Loans

New York Legislators Introduce Small Business Usury Bill

February 20, 2019Two members of the New York State legislature have introduced a bill to apply consumer usury protections to small businesses. Bill A03638, introduced by New York Assemblymembers Yuh-Line Niou and Crystal Peoples-Stokes define a small business as “one which is resident in this state, independently owned and operated, not dominant in its field and employs one hundred or less persons.”

The bill is separate from the one introduced to outlaw Confessions of Judgment in financial contracts.

Commonbond Receives Financing From Major Banks

February 14, 2019 Commonbond announced today that it has signed $750 million in lending capacity from Goldman Sachs, Citibank, Barclays, BMO, and ING.

Commonbond announced today that it has signed $750 million in lending capacity from Goldman Sachs, Citibank, Barclays, BMO, and ING.

“From the start, we have set out to build the highest levels of trust with our customers and our capital partners,” said CommonBond CEO and co-founder David Klein. “Access to this level of capital, and at a lower cost, is a testament to the platform we’ve built, the quality of our members, and the success of our capital markets program. We’re thrilled to have some of the world’s top banks recognize [this], and work with us in a way that ultimately benefits the consumer.”

This new financing will support growth for Commonbond, which provides student loans and student loan refinancing. According to a company statement today, in addition to growth, the new lending capacity reflects significantly lower cost of capital for CommonBond, improving the company’s borrowing spreads and advance rates.

This financing comes a little less than a month after Reuters reported that Commonbond laid off 18% of its staff, which affected 22 people. Based in New York and founded in 2013, Commonbond has originated over $2.5 billion in loans.

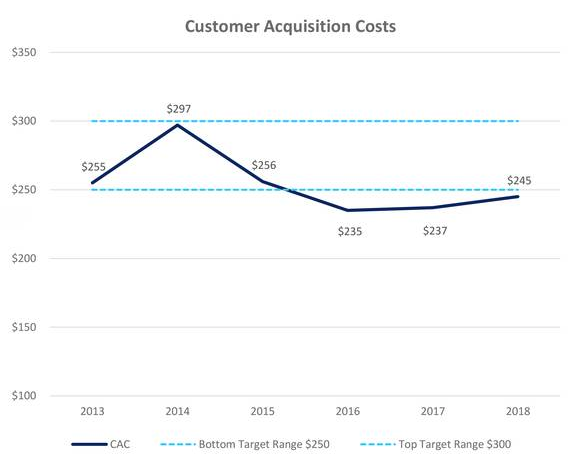

How Much Elevate Spends to Acquire Customers

February 11, 2019How much does a non-prime consumer lender spend to acquire a borrower? According to Elevate’s Q4 earnings report, the company spent less than $150 per borrower to originate $31 million in loans towards their partnership with FinWise Bank. Overall, however, their cost of acquisition has hovered below $245.

Elevate’s direct mail channels made up 42% of acquisitions in 2018. That’s down from 54% in 2017. In the company’s earnings call, Elevate CEO Ken Rees said of the decreasing reliance on direct mail, “we believe this sets us up for strong future growth through these expanded channels.”

Elevate offers three products to non-prime customers: RISE, a state-licensed online lender that offers up to $5,000 in unsecured installment loans and lines of credit, Elastic, a bank-issued line of credit, and Sunny, a short-term loan product for customers in the UK. RISE and Elastic serve the US market.

Separately, Elevate reported $787 million in revenue for 2018, an increase of $113 million, or 17%, compared to 2017’s full-year revenue of $673 million.

Home Improvement Loans on the Rise

February 6, 2019 A story this week in American Banker suggested that popular home improvement TV shows like HGTV’s “Fixer Upper,” “Love It or List It” and “Property Brothers” are creating a growing demand for home renovation, and hence, home renovation loans.

A story this week in American Banker suggested that popular home improvement TV shows like HGTV’s “Fixer Upper,” “Love It or List It” and “Property Brothers” are creating a growing demand for home renovation, and hence, home renovation loans.

Nielsen rating data shows that the combined viewership of the three aforementioned shows on the HGTV (Home and Garden Television) channel rose from 5.4 million viewers in 2014 to 8.6 million viewers in 2018.

deBanked spoke to Michael Funderburk, Director of Personal Loans at LendingTree, which encompasses home improvement loans, and he said that he has seen an increase in home improvement loan volume at LendingTree. But he doesn’t necessarily think there is a correlation to the popularity of the HGTV shows.

Funderburk said people are likely to renovate their home as opposed to buy a new one for a few reasons. One is that new home supply hasn’t quite caught up with demand yet, which is causing home prices to increase. Secondly, mortgage rates are higher than they have been for the last several years.

“Despite the fact that the economy is doing well, people are in better financial positions, have better income, people are thinking ‘What do I do with this [money]? I don’t necessarily [have enough] to move homes, but maybe I can renovate my current home?”

