peer2peer lending

LendingClub Formally Ends “Peer” Aspect of Its Business, Proceeding With Radius Bank Acquisition

October 7, 2020 LendingClub is finally ending the “peer-to-peer” aspect of its platform for good. Earlier today, the company announced that it would cease offering and selling Member Payment Dependent Notes effective December 31st.

LendingClub is finally ending the “peer-to-peer” aspect of its platform for good. Earlier today, the company announced that it would cease offering and selling Member Payment Dependent Notes effective December 31st.

“Ceasing the Retail Notes program will allow LendingClub to redeploy capital and improve platform efficiency, enabling the company to help even more members as LendingClub progresses towards closing the Merger and becoming a bank holding company,” the company said in an official statement. “All Retail Notes outstanding as of the date the Retail Note program is ceased will be unaffected by the cessation of the program. Accordingly, with respect to such outstanding Retail Notes, LendingClub will continue servicing the corresponding member loans and information regarding such Retail Notes will remain viewable in the applicable Retail Note investor accounts.”

LendingClub rose to fame with its peer-to-peer model nearly a decade ago, but using retail investors to fund loans has been eroding over time. ‘Peers’ Are Almost Gone From Lending Club’s Funding Mix was the title of a February 2019 deBanked story that highlighted this trend, for example.

LendingClub rose to fame with its peer-to-peer model nearly a decade ago, but using retail investors to fund loans has been eroding over time. ‘Peers’ Are Almost Gone From Lending Club’s Funding Mix was the title of a February 2019 deBanked story that highlighted this trend, for example.

Meanwhile, the focus on Radius Bank is a reminder that the announcement made nearly 8 months ago is still a work-in-progress.

“In connection with and in furtherance of the Merger, LendingClub has been in regular contact with federal banking regulators and, on September 25, 2020, filed an FR Y-3 application with the Federal Reserve to become a bank holding company,” the company said. “LendingClub plans to offer a full suite of products as a bank. This includes a high-yield savings account that will be initially exclusively available to its existing retail investors and will offer a compelling interest rate, as well as other products that take advantage of the marketplace to allow its customers to both pay less when borrowing and earn more when saving.”

Radius Bank was the subject of a major deBanked Magazine story in 2017 titled Tech Banks: Will Fintech Dethrone Traditional Banking?

China Ponzi Scheme: Police Crack Down on Shanghai Lender, Wealthroll

May 16, 2016

The crackdown of newfangled finance firms that emerged from the ashes of the Ezubao ponzi scheme opened up a can of worms.

And the latest head to roll is of Xu Qin, owner of Shanghai-based wealth management firm, Wealthroll Asset Management Co. who confessed to the authorities that his company still owed 5.2 billion yuan ($797 million) to 12,800 investors. Qin and 34 other executives from the firm were arrested on May 13th.

Qin who started the firm in 2011 with an initial investment of 5 million yuan from friends and family allegedly misused investor money on homes, luxury cars and on buying high-end office spaces for the firm in Shanghai.

This emerges in the wake of the shakedown of Ezubao, the Chinese P2P lending site which duped 900,000 investors of $7.6 billion in February this year. Following which, the Chinese police were ordered to shut down illegal online lending sites and take swift action against suspects.

The Ministry of Public Security also launched an online platform in a quest to garner more information from the public and warned of P2P lender defaults in June, when payments will be due.

The country’s banking regulator, China Banking Regulatory Commission (CBRC) and insurance regulator had also alerted the risks associated with investing in these schemes and barred these lenders from raising funds and signaled that close to 1,000 such businesses accounting for 30 percent of the industry could go belly up.

The Ezubao scam that surfaced on February 3rd revealed that 266 executives of Chinese P2P companies had fled and gone into hiding in the last six months. Ratings agency Moody’s has said that 800 platforms have already failed or were recently facing liquidity issues.

