Loans

Funding Down to a Science

December 21, 2012Account rep: Congratulations, you’ve been approved for $27,000!

Merchant: How did you come up with these figures?

Account rep: It was science. Science did this.

Funny? Maybe not, especially since an underwriting super algorithm may be on its way to the United States. In the days after we posted Made for Each other?, friends, acquaintances, and strangers have been telling us to keep an eye on Wonga’s potential acquisition of On Deck Capital. “It’s not just a european company’s gateway to the US. They’re going to change everything,” a few have said. Aside from their background of being a payday lender, having prestigious VC backing, and the resources to throw a quarter billion dollars at a main street lender in a takeover bid a lot of people didn’t see coming, apparently there is much more to be seen.

Just like MCA in years past, Wonga has worked hard to repel a negative image. Not easy stuff, especially considering they embrace their hefty costs wholeheartedly. Sure, it’s easy to calculate an APR equivalent of a very short term loan and spin whatever number you come up with as the symbol of something evil. If I let a stranger borrow $100 today with the stipulation that they pay me the whole thing back tomorrow plus 1 dollar extra to make it worth my while, would I be evil? That’s an APR of 365%. If I did the same thing with 100 strangers, what are the real odds that all 100 would actually pay me back? Somewhere along the line because of a borrower’s circumstances, bad decisions, or even malicious intent, I’m going to lose the entire $100 I lent out. Others might need more time to pay me back. If one person out of those hundred doesn’t pay back, I break even. If two people don’t pay back, I lose money. If one person doesn’t pay back and another can’t come up with the whole thing, I lose money. You can lend money at 365% APR and lose BIG.

So how do banks manage to charge 4, 7, and 10% APR? Is it just because they’re smarter? No. They don’t make money off loans at these rates either. In the US, interest rates are distorted by government guarantees. Politicians have decided that certain interest rates sound “fair,” then push big banks to lend money at these low unsustainable rates. But of course it doesn’t work and so government agencies sweeten the deal by reimbursing banks for up to 90% of the losses on the borrowers that default. Banks make money on the loan closing fees and other services they sell to the businesses. The loan is the doorbuster offer the bank puts in the storefront window. Once you come inside, they try to sell you on other things so that you don’t walk away with just the loan, otherwise they’re losing money.

So when you hear “banks aren’t lending,” don’t be so surprised. Lending money means giving it away to someone that might not pay it back. That’s a really tough business to be in, no matter how qualified the borrowers are or how good the underwriters are supposed to be.

But somewhere in between the opinions of the Merchant Processing Resource staff and government bureaucrats over what is fair, is a special recipe that determines once and for all what works best. It’s science. Wonga’s lending success is rooted in science and propelled by an advanced algorithm that can systematically calculate risk better than any bank in the world, or so they say.

One of Wonga’s major investors, Mark Wellport, is a knighted renowned immunologist and rheumatologist that has defended Wonga’s methods against regulation. He believes their data-based process and strong motivation to make their borrowers satisfied places them in an entirely different category than payday lenders.

One of Wonga’s major investors, Mark Wellport, is a knighted renowned immunologist and rheumatologist that has defended Wonga’s methods against regulation. He believes their data-based process and strong motivation to make their borrowers satisfied places them in an entirely different category than payday lenders.

Wonga takes a human-free approach, something no MCA provider in North America does regardless of how automated their process may seem. In the UK, their business loan application process takes only 12 minutes and the funds are wired 30 minutes later. That’s it. Their max loan is £10,000 but just think about how that compares to MCA in the US. How much time and overhead is being spent on printing documents, underwriters, conference room meetings to discuss deals, setting up the merchant interview, trying to reach the landlord, trying to get page 7 of a bank statement from 6 months ago and the signature page of the lease, etc. etc. Funders might have had the wrong approach all along.

Wonga’s founder, Errol Damelin believes in data. According to some quotes in The Guardian, Damelin believes interacting with the borrower actually impairs a lender’s judgement.

From the Guardian:

Asking for a loan from a financial institution had traditionally involved making a strong first impression – putting on a suit to see the bank manager – then rigorous questioning, checking your documents and references, before the institution made an evaluation of your trustworthiness. In a way, it was exactly the same as an interview, but instead of a job being at stake it was cash.Damelin found this system old-fashioned and flawed. “The idea of doing peer-to-peer lending is insane,” he says. “We are quite poor at judging other people and ourselves – you get to know that in your life, both with personal relationships and in business. You realise that we’re not as good as we think we are at that stuff, and that goes for almost everybody. I certainly thought I was much better at it.

