Fintech

Drift Capital Partners Credit Facility Shows Confidence in Fintech

January 20, 2018Drift Capital Partners, LLC, an alternative asset management company, announced a new $50 million credit facility earlier this month. The funds will be used to “expand its portfolio of structured credit solutions to FinTech enabled Non-Bank Financial Services companies and allow them the opportunity to increase lending to ‘main street’ businesses,” a company release said.

Drift previously provided $25 million in financing to McClean-based Breakout Capital.

“Since its inception, Drift has been focused on developing solutions to bridge the chasm between institutional investors and main street businesses and we believe this facility is an important step toward solidifying that connection,” said McLean Wilson, Managing Partner of Drift in a company release.

Will 2018 Be a Special Year?

December 29, 2017 2018 is going to be different, in a good way. That’s word on the street in the alternative finance industry, many of whom have told me that it’s just something they feel.

2018 is going to be different, in a good way. That’s word on the street in the alternative finance industry, many of whom have told me that it’s just something they feel.

I feel it too. The S&P 500 is at an all-time high, Bitcoin is up more than 1,400% for the year, lenders are lending in full force, and on top of it all, Donald Trump is president. The world is changing and from a one thousand foot view, it’s an exciting time for finance.

2018 will welcome Broker Fair, the inaugural conference for MCA and business loan brokers.

2018 will transform alternative finance into just finance. For example, a mailer I received from PayPal advertising a small business loan up to $500,000 in as quick as 1 business day, included a letter signed by a top manager of Swift Capital. PayPal acquired Swift in 2017. Yesterday’s alternative loan is simply today’s loan. The one-day small business loan is becoming normalized and being offered by widely recognized financial companies.

Ripple surpassed Ethereum this morning to become the 2nd largest cryptocurrency by market cap. Cryptocurrency, once the domain of Bitcoin-obsessed internet anarchists, is quickly being adopted by the world’s largest banks.

It’s one thing to just talk about innovations in finance and another to realize that you now rely on those innovations. My company got a loan from Square, I got insurance through CoverWallet, I have funds in Lending Club, Prosper, Bitcoin, Ethereum, and Bitcoin Cash. Coinbase is the new etrade. MCA and online business loans are the new community banks. Payments can be made instantly and cost effectively.

2018 will be special because the world that we predicted would come, has come. That means it will be time to think about what will come even next. Online lending has come, instant payments has come, cryptocurrency is fast approaching. What will be the cool edgy hip thing in the ’20s that we may once again refer to as alternative? Mull that one over for a bit and consider that in the next decade the sexy fintech companies of the 20-teens will be stodgy financial institutions in the 2020s. This decade’s innovation will become part of the boring normal manner in which finance is transacted. That’s a fact.

Enjoy 2018. I know I will.

Happy new year,

– Sean

Technology Drives Changes in CRE Lending Space

December 21, 2017 Online technology, which paved new paths for consumer and small business lending, is making similar inroads with the commercial real estate industry.

Online technology, which paved new paths for consumer and small business lending, is making similar inroads with the commercial real estate industry.

Over the last few years, several online marketplaces have been established to try and match commercial real estate borrowers with lenders quickly and efficiently using technology. In the past, commercial real estate lending depended heavily on having local connections, but online platforms are blurring these lines—making geographical borders less relevant and opening doors for new types of lenders to establish themselves.

While banks remain the largest source of commercial real estate mortgage financing, non–bank players—including credit unions, private capital lenders, accredited and non–accredited investors, hedge funds, insurance companies and lending arms of brokerage firms—have become more formidable opponents in recent years. Online platforms offer even more opportunity for these alternative players to gain a competitive edge.

At present, most of these commercial real estate marketplaces are purely intermediaries—they’re matching borrowers and investors, not actually doing the lending. Certainly, it’s an easier business model to develop than a direct lending one, but things could change over time, as borrowers become more comfortable with the online model and develop confidence that these platforms can perform, industry participants say.

“You have to be viewed as credible with a certainty of funding for borrowers to come to you. You can’t just put up a flag and say ‘Hey we’re making loans’ because borrowers won’t trust you and they won’t have the confidence that the loan is going to close,” says Evan Gentry, founder and chief executive of Money360, one of the few online direct lenders in this space. “However, once you develop a reputation of strong performance, the tide turns very quickly and that confidence is established,” he says.

