Are Your Sales Agents or ISOs Up to Snuff? (Take Our Research Survey)

August 12, 2015If you enjoy reading deBanked’s articles, please take the time to take our short survey:

Some background:

What started as a few sensational articles about practices in small business lending and merchant cash advance is now turning into a cry for a governmental crackdown by not only observers outside the industry but lenders from inside the industry itself.

Stories that look like they’ve been written by consumer activist groups are being penned by your peers. Just recently, Fundera’s Brayden McCarthy submitted his thoughts to American Banker and the Huffington Post.

Stories that look like they’ve been written by consumer activist groups are being penned by your peers. Just recently, Fundera’s Brayden McCarthy submitted his thoughts to American Banker and the Huffington Post.

“As evidence,” he wrote. “One need only look to some lenders’ triple-digit interest rates, the proliferation of shady loan brokers and inadequate or nonexistent disclosure of price and terms. Some practices, such as brokers that brand themselves as impartial but take incentives to market certain lenders over others, resemble behavior seen in the run-up to the financial crisis.”

Along with the Treasury’s RFI, there is a mass lobbying effort to regulate the industry as fast possible. As Patrick Siegfried, Esq pointed out recently, former SBA Administrator Karen Mills recently urged the the CFPB to implement the Small Business Data Collection Rule of the Dodd-Frank Act, a law which could potentially outlaw the underwriting practices of the entire business lending and merchant cash advance industries.

There’s also been the publication of a Small Business Borrowers’ Bill of Rights and the formation of the Responsible Business Lending Coalition. And on Forbes, an interview with loan broker Ami Kassar described the industry as the wild, wild west.

As a long time participant and observer in the industry, (this is my 10th year now) I want nothing more than a bright and prosperous future for both my peers and America’s small businesses. I hope you’ll take two minutes to take our survey above.

Thanks!

Former SBA Administrator Karen Mills Urges CFPB to Enact Small Business Data Collection Rule

August 11, 2015 Last week a handful of small business lenders announced the formation of the Responsible Business Lending Coalition. The announcement was made at an event held at the National Press Club in Washington, DC. The event’s Keynote speaker was former SBA Administrator Karen Mills.

Last week a handful of small business lenders announced the formation of the Responsible Business Lending Coalition. The announcement was made at an event held at the National Press Club in Washington, DC. The event’s Keynote speaker was former SBA Administrator Karen Mills.

During her presentation, Ms. Mills called on the CFPB to implement the Small Business Data Collection Rule of the Dodd-Frank Act. Ms. Mills’ request echoes the recent letter signed by 19 US senators urging the Bureau to issue the regulations contemplated by section 1071 of the Act. Ms. Mills argued that the data collection rule will be critical to understanding small business credit availability, especially for women and minority owned businesses.

Ms. Mills’ statements are the most recent in a series of requests to the CFPB to implement 1071. In addition to the 19 senators, multiple community activist groups along with the National Community Reinvestment Coalition have demanded that the Bureau take action.

The White House has remained silent on the issue so far. If the Bureau does decide to act, the new rule could be added to its list of action items as early as this winter.

Commission Chargebacks: The Good, the Bad and the Ugly

August 10, 2015 Imagine you’re a 20-something-year-old broker who’s just, in good faith, referred a merchant to a funder. You walk away with a few thousand dollars in your pocket, and you promptly spend it on rent and a celebratory steak dinner. Then all of a sudden…BAM! Just like that the merchant goes belly up and the funder’s knocking on your door to clawback your hard-earned commission money, which, of course, you’ve already spent.

Imagine you’re a 20-something-year-old broker who’s just, in good faith, referred a merchant to a funder. You walk away with a few thousand dollars in your pocket, and you promptly spend it on rent and a celebratory steak dinner. Then all of a sudden…BAM! Just like that the merchant goes belly up and the funder’s knocking on your door to clawback your hard-earned commission money, which, of course, you’ve already spent.