The 42-year-old entrepreneur grew up in apartheid South Africa, and he believes the experience of living in that country in the 80s has had a significant impact on his outlook. He was active in student politics at the University of Cape Town and marched in civil disobedience protests. So, when it came to deciding who should be lent money, Damelin says he wanted to strip away some of the prejudice – decisions would be taken without a face-to-face meeting; you wouldn’t even speak to an adviser on the phone, because people subconsciously judge accents too. The final call on whether to hand out cash would be based on “the belief that data could be more predictive than emotion”.

According to Wired, Damelin and his team created a system to approve or decline applicants all on its own. They tested it on a site called SameDayCash by using Google Adwords and within ten minutes of their ad going live, their system had already approved its first customer. In its early forms, it wasn’t very profitable from a lending standpoint but it did allow them to collect a massive amount of data.

From Wired

its strategy over this period wasn’t just to disburse money — it was to accumulate facts. For every loan, good or bad, SameDayCash gathered data about the borrowers — and about their behaviour. Who were they? What was their online profile? Did they repay the money on time? The site was feeding an algorithm that would form the basis of Wonga, launched a year after the beta experiment that was SameDayCash.

MCA has utilized Adwords for lead generation for years with mixed success, but few have used it for the purpose of accumulating facts. This isn’t to say that the firms collecting information for the purpose of leads aren’t sitting on treasure troves of data, it’s just that none of it to date has led to 100% computerized underwriting. The MCA industry is quite possibly about to undergo a major shift in how they promote their product on Adwords as a result of Google’s ominous warning a couple weeks ago. New disclosure requirements may change the way consumers respond and apply, ultimately impacting the data collected.

So will european science work in the good ‘ol US of A? If Wonga acquires On Deck Capital, you can bet they’ll try to replicate their success. There is a gigantic market of really small businesses that aren’t getting funded, and even the ones that are, they’re waiting 3-7 days to deal with the paperwork, handle the phone calls, fax documents, complete a landlord verification, and in some cases, deal with a credit card processing equipment change. If On Deck Capital becomes a household name as Wonga is in the UK, a lot of smaller funders are going to get squeezed.

Wonga claims to have a net-promoter score above 90%, a customer satisfaction metric that beats most banks and even Apple Computer. It’s a company that seems to be winning on every front.

Critics will say that the American lending market is big enough for everyone, that the loans Wonga has done traditionally are really small and therefore not in the same league as MCA, or that their own company has something similar or better. We believe however, that if this deal goes through that it’s a bad idea to get comfortable. There are Wonga-like companies in the US already, data fortresses that will soon revolutionize how loans are issued and determine what makes a successful business. New York based Biz2Credit is one such example.

We’ve been right about a lot of things in the last couple years and wrong about some. But we believe it is inevitable that any lender ignoring the automation revolution on the horizon is not going to last very long. Go ahead, brush it aside and convince yourself that this whole Automation thing is just hype as BusinessWeek did in 1995 about the Internet. “Automation? Bah!”

As Damelin told Wired in June, 2011, “For me the epiphany was right there. People were online, looking for a solution to a problem.” Ask any funder using Adwords or pouring work into SEO and they’ll tell you the same thing. People are looking online for money. What happens after they fill out the form on the website is what makes the USA MCA/alternative lending industry different from Wonga.

But will a perfected european algorithm work in the US? Americans approach debt and money differently than the rest of the world and small businesses operate in a much more open manner. You never know, the european lab coat wearing scientists could come here and get their butts handed to them. Plenty of smart companies have jumped headfirst into MCA and left after disastrous results. Some veterans that have been in this business a long time will you tell that an impressive resumé, big investors, and a fancy algorithm will help you make it through the first six months. After that, you better know what the hell you’re doing, if you can continue to do it at all.

But will a perfected european algorithm work in the US? Americans approach debt and money differently than the rest of the world and small businesses operate in a much more open manner. You never know, the european lab coat wearing scientists could come here and get their butts handed to them. Plenty of smart companies have jumped headfirst into MCA and left after disastrous results. Some veterans that have been in this business a long time will you tell that an impressive resumé, big investors, and a fancy algorithm will help you make it through the first six months. After that, you better know what the hell you’re doing, if you can continue to do it at all.