“You have to be viewed as credible with a certainty of funding for borrowers to come to you. You can’t just put up a flag and say ‘Hey we’re making loans’ because borrowers won’t trust you and they won’t have the confidence that the loan is going to close,” says Evan Gentry, founder and chief executive of Money360, one of the few online direct lenders in this space. “However, once you develop a reputation of strong performance, the tide turns very quickly and that confidence is established,” he says.

For now, however, many of the marketplaces say they are content to remain intermediaries and offer business opportunities to lenders instead of competing with them. The sheer size of the market— commercial/multifamily debt outstanding rose to $3.01 trillion at the end of the first quarter, according to data from the Mortgage Bankers Association—and the fact that is an enormously diverse industry with no plain vanilla product makes it more likely that several platforms can co–exist without completely cannibalizing each other’s business, observers say.

Each of the online marketplaces has a different business and pricing model. Some marketplaces focus on small loans, while some have larger minimums; some focus on just debt; some focus on a mixture of equity and debt. Some sites cater to institutional lenders and accredited investors to help fund loans. Other sites invite non–accredited investors who meet certain criteria to participate in loans, opening doors to a segment of the population which previously had minimal access to commercial real estate deals. While the sites differ in their approach, the upshot is clear: banks—while still formidable competitors in commercial real estate lending—are no longer the only game in town for funding these deals.

The struggle for lenders is how to work most effectively with these marketplaces. “If you can acquire customers through only your own channels, then of course you’re going to do that,” says David Snitkof, chief analytics officer at Orchard Platform, which provides data, technology and software to the online lending industry. Otherwise, these marketplaces present a viable opportunity to expand distribution, he says.

GROWTH OPPORTUNITIES ABOUND

The surge of new companies acting as marketplaces between borrowers and lenders of all kinds comes as the commercial real estate industry is finally coming up to speed with respect to technology. The commercial real estate business has been static for decades in terms of how loans are processed and originated, according to industry participants.

“The use of technology is going to be an enormous disrupting force in that space,” says Mitch Ginsberg, co–founder and chief executive of CommLoan, one of the newer marketplaces for commercial real estate lending. Commercial real estate lending is “probably one of the last industries that hasn’t been touched by technology, and it’s ripe for massive disruption,” he says.

CommLoan of Scottsdale, Ariz., was founded in 2014, but the marketplace has only been fully operational since 2016. The platform targets borrowers seeking $1 million to $25 million of capital for all types of commercial real estate loans. It works with more than 440 lenders—including banks, credit unions, commercial mortgage companies, private money lenders and Wall Street firms. Altogether, CommLoan says it has processed more than $680 million in commercial transactions.

Online marketplaces can help make the commercial real estate industry more efficient and transparent, says Yulia Yaani, co-founder and chief executive of RealAtom of Arlington, Va., another new online commercial real estate marketplace. “People are tired of paying huge fees as a result of the market being so opaque,” she says.

RealAtom began operating in 2016 and targets borrowers who are seeking commercial real estate loans from $1 million to $70 million. The lenders on the platform include banks, alternative lenders, insurance companies, pension funds, hedge funds and hard money lenders. The company processed $468 million in commercial loans in its first 11 months of operating, according to Yaani.

Another benefit of online marketplaces is that they “create a liquid, national marketplace where lenders all across the U.S. can bid on a borrower’s business,” says Ely Razin, chief executive of commercial real estate data company CrediFi, which operates the upstart CredifX marketplace. Historically people who own commercial real estate have only been able to get financing through a local relationship with a bank or broker. “For borrowers, this means more certainty of obtaining a loan and optimized capital not limited by the relationship with the local lender,” he says.

CredifX started operating earlier this year to match commercial real estate borrowers, brokers and lenders including banks, finance companies, mortgage companies, hard money and bridge lenders. The platform is for loans of $1 million to $20 million across all major property types in the commercial space. It matches borrowers with appropriate lenders using the information that parent company CrediFi collects and analyzes. The company declined to disclose how much it has processed in commercial transactions.