Spending on home remodelling has steadily increased over the last two years from approximately $295 billion at the start of 2017 to nearly $340 billion at the end 2018, according to a study from the Joint Center for Housing Studies of Harvard University.

According to the American Banker story, Doug Duncan, Chief Economist at Fannie Mae, said that there are two reasons why home remodelling spending (and resulting borrowing) is increasing.

“Baby boomers [have] said they intend to age in place,” Duncan said. “As you get older, it requires some accommodations, things like door handles, potential wheelchair ramps, bars in the shower, that type of thing.”

The other reason for increased home improvement, he said, is that Generation X (those born between 1965 and 1979) will also be remodelling their homes.

“Gen Xers maybe have kids in junior high or high school and would like to move up,” Duncan said. “But there simply isn’t inventory, and it’s expensive if they’re in an urban center and in a school district they like.”

Whether it’s because someone saw a beautiful new den built on the “Property Brothers,” or they’re just too settled in to move, the market for the home improvement loans seems to be growing and is likely to continue. And it’s possible that small businesses may seek similar loans to freshen up their stores rather than find a new space.

PayPal Credit Commits $25 Million to Help Unpaid Government Workers

January 21, 2019 PayPal announced Friday that it was devoting $25 million to a program that offers interest-free cash advances of up to $500 to federal workers who have been impacted by the record long partial government shutdown.

PayPal announced Friday that it was devoting $25 million to a program that offers interest-free cash advances of up to $500 to federal workers who have been impacted by the record long partial government shutdown.

“No matter where you stand on the issues, the fact is that 800,000 of our fellow Americans suddenly find themselves without a paycheck,” PayPal CEO Dan Schulman wrote in a blog post. “We think that the private sector and the public sector need to come together to think about creative solutions, to be able to help,” he said in a video.

Josh Criscoe, a PayPal spokesperson told deBanked that borrowers need only make the minimum monthly payment, generally equal to 3% of the outstanding balance. The APR is 0% until the cash advance is repaid.

Crisco said that any government worker who has gone without pay due to the shutdown qualifies for a $250 cash advance, while most of the others who meet certain credit criteria, are eligible for the full $500.

“We’ve seen strong interest since Friday and through the weekend,” said Criscoe.

PayPal is using public records to confirm that applicants seeking the interest-free cash advances are, indeed, unpaid government workers. And they are asking for certain forms of verification as well.

PayPal is not the only lending institution that is trying to help unpaid government workers. In California, nearly a dozen credit unions are providing financial assistance to their members affected by the shutdown.

“The uncertainty as to when the shutdown will end has created stress and hardship for many credit union members who are now struggling to pay their bills and provide for their families,” said Elizabeth Dooley, President and CEO of the Educational Employees Credit Union, in a statement.

“Credit Unions are offering options to federal employees affected by the partial shutdown – such as skipping a loan payment or zero percent loans – to help their members get through this challenging time.”

LendUp Gets a Shake-up

January 11, 2019

Among other company news, LendUp announced yesterday that it has formed a separate company called Mission Lane that will be devoted to scaling its credit card business. LendUp will continue to operate under its name and will focus on personal loans, education and savings opportunities, according to the announcement. Along with the division of LendUp, company co-founder and CEO Sasha Orloff is stepping down and is being replaced by Anu Shultes, the former General Manager of LendUp Loans.

“Both organizations are focused on helping get consumers on a path to better financial health,” Shultes said of LendUp and Mission Lane, “one will do this through offering loans, and the other through credit cards. I appreciate the Board’s confidence in me and am excited to lead this fantastic organization,” said Shultes.

According to the company announcement, Orloff, who co-founded the company with Jake Rosenberg, will remain involved in LendUp as a board member and in Mission Lane as an advisor. LendUp’s office is in Oakland, CA while the Mission Lane team is in San Francisco.

“Anu brings the perfect combination of background, skills and vision to her role as CEO,” said Orloff. “She’s an absolutely fearless leader, and she’s the right person to shepherd LendUp through its next stage.”

Shultes didn’t say if the company headcount has changed as a result of the creation of Mission Lane, but she said that they plan to grow both businesses. Former Chief Operating Officer of LendUp is interim CEO of Mission Lane, while the company looks for a permanent CEO.

Additionally, with the creation of the new company, LendUp announced that they had received an investment for an undisclosed amount that will be used to scale Mission Lane. The investment was led by LL Funds LLC and Invus Opportunities.

LendUp provides unsecured loans of up to $1,000 to subprime borrowers who might otherwise go to payday lenders. Last year, Orloff told deBanked that one’s credit score is based primarily on two factors: on-time repayment and access to credit that you don’t use.