If in three years the average small business owner thinks Wonga is the last name of a guy that owns a chocolate factory, we promise to write a jingle that admits we were wrong about them. But On Deck Capital has been around the block and knows the business. They would allow Wonga to skip the learning curve and together could quite possibly nail lending down to a science.

Oompa Loompa do-ba-dee-doo, I’ve got another algorithm for you.

– Merchant Processing Resource

https://debanked.com

There is great feedback to this article in a LinkedIn Group HERE

Made for Each Other?

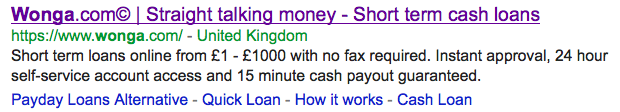

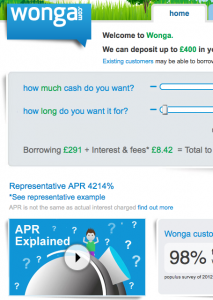

December 12, 2012You want fast cash loan? “We have Short term loans online from £1 – £1000 with no fax required. Instant approval, 24 hour self-service account access and 15 minute cash payout guaranteed.” Not exactly the kind of advertising you’d see in the Merchant Cash Advance Industry. It sounds like a payday lender headline, the kind of marketing that critics would jump on and rally regulators to put an end to. It’s the antithesis of what many alternative loan providers that operate in the MCA space have come to stand for. And it could be coming to a theatre near you.

Meet Wonga, an online payday loan company in the U.K. with a representative APR of 4,214%. According to many news sources, they’re looking for an entry point into North America and they may have found one (Watch out Silicon Valley, the Redcoats are coming!). In a deal that would be valued at around $250 million, Wonga is getting cozy with On Deck Capital (ODC). It was only a few years ago that former ODC CEO Mitch Jacobs was warning the public about the high costs of Merchant Cash Advances. It appears their views may be evolving. Not that we have anything against either company, because we don’t. It’s just that when you think of how respected ODC is in the market today, it’s hard to picture them being gobbled up by a company that offers fast cash loans from 1£ and up for a four figure interest rate.

Meet Wonga, an online payday loan company in the U.K. with a representative APR of 4,214%. According to many news sources, they’re looking for an entry point into North America and they may have found one (Watch out Silicon Valley, the Redcoats are coming!). In a deal that would be valued at around $250 million, Wonga is getting cozy with On Deck Capital (ODC). It was only a few years ago that former ODC CEO Mitch Jacobs was warning the public about the high costs of Merchant Cash Advances. It appears their views may be evolving. Not that we have anything against either company, because we don’t. It’s just that when you think of how respected ODC is in the market today, it’s hard to picture them being gobbled up by a company that offers fast cash loans from 1£ and up for a four figure interest rate.

Or maybe this is exactly what we’ve been predicting all along. One of Wonga’s primary investors is Accel Partners, the guys that got in early on Facebook and did a nice deal with Capital Access Network. They are joined by Greylock Partners, a self-described “Leading Silicon Valley Venture Capital Firm,” that coincidentally also invested in Facebook. So what the heck are these two companies doing in the U.K.? It sure looks like they are fulfilling our Silicon Valley Invasion prophesy:

How the Facebook IPO Affects the Merchant Cash Advance Industry 5/18/2012

The Bubble That Wasn’t 8/17/2012

The End of an Era 9/19/2012

Ten Days 9/28/2012

Bloomberg.com’s article about the advanced stage talks between ODC and Wonga came just TWO DAYS after Steven Mandis walked into the room and bought a material stake of the 2nd largest company in the industry, RapidAdvance.

It seems like just yesterday we were all saying something about financing based off of credit card sales, but now? Now… it’s starting to look like you can get fast cash loan 15 minutes, no fax!

This business gets more interesting every day.

—–

Update: 12/13/12

Wonga does make loans to businesses already in the U.K. The application process takes about 12 minutes and funding happens in 30 minutes. This would be a game changer in the U.S. Refer to this article: http://techcrunch.com/2012/05/07/wonga-extends-its-payday-loans-to-small-businesses-in-uk/

– Merchant Processing Resource

https://debanked.com

Adwords Trouble Ahead for MCA Industry?

