MPR Authored

No End in Sight for Alternative Lending

September 17, 2013 Which one of these three isn’t like the other two?

Which one of these three isn’t like the other two?

- Quicken Loans

- RapidAdvance

- Cleveland Cavaliers

It’s a trick question because as of September 16, 2013, All three are owned by Rockbridge Growth Equity, a Detroit-based private equity firm. RapidAdvance announced the acquisition over the news wire, shocking many people around the industry. The move opens RapidAdvance to the connections and prowess of Dan Gilbert, the 126th richest man in the United States. Gilbert is worth approximately $3.9 Billion, is the founder of Quicken Loans, and he owns 4 sports teams, including the NBA’s Cleveland Cavaliers.

Compare that to On Deck Capital board member Peter Thiel, who is worth $1.9 Billion and is the 309th richest person in the U.S. You may remember Thiel, the co-founder of PayPal and first investor in Facebook as participating in a series D round for On Deck Capital along with Google Ventures back in May.

These are truly some historic times. Two of the richest people on all of planet Earth have stock in the merchant cash advance industry. Does that tell you anything about the direction things are moving in? Think about that one again… Two of the richest men in the world have invested in the merchant cash advance industry.

Four years ago, an influential friend advised me that this industry would be eradicated by 2010. As told through The Bubble That Wasn’t, some people left the business prematurely fearing the best days of alternative lending were over. At present, it looks as if those best days are still yet to come.

The Rockbridge Growth Equity move comes less than a year after Steven Mandis bought into RapidAdvance. He will reportedly stay on as a shareholder.

On Deck Capital

In other news, On Deck Capital announced that they’ve raised another $130 million in debt financing, leveraging themselves out even further. ISOs in the industry report that they’re ON FIRE with approvals. Rumors about a possible IPO on the horizon are starting to pick up again but my sources tell me that isn’t likely to happen with On Deck for another 2-3 years.

Alternative Lending: People are Finally Getting it

September 12, 2013 Alternative lending is all the rage these days and so much so that BusinessWeek asked the question: What Do Small Businesses Need Banks for Anyway?. They go on to name many companies with ties to the merchant cash advance industry, which is no surprise to us of course. It is interesting however to notice that the mainstream media is not only giving us the time of the day, but starting to treat us like royalty.

Alternative lending is all the rage these days and so much so that BusinessWeek asked the question: What Do Small Businesses Need Banks for Anyway?. They go on to name many companies with ties to the merchant cash advance industry, which is no surprise to us of course. It is interesting however to notice that the mainstream media is not only giving us the time of the day, but starting to treat us like royalty.

Five and a half years ago this very same collective of lenders were referred to as bottom feeding vampires¹. Over the next couple years they upgraded us to a very expensive alternative, then to an acceptable alternative, and now finally to who the hell needs banks when you have these great companies?!. You have to laugh just a little bit at the shift.

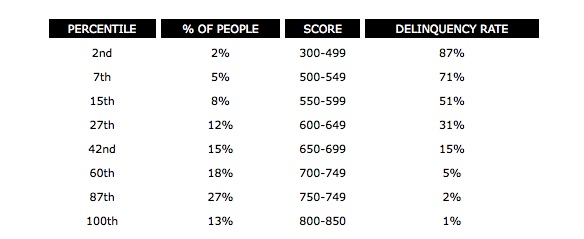

It’s easy to call a lender that charges high rates a bad seed when you have no sense of the context. The reality in lending is that a material amount of borrowers don’t make their payments on time or they don’t pay back the loan at all. That causes rates to go up to compensate for the losses. Critics argue that borrowers can’t make the payments or default because the rates were too high to begin with. Some lenders cave to that assumption and position themselves as a fair lender by undercutting the market rates. They eventually learn that defaults are less related to the cost of the loan and more so tied to a borrower’s willingness to repay or ability to repay. Meaning, loans with no interest tacked on to the principle will still be rocked by late payers and defaults. Wait, seriously?

Yes, welcome to America where sometimes borrowers face circumstances beyond their control or they maliciously decide they don’t want to pay. The overwhelming majority are in the former camp, the ones where sudden or gradual hardship is interfering with their ability to make good on their commitment. I admit, even I feel uncomfortable mentioning this. Nobody wants to be seen as picking on borrowers. We’d all rather pretend that lenders are inherently bad and borrowers are inherently innocent. The truth is that most lenders and borrowers are good but some lenders and borrowers are bad. Lending is a two way street and what’s fair for all is somewhere in the middle.

My friends in the commercial banking sector tell me their tolerance for bad debt is less than 1%. Even 1 single loan default over the course of a year could cause their entire portfolio performance to come crumbling down. They do make loans, but they’re often in the tens of millions or hundreds of millions of dollars and only to large established businesses that quite often, don’t even need the capital but would rather not jeopardize their liquidity by spending their own cash. Some of these loans end up getting classified as small business loans even though there’s nothing small business about them.

Mom and pop shops see the statistics and the corresponding rates of say 4% to 10% APR and set that as the bar to shoot for. Then they head down to their local bank and hit a roadblock. The average small retail/food service business is going to have a greater than 1% chance of default no matter how good it looks on paper. I mean think about it, what are the odds that things will go 99% as planned for a restaurant over the next 12 months? Do you think it’s reasonable to assume there is at least a 5% chance that any of the following could happen in the next year even without knowing anything specific? A failed health inspection, bad reviews published online, a revoked liquor license, construction outside impeding pedestrian traffic, internal damage caused by a flood or disaster, extreme weather hurting sales, major job losses in the area leading to people having lower disposable income, key employees quitting, theft, landlord not renewing the lease, competitor opening up in the neighborhood, or declining sales for no single identifiable reason? Lending money to retail businesses is risky, really risky. Suppose the above business owner had a history of late payments and defaults to begin with. At what cost does it begin to make sense to do this deal? And those are just the risks of what could happen to the business itself, so what about the other risks involved?

To a bank, the stereotypical entrepreneur is damaged goods. The hard knock humble beginnings of turning a vision into a successful business usually comes with personal financial sacrifice and in turn a lower credit score. And just as the successful entrepreneur is getting ready to explain his/her high debt to income ratio and story of triumph, they’re already being declined. Banks don’t care about the story. They care about the aggregate mathematics. If there’s just a 5% chance that the business isn’t going to be where it thinks it will be in a year from now, then the deal’s probably a non-starter. Leveraged? Declined. Poor credit? Declined. Business is running smoothly? Who cares, it’s declined already!

Extension on your taxes? Declined. Showing modest profit or a loss for tax purposes ::wink wink:: ? Declined. Didn’t file a tax return? Declined. Co-mingling funds with your personal finances? Declined. Overdrafts or NSFs? Declined. Unaudited financials? Declined. No collateral? Declined. Doing the books with paper and pen? Declined. Have less than 5 employees? Declined. Can’t find a document the bank wants? Declined. Need the money really badly? Declined. Experiencing a downturn? Declined. Have a tax lien? Declined. Have a criminal record? Declined.

Extension on your taxes? Declined. Showing modest profit or a loss for tax purposes ::wink wink:: ? Declined. Didn’t file a tax return? Declined. Co-mingling funds with your personal finances? Declined. Overdrafts or NSFs? Declined. Unaudited financials? Declined. No collateral? Declined. Doing the books with paper and pen? Declined. Have less than 5 employees? Declined. Can’t find a document the bank wants? Declined. Need the money really badly? Declined. Experiencing a downturn? Declined. Have a tax lien? Declined. Have a criminal record? Declined.

Get the picture? If you take a look at Lending Club, an alternative lender, they’re widely known to have a 90% decline rate. Their maximum interest rate is 29.99% APR. Think about that for a second. Some people would say, “WOW, 30% are you kidding me?” but statistically, Lending Club would be losing money on the deal 9 times out of 10 if they approved every single person that applied. Lending Club actually used to be more liberal with their approvals when they first started and what happened is that too many borrowers just didn’t pay. If you believe that Lending Club should approve even more loan applications than they already do, then they would have to compensate for the increased risk and we’d quickly see APRs reach well into the 40s,50s,and 60s.

