Loans

Getting in on the ONDK and LC IPO

December 4, 2014According to Investopedia, “Getting a piece of a hot IPO is very difficult, if not impossible.”

The Motley fool says:

If the bankers think a stock will soar, they earmark much of the shares for their favorite institutional clients (ones that bring in the most in commissions). In a sense, brokerages use lucrative IPOs to curry favor with big clients, to win and retain their business. When brokers aren’t so confident about the company’s prospects, they will try to sell the stock to less-favored institutional clients.

Admittedly these are generalities, not unyielding truths.

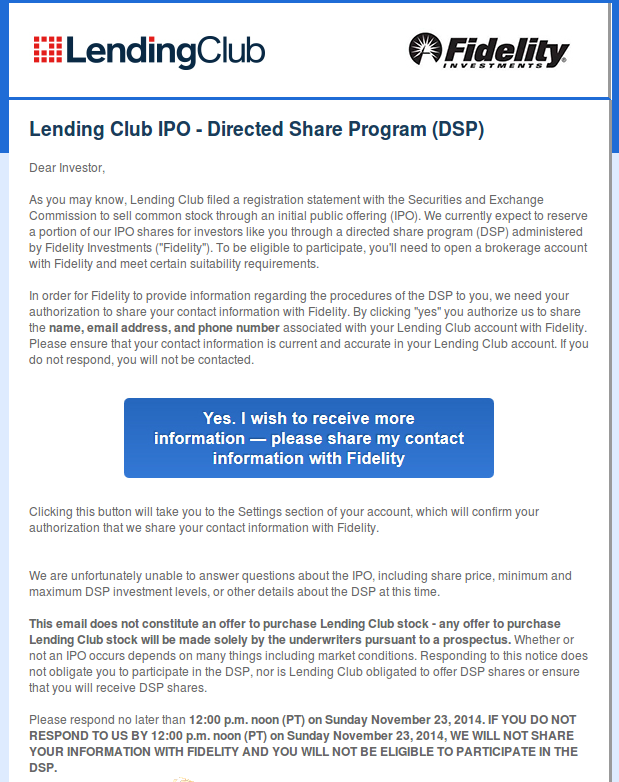

But when Lending Club mass e-mailed all their platform lenders on November 17th that they would be rewarded with a chance to get in on the IPO, people got excited. They wouldn’t just automatically get stock though, they’d be given the chance to buy it. An allocation was not guaranteed and a limit as to how much was not immediately disclosed, though it was recently revealed that platform lenders could buy up to a maximum of 350 shares.

At $10-$12 a share, that’s an opportunity to spend a max of $3,500 to $4,200 on the IPO. Getting in won’t make you a millionaire but it’s a little way for Lending Club to say thank you to all those who invest on their platform.

I got the offer and turned it down. I’m very bullish on Lending Club stock but I feel like I’m already invested enough in them as a company through platform lending to need to get even more in. For those not sure how Lending Club really works, their system is not actually peer-to-peer. Investors buy Lending Club notes that are tied to the loans they issue. You are ultimately only investing in Lending Club with every note you buy. You have no relationship or claim to the borrower.

With that being the case, my tens of thousands invested in them is enough, especially from a retail investment standpoint. But I enjoyed the proposal nonetheless because it felt like a gift for getting in on the ground floor of something huge.

I also liked telling people over the last two weeks that I could get in on the Lending Club IPO.

“You hear about Lending Club going public?” I’d ask a friend. And then brag, “Yeah, well I have a chance to get in on the IPO if I want. I could talk to my guy to try to get you in but I don’t know if I can swing it. Maybe though.”

I was pretty damn important.

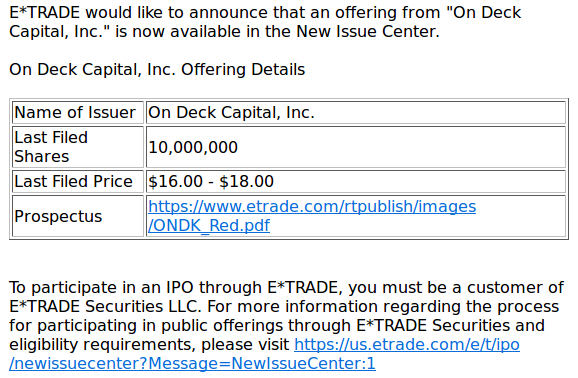

Until someone told me they could get in on the OnDeck IPO today. He apparently had an inside guy and that inside guy was E*Trade, as in he could apparently get in on OnDeck’s IPO just for having an E*Trade account.

One had to wonder why any schmo with a brokerage account was being asked to buy in. It didn’t sound good for OnDeck but I let my friend have his moment. His guy could try to get me in, etc.

The mass blanket invitation to get in might appear that brokers aren’t so confident about the company’s prospects. But actually back in January of this year E*Trade forged a “retail alliance” with middle-market investment bank Jefferies LLC. A Reuter’s story said that, “E*Trade is betting that it can score points with investors by guaranteeing access to IPOs that brokerage firms normally reserve for their best customers.”

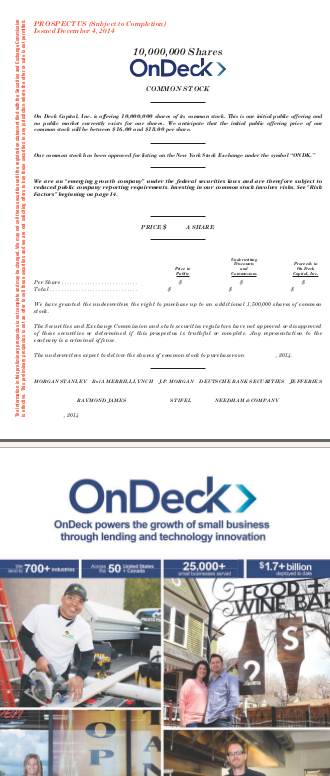

OnDeck’s underwriters include Morgan Stanley, Bank of America Merrill Lynch, JPMorgan Chase, Deutsche Bank and Jefferies. This is in line with “giving its customers access to initial public offerings and follow-on offerings underwritten by middle-market investment bank Jefferies LLC” though I haven’t confirmed the alliance is the cause of this.