December 6, 2012The MCA industry is complicated. Tons of funders purchase future receivables, some do traditional loans, and others operate in a gray area in between. But what will Google make of it? The rules are changing and we predict a lot of funders are going to face a massive challenge in advertising with Google Adwords. See the e-mail that went out:

Dear AdWords Advertiser,

We’re writing to let you know about a change to Google’s advertising policies that might affect your AdWords account.

Beginning in the coming weeks, we will require all short-term loans advertisers to display the following prominently on the landing page:

1. Display the APR. Aggregators/lead generators may provide a representative APR range for their network.

2. Display the implications of non-payment, including the following:

– Financial implications (fees and interest)

– Collection practices

– Potential impact to users’ credit score

– Renewal policy information, including if the renewal is automatic and if there are fees associated with the renewal

– Aggregators/lead generators may provide sample implications from their network to satisfy the above requirements. Implications of non-payment should be grouped together in one location on the landing page.The above must be displayed prominently, meaning the same font type, size, and color as the base text on the landing page. These guidelines apply to lenders, aggregators, and lead generators alike.

In addition, we are updating our policy on consumer advisories. Going forward, payday loan ads (a subset of short-term loans) will only be shown on Display Network sites that are related to payday loans. Ad serving in the Search Network will not change.

When we make this change, Google will suspend all campaigns identified as being in violation of our revised policy. Our system identified your account as potentially affected by this policy change. We ask that you make any necessary changes to your ads and sites to comply, so that your campaigns can continue to run.

We’ve given much consideration to our stance on the advertising of this content and the potential effect our policy decision could have on AdWords advertisers. However, as a business, Google must make decisions regarding the advertising that we accept. As noted in our advertising Terms and Conditions, Google may refuse any ads or terminate ad campaigns at any time, for any reason. You can view our Terms and Conditions at https://adwords.google.com/select/tsandcsfinder.

Sincerely,

The Google AdWords Team

Good luck!

MCA History in Honor of Thanksgiving

November 21, 2012

Before fax, e-mail, and e-signatures, merchants used to travel up to 400 miles to fill out a funding application.

The famous response to a British sea captain by John Paul Jones is actually believed to be a misquote. 'Fund' was changed to 'fight' to better preserve his memory but it is theorized that he predicted the birth of Merchant Cash Advance. He died in 1792, two hundred years before the first small business got funded based on their credit card sales

In 1621, the local merchants were funded on the third Thursday of November, just narrowly beating the wire deadline. This feast was almost not possible.

The first underwriters. Yeah... they were British.

The first collections department.

Back then you needed a lot more than just a payoff letter to change companies...

This merchant successfully opened his 2nd location.

This winery just refi'd again last week. $132,292,222,144,923,383,293,819,183,189,380,678 was withheld and credited to the outstanding balance.

Reason for Advance: Need to stock up on more tea inventory.