To be sure, it’s hard to say how the marketplace model will evolve over time and which players will withstand the test of time. Certainly a similar model has faced challenges on the consumer and small business lending side.

“I think the pure marketplace will become more rare as time goes on,” says Peter Renton, founder of Lend Academy, an educational resource for the P2P lending industry. “There are examples of successful companies with a pure marketplace, but they are rare and difficult to scale. The only well-established company that seems completely wedded to the pure marketplace is Funding Circle; pretty much all other companies have switched to a hybrid model of some sort,” he says.

Commercial vs Residential

While much of the recent growth has been within commercial real estate, there are also some marketplaces that cater to residential borrowers or offer a mix of commercial and residential opportunities.

Magilla Loans, for instance, started out in 2016 as a solely commercial marketplace, but expanded outside this silo because customers were asking for residential and other types of loans, says Dean Sioukas, the company’s founder. The company now connects borrowers with lenders for a whole host of loan types—commercial, residential and others like franchise loans and equipment loans. Lenders on the platform include roughly 130 banks, mortgage loan originators, accredited investors, credit unions and online non-depository institutions. The average loan size is $1.4M for business loans and $500K for home loans. Nearly $4 billion in loans has been channeled through the platform since January 2016; of that 70 percent is tied to commercial real estate, according to the company.

Magilla Loans, for instance, started out in 2016 as a solely commercial marketplace, but expanded outside this silo because customers were asking for residential and other types of loans, says Dean Sioukas, the company’s founder. The company now connects borrowers with lenders for a whole host of loan types—commercial, residential and others like franchise loans and equipment loans. Lenders on the platform include roughly 130 banks, mortgage loan originators, accredited investors, credit unions and online non-depository institutions. The average loan size is $1.4M for business loans and $500K for home loans. Nearly $4 billion in loans has been channeled through the platform since January 2016; of that 70 percent is tied to commercial real estate, according to the company.

While there are marketplaces that focus on residential mortgage lending, some industry participants say that side of the business isn’t as appealing to new online entrants in part because the cost to acquire customers is really high and there are more challenges to working on a national scale.

“It may not be that commercial is more attractive. It may just be easier. Going directly to borrowers in the residential space has proven harder than many companies expected,” says Brett Crosby, co-founder and chief operating officer of PeerStreet, a marketplace for accredited investors to invest in high-quality private real estate backed loans. Experience seems to suggest that for residential mortgage origination, “it’s much better to have a good ground game and know your local market,” he says.

To be sure, as the online market for real estate matures, it’s not so surprising that companies would shift business models to find their own sweet spot. RealtyMogul.com is one example of a company that has morphed over time. The online platform began operating in 2013 in both the residential and commercial space, but has since moved away from the residential business. Accredited investors, non-accredited investors and institutions can use the platform to find equity or debt-based commercial real estate investment opportunities, and borrowers can apply for private hard money loans, bridge loans and permanent loans.

Money360 is another example of a company that has shifted gears. It started out as a pure marketplace, but changed its business model to become a lending platform in 2014. Now the online direct lender in Ladera Ranch, Calif., provides small-to mid-balance commercial real estate loans ranging from $1 million to $20 million. It’s one of the only companies targeting the commercial real estate space in this way and has closed nearly $500 million in total loans since 2014.

Gentry, the company’s founder, says he would expect to see more industrywide changes as the online commercial real estate business continues to evolve. The key to success, he says, is executing well and “knowing when to pivot when you realize something’s not working just right.”

Ultimately, Gentry predicts more online lenders will target the commercial real estate space. He says technology-based alternative lenders have an advantage because they can operate more quickly and efficiently while still being very competitive from a pricing perspective.

“You put all those things together (speed, efficiency and competitive pricing) and that’s what borrowers are looking for,” Gentry says.

Startups, Big Financial Institutions Play Nice in the Sandbox

December 20, 2017Data is the lifeblood of financial technology and more established companies frequently supply data to fintech startups for free as part of their growth model.

A Boston business incubator is basing its operations on that dynamic.

FinTech Sandbox, a non-profit group, launched two years ago and now claims more than 30 data sources that it calls partners for the startups going through its six-month program that benefits both data providers and users.

Testing new technology under a load of data is an important factor facing fintech startups so there’s a tradeoff: established financial services companies are providing data in exchange for a glimpse of the latest tech tools being developed.