OnDeck’s underwriters include Morgan Stanley, Bank of America Merrill Lynch, JPMorgan Chase, Deutsche Bank and Jefferies. This is in line with “giving its customers access to initial public offerings and follow-on offerings underwritten by middle-market investment bank Jefferies LLC” though I haven’t confirmed the alliance is the cause of this.

Just as with Lending Club’s allocation offer, no one is guaranteed anything with OnDeck through E*Trade. There’s a required approval process which may ultimately yield nothing.

And yet it still feels a little weird, maybe because I’ve been hearing about an OnDeck IPO for years now and I just can’t grasp it’s actually happening. It’s one thing for a big banker to talk about it and another for an old college buddy, my doorman, and Jim who’s the cashier at the local hardware store ask me if I know anything about this OnDeck loan stock advance thing they heard about.

All I know is that sentiment on them is mixed but that ultimately insiders believe it’s great for the industry.

As for both of these the IPOs? I don’t know. I’m not getting in on either of them but it has nothing to do with how I feel about the companies. I can’t wait to watch this all unfold though.

Check out the 224 page OnDeck Prospectus!

Income Correlates With Loan Performance

November 24, 2014 Now that I’ve bought into nearly 1,800 personal loans on Lending Club, I think I’ve got a good enough sample to start running analyses.

Now that I’ve bought into nearly 1,800 personal loans on Lending Club, I think I’ve got a good enough sample to start running analyses.

The data isn’t perfect especially since none of the loans have reached maturity yet. Most are still between two and four and a half years away from completion. But strangely, 70 loans paid off early and a good number have already defaulted or are more than 16 or 30 days late and are on their way there.

With at least that to work with, I compared three groups:

- Early payoffs

- 16+ days late or defaulted

- All others

I examined 4 initial factors and I will surely examine many more. While I saw some weak correlation regarding FICO score, it’s borrower income that really stood out.

Ignoring all other factors, the accounts that paid off early reported earning 29% more annual income than the accounts that are bad.

I had heard Peter Renton preach the high income borrower strategy and truthfully I ignored income as a factor in my decision making up until this point. On equities.com, Renton said, “I typically like more than $50,000 in annual income, although $75,000 is even better, and $100,000 is better still.”

Looking at my own sample, there is indeed correlation between the $75,000+ income earners with paying off Lending Club loans early.

Unlike some business loan products, Lending Club personal loans accrue interest rather than bake interest into a fixed total cost. That means a borrower that paid back a 5 year loan in just 3 months only paid 3 months worth of interest.

It was surprising to see that 70 borrowers repaid the loans in their entirety within a matter of months.

Regarding FICO, the score spread between bad loans and early payoffs was only 8 points, a lot smaller than I’d expect. But the portfolio is young and some loans have only just issued in the last few months. With another 2+ years left to go, the sample size of defaults will get bigger and I will be running the numbers on this again.

In in meantime, low income borrowers regardless of all other factors appear to be more risky investments. I guess you could say I’m not surprised, but it’s exciting to see data that supports a hypothesis.

Ready to Trade ONDK and LC?

November 16, 2014 On November 10th, OnDeck Capital finally made their S-1 public. Immediate reactions from inside the industry were mixed. The bears criticized the years of losses while the bulls pointed out that the tide is turning. With a profitable 3rd quarter, OnDeck’s bet on the long game might finally be proving itself.

On November 10th, OnDeck Capital finally made their S-1 public. Immediate reactions from inside the industry were mixed. The bears criticized the years of losses while the bulls pointed out that the tide is turning. With a profitable 3rd quarter, OnDeck’s bet on the long game might finally be proving itself.

And without delving into their S-1 for now, the industry should be bracing itself for change. The mysterious world of daily funders (financial companies that deal in daily payments) is about to come under the scrutiny from another body, stock analysts.

Unlike journalists which have bruised the industry with sensational headlines and surface level criticism (high costs, light regulation), analysts will be tasked with truly understanding the fundamentals of nonbank business lending. Not to mention that everyday retail investors looking for an edge will want to learn more about the industry than what a single company’s quarterly financials will tell them.

Daytraders might make decisions based on melodramatic stories but those buying and holding for the long run will be conducting something that’s rarely taken place in this industry, research. Expect these questions to be asked and deeply considered:

- Who are OnDeck’s competitors? (and not just the top 3, but the hundreds that follow them)

- What are ISOs/brokers and how do they operate?

- How do they generate deal flow?

- What is Merchant Cash Advance and how is it similar or different to OnDeck?

- What is the real regulatory environment? (Because there are actually applicable regulations despite articles that say there aren’t any)

- Why does OnDeck collect payments daily?

- Why is OnDeck’s model so much different than Lending Club’s?

Look for the last bullet point to be explored greatly. If OnDeck and Lending Club are both innovative small business lenders broadly targeting the same market, why is OnDeck charging an average of 50% APR paid daily over 6 months and Lending Club charging as low as 5.9% APR paid monthly up to 5 years?

Their products couldn’t possibly be more different. And while Lending Club’s IPO path has curiously stalled, there is nothing to indicate that it will not proceed. That means we should expect comparisons between the two upcoming tickers LC and ONDK, a lot of them.

Details about commissions, closing fees, marketing practices, and transparency will be talked about in open forums by the general public. If it’s controversial, it will be debated. If it’s unique, it will be scrutinized. To an extent, OnDeck, Lending Club, and many of their competitors will cede control of their destiny to the general investing public.