We apologize if our history is a little off 😉

– Merchant Processing Resource

https://debanked.com

Betting on the Future With Merchant Cash Advance

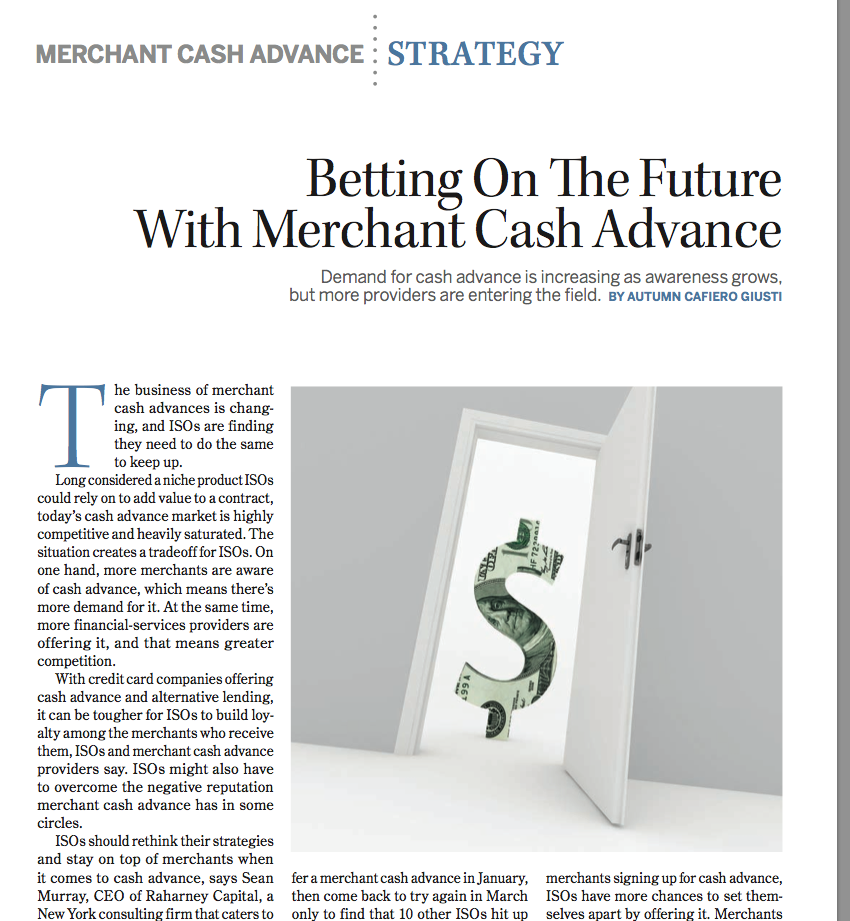

November 14, 2012 An excerpt of the article in ISO&Agent’s November/December 2012 Issue:

An excerpt of the article in ISO&Agent’s November/December 2012 Issue:

“The business of merchant cash advances is changing, and ISOs are finding they need to do the same to keep up.

Long considered a niche product ISOs could rely on to add value to a contract, today’s cash advance market is highly competitive and heavily saturated. The situation creates a tradeoff for ISOs. On one hand, more merchants are aware of cash advance, which means there’s more demand for it. At the same time, more financial services providers are offering it, and that means greater competition.

With credit card companies offering cash advance and alternative lending, it can be tougher for ISOs to build loyalty among the merchants who receive them, ISOs and merchant cash advance providers say. ISOs might also have to overcome the negative reputation merchant cash advance has in some circles.

ISOs should rethink their strategies and stay on top of merchants when it comes to cash advance, says Sean Murray, CEO of Raharney Capital, a New York consulting firm that caters to merchant cash advance companies. “You know the saying, ‘Always be closing?’ Well, you should always be offering merchant cash advance,” he says.

It’s not uncommon for an agent to offer a merchant cash advance in January, then come back to try again in March only to find that 10 other ISOs hit up the merchant in February, Murray says. “You can’t just throw it in there casually every few months. Everyone is marketing cash advance,” he says.

But opportunities arise…”

Read the full article in the November/December magazine available on the site.

It requires you sign up for a FREE subscription

Forward?

November 8, 2012The election is over and now it seems we will be “Moving forward, not back.” The republicans that have already come to accept Romney’s defeat are sounding a lot like Sookie Stackhouse:

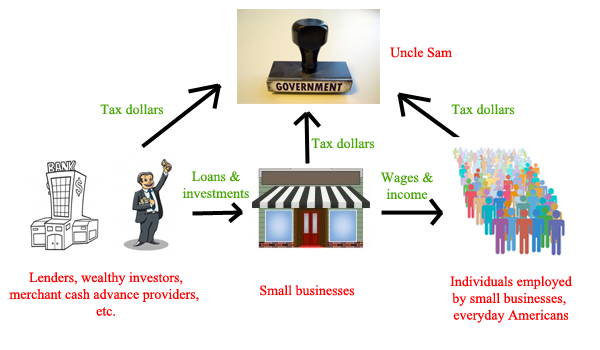

Onwards we go to help the little guy, a process many feel can’t happen until we end trickle-down economics. It’s the trickle part that doesn’t sound good. Money should flow freely gosh darn it, not trickle! We couldn’t agree more. Here’s a broad diagram of the economy at work:

It’s popular to hate Wall Street, but Wall Street provides small businesses with financing to expand, who in turn employ more people in the process. Wall Street is not just banks and Merchant Cash Advance companies. It is any party that has enough money to invest in others while being able to absorb potential losses. A private investor is Wall Street. Wealthy friends or family members are Wall Street.