FinTech Sandbox participants get to test drive their technology with large amounts of free financial data, which can be crucial step before taking on customers real time, Executive Director Jean Donnelly told deBanked.

“In order to be taken seriously, you have to test. That’s why we came about,” she said. “It’s for beta testing, to get feedback.”

Without partnerships, startups would need to buy data or scrape it from the Internet. However, providers generally don’t want to deal with the small amounts startups need versus larger paying customers. As a result, programs such as FinTech Sandbox’s can play an important role in the fintech ecosystem.

To date, four FinTech Sandbox portfolio companies have been acquired by larger companies. Most recently, machine learning company DataRobot Inc. bought software maker Nutonian in May.

Data sources for FinTech Sandbox’s startups include Fidelity Investments, F-Prime Capital, Thomson Reuters and Silicon Valley Bank.

Several banking and financial services companies operate accelerator programs and gain access to the latest technology by doing so. They include Deutsche Bank Innovation Labs, Barclays Accelerator and the Wells Fargo Startup Accelerator.

Earlier this year, Pricewaterhouse Coopers reported that the demand for data analytics is fueling the trend of traditional financial institutions folding fintech startups—and the tools they develop—into their companies.

“FinTech companies create an ecosystem that fosters the collection of vast amounts of data and builds trusted relationships with clientele. Financial institutions have realized the importance of these ecosystems and are attempting to engage with and bring innovation inside their companies. Partnering with FinTech companies is up from 32 percent in 2016 to 45 percent this year on average, but large discrepancies by country do exist.”

Ninety-eight startups have participated in FinTech Sandbox’s six-month program. They’ve raised a combined $380 million in funding, Donnelly said.

Artificial intelligence may be the hottest trend in the technology industry. But tech tools related to environmental, social and governance, also called ESG or socially conscious business models, are fueling the strongest growth trend with fintech entrepreneurs, she said.

One such startup, California-based Data Simply Inc., went through the FinTech Sandbox program in fall 2015 and now provides data to sustainability-focused companies.

The financial technology sector has changed over time to become one in which legacy and startups regularly team up, Data Simply CEO Michelle Bonat told deBanked.

“It used to be more of a competitive environment, but it’s now more collaborative,” she said. “Each realizes they can gain more from the other.”

FinTech Sandbox also collaborates with 11 accelerator programs such as Techstars, Startup Bootcamp and FinTex Chicago. Partnering with larger fintech companies turbo charges the growth of a business, Bonat said.

“It started so many useful discussions and it happened so much faster than it would have happened otherwise,” she said. “It’s all about an ecosystem and accelerating that in different ways.”

In July, Boston-based investment analytics startup FinMason Inc. disclosed that it was making its enterprise software available to FinTechSandbox participants.

The software is a suite of investment analytics with access to more than 700 analytical data types, including risk and performance metrics, aggregate factor exposures, scenario analyses and stress testing.

CEO Kendrick Wakeman told deBanked FinMason is partnering with the accelerator’s portfolio companies with a plan that such startups are prospective customers in the future.

Startup partnerships are more common in the financial services industry because an aversion to risk has slowed the adoption of innovation. Now, the industry is playing catch up and working with startups and young entrepreneurs is one way to close the innovation gap faster than developing products in house, Wakeman said.

“Institutions know they have to innovate. Consumers demand it and regulators demand it,” he said. “They have a long ways to go.”

Hard Work, Big Success – The True Story of an MCA Broker

December 15, 2017Sales is a tough field for anyone to break into even if they come from the most ideal of circumstances. At some point, the rubber meets the road for every MCA broker, at which time they must decide whether they’ve got what it takes to make it in this business.

This is what makes Lerry Dore’s story so remarkable, as it seems that the more he got knocked down in life, the higher he was destined to rise. Today he’s employed as an MCA broker at Cresthill Capital. And while education has been paramount to getting him here, evidenced by the fact that during his entire employment he has been in college and he is still one of the funding company’s most successful brokers, Dore more than anything else was trained at the school of hard knocks.

Coming to America

Dore was born in South Florida, but he wouldn’t stay in the United States for long. After his parents split up, his mom was having a tough time making ends meet and made the impossible decision to send him to Haiti to live with extended family.