A critic might argue that once an applicant exceeds the risk of a 30% APR loan, they probably shouldn’t be getting a loan from anyone. That’s not a bad suggestion and what happened is that when the lending world concurred with that 5 years ago, Americans and politicians went up in arms because “Banks weren’t lending.” No loans? Businesses can’t hire. No loans? Businesses can’t grow. No loans? Economy gets stuck in neutral. The nation demanded that capital flow despite the risks presented to the lenders. And so the finance world heeded the call to provide solutions and came up with a smorgasbord of financial products. Merchant Cash Advance financing was already established but had an especially unique characteristic that allowed it to take off. It structured financing as a sale, not a loan. A big problem was that traditional lenders and alternative lenders were at the mercy of state regulated interest rate caps. Once an applicant reached a certain risk threshold, they just couldn’t do the deal anymore. But when financial companies came in to buy future revenues in exchange for a large chunk of cash upfront, the system started to gain some traction.

The effective cost of the money got high, very high, yet they weren’t predatory. I say that because despite how expensive it seemed, most of them were getting eaten alive by defaults. From 2008 – 2010, many merchant cash advance companies filed for bankruptcy. One of the main attributes of a predatory lender is for the lender to actually be getting filthy rich. That means layering on interest way in excess of a healthy profit. Losing a lot of money to help borrowers and small businesses when no one else will can hardly describe a predatory lender.

One has to wonder that perhaps there is a better way. If unsecured financing breeds high defaults, then surely things would be different if a risky applicant secures the loan with collateral. Have the borrower put skin in the game and we’d have a different outcome right? Lenders such as Borro publicly describe their default rate as falling between 8-10%. They offer collateralized personal loans and are described as a “pawn shop for the posh” in the below video, though most of their clients are small business owners. This tells me that even in the instance where borrowers have something very valuable to lose, a significant percentage of them will not repay the loan in full regardless.

A look around at what merchant cash advance companies have been willing to admit has put their average bad debt between 2-5%. In my experience in this industry however, 8% – 15% is a lot more realistic. But are these funding companies getting filthy rich or treading water? Anyone can look at the financial statements of IOU Central², a lender that’s part of the broader merchant cash advance industry. Since they’re owned by a publicly traded company in Canada, we get to see firsthand that they’re suffering tremendous losses quarter after quarter. I find that to be perfectly in line with what I suggested about undercutting the market earlier. IOU Central’s allure is that their loans cost less than a traditional merchant cash advance. The end result is that after paying commissions to sales agents, paying interest on their capital, and factoring in bad debt, they’re hurting pretty badly.

On Deck Capital too, a company mentioned in the BusinessWeek article above acknowledges that they are not profitable, though they do not make their financials public to verify how unprofitable they are or if that’s really even the case.

An SBA loan through a bank may cost approximately 5.5% APR, but if the loan goes bad, the SBA covers almost all of the bank’s losses. There is no such security blanket in the real private sector. The market determines the rates based on the risk. Each funder measures risk differently and in 2013, there is no longer a one-size-fits-all cost of unsecured funding much like there was in 2007 with merchant cash advances. Compared to a bank loan, almost all of these alternative options will be perceived as expensive, but if banks don’t approve anyone, then they’re a terrible standard for a comparison.

It’s taken a long time for the public and the media to come to terms with that. Banks are still technically in the game but by proxy. They are financing numerous alternative lenders and merchant cash advance companies. Banks shouldn’t be lending out their client’s deposits to really risky businesses anyway. A bank is supposed to be safe. If they’re lending money to 100 businesses and 15 of them aren’t paying it back, then that’s the opposite of safe.

So what do small businesses need banks for anyway? Checking, payroll, overdraft coverage, debit cards, wires, record keeping, CDs etc. There is a place for banks in 2013 and beyond. Alternative lenders charge more and that’s okay. Ultimately it’s up to the borrowers to decide what they can sustain. It is better to have expensive options than no options at all. There’s endless proof of that when credit dried up five years ago. Small businesses cried foul so the market reacted. And here we are now with Kabbage, On Deck Capital, Business Financial Services, and Capital Access Network being portrayed as the norm, the new standard. Almost everything that would cause a bank to say “no” can be resolved in some way. That’s incredible and how it should be.

So what do small businesses need banks for anyway? Checking, payroll, overdraft coverage, debit cards, wires, record keeping, CDs etc. There is a place for banks in 2013 and beyond. Alternative lenders charge more and that’s okay. Ultimately it’s up to the borrowers to decide what they can sustain. It is better to have expensive options than no options at all. There’s endless proof of that when credit dried up five years ago. Small businesses cried foul so the market reacted. And here we are now with Kabbage, On Deck Capital, Business Financial Services, and Capital Access Network being portrayed as the norm, the new standard. Almost everything that would cause a bank to say “no” can be resolved in some way. That’s incredible and how it should be.

People are finally getting it.

– Merchant Processing Resource

https://debanked.com

MPR.mobi on your iPhone, Android, or iPad

¹ It took 5 years but Forbes has Finally deleted the March 13, 2008 article that haunted the merchant cash advance industry forever. In Look Who’s Making Coin off the Credit Crisis, Maureen Farrell referred to merchant cash advance companies as vampires that were feasting on small businesses and singled out some of the biggest names in the business at the time. It was Global Swift Funding* (GSF), one of the major funders cited by Farrell that exposed this assertion to be blatantly false. Not too long after the article was published, GSF closed their doors and filed for bankruptcy. It would seem that small businesses actually feasted on them by defaulting in record numbers. Back in April of this year, Forbes essentially rebuked that article when Cheryl Conner revisited the industry to note how much good it was doing in ‘Money, Money’ — How Alternative Lending Could Increase Your Company’s Revenue in 2013

*Disclosure: Raharney Capital, LLC the owner of this website currently owns the former domain of Global Swift Funding (GlobalSwiftFunding.com) though the companies did not have and do not have any ties to each other.

² IOU Central is a subsidiary of IOU Financial Inc. Management’s Discussion and Analysis of Financial Condition and Results of Operations as of August 22, 2013 are available at: http://cnsxmarkets.com/Storage/1563/144040_MDA_%282Q2013%29_-_FINAL.pdf

Funder Says Farewell to Car Dealerships

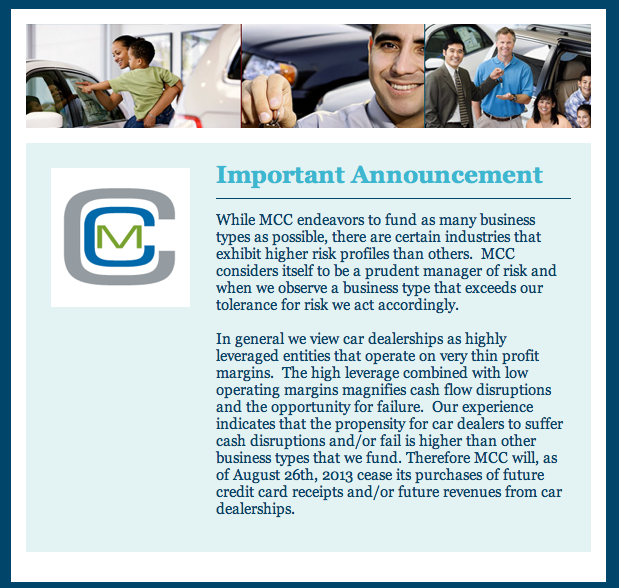

August 26, 2013Merchant Cash and Capital announced today that they will no longer be funding car dealerships. See screenshot of their announcement below:

Over the last 18-24 months, MCC and many other funders have greatly expanded their lists of accepted business types. It will be interesting to see if any other funders follow suit in re-restricting certain industries.

Gas stations, high-ticket furniture stores, and online businesses come to mind…

Split Funding is Here to Stay

August 21, 2013 I’ll say it for the hundredth¹ time, the advantage of split-funding is the ability to collect payments back from a small business that has traditionally had average, weak, or poor cash flow. Let’s put that into perspective. There is a distinct difference between a working business with poor cash flow and a failing business. A failing business is typically not a candidate for merchant cash advance or similar loan alternatives.