For many brokers, it’s a familiar-sounding story—with an ending they’d like to rewrite. Their thinking goes like this: underwriters, not brokers, are the ones who are supposed to dig into a company’s finances before approving a deal. Underwriters, not brokers, are the ones who make the financial decisions about whether or not a deal can go forward. Therefore, underwriters, not brokers, should be responsible when deals implode.

“There are a lot of people who think there should not be commission clawbacks—that they’re unfair,” says Archie Bengzon, who runs the New York sales office for Miami-based Rapid Capital Funding, a direct funder. Bengzon was previously the president of Merchant Cash Network, an ISO in New York.

While there’s a fair amount of closed-door grousing by brokers, most funders are standing their ground—with only a select few companies kicking these controversial policies to the curb. More commonly, funders claim clawbacks, despite being hated by brokers, are a necessary evil. These funders say that without them, they’d stand to lose too much on bad deals and that they need a way to protect themselves from rogue brokers.

“There is a group of people out there who are trying to game the system,” says industry attorney Paul Rianda, who heads a law firm in Irvine, California.

The Case for Scrapping Clawbacks

Brokers in favor of changing the status quo understand the need to prevent bad apples from smelling up the entire industry. But even so they believe that chargebacks are patently unfair to the honest majority of brokers who often make just enough to scrape by. In most cases, the brokers are typically young—18-to-26-year-olds trying to make money and learn the industry. They don’t have the financial resources that the funders do and the onus shouldn’t be on them if the deal they brought in—with good intentions—goes bust in a short time, according to the owner of a top-tier ISO/Hybrid in Staten Island, New York, who requested his name not be used.

This is especially true in cases where the underwriter took risks they shouldn’t have or decided to fund merchants in cases where they shouldn’t have. “It’s the underwriter’s job to protect the money that their company is lending out,” he says. “[Chargebacks] shouldn’t be going on in this industry.”

One solution might be for more ISOs to stand up to funders and refuse to send them future deals. That’s exactly what the Staten Island executive did a few years ago when a funder he repeatedly worked with tried to claw back his commission on a particular deal. He made a big stink and told them he’d never send them business again. It was enough of a threat to convince the funder to back off. “If more ISOs start saying that…then the funders will start sweating and change their contracts. Because it really isn’t fair,” he says.

For some brokers, however, taking such a strong position with funders is a risky strategy in a cottage industry where all the major players know each other and there’s no shortage of hungry young brokers willing to do business. So while these brokers don’t like losing money, they aren’t necessarily loudly crying foul either.

Matthew Ross, managing member of Go Ahead Funding, a broker and funder in Basalt, Colorado, has been in the business for nine years. He’s only had one commission clawed back once in this time period—it was a commission for $1,500 on a $25,000 deal that went sour within a month, he recalls. He was upset at the time and felt the underwriter should have done more to vet the merchant who went belly up. “Why didn’t the underwriters catch this?” he remembers asking at the time.

Matthew Ross, managing member of Go Ahead Funding, a broker and funder in Basalt, Colorado, has been in the business for nine years. He’s only had one commission clawed back once in this time period—it was a commission for $1,500 on a $25,000 deal that went sour within a month, he recalls. He was upset at the time and felt the underwriter should have done more to vet the merchant who went belly up. “Why didn’t the underwriters catch this?” he remembers asking at the time.

Nonetheless, Ross was a lot calmer than some brokers might have been under the circumstances. For instance, he says he never threatened to stop sending the funder business as many brokers might have done. “I don’t necessary like it, but I understand it. I’m not going to fight it,” he says.

Some brokers are making their displeasure with the practice known by declining to sign contracts that contain clawback clauses. Nathan Abadi, founder and president of Excel Capital Management, a New York-based funder and ISO, says he either refuses to do business outright or he comes to a verbal agreement with a funder that he’ll wait two weeks for payment to make sure the deal has legs. “I meet them in the middle,” he says.

The reason he likes this approach is that it’s more palpable for brokers to lose paper commissions versus actual money that they’ve already been given and possibly spent. Otherwise, as a business owner working with numerous agents, it’s bad for business. “It causes an internal conflict because now you have to penalize the person who’s working for you,” Abadi says.

