Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.

Articles by Sean Murray

With Trump and Co. Now in Control, Has The CFPB Made a Costly Mistake?

November 11, 2016 For years, the CFPB has rejected all calls by republicans (and even some democrats) to reconfigure its one-director leadership to a multi-member commission. At present, Director Richard Cordray has full authority to create the rules and enforce the rules and reports to no one, not even the President of the United States. As the only executive agency with significant authority to operate in this manner, critics have become increasingly worried the CFPB might abuse its power. And just last month, the agency was accused to have actually done so.

For years, the CFPB has rejected all calls by republicans (and even some democrats) to reconfigure its one-director leadership to a multi-member commission. At present, Director Richard Cordray has full authority to create the rules and enforce the rules and reports to no one, not even the President of the United States. As the only executive agency with significant authority to operate in this manner, critics have become increasingly worried the CFPB might abuse its power. And just last month, the agency was accused to have actually done so.

In PHH Corp. v. CFPB, the CFPB was alleged to have made legal errors in their enforcement action against a mortgage lender, but more to the point, that the CFPB itself was unconstitutional. The United States Court of Appeals for the District of Columbia Circuit agreed in part, ruling the agency’s structure unconstitutional. The agency was ordered to cure the defect either by conceding its directorship to a multi-member commission or making its leader report directly to the President of the United States.

But the CFPB has refused to comply, arguing shortly thereafter in another case that the “decision was wrongly decided and is not likely to withstand further review,” amplifying fears that the agency had gone rogue and potentially become drunk with power.

Cordray, who has tried to assure critics that his agenda is merely meat and potatoes, now faces a new challenge, a Republican president and a Republican-controlled Congress, who may see this as their only opportunity to rein him in.

According to Bloomberg, sources contend that the CFPB’s and Democrats’ previous unwillingness to concede anything at all, now puts the entire agency itself in jeopardy. Cordray himself is at great risk of losing his job, the Huffington Post asserts.

Already there is chatter of firing Cordray on Trump’s first day in office either for cause as Dodd-Frank allows for, or simply at his own discretion, as the Appeals Court ruled would be acceptable.

Has the CFPB erred all this time?

The Remedy For a Bad Industry Decision?

November 9, 2016 A recent disappointing New York trial court decision concerning merchant cash advances has been making the rounds over the past few weeks and a few industry players have been asking if there is cause to be concerned. While the case will likely have little precedential value, it should serve as a reminder to all funders and ISOs in the industry to invest resources where they matter; on employee education, contract review, legal representation, and customer service.

A recent disappointing New York trial court decision concerning merchant cash advances has been making the rounds over the past few weeks and a few industry players have been asking if there is cause to be concerned. While the case will likely have little precedential value, it should serve as a reminder to all funders and ISOs in the industry to invest resources where they matter; on employee education, contract review, legal representation, and customer service.

Failures or breakdowns in these areas can lead to consequential events. With so many products being offered in the marketplace to small business owners today, it is of great importance to be educated on what they all are and how they work. Sales reps, underwriters, and other staff should know what’s in the language of the contracts and be able to articulate it accordingly.

A starting point, of course, is getting your certificate in Merchant Cash Advance Basics, the online tutorial that covers the differences between the purchases of future sales and loans. It is worthwhile even for industry veterans to take considering how much MCAs have evolved over the years.

We’ve also got a list of several industry attorneys on our website, none of whom pay to be there.

Of note for contracts and legal compliance is Hudson Cook, LLP, who actually created the MCA Basics course.

Of note for litigation concerning the validity or enforcement of contracts in New York courts, is Christopher Murray of Giuliano McDonnell and Perrone, LLP, whose experience includes the VIP Limo case and several others.

It helps to have a system in place to try and resolve conflicts with merchants before they escalate. But that job is made far easier when the contractual expectations of all parties is understood from the beginning.

What’s the takeaway from a case that has gone wrong? That you should work hard to do everything right.

Make Funding Great Again – Triumphant Trump Trumps Clinton In Big Upset

November 9, 2016

The signs were there, surveys showed, at least a few that deBanked made reference to back in August. Small business owners felt Trump had their best interests at heart by a 2 to 1 margin over those who felt that about Clinton, according to a Capify survey.

Taxes ranked among their biggest concerns, with 20% of business owners ranking taxes as the single most important problem facing their business, according to a survey conducted by the National Federation of Independent Business. And Trump was in tune to that.

“Under my plan, no American company will pay more than 15% of their business income in taxes,” Trump said in Detroit on August 8th. He’s also proposed a moratorium on new financial regulations.

But up on the hill, the chatter over the last few months among the political establishment, including republicans, has been one of uncertainty. No one has been able to ascertain for sure what Trump’s positions would actually be or what agenda he’d actually set. And this wildcard status is probably what helped him win the election in the first place.

On his website however, Trump says that “we will no longer regulate our companies and our jobs out of existence,” and that he’ll “issue a temporary moratorium on new agency regulations that are not compelled by Congress or public safety in order to give our American companies the certainty they need to reinvest in our community, get cash off of the sidelines, start hiring again, and expanding businesses.”