“My mom had a very hard time supporting us right out of the gate. Soon after I was born, I was sent to Haiti to live with my aunt and cousins,” he said, adding that this gave his mom a chance to get on her feet. “She needed to get a job so that she could provide for us at a basic level.”

Dore would remain in Haiti for the first three years of his life, where his first language would become Haitian Creole. But you wouldn’t detect a hint of an accent talking to him today at the age of 23.

Dore’s mom eventually found a job. She was only earning minimum wage at a hospital, but it was enough to get the wheels in motion to bring her son home.

“She was in a position to provide food, electricity and shelter for us. That’s why I came back,” said Dore, adding that he doesn’t remember much of Haiti with the exception of the plane ride home. “That’s where my memories start,” he said. Perhaps it was somewhere over the Caribbean that young Dore’s dreams began to form.

When he got back to Florida, Dore was able to meet his mom for what felt like the first time for him. He also met his brothers and sisters for the first time ever. He explained how at this point, his mom was still getting adjusted to life in America as an adult immigrant.

“There were a lot of things that I went through as a kid to this point that she couldn’t give me guidance on. She simply didn’t have that experience. That brought a challenge,” he said. Little did he know that these obstacles would help shape him into the resilient person and successful MCA broker he is today.

“There were a lot of things that I went through as a kid to this point that she couldn’t give me guidance on. She simply didn’t have that experience. That brought a challenge,” he said. Little did he know that these obstacles would help shape him into the resilient person and successful MCA broker he is today.

While getting used to the American culture was a challenge, something that his mother never lost sight of was the importance of education. “She was very big into education,” he said. Dore’s mom discovered Head Start, a government subsidized program that provided a pre-school education for families who couldn’t otherwise afford it. That was where it would all begin for Dore, and come hell or high water his mother was going to enroll him. Without the luxury of an air-conditioned vehicle to drive in the hot Florida heat, the pair set off on foot to sign up. Some 12-15 blocks later they arrived.

“Both of us were sweating bullets. She didn’t know it, but there was a small registration fee. At the time, she didn’t have it,” Dore explained. It was then that fate seems to have stepped in in the form of the woman who was handling registration. She pulled the pair aside and told them that after witnessing the dedication that this mother had toward her son, she was going to waive the fee. In return she only asked that they keep it on the down low.

“That small gesture made a dramatic difference in my life,” Dore said. “If I was not able to attend, I wouldn’t start school until I was seven or 10 years’ old. That was a very important moment in my life.”

Indeed, it was, as it would set in motion a series of events that would lead Dore to where he is today, a successful MCA broker at Cresthill Capital. But before he would join the firm, there were still more hardships waiting for him, not the least of which was the death of a friend in his teenage years. “That could have been me,” Dore exclaimed.

For the average person, life’s setbacks could have held them down forever. For Dore, they seem only to have propelled him further. “The reason why I stayed out of trouble was I was in school and my mother kept us grounded,” he said.

During his teenage years, Dore and his family lived in an apartment complex in a neighborhood of immigrant Haitians where he said the median income was $25,000 to $30,000 per year. He shared a room with his brothers and sisters.

“I focused on athletics,” he said, adding: “That’s where I got my competitive nature. Also, my thick skin,” both of which, incidentally, are characteristics that would serve him well as a broker later in life.

While he excelled at basketball at his Boca Raton high school, Dore wouldn’t be able to pursue those dreams for long. He and his family would be uprooted from their home time and time again amid landlord trouble. This series of setbacks, which involved him sleeping on his brother’s couch for a time, instilled a sense of maturity in Dore at a very young age.

He had a few Division II and Division III offers to play basketball in other states, but he turned them down. Instead of chasing his own dreams, Dore decided to focus on business and find a way to sustain and support his family “Once I graduated, I was not interested in basketball. I wanted to finish college,” said Dore, and lucky for the MCA industry he had his sights set on the field of finance.

Funding Merchants

After High School, the first thing that Dore did was to go online and look for a job. As it so happens, the first ad he saw was at a stock brokerage in Boca Raton. “That’s where I started, in phone sales. I didn’t have a Series 7 license at the time. I was just calling from the Yellow Pages. Once I got someone on the phone, I would transfer the call to someone who had a license,” he explained.

