Does Your Merchant Cash Advance Company Pass The Scrutiny Test?

April 29, 2019

The merchant cash advance business has come under repeated fire of late from regulators, legislators and customers. “Every aspect of the industry is under scrutiny right now. Syndication agreements, underwriting, and collections are the subject of bills in Congress and across multiple states,” says Steven Zakharyayev, managing attorney for Empire Recovery Services in Manhattan, which offers debt recovery services to financial companies. So how should funders respond amid these obstacles? Here are a few pointers to help funders succeed despite ongoing challenges from a legal, regulatory, business and public relations perspective:

DIFFERENTIATE BETWEEN CASH ADVANCES AND LOANS AND MODEL BUSINESS DEALINGS ACCORDINGLY

In the eyes of the law, merchant cash advances and loans are very different. With a cash advance, a funder advances the merchant cash in exchange for a percentage of future sales, plus a fee. A loan, on the other hand, is a lump sum of cash in exchange for monthly payments over a set time period at an interest rate that can be fixed or variable. While the two types of funding options have certain similarities, funders have to be extremely careful to make appropriate distinctions in their business practices; otherwise legal trouble can easily ensue, experts say.

Most funders know that they are supposed to draw a bright line between merchant cash advance and lending, but it’s critical they put this knowledge into practice. Funders have to ensure the distinction is evident in their business lexicon, says Gregory J. Nowak, a partner in the Philadelphia office of law firm Pepper Hamilton LLP who focuses on securities law.

For example, it’s extraordinarily important that funders don’t refer to merchant cash advances as loans in their business dealings. Business records, emails and other documents can be requested in litigation for discovery purposes. If the funder’s internal documentation refers to cash advances as loans, it’s going to be hard for the company to argue that they aren’t, in reality, loans.

For example, it’s extraordinarily important that funders don’t refer to merchant cash advances as loans in their business dealings. Business records, emails and other documents can be requested in litigation for discovery purposes. If the funder’s internal documentation refers to cash advances as loans, it’s going to be hard for the company to argue that they aren’t, in reality, loans.

“Most judges want to see consistency of treatment and that includes your vocabulary,” Nowak says. “The word ‘loan’ should be banned from their email and Word files.”

There’s a fair amount of litigation surrounding what is and what isn’t a cash advance. This can be helpful guidance for funders in setting out the criteria they need to follow to be able to defend their activities as cash advances. Even so, the line is somewhat of a moving target and funders need to be stalwart in these efforts given heightened regulatory scrutiny, experts say.

“If it looks like a loan, the law will treat it as a loan—and all the consequences that follow such a determination,” says Christopher K. Odinet, an associate professor of law at the University of Oklahoma College of Law.

BE CAREFUL ABOUT YOUR COLLECTION POLICIES

Obviously companies want to collect their payments. But some funders are too quick to file lawsuits, which could lead to unwanted trouble, says Paul A. Rianda, who heads a law firm in Irvine, Calif.

“The business model of sue first, ask questions later can be a problem,” says Rianda, whose clients include merchant cash advance companies.

The concern is that when funders sue, merchants start talking to attorneys and that could open the MCA firm to other types of lawsuits. The more a funder sues, the more it increases media attention and invites examination by state regulators and others. “You invite class action lawsuits and regulatory scrutiny that you really don’t want. It’s a boomerang thing,” he says.

The issue is especially pertinent now as legislators grapple with how to handle the thorny issue of confessions of judgement, more popularly known as COJs. For instance, since the start of the year, New York courts and county clerks have become much more rigid in processing confessions of judgments.

Certainly, not all funders use COJs. Just recently, for instance, Greenbox Capital suspended the use of COJs indefinitely, in response to the heightened industrywide debate over their use. While there’s no all-encompassing directive to stop using COJs, experts say it is incumbent upon funders to ensure they are used in a responsible and proper manner, especially amid political and regulatory uncertainty.

For instance, it would be irresponsible and potentially actionable to execute on a COJ simply because the merchant doesn’t remit receivables the merchant cash advance company purchased because he didn’t generate receivables, says Catherine M. Brennan, a partner at the law firm Hudson Cook LLP in Hanover, Maryland.

To be lawful, the COJ has to be based on a breach of performance under the agreement. Fraud, for instance, is actionable. But simple failure to remit receivables because the business has failed is not, she says.