The Flip Side of the Chargeback Coin

Meanwhile, there’s a whole other camp within alternative funding—including some brokers—who feel chargebacks are important as a fraud-deterrent. Given the fact that the industry is still largely unregulated, many believe that funders need some type of fire retardant to prevent being burned by unscrupulous brokers.

“We think that they serve an important role,” says Stephen Sheinbaum, founder of Merchant Cash and Capital, a New York-based funder. “Most of our stronger referral partners do not object to it. It’s a way of aligning our interests with the sales force.”

About 60 percent of the company’s funding business comes from third-parties including ISOs; its direct sales force accounts for the other 40 percent.

Even some brokers concede that clawbacks can serve a valuable purpose. Sure, it’s aggravating to lose money, but they feel that without clawbacks the industry would be even more of a free-for-all than it already is.

“I can see both sides,” says Bengzon, the funder and broker. Wearing his broker hat, Bengzon has felt the sting of losing a commission once or twice in the 100 or so deals he’s done. But he still understands why funders—who take a big monetary hit when deals go sour—would want to protect themselves and require brokers to have some skin in the game.

“If we’re going to reap the rewards of a nice commission, we should also understand that it can still be taken away if a deal goes bad,” he says.

When he sends leads to funders, Ross of Go Ahead Funding says he does his best to make sure he’s sending only high quality merchants. He tries to vet them upfront—to the limited extent he can—in order to avoid problems later on. Clawback provisions serve as “an incentive for [brokers] to keep their eyes open,” he says.

Know What You’re Signing

About 80 percent of the agreements that come across the desk of Rianda, the industry attorney, have a 30-day clawback provision. But he’s seen some agreements that have longer time frames—60, 90 or even 120 days. Those types of contracts aren’t as common, but they’re out there.

It’s important for brokers to carefully read the fine print of a contract before signing on the dotted line. “It sounds obvious, but a lot of people don’t do that,” says Bengzon.

The shorter the clawback time frame, the less brokers tend to balk. “People don’t want to be paid on a deal and three months later they lose that commission, which they’ve already spent,” he says.

Bengzon believes a clawback that extends any more than a month is excessive. “I would never sign something greater than 30 days,” he says.

According to Sheinbaum of Merchant Cash and Capital, 30 days is an appropriate time frame to help weed out fraud without putting unnecessary burden on brokers who are sending legitimate business. “The purpose of the provision is to try and stop people from committing fraud at the outset,” he says.

According to Sheinbaum of Merchant Cash and Capital, 30 days is an appropriate time frame to help weed out fraud without putting unnecessary burden on brokers who are sending legitimate business. “The purpose of the provision is to try and stop people from committing fraud at the outset,” he says.

David Sederholt, executive vice president and chief operating officer at Strategic Funding Source Inc. in New York, says clawback provisions in the contracts Strategic uses range from 30 to 45 days depending on the contract. He says he understands brokers don’t like them, but that it’s nonetheless important to have the provision in order to protect the funders. “There’s got to be some partnership involved here,” he says.

Clawbacks Not A Free-For-All

Many funders recognize that there’s a fine line between protecting their business and cutting off potential revenue sources.

“You start clawing back commissions on every default, a broker will stop sending business,” says Ross of Go Ahead Funding.

Sheinbaum of Merchant Cash and Capital notes that clawbacks aren’t used as often as some brokers might think. He says out of 800 deals in a 30- or 31-day period, his company enforces its clawback policy only a handful of times each month.

He also points out that while the clawback policy is on the books, Merchant Cash and Capital looks at each situation individually. If it’s clear that the broker tried to defraud the funder, that’s one thing, he says. But, if for instance, a merchant has a heart attack and dies 20 days into a deal and can’t pay back the funds, Merchant Cash and Capital wouldn’t try to clawback the broker’s commission in that situation, he says.

Strategic Funding has only clawed back commissions once or twice in the past nine years, says Sederholt, the EVP.

