cryptocurrency

ConstitutionDAO NFTs

November 20, 2021If NFTs can be used to capture a moment or experience, then there should be some already available to showcase the current state of the movement. Here are some that we have found:

So We Didn’t Buy The Constitution

November 18, 2021 An internet movement started last week to buy one of the only remaining original copies of the United States Constitution reached a roaring climax on Thursday night and then descended into chaos and confusion as almost no one seemed to know what the outcome was, how auctions work, who was bidding on the movement’s behalf, or anything at all.

An internet movement started last week to buy one of the only remaining original copies of the United States Constitution reached a roaring climax on Thursday night and then descended into chaos and confusion as almost no one seemed to know what the outcome was, how auctions work, who was bidding on the movement’s behalf, or anything at all.

Several news outlets reported that the Decentralized Autonomous Organization, aka DAO (pronounced “Dow”), representing the internet movement, had won, including the crypto-focused outlet Coindesk. The DAO raised approximately $47 million via ethereum contributions in a matter of just days from a total of more than 17,437 people who joined in (yours truly included). Knowing that, most people were lured into believing that the winning bid of $43.2 million had to have been the DAO. Unfortunately, the contributors seemed largely unaware of the hefty fees charged on top by Sotheby’s, the 8.875% sales tax, and more. I wrote about this two days prior.

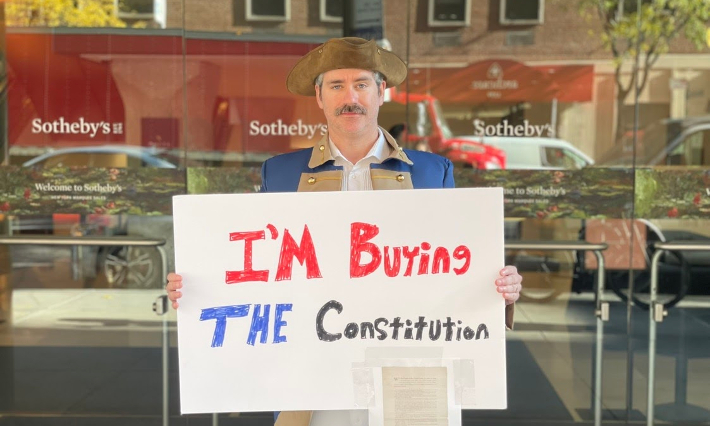

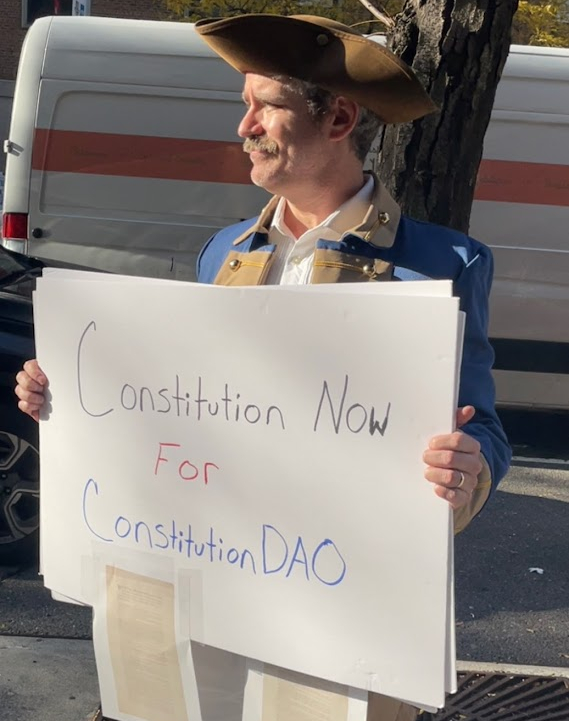

This snafu seems to have been expected by those skeptical of an internet movement. Having actually stood outside of Sotheby’s earlier in the day in full George Washington-esque garb, I was asked by someone seemingly connected to a bidder if the DAO was aware of the added fees. I told them what I knew, but I couldn’t speak in the affirmative for the other 17,436 people.