P2P Insurance Startup Lemonade Hires Behavioral Economist, Dan Ariely

February 24, 2016 “If you tried to create a system to bring out the worst in humans, it would look a lot like today’s insurance. @Lemonade_Inc changes that!”

“If you tried to create a system to bring out the worst in humans, it would look a lot like today’s insurance. @Lemonade_Inc changes that!”

That was a tweet by Dan Ariely, professor of psychology and behavioral economics at Duke University known for his bestseller ‘Predictably Irrational.’ Ariely, a leading behavioral economist is the latest hire at Lemonade Inc, a P2P insurance personal insurance.

Ariely will serve as the startup’s chief behavioral officer where he will design systems using his research to mitigate risks and ensure to align the interests of both the insurers and the insured.

“Dishonesty is influenced a lot by our ability to justify it. If we are dealing with a party that we think is immoral itself than we [are immoral] and justify it. We think that everybody else cheats… it feels like a victimless crime,” TechCrunch quoted him saying.

Ariely’s research has found that people tend to be more honest while filling out forms if they sign at the top of the page. Lemonade’s approach to disrupting the insurance industry will definitely have such applications.

The startup secured a $13 million funding round from Sequoia Capital and Israeli investor Aleph in December last year and has since made many significant hires from leading insurance firms like AIG and has lined up the likes of Berkshire Hathaway’s National Indemnity and Lloyd’s of London as reinsurers.

Investing in the Industry: Break Out of Your Bubble

June 29, 2015 Even if you’re already working in alternative lending and know a lot about your particular area, the industry is growing by leaps and bounds and you might be feeling a little overwhelmed by the multitude of investment opportunities. Amid all the options, finding the right place to invest your money can feel as challenging as picking out the proverbial needle in a haystack.

Even if you’re already working in alternative lending and know a lot about your particular area, the industry is growing by leaps and bounds and you might be feeling a little overwhelmed by the multitude of investment opportunities. Amid all the options, finding the right place to invest your money can feel as challenging as picking out the proverbial needle in a haystack.

“Most people don’t know everything that’s out there. There are huge opportunities,” says Peter Renton, an investor and analyst who founded Lend Academy LLC of Denver, Colorado, a popular resource for the online lending industry.

Indeed, there are a growing number of online alternative lending sites that theoretically allow a person to invest in all shapes and sizes of loans. There are sites like Lending Club and Prosper that allow smaller investors to tap into the burgeoning P2P market. There are also a plethora of platforms that cater only to wealthier, more sophisticated investors in a host of areas like small business, real estate, student loans and consumer loans.

Even though there is a surplus of options, prudent investing is not quite as simple as depositing ample funds in an account and clicking the “go” button. Before you get started, you need to carefully consider factors such as your own finances and risk tolerance. You should also have a good handle on the specifics about the online platform—how it works, its history and track record, the types of investments it offers, the platform’s management team, technology and your ability to diversify based on available investment opportunities.

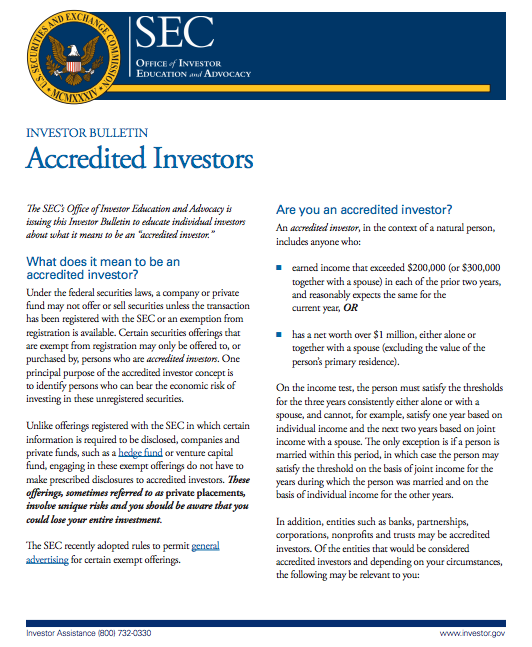

One of the first things you’ll have to think about as a potential investor is whether you have the financial wherewithal to be considered accredited by the SEC. If the answer’s yes, you’ll have a lot more choices of online marketplaces to choose from as well as types of investments. Basically, to meet the SEC’s threshold, you’ll need to have earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expect to earn the same for the current year. Alternatively, you need to have a net worth over $1 million, either alone or together with a spouse (excluding the value of your home). (Check out the SEC’s website for more detailed info.)