“Conflating those two things—breaches of repayment versus performance—leads to a world of hurt,” she says. “MCA transactions do not have repayment as a concept.”

In places like New York, where COJs are more controversial, funders have to be especially careful about using them properly, experts say. Even though COJs are still enforceable under New York law for the time being, funders should understand every county processes them a bit differently, says Zakharyayev of Empire Recovery Services. “If they have a preferred county for filing, they should ensure their COJs are not only compliant with state law, but also complies with local rules,” he says.

What’s more, funders should ensure their COJs are properly notarized under New York law, ensure party names and the amount confessed is accurate, and avoid blanket statements such as naming each and every county in New York as a possible venue for filing, he says.

While some funders have suggested changing their venue provisions to a COJ-friendly state if New York outlaws COJs, Zakharyayev says he recommend New York funders keep their venue in New York regardless since it would still be one of the most efficient states to enforce a judgment. “I’ve filed COJs outside of New York and, even without a COJ, New York is much more efficient in judgment enforcement as New York courts are less restrictive in allowing the judgment creditor to pursue the debtor’s assets,” he says.

BE CAREFUL WHEN RAISING THIRD-PARTY MONEY

Aside from their dealings with merchants, funders also have to be cautious when it comes to interactions with potential investors.

Some companies have ample balance sheets and don’t need money from third parties to fund their operations. But funders that decide for business purposes to solicit money from investors, have to be careful not to run afoul of SEC rules, says Nowak, the attorney with Pepper Hamilton.

He recommends funders treat these fundraising efforts as if they are issuing securities and follow the rules accordingly. Otherwise they risk being the subject of an enforcement action where the SEC alleges they are raising money using unregulated securities. “You need to be very careful here because these rules are unforgiving. You can’t ignore them,” Nowak says.

TACKLE ACCOUNTING CHALLENGES

Accounting is another business challenge many funders face. Some have fancy customer relationship management systems, but the systems aren’t always set up to provide the detailed information the accounting department’s needs to effectively reconcile the firm’s books, says Yoel Wagschal, a certified public accountant in Monroe, New York, who represents a number of funders and serves as chief financial officer at Last Chance Funding, a merchant cash advance provider.

Ideally, a funder’s CRM and accounting systems should be integrated so both sales and accounting receive the relevant data without the need for either department to input duplicate data. The two systems need a way to get information from each other, without someone manually entering the data in both systems, which is inefficient and prone to error, Wagschal says.

DON’T SKIMP ON LEGAL SERVICES

There’s no set standard for funders to follow when it comes to legal advice. Some funders have in-house counsel, some contract with external law firms and some don’t have attorneys at all, which, of course, can be a risky proposition.

Some funders use contracts they’ve poached from a reputable funder online or from a friend in the industry, says Kimberly M. Raphaeli, vice president of legal operations at Accord Business Funding in Houston, Texas. The trouble is what flies in one state may not be legal in another, she says.

Many contracts include things such as jury waivers and class-action waivers or COJs and depending on the state, the rules surrounding the enforcement of these types of clauses may be different. So it’s really important to know the nuances of the state you’re doing business in and even potentially the states where your merchants are located, she says.

Having dedicated legal staff is arguably better. But at the very least, funders should have an attorney on speed dial who can provide advice on contracts, compliance and other areas of their business. Even when a funder has in-house attorneys, Raphaeli says it’s a good idea to tap external counsel to review documents in situations where potential liability exists. Not only does this offer a second set of eyes, it can provide added peace of mind. “A funder should never shy away from paying a little bit of money for long-term business security,” Raphaeli says.

FOLLOW BEST PRACTICES

The Small Business Finance Association, an advocacy group for the non-bank alternative financing industry, has developed a list of best practices for industry participants to follow. These encompass principles of transparency, responsibility, fairness and security.

The Small Business Finance Association, an advocacy group for the non-bank alternative financing industry, has developed a list of best practices for industry participants to follow. These encompass principles of transparency, responsibility, fairness and security.

“It’s a very competitive market and companies are trying to differentiate themselves. I think it’s important to make sure you’re following industry standards,” says Steve Denis, executive director of the association whose members include funders and lenders.

Funders also need to be mindful that best practices can change based on business and competitive realities, so it’s important for funders to review procedures periodically, says Raphaeli, of Accord Business Funding. Because the industry is fast-moving, a good rule of thumb might be for a funder to review the entire set of policies and procedures every 18 months. But more frequent review could be necessary if outside factors such as new case law or regulation demand it, she says.