Having also crossed paths with Julian Weisser, however, a Core team member and nice fellow, it was clear that he was extremely knowledgeable about all the details involved. Weisser was also the first team member to officially announce the loss on the discord.

“@everyone – We did not win the bid for the copy of the U.S. constitution.

While this wasn’t the outcome we hoped for, we still made history tonight with ConstitutionDAO. This is the largest crowdfund for a physical object that we are aware of—crypto or fiat. We are so incredibly grateful to have done this together with you all and are still in shock that we even got this far.

Sotheby’s has never worked with a DAO community before. We broke records for the most money crowdfunded in less than 72 hours. We have educated an entire cohort of people around the world – from museum curators and art directors to our grandmothers asking us what eth is when they read about us in the news – about the possibilities of web3. And, on the flip side, many of you have learned about what it means to steward an asset like the U.S. constitution across museums and collections, or watched an art auction for the first time.

We had 17,437 donors, with a median donation size of $206.26. A significant percentage of these donations came from wallets that were initialized for the first time.

You will be able to get a refund of your pro rata amount (effectively minus gas fees) through Juicebox. Please expect more details from us about this tomorrow – our team has not slept in the past week, and we are giving people the night to get some rest before we’re back at it tomorrow AM.

Every one of you were a part of this. We want to also thank our partners in this work: Alameda Research, Endoament, FTX US, Juicebox, Morning Brew, and SyndicateDAO”

Once the results finally started to kick in, feelings were mixed. Discord members were torn between feeling completely bamboozled or excited to use a DAO to make some other kind of meaningful purchase. The leadership behind the organization’s official twitter account signed off for the night early after working around the clock for about a week to even put the entire thing together.

Once the results finally started to kick in, feelings were mixed. Discord members were torn between feeling completely bamboozled or excited to use a DAO to make some other kind of meaningful purchase. The leadership behind the organization’s official twitter account signed off for the night early after working around the clock for about a week to even put the entire thing together.

gn everyone we’ll be back tomorrow

thanks for all your love and support. can’t wait to shape the next leg of this journey with you all 🙂 🌙 📜 https://t.co/Vhtiglpntg

— ConstitutionDAO (📜, 📜) (@ConstitutionDAO) November 19, 2021

By any measure, the dollars involved were astounding. This particular copy of the Constitution last sold in 1988 for the price of $165,000. Sotheby’s pegged the current value at $15 – $20 million. With $47 million in hand, winning seemed a strong possibility. The one major problem, however, is that with the blockchain being a public ledger, the rival bidder already knew the DAO’s best bid.

Overall, it was a rather strange experience, no doubt made more unusual by my throwing down eth and then donning a costume on the Upper East Side of Manhattan to the bewilderment of many locals.

Was this ultimately a loss for crypto or still a win? Only time will tell…

They’re Actually Going to Buy the Constitution

November 17, 2021 It was Tuesday night in the ConstitutionDAO discord. Users posted the same questions that the mods had answered hundreds of times already.

It was Tuesday night in the ConstitutionDAO discord. Users posted the same questions that the mods had answered hundreds of times already.

“Wen constitution fren?” wrote apelord37.

Another begged the number to hit $6 million already just so they could go to sleep. It was a weak milestone. The earlier thresholds had been more exciting.

“A million, no two million, no THREE MILLION!” the crowd cheered on social media.

But the deadline to reach $20 million, the figure that the auction house had estimated on the high end of what a rare copy of the Constitution of the United States could sell for, was rapidly approaching.

$20 million would be a respectable bid, but it wouldn’t even guarantee a win, and besides that wouldn’t even account for the separate $5 million needed just for auction fees and sales tax. What the DAO really needed was $25 million just to be in the game.

Ouch.

With less than 48 hours to go, hope began to dissipate. A betting site pegged the odds of the DAO actually succeeding at 19%, a discouraging sign.

Just as the people began to pray that Elon Musk might ride in like a white knight, contributors to the DAO awoke Wednesday morning to find that someone had anonymously contributed 1,000 eth to the cause, the equivalent of more than $4 million.

“Holy sh**, this could actually happen,” $people said.