The company works with a variety of brokers. Some have less than a 1 percent default rate and others have 12 percent to 14 percent default rates. As extra protection with brokers who have bad track records, Strategic Funding either declines to work with them at times, or has in place a stronger underwriting procedure with these deals.

Being more careful upfront is a better tactic than trying to go after commissions, which is extremely hard, Sederholt says.

Changing the Modus Operandi

While it’s not the industry norm, there are a few funders who have stopped using clawbacks, or are considering doing so, given all the headaches they can cause. Isaac D. Stern, chief executive of Yellowstone Capital LLC, a New York-based funder, says his company no longer tries to clawback commissions when deals go bust. The few times they tried to clawback commissions several years back, the brokers they went after were upset and threatened not to do business with them anymore. Yellowstone decided this approach was bad for business and that it would be more prudent to try something else.

“There’s too much competition, and if we were going to do clawbacks it would decimate our business,” he says. “It’s the broker’s job to bring in the deals. It’s our job to underwrite it. If something goes wrong on the deal, that’s on us. It’s not the broker’s fault.”

As protection, the contracts Yellowstone uses with brokers contain a provision allowing it to seek damages when fraud’s alleged. But in cases where brokers send what seems to be a legitimate deal that goes bad for something other than fraud, Yellowstone turns the other cheek. Yellowstone can afford to eat the $5,000 or $6,000 commission to ensure ongoing—and hopefully more positive leads—or so the thinking goes, according to Stern.

Overtime—if peer pressure continues to mount—it’s possible that more even more funders will decide chargebacks just aren’t worth the trouble. “I think the reason why some funders are moving away from [clawbacks] is because people are afraid of losing volume. Once one funder acquiesces, others will follow suit,” says Sheinbaum of Merchant Cash and Capital.

The Importance Of A Profitable Business Model And Creative Financing For Your Broker Office

August 10, 2015 Continuing The Year Of The Broker Discussion, I wanted to touch on another aspect that isn’t discussed too often in our space (Independent Broker or Independent Agent space), and that’s the importance of creating a profitable business model and rounding up creative debt financing for our Office.

Continuing The Year Of The Broker Discussion, I wanted to touch on another aspect that isn’t discussed too often in our space (Independent Broker or Independent Agent space), and that’s the importance of creating a profitable business model and rounding up creative debt financing for our Office.

I believe it was the Roman Playwright, Plautus, that said, You must spend money to make money. This is certainly true for Independent Brokers and Agents, as we are entrepreneurs in every sense of the word, or if you operate a one man show like I do, then you would be more along the lines of a solopreneur which is new terminology floating around that refers to certain special entrepreneurs who run their business solo with full responsibility over the day-to-day operations.

However, despite the fact that one must spend money in order to make it, it begs the question as to why many new Brokers have very little networks, resources and other sources for financing?

Not only do they lack these resources, but many new Brokers also have not truly developed a scientific business model for their office based on: If I invest XYZ in data, marketing and all other aspects in association of producing 1 new closed deal, I would receive XYZ back into terms of the revenue off the initial closed deal as well as XYZ back in terms of recurring revenues on the renewals of said merchant.

Many new brokers lack both a scientific and profitable business model, along with efficient financing for said business model, which threatens their survival going forward.

Your Profitable Business Model

I argue with investors across the Investment Community all of the time in relation to which is better in terms of building the most Wealth, is it investing in Stocks or operating your own Profitable Business Model? I have always believed creating your own Profitable Business Model was the fastest way to Wealth due to the lack of control one has over the returns you can generate through the Stock Market. Commentators like James Altucher tend to agree with my mentality as he says: The best way to take advantage of a booming stock market is to invest in your own ideas. If you have an extra $50,000 don’t put it into stocks. Put it into yourself. You’ll make 10,000% on that instead of 5% per year.

I’ve always used a model of at least a 400% return within 24 months for operating my office because, not only did I have to cover business expenses and taxes, but I also had to cover my personal expenses, the funding of my emergency funds/savings, and the funding of my retirement accounts which includes SEP IRAs, Social Security, and Health Saving Accounts.