If you don’t fit the definition of accredited investor, it’ll be more difficult for you to find out about all the investment possibilities that are on the market today. That’s because the platforms that cater to accredited investors aren’t allowed by SEC rules to solicit, so many online marketplaces are hesitant to say much of anything for fear their words will be misconstrued by regulators as an attempt to drum up new business. With limited exceptions, you won’t be able to get more than very basic information from and about these platforms’ unless you are accredited.

If you don’t fit the definition of accredited investor, it’ll be more difficult for you to find out about all the investment possibilities that are on the market today. That’s because the platforms that cater to accredited investors aren’t allowed by SEC rules to solicit, so many online marketplaces are hesitant to say much of anything for fear their words will be misconstrued by regulators as an attempt to drum up new business. With limited exceptions, you won’t be able to get more than very basic information from and about these platforms’ unless you are accredited.

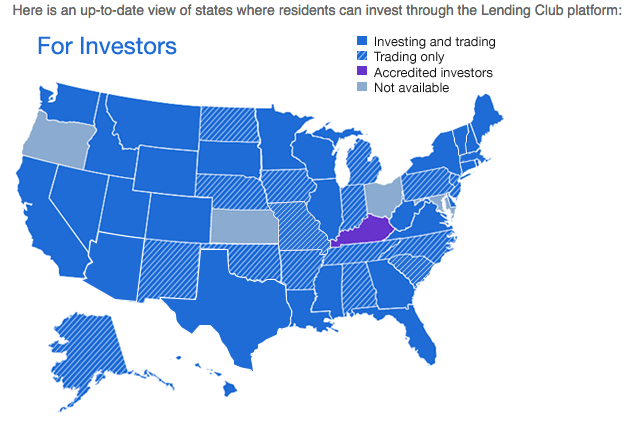

But smaller investors do have options. Two San Francisco-based online lending platforms, Lending Club and Prosper, cater to individual investors, and you can still make a pretty penny plunking down money with these venues. You’ll also find a wealth of information about investing with them by perusing their websites as well as by reading the blog posts of media-savvy financiers.

“Right now, Lending Club and Prosper provide a great entry point for people who want to get involved in investing in alternative lending,” says Renton of Lend Academy.

The caveat is that these platforms aren’t yet open to investors in every state, so if yours isn’t on the list you’re out of luck for now. However, with each marketplace you’ve got more than a 50 percent chance your state is on the approved list, so it’s worth digging deeper.

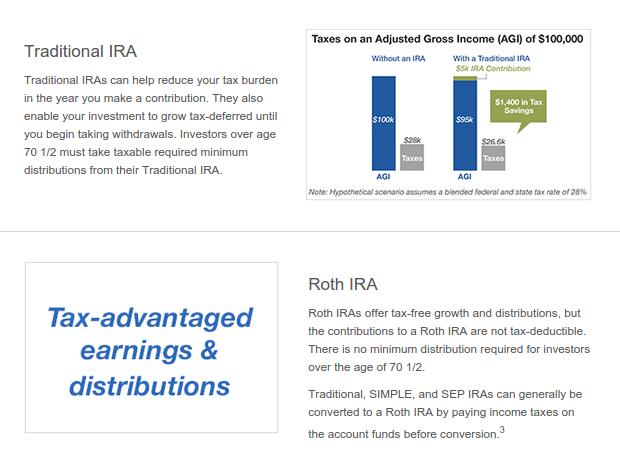

Assuming you meet their respective suitability requirements, you can choose to invest on one platform or both. To be sure, they are alike in many ways. Both allow you to invest with as little as $25 and fund one loan, however they recommend you buy at least 100 loans to be properly diversified, which you can do for as little as $2,500. You can manually choose which loans to buy, or enter your investment criteria so loan picking is automated. You can also invest retirement money in an IRA through Lending Club or Prosper.