With renewed energy, the DAO reached $20 million by noon and was at $35 million at the time this story is being posted. All of the data is public. A review of it shows that there are more than 11,700 contributors. The top 20 contributors, however, account for more than half of all the funds raised.

On the ConstitutionDAO discord, confidence has surged.

“WAGMI,” one user wrote.

The questions have shifted to what happens if too much is raised and who is going to be hosting parties irl to watch the auction live.

Still others have begun to make other suggestions, like using excess funds for starving children. The crowd isn’t pleased by this, however.

“people, people, focus here, we have only set out to do one thing and that is We’re All Gonna Buy the Constitution,” a user writes.

Crypto Fans Want to Buy The Constitution of the United States and They Might Actually Succeed

November 15, 2021

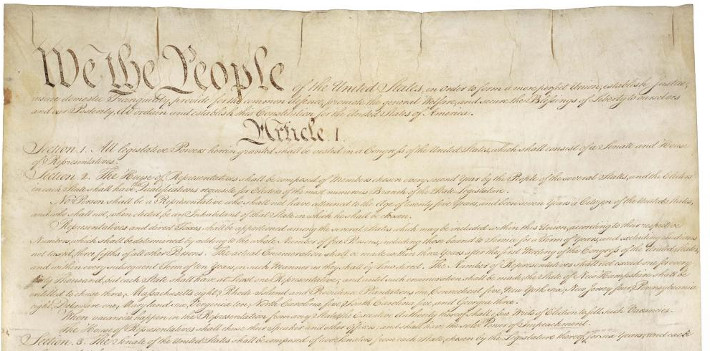

It’s the ultimate NFT, the Constitution of the United States. On November 18th, Sotheby’s will auction off one of the only thirteen surviving copies of the United States Constitution, an opportunity the public hasn’t had since 1988.

But a private collector hoping to pocket the national treasure will have some competition, the crypto mob on twitter. On November 11th, at least two individuals launched @ConstitutionDAO, a twitter account dedicated to crowdfunding crypto with the intent of raising enough money to be the winning bid.

The buyer would technically be a DAO, a Decentralized Autonomous Organization, a community-led entity with no central authority that is governed by a smart contract.

It’s predicted that if the DAO can raise significant cash before the auction that Sotheby’s will allow it to place legitimate bids. Sotheby’s put the estimated winning bid price at $15 million – $20 million.

It might not be out of reach, the DAO raised nearly $2 million in just the few hours since it began crowdfunding the money through a platform called juicebox.

If the DAO wins, theoretically “ownership” of the constitution would be fractionalized into shares based upon each member’s contribution. With a DAO, no one need even disclose who they are. Only a crypto address is required.

We have coordinated a DAO to acquire The Constitution of the United States.

I give you: @ConstitutionDAO

Ping me if interested in being a part of a monumental moment. https://t.co/VHkCTrq4fa

— Austin Cain (📜,📜) (@j_austincain) November 12, 2021

Members contributing to the pool of funds have the option of including a public message.

“To secure the blessings of liberty”

“Another first generation immigrant hoping to be the proud owner of the US constitution.”

“American Dream!!!”

“cant wait to explain this at Thanksgiving”

“in satoshi we trust”

The official website of the ConstitutionDAO is here.

For the sake of following the success or failure of this project accurately, deBanked contributed a very small amount to the DAO so that it could participate in the possible ownership and community of the Constitution. Weird, I know.

Blockchain Expert says Crypto Tools will Revolutionize Lending

November 11, 2021 Blockchain technology can seem complex, but many individuals operating companies that utilize the technology are planning for their world to collide with mainstream finance very soon. Mark Shekleton, CEO of Smart Seal, a company that provides digital identifications for physical goods, believes that those in fintech and small business lending will utilize the technology that blockchains offer on a daily basis in the near future. The technology that will be most useful according to Shekleton, is a type of token he refers to as an (non-transferable token) NTT.

