Online Lending

NerdWallet Names its Competition, Reveals Its Web Traffic Figures

October 12, 2021 Personal finance company NerdWallet disclosed who its direct competitors were last week in an S-1 filing.

Personal finance company NerdWallet disclosed who its direct competitors were last week in an S-1 filing.

Those companies include: Bankrate, Credit Karma, LendingTree, and Zillow.

“We currently compete with a number of companies that market financial services online, as well as with more traditional sources of financial information, and with financial institutions offering their products directly, and we expect that competition will intensify,” NerdWallet said.

“… We also face direct or indirect competition from providers of consumer personal finance guidance and online search engines,” the company added.

NerdWallet generated 16 million unique users per month last year, defining that metric as a unique user with at least one session in a given month as determined by unique device identifiers. That was up from the 13 million per month in 2019.

The company had more than 8 million registered users as of December 2020, 2 million of which registered in 2020.

Fundera Sold For $29.2M + Up to $66M Earn-Out

October 12, 2021 When NerdWallet acquired Fundera last year, terms of the deal were not revealed.

When NerdWallet acquired Fundera last year, terms of the deal were not revealed.

NerdWallet recently disclosed that it paid $29.2M at closing to acquire Fundera with an additional potential earn-out of up to $66M over the following two years if certain metrics were met.

“As of December 31, 2020, the estimated fair value of the contingent consideration was $35.2 million,” NerdWallet reported.

Fundera had entered the market strong, launching in 2013, raising $3.4M in 2014, followed by another raise of $15.5M in 2015. The party slowed thereafter.

NerdWallet has big plans for Fundera, however. “We plan to invest significant resources to integrate, develop and expand new offerings and technologies in the markets in which Fundera operates,” the company wrote in its S-1 filing.

NerdWallet filed its S-1 on October 8th.

Upstart Launches First Spanish Digital Lending Platform

September 1, 2021 One of the nation’s top artificial intelligence lending platforms announced Tuesday that they will be operating the first ever online lending platform in Spanish. Upstart will mimic its English platform with full access to loan information, borrowing tools, loan agreements, and customer support for Spanish speaking customers.

One of the nation’s top artificial intelligence lending platforms announced Tuesday that they will be operating the first ever online lending platform in Spanish. Upstart will mimic its English platform with full access to loan information, borrowing tools, loan agreements, and customer support for Spanish speaking customers.

“Inclusion often starts with language,” said Dave Girouard, co-founder and CEO, to deBanked. “We founded Upstart with the belief that better technology could improve access to affordable credit. While better AI models are the primary lever we use to create a more inclusive platform, they are not the only lever.

“While restaurants and retailers routinely offer a Spanish-language alternative, online lenders unfortunately do not,” Girouard continued. “Taking out a loan is a big decision and comes with important obligations, so it’s clearly better for the consumer if the entire experience, including disclosures, the loan agreement, and customer support, are available in their preferred language.”

With more than 60 million Latinos living in the United States, access to information about personal loans in another language will be able to provide more clarity and transparency for a new breed of customers who may be hesitant about lending as is.

The launch of the platform is somewhat unique, as they are introducing borrowing services to an entire demographic that is perceived as untapped. Getting access to an entire community of people by breaking a language barrier could definitely be one way to add potential borrowers to Upstart’s book of business.

This pattern of increasing qualified borrowers is nothing new for Upstart, whose business model has been to work with both banks and credit unions by examining potential borrowers on more than just raw credit scores. Work history, education, academic standing, and standardized test scores are also factors that Upstart considers when underwriting their loans.

The loans are offered exclusively through Cross River Bank, but could be offered by other institutions that work with Upstart in the near future.

Prosper Marketplace Originated $450M in Loans in Q2, Posted $5.8M Net Loss

August 31, 2021 Prosper Marketplace originated $450M worth of loans in Q2, according to the company’s latest financial disclosures. While the company is not publicly traded, it is required to file quarterly reports because of its note platform for retail investors. Only 13% of their loans were funded through that channel for the quarter, while the rest went through the Whole Loan Channel. Technically, the loans are funded through WebBank and Prosper earns a transaction fee from WebBank for facilitating them.

