The Missing Puzzle Pieces

About 1% of my LendingClub consumer loan portfolio bounces their very first payment. It’s discouraging stuff, especially considering these loans range between 3 and 5 years. Granted, most manage to get caught back up at least for a little while.

About 1% of my LendingClub consumer loan portfolio bounces their very first payment. It’s discouraging stuff, especially considering these loans range between 3 and 5 years. Granted, most manage to get caught back up at least for a little while.

LendingClub, like the rest of the alternative lending industry relies on ACH debits to retrieve those monthly payments. I’ve published my feelings before on single monthly debit payment systems (they’re like roulette). Out of 30 days of the month, you’re betting on the balance being available on just 1 particular day. When I noticed that 1% of my borrowers were failing right out of the gate, it validated two practices that originated in the merchant cash advance industry, daily payments and the analysis of historical cash flow.

For all the underwriting data points that LendingClub offers its investors, I don’t get to see average daily bank balance, overdraft activity, NSF data, or anything at all related to the borrower’s bank account. Ironically, many merchant cash advance companies consider that data to be the single most important piece of assessing a deal.

The problem my 1%-ers have is not a credit problem or a stable income problem, it’s a cash flow problem. You can have 750 credit and be broke. You can have a good job with a hefty salary and be broke. You and I knew this already, which is why it’s odd that LendingClub and other p2p lenders like them still rely mainly on employment data and FICO score.

What I want to know is if the borrower is broke…

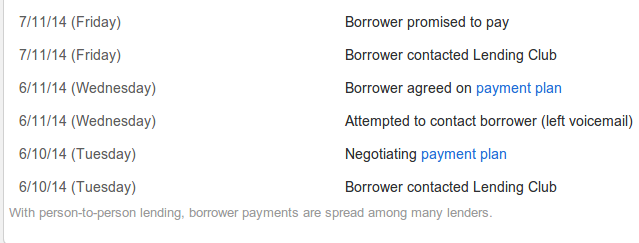

That’s something that LendingClub can’t tell me and doesn’t know. Hence a good looking borrower like the one mentioned below, missed the first payment. That led to a negotiation for a reduced monthly payment. They then failed to pay even the reduced amount.

This was a very low risk B1 note. The borrower is a nurse that has worked at their current job for 5 years. They had over 700 credit and very little revolving debt, only $5,500 (compared to some on the platform that have more than 50k!). It was a 3 year loan and it has blown up in my face.

The borrower is broke and nobody knew it.

The Missing Puzzle Pieces

The Missing Puzzle Pieces

This borrower may very well have done better with a change in how the deal was both underwritten and structured. With daily payments:

- The borrower will know exactly how much cash they can really spend on any given day. They don’t have to worry about trying to set aside for that one big day.

And

By examining their last 3 months bank transactions:

- Their payment plan will be based on more relevant data. There are 3rd party tools like yodlee that consumers could connect their bank accounts to, so at the very least LendingClub could see what’s really going on. Why business lenders consider this essential while consumer lenders completely ignore this, I don’t understand. Business lender Kabbage for example requires applicants to connect their bank accounts in the application process before they even type in their business address. It is the single most important part of their underwriting.

Picking loans on LendingClub is like trying to complete a puzzle without half the pieces. If you guessed the puzzle on the right was an ocean scene with dolphins playing because of the pretty blue border pieces, you were wrong. It’s actually a picture of a guy on a boat holding a bank statement that shows a negative $3,000 balance and 10 NSFs.

Oops…

Last modified: July 24, 2014Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.