I’ll say it for the hundredth¹ time, the advantage of split-funding is the ability to collect payments back from a small business that has traditionally had average, weak, or poor cash flow. Let’s put that into perspective. There is a distinct difference between a working business with poor cash flow and a failing business. A failing business is typically not a candidate for merchant cash advance or similar loan alternatives.

Poor cash flow could be the result of paying cash up front for inventory that will take a while to turn over. A hardware store with a healthy 50% profit margin may be able to turn $10,000 worth of inventory into $15,000 in revenue over the course of the next 90 days. The only problem is that the full $10,000 must be paid in full to the supplier on delivery.

Enter the merchant cash advance provider of old that discovers the hardware store has had a fair share of bounced checks in the past, mainly because of the timing of payments going in and out. Cash on hand is tight, the credit score is average, but the profit margin is there. Most lenders would take a pass on financing a transaction that carries legitimate risk such as this one does, that is until the ability to split-fund a payment stream became possible.

Advocates of the ACH method tout that it’s just so much easier to set up a daily debit and scratch their heads and wonder, “man, why didn’t we think of just doing ACH in the first place?”

The thing is, people did think of it and they concluded that for a large share of the merchants out there that needed capital, it didn’t make financial sense to try and debit out payments every day with the hope that there would always be cash available to cover them. Banks have had a hard enough time collecting just one payment a month, so what makes 22 payments in a month so much more likely to work?

I’m not inferring that there is something wrong with the daily ACH system that has taken the alternative business lending industry by storm. There’s plenty of situations for which that may be the best solution, especially for businesses that take little or no credit card payments. My point is that the split-funding method isn’t going to shrivel up and die. It’s here to stay. So long as businesses have electronic payment streams, they will be able to leverage them to obtain working capital.

When it comes to splitting card payments however, it’s important for a business to have faith in the payment processor. Reputation, compatibility with payment technology, and the assurance that the business will be able to conduct sales just as it always has are important. If you’re a funder, ISO, or account rep, it’s your responsibility to make sure that those three factors are addressed. A lot of processors are willing to split payments but they haven’t all made a name for themselves in the industry. Integrity Payment Systems (IPS) comes to mind as one that almost everyone works with and I’ve been in touch with Matt Pohl, the Director of Merchant Acquisition of IPS for some time. He’s been nice enough to share a little bit about what makes a split partner special, and what has made them particularly stand out in the merchant cash advance industry.

Clearly, the role of the credit card processor has diminished over the last couple years when it comes to merchant funding. ACH/Lockbox models have become more prevalent which created a sales mindset that switching a merchant account was more of a hindrance than a necessity. Some argue the decline in profit margin on residuals, due to price compression, made it no longer worth the time and effort to make an aggressive pitch to switch the merchants processing. ISOs also argue that too often merchants have reservations to switch processors because of previous bad experiences, cancellation fees, or because they simply know its not necessary in order to be funded. This is where it’s important to have the RIGHT split partner, not just any split partner

What makes Integrity Payment Systems a “special” split partner is the fact we control the settlement of the merchants funds, in house. IPS is partnered with First Savings Bank (FSB), which allows us a unique way of moving money. Because of our state-of-the-art settlement system and direct access to FSB’s Federal Reserve window, we eliminate the necessity of having layers of financial institutions behind the scenes that merchants funds typically filter through. This is a HUGE benefit to cash advance companies for several reasons. First, we implement the fixed split % when we receive the request, in real time. This allows the deal to be funded quicker. Secondly, since we handle the settlement process we have access to the raw authorization data which allows us to provide comprehensive reporting on a daily basis from the previous days activity. But also we can do true next day deposits, including Friday, Saturday, and Sunday funds available for the merchant on Monday morning. This is especially valuable when selling to restaurants/bars, or any other industry with a lot of weekend volume. Lastly, IPS makes outbound calls to merchants, on behalf of the sales agent and cash company, to download and train the merchant on their terminal. A confirmation email is sent to the agent which includes any batch activity so the deal can fund.

As an added example of this, on the last week of every month, the merchant boarding and sales support team fully understands that our MCA partners have monthly funding goals they need to reach. The IPS team goes above and beyond to ensure merchants get setup properly in time so those accounts can be funded before the month is over. We have a motto at IPS that the sales force are our #1 customers, and nowhere is that more apparent than by the way we take over all the heavy lifting once the agent gets the signatures on our contract. We firmly believe that by helping the agent by taking over the boarding process, that this will allow them to do what they do best, sell more deals!! A lot of competitors expect the agent to be involved in the boarding process, and that’s valuable time that takes them away from selling.

IPS has opened their doors to every MCA company that wishes to have an exceptional split funding partner/processor. We have all the necessary tools to provide this service the right way, and we want the opportunity to earn the business of every working capital provider out there. You don’t have to listen to a sales pitch from me, because I strongly believe that our reputation in the cash advance space speaks for itself. We would love the opportunity to talk to any MCA provider about a few additional services we offer utilizing our settlement system that will allow ISOs to fund more deals.

– Matt Pohl

(847) 720-1129

Integrity Payment Systems

One thing I can personally attest to about Integrity is their human factor. You can actually meet some of their team and see inside their office in the fun youtube video below:

Getting deals done

Ultimately, the financing business is about getting deals done and there are countless small businesses that just won’t ever be a candidate for ACH repayment. Heck, for many years the merchant cash advance industry wasn’t even a financing industry of its own, but rather it was one of many acquisition tools for merchant account reps. (See: Before it Was Mainstream). Technically it still is. You don’t want to sign up a merchant for processing and then have to move the account because the processor doesn’t split or because there is no dedicated customer service. I’ve been in that situation before personally and it’s a nightmare.

There’s a reason this website which is dedicated mainly to merchant cash advance is called the Merchant Processing Resource. You can’t know everything about cash advance without knowing about merchant processing. Get acquainted!

If you’d like to read the lighter side of Merchant Cash Advance History, you just might want to check out MCA History in Honor of Thanksgiving. 😉

¹ I said it for the 99th time on the Electronic Transactions Association’s Blog in Preserving the Marriage Between Merchant Cash Advance and Payment Processing

When Merchant Cash Advance isn’t the Right Fit

August 12, 2013 “I know you do a million in gross sales monthly but since you process only $5,000 in credit cards, we can only approve you for $7,000.”

“I know you do a million in gross sales monthly but since you process only $5,000 in credit cards, we can only approve you for $7,000.”

Before ACH repayment became mainstream, the MCA industry was incredibly restrained in its ability to help businesses. A merchant seeking a half million dollars with the cash flow and size to back that request up was being told that the absolute best they could get would be maybe $10,000, and that’s with a 100% holdback in place instead of the industry standard max of 30-35%. It was an awkward sale for both parties.

To pitch a business owner generating $12 million a year in sales a paltry $10,000 is like telling your boss that the only thing you did at work this month is forward a single e-mail. To the business owner, they’re probably left wondering if lending really has dried up that much or perhaps they’re wondering if they’re just talking to the wrong people. Some of these mismatched situations actually turn into closed deals. I can personally remember one where a semi-serious request for $2 million became a $6,000 signed contract. I think they waited only 24 hours before applying for a renewal. The majority of these sales calls go nowhere though because what’s being offered is not a fit for what is needed.

It’s okay to have mismatches in life. As a salesman, your product is not the right solution for EVERY problem, no matter what your rebuttal script says. If a man is wheeled into an emergency room with 7 deep stab wounds, Johnson & Johnson is going to have to pass up the opportunity to offer him Band-Aids as the answer. A million Band-Aids might work, but they’re not the right solution.

In 2013, I am hearing a wider call to diversify product offerings to stay competitive. Yes, offering a fixed daily repayment loan based off of gross sales is a nice way to compliment the purchase of future credit card sales, but that’s not really diversity anymore, that’s a necessity to stay alive. By really diversifying, I’m talking about financial products beyond daily repayment loans and advances. Almost everyone agrees that being able to service more deals is a good thing but when it comes right down to it, they may see it as a distraction from their main focus.