Prosper Marketplace originated $450M worth of loans in Q2, according to the company’s latest financial disclosures. While the company is not publicly traded, it is required to file quarterly reports because of its note platform for retail investors. Only 13% of their loans were funded through that channel for the quarter, while the rest went through the Whole Loan Channel. Technically, the loans are funded through WebBank and Prosper earns a transaction fee from WebBank for facilitating them.

The company also generated a net loss of $5.8M on $34.7M of net revenue, an improvement over the $44M net loss last quarter. In fairness, Q1’s whopping loss was entirely attributed to a “Change in Fair Value of Convertible Preferred Stock Warrants” which generated a $44.4M expense.

Prosper’s surviving note platform is unique. Company rival LendingClub, for example, wound its note platform down when it acquired Radius Bank.

Kabbage Spotted in American Express Cardholder Dashboard

May 27, 2021 American Express business cardholders may be seeing a notification from Kabbage in their online dashboards. This writer did today.

American Express business cardholders may be seeing a notification from Kabbage in their online dashboards. This writer did today.

“Introducing Kabbage®, now an American Express company. Streamline your business banking with Kabbage Checking™ and earn 1.10% APY on balances of up to $100,000, with no monthly maintenance fees. It’s digital checking for the way you work today. Terms apply. Learn More.”

The Learn More link goes to the Kabbage website where users can apply. The product itself may not be ready yet however, as clicking the application link tells users that they can join the waitlist because they’re “not currently accepting new customers.”

The rollout is consistent with statements that American Express has made about Kabbage’s role in the company.

2021: The Year of Uncertainty

January 7, 2021 For alternative lenders and funders, 2021 is starting out with a question mark and will lead (hopefully) to a resounding exclamation point of recovery.

For alternative lenders and funders, 2021 is starting out with a question mark and will lead (hopefully) to a resounding exclamation point of recovery.

Many industry participants waved goodbye to 2020 with relief, and are welcoming a bounce-back in 2021, despite some trepidation about potential bumps along the way and how long a full recovery will take. While things started to improve somewhat toward the latter half of 2020 after grinding to a halt earlier in the year, the pandemic is still raging, with economic growth highly dependent on the immunization trajectory. Then there’s the incoming Democratic administration and the possibility of new rule- making, along with January’s runoff elections in Georgia that could change the balance of power in the Senate, and thus impact the new president’s law- making abilities.

Beyond these macro-issues, the funding industry is also dealing with its own uncertainties. Small business lenders and funders have been hit particularly hard, with underwriting decidedly more difficult in this environment. Some industry players have been forced to find alternative revenue streams in order to ride things out. Not only that, but there are scores of small businesses still reeling from pandemic-induced shutdowns and lighter foot traffic, with some gloomy estimates about their ability to bounce back. Many alternative players are weighing diminished returns against a widely-held bullish outlook for the industry long-term. Many are simply hoping they can hunker down and stick it out long enough and to avoid additional carnage and consolidation that’s widely expected over the short-term.

Ultimately things will get better, but it’s unclear precisely when, says Scott Stewart, chief executive of the Innovative Lending Platform Association. “It’s going to be a bumpy ride for the next year to figure out who is going to be able to survive,” he says.

Here’s a deeper dive into how industry participants see 2021 shaping up in terms of the challenges, competition, M&A, regulation, changing business model, expansion opportunities and more.

SPECIFIC CHALLENGES FOR SMALL BUSINESS FINANCERS

Companies that focus on consumer financing haven’t struggled quite as much amid the pandemic as their small business brethren, and they could continue to see demand grow in 2021. Even amid high unemployment rates, many consumers still need loans for home repairs or as a stop-gap to pay necessary expenses, helping to mitigate the impact on firms that focus on personal loans.

Small business financers, however, got pummeled in 2020 and the situation remains precarious, especially given the prognosis for small companies broadly. Consider that 163,735 Yelp-listed businesses closed from the beginning of the pandemic through Aug. 31—at least 97,966 of them permanently. Further underscoring how dire the situation is for small businesses, 48 percent of owners feared not earning enough revenue in December to keep their businesses afloat, according to a recent poll by Alignable, an online referral network for small businesses. What’s more, 50 percent of retail establishments and 47 percent of B2B firms could close permanently, according to the poll of 9,204 small business owners.