Blockchain technology can seem complex, but many individuals operating companies that utilize the technology are planning for their world to collide with mainstream finance very soon. Mark Shekleton, CEO of Smart Seal, a company that provides digital identifications for physical goods, believes that those in fintech and small business lending will utilize the technology that blockchains offer on a daily basis in the near future. The technology that will be most useful according to Shekleton, is a type of token he refers to as an (non-transferable token) NTT.

“When I’m talking about NTTs, I’m talking about a token that is like an NFT, but it can’t be transferred. It’s issued against a wallet and it can be revoked from that wallet by the issuer,” said Shekleton.

“By issuing NTTs, you allow [merchants] operating in the crypto space to gain reputation and credit for the activity they do under that wallet. So if I am operating a business, and I’m using a crypto wallet to operate, and I borrow some money, and I pay it back, the lender can issue me a positive credit report; a positive token. A token that symbolizes a positive [payment history].”

This token, issued as a one-way NFT, would be a permanent record on an objective platform that could be referenced by anyone who is looking to view the credit history of a specific merchant.

“If I go to another lender [as a merchant], they can look at all of these NTTs that are issued against my wallet and they can say ‘hey look, we saw this other lender issue one of these tokens’, [thus] you paid back your loan, and have this positive piece of reputation associated with your wallet.”

“As you go, the level of trust around a certain wallet increases. If you operate your business, and you can demonstrate that you are trustworthy, and you have people who are issuing these tokens in your wallet, you can prove to anyone else that you are a trustworthy business.”

Shekleton expanded his ideas of potential uses for blockchain technology into identity verification as well. He explained how the same process used for credit history for merchants can be used for individuals or businesses when trying to prove who they are virtually.

“Companies or banks that have services where they’re verifying the identifying of online customers, there’s a really good opportunity here for (Know Your Customer) KYC companies to issue identity tokens,” said Shekleton.

“Say I have a wallet. And right now I created a new wallet, it’s completely anonymous, I’ve never associated my identity with it. But I want to use that wallet to borrow money. I want to make sure there’s no money laundering, the lender needs to know my identity. I go to a KYC issuer, I upload my ID, meet all my requirements to verify my ID, and I sign with the wallet to prove that I’m the holder of this wallet. Then, they issue an identity token, and I can’t transfer that token to anyone else’s wallet, it can only stay in my wallet.”

According to Shekleton, an NTT’s ability to be revoked by the issuer makes it a great way to counteract fraud or identity theft, as the authenticity of the token can be revoked at any time, making the token visibly unusable to all who attempt to use it fraudulently. When asked why this idea hasn’t caught on, and why he referred to NTTs as “not talked about, and complex” at NFT.NYC last week, he blamed the infancy of NFTs and how NTTs are just too new to be widespread.

“The technology itself is just in its infancy. I think there’s a huge opportunity here, virtually untapped, but it’s still very young so it’s going to be a couple of years before anyone realizes the gains of this tech if you start building it now. I think when you start talking about NFTs as utilities to fintech and lending companies, I just don’t think they are awake to that yet. They haven’t started building.”

NYC Rapper’s Experience With Fat Joe is Becoming an NFT

November 5, 2021Rami Even-Esh, better known by his rap name Kosha Dillz, went viral last week after hip-hop artist Fat Joe joined him in his ritual of rapping for Knicks fans outside of Madison Square Garden before and after home games. When Fat Joe approached him while he was rapping, Even-Esh’s life changing moment spiraled into a world of opportunities. Now, he’s trying to turn a once in a lifetime experience, along with other highlights from his life, into NFTs.

Even-Esh spoke with deBanked at NFT.NYC on Wednesday about his performance at the event, after he just showed up and was given a stage—subsequently stealing the crowd away from the speaker’s showcase in the next room, and towards his crypto-inspired rhymes.

“Fat Joe heard me rapping on the beat, got on the mic, and tipped me twenty bucks,” said Even-Esh, when describing the incident he wishes to mint. “He got on the mic and spit a verse that I knew word for word, from Big L’s ‘Enemy’, it’s a very classic song. That went to one page, then it went to another page, and then that was it. Game over. You know, we probably hit about nine million views and now more people are posting it.”

After the iconic moment outside of Madison Square Garden, Even-Esh immediately hopped on a flight to Colorado to try and make another connection with Fat Joe during one of his shows there.