“Periodically taking a look at your collections techniques, your default procedures, even your funding process down to your funding call – these are all critical components of having a successful MCA funder,” she says.

TAKE PAINS TO AVOID INDUCTION INTO THE PUBLIC HALL OF SHAME

While there is no shortage of unseemly news stories involving MCA, funders need to do their best to avoid negative press. This means being extra careful about the way they present themselves to businesses, at public speaking engagements, at conferences, industry trade shows, brokers and others, says Denis of the Small Business Finance Association.

Denis, a long-time Washington, D.C., resident, recommends funders invoke what he calls the “The Washington Post test,” though it applies broadly to any news outlet. Before sending an email, leaving a voicemail or saying anything publicly, funding company employees need to ask themselves: Am I comfortable with that information being on the front page of the paper? “I think our industry has a big problem with public relations right now,” he says. “The stigma is only as true as our industry allows it to be.”

Has PayPal Eclipsed OnDeck in Small Business Loans?

April 26, 2019

It’s been said that Kabbage is on pace to surpass OnDeck in small business loan originations, but PayPal has already done it.

When PayPal announced a working capital program in the Fall of 2013, few were predicting that the initiative would propel them to the top of the small business lending charts. Just two years later, however, the payment processing giant had already loaned more than $1 billion to small businesses.

Today, that number is over $10 billion, according to a comment made by PayPal CEO Dan Schulman on the company’s Q1 earnings call.

That figure would suggest that they had loaned approximately $9 billion from Fall 2015 to the end of Q1 2019. OnDeck, by comparison, loaned $7.5 billion since Fall 2015 through Q4 2018. Several other data sources, including previous statements from PayPal that they had surpassed more than a billion dollars in quarterly small business funding in 2018 (already more than OnDeck), indicate that PayPal has become #1 on the deBanked small business funding leaderboard.

PayPal’s growth was helped in part by its acquisition of Swift Capital in 2017.

Two of the top four are payment processors:

| Company Name | 2018 Originations | 2017 | 2016 | 2015 | 2014 | |

| PayPal | $4,000,000,000* | $750,000,000* | ||||

| OnDeck | $2,484,000,000 | $2,114,663,000 | $2,400,000,000 | $1,900,000,000 | $1,200,000,000 | |

| Kabbage | $2,000,000,000 | $1,500,000,000 | $1,220,000,000 | $900,000,000 | $350,000,000 | |

| Square Capital | $1,600,000,000 | $1,177,000,000 | $798,000,000 | $400,000,000 | $100,000,000 | |

| Funding Circle (USA only) | $500,000,000 | |||||

| BlueVine | $500,000,000* | $200,000,000* | ||||

| National Funding | $427,000,000 | $350,000,000 | $293,000,000 | |||

| Kapitus | $393,000,000 | $375,000,000 | $375,000,000 | $280,000,000 | ||

| BFS Capital | $300,000,000 | $300,000,000 | ||||

| RapidFinance | $260,000,000 | $280,000,000 | $195,000,000 | |||

| Credibly | $180,000,000 | $150,000,000 | $95,000,000 | $55,000,000 | ||

| Shopify | $277,100,000 | $140,000,000 | ||||

| Forward Financing | $125,000,000 | |||||

| IOU Financial | $91,300,000 | $107,600,000 | $146,400,000 | $100,000,000 | ||

| Yalber | $65,000,000 |

*Asterisks signify that the figure is the editor’s estimate

Merchant Cash Advances Surpass Leasing As Goto Financing Option for Small Businesses

April 16, 2019

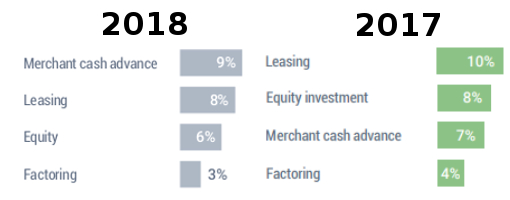

More small business applied for merchant cash advances in 2018 than they did leasing, factoring, or equity investments. That’s according to a recent Federal Reserve study of small businesses with less than 500 employees.

Nine percent of applicants applied for merchant cash advances in 2018 while only 3% applied for factoring. Leasing dropped year-over-year from 10% in 2017 to 8% in 2018.

