Online Lending

State of Fintech Lending in Canada Report Reveals Key Information for Lenders

November 23, 2020 Smarter Loans, Canada’s loan comparison giant, has published its 3rd annual State of Fintech Lending report.

Smarter Loans, Canada’s loan comparison giant, has published its 3rd annual State of Fintech Lending report.

“As Canadians stayed home longer, adoption of fintech products has accelerated dramatically,” the report says, accelerating trends that had already been developing for years. The data is based on survey results submitted by nearly 2,600 fintech lending customers.

While there are dozens of important takeaways, respondents indirectly signaled how valuable it is to be among the brands that are found first by borrowers.

That’s because loan applicants said that they researched fewer lenders than ever before (35% only researched 1 or 2 lenders before applying) and they spent less time researching lenders than ever before (31% said they spent less than 1 hour researching). Furthermore, 51% of respondents said that they only applied with a single provider.

This approach worked. Of those that got approved, 89% of respondents said that they were satisfied or very satisfied with their loan provider.

The trend should signal to lenders that borrowers may simply come to expect a satisfactory experience regardless of where they apply and that there is tremendous value in simply being the first 1-2 lenders that a prospective borrower considers.

And hint hint, it pays to be easily discoverable online. Fifty eight percent of respondents said they discovered their loan provider through online search.

Click here to view the full survey results in Smarter Loans’ official State of Fintech Lending.

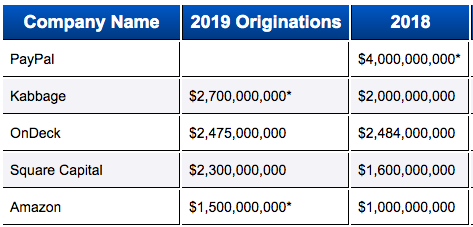

PayPal Still Leads in Unsecured Small Business Lending

November 12, 2020PayPal recently disclosed the dollar amount of receivables it had “purchased” between its working capital and business loan program for the first 3 combined quarters of 2020. The figure was $1.5B, down by more than half from over the same period last year. That would seem to suggest that the actual origination figure is probably $1.3B, which is still larger than some of its closest competitors. Numbers from rivals like Kabbage (recently acquired by Amex) and Amazon were not readily available.

For a larger comparison chart, click here.

2020 YEAR TO DATE:

| Company | Q1 2020 | Q2 | Q3 | YTD TOTAL |

| PayPal | $1.3B | |||

| OnDeck | $592M | $66M | $144M | $806M |

| Square Capital | $548M | $0 | $155M | $703M |

| Shopify Capital | $162.4M | $153M | $252.1M | $567.5M |

Upstart Files for $100M IPO – Reveals Financials

November 6, 2020

Upstart, the online personal lender that uses non-traditional data like a college education, job history, and residency to evaluate borrowers, is moving forward with an IPO.

The company revealed its financial statements in an S-1 filed on Thursday. In 2019, Upstart generated $164.2M in revenue and had a net loss of $5M. For 2020 through Sept 30th, revenue was at $146.7M with a net income of $4.5M.

The company said that in 2020, 98% of its revenue was generated from platform, referral and servicing fees that it receives from its bank partners. Their bank partners “include Cross River Bank, Customers Bank, FinWise Bank, First Federal Bank of Kansas City, First National Bank of Omaha, KEMBA Financial Credit Union, TCF Bank, Apple Bank for Savings and Ridgewood Savings Bank.”

Upstart borrowers tend to have limited or no credit history, which is where its AI-driven models with 1,600 variables come into play.

“Our bank partners have generally increasingly retained loans for their own customer base and balance sheet,” the company wrote in its S-1. “In the third quarter of 2020, approximately 22% of Upstart-powered loans were retained by the originating bank, while about 76% of Upstart-powered loans were purchased by institutional investors through our loan funding programs.”

Upstart was valued at $750M during its 2019 Series D.

In 2017, deBanked referred to Upstart as the Tesla of alternative lending.

“You hear so much about how Tesla cars will drive themselves, how Google or Amazon home assistants talk to you to as if you’re human,” said Dave Girouard, Upstart co-founder, in an interview back then. “In lending we are the first company to apply these types of technologies to lending.”

Girouard’s co-founder Paul Gu, who serves as SVP of Product and Data Science, was only 21 when Upstart launched in 2012. He’s now 29.

Anna M. Counselman, the third co-founder, is SVP of People and Operations.

Upstart is planning to raise $100M from its IPO.

LendingClub’s Delinquency Rates Are Lower Now Than They Were Pre-Covid

November 5, 2020“Delinquency rates for the personal loan portfolio continue to outperform pre-Covid levels, even as most hardship plans have come to an end,” LendingClub announced in its Q3 earnings report. “Strong performance continues despite unemployment benefits largely coming to an end in July.”

The company ramped loan originations back up to $584M last quarter after hitting a low of $326M in Q2. Prior to Covid, the company was lending $2.5B to $3.5B a quarter.