There are folks in the industry giddy over the chance to buy and sell stock in both companies. They have years of experience on the front lines. But just as they’re gearing up to trade ONDK and LC, so too is everyone else.

Get ready for major change…

Kabbage TV Commercial

November 1, 2014Another company has joined the TV commercial party and this one’s a little different. Atlanta-based Kabbage has chosen Puddles the Clown as their spokesman. What do you think?

Below are some of their competitor’s commercials:

Keeping Lending Club (and others) Honest

October 19, 2014 Now that institutional money is flowing into the alternative lending industry, some retail investors are starting to express concern that the rules are changing. Lending Club for example is no longer considered a peer-to-peer lending platform, but rather an online credit marketplace.

Now that institutional money is flowing into the alternative lending industry, some retail investors are starting to express concern that the rules are changing. Lending Club for example is no longer considered a peer-to-peer lending platform, but rather an online credit marketplace.

Investors don’t exactly make loans to individuals in that marketplace, but that’s sort of how the concept began. Today, a bank issues the loan to the borrower, Lending Club buys the loan and creates a note tied to the performance of the loan, and then sells that note to investors.

Lending Club holds all the power and that worries retail investors who believe that the company is not always forthcoming about what they’re doing. It’s not easy to find dissenting voices when the market is growing rapidly especially since the media is cheering the revolution on.

But in the back corners of the Internet there are groups of investors growing suspicious, if not downright paranoid that all is not right in Lending Club land.

On Peter Renton’s Lend Academy forum for example, healthy discussions are being replaced by collaborative investigations into Lending Club’s practices. As a retail investor myself, I can’t help but be drawn to it. Below is a list of some of the issues:

The Borrower Member ID number is never reused

If a consumer borrows money from Lending Club in 2013 and again in 2014, it would probably be useful for investors to know about the previous Lending Club loan. Instead, borrowers are issued additional Member IDs with each successive loan, masking the history of past loans.

Borrowers may be taking two loans simultaneously

Acknowledging that Member IDs can never be reused, curious retail investors used other data points disclosed by Lending Club to link borrowers together. They believe they discovered a number of borrowers who got two Lending Club loans back-to-back, sometimes within days of each other.

The concern here is that the borrowers were taking on much more debt than the investor was led to believe. For instance, an investor might feel comfortable with the borrower taking a $10,000 loan, but has no idea that another $20,000 is being issued to them days later under another Member ID number.

Whether or not this is actually happening and the scale of how often it is happening is tough to say, but a little detective work by others indicates that it has possibly occurred.

What happens if Lending Club goes bankrupt?

While a poll with so few responses (52 total) on the Lend Academy forum may not be statistically relevant, 75% of the respondents claimed to be concerned in some capacity that Lending Club has no Bankruptcy Remote Vehicle for retail investors. 21% said they were extremely concerned. Absent a BRV, a Lending Club bankruptcy endangers all retail investors from getting paid regardless of whether or not the borrowers are actually paying their loans.

Anil Gupta, the founder of PeerCube wrote the following on the Lend Academy forum in response to the BRV issue:

You are not alone. I am also in the extremely concerned category when it comes to BRV for LC. This segment has been wild-wild west and reminds me of combination of dot-com bubble in 1999 and housing bubble of 2007. Overall, I am very concerned with platform risks.

Premature IPO attempts by p2p platforms is also concerning. I am taking that as indication of founders, VCs and early employees want to cash out and exit while the market is hot. They may be seeing the growth reaching a plateau and increased competition. I believe we will see a lot of shake out when interest rate start to rise. Potentially stepped up government regulations of p2p platforms once investors lose money.

Startup woes?

Retail investors, particularly those that have deployed a substantial amount of their capital in Lending Club notes gripe that sometimes the financial reports they get are missing data, experience glitches, or are just totally wrong. While usually resolved to everyone’s satisfaction, as a seven year old company, one might expect for Lending Club to be much more careful at this stage in the game. With an IPO in the works at this very moment, they should be way past problems such as data in the downloadable files not matching the website.

New fees

In August, Lending Club announced they would begin charging investors 18% of the delinquent amount recovered if the loan is at least 16 days late and no litigation is involved. When investors pushed back, it turned out that was always their written policy, they were just waiving it for everyone’s benefit until now.

While the move means a few more dollars out of every investors pocket, it was noticed that loans that have been restructured at the borrowers request are not marked as current for the duration of the payment plan even if they are in fact current on the payment plan itself. So when loans get restructured, Lending Club begins taking 18% of every payment as if it were a continuing collections problem.

From a firsthand perspective, I had several loans entering into payment plans almost immediately following the issuance of the loans. Basically the loan would be issued, the borrower would make their first payment, they’d plead hardship, go on a payment plan, and then Lending Club would begin deducting 18% of every payment going forward.

In these situations, our interests are not aligned. By entering a payment plan, not only is the amount the borrower is paying monthly reduced, but 18% of each of my payments now belongs to Lending Club instead of me. Basically, the appearance that Lending Club has a personal incentive to place borrowers on a modified plan at my expense and without my consent is a conflict worth monitoring.

Automated Investing under delivers?

For those with too much money or too little time to choose notes to buy themselves, Lending Club offers Automated Investing, a program that will automatically buy notes within parameters you set when they become available. The draw back is that the filters are limited and some investors are complaining that they’re ending up with notes they never would’ve bought manually.

WebBank woes

On October 6th, Lending Club announced that investors would have to sacrifice several days worth of accrued interest to WebBank, the bank that issues the loans for Lending Club.

Citing the move as necessary to keep Lending Club robust in a changing environment, the run up to the IPO has had some investors feel like they are suddenly being nickel and dimed.