This went on for a couple of months until he heard about a startup company in nearby Delray Beach. “At the time, they were prospecting merchants. That’s how I got into the industry,” he said.

His first job in the MCA niche was with a very small ISO shop. But it was there that he would make a connection to change the course of his career. He was working on a deal that was hard to place and was only getting rejections. That is until he came across Mike Daniels, Cresthill’s No. 1 producer.

His first job in the MCA niche was with a very small ISO shop. But it was there that he would make a connection to change the course of his career. He was working on a deal that was hard to place and was only getting rejections. That is until he came across Mike Daniels, Cresthill’s No. 1 producer.

“I couldn’t get the deal done anywhere else. The merchant was getting frustrated with the process. I heard of a company that takes chances on merchants with imperfect credit,” he said. That funder was Cresthill Capital. Little did he know at the time, but they would eventually become his employer.

He sent the merchant file over to Daniels, who then reached out to the merchant and got the deal funded. It was at that point, Dore said, that he started to fall in love with Cresthill “because of how [Daniels] was able to treat the merchant with respect and get the deal done.”

For the next six months, Dore would proceed to trust all of his business with Cresthill. He was still employed by the small ISO shop, but he began to outgrow his environment and long for a platform that allowed him to explore his talent and excel. But his pursuit only left him frustrated and thinking about leaving the MCA industry, something he confided in Cresthill Capital’s Daniels, who was turning into a mentor, about.

It was at this point in his life and career that instead of being the rock, Dore needed to lean on someone else. Daniels and Cresthill Capital were there for him. He was invited in for an interview, and as they say the rest is history.

“I was shocked at how diverse the workforce is. There were different types of people with different backgrounds. I liked it right off the bat. And then everyone was very friendly to me from the moment I walked in,” he said. He was greeted at the front door by Cresthill Capital’s Mike Marano, who then proceeded to interview him.

“I’ve actually interviewed and sat with every single person at my company and hired them personally. What I can say about Lerry is that from the moment I looked at his face and saw his eyes, I knew intuitively that he was a good person. And responsible. I had no idea how deep of a person he was, how much humanity he would show. He was a willing student, and we were happy to teach him. And he continues to soak it up like a sponge,” Marano told deBanked.

“I’ve actually interviewed and sat with every single person at my company and hired them personally. What I can say about Lerry is that from the moment I looked at his face and saw his eyes, I knew intuitively that he was a good person. And responsible. I had no idea how deep of a person he was, how much humanity he would show. He was a willing student, and we were happy to teach him. And he continues to soak it up like a sponge,” Marano told deBanked.

Dore was convinced Cresthill Capital was the right place for him when Marano insisted that Dore stay in school and continue his education. “They said, ‘we will work around your schedule,’ and that really drew me in,” he said, adding that the dog-friendly environment was a bonus.

Dore has been employed by Cresthill Capital for the past 18 months and is graduating from college this week. He is not only supporting himself, but he’s the highest earner in his family, which has allowed him to help support them.

Paying it Forward

As if on cue from the mystery lady that paid his school tuition when he was just a child, Dore is now interested in paying it forward in life. He said that similar to how Cresthill Capital is involved with philanthropy, he’d like to give back to the community. But his vision goes beyond his neighborhood.

“I want to help kids that are similar to me, who are in programs that try to help them excel in this country. I want at some point to work with immigrants that come in from Haiti and work with them to give them a platform, like the lady who gave us a chance,” said Dore.

Since the Haiti earthquake, his extended family has relocated north to Canada. “But I still feel to some degree a responsibility to try and help out the people in that country and the ones who come here through immigration,” he said.

As for Marano, he said all Dore needs to do is exactly what he’s been doing. “When he leaves me, he won’t have to work again. But knowing this kid, he probably will anyway,” Marano said.

C-level Credit Exec Leaves Lending Club for Affirm

September 21, 2017Lending Club’s Chief Credit Officer and Interim General Manager, Sandeep Bhandari, has joined fintech lender Affirm, according to Affirm CEO Max Levchin. Levchin posted the following on LinkedIn:

I am excited to announce and welcome Sandeep Bhandari to Affirm, Inc. as Chief Strategy and Risk Officer (CSRO).