“I showed up on my own flight, and went there unannounced. Then he saw me, embraced me, there were bunch of cameras around us. Fat Joe sent his people to bring me backstage, they interviewed me, and then they said man, we’re going to put you on stage.”

“That’s when I told Fat Joe, I said, my whole life is changing man, we should make this into an NFT.”

“That’s when I told Fat Joe, I said, my whole life is changing man, we should make this into an NFT.”

Even-Esh has had impressive bouts in the music industry prior to this event, which are what he hopes to build upon when he mints NFTs out of his experiences. His website mentions collaborations with rappers like Matisyahu and Rza, and even a tour with Wu Tang Clan. According to Spotify, Kosha Dillz has almost 16,000 monthly listeners on their platform.

Even-Esh has long taken interest in the crypto space, and talked extensively about what NFTs and blockchain technology mean to communities like his who are trying to make a name for themselves while also trying to pay their bills.

“With NFTs, you can mint a moment. There’s so much stuff that happens. That could be a whole series of NFTs, moments that weren’t documented that offend people, or moments of people [that are] in trouble, that could be a thing,” said Even-Esh.

“Moments where great rap music happened but no one ever saw— these could be NFTs.”

Even-Esh appears to be hoping to turn these his minted life experiences into a revenue stream. He claims that all of the places he has been to along with the people he has met create value for potential buyers. “I’m looking to mint more of my experiences because I think my experiences are gold. I have golden life experience.”

Whether it is the NFTs or his music that takes off, the exposure that the moment with Fat Joe gave Even-Esh has set his life on a new path.

He shared his advice to others after appearing to be inspired by the publicity he has received. “Someone told me there’s a million dollars out there for everybody. You have to seek it, go out, and find it.”

The timetable on the minting of his experiences is still undetermined, but that is only because of the amount of attention he has gotten, and the more opportunities that have come his way.

“I’ve been approached by a lot of record deals. Lawyers, agents, major companies, you know that’s what I’m trying to do, investors to take my thing to the next level and sell my story. My job is to tell my story.”

Winner of Broker NFT Made Unusual Request

November 4, 2021One winner of The Broker NFT Giveaway Raffle made an unusual request shortly after we aired his name.

The prize was supposed to be one of the ten Broker NFTs, but Josh Feinberg, who is the CEO of Everlasting Capital, inquired about the private mints, which were not up for grabs, but had been displayed in some of our NFT livestreams.

The prize was supposed to be one of the ten Broker NFTs, but Josh Feinberg, who is the CEO of Everlasting Capital, inquired about the private mints, which were not up for grabs, but had been displayed in some of our NFT livestreams.

He asked about token #3, which was, ironically, the NFT of myself that I had hand-autographed in photoshop and hand-minted via our own ethereum smart contract.

Upon discovering that his selection had not been made in jest, the decision was made to authorize the transfer of it to his ethereum wallet. Unusual (and flattering) as it was, I am honored that he wanted it.

Robinhood Posts Rough Q3

October 26, 2021 Robinhood revealed a steep $1.3B loss on Tuesday. Thought it was highly attributable to share-based compensation, several areas of their growth went into reverse. Transaction-based revenues, for example, were only $267M in Q3, a sharp drop from the $451M in Q2.

Robinhood revealed a steep $1.3B loss on Tuesday. Thought it was highly attributable to share-based compensation, several areas of their growth went into reverse. Transaction-based revenues, for example, were only $267M in Q3, a sharp drop from the $451M in Q2.

That’s not all. Assets Under Custody, Average Revenue Per User, and Monthly Active Users all shrank as well.

“This quarter was about developing more products and services for our customers, including crypto wallets,” said Vlad Tenev, CEO and Co-Founder of Robinhood Markets, in the company’s official statement. “More than one million people have joined our crypto wallets waitlist to date. With 24/7 live phone support, we believe that Robinhood is becoming the most trusted and intuitive platform for retail and crypto investors. And looking ahead, we’re committed to delivering tax-advantaged retirement accounts to help everyone invest for the long term.”