A SHRINKING COMPETITIVE LANDSCAPE

For many lenders and funders, the latter part of 2020 proved more successful for originations, though business is still a far cry from before the pandemic. A number of players who suspended or reduced business operations for a period of time during the first wave of the pandemic have dipped their toes back in and are in the process of trying to adapt to the new normal. For some, though, the challenges may prove too great, industry observers say. Given that many brokers and funders that were on the fringe have been hurt by the pandemic, more shake- out can be expected, says Lou Pizzileo, a certified public accountant who advises and audits alternative finance companies for Grassi in Jericho. N.Y.

And, with fewer competitors, there will be more of a need for those who are left to pick up the slack, says Peter Renton, founder of Lend Academy. Beyond being a lifeline for many alternative financers, PPP loans helped open the eyes of many small businesses who hadn’t previously considered working with anyone but a bank. In the beginning, when it was so difficult for small businesses to get these funds, they looked beyond banks for options and some found their way to online providers. This could be a boon for the industry going forward since alternative providers are now on the radar screen of more small businesses, says Moshe Kazimirsky, vice president of strategic partnerships and business development at Become.

He predicts that larger, stronger players will gradually ease some of their lending and funding criteria early on in 2021, but no one is expecting a quick revival, with some predicting it could be well into 2022 before the industry is on truly stable footing. “I think it’s going to be a very slow recovery,” Kazimirsky says.

M&A

In 2020, the industry saw bellwethers like Kabbage and OnDeck get swallowed up, and with so many businesses pinched, there are likely to be more bargains ahead from M&A standpoint, Pizzileo says. “The damage from Covid is palpable; we just haven’t seen the real impact of it yet,” he says.

No matter what product you are providing, if you’re a smaller player who can’t find your way, you’re going to have a hard time staying in business,” says Stewart of the Innovative Lending Platform Association. “There will be some collateral damage going into next year,” he predicts.

In terms of likely buyers, Renton says he expects other fintechs to step in, and possibly even mid-size community banks snap up some alternative providers. If you can buy something for “a song” it’s compelling, he says. “I expect to see a few more offers that are too good to refuse,” he says.

CHANGING BUSINESS MODELS

Pizzileo, the CPA, predicts there will be ongoing opportunities in the year ahead for well-positioned, strong businesses with available capital. In some cases, however, this may require tinkering with their existing ways of doing business.

Before the crisis, some lenders applied the same or very similar lending model across industries. “That is going the way of the dinosaur. That’s not going to be a successful model going forward,” Renton says. Lenders will focus more on having a differentiated model for the businesses they serve. “I think the crisis created this necessity to treat each industry on its own merits and create a model that has some level of independence, he says.

The year ahead is also likely to be one in which e-commerce lending continues to thrive. According to the third quarter 2020 report from the U.S. Census Bureau, U.S. retail e-commerce stood at $209.5 billion, up 36.7% year over-year. E-commerce accounted for 14.3% of total retail sales in Q3. Because it’s such a high-growth area, and many businesses that didn’t have this vertical before are moving in this direction and more lenders are focusing on it and growing that part of their business, says Kazimirsky of Become.

It will also be interesting to watch how lenders and funders continue to reshape themselves. Sofi, for instance, is continuing to pursue its goal of receiving a national bank charter. Other lenders and funders may also seek to reinvent themselves as they attempt to stay afloat and compete more effectively.

“Monoline lenders that rely on a single product will have more difficulty supporting customers in the wake of Covid,” says Gina Taylor Cotter, senior vice president and general manager of global business financing at American Express, which purchased Kabbage in 2020. “Small businesses need multi-product solutions to not only access working capital, but also real-time insights to help them be more prudent with their cash flow and accept contactless payments safely to encourage more business,” she says.

CHANGES IN RISK MODELING

Another pandemic-driven change is that lenders have had to tweak their risk modeling. Everyone understands the economy is not in the greatest spot, but their challenge in 2021 will be developing a way to assess future losses in the absence of a baseline, says Rutger van Faassen, head of product and market strategy for the benchmarking and omnichannel research group at Informa Financial Intelligence.

Consumer behaviors have changed, for instance. So even though the pandemic will end, it’s too soon to say what the structural impacts on an industry will be and how that affects the desirability of lending to especially hard-hit businesses, such as restaurants, cruise lines and fitness centers. “Clearly the behavior that everyone is showing right now is because of the pandemic. The question is: how will people behave once the pandemic ends,” he says.