Refinanced

Not that this is necessarily bad, but there’s evidence that shows Lending Club is encouraging its own borrowers to refinance their loans to a lower rate. If they do it, it results in the original note being paid off. The payoff returns the cash to the investor who then may have to wait two weeks or more to put that money back into a new note.

It must be said that any time I’ve published a gripe about something Lending Club is doing, my account representative there has called me to try and resolve it. That’s surprisingly good service!

But while I feel safe enough about my investments now to keep them there, there’s nothing wrong with reminding Lending Club and all of the other disruptive financial companies out there that investors are watching their every move.

As long as they have your money, it’s healthy to keep them honest.

Why Your Deal Got Stolen

September 16, 2014 Back in April, I presented the idea of trigger leads coming to the alternative lending industry. In subsequent discussions about that blog post, many folks particularly in merchant cash advance questioned whether such a concept could possibly exist or would even be legal.

Back in April, I presented the idea of trigger leads coming to the alternative lending industry. In subsequent discussions about that blog post, many folks particularly in merchant cash advance questioned whether such a concept could possibly exist or would even be legal.

For those not familiar, this is the methodology behind trigger leads using a hypothetical scenario:

- OnDeck runs the personal credit of a merchant using Experian.

- Experian sells the contact information of that merchant to OnDeck’s competitors immediately after credit is pulled.

- Competitors solicit that merchant and convince them to go with them instead.

Again, the reaction I get to the above scenario by most people is, “yeah, right. I don’t believe that could happen.” But if you look at the raw amount of ISOs complaining their deals got stolen, it’s evident that perhaps there is something else brewing than just the usual assortment of rogue underwriters and shady funders.

Most ISOs are convinced that if their client is working with them and only them, that a shady business dealing has taken place if that client is randomly called out of the blue with the knowledge that they’re pursuing funding. To them, the only conclusion is that their deal got backdoored.

And while backdooring does seem to happen out there from time to time, another culprit may very well be trigger leads. Credit bureaus and big data aggregators are selling credit pull data in real time. UCC-1 leads are leads after the funding has taken place. Trigger leads are leads before the funding has taken place. But do they really exist?

And while backdooring does seem to happen out there from time to time, another culprit may very well be trigger leads. Credit bureaus and big data aggregators are selling credit pull data in real time. UCC-1 leads are leads after the funding has taken place. Trigger leads are leads before the funding has taken place. But do they really exist?

Elsewhere in alternative lending, trigger leads are the backbone for how companies tailor their direct mail campaigns. If a consumer’s credit was pulled today by a mortgage lender, companies like Lending Club and Prosper will make sure that consumer receives a mail ad for a home improvement loan tomorrow.

Today at the Apex Lending Exchange conference in New York City, Ron Suber, the president of Prosper, referred to this trigger methodology as “getting to the right borrowers at the right cost.” In their sector, trigger leads are marketing 101. In merchant cash advance, it’s perceived as a pipe dream. Odds are that whoever is taking advantage of trigger leads in this industry would want to keep all the other players in the dark about it.

As much as you might hate to believe it, all of the backdooring paranoia that’s been rampant lately might actually be caused by the credit bureaus, not the funders. The lesson here is that as soon as your merchant’s credit is pulled, the clock is ticking until your competitors find out even if that merchant talks to nobody else.

I know ISOs want to believe that their merchant is only theirs, but in the age of advanced technology and big data, your merchant belongs to the cloud. As soon as your relationship with the merchant interacts with technology, somebody else will find out about it. And that’s why your deal got stolen.