We’ve all seen a friend or two bite off more than they can chew by trying to broker an SBA loan or commercial real estate deal. There’s no shortage of financial companies sitting on the periphery of the MCA industry waving a flag that says “if a deal isn’t compatible for you, then send it our way.” They don’t really speak the MCA language though and they expect you to do a lot of the closing and negotiating on your own. Some of these deals take months to process and if the lender believes the deal is only a one-time thing, they might not even pay you for it. Ugh! Looking at it from this perspective, perhaps it’s better to just stick with MCA and let every other type of deal fall by the wayside, that is until you look at your marketing expenses again and wonder…

An inbound lead is one that you’ve already paid for, so if they’re not a candidate for a daily repayment loan or advance, then what is the most efficient way to monetize and service them? Who can you really depend on to make servicing it a reality and how long will it take? How easy will it be? I searched beyond the industry for answers but began to find them inward. It seems New York City based Strategic Funding Source has recognized the need for product diversification and is eager to assist account reps in servicing more clients and closing more deals. Your marketing dollars are already spent, so now it’s time to monetize what they’re bringing in. There is a universe beyond daily repayment deals and if you hope to stay ahead of the curve, I recommend you become intimately familiar with programs like invoice factoring and accounts receivable factoring. You can and should be doing deals of this nature every month, not once in a blue moon.

While I like to consider myself knowledgeable on a wide range of financial topics, Lenny Leff, who heads Strategic Plus, a new division of Strategic Funding Source, has offered to write his own regular column on Merchant Processing Resource.

I spoke to David Sederholt, Strategic Funding Source’s COO, about this first in regards to Lenny’s role at the company:

“Through this new division of Strategic Funding Source, led by Lenny, we can say ‘yes’ to more businesses seeking capital to grow and are not limited to cash advance and loan products. We take a human approach to financing and know that the needs of small business owners are as diverse as the businesses themselves. With more product offerings, we are able to continue to be true partners to the small businesses we finance.”

– David Sederholt, Strategic Funding Source COO

Lenny’s posts will provide guidance and information about opportunities outside of MCA. After a few in-person meetings, I think he is uniquely positioned to discuss this topic, especially considering his prior experience in the MCA industry. I asked if Lenny would introduce himself in this post and he added the following:

“I am happy to be joining Strategic and look forward to sharing my 15+ years experience in factoring and asset based lending. The blog will give business owners and ISOs the opportunity to learn more about the different solutions and alternatives available when they go to someone offering a one-stop shop; Purchase Order Financing, Invoice Factoring, Equipment Leasing, Healthcare Lending to Business Loans and MCA. Our goal is to expand the knowledge within our community and help our partners find customized financing for their clients. We are thrilled and excited to share our insights with Sean and the Merchant Processing Resource site.”

– Lenny Leff, Strategic Plus

When the deal doesn’t fit, will you try to sell it anyway? Will you throw it out? Or will you try to monetize the lead you’ve already paid for? I don’t like the first two options… and I’m sure many of you don’t either.

Learn more about Strategic Plus at http://www.sfscapital.com/news/view/3596

Contributors

David Sederholt

Lenny Leff

Discuss factoring on DailyFunder

http://dailyfunder.com/showthread.php/353-PO-Financing-Factoring/page2

Your Merchant Cash Advance Press Release May be Hurting You

August 8, 2013Part of keeping up with the merchant cash advance industry means reading up on the press releases published online, but it’s not such an easy job. Legions of funders, ISOs, and lead generators are competing for valuable real-estate in search results and they’ll use every trick in the book to get it. It almost always comes with a price and these tricks don’t always work. By tricks here, I’m referring to using optimized anchor text in press releases as a way to build backlinks.

Have you ever seen a press release with thin information but lots of embedded links that say something like “best small business loan companies”? There’s a reason for that. These companies are trying to manipulate PageRank, a Google search ranking factor that calculates the value of the page the link is on, calculates the value of the website it’s on, uses the anchor text as a signal of what the page is about, and then passes that value onto the destination page. PRWeb has a solid PageRank of 7 out of 10 and last I checked, they don’t nofollow the links. That means a webpage can gain some serious ranking points by using optimized anchor text in a press release. But that’s just on PRWeb’s domain. Consider the fact that press releases are usually syndicated to tens, hundreds, or even thousands of other websites, most of which will keep the links intact, and multiplying the value being passed to the destination site.

Have you ever seen a press release with thin information but lots of embedded links that say something like “best small business loan companies”? There’s a reason for that. These companies are trying to manipulate PageRank, a Google search ranking factor that calculates the value of the page the link is on, calculates the value of the website it’s on, uses the anchor text as a signal of what the page is about, and then passes that value onto the destination page. PRWeb has a solid PageRank of 7 out of 10 and last I checked, they don’t nofollow the links. That means a webpage can gain some serious ranking points by using optimized anchor text in a press release. But that’s just on PRWeb’s domain. Consider the fact that press releases are usually syndicated to tens, hundreds, or even thousands of other websites, most of which will keep the links intact, and multiplying the value being passed to the destination site.

One press release could result in hundreds of powerful ranking signals for the keyword, “best small business loan companies.” Now if there were on-page signals for that keyword and additional external factors at work, then there’d be no reason for that page not to rank high in search results for best small business loan companies. And so anyone not totally asleep at the wheel has been using that method for months, if not for years.

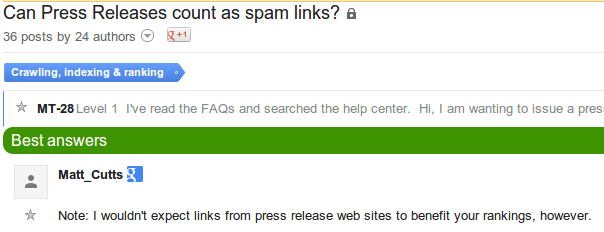

There’s only one problem. Google’s Director of web spam (yes, this is a real title) had said back in December of 2012 that links in press releases shouldn’t count.

The Internet went wild over this statement especially since his choice of words implied that there is a chance they did count, he just wouldn’t expect them too. Search Engine Optimization (SEO) diehards decided this was a battle worth fighting and optimized anchor text in press releases became more used than ever before, that is until Google decided to take action.

Wouldn’t expect was apparently proven to mean definitely does. The fact is that links in press releases were passing PageRank and the sites on the other end of them were getting valuable ranking signals. That’s why to this day we see merchant cash advance releases read like an itemized list of keywords on PRWeb…

The best merchant cash advance company has announced a new program to help provide bad credit business financing to restaurants in need of a fast cash loan.

If you’ve stopped reading the article at this point, you’re in trouble. The gravy train is no longer running express. Less than two weeks ago, Google conceded that optimized anchor text in press releases works and are a form of cheating the system. That means that overuse or quite possibly any usage of a keyword rich anchor in a release means your website is at risk of a rankings penalty. Google advises that in order to be safe, webmasters should nofollow the links. There’s just one problem with that; Credible wire and release services do not under any circumstances allow companies to code in HTML attributes in their releases, rendering this feat impossible.

That means the burden of nofollowing the links is on the release services and syndicating websites, something that isn’t likely to happen anytime soon. Release services have not been shy about the potential SEO benefits they can provide, with some going so far as to offer paid consulting services to clients on how to optimize their anchor text for search engines. To them, a crackdown on links in releases means a crackdown on a very profitable portion of their business model.

Watch Matt Cutt’s explanation of links in advertorials:

Google offers the following guidance on link schemes:

The following are examples of link schemes which can negatively impact a site’s ranking in search results:

- Buying or selling links that pass PageRank. This includes exchanging money for links, or posts that contain links; exchanging goods or services for links; or sending someone a “free” product in exchange for them writing about it and including a link

- Excessive link exchanges (“Link to me and I’ll link to you”) or partner pages exclusively for the sake of cross-linking

- Large-scale article marketing or guest posting campaigns with keyword-rich anchor text links

- Using automated programs or services to create links to your site

Additionally, creating links that weren’t editorially placed or vouched for by the site’s owner on a page, otherwise known as unnatural links, can be considered a violation of our guidelines. Here are a few common examples of unnatural links that violate our guidelines:

- Text advertisements that pass PageRank

- Advertorials or native advertising where payment is received for articles that include links that pass PageRank

- Links with optimized anchor text in articles or press releases distributed on other sites. For example:

There are many wedding rings on the market. If you want to have a wedding, you will have to pick the best ring. You will also need to buy flowers and a wedding dress.- Low-quality directory or bookmark site links

- Links embedded in widgets that are distributed across various sites, for example:

Visitors to this page: 1,472

car insurance- Widely distributed links in the footers of various sites

- Forum comments with optimized links in the post or signature, for example:

Thanks, that’s great info!