So for example, my model might have it to where if I invest $30,000 into my office, that should produce revenues of around $180,000 within 24 months, revenues include commissions from new deals, renewal deals, side processing residuals and other valued added products. This would leave a profit before taxes of $150,000 or a 500% return. Now the 500% range is just the benchmark used, in terms of actual returns, they have been at least double this amount due to my focus on maintaining clients for the long term as with recurring clients, there are no investment dollars spent on the acquisition of those additional revenues but they do continue to add to the overall “profitability” measurement of the original investment.

Utilizing this predictable model allows for the use of creative financing for leverage, cashflow management, along with the preservation of savings, and other investment portfolios. One of the tools I have been using for creative financing have been Credit Card No Interest Promotional Offers.

Using Credit Card Promotional Offers To Finance Your Office

I’m a Dave Ramsey fan like many Americans, but I’m totally against Mr. Ramsey’s consistent hammering of the use of “debt,” specifically the use of Credit Cards. Credit Cards are just like hand guns, if you put the gun in the hands of a solider, police officer, hunter, or a responsible home owner, then you protect human life, build nations and protect communities. If you put the gun in the hands of the common Chicago inner city street thug, then you get crime and homicide. If you put a Credit Card in the hands of a responsible person, the Credit Card is used to bring a variety of additional benefits to said user. But in the hands of an irresponsible person, the Credit Card just adds to their financial woes.

If you strive to keep your personal credit profile clean and with high efficiency, you should qualify for a number of Credit Cards that not just provide cashback rewards, but they provide short term financing in the form of 0% interest for 12 – 18 months, with a 1% – 3% upfront fee. This means you can receive an up to 18 month loan for only 1% – 3% in borrowing costs. These offers are not presented just when the card is opened, but they are generated usually on a monthly or quarterly basis.

So coming back to my business model, I might put that entire $30,000 on a credit card promo deal for 18 months with an upfront fee of 3%, which means the borrowing costs are $900. I would continue paying the minimum payment every month which is usually calculated as no more than 0.5% – 1% of the outstanding balance. I would invest the $30,000 into my business model and would have obtained the break-even return and profit measurement in a relatively short period of time (usually 3 – 5 months) and then be profitable on the investment. I would eventually end up paying off the outstanding balance on the Credit Card well before the promo period ends, which further increases my positive credit history allowing for larger credit limits to be requested.

Other Benefits Of Credit Cards Over Other Payment Options

Credit Cards also provide a host of other benefits including cashback rewards of anywhere from 1% – 45% depending on the reward category, these rewards and savings are not available through any other form of payment option. If you seek out cards with no monthly fees, setup fees or annual fees, you could run up balances, pay them off before the grace period ends, and obtain a stream of free income.

Credit Cards also include Chargeback Protection that can save you a significant amount of headaches down the line should you run into an unscrupulous vendor, or if you are the unfortunate victim of theft such as a robbery, identity theft, strong-arm theft, etc. For example:

- If someone steals your wallet and goes on a “card swiping spree”, once you report your Credit Card stolen then you aren’t responsible for any of those transactions. This isn’t as efficient if you carried a Debit Card, as the money would be gone from your Checking Account until the Bank recovers the funds in 30 – 90 days, which might cause you some cashflow issues. If you carried Cash, the money might never be recovered.

- If you ordered something from a vendor and didn’t receive it, you are protected with the use of Credit Cards. With a Debit Card or Check, it will again take 30 – 90 days for the dispute to complete with the Bank, however, throughout this period of time the money is still gone from your account until the dispute is over, which might cause some cashflow issues. If you used Cash for the order, the money might never be recovered in this case as even though you are likely to obtain a judgment by suing the vendor, the Courts do not assist you with collections.

To Wrap

In order to survive going forward as an Independent Broker or Agent, remember the importance of developing a profitable business model as well as having low cost sources of financing for said model. Credit Cards are one of the ways you can creatively finance your business model.