On average, merchant cash advances were approved 85% of the time compared to business lines of credit (73%), business loans (67%), and SBA loans (52%). Six percent of all small businesses surveyed said they used merchant cash advances on a regular basis, versus 9% for leasing and 3% for factoring.

Unsurprisingly, small businesses overwhelmingly still sought loans or lines of credit. Of those surveyed that applied for any type of financing in 2018, 85% applied for a loan or line of credit and 28% applied for a credit card.

You can download the Federal Reserve’s complete report here.

Learn From Josh Feinberg and Will Murphy in Person at Broker Fair

April 16, 2019You’ve seen them on social media. Now you can see them in person. Josh Feinberg and Will Murphy of Everlasting Capital will be doing a joint presentation on how to scale your broker shop at Broker Fair on May 6th at The Roosevelt Hotel in New York City.

Limited tickets are still available. Register now at Brokerfair.org

The Everlasting Capital co-founders will be presenting at 3:15pm on May 6th in the Promenade Suite. To view the full agenda, CLICK HERE.

-

Brokers

Access to the conference as a broker - Full access to the May 6th conference

- Complimentary access to the post-event cocktails on the rooftop of The Roosevelt Hotel

- Your conference badge will identify you as a broker

-

Funders/Lenders

Access to the conference as a capital provider - Full access to the May 6th conference

- Complimentary access to the post-event cocktails on the rooftop of The Roosevelt

- Your conference badge will identify you as a direct capital provider

-

General Admission

Access to the conference as a third party - Full access to the May 6th conference

- Complimentary access to the post-event cocktails on the rooftop at The Roosevelt

What Am I?

Broker

- You are employed by a non-bank business financing Broker/ISO — OR — You are an independent sales agent

- You are NOT employed by a direct lender or direct funder

- Broker Fair reserves the right to verify your selection.

- Your conference badge will identify you as a broker

Funder/Lender

- You are employed by a direct capital provider whether it’s loans, merchant cash advances, factoring, or other products

- Your conference badge will identify you as a direct capital provider

General Admission

- You are not employed by a broker/ISO or direct capital provider

- Your conference badge will not display a specific business model designation

- You will have the same conference access as a funder/lender does

Give Up Equity In Your Business?! Try Alternative Funding Instead

April 4, 2019One thing you can’t get back is your company.

Michele Romanow, a judge on Dragon’s Den, Canada’s version of Shark Tank, realized from the show that a lot of companies should not be pursuing venture capital at all. She recalled a company that was willing to give an investor 25% of their company in exchange for $100,000.

“Why use the most expensive form of capital, which is equity?”

It led her to co-found Clearbanc, a Toronto-based small business funding provider that does their own spin on merchant cash advances. The amounts range from $10,000 to $10 million and their caution against equity capital-raising is explicit.

“No equity, no fundraising, no dilution, no warrants/no covenants, no board seats, and no bullshit” is a pitch prominently displayed on the company’s homepage.

Romanow speaks from experience. In 2014, GroupOn acquired a company she co-founded and she joined Dragon’s Den shortly after at just 29 years old. She’s a serial entrepreneur with a net worth reported to be over $100 million.

VC money may be harder to obtain, regardless, even if an entrepreneur is willing to make the sacrifice. Funding from VCs tends to be unequally distributed geographically. She cited a May 2018 report by PwC and CBInsights that showed that more than half of all VC dollars invested in small businesses and startups during the first quarter of 2018 went to companies in California. And 80% of VC money in that quarter funded companies either in California, New York, Massachusetts or Texas, a trend bucked by alternatives provided by companies like Clearbanc whose backgrounds are much more diverse.

The message has worked. Clearbanc recently announced that it plans to invest $1 billion in 2,000 e-commerce companies within the next 12 months and the company has raised more than $120 million to-date. It probably helps that Romanow is a TV business celebrity. She is now on her fifth season of Dragon’s Den. And as for those pesky VCs? They tend to be big referral partners for Clearbanc. Go figure.

Undercover in the Underwriting Room

March 22, 2019 Think of the stereotype of a high energy, high testosterone sales floor of men practically shouting on the phone. And then scale it down to a level of about 2 out of 10. That was the environment I stepped into on a recent visit to a room of small business finance underwriters. They let me shadow one for a day so long as I didn’t reveal who they were.