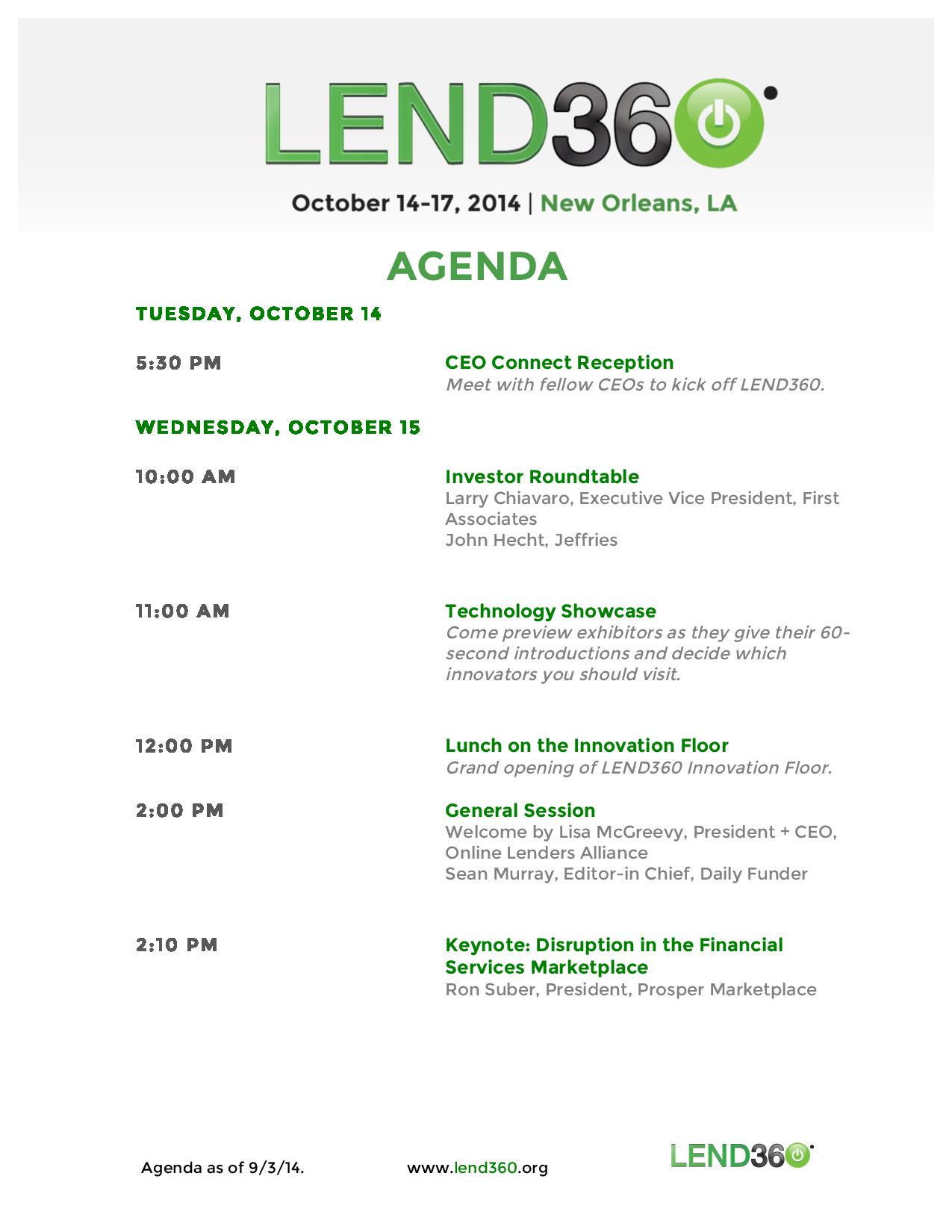

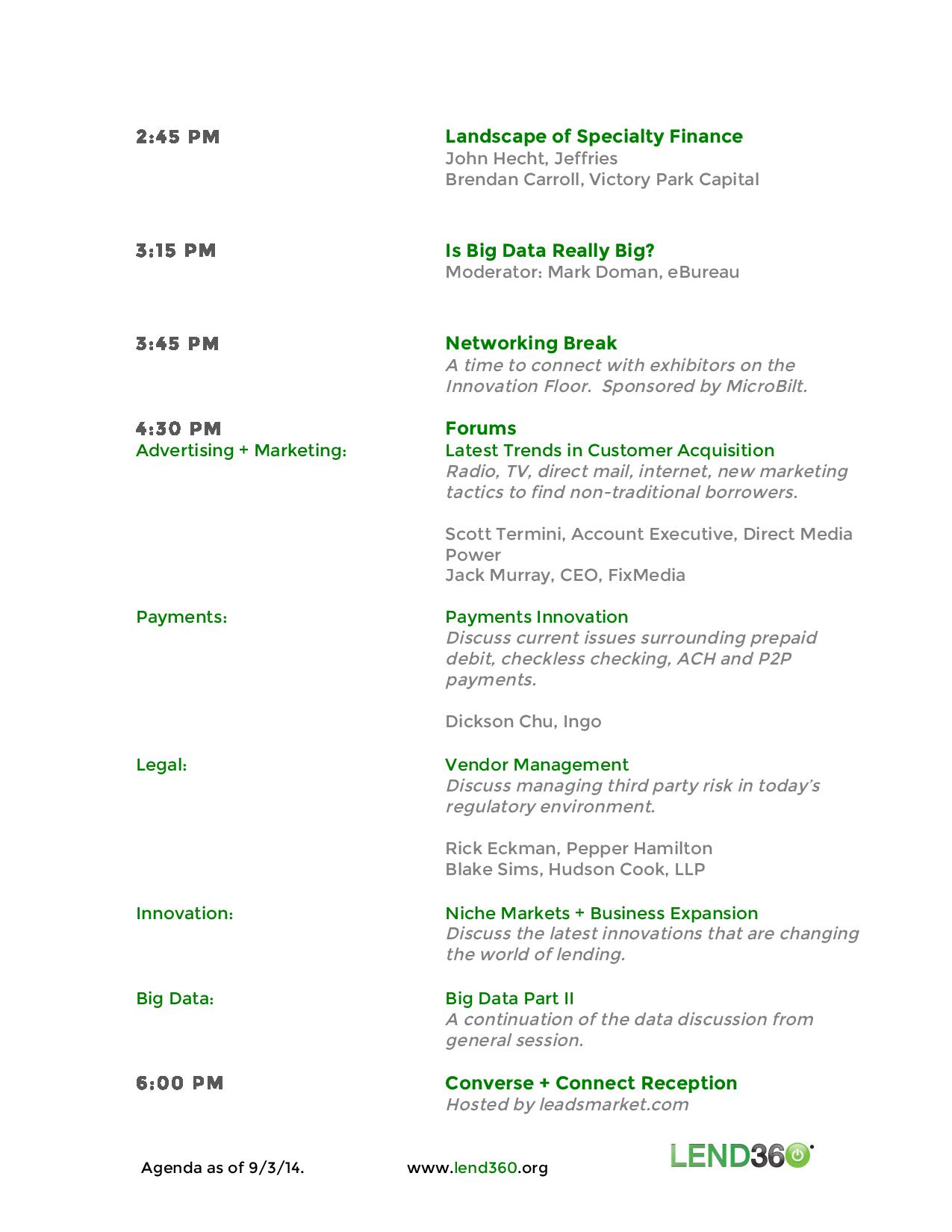

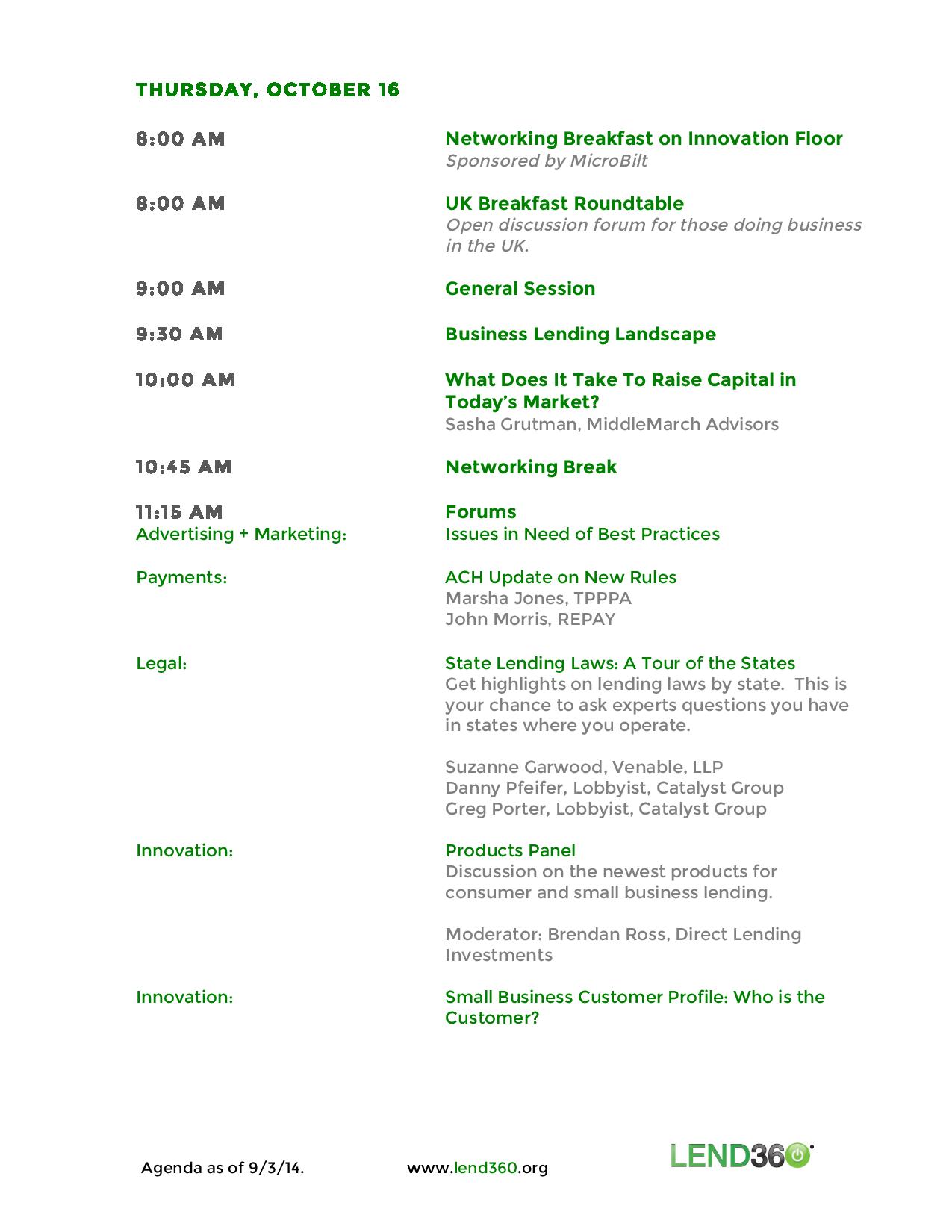

Lend360: The Industry Event of the Year

September 5, 2014It’s being called the full circle of lending. Non-bank business lenders, merchant cash advance companies, peer-to-peer lenders, consumer lenders, lead generators, and Wall Street tycoons are descending on New Orleans from October 14th to 17th to attend Lend360. I’ve partnered up with the event through the DailyFunder name.

From the governmental arena, Governor Bobby Jindal (left) and U.S. Senator David Vitter (right) are speaking at the conference.

On the business side, here are some speakers you might recognize that are definitely confirmed.

- Brendan Carroll, Victory Park Capital

- Brendan Ross, Direct Lending Investments

- Scott Termini, Direct Media Power

- Bob Coleman, Coleman Report

- Heather Francis, Merchant Cash Group

- Nick Owens, Magnolia Strategic Partners

- Sean Murray, DailyFunder (myself)

- Ken Rees, Elevate

- Mark Curry, Sol Partners

- Sasha Grutman, MiddleMarch advisors

- Al Wild, Crest Financial

- Mark Doman, eBureau

- Tim Madsen, PartnerWeekly

- Dickson Chu, Ingo

- John Hecht, Jeffries

If you’re involved in MCA or business lending, you NEED to be there.

Here’s the most recent version of the agenda:

October 14-17, 2014 New Orleans, LA

In Partnership with

| REGISTER TODAY |

On Deck Capital IPO, An Insider’s Perspective