“In the meantime, a lot of lenders will have to do more in-the-moment decision-making, until we get to a point when we’re truly in a new normal, when they can start recalibrating models for the longer-term,” he says.

OPPORTUNITIES TO HELP SMALL BUSINESSES

One certainty in the year ahead is the need to help existing small businesses with their recovery, says Cotter of American Express. “Small businesses represent 99 percent of all jobs, two-thirds of new jobs and half of the non-farm GDP in America. Our country’s success depends on small businesses, and financial institutions have a great opportunity to meet their needs to recover and return to positions of growth in 2021,” she says.

How to make this happen is something many alternative financers will grapple with in 2021. Another opportunity may exist in providing funding solutions to new businesses or those that have pivoted as a result of the pandemic. Cotter points to the inaugural American Express Entrepreneurial Spirit Trendex, which found 76% of businesses have already pivoted their business this year and 73% expect to do it again next year. “New-business applications have reached record heights as entrepreneurs pivot and adapt, indicating a surge of new ventures that will require financial solutions to build their business,” Cotter says.

REGULATORY WATCH

Several regulatory issues hang in the balance in 2021, including state-based disclosure laws, expected rules on third-party data aggregation and demographic data collection, and the status of a special purpose charter for fintechs, says Ryan Metcalf, head of U.S. public policy, regulatory affairs and social impact at Funding Circle. With a new administration coming in, the regulatory environment could become more favorable for measures that stalled during Trump’s tenure.

Armen Meyer, vice president of LendingClub and an active member of the Marketplace Lending Association, says he’s hoping to see a bill pass in 2021 that requires more transparency for small business lending. He would also like to see more states follow the lead of California and Virginia and make the 36% interest rate standard of Congress’s Military Lending Act, which covers active- duty service members (including those on active Guard or active Reserve duty) and covered dependents, the law of the land. “We’re calling for this to be expanded to everybody,” he says.

CANADA

Meanwhile, our neighbors to the North have their own challenges and opportunities for the year ahead. The alternative financing industry in Canada originated out of the 2008 recession when banks restricted their credit box and wouldn’t lend to certain groups. While conditions are very different now, “this period of economic uncertainty is going to be an incredible fertile period of time for fintechs to come up with new and interesting and creative credit products just like they did entering the last financial crisis,” says Tal Schwartz, head of policy at the Canadian Lenders Association.

Open banking continues to be on the Canadian docket for 2021 and how the framework shapes up is of utmost interest to fintech lenders in Canada. Schwartz says he’s also hopeful that alternative players in Canada will have a role to play in subsequent government- initiated lending programs. He’s also expecting to see more growth in the e-commerce area, particularly when it comes to extending credit to e-commerce companies and in financing solutions at checkout for online shopping.

Canada’s Top Lending Leaders of 2021

December 16, 2020 The Canadian Lenders Association released its 2021 Leaders in Lending awards. The association is the voice of Canada’s lending ecosystem and represents more than 100 companies in commercial and consumer lending.

The Canadian Lenders Association released its 2021 Leaders in Lending awards. The association is the voice of Canada’s lending ecosystem and represents more than 100 companies in commercial and consumer lending.

All CLA members are vetted and accredited based on their corporate standards

and values. Their role is to support the highest level of lending in Canada,

servicing a wide spectrum of business and consumer borrowers’ growth requirements.

See previous year’s leading lending companies

See previous year’s leading lending executives

2021 Award Winners:

Lending Woman of the Year

|

Tiffany Kaminsky | Co-Founder of Symend

Tiffany Kaminsky is the co-founder of Symend, a fintech that uses analytics and behavioural science to create individualized debt recovery programs. The startup, which has offices in Calgary, Toronto and Denver, received USD $52 million in funding earlier this year and plans to hire up to 200 more roles in 2021. |

|

Nicole Benson | CEO of Valeyo

Nicole Benson is the President & CEO of Valeyo, a business solutions provider to financial institutions in Canada. Nicole drives every facet of business forward, with a focus on growing, evolving, and innovating Valeyo’s suite of solutions to meet the changing needs of its clients and the financial services industry. |