– Paul

paul’s pizza san diego pizza best pizza san diegoNote that PPC (pay-per-click) advertising links that don’t pass PageRank to the buyer of the ad do not violate our guidelines. You can prevent PageRank from passing in several ways, such as:

- Adding a rel=”nofollow” attribute to the < a > tag

- Redirecting the links to an intermediate page that is blocked from search engines with a robots.txt file

You can watch John Mueller, one of Google’s lead Webmaster Trends Analyst answer questions to Google’s new link policies in the hangout below:

There are other purposes for publishing thin releases as both Google and Bing can decide to display a snippet of the release on the first page of the results for the keywords used in the announcement. So no, it’s not just about links, at least that isnt’t all of the SEO benefit to be gained.

These news snippets can last up to a week, helping companies that might not be ranking well jump to the front of the line for exposure.

Link Removal

We’re not going to call anyone out by name but ever since Google Penguin 1.0 was released, many merchant cash advance companies and payment companies have hired link removal experts to identify bad links for them and are paying them to have them taken down. The only way to take down a link is to ask the webmaster hosting the site to take it down. Unfortunately, this has led to some companies finding the cheapest link removal service they can find, resulting in a poorly qualified consultant setting off to remove 100% of a site’s links instead of just the bad ones. We know this firsthand because we have had no shortage of e-mails from people claiming to be the hired link removal representative of a merchant cash advance related company.

The e-mails usually look like this:

Hello sir,

I am contacting you on behalf of Cash Advance Funder ABC and recently we have been instructed by Google to remove all of our links to have a penalty removed. Therefore we are asking that you remove our spam link from your website. We appreciate your immediate assistance in this matter.Sincerely

sfahfdspfu547@spamlinkremovalservicecompanyseobest.com

A great way to make sure your website never ranks ever again is to remove all your good links too. We can assure you that links on this website are not bad.

So…

In conclusion, if your hired SEO consultant is still banging away on optimized anchor text in press releases, there’s a good chance now that they’ll be causing damage over the long term. Press releases are for the purpose of making important company announcements and Google is on to anyone using them for any other reasons.

Your press releases might be hurting you with Google. Bing on the other hand…

Other SEO related articles on Merchant Processing Resource:

- Is Google Your Only Web Strategy?

- Google Penguin Kills Survivors

- The SEO War for Merchant Cash Advance Continues

- The SEO War for Merchant Cash Advance

https://debanked.com

Merchant Cash Advance Contract Language

July 24, 2013 Below is a look back at some of the contract language used in the industry.

Below is a look back at some of the contract language used in the industry.

2009 First Funds Contract

Purchaser agrees to purchase from Seller and the Seller agrees to sell to Purchaser, in consideration of the purchase price specified below (the “Purchase Price”), Seller’s interest in the percentage specified below (the “Specified Percentage”) of each of its future credit card receivables (the “Future Receivables”) due to Seller from the credit card processor identified below (“Processor”) until the amount specified below (the “Specified Amount”) of Future Receivables has been collected by Purchaser according to the additional terms and conditions set forth in this Purchase and Sale Agreement (“Agreement”).

The undersigned principal(s) of Seller (such principals, whether shareholders, partners or other owners are referred to herein as the “Guarantor’) hereby unconditionally, jointly and severally, guarantee Seller’s performance and satisfaction of all the covenants, representations and warranties set forth in Section 3 of the Agreement. This guarantee is continuing and shall bind Guarantor’s heirs, successors and assigns, and may be enforced by or for the benefit of any assignee or successor of Purchaser. Purchaser shall not be obligated to take any action against the Seller prior to taking any action against the Guarantor. Guarantor shall pay Purchaser for all its overhead and expenses incurred in enforcing this guarantee and underlying Agreement, including all Purchaser’s reasonable attorney’s fees. The release and/or compromise of any obligation of Seller or any other obligors and guarantors shall not in any way release Guarantor from his or her obligations under this guarantee. This guarantee shall be governed and construed according to the laws of the State of New York. ALL ACTIONS, PROCEEDINGS OR LITIGATION RELATING TO OR ARISING FROM THIS GUARANTEE OR UNDERLYING AGREEMENT SHALL BE INSTITUTED AND PROSECUTED EXCLUSIVELY IN THE FEDERAL OR STATE COURTS LOCATED IN THE STATE AND COUNTY OF NEW YORK NOTWITHSTANDING THAT OTHER COURTS MAY HAVE JURISDICTION OVER THE PARTIES AND THE SUBJECT MATTER, AND GUARANTOR FREELY CONSENTS TO THE JURISDICTION OF THE FEDERAL OR STATE COURTS LOCATED IN THE STATE AND COUNTY OF NEW YORK. Service of process by certified mail to Guarantor’s address listed below or such other address that Guarantor may provide Purchaser in writing from time to time will be sufficient for jurisdictional purposes. GUARANTOR FREELY WAIVES, INSOFAR AS PERMITTED BY LAW, TRIAL BY JURY IN ANY ACTION, PROCEEDING OR LITIGATION ARISING FROM OR IN ANY WAY RELATING TO THIS GUARANTEE. GUARANTOR WAIVES, TO THE EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT TO PURSUE A CLAIM AGAINST PURCHASER OR ITS ASSIGNS AS PART OF A CLASS ACTION, PRIVATE ATTORNEY GENERAL ACTION OR OTHER REPRESENTATIVE ACTION. Guarantor grants continued authority to Purchaser and its agents and representatives and any credit reporting agency employed by Purchaser to obtain Guarantor’s credit report and/or other investigative reports, and to investigate any references given or any other statements or data obtained from or about Guarantor or Seller or any of Seller’s principals for the purpose of this guarantee, Agreement or renewal thereof.

1. Methods of Collection; Use of Approved Processor.

Purchaser shall collect the cash attributable to the Specified Percentage in one of the following ways: (i) directly from Seller’s credit card processor; (ii) by debiting the Seller’s credit card processing deposit account or another of Seller’s accounts that has been approved by Purchaser; or (iii) by debiting an account established by the Seller with Purchaser’s approval specifically to hold funds that are due to Purchaser (“Dedicated Account”). Purchaser may decide in its sole discretion which of the three methods it will accept for the remittance of the Specified Percentage. If Purchaser elects to use method (i) or (ii), then Seller agrees to enter into an agreement with a credit card processor acceptable to Purchaser (“Approved Processor”). Purchaser reserves the right to change the collection method at any time, with five (5) days notice to Seller, if it is unable to collect funds on a consistent basis through the collection method initially selected.

1.1 Collection Directly from Processor.

If Purchaser agrees to accept the remittance of the Specified Percentage directly from the Seller’s Approved Processor, then Seller authorizes the Approved Processor to pay the Specified Percentage directly to Purchaser rather than to Seller until the Specified Amount has been received by the Purchaser from the Approved Processor. This authorization is irrevocable, absolute and unconditional. Seller further acknowledges and agrees that the Approved Processor will be acting on behalf of Purchaser to collect the Specified Percentage. Seller hereby irrevocably grants Approved Processor the right to hold the Specified Percentage and to pay Purchaser directly (at, before or after the time Approved Processor credits or remits to Seller the balance of the Future Receivables not sold by Seller to Purchaser) until the entire Specified Amount has been received by Purchaser. Seller acknowledges and agrees that the Approved Processor may provide Purchaser with Seller’s credit card, debit card and other payment card and instrument processing history, including without limitation Seller’s chargeback experience and any communications about Seller received by Approved Processor from a card processing system, as well as any other information Purchaser deems pertinent. Seller understands that Purchaser does not have any power or authority to control the Approved Processor’s actions with respect to the authorization, clearing, settlement and other processing of transactions and that Purchaser is not responsible for the Approved Processor’s actions. Seller agrees to hold Purchaser harmless for the Approved Processor’s actions or omissions.