August 16, 2014It was August 23, 2011, the day the Virginia Earthquake could be felt all the way up in New York City. The four of us were enjoying outdoor seating at a restaurant on the Upper East Side. The ground shook, my drink spilled and Ace looked at each one of us and said, “Okay so I’m putting you down for five deals this month.” OnDeck Capital’s relationship managers were aggressive. If you were a small Independent Sales Organization (ISO), they didn’t expect to get all of your dealflow so they roped you in little by little. It was hard to say no. If five deals was too much, Ace would say three and if three was too much, then he’d put you down for three anyway. Zero was not in the cards. OnDeck owned a specific niche and if you didn’t send your premium credit clients to them, then any ISOs you were competing against would. That was a death knell in those days. Just a few years earlier I would’ve shrugged them off, but public sentiment was changing. Merchants were embracing the fixed daily payment methodology and the merchant cash advance industry would never be the same.

OnDeck Capital is now going public. Will you buy stock?

I’m in a unique position to discuss OnDeck. I started my career in this industry before they even existed. I’ve competed against them as an underwriter at a rival firm, worked with them as a referral partner when I was in sales, and covered them in my capacity as Chief Editor of an industry trade publication.

I’m in a unique position to discuss OnDeck. I started my career in this industry before they even existed. I’ve competed against them as an underwriter at a rival firm, worked with them as a referral partner when I was in sales, and covered them in my capacity as Chief Editor of an industry trade publication.