|

Andrea Fiederer | CMO of goeasy

Andrea Fiederer is EVP & CMO of goeasy, a leader in non-prime financial services with over 2000 employees. Andrea is responsible for goeasy’s overall marketing and brand strategy for both the easyhome and easyfinancial business units. |

|

Elena Ionenko | Co-Founder of Turnkey Lender

Elena Ionenko is the Co-Founder of Turnkey Lender, a loan origination platform. Under Elena’s leadership, the company has entered 50+ local markets, raised over $3.5 million in venture capital and launched regional offices all over the globe. |

|

Minal Shankar | CEO of Easly

Minal is the CEO of Easly, a SR&ED financing firm. This year Minal has doubled Easly’s capital under management & customer base. Prior to leading Easly, Minal was an investment manager for the VC firm Northgate Capital and an associate in the Technology Investment Banking group at J.P. Morgan Chase. Minal holds an MBA from the NYU Stern School of Business. |

Fintech Innovator the Year

|

Flinks

Flinks is a data company that empowers businesses to connect their users with the financial services they want. |

|

REPAY

REPAY is a leading provider of vertically-integrated payment solutions. |

|

VoPay

VoPay seamlessly connects you to the banking ecosystem enabling anyone to offer efficient and simple bank account payment processing. |

|

Fundmore

FundMore.ai is an automated underwriting system that uses machine learning to streamline the Pre-Funding process for loans. |

|

Provenir

Provenir offers a suite of risk analytics tools for lenders to make adjudication faster and simpler. |

Executive of the Year

|

Jason Mullins | CEO of goeasy

Jason Mullins is the President & CEO of goeasy, a leader in non-prime financial services with over 2000 employees. Since joining goeasy in 2010, Jason has helped the company scale to $1 billion in market capitalization with compound earnings growth of 28%. Jason is a recipient of Canada’s Top 40 Under 40 Award. |

|

Wayne Pommen | CEO of PayBright

Wayne Pommen is the CEO and Founder of PayBright, a Canadian leader in the BNPL space. His firm has partnered with 7,000 domestic and international retailers, and has approved over $1 billion in consumer credit. This year PayBright was acquired by Affirm in a $340 million transaction. |

|

Lawrence Krimker | CEO of Simply Group

At just 33 years of age, Lawrence Krimker has built Simply Group into a category leader in home equipment financing. This year his firm acquired competitors Dealnet & SNAP Financial in transactions that totalled over $750 million and brought his firm to $1.45 billion in assets under management. |

|

Andrew Graham | CEO of Borrowell

Andrew Graham is the CEO and Co-Founder of Borrowell, Canada’s first fintech to provide free credit monitoring. This year Andrew launched Borrowell Boost to help the 53% of Canadians living paycheck to paycheck meet their bill payments. |

|

Maria Soklis | President of Cox Automotive

In the 6 years that Maria Soklis has led Cox Automotive Canada, the company has become a category leader in software and financing solutions for consumers and dealers across the country. Maria has also left her mark with initiatives that promote diverse and inclusive workplaces, and this year signed the BlackNorth Initiative CEO Pledge. |

Emerging Lending Platform of the Year

|

Moselle

Moselle is a digital platform that simplifies the importing workflow for small medium business owners. |

|

Moves

Moves is a financial services platform for independent “gig” workers. |

|

Vendor Lender

VendorLender is Canada’s first POS lender for dealers in the equipment finance space. |

|

Lendle

Lendle is Canada’s first interest free credit provider. |

|

goPeer

goPeer helps everyday Canadians to achieve financial freedom through Peer-to-Peer Lending |

Small Business Lending Platform of the Year

|

Merchant Growth

Merchant Growth is a leading Canadian financial technology company that specializes in small business financing. Over the past decade, Merchant Growth has supported Canadian businesses with hundreds of millions of dollars in growth financing. |

|

Loop

Launched this year, Loop builds credit & payment products specifically for online merchants. The company is operated by the LendingLoop team that popularized P2P lending in Canada. |

|

Thinking Capital

Thinking Capital is one of Canada’s best known fintech lenders to the small business sector. This year the firm has forged relationships with multiple Credit Unions and hit $1 billion in loans deployed. |

|

OnDeck

Since its launch in 2015, OnDeck Canada has |

|

Clearbanc

Canadian based Clearbanc is the world’s largest e-commerce funder. Their data-driven approach takes the bias out of decision making. Clearbanc has funded 8x more female founders than traditional VC. |