1.2 Collection via ACH Withdrawals.

If Purchaser agrees to accept the remittance of the Specified Percentage by debiting the Seller’s credit card processing deposit account, then Seller (i) irrevocably authorizes the Approved Processor or their representative to provide daily reports to Purchaser regarding Seller’s credit card processing batch amounts, and (ii) irrevocably authorizes Purchaser, or its designated successor or assign to withdraw the Specified Percentages of the Future Receivables and any other amounts now due, hereinafter imposed, or otherwise owed in conjunction with this Agreement by initiating via the Automatic Clearing House (ACH) system debit entries to Seller’s account at the bank listed above or such other bank or financial institution that Seller may provide Purchaser with from time to time (“Bank Account”). In the event that Purchaser withdraws erroneously from the Bank Account, Seller authorizes Purchaser to credit the Bank Account for the amount erroneously withdrawn via ACH. Purchaser shall not be required to credit the Bank Account for amounts withdrawn related to credit card transactions which are subsequently reversed for any reason. Purchaser, in its sole discretion, may elect to offset any such amount from collections from Future Receivables. Seller represents that the Bank Account is established for business purposes only and not for personal, family, or household purposes. Seller understands that the foregoing ACH authorization is a fundamental condition to induce Purchaser to enter into this Agreement.

Before 2:00 P.M. EST of the day following each day that Seller conducts business, Seller shall cause Approved Processor or Approved Processor’s agent to deliver to Purchaser, in a format acceptable to Purchaser, a record from Approved Processor reflecting the total gross dollar amount of the preceding day’s credit card transactions processed by Approved Processor for Seller, irrespective of whether such amount consists of sales, taxes or other amounts collected by Seller from its customers (“Daily Batch Amount”). In the event that Seller is unable to procure Approved Processor’s compliance in a timely manner or as otherwise required under this section, within two (2) business days’ written notice by Purchaser to Seller of the same via facsimile to Seller at the fax number listed herein, Seller shall at its sole expense terminate its relationship with Approved Processor and exclusively engage the services of an alternative credit card processor that Purchaser approves in writing and enter into any merchant credit card processing agreement as the alternative credit card processor may require, which credit card processor shall thereafter be referred to and included within the meaning of “Approved Processor” herein. Alternatively, in the event of Approved Processor’s noncompliance, Purchaser is hereby authorized to estimate the Daily Batch Amount based upon Purchaser’s analysis of Seller’s historical experience and to collect the Specified Percentage of the Future Receivables as provided in Section 2 of this Agreement based upon such estimate. Purchaser will make appropriate adjustments upon the submission by Seller of statements with respect to the period of Approved Processor’s non-compliance. Further, Seller hereby irrevocably authorizes Purchaser to obtain information regarding its other bank account(s) from Approved Processor and/or from the sales agent, and to debit such bank account(s) in the event that Purchaser is unable to debit the Specified Percentage from Seller’s credit card processing account.

1.3 Collection from a Dedicated Account.

If Purchaser agrees to accept the remittance of the Daily Percentage by debiting a Dedicated Account, Seller agrees to complete all necessary forms to establish the Dedicated Account. Seller (i) irrevocably authorizes and will require Seller’s processor to deposit directly into the Dedicated Account a daily amount corresponding to Seller’s Daily Batch Amount multiplied by the Specified Percentage; and (ii) acknowledges and agrees that any funds deposited into the Dedicated Account by Seller’s processor will remain in the Dedicated Account until the Specified Percentage is withdrawn by Purchaser and then the remaining funds, minus any amount required to maintain the minimum balance for the account, will be forwarded to Seller’s Bank Account. If the Dedicated Account requires a minimum account balance, Purchaser may, in its sole discretion, fund the required minimum balance for the Dedicated Account out of the Purchase Price. Seller acknowledges and agrees that it shall not have the right to directly withdraw funds from the Dedicated Account.

2. Processing Trial; Commencement of Agreement. After this Agreement has been signed by Seller but prior to Purchaser’s acceptance, the parties shall conduct a processing trial of four or fewer business days in order to ensure that the Seller’s credit card transactions are being correctly processed through Approved Processor and that Purchaser timely receives the Daily Batch Amount in a satisfactory manner and format. Nothing herein shall create an obligation upon Purchaser to enter into this Agreement. The Agreement shall commence upon Purchaser’s payment to Seller of the Purchase Price.

3. Seller’s Covenants, Representations and Warranties. Seller and Guarantor represent, warrant and covenant the following as of this date and during the term of this Agreement:

a) Seller represents that it is not contemplating closing its business.

b) Seller represents that it has not commenced any case or proceeding seeking protection under any bankruptcy

or insolvency law, or had any such case or proceeding commenced against it, and it is not contemplating

commencing any such case or proceeding.

c) Seller represents that the Future Receivables are free and clear of all claims, liens or encumbrances of any

kind whatsoever.

d) Seller represents that it does not intend to temporarily close its business for renovations or other reasons

during the next twelve months.

e) Seller shall not take any action to discourage the use of credit cards which are settled through its processor or

to permit any event to occur which could have an adverse effect on the use, acceptance or authorization of credit cards for the purchase of Seller’s services and products;

f) Seller shall not change its arrangements with its credit card processor in any way which is adverse to Purchaser;

g) Seller shall not change the credit card processor through which the major credit cards are settled from Approved Processor to another credit card processor or to permit any event to occur that could cause a diversion of any of Seller’s credit card transactions to another processor without Purchaser’s prior written consent;

h) Seller represents that as of this date, all Seller’s credit card sales and transactions are being processed exclusively with Approved Processor or are being deposited exclusively into a Dedicated Account;

i) Seller shall not sell, dispose, convey or otherwise transfer its business or assets without the express prior written consent of Purchaser; Seller shall not enter into a concurrent agreement for the purchase and sale of future receivables with any purchaser aside from First Funds.

j) Seller shall furnish Purchaser with the bank statements for its Bank Account and any and all other accounts to which proceeds from Seller’s sales are deposited within seven (7) days’ of any such request by Purchaser;

k) Seller shall unconditionally ensure that the cash Seller receives from Approved Processor attributable to the

Specified Percentage of the Future Receivables is immediately thereafter available to Purchaser for collection

via ACH from Seller’s Bank Account;

l) Seller shall not attempt to revoke its ACH authorization to Purchaser set forth in this Agreement or otherwise

take any measure to interfere with Purchaser’s ability to collect the cash that Seller receives (i) from Approved Processor attributable to the Specified Percentage of the Future Receivables or (ii) from the Dedicated Account;

m) Seller shall not close its Dedicated Account, or close or change the bank account into which Approved Processor deposits the Future Receivables to another account without Purchaser’s prior written consent;

n) Seller shall not conduct its businesses under any name other than as disclosed to Purchaser or change any of its places of business without Purchaser’s prior written consent; and

o) Seller represents that the information it furnished Purchaser in this Agreement and preceding application, including without limitation, Seller’s processing statements, is true and accurate in all respects and fairly represents the financial condition, result of operations and cash flows of Seller at such dates, and since the dates therein, there has been no material adverse change in the business or its prospects or in the financial condition, results of operations, or cash flows of Seller.

4. Agency; Modifications & Amendments; Entire and Final Agreement. Purchaser does not have any power or authority or control over Approved Processor’s actions with respect to the processing of Seller’s credit card transactions. Purchaser is an entirely separate and independent entity from the Processor and ISO (if any) and their respective agents. Neither Approved Processor nor ISO (if any) is Purchaser’s agent and neither is authorized to waive or alter any term or condition of this Agreement and their representations shall in no way affect Seller’s or Purchaser’s rights and obligations set forth herein. This Agreement contains the entire and final expression of the agreement between the parties, and may not be waived, altered, modified, revoked or rescinded except by a writing signed by one of Purchaser’s executive officers. All prior and/or contemporaneous oral and written representations are merged herein. No attempt at oral modification or rescission of this Agreement or any term thereof will be binding upon the parties.

5. Governmental Approvals. Seller possesses and is in compliance with all permits, licenses, approvals, consents and other authorizations necessary to own, operate and lease its properties and to conduct the business in which it is presently engaged. Seller is in compliance with any and all applicable federal, state, and local laws and regulations, including, without limitation, all laws and regulations relating to the prosecution of the confidentiality of information received from credit card users.