I’m on track to end the year with near or over $200,000 in total credit limit availability. This credit limit availability is spread out over a number of different accounts, but some of my favorite Credit Card Accounts include: The Double Cash Card ™ from CitiBank, The Discover IT Card ™ from Discover Bank, The BankAmericard Cash Rewards Card ™ from Bank of America, The Chase Freedom Card ™ from Chase Bank, The Upromise Mastercard ™ from Barclay’s Bank, The QuickSilver Rewards Card ™ from Capital One Bank, and The Blue Cash Everyday Card ™ from American Express.

MCC and BizFi Founder Stephen Sheinbaum on Bloomberg

August 4, 2015Earlier today on Bloomberg TV:

“Automation doesn’t mean no underwriting,” said Stephen Sheinbaum, the founder of Merchant Cash and Capital and BizFi.

Sheinbaum also said that they have never raised an equity round from an institution.

“We do want to go public,” he added. If they can obtain an equity investor, he put their timeline to go public at 12 to 18 months.

Watch the video below:

Have Your Marketing Response Rates Changed?

August 4, 2015 Notice anything different with your marketing response rates lately? OnDeck has…

Notice anything different with your marketing response rates lately? OnDeck has…

During the OnDeck Q2 earnings call yesterday, company CEO Noah Breslow said, “there are no two or three competitors dominating this trend (direct marketing), but we know the sheer number of marketing solicitations targeted to small businesses has grown meaningfully over the last six months which impacts our response rates.”

The comments were interesting because while they opposed any correlation between the increased competition and their continuously declining interesting rates, it was an acknowledgement that they are not alone in their marketing efforts, nor are their marketing methodologies proprietary.

The comment was focused mainly on direct mail campaigns and Breslow argued their strategy was to “break through the clutter” and “better communicate our value proposition.”

“Competition for customer response remains elevated,” he later added.

OnDeck still managed to fund $419 million for the quarter, up only $3 million from the previous quarter, but a 69% increase over the same time period a year ago.

During the Q&A which was unfortunately not part of the recorded transcript so I will paraphrase as best I can from memory, a few analysts inquired deeper about the competition.

One wondered if their competitors’ marketing efforts were sustainable or if they were simply on a market share binge and would eventually go away. Breslow said there would probably be a combination of both, that some would continue to stick around long term and others might fall off. It was a safe answer because while some of their competitors may indeed have high acquisition costs, there are still profits being made and nobody should expect the competition to subside any time soon, if ever.

Breslow also shared that the competition was bidding up the price online, talking at least in part about Pay-Per-Click marketing.

OnDeck shed more Funding Advisors (brokers) in Q2 than they expected to because of their “re-certification program.” Brokers either didn’t make the cut or would not go through the program. Only 20.6% of their loans were originated by brokers in Q2 of this year as opposed to 30.8% during this time last year. Brokers brought in bigger loans though on average because they made up 28.4% of the dollar volume of loans originated this year. Last year at this time they made up 42.9% of the volume.

OnDeck has managed to grow despite their dwindling reliance on brokers and a marked increase in competition.

Have your direct mail and online advertising response rates changed recently? If OnDeck has taken notice, surely you must have too…