“So we design our loans and our card products to help people make sure they’re paying on time and make sure that they’re only using the credit that they need.”

Orloff also said that LendUp places an emphasis on financial education and offers customers more money at lower rates if they take the company’s education courses.

Selling a Home, Selling Commercial Financing – What’s the Difference?

November 16, 2018 Alternative funding brokers come from all different backgrounds, but for many them, being a broker is not their first job in sales. Some sold equipment, some sold cars and others sold homes. They were realtors. deBanked found two alternative funding brokers with a background in residential real estate and we asked them to compare the similarities and differences between selling a home and selling money.

Alternative funding brokers come from all different backgrounds, but for many them, being a broker is not their first job in sales. Some sold equipment, some sold cars and others sold homes. They were realtors. deBanked found two alternative funding brokers with a background in residential real estate and we asked them to compare the similarities and differences between selling a home and selling money.

Alex Alpert is the owner and CEO of Philadelphia-based Solomon Commercial Lending, which provides clients with a wide variety of funding from SBA loans, equipment leasing, factoring and some MCA. Before starting his company, he had worked as a residential realtor for about five years. When asked about his approach to selling a home versus selling money, he sees them as very different.

“When I consider non-investment home ownership, it is 100% emotional,” Alpert said. “If you think about it, the most expensive and most intimate and emotional purchase that you’re ever going to make is going to be your home. As people, we pour ourselves into our homes. Our homes speak so much about our personalities – what we like, what we don’t. It’s literally like a biography [of someone.]”

Alpert spoke about the intangibles involved in residential real estate, how a lot of it is about the feel of a home, which is highly subjective.

“Instead of you manipulating what they want, it’s just guiding them to reach that ‘ah-ha’ moment,” Alpert said. “I didn’t walk around the house with them and say ‘This is the bedroom and this is the bathroom.’ I would stay back and just say ‘Take a walk around, see how it fits, jump in the bed if you want to, and see how you feel.’ And when they came back down, one of my common first questions would be, ‘Can you picture yourself living here?’ Because that question makes you visualize yourself waking up there. If you can pick up on what the person is showing at that moment, you can guide them better…I think I’m successful because I’m honest, I’m transparent, and I will tell you things you won’t expect. And at the end of the day, that’s how you build referrals and address the needs of an emotional transaction.”

On the other hand, Alpert sees non-primary home deals as more transactional.

“When it comes to business, it’s much less personal,” Alpert said. “People will certainly do their research on who they engage with. Most all of my business comes from referrals. But still, you don’t know me from Adam, and you’re sending me over everything…With [business transactions,] it’s based on need and your ability to serve that need. The emotional part, just from the start, is not that present. It’s a need and solution type of approach.”

Alpert will work with clients with tens of millions of dollars in revenue. But he acknowledged that for some of his smaller “mom and pop shop” clients, transactions can be emotional, like with a small town dance studio client he is helping to secure a 7(a) SBA loan for.

James Celifarco, President of Horizon Financial Group in Brooklyn, which offers mostly small business loans and MCA, currently works as a realtor as well. He doesn’t see much of a difference in the way he approaches residential real estate clients versus small business merchants.

“I think they’re very similar in that if [people] are buying or selling a home, it’s their most coveted possession,” Celifarco said. “It’s what they’ve worked the hardest to obtain. It’s their biggest asset. And it’s the same thing when dealing with a business owner. Business owners are probably more passionate than a homeowner. Either way, if you’re dealing with a business owner or a homeowner, it’s their prized possession.”

While not using the word “emotional,” Celifarco seemed to suggest that non-residential real estate deals are just as emotional.

“[For both homeowners and business owners,] you really have to deal with kid gloves in that they play very close to the vest,” Celifarco said. “You have to have a certain approach where they feel comfortable speaking with you about their home and their finances or their business and their finances. They want to know that their information is protected.”

Celebrity residential real estate agent Ryan Serhant, who spoke at Broker Fair 2018, said that he lives be three rules to successful in real estate: Follow up, Follow through and Follow back. The last refers to following back a client on social media. This part might not always apply, but Celifarco said that the same persistence is required regardless of the sales client.

“It’s all sales,” he said. “You eat what you kill. You close a deal, you make money. You sell a house, you make money. If you don’t, if you’re not reaching out to your clients, you’re not going to make any money. It’s the same in that you get paid for how hard you work.”

SoFi Has Another Loss in Q3

November 12, 2018According to the WSJ, SoFi experienced a $12 million EBITDA loss in the 3rd quarter. That follows a $150 million loss in Q2.

“We optimized for investing over profitability this quarter, and expect this to continue given the opportunity in front of us,” SoFi CEO Anthony Noto wrote in a letter to shareholders obtained by the WSJ.

At Money2020 last month, Noto suggested that the company would eventually need to open physical locations to manage cash transactions.