Think of the stereotype of a high energy, high testosterone sales floor of men practically shouting on the phone. And then scale it down to a level of about 2 out of 10. That was the environment I stepped into on a recent visit to a room of small business finance underwriters. They let me shadow one for a day so long as I didn’t reveal who they were.

In the glass room where almost 10 underwriters sat, some spoke on the phone, but the conversations were measured. No shouting. No arguing. Sometimes there was near silence. More than anything, there was an air of focus. After all, when you’re evaluating dozens of documents, just a single oversight can cost the company a lot of money.

“You don’t want to be the guy who loses the company money because you didn’t see a red flag,” said the underwriter.

He asked me to sit beside his desk and watch the funding decisions he was making based on what he saw in the file. He surely didn’t take the merchant’s monthly sales numbers at face value. For instance, in one file, in addition to subtracting a $2,000 transfer from the owner’s personal account into their business account, he also noticed a $4.18 refund from Walmart that was being counted as sales.

“That’s not sales,” he said, and he subtracted $4.18 from the monthly sales number. In one instance, $103,000 in reported sales became $75,000, according to the underwriter.

While you could certainly feel the concentration in the room, it wasn’t quite a library either.

While you could certainly feel the concentration in the room, it wasn’t quite a library either.

“His FICO sucks,” one of the underwriters said to the others. “His FICO went down and he’s stacked. No.”

When an underwriter is uncertain about a decision, he’ll ask for everyone’s two cents. He said they call these impromptu discussions the “underwriters’ den.”

All the deals we looked at got declined, but I’m told that one underwriter can fund as many as five deals in a day, and then go a few days without funding any.

While the underwriting criteria is taken seriously, sometimes you can be a little more aggressive and push the boundaries a bit if it’s a deal you really like. That takes considerable thought and reasoning. But when the answer is going to be no, it can come at light speed. A few of them happened in under three minutes while I was there. And that was with him slowing down to narrate for me what he was thinking.

“I give a look at [most of] the documents in the file first,” he said, “so that if there’s an obvious red flag, I don’t want to spend time on it.”

In his cursory glance, he’ll look at the business owner’s FICO score, years in business, if the company has other financing, and if so, how they’ve been able to handle those payments. He’ll also count the number of negative days (when the company owes money and has none) and note how consistently the company makes sales.

“Consistency gives me comfort,” he said. “I can give them a stronger offer when they show consistent sales.”

Of course, funding a file takes a good bit longer because you have to continue to vet the business and the business owner, almost as if you suspect there’s something wrong. Has the owner ever been convicted of fraud? Have they owned any other businesses? Did the owner ever default on a loan? It can seem hard for small businesses to pass all these background checks. But the funder has to protect itself and the underwriter’s job is to do just that.

“We’re in the business of giving out money, but within limits.”

LinkedIn Posts Are Turning Into Deals & Dollars

March 14, 2019

On average, I sign up one ISO every time I post a message on LinkedIn, says Jennie Villano, VP of Business Development at Kalamata Capital Group. They don’t all end up submitting business, she adds, but overall it works. It costs her nothing more than her time and it produces results.

On average, I sign up one ISO every time I post a message on LinkedIn, says Jennie Villano, VP of Business Development at Kalamata Capital Group. They don’t all end up submitting business, she adds, but overall it works. It costs her nothing more than her time and it produces results.

Villano is among the growing crowd of industry insiders attempting to convert social media posts into measurable business. With more than 600 million users on LinkedIn, there is no question about the potential to reach clients. The prevailing wisdom is that you need to be on social media and sharing, but share what exactly?

New Hampshire-based Everlasting Capital is building a window into the business lives of co-founders Josh Feinberg and Will Murphy. One of their recent social media posts focused on their search for a new office lease, while another was a video stream of Feinberg making a real live cold call. The rewards span the gamut, from merchants seeking funding to offers to speak professionally in front of large audiences. And it’s not just about them. “We have worked with our employees to get confident on camera which is making them a lot more comfortable on the phone,” Feinberg said.

Anthony Collin, CEO of New York-based Smart Business Funding, also attests to LinkedIn. “We definitely generate sales from posting online,” Collin shared, explaining that it was a mix of ISOs and merchants who reach out. Collin said that he and two others in the company meet weekly to generate ideas for the daily posts. They try to make the posts timely, either related to something going on in the industry or to current events, like national elections.