Sandeep joins us from Lending Club where he was the Chief Credit Officer (CCO). Prior to Lending Club, he was at Capital One for many years, where he was Assistant Chief Credit Officer at Capital One Bank (Credit Risk Management) and Venture Partner (Capital One Ventures). Prior to that Sandeep held a variety of roles requiring expertise in strategy, credit risk management, marketing, product development, and underwriting across several lines of business including consumer and small business credit card, auto lending, and mortgage and home equity lending.

We are excited for Sandeep to join us for our next phase of rapid growth and to help us fulfill our mission of delivering honest financial products that improve lives.

The move comes on the heels of Lending Club announcing their “most advanced and predictive credit model ever.” Bhandari was responsible for credit strategy and overall credit risk management at Lending Club and presumably would’ve overseen that.

Talkative investors on the LendAcademy forum were not immediately sold on Lending Club’s new system, however. Some users bemoaned that Lending Club is ignoring common sense in favor of data. In one instance, the CEO of PeerCube referenced an interest rate anomaly alleged to be discovered in Lending Club’s pricing as “Data-driven but knowledge-unaware.”

Affirm and Lending Club differ. Whereas Lending Club targets the credit card refinancing market, Affirm helps consumers finance purchases. Last month, Affirm and Walmart were reportedly in talks to offer financing to consumers.

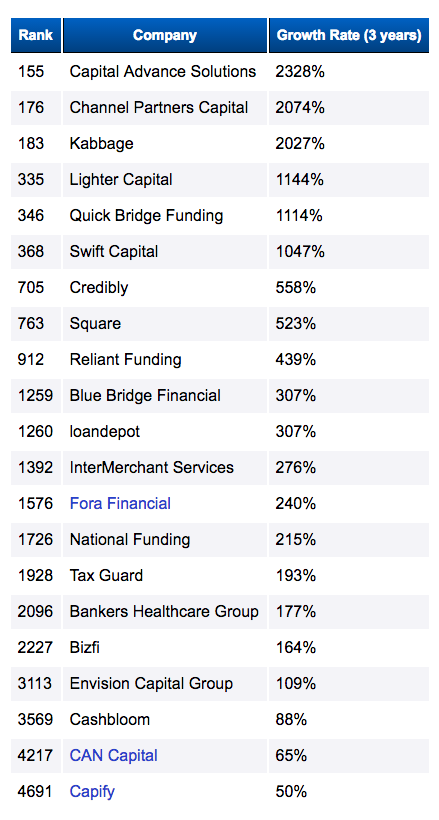

Where Alternative Finance Ranks on the Inc 5000 List

September 14, 2017Here’s where your peers rank on the Inc 5000 list for 2017:

| Ranking | Company Name | Growth | Revenue | Type |

| 15 | Forward Financing | 12,893.16% | $28.3M | MCA |

| 47 | Avant | 6,332.56% | $437.9M | Online Consumer Lender |

| 219 | OppLoans | 1,970.22% | $27.9M | Online Consumer Lender |

| 260 | US Business Funding | 1,657.42% | $5.8M | Business Lender |

| 361 | nCino | 1,217.53% | $2.4M | Software |

| 449 | Kabbage | 979.31% | $171.8M | Online Consumer Lender |

| 634 | Lighter Capital | 712.03% | $6.4M | Online Business Lender |

| 694 | Swift Capital | 652.08% | $88.6M | Business Lender |

| 789 | CloudMyBiz | 575.46% | $2.1M | IT Services |

| 1418 | loanDepot | 286.11% | $1.3B | Online Consumer Lender |

| 1439 | Nav | 281.98% | $2.7M | Online Lending Services |

| 1731 | United Capital Source | 224.85% | $8.5M | MCA |

| 1101 | ZestFinance | 165.99% | $77.4M | Online Lending Services |

| 2050 | National Funding | 184.74% | $75.7M | Online Business Lender |

| 2572 | Blue Bridge Financial | 136.73% | $6.6M | Online Business Lender |

| 2708 | Bankers Healthcare Group | 127.51% | $149.3M | Financial Services |

| 2714 | Tax Guard | 127.02% | $9.9M | Financial Services |

| 2728 | Fora Financial | 125.81% | $41.6M | Online Business Lender |

| 2890 | Reliant Funding | 121.61% | $51.9M | Online Business Lender |

| 4005 | Cashbloom | 70.47% | $5.4M | MCA |

| 4945 | Gibraltar Business Capital | 42.08% | $16M | MCA |

Compare that to last year’s list below:

Of the companies on the 2016 list, Capify and Bizfi were wound down while CAN Capital ceased operations but then later resumed them more than half a year later.