I left my post as Merchant Cash & Capital’s Director of Underwriting in late 2008. I was 25, about a year or two older than the average employee in the industry. Several of MCC’s rivals got demolished in the financial crisis but OnDeck wasn’t one of them. They also weren’t much of a competitor either. Struggling to define themselves as the anti-merchant cash advance, their product ran counter to the spirit of the industry’s rise. The single biggest allure of a merchant cash advance wasn’t that it was easy to obtain but that there was no fixed repayment term. The funds came with a pre-determined net cost but no specific date on when the delivery of future sales would be due.

Outsiders like the news media aren’t exactly sure what separates merchant cash advance from OnDeck except for maybe the cost of funds. Cash advance just sounds expensive, doesn’t it?

Outsiders identify the company by three characteristics.

1. They’re a non-bank business lender

2. They’re more expensive than a bank

3. They’re a tech company

These bullet points gloss over the fact that OnDeck’s loans require payments to be made every day. Can you imagine a credit card company forcing you to send a payment every day of the month? Or your landlord asking for rent on the 1st of the month, the 2nd, the 3rd, 4th, 5th, and so on every day until your lease is up?

This is not to say that this system is necessarily bad for borrowers, but that it is quite possibly the most unique and important part of what makes OnDeck different. It’s their secret sauce. It is why OnDeck gets lumped in with merchant cash advance companies in many conversations. OnDeck and the legion of copycats they have spawned are part of a broader industry that includes merchant cash advance companies. I call them daily funders. Daily funders provide financing on the condition that payments are made daily. I don’t call them daily lenders because traditional merchant cash advance products are not made by lenders, but by a unique group of investors that purchase future revenue streams.

Transition

Under company founder Mitch Jacobs, OnDeck had established themselves as the de facto loan option.

The merchant’s not biting on merchant cash advance? Send it to OnDeck. The merchant doesn’t accept credit cards? Send it to OnDeck.

They were every merchant cash advance ISO’s frenemy. They’d solicit you for your deals and then throw you under the bus to journalists as evil purveyors of expensive financing. They needed us to source dealflow and we needed them to maximize closing ratios but neither was quite satisfied with the arrangement.

When the company’s first employee took over as CEO in June 2012, the rhetoric changed. While still happy to be portrayed as the anti-merchant cash advance, OnDeck transformed their image from a niche Wall Street lender to a Silicon Valley-esque tech company. Noah Breslow was a curious choice. He has a BS from MIT and an MBA from Harvard Business School. He’s tall, charismatic, and he introduced vocabulary words such as algorithm to an industry that relied entirely on manual human underwriting.

At a recent lending conference, the younger crowd characterized Breslow as the Steve Jobs of business loans. He commands a cult-like following inside and outside the company, and in 2013 was embraced by New York City’s Mayor Bloomberg.

Breslow fast tracked OnDeck. With only $43 million raised in the first 5 years, the company went on to raise more than $300 million in the first 24 months under Breslow’s leadership.

This was their plan all along

In November 2012, OnDeck entertained a buyout offer from UK-based payday lender Wonga in which they reportedly received a $250 million valuation. The deal fell apart in the late stages but at the time I believed the negotiations were all a ploy for OnDeck to get a true market valuation. With a solid offer on the table, they knew both where they stood and where they needed to go. Last week the WSJ reported that preliminary IPO discussions valued them at $1.5 billion, six times higher than where they were two years ago.

With stock options being offered to new employees at least as far back as 2012, the plan to go public should come as no surprise. Later this year, those employees may actually get to do something very few startup workers ever get to do, convert those options into real shares.

So will OnDeck ride off into the sunset of billion dollar bliss? Not so fast say several industry insiders, some of whom are itching to short the stock on the first day they can.

Smoke and mirrors?

Smoke and mirrors?

As OnDeck took advantage of the swing in public consensus (that fixed terms were better and lower costs increased the attactiveness ), insiders began to ask an important question. Why weren’t merchant cash advance companies collectively countering with lower prices to remain competitive? Greed was fingered by journalists especially in the wake of the financial crisis. But greed is a weak prerogative if you consider that merchant cash advance companies were filing for bankruptcy left and right in 2009.

And oddly or perhaps even ominously, an entire segment of merchant cash advance companies began to raise their prices just as OnDeck was lowering theirs. When I wrote The Fork in the Merchant Cash Advance Road in April 2011, I said:

While the margins earned on high credit accounts shrank, funding providers were dealing with another challenge simultaneously, defaults. Whether the business owner intentionally interfered with their credit card processing or the store went out of business altogether, bad debt in the MCA world was mounting…FAST!

Risk was and still is the number one reason that merchant cash advances cost so much. While it’s true that OnDeck serviced higher credit businesses, insiders speculated that the spreads were too thin. For years, OnDeck’s merchant cash advance competitors have doubted the soundness of their model.

It’s a debate that continues even to this day and yet OnDeck has secured hundreds of millions in investments from companies like Google Ventures, Goldman Sachs, Peter Thiel, and Fortress Investment Group. Their notes got an investment grade rating from DBRS. And as far as volume is concerned, they have likely eclipsed the industry’s all time reigning giant CAN Capital. If they had reached none of these milestones, OnDeck would have little credibility to convince critics of their sanity.

It’s a debate that continues even to this day and yet OnDeck has secured hundreds of millions in investments from companies like Google Ventures, Goldman Sachs, Peter Thiel, and Fortress Investment Group. Their notes got an investment grade rating from DBRS. And as far as volume is concerned, they have likely eclipsed the industry’s all time reigning giant CAN Capital. If they had reached none of these milestones, OnDeck would have little credibility to convince critics of their sanity.

With a mountain of circumstantial evidence through big name backing in OnDeck’s favor, it seems to be indicative that the skeptics are wrong. But maybe they’re not. Could their model be both seriously flawed and superior at the same time?