6. Exclusive Use of Processor. Seller understands that services of Approved Processor are the exclusive means by which Seller may process its credit card transactions, unless it has set up a Dedicated Account, in which case all of Seller’s credit card processing must be subject to daily withholding of the Specified Percentage in the Dedicated Account.

7. Sale of Future Receivables; Non-Consumer Transaction. Seller and Purchaser agree that the Purchase Price paid by Purchaser in exchange for the Specified Amount of Future Receivables is for the purchase and sale of the Specified Amount of Future Receivables and is not intended to be, nor shall it be construed as, a loan or an assignment for security from Purchaser to the Seller. Seller and Guarantor hereby acknowledge and agree that neither party is a “consumer” with respect to this Agreement and underlying transaction, and neither this Agreement nor any guarantee thereof shall be construed as a consumer transaction.

8. No Right to Repurchase. Seller acknowledges that it has no right to repurchase the Specified Amount of Future Receivables from Purchaser.

9. Sale of Additional Future Receivables; Schedules; Right of First Refusal. Nothing herein shall obligate either party to sell and purchase future credit card receivables; however, Seller grants Purchaser the right of first refusal to purchase any such additional future credit card receivables that Seller may wish to sell during the term of this Agreement and during the period ending ninety (90) days after termination of this Agreement. Under such right of first refusal, if Seller desires to sell additional future credit card receivables, Seller agrees to sell such receivables to Purchaser only, and not to any other prospective purchaser, so long as Purchaser purchases such future credit card receivables on terms that are no less favorable to Seller as the terms and conditions of this Agreement.

10. Default. A “Default” shall include, but not be limited to, any of the following events: (a) The breach by Seller of any covenants contained in this Agreement; (b) Any representation or warranty made by the Seller in this Agreement, proving to have been incorrect, false or misleading in any material respect.

11. Remedies. In the event of a Default, Purchaser shall be entitled to all remedies available under law. Without limiting the generality of the foregoing, in the event of Seller’s default under Section 10 herein, Purchaser will be entitled to require Seller to purchase the remaining Future Receivables for an amount equal to the amount by which the Specified Amount of Future Receivables exceeds the amount of cash received from Future Receivables that Purchaser had previously collected under this Agreement, which amount Purchaser may automatically debit from Seller’s Bank Account via ACH without notice to Seller. No failure on the part of Purchaser to exercise, nor any delay in exercising any right under this Agreement shall operate as a waiver thereof, nor shall any single or partial exercise of any right under this Agreement preclude any other or further exercise of any other right. The remedies provided hereunder are cumulative and not exclusive of any remedies provided by law or equity.

12. UCC-1 Financing Statements. Seller authorizes Purchaser to file one or more UCC-1 Financing Statements prior to each sale of Future Receivables for purposes of providing public notice of the purchase by Purchaser from Seller of the Specified Amount of Future Receivables. The UCC-1 Financing Statements will state that the sale of the Future Receivables is an outright sale and not an assignment for security.

13. Notices. All notices, requests, demands and other communications hereunder, including disputes or inaccuracies concerning information furnished to credit reporting agencies shall be, unless otherwise provided herein, in writing and shall be delivered by mail, overnight delivery or hand delivery to the respective parties to this Agreement at their respective addresses listed on the face of this Agreement or at such other address that either may provide to the other in writing from time to time.

14. Binding Effect; Assignment. This Agreement shall be binding upon and inure to the benefit of Seller, Purchaser and their respective successors and assigns, except that Seller shall not have the right to assign its rights hereunder or any interest herein without the prior written consent of Purchaser which consent may be withheld at Purchaser’s sole discretion. Purchaser may assign this Agreement without notice to Seller.

15. Governing Law and Jurisdiction. This Agreement shall be governed by and construed in accordance with the laws of the State of New York. Seller consents to the jurisdiction of the federal and state courts located in the State and County of New York and agrees that such courts shall be the exclusive forum for all actions, proceedings or litigation arising out of or relating to this Agreement or subject matter thereof, notwithstanding that other courts may have jurisdiction over the parties and the subject matter thereof. Service of process by certified mail to Seller’s address listed on the face of this Agreement will be sufficient for jurisdictional purposes.

16. Purchaser’s Costs of Enforcement; Attorney’s Fees. Purchaser shall be entitled to receive from Seller and Seller shall pay to Purchaser, all Purchaser’s costs and expenses, including Purchaser’s collections overhead and Purchaser’s reasonable attorney’s fees, in enforcing any of the terms of this Agreement, regardless of whether or not a legal action has been commenced. If Seller files action against Purchaser and the matter is dismissed or Purchaser prevails in the matter, Seller agrees to pay all of Purchaser’s attorney fees and costs incurred whether in court or arbitration.

17. Severability. In case any one or more of the provisions contained in this Agreement should be invalid, illegal or unenforceable in any respect, the validity legality and enforceability of the remaining provisions contained herein and therein shall not in any way be affected or impaired thereby.

18. Limitation of Liability. In no event will Purchaser be liable for any claims asserted by Seller under any theory of law, including any tort or contract theory for lost profits, lost revenues, lost business opportunities, exemplary, punitive, special, incidental, indirect or consequential damages, each of which is hereby expressly waived to the fullest extent permitted by law by Seller.

19. Waiver Of Jury Trial; Limitation On Action. PURCHASER AND SELLER KNOWINGLY, WILLINGLY AND VOLUNTARILY WAIVE, INSOFAR AS PERMITTED BY LAW, TRIAL BY JURY IN ANY ACTION, PROCEEDING OR LITIGATION BROUGHT BY PURCHASER, SELLER OR GUARANTOR HERETO ARISING FROM OR IN ANY WAY RELATING TO THIS AGREEMENT OR THE UNDERLYING TRANSACTION. SELLER SHALL COMMENCE ANY ACTION OR COUNTERCLAIM BASED IN CONTRACT, TORT OR OTHERWISE ARISING FROM OR IN ANY WAY RELATING TO THIS AGREEMENT OR THE UNDERLYING TRANSACTION WITHIN ONE YEAR OF THE ACCRUAL OF THAT CAUSE OF ACTION AND NO SUCH ACTION MAY BE MAINTAINED WHICH IS NOT COMMENCED WITHIN THAT PERIOD. SELLER KNOWINGLY, WILLINGLY AND VOLUNTARILY WAIVES, TO THE EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT TO PURSUE A CLAIM AGAINST PURCHASER AS PART OF A CLASS ACTION, PRIVATE ATTORNEY GENERAL ACTION OR OTHER REPRESENTATIVE ACTION.

—————–

2006 AdvanceMe Contract

In exchange for payment by Company to Merchant of the purchase price specified below (“Purchase Price”), Company hereby purchases from Merchant and Merchant hereby sells to Company all of Merchant’s right, title and interest in and to the amount specified below (“Specified Amount”) of Merchant’s future receivables (“Future Receivables”) arising from payments by Merchant’s customers with cards (“Cards”) of a type settled, directly or indirectly, by Processor (as defined below). Merchant will remit the Specified Amount of Future Receivables to Company by causing a processor acceptable to Company (“Processor”) to pay Company each day an amount of cash equal to the percentage specified below (“Specified Percentage”) of all Card receivables due to Merchant on the day in question (“Receivables”). Company will continue to receive the Specified Percentage of Receivables until Merchant has remitted to Company the entire Specified Amount of Future Receivables.

Company will not increase the Specified Percentage without Merchant’s prior written consent. Merchant (i) will enter into an agreement acceptable to Company with Processor to obtain processing services (“Processing Agreement”) and (ii) hereby authorizes Processor and/or Operator (as defined below) to pay daily the cash attributable to the Specified Percentage of Receivables to Company rather than to Merchant and to debit the Account (as defined below) in such amounts until Company receives the cash attributable to the entire Specified Amount of Future Receivables.