Tax these parties more and there is less money to invest in small businesses which means fewer businesses will receive capital to expand and hire. Wall Street will make less money as a result of less money being invested and therefore tax revenue will decrease. With fewer businesses hiring, less people will be employed and therefore less people will be paying taxes. Taxing Wall Street more does not necessarily mean more net tax dollars.

This Darn Trickle

One can dislike the economic chain since the flow of money between parties may not happen perfectly or because it allows Wall Street to get richer. There is nothing wrong with the rich getting richer, so long as the middle class and poor get richer too. If small businesses use the money invested by Wall Street wisely, they too will eventually become Wall Street. The amount of new jobs created as a result of a small business’s success means more wage earners will have a shot at becoming small businesses. In economics, a wide divide between rich and poor can be positive, for it creates a ladder that anyone can climb with no cap.

Empower the Little Guy

There is a competing theory and that is to believe that the economic chain starts with middle class wage earners. One could argue to significantly lower taxes on the middle class and the poor and impose much higher taxes on the rich. By doing so, consumers would have more money to spend at small businesses, prompting those small businesses to draw up plans to expand. That expansion capital still needs to come from somewhere and less of it will be there if Wall Street has been further taxed. Perhaps a small business could save money for a few years and use their savings to self-finance their own expansion. Under this theory, everyone becomes part of a very broad middle class. The extremes disappear.

Whoops

When the extremes disappear, there will be few investors with the capability to make large investments or investments that are particularly risky. A small business owner could save up for several years and open a 2nd location without an investment, but could he open 200 nationwide? Not without Wall Street. How many jobs will be created by the opening of 1 store? How many would be created by the opening of 200?

Now calculate how much new tax revenue is generated in each scenario, as well as the number of people that move up from being poor and unemployed to middle class and employed.

When the rich aren’t getting richer, the other classes can’t really move up either. Everyone stays in a broad middle class and innovation and advancements decline. The consumer or small business owner with a potential $100 million innovative idea won’t be able to raise the capital to see it through. How can they when the rich have been prevented from becoming really rich? What if they had a $10 billion idea?

One could argue as a single class society, that a $100 million idea or $10 billion idea could be financed by the government. This is true. It is also textbook state socialism. A one class society is also the premise of Marxism, where everyone is getting their needs met through cooperative work.

Marxism ignores the realities of a global economy. Ultimately, Americans need to obtain resources from other nations, and stay ahead technologically so as not to be conquered by outside forces. A classless society is a stale society, with no economic movement, social movement, or technological advancements.

How will the Merchant Cash Advance Market be Affected?

Merchant Cash Advance companies typically invest in businesses with less than 50 employees. Under Obamacare, any business with less than 50 employees does NOT HAVE to provide health insurance. This program may not affect the business as a whole, but the law mandates that all individuals purchase health insurance for themselves if they don’t have coverage already. Small business owners in the MCA market may be incrementally stressed by having to purchase health insurance. Their employees will be further stressed by having to buy it as well. As a result, wages may need to go up to help workers pay for their own insurance and less money will be available to grow and hire.

The total public debt outstanding has exceeded $16 trillion. That debt has to be paid for somehow and it is more likely than ever that Wall Street is going to have to pay up. This will not stimulate growth and as such, the economy is not likely to pick up any time soon.

Traditional lenders are going to remain quiet while the alternative lenders are going to power through it. A business could save up for three years and open a 2nd location or it could open it today with a Merchant Cash Advance. In three years, the location they want may no longer be available and that individual looking for a job will have run out of unemployment benefits long ago.

A Merchant Cash Advance helps small businesses expand today, hire today, generate more tax revenue for the government today, and helps everyone move up the economic ladder. Baby steps are better than none at all. What starts with a 2nd location may lead to a dream of owning 200 locations nationwide. They’ll need a bigger fish than MCA to get there. Let’s make sure we don’t tax those fish to death.

What do you think Michael?

Forward!

– Merchant Processing Resource

https://debanked.com

Traditional MCA Gets a Speed Makeover

October 24, 2012 “How about you fund me first and then you change my merchant account?”

“How about you fund me first and then you change my merchant account?”