There’s no fee to get started investing on either platform. For Lending Club, investors pay a service fee equal to 1 percent of the amount of payments received within 15 days of the payment due date. Prosper charges investors 1% per year on the outstanding balance of the loan. As the loan gets smaller, the servicing fee, which is charged monthly, gets smaller too.

To invest in Lending Club, in most cases you’ll need either $70,000 in income and a net worth of at least $70,000, or a net worth of at least $250,000. There may be other financial suitability requirements that vary slightly depending on the state you live in. For Prosper, individual investors must be United States residents who are 18 years of age or older and have a valid Social Security number.

At any given time, Lending Club has more than 1,000 loans visible on the platform and new ones get added every day, according to Scott Sanborn, chief operating officer and chief marketing officer. Prosper, meanwhile, on average has more than 200 loans for people to invest in, says Ron Suber, president.

Returns tend to be favorable compared with other fixed income investments—a major reason investing in online loans is becoming more desirable. Of course, actual returns will depend on what loans you invest in and the level of risk you take—typically the more risk you take on, the greater your potential return will be. At Lending Club, for instance, Grade-A loans have an adjusted net annualized return of 4.89%, compared with 9.11% for Grade-E loans, according to the company’s website.

Returns tend to be favorable compared with other fixed income investments—a major reason investing in online loans is becoming more desirable. Of course, actual returns will depend on what loans you invest in and the level of risk you take—typically the more risk you take on, the greater your potential return will be. At Lending Club, for instance, Grade-A loans have an adjusted net annualized return of 4.89%, compared with 9.11% for Grade-E loans, according to the company’s website.

To encourage more people to start investing, some savvy investors have started to self-publish online the quarterly returns they accumulate through the Lending Club and Prosper platforms. Renton, of Lend Academy, reported a balance of $476,769 on Dec. 31, 2014 and a real-world return for the trailing 12 months of 11.11 percent. Another well-known P2P investor and blogger, Simon Cunningham—the founder of LendingMemo Media in Seattle—reported a 12-month trailing return of 12.0 percent over the same time period, with a published account value of $41,496. Both investors say they expect returns to drop back somewhat over time, however, as the online marketplaces continue to lower interest rates to attract more borrowers.

Of course, if you’re an accredited investor, you will have access to even more online marketplaces. For instance, there’s SoFi of San Francisco for student loans, Realty Mogul of Los Angeles for real estate loans and Upstart of Palo Alto, California, that focuses on loans to people with thin or no credit history. The list of possibilities goes on and on.

Generally speaking, the more money you have to invest, the more options you have. “In this country today, you’ve got well over a hundred options if you’re willing to put seven figures in,” Renton says.

The minimums at venues that focus on accredited investors tend to be more than you’d find at Lending Club or Prosper. At SoFi, accredited investors need at least $10,000 to begin investing in the company’s unsecured corporate debt. SoFi’s been in the lending business for several years now and currently focuses on student loans, mortgages, personal loans and MBA loans. Investors, however, can’t currently invest in these loans, says Christina Kramlich, co-head of marketplace investments and investor relations at SoFi. The company plans to eventually offer investment opportunities in the areas of mortgages and personal loans, she says.

At Funding Circle USA in San Francisco, accredited investors can buy into a limited partnership fund for at least $250,000. Or they can buy pieces of small business loans for a minimum of $1,000 each, though the recommended minimum is $50,000, explains Albert Periu, head of capital markets. There may also be upper limits on your investment, based on your financials. If you’re part of the pick-and-choose marketplace, you’ll pay an annual servicing fee of 1%. With the fund, you’ll also pay an administration fee of 1%. Trailing 12-month net returns for investors are north of 10%, Periu says.

