Article condensed 10/8/12

Merchant Cash Advance Community Teams up for Charity

September 27, 2012You may have seen the news story somewhere already: Twelve Members of the Alternative Small Business Lending Community Join Forces for Charity, but you haven’t heard the background of all the companies involved. We’d like to shed some light on the competitors that are battling it out in an epic competition of fantasy football:

Merchant Cash Group

Based in Gainesville, FL, they are a charity league co-founder and direct provider of capital. They recently launched their Fast Funding Equity Program, a unique financial solution to merchants that may not be able to get approved anywhere else.

Competing for: Kiva

Kiva is a non-profit organization with a mission to connect people through lending to alleviate poverty.

Rapid Capital Funding

Based in Miami, FL, they are a direct financing source. They are one of the industry’s fastest growing companies and recently acquired a major credit facility from Veritas Financial Partners.

Competing for: Epilepsy Foundation

Financial Advantage Group

Based in Land O’Lakes, FL, they have been a financial provider since 2004. They have helped fund some big name franchises including individual locations for Sonic, Dunkin’ Donuts, and Quiznos.

Competing for: Society of St. Vincent De Paul

The Society of St. Vincent de Paul offers tangible assistance to those in need on a person-to-person basis.

RapidAdvance

Based in Bethesda, MD, RapidAdvance is one of the oldest and largest MCA firms in the country. They are often called upon to offer expert insight on the industry.

Competing for: Cystic Fibrosis Foundation

This foundation is the world’s leader in the search for a cure for cystic fibrosis.

Sure Payment Solutions

Based in New York City, they made a name for themselves by offering low credit card processing rates to merchants nationwide and expanded on that success by providing businesses with financing. They are well known for their industry blog, Sure Resources.

Competing for: ALS Association

The ALS Association is the only national non-profit organization fighting Lou Gehrig’s Disease on every front.

Meridian Leads

Meridian provides direct marketing programs for financial services companies. They are one of the most used and acclaimed marketing firms in the MCA space.

Competing for: 100 Urban Entrepreneurs

100 Urban Entrepreneurs is dedicated to helping provide a meaningful, long-term economic boost to urban communities throughout the United States by supporting minority entrepreneurship at its earliest stages.

Merchant Cash and Capital

Headquartered in New York City, they have funded over half a billion dollars to small businesses since 2005. They’re heavily involved in the financing of retail and food service franchises. Check out their new website.

Competing for: Gift of Life Bone Marrow Foundation – on behalf of The Silver Project

Gift of Life is a world leader facilitating transplants for children and adults suffering from many life-threatening diseases, among them leukemia and lymphoma.

NVMS, Inc.

A Manassas, VA firm, NVMS offers a full range of inspection services for the Mortgage, Banking, Commercial and Residential Property, Construction and Insurance industries. They’ve established a stellar reputation and are the inspection company of choice for many MCA providers.

Competing for: The Missionaries of our Lady of Divine Mercy

They provide humanitarian assistance to those suffering from poverty

United Capital Source

Based in Long Island, NY, United Capital Source has garnered much attention from their recent spate of seven figure financing deals. They are constantly adding new staff to satisfy the incredible demand for funding from mid-sized businesses.

Competing for: Smile Train

Smile Train partners with local surgeons in developing countries to provide free cleft care for poor children and follow-up services 24/7, 365 days a year.

Swift Capital

From the wonderful city of Wilmington, DE, Swift Capital has made a major splash in the alternative business loan space with low cost working capital. They have helped over 10,000 small businesses nationwide.

Competing for: American Heart Association

This association helps to build healthier lives, free of cardiovascular diseases and stroke.

TakeCharge Capital

TakeCharge Capital has offices in Connecticut, Mississippi, and Florida. They built their reputation on spectacular payment processing services and grew into becoming a national financing provider.

Competing for: Distressed Children & Infants International

DCI’s primary objective is to provide children in rural areas the opportunity to receive an education instead of entering into child labor.

Raharney Capital, LLC

Raharney Capital is a Merchant Cash Advance industry consulting firm based in New York City. They are a charity league co-founder and the operators of this very website, Merchant Processing Resource.

Competing for: Network for Teaching Entrepreneurship

This organization’s mission is to provide programs that inspire young people from low-income communities to stay in school, to recognize business opportunities and to plan for successful futures.