Anthony Collin, CEO of New York-based Smart Business Funding, also attests to LinkedIn. “We definitely generate sales from posting online,” Collin shared, explaining that it was a mix of ISOs and merchants who reach out. Collin said that he and two others in the company meet weekly to generate ideas for the daily posts. They try to make the posts timely, either related to something going on in the industry or to current events, like national elections.

For Jennie Villano, it’s not always a sales pitch. She has posted about being a single mom and about how to keep an upbeat attitude. “Your co-workers, your friends. Are they positive, or are they always complaining?” Villano asks in the video. “Try to surround yourself with positive people who see the best in everything.” She’ll typically extend the offer to do business in the videos that she makes and shares, but not all of them. She shares 2-3 videos a week and her posts typically receive thousands of views.

Sometimes a video needs a little bit of priming to draw the viewer in. Everlasting Capital, for example, filmed an executive making a sales pitch in their conference room to company CEO Josh Feinberg. But it’s something you must watch, or so the title of the post suggests, because they say the executive drove 10 hours to the office for the opportunity.

Sometimes a video needs a little bit of priming to draw the viewer in. Everlasting Capital, for example, filmed an executive making a sales pitch in their conference room to company CEO Josh Feinberg. But it’s something you must watch, or so the title of the post suggests, because they say the executive drove 10 hours to the office for the opportunity.

Though other social networks are being used in full force by many industry players, LinkedIn is definitely a platform to consider. “We’ve gotten tremendous value from posting to LinkedIn,” Smart Business Funding’s Collin said.

The Art of Moving The Deal – When it becomes too high risk for you

February 27, 2019 OakNorth, a small and medium sized business lender and online bank, has mastered a strategy to avoid merchants from defaulting 100% of the time, according to a story published in Quartz. The strategy: tell the merchants at risk of defaulting to refinance their loans at a competitor.

OakNorth, a small and medium sized business lender and online bank, has mastered a strategy to avoid merchants from defaulting 100% of the time, according to a story published in Quartz. The strategy: tell the merchants at risk of defaulting to refinance their loans at a competitor.

“We’ve said [to merchants], ‘Go renegotiate with another bank and refinance,’” OakNorth co-founder Joel Perlman said at the Finovate Europe conference in London on February 14, according to the Quartz story. “And they’ve gone and refinanced and then a few months later they’ve gone into default.”

Perlman’s phrasing may sound a little harsh, but the practice of moving at-risk merchants to another funder is really not uncommon. In fact, it seems like a fairly common and well-understood concept.

CEO of Accord Business Funding Adam Beebe said that brokers will contact Accord when their merchant is up for renewal. And if Accord knows it can’t continue to fund the merchant – either because it has missed payments or because it has become overburdened with other debt – the broker will shop that undesirable merchant elsewhere.

The merchant goes to a new funder and Accord is pleased to be rid of the merchant and not have it default on Accord’s balance sheet. Beebe notes, however, that the new funder is made aware of the merchant’s financial situation and is able to handle the higher risk. Transparency, he says, is important, particularly in a scenario like this.

Similarly, Heather Francis, CEO of Elevate Funding, said that she is more than happy for an ISO to move a stacking and defaulting merchant away from Elevate, as long as Elevate gets paid. Elevate only funds first position and Francis said they make it very clear to merchants that stacking (taking on additional funding from other sources before satisfying an existing contract) is not allowed.

“If a merchant is stacking, that’s not someone we want to work with,” Francis said. “And if the [new] funder understands the high risk, then is fine.”

As long as nothing is being hidden from the new funder, then it seems this practice is just an element of how funding works.

From the broker side, Rob Addison, Managing Member of Sentra Funding, an ISO, said that when a funder knows it will not be renewing one of his merchants, they will ask him to take the merchant away.

Addison said that some funders are so eager to get rid of defaulting merchants that they will offer deals like reducing the merchant’s balance just to get the merchant away from them.

It may not sound nice to jettison a defaulting merchant, but if a funder can avoid a merchant defaulting on its dime, then in many cases, it will.

“We try to move a financially distressed merchant from from, say, an MCA to a longer term loan,” Addison said. “If they haven’t been stacked, they have options. If they have, it’s harder. But if they have something, like commercial property or equipment, there’s usually a [a funder] willing to step in.”