Some account reps will testify that closing a traditional split-funding or lockbox deal can be a bumpy road. The pay-as-you-grow system sounds fantastic over fixed payments until they learn that they have to change their merchant service provider, process sales for two full days, and then wait an extra day for the ACH to arrive in their bank account. The switch could take a few days to several weeks. Have you ever tried to convert MICROS?! A good account rep can keep the customer patient, but that job gets a lot tougher when the fixed daily ACH guys interject right before the contract is signed. We’ll fund you in two days with no processing change required! The customer would have to settle for a fixed daily payment, but that may be secondary to their stress about switching processing before receiving funds. Many things could cross their mind:

- What happens if the download fails?

- What if they say I need a new credit card machine?

- What if my current processor locked my machine with a password? How long will this delay everything?

- What if I don’t process sales every day? Will I need to wait until I have two full days of activity?

- What if there are additional underwriting steps after I switch?

- Are they going to withhold a percentage from my processing before I even get the money?

- How long is this really going to take? I would prefer if I just had the money now and then I’d feel a lot more comfortable doing the rest.

- I kind of need the money by tomorrow, I really can’t risk this taking longer than they expect.

So when RapidAdvance announced their new Rapid Funding Program, we thought, “is this really what we think it is?” We had Sean Murray reach out to Mark Cerminaro, the SVP of RapidAdvance and we learned the program is real. They can and will fund merchants prior to changing the merchant account or setting up the lockbox. In the interim, they set up a temporary daily ACH repayment to protect themselves should the conversion experience any hiccups. Murray asked if this was perhaps a response to the fixed ACH payment phenomenon that has exploded in the last year. Cerminaro responded (We paraphrased some of his words in this story), “Variable payments offer benefits. Many merchants would prefer to set up their financing this way. Some of our biggest resellers still focus heavily on split-funding as opposed to the alternatives. We believe this program will help both them and the merchant.”

With the slew of new players in the merchant financing market, is speed just window dressing for an old product? An article in Upstart Business Journal called MCAs old! The fixed payment merchant loan seems to be all the rage these days, leaving some to wonder if traditional MCA is on the decline. Cerminaro says that assertion is false. “We’ve experienced substantial growth this year on our traditional MCA product, on all of our products actually. When big companies like American Express and Amazon came in offering their own Merchant Cash Advance or loan program, it made merchants more comfortable that our product and similar ones to it are mainstream. The New York Times even ran an article that listed Merchant Cash Advance as an acceptable form of financing for small businesses. This is all making Merchant Cash Advance more attractive than it ever was before.”

On 7/28/11, we penned an article that said the Merchant Cash Advance industry was waiting for its big moment. At that time, we believed the merchants weren’t using Merchant Cash Advance financing simply because they just hadn’t heard of it. It was the hottest thing that no one was talking about. Of course the era of anonymity is gone and businesses are rushing to get funding hand over fist. The only question now is whether or not this will continue to drive rates down. Cerminaro alluded that some funders are undercutting so much that they’re forgetting to price in the risk. Other industry insiders feel the same way and the debate over it has become the most active thread on the recently founded, DailyFunder.com forum.

Contact Mark Cerminaro for any questions or clarifications regarding RapidAdvance’s Rapid Funding Program at mcerminaro[at]rapidadvance[dot]com.

– Merchant Processing Resource

https://debanked.com

Is Google Getting Greedy?

October 21, 2012By now, you’ve probably heard of Google’s earnings release blunder when their financial printer published an unfinished report. That version went viral and was clearly not ready for print since it included a placeholder note that said “Pending Larry Quote,” a space that was reserved for a quotable by CEO Larry Page.

Ad revenue was up 16% for the quarter, a 33% surge over last year’s numbers. But is Google getting greedy? We like to search for MCA industry news and in the last couple weeks, we noticed an interesting “glitch” that started to happen. Approximately 1 out of every 15 times (we didn’t run a statistical analysis), zero results show on the page. It doesn’t actually say “no results found,” but rather looks as if the results failed to load. That is of course except for the ads. The ads conveniently become the only clickable options.

This happens often enough that it has become annoying. We’ve experienced it with multiple browsers and three computers. Has anyone else fallen victim to this glitch?

Perhaps it’s psychological, but it seems like this occurs most frequently on business lending related searches, when the revenue-per-click Google earns just happens to be at its highest. Is Google getting greedy?