Merchant agrees (i) to conduct its business consistent with past practice; (ii) to exclusively use Processor for the processing of all of its Card transactions, to not change its arrangements with Processor in any way that is adverse to Company and to not take any action that has the effect of causing the processor through which Cards are settled to be changed from Processor to another processor; (iii) to not take any action to discourage the use of Cards and to not permit any event to occur that could have an adverse effect on the use, acceptance or authorization of Cards for the purchase of Merchant’s services and/or products; (iv) to not open a new account other than the Account to which Card settlement proceeds will be deposited and to not take any action to cause Future Receivables or Receivables to be settled or delivered to any account other than the Account; (v) not to sell, dispose, convey or otherwise transfer its business or assets without the express prior written consent of Company and the assumption of all of Merchant’s obligations under this Agreement pursuant to documentation reasonably satisfactory to Company; and (vi) to maintain a Minimum Balance (as defined below) in the Account (collectively, the “Merchant Contractual Covenants”).

The owners of Merchant (such owners, whether shareholders, partners, members or other owners are referred to herein as “Owners”) hereby guarantee the performance of all of the covenants made by Merchant in this Agreement, including the Merchant Contractual Covenants.

To the extent set forth herein, each of the parties is obligated upon his, her or its execution of the Agreement to all terms of the Agreement, including the Additional Terms set forth below. Each of above-signed Merchant and Owner(s) represents that he or she is authorized to sign this Agreement for Merchant and that the information provided herein and in all of Company’s forms is true, accurate and complete in all respects. If any such information is false or misleading, Merchant shall be deemed in material breach of all agreements between Merchant and Company and Company shall be entitled to all remedies available under law. Company may produce a monthly statement reflecting the delivery of the Specified Percentage of Receivables from Merchant via Processor and/or Operator. Merchant hereby agrees to a $___ administrative fee per month for the production of the monthly statement and further agrees that Company and its designees may debit such administrative fee from Merchant’s bank account each month via the automated clearing house (“ACH”) system. An investigative or consumer report may be made in connection with the Agreement. Merchant and each of the above- signed Owners authorizes Company, its agents and representatives and any credit reporting agency engaged by Company, to (i) investigate any references given or any other statements or data obtained from or about Merchant or any of its Owners for the purpose of this Agreement, and (ii) pull credit reports at any time now or for so long as Merchant and/or Owner(s) continue to have any obligation owed to Company as a consequence of this Agreement or for Company’s ability to determine Merchant’s eligibility to enter into any future agreement with Company.

I. PROCESSING TERMS AND ARRANGEMENTS.

Section 1.1. Processing Agreement. Merchant understands and agrees that the Processing Agreement and the authorizations to debit set forth above irrevocably authorize Processor and Operator to pay the cash attributable to the Specified Percentage of Receivables to Company rather than to Merchant until Company receives the cash attributable to the entire Specified Amount of Future Receivables from Processor and/or Operator. These authorizations may be revoked only with the prior written consent of Company. Merchant agrees that Processor and Operator may rely upon the instructions of Company, without any independent verification, in making the cash payments described above. Merchant waives any claim for damages it may have against Processor or Operator in connection with actions taken based on instructions from Company, unless such damages were due to such Processor’s or Operator’s failure to follow Company’s instructions. Merchant acknowledges and agrees that (a) Processor and Operator will be acting on behalf of Company with respect to the Specified Percentage of Receivables until the cash attributable to the entire Specified Amount of Future Receivables has been remitted by Processor and/or Operator to Company, (b) Processor and Operator may or may not be affiliates of Company, (c) Company does not have any power or authority to control Processor’s or Operator’s actions with respect to the processing of Card transactions or remittance of cash to Company, and (d) Company is not responsible for, and Merchant agrees to hold Company harmless for, the actions of Processor and Operator. For purposes of this Agreement, the term “Operator” shall mean any party Company designates to debit any amounts from Merchant’s or Owners’ accounts as authorized or permitted by this Agreement.

Section 1.2. Instructions to Processor. Merchant will irrevocably instruct Processor to hold the Specified Percentage of Receivables on behalf of Company and to remit directly to Company the cash attributable thereto at the same time it remits to Merchant the cash attributable to the balance of the Receivables. Merchant acknowledges and agrees that Processor shall provide Company with Merchant’s Card transaction history.

Section 1.3. Indemnification. Merchant indemnifies and holds each of Processor and Operator, their respective officers, directors, affiliates, employees, agents and representatives harmless from and against all losses, damages, claims, liabilities and expenses (including reasonable attorneys’ fees) suffered or incurred by Processor or Operator resulting from actions taken by Processor or Operator in reliance upon information or instructions provided to Processor or Operator by Company.

Section 1.4. Limitation of Liability. In no event will Processor, Operator or Company be liable for any claims asserted by Merchant under any theory of law, including any tort or contract theory for lost profits, lost revenues, lost business opportunities, exemplary, punitive, special, incidental, indirect or consequential damages, each of which is hereby expressly waived by Merchant.

Section 1.5. Processor Commissions. Merchant understands and agrees that Processor will charge a fee or commission for processing receipts of Receivables (the “Processor’s Fee”) as set forth in the Processing Agreement and that the Processor’s Fee will be deducted from the portion of the Receivables payable to Merchant and not from the cash attributable to the Specified Percentage of Receivables payable to Company.

Section 1.6. No Modifications. Merchant will comply with the Processing Agreement and will not modify the Processing Agreement in any manner that could have an adverse effect upon Company’s interests, without Company’s prior written consent.

Section 1.7. Account. Merchant represents and warrants that Merchant’s sole bank account (“Account”) into which all settlement proceeds of Receivables will be deposited is that account identified by account name, account number and bank name and address that is shown on the face of the voided check that Merchant shall provide to Company along with this Agreement, the delivery of which voided check is a condition precedent to Company’s obligations under this Agreement. If Processor transfers to the Account or any other account of Merchant or Owner(s) any funds that should have been transferred to Company pursuant to Sections 1.1 and 1.2 hereof, or if Merchant otherwise has monies deposited in its or Owner(s)’s account(s) that otherwise should have been transferred to Company pursuant to Sections 1.1 and 1.2 hereof, Merchant shall immediately segregate and hold all such funds in express trust for Company’s sole and exclusive benefit. In any such circumstance, Merchant shall maintain in the Account a minimum balance equal to Company’s undivided interest in such funds or the Specified Percentage multiplied by the Merchant’s average daily Card volume based on the processing records provided to Company prior to the execution of this Agreement (assuming twenty-one days of processing per month) multiplied by three (3), whichever is greater (“Minimum Balance”), until such funds are paid to Company. Merchant and each Owner authorizes Company, Processor and Operator to debit such funds directly from all such accounts, including the Account, and agrees to not revoke or cancel such authorizations until such time as Company has received the entire Specified Amount of Future Receivables. Merchant acknowledges and agrees that Company, Processor and Operator may issue a pre-notification to Merchant’s and/or Owner(s)’s bank(s) with respect to such debit transactions. Within twenty-four (24) hours of any request by Company, Merchant shall provide, or cause Processor or Operator to provide, Company with records and other information regarding Merchant’s Card sales, the Account and any other accounts of Merchant or Owner(s).

Section 1.8. Processing Trial. After this Agreement has been signed by both Merchant and Company but prior to Company’s determination as to whether to pay the Purchase Price, Merchant agrees to permit Company to instruct Processor and/or Operator to conduct a short processing trial (the “Processing Trial”) to ensure that Merchant’s Card transactions are being correctly processed through Processor and that the cash attributable to the Specified Percentage of Receivables will be appropriately remitted to Company. Company agrees to make a determination as to whether to purchase the Specified Amount of Future Receivables promptly after the commencement of the Processing Trial. If Company elects to purchase the Specified Amount of Future Receivables, then all of the cash received by Company in connection with the Processing Trial prior to the payment of the Purchase Price shall be applied to reduce the Specified Amount. Nothing herein shall create an obligation on behalf of Company to purchase any Future Receivables, and Company expressly reserves the right to not purchase the Specified Amount of Future Receivables and not pay the Purchase Price to Merchant. If Company decides to not purchase the Specified Amount of Future Receivables and not pay the Purchase Price, this Agreement shall have no further effect and Company shall, promptly after receipt from Processor or Operator, return to Merchant any cash received by Company in connection with the Processing Trial.