It’s all about eyeballs

Going back to the 1990s, Internet companies have been judged, valued, and made famous by the price of eyeballs and the number of site visits. It’s a measure that’s never disappeared and according to USA Today is making a comeback. And while OnDeck Capital has always been based in New York City, true to their Silicon Valley form, their model has been to conquer market share first  and take on profitability second. In their case, it’s not eyeballs or site visits, it’s loan origination volume.

and take on profitability second. In their case, it’s not eyeballs or site visits, it’s loan origination volume.

Five months ago Breslow was quoted in the WSJ as saying OnDeck is “imminently profitable“. With seven years in business, it’s proof that their critics have been right all along, that their model doesn’t make money.

What scares their competitors though, is that this strategy has been intentional. Very few if any players in the industry have had the luxury, guts, or the purse to lose money for seven years as part of a coup to conquer the market. Disbelievers in this long term wildly risky strategy are salivating at the opportunity to inspect the company’s financial statements in the IPO.

In When Will the Bubble Burst?, RapidAdvance CEO Jeremy Brown, whose company became part of the Quicken Loans family last winter, fired shots at OnDeck, “To accomplish high growth rates, which may be driven by a desire or need for an IPO or to raise investment or to sell to private equity, assets are being overpaid for through higher than economically justified commissions (I’ve heard 12-15 points upfront from the more aggressive companies) and stretch the repayment term of the MCA or loan even further (On Deck24, I am talking about you).”

Insiders testify that OnDeck’s strategy has not so much been about lower costs but about growth at all costs. Among the evidence is the sudden removal of an industry-wide practice of verifying the business owner is current on their rent. Repayment terms are getting stretched out, commissions have shot up, and for a while they ran a program that allowed applicants to get funding with the submission of just a single bank statement.

Merchant cash advance companies look at their own default figures and scoff at the notion that OnDeck’s aggressive practices could produce low single digit defaults as they’ve publicly claimed.

Imminent

Through it all, there remains the fact that OnDeck has never claimed their methodologies to be profitable, at least not yet. Red ink at IPO time might reward their detractors with a certain delicious satisfaction, but what will they say if and when they become profitable?

Through it all, there remains the fact that OnDeck has never claimed their methodologies to be profitable, at least not yet. Red ink at IPO time might reward their detractors with a certain delicious satisfaction, but what will they say if and when they become profitable?

I’m reminded of The 20 Smartest Things Amazon Founder Jeff Bezos ever said. Below is a few of them.

- “There are two kinds of companies: Those that work to try to charge more and those that work to charge less. We will be the second.”

- “Your margin is my opportunity.”

- “We’ve done price elasticity studies, and the answer is always that we should raise prices. We don’t do that, because we believe — and we have to take this as an article of faith — that by keeping our prices very, very low, we earn trust with customers over time, and that that actually does maximize free cash flow over the long term.”

- “If you never want to be criticized, for goodness’ sake don’t do anything new.”

- “Invention requires a long-term willingness to be misunderstood. You do something that you genuinely believe in, that you have conviction about, but for a long period of time, well-meaning people may criticize that effort. When you receive criticism from well-meaning people, it pays to ask, ‘Are they right?’ And if they are, you need to adapt what they’re doing. If they’re not right, if you really have conviction that they’re not right, you need to have that long-term willingness to be misunderstood. It’s a key part of invention.”

I wonder if the executive team at OnDeck would share these philosophies.

They’ve always claimed themselves to be a tech company, much to the bewilderment of their competitors. Will technology come through for them?

The data available on businesses has changed. Bank statements and a credit report might’ve been all there was to go on when the company first started, but in Automated Intelligence Breslow said, “the fact is most businesses operating today, in 2014, are already technology focused to one degree or another. They have computers, they have online banking, they use credit card processors, their customers are reviewing them online, there are public records, etc. All this electronic data helps paint a deeper and more accurate picture of the health of a business.”

With such easy access to important data, it might be possible that through the use of 2,000 data points, OnDeck doesn’t need to do all the manual investigations that their competitors still place high values on. The available data might be able to predict loan repayment success just as well as a human analyst.

And if that’s true, then they can reduce the cost of overhead as they scale. As their predictive algorithms get fed more data, they might be able to eliminate humans altogether. At the May 2014 LendIt conference, Breslow admitted that 30% of their loans were still manually underwritten but said that “if customers want full automation, we are prepared to deliver it.”

By that charge, a sustainable model should not be that far out of reach. Through advanced data analysis and decreasing fixed costs, profitability may indeed be imminent.

Winner

If the story of the merchant cash advance industry has been a race to the top, then OnDeck might be declared the winner in a successful IPO. It would be an ironic achievement for the company that positioned itself as the anti-merchant cash advance. In their wake today are hundreds of daily funders offering fixed payment products.

OnDeck’s critics are in a paradoxical position because a successful IPO is good for them too. They want to believe OnDeck’s model never worked, can’t work, and have it be proven a failure. But if it goes the other way, the legitimacy of the daily funder universe will be solidified in the mainstream. What’s good for the goose is good for the gander.

OnDeck’s critics are in a paradoxical position because a successful IPO is good for them too. They want to believe OnDeck’s model never worked, can’t work, and have it be proven a failure. But if it goes the other way, the legitimacy of the daily funder universe will be solidified in the mainstream. What’s good for the goose is good for the gander.

As AmeriMerchant CEO David Goldin said to Inc, “the OnDeck IPO shows that Wall Street is now taking this industry seriously.”

So does that mean he’d buy stock? Somewhere out there at a restaurant in New York City, an OnDeck relationship manager is probably putting Goldin down for five shares.

Cue the earthquake, the industry will never be the same.

Curious how it will change it exactly? Read my magazine published prediction, The Retail Investor.