At Funding Circle USA in San Francisco, accredited investors can buy into a limited partnership fund for at least $250,000. Or they can buy pieces of small business loans for a minimum of $1,000 each, though the recommended minimum is $50,000, explains Albert Periu, head of capital markets. There may also be upper limits on your investment, based on your financials. If you’re part of the pick-and-choose marketplace, you’ll pay an annual servicing fee of 1%. With the fund, you’ll also pay an administration fee of 1%. Trailing 12-month net returns for investors are north of 10%, Periu says.

Because it’s still so new, it can be hard for investors to know how to compare marketplaces. For starters, consider the platform’s historical performance. There are a lot of new marketplaces popping up, but it takes time to develop a proven track record. This isn’t to say you shouldn’t dabble with the newer platforms, but if you do, you’ll want above-average returns to balance out the higher risk, says Sanborn of Lending Club. “About three years in, we started to build a track record. At five years in, it was very solid,” he says. “You need time to see how a basic batch of loans is going to perform.”

Before investing, you’ll want to get a sense of how committed senior management is to the company and try and get a sense of whether the company seems to have enough capital for the business to run well. Try to find out about the cash position of the company, how the loans are going to be serviced, what entity is doing the underwriting and how and where your cash will be held.

“It’s not just assessing the risk of the asset and the investment, it’s assessing the risk of the enterprise that is making it available to you,” Sanborn says.

It’s also important to ask questions about the loans themselves. Where do they come from and is the volume sustainable? Ideally, a platform should offer a variety of loans so investors can properly diversify, or you might need to consider investing with multiple platforms to achieve your desired balance.

Before you get started, you’ll also want to ask about the company’s compliance procedures and controls and how you can recover your money if you no longer want to invest. Data security is another area to explore. Not every company is as protective of customer data as perhaps they should be.

Before you get started, you’ll also want to ask about the company’s compliance procedures and controls and how you can recover your money if you no longer want to invest. Data security is another area to explore. Not every company is as protective of customer data as perhaps they should be.

When you’re asking all these questions, try to get a sense of how receptive the platform is to the feelers you’re putting out. Investors should only work with companies that are willing to be open about how they are investing your money, their historical returns and other important data. “I can’t stress transparency enough,” says Periu of Funding Circle.

The technology the platform uses is another key element. Is the technology easy to use, or does the platform create stumbling blocks for investors? Are there ways to automate lending, or do you have to log on every day and manually invest in loans?

Suber of Prosper says investors should also consider whether platforms work with a back-up servicer in case there’s a disruption and whether they run regular tests to make sure everything works as expected. “It’s just like a backup generator and you have to test it every once in a while and make sure it goes on.”

Certainly it pays to do your homework before you invest your hard-earned cash with an online platform. Ask around, attend industry conferences and absorb all you can from publicly available data. The good news is that there will probably be even more information for you to tap into as the industry continues to grow.

“Two years ago [marketplace lending] was very esoteric. A year ago it was still esoteric,” says Funding Circle’s Periu. Now, more and more investors are hearing about marketplace lending and want to make it part of their broader fixed income bucket. Even so, more has to happen for it to become a mainstream investment. “Awareness and education need to continue,” he says.

Once more people understand the extent of what’s out there, Suber of Prosper expects investing in online marketplaces will take off even more than it already has. “A lot of people still don’t know this as an investment opportunity,” he says.

Would You Bet Your Retirement on Consumer Loans?

March 12, 2015I like Lending Club. I have a rather sizable portfolio of their notes. I’m also long-term bullish on platform lending in general, at least long-term enough to feel confident to buy 3 and 5 year notes (and who knows how much things will change by 2020!).

There are limits of course to my optimism. The amount I’ve invested is essentially play money. It’s separate and smaller than some of my other more serious long term investments like mutual funds. I think that’s how everyone should invest on these platforms, even a rather vetted one like Lending Club. Only invest what you can afford to lose.