LendingClub reported a Q3 net loss of $34.3M, bring the ytd net loss total to $160M.

Lufax, a Chinese Online Lending Marketplace, to IPO on NYSE Next Month

October 27, 2020 Lufax, an online lending marketplace and one of China’s largest fintech companies, plans on going public by the end of the month on the New York Stock Exchange. Lufax is one of the multiple Chinese fintech companies grappling for a public offering amidst increasing tension between U.S. and Chinese markets.

Lufax, an online lending marketplace and one of China’s largest fintech companies, plans on going public by the end of the month on the New York Stock Exchange. Lufax is one of the multiple Chinese fintech companies grappling for a public offering amidst increasing tension between U.S. and Chinese markets.

Offering an online shopping mall for financial products, Lufax connects borrowers to various lending products supplied by traditional and alternative investors alike. Lufax was one of the largest, if not the largest P2P lender in China just two years ago before a major crackdown on the P2P industry forced the company to revamp completely.

Lufax plans to issue 175 million shares that will be priced from $11.5 to $13.5 each, according to a prospectus with the U.S. Securities and Exchange Commission last week. This would net the company around $2.36 billion.

The IPO would give the company around a $30 billion in valuation, lower than the $39.4 billion valuation it received in 2019 from a major backer Ping An Insurance Group.

Lufax reported more than $1 billion of profit in the six months up to June 30th, according to the filing. Last year, the firm’s assets dropped by 6.1% after a 30% reduction in transaction volumes. This was a cut of nearly all P2P transactions, in compliance with regulation from the Chinese government.

After the P2P industry grew unchecked for a decade, fraud concerns bloomed into outrage as hundreds of platforms covering hundreds of billions of dollars defaulted. According to Mckinsey, from 2013 to 2015, fintech firms offering P2P products exploded from 800 to more than 2,500 companies. More than 1,000 of these firms began to default on their debt, ballooning to an outstanding loan value of $218 billion in 2018.

In response to protests, outrage, and stadiums of helpless borrowers trying to gain their funds back from Ponzi schemes, the Chinese government cracked down hard on fraudulent firms. According to Reuters, regulators placed every P2P firm on death row, stating in 2019 that the industry had two years to switch to “small loans.” The shutdowns have cost Chinese investors $115 billion, according to Guo Shuquing, China Banking Regulatory Commission.

Pivoting away from these shutdowns, Lufax and many firms like Alibaba funded Ant Group are switching to lending marketplaces. Lufax works with 50 lending providers that hold $53 billion in assets as of June. Lufax believes that there are trillions of dollars in the untapped alternative finance market in China.

Avant CEO: Colorado Decision Framework for Bank Fintech Partnerships

October 13, 2020 After three years of litigation, in August, the Colorado “true lender” case settled with an agreement between the fintech lenders, bank partners, and the state regulators. Along with lending restrictions above a 36% APR, the fintech lenders will have to maintain a state lending license and comply with other regulatory practices.

After three years of litigation, in August, the Colorado “true lender” case settled with an agreement between the fintech lenders, bank partners, and the state regulators. Along with lending restrictions above a 36% APR, the fintech lenders will have to maintain a state lending license and comply with other regulatory practices.

The decision has been called unfair regulation and a bad precedent for other similar regulatory disputes across the country.

But James Paris, the CEO of Avant, sees the decision as a victory for fintech lenders. Paris said the decision was an excellent framework for fintech/bank partnerships across the nation and a sign that regulators are finally taking the benefits of alternative finance seriously.

“For us, the case also involved being able to continue to provide these good credit products to deserving customers who maybe weren’t being served as well through some of the legacy providers,” Paris said.

Paris called back to the Madden vs. Midland Funding case in the US Court of Appeals Second Circuit decided in 2015. That case called into question if loans made in fintech bank partnerships in the state of New York were valid at the time of origination. Regulators charged that though national banks can create loans higher than state regulations allow, fintech partners buying those loans to take advantage of higher rates were skirting state regulations.

“The ruling was essentially that the loan would not continue to be valid,” Paris said. “Because the individual state in question, which was New York’s local usury law, would apply because it was no longer a national bank that held that loan after it had been sold.”

The decision called into question loans made in the fintech space. Paris said that the Colorado true lender Case was not about whether the banks were even making loans. Instead, fintech lenders were called the true originators and therefore didn’t have a license that allowed them to make loans at higher rates than the state allowed.

Paris said the decision showed confidence that fintech bank partnerships were not exporting rates, and that by limiting lending to under 36%, regulators were protecting bank fintech partnerships and consumers.

“All of the lending Avant does is under 36%, and that’s been the case for years,” Paris said. “In the space where we do play, from 9% to just under 35%, through our partnership with WebBank, we are confident in running a portfolio extremely focused on regulatory compliance.”

Colorado went from not allowing partnerships at all, to working with fintech companies to developing a set of terms that allowed partnerships to function, Paris said. He added that Avant’s products have always been to customers below nonprime credit, from 550 to 680 Fico scores, serviced by up to 36% APRs.