The above companies are participants in the Merchant Cash Advance/ Microloan fantasy football league. Other firms within the same industry are constantly making charitable efforts as well, such as Yellowstone Capital. They recently raised money to help Hatzalah Volunteer Ambulance Corp acquire two ambulances. Noticeable company donors included Strategic Funding Source and Benchmark Merchant Solutions.

All of the mentioned firms are strongly recommending others to donate to the charities they are representing. In addition, any company or person that would like to contribute to the competition’s prize donation can do so by contacting sean@raharneycapital.com or heather@merchantcashgroup.com. We are not accepting contributions to individual charities, only to the prize donation that will be given to the winner’s charity. $5,850 has already been pledged to the prize as of the publication of this story.

– Merchant Processing Resource

https://debanked.com

New and improved New York City office location coming soon!

1375 Broadway, 6th Floor, New York, NY 10018

Donate to one of the represented charities today!

The End of an Era

September 19, 2012It’s the end of an era. Sound ominous for a blog that reports on the Merchant Cash Advance (MCA) industry? It shouldn’t. In the last 10 years, MCA firms played in the minor leagues. No one was really paying attention to them and truthfully, a lot of critics didn’t think this business model would still be around. But today it still stands, funders are still funding, and this blog is practically struggling to keep up with the incredible amount of action that is taking place. Coincidentally, 2012 marks the end of the Mayan Calendar. Yes, it’s the end of an era.

MCA Goes From 0 to 60

There were a few big firms in the Mid-2000s (RapidAdvance, Merchant Cash and Capital, Strategic Funding Source, AdvanceMe, etc.) and they’ve all experienced modest success. It was “modest” in the sense that it is nothing compared to today’s standards. The level of play is changing. Wining and dining an Independent Sales Office (ISO) that could bring in $300,000 a month in deal flow used to be all the rage. 300k for one company was 300k less for a competitor. An extra point of commission here or a freebie approval there was enough to make you the big dog in town, at least for awhile. Despite all the supposed innovation and growth, the talent pool remained the same. Lead generators became agents, agents became ISOs, ISOs became syndication partners, syndication partners became funders, and funders became technology companies that were basically clearing houses for groups of funders. If the industry was Sally, Joe, and Tom in 2005, it was still Sally, Joe, and Tom in early 2011, just with new company names or titles. Then everything changed…

Money poured in:

Merchant Cash and Capital Announces $25 Million in new financing 10/4/11

Snap Advances raises $3 Million from TAB bank 11/21/11

Capital Access Network raises $30 Million 2/7/12

RapidAdvance Receives new financing facility through Wells Fargo 4/2/12

1st Merchant Funding | $5 Million re-discount line of credit from TAB bank 6/12

Strategic Funding Source secures $27 million 6/27/12

On Deck Capital raises $100 Million 8/23/12

Kabbage raises $30 Million 9/17/12

Industry insiders loosely redefined what a Merchant Cash Advance was:

Merchant Cash Advance Redefined Merchant Processing Resource 3/25/12

Big companies entered the market:

American Express Announces Their Own Merchant Cash Advance Program 9/22/11

PayPal Pilots Merchant Cash Advance Program in the U.K. 7/13/12

Some funders became licensed lenders in major states such as California:

A New Chapter Opens for Merchant Cash Advance The Green Sheet 6/25/12

Search the California licensed lender registry

New products formed:

FundersCloud creates platform to raise capital and find syndicate partners faster 8/29/12

A charity announces a new way to make subsidized business loans using the split-funding method 9/6/12

These barely scratch the surface of industry events. What used to be a competition to score the local neighborhood ISO has morphed into a race to be the first to partner up with Facebook, twitter, Groupon, and Square. Anyone not moving full speed ahead to integrate technology and social media will be gone in the next 24 months.

May 18, 2012 was the first time we noticed and commented on what was happening. In How The Facebook IPO Affects the Merchant Cash Advance Industry, venture capitalists and Silicon Valley had finally found MCA and there’s no hiding from them. Now it seems all of our far-fetched predictions are not only coming true, they’re happening moments after we predict them. In our last article we instructed everyone to keep their eyes on Kabbage. Six days later they announced they had raised $30 million in new financing and would be expanding overseas. For a company that makes wild claims about the correlation of facebook fans with account performance, all while humorously being named after a boring vegetable, they sure seem perfectly able to threaten the status quo. Nobody dared touch Ebay or Amazon businesses until they came around.