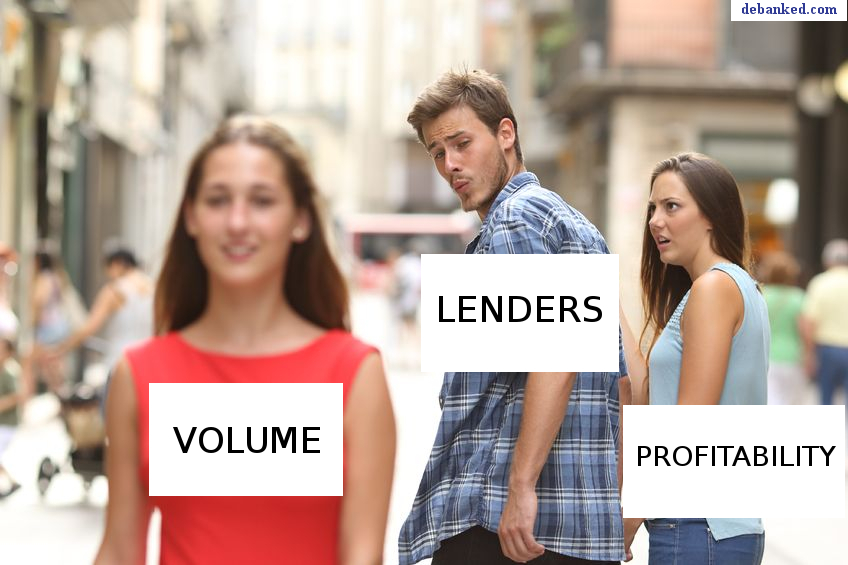

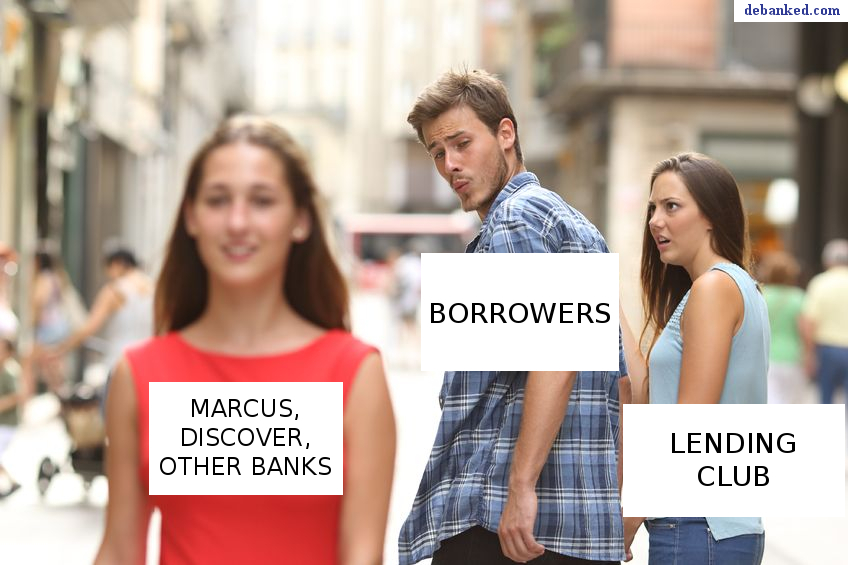

The State of The Industry (In Memes)

September 2, 2017The state of things in MCA, online lending, and fintech through the disloyal boyfriend meme:

SEE MANY MORE DEBANKED MEMES

The History of Alternative Finance (As Told Through Memes)

Ready to Trade ONDK and LC? Scroll to the bottom of the page

10 Clues You’re Hardcore About Merchant Cash Advance