If you’re going to earn Wall Street yields such as 7-12% (after defaults) in a 0% interest rate environment, know that in the back of your head that you could encounter a Wall Street style loss. And don’t expect a bailout.

It’s important to remember that Lending Club is not peer-to-peer. Investors are not connecting with borrowers and lending them money. Lending Club is connecting with borrowers and investors are lending money to Lending Club. If Lending Club goes bankrupt, you could lose everything. I’ve accepted that risk for play-money.

But this scares me:

Putting your retirement funds in the fate of Lending Club and its young consumer lending model is being marketed as a quick way to lower your tax bill before April 15th.

I said I am bullish. I am not 30+ years bullish. A Lending Club IRA is the same as putting your life savings in a young tech stock, quite literally in fact since Lending Club only went public 3 months ago.

My hope is that Lending Club might actually read this post and re-evaluate the slippery slope of this marketing strategy.

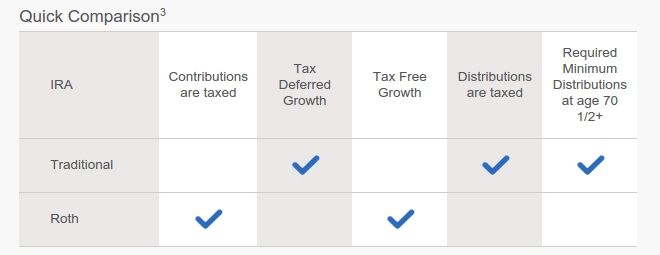

A further explanation of a Lending Club IRA on their website:

Lots of tax savings talk, but no mention of how illogical it is for someone to put the fate of their retirement into the hot lending company of the moment.

Is your money safe? Two months ago Lending Club said it had not begun to explore the cost and requirements of licensing its lending operations in all 50 states. Right now, their entire business model relies on the longevity of their relationship with WebBank.

Mark Cuban says we’re in the midst of a major tech bubble. Maybe he’s wrong, but I wouldn’t bet my retirement on it.

Hopefully someone doesn’t invest their entire retirement portfolio into something as new and exotic as Member Payment Dependent Notes under the guise of a tax deduction today.

I’m bullish on them. I like them as a company. They should probably fix the way their retirement accounts are marketed.

Just saying…

Lending Club (LC) Q4 Earnings Call

February 23, 2015 The first company to bring platform lending into the public eye will release their 4th Quarter and 2014 earnings on Tuesday, February 24th at 5pm EST. Anyone can join the live webcast by clicking here. If not by a computer, you can also dial in by phone at 888-317-6003. Use conference ID 4117710 ten minutes prior to the start of the call.

The first company to bring platform lending into the public eye will release their 4th Quarter and 2014 earnings on Tuesday, February 24th at 5pm EST. Anyone can join the live webcast by clicking here. If not by a computer, you can also dial in by phone at 888-317-6003. Use conference ID 4117710 ten minutes prior to the start of the call.

Investor attitudes are likely to be affected by the outcome of OnDeck’s earnings. While the two companies have different models, they have generally followed the same ups and downs. Many investors are still not clear how they’re different. Lending Club earns fee income by servicing loans and is not exposed to the risk of the loans themselves. Some critics believe that puts them at odds with their platform lenders over the long term.

Lending Club has already experienced a low of $18.30 a share and a high of $29.29. It closed yesterday at $22.89.

Since going public a few months ago, they announced a partnership with Alibaba and Google.

Now that institutional money is flowing into the alternative lending industry, some retail investors are starting to express concern that the rules are changing. Lending Club for example is no longer considered a peer-to-peer lending platform, but rather an online credit marketplace.

Now that institutional money is flowing into the alternative lending industry, some retail investors are starting to express concern that the rules are changing. Lending Club for example is no longer considered a peer-to-peer lending platform, but rather an online credit marketplace.