Price

On the cost basis front, the middle ground is eroding even further. We first discussed this phenomenon on April 25, 2011 in The Fork in the Merchant Cash Advance Road. In it, we explained that the combination of competition and defaults were placing downward pressure and upward pressure on price at the same time. Today, there is surging demand for “starter deals” at 1.49 factors that are payable over 3 months at the same time that more and more new lenders are offering 1 year loans at 10%. The low rate, 12-18 month term deals are nothing new. A few funders tried them in the past and most suffered irrecoverable consequences. This is history that the new players didn’t witness.

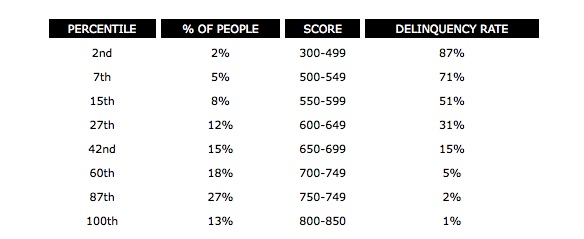

Some outsiders view the MCA industry as a bunch of Wall Street guys that got fat, happy, and disincentivized to lower costs. On the contrary, one only needs to take a single look at this chart to realize that undercutting the entire market isn’t so genius after all. How can a funder survive with extremely low margins when 15% – 71% of their target market is likely to experience problems repaying their loans? These aren’t our stats, these are FICO’s:

Veteran industry insiders know this and acknowledge that the coming tide of low rate financing is a bubble that has burst before. On the DailyFunder, a few folks have offered this insight:

The mca/unsecured loan biz is very risky. It’s all fun and games till deals start going south. My guess is they either adjust rates to match defaults or go out of business. I know first hand that this is not a get rich quick business. It may look like it is from the outside but once you are inside you see the world differently pretty quickly.

[these new low rate deals are] just like On Deck did. When they first came out, they offered 12 month 1.09’s. Then it dropped to 6 month 1.12’s, then 1.18’s. Now you see 1.25’s to 1.35’s offered by them

Governance

On the other side of the cost war is potential federal regulation. At least one D.C. consulting firm is prodding the leaders of the MCA industry to take a proactive approach on self-governance. According to Magnolia Strategic Partners, MCA is on the radar of regulators and members of congress, especially in light of the Dodd-Frank Wall Street Reform and Consumer Protection Act. The new MCA playing field has invited media attention, and not all of it is positive.

The North American Merchant Advance Association is the only organization for industry cooperation but their ability to dictate policies and standards is weak. They receive very little press and their website has been down for weeks. Many argue that they have been effective in minimizing defaults by sharing data on fraudsters. While this does stand to serve the community, it is but a footnote in their orignal intended purpose.

New Barriers to Entry

For the first time ever, potential resellers are facing barriers to entry. Becoming an ISO has long been as simple as owning a phone and purchasing a list of businesses that have used MCA financing before. Today, it’s not that easy. These lists have been sold literally hundreds of times over and called tens of thousands of times over. Pay-Per-Click marketing is dominated by the million and billion dollar firms with money to burn. If John Doe ISO wants to advertise on Google, he better be prepared to compete with the likes of American Express and Wells Fargo. Good luck! Putting skin in the game has also become more of a prerequisite for ISOs to succeed. Funders want to know if a sales agent would put his or her own money into a deal… and then actually commit them to doing just that. The odds are becoming stacked against the undercapitalized and it isn’t likely to change.

In 2009, the most prevalent pitch used by sales agents was to inform prospects that they themselves were “a direct lender” and that anyone else the prospect might be talking to was a broker. “Cut out the middleman and go direct with us,” they’d convincingly argue. This line became less effective when prospects heard this from all five agents they spoke to. Name dropping strategic partnerships will be the new way to build credibility. “We’re partnered with Facebook, twitter, Groupon, and Square,” a sales agent will soon be saying. “Can our competitors make the same claims? Go with us.”

See You On the Other Side

See You On the Other Side

2013 will kick off a single elimination tournament. Funders that didn’t realize 2012 was the end of an era will begin to fade. 2014 will eliminate the weaker firms that remain and by 2015, Merchant Cash Advance will no longer be a term that anyone uses. Big banks and billion dollar technology companies will go on to rebrand all that which the funding warriors of the last decade have worked so hard to establish. MCA will simply assimilate into other financial products. The metaphorical Sally, Joe, and Tom will probably still be in the business, but be working for companies like Capital One, Wells Fargo, and American Express. And as for us…well… we’re going to need something else to talk about. But we’ll keep you posted until that day. 🙂

– Merchant Processing Resource

https://debanked.com