Paris said he does not know about customers outside of this range, or how they are affected by limiting APR to 36%, but he cited a study done by economist Dr. Michael Turner. Turner is the CEO and founder of the Policy and Economic Research Council (PERC), a non-profit research center.

The study compared lending after the Madden case in New York with how customers can be served after the Colorado true lender case. In the credit market Avant serves, Turner found that customers are better off with access to regulated fintech loans, as opposed to not having access at all.

The study looked at the average borrower credit score, APR, and loan size of Avant and WebBank borrowers, and found that if WebBank loans through Avant were prohibited, borrowers would be forced to access other means of credit, through much higher rates.

“Should WebBank loans be prohibited in Colorado, then we can reasonably expect that some non-trivial portion of the WebBank loan borrower population, as well as prospective future borrowers, will be forced to meet their credit needs with higher cost products,” Turner wrote. “This outcome is financially detrimental for this borrower population, most of whom have no access to more affordable mainstream alternatives.”

Given this data, Paris is happy to comply with the regulation. Without the framework Colorado has provided, Paris said borrowers would be worse off. Paris hopes that this decision will precede other state frameworks because what fintech bank partnerships need the most are consistent regulatory practices.

“I’m hopeful that to the extent there are ongoing concerns around bank models across other states, that this type of safe harbor model that Colorado helped develop is something that others could look to as a precedent or a model. Because I think the more that we can have consistency across the relevant jurisdictions, the better.”

Jackie Reses is Leaving Square Capital

October 2, 2020 Square Capital’s lead executive, Jacqueline Reses, is leaving the company. Square announced on October 2, that her resignation would be effective as of October 31. Reses is largely responsible for developing Square’s robust lending business, one that effectively made the company one of the largest non-bank small business lenders in the country.

Square Capital’s lead executive, Jacqueline Reses, is leaving the company. Square announced on October 2, that her resignation would be effective as of October 31. Reses is largely responsible for developing Square’s robust lending business, one that effectively made the company one of the largest non-bank small business lenders in the country.

It’s time to hang up my boots and say goodbye to my good friends at @Square. To the people I’ve worked with: everything I love about Square is related to you. It is my privilege and honor to have been along for the ride with you.

— Jackie Reses (@jackiereses) October 2, 2020

I shared my thoughts with Squares today because the place is so special! I thought I would share. pic.twitter.com/tXAE0dZhK9

— Jackie Reses (@jackiereses) October 2, 2020

CredoLab Lands $7M Funding, Bringing the “Gini” to US, Elsewhere

October 2, 2020

Chief Product Officer Michele Tucci said the platform uses 50,000 data points of mobile phone activity to predict a prospective borrower’s debt capabilities. CredoLab serves the 1.7 billion “credit-invisible” customers across the globe that may have some credit history, but not enough for a score, let alone a prime score.

“We do this in real-time: in less than a second a lender anywhere in the world, receives a credit score from Credolab,” Tucci said. “We don’t know the identity of the user; it’s only known to the bank or the lender, not to Credolab.”

CredoLab anonymously collects thousands of mobile data points, uses that data to create behavioral models, and then derives a credit score. The data can be anything- from the type of apps a user downloads, to the number of calendar events created- even the amount of texts the user sends. Is the user a gambler, a gamer, does the user use a work email during the week, and how many calendar events they schedule- all go into the predictive model.

“Some of these micro behavioral patterns could be the type of files being downloaded. Is it mostly music, or is it PDFs- or the percentage of photos taken in the week prior to the loan application that are selfies,” Tucci said. “So these are all indications that we collect and find a correlation we compare and analyze about 1.3 million micro behavioral patterns.”

Tucci said the CredoLab platform offers unmatched speed and predictability for customers’ future credit habits. He said Credolab helps lenders save money because they can better predict how their borrowers will act. Borrowers benefit by the program: Tucci argued that if lenders can better expect how they will be repaid, they tend to lend more.

The team built the platform for the world’s risk managers, whom Tucci knows constantly worry about the health of their transactions.

“Our CEO and founder Peter Bartek has more than 20 years of experience managing risk,” Tucci said. “So he feels the pain of the CROs out there, and our solution is built to address the very specific needs of chief risk officers.”

To explain the CredoLab platform’s accuracy, Tucci used a data metric called the Gini coefficient, a number between 0 and 1 that identifies to which category a request belongs. In this case, the GINI is used to classify borrowers as creditworthy or unworthy based on their mobile data.

“Zero is like flipping a coin; you have a 50/50 chance of getting the decision right. Basically no predictability,” Tucci said. “A GINI of one is like my wife; she’s always right. You know exactly what outcome to expect every single time.”

CredoLab’s platform has a predictive power of 0.6. Tucci cited World Bank economist David Mckenzie, who found for each decimal increase in GINI, there is a 1% cost savings from a risk point of view.