Consumer Lending Platform of the Year

|

Flexiti

Flexiti is a leader in point of sale financing for retailers and has been named one of Canada’s fastest growing companies two years straight. |

|

CHICC

CHICC is one of the country’s leading rental & homeimprovement financing companies. |

|

Marble Financial

Marble uses fintech to empower Canadians to improve their credit score, manage debt, and budget to achieve financial goals. |

|

PayBright

PayBright is one of Canada’s leading buy now, pay later providers. This year the firm was acquired by BNPL giant, Affirm for $340 million. |

|

goeasy

Canada’s leading alternative financial services provider servicing non-prime Canadians through its easyhome and easyfinancial divisions. |

Auto Lending Platform of the Year

|

GoTo Loans

GoTo Loans is a fintech lender focused on helping consumers access the equity from their vehicle and the leading provider in Canada for automotive repair loans. |

|

Auto Capital Canada

AutoCapital Canada is a national auto finance company that works with dealer partners to help clients finance the purchase of new and used vehicles. This year the firm acquired competitor Rifco. |

|

Carfinco

The Western Canada based lender is a leader in non-prime lending to the auto sector. |

|

Canada Drives

Canada Drives is a leader in fintech auto lending. This year the firm hit over 400 employees and 1 million transactions, servicing consumers across Canada, the US, and the UK. |

|

Clutch

Clutch aims to bring speed and convenience to used car sales by taking the experience completely online. The fintech raised a $7 million round this year from Real Ventures. |

Technology Lending Platform of the Year

|

BDC

Launched only five years ago, BDC’s Tech Group has become a leader in lending to Canadian technology entrepreneurs. |

|

TIMIA

TIMIA is a specialty finance company that provides growth capital to technology companies in exchange for payments based on monthly revenue. |

|

Flow Capital

Flow Capital Corp. is a diversified alternative asset investor, specializing in providing minimally dilutive capital to high-growth businesses. |

|

Venbridge

Venbridge is a Canadian finance company offering non-dilutive venture debt, SR&ED financing, and tax credit consulting services. |

|

SVB

SVB has lead the technology lending movement for 35 years. The firm opened their first Canadian office last year. |

Merchant Indicted For Sending Fake Bank Statements to Online Lenders

December 7, 2020 On December 17, 2018, the owner of a mexican restaurant in Springfield, Illinois, is alleged to have submitted altered bank statements to National Funding, Inc as part of a loan application to obtain $35,000. What he got in return was an indictment by a federal grand jury.

On December 17, 2018, the owner of a mexican restaurant in Springfield, Illinois, is alleged to have submitted altered bank statements to National Funding, Inc as part of a loan application to obtain $35,000. What he got in return was an indictment by a federal grand jury.

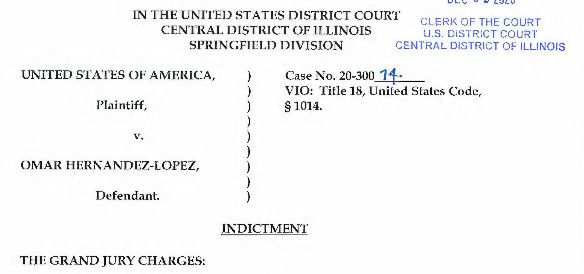

On Dec 2, 2020, the US District Court for the Central District of Illinois unveiled a seven-count indictment against Omar Hernandez-Lopez. Hernandez-Lopez is the owner of El Tapatio De Jalisco Inc DBA La Fiesta Grande.

Prosecutors say Hernandez-Lopez sent doctored PNC bank statements to two lenders, National Funding and Loan Depot in multiple instances. The actual charge is that the defendant knowingly made a false statement for the purpose of influencing the action of a lender in connection with a loan application.

Apparently, no falsehood is too small. For example, in one count the defendant is alleged to have changed a monthly ending bank statement balance of negative $72.91 to positive $131.90, a difference of $204.81. He is also said to have obscured the amount incurred in overdraft fees.

The penalty if found guilty on any one count? Up to 30 years in prison.

Prosecutors cite Title 18, United States Code,§ 1014.

Defendant is innocent until proven guilty. A copy of the indictment can be viewed here.