Update: You can read the full transcript of the call here, including the Q&A

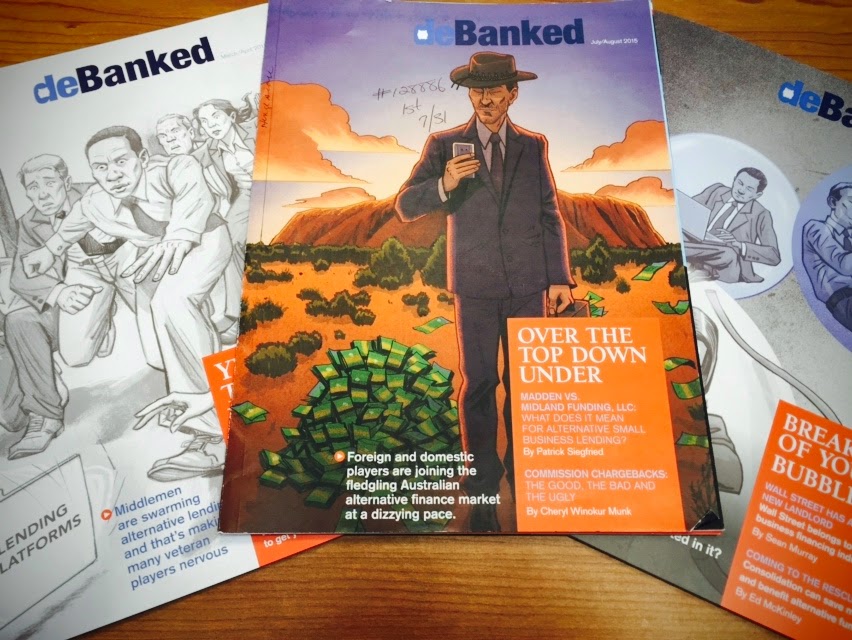

deBanked’s Next Issue Shipping Soon

August 3, 2015Are you ready for another issue of deBanked Magazine?!

In this edition, we explore the Australian market, the commission chargeback debate here at home, the quest for national bank charters, a deeper look at the Midden v. Midland case and MORE!

Haven’t been receiving the print edition in the mail? You need to SUBSCRIBE for that. It’s free.

We distribute thousands of copies to ISOs, brokers, lenders, funders, and other players in the alternative business lending ecosystem. Want to be included in future issues? Drop me a line at sean@debanked.com

New Funding Brokers Struggle As Industry Grows

August 3, 2015 Here’s a few things that will have you scratching your head.

Here’s a few things that will have you scratching your head.

1. A new sales agent recently took to an industry forum to ask for help with ACH processing. According to him, he charged a closing fee on a loan that closed and then realized that he had no idea how to collect the fee. His problem was perplexing because he had the merchant sign an agreement that authorized him to debit the funds out despite not having an ACH processing account.

Some sympathetic veterans advised him to have the merchant write him a check, but others were too dumbfounded by his use of an ACH agreement when he did not know anything about ACH. The agreed fee was probably too large to write off as a mistake so hopefully the merchant will understand and write him a check for services rendered.

The lesson: If you don’t know how to do something, don’t guess. The agent would’ve been in a much better situation if he had asked how to collect fees prior to drawing up an agreement that referred to a methodology he had no familiarity with.

2. A semi-seasoned sales agent griped about a recent experience on an online message board about a business lender that stole his deals and turned out to be a repeat felon. The broker community was not sympathetic when they learned that the “lender” used a gmail address to communicate. What’s worse is that a perfunctory Google search revealed a record of violent crime.

The lesson: At the very least, do not send deals to anyone using a free email address. This was item #3 on my Advice to New Brokers list, published back in February. This also violated item #4 on my list, which says, don’t send your deal to some random company just because they went around posting on the web. A simple Google search for this broker would’ve showed that the “lender” was a serial criminal.

3. One broker e-mailed me to say that a lender had stolen his syndication money and disappeared. Another told me that they had stopped receiving their syndication deposits for their entire portfolio and wasn’t sure what was going on. This situation often doesn’t make the public forums because the aggrieved parties are sometimes too embarrassed to tell others that they got hustled. I recommended a lawyer to one of them.

The lesson: Refer to #4 on my Advice to New Brokers list. Even if others claim to be having a positive experience, there are a few red flags to look out for when it comes to syndication:

- Were they too eager to accept your money?

- Did they have an Anti-Money Laundering process in place?

- Would your funds be co-mingled with their operating funds or isolated in a separate account?

- How is their system structured? Will you get paid even if they declare bankruptcy?

- Was the owner of the company ever charged or convicted with fraud? This is probably the most important and for some reason the most overlooked. If the owner was previously charged with fraud and your money eventually gets stolen, you can only blame yourself. And if you don’t know if someone has a past criminal history, you should probably ask around in addition to conducting a formal background check.

Syndicating brings me to item #1 on my Advice list, hire a lawyer. If you can’t afford a lawyer, you definitely can’t afford to syndicate.