That may be good news for the fintech industry which has grown increasingly concerned and preoccupied with potential regulatory changes. One potential conflict could arise with the CFPB, however, which has argued that its own executive branch authority operates outside the scope of the President of the United States.

In October, the United States Court of Appeals for the District of Columbia Circuit, ruled that the CFPB’s power structure violated Article II of the Constitution.

It’s too early to tell what Trump will really do and we’ll likely learn more about his goals over the next few months. Until then, prepare to Make The Industry Great Again…

Merchant Cash Advances Are Not Loans – Take the Online Course to Learn Why (And Get a Certificate)

November 3, 2016

A New York Supreme Court decision in June was pretty deliberate when it said a purchase of future receivables was not a loan.

Essentially, usury laws are applicable only to loans or forbearances, and if the transaction is not a loan, there can be no usury. As onerous as a repayment requirement may be, it is not usurious if it does not constitute a loan or forbearance. The Agreement was for the purchase of future receivables in return for an upfront payment. The repayment was based upon a percentage of daily receipts, and the period over which such payment would take place was indeterminate. Plaintiff took the risk that there could be no daily receipts, and defendants took the risk that, if receipts were substantially greater than anticipated, repayment of the obligation could occur over an abbreviated period, with the sum over and above the amount advanced being more than 25%. The request for the Court to convert the Agreement to a loan, with interest in excess of 25%, would require unwarranted speculation, and would contradict the explicit terms of the sale of future receivables in accordance with the Merchant Agreement.

Lawyers around the country are pointing to this published decision and other similar ones as becoming the standard rule of law in New York State.

Finally, there are extracurricular steps you can take as a sales rep, underwriter, or other participant in the industry to educate yourself on what it means to buy future receivables at a discount versus a loan.

Finally, there are extracurricular steps you can take as a sales rep, underwriter, or other participant in the industry to educate yourself on what it means to buy future receivables at a discount versus a loan.

A new online course created by law firm Hudson Cook LLP, teaches the basic and unique characteristics of merchant cash advance contracts. New entrants and veterans alike can take the course and corresponding exams to brush up on the core fundamentals of MCA. Those that pass will receive a certificate of completion in “Merchant Cash Advance Basics” that is valid for two years. There are even video tutorials in case you don’t like to read.

Co-produced by deBanked as part of an effort to foster educational standards in the industry, the course just only recently went live. An educated sales force is no doubt integral to the success of the industry and the businesses it serves.

This in no way implies that company in-house training programs are currently insufficient. Instead, companies can use the course to supplement their own in-house training efforts with new hires or to test current employee education levels. More comprehensive versions of the course or new components of it may be developed in the future. We realize this can be evolved to cover more, but for now, it’s the basics.

Can YOU pass MCA Basics?

That’s a copy of my real certificate on the right (shrunken down to fit in this story). I got a perfect score.

Hosted on Counselor Library, you can sign up to purchase the course here.

Update 11/4: Link to the course in the story has been fixed: http://www.counselorlibrary.com/public/courses-mca.cfm

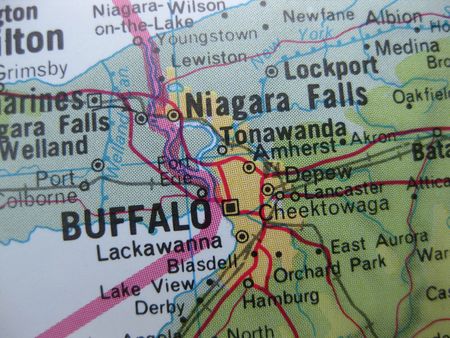

A GIANT BUFFALO ‘BILL’: Fake Debt Settlement Company Allegedly Defrauded Merchants, Business Lenders and MCA Companies Out of Lots of Cash

November 2, 2016

Several companies controlled by an alleged fraudster run out of western New York, promised merchants they could settle MCA agreements and alternative business loans for cheap.

Sergiy Bezrukov AKA John Butler AKA Thomas Paris AKA Christopher Riley was arrested last week after being charged with mail fraud. A joint investigation between the Department of Homeland Security, the IRS and the US Postal Inspection Service concluded that he scammed more than 100 victims and caused damages in excess of over $500,000.

“The victims and losses are the direct result of Bezrukov’s scheme involving the mailing of thousands of fraudulent solicitations to vulnerable small business owners, luring them into paying him for a service he never intended to provide, and resulting in hundreds of defaulted loans, worth hundreds of thousands of dollars,” an affidavit signed by Postal Inspector Clinton E. Homer states.

$400,000 in hidden cash was seized by investigators. The prosecution argued he was a great flight risk after it was discovered Bezrukov has dual Ukranian citizenship and that an identical copy of his US passport exists which he claims is missing and cannot forfeit. That combined with his propensity to use fake aliases resulted in his bail being denied and his being detained pending trial.

Bezrukov is currently being charged with mail fraud.

Bezrukov is currently being charged with mail fraud.

Records, surveillance and witness interviews confirmed that he paid to have 75,000 mailings sent out to advertise his service just between the first week of August and the first week of October 2016. Those services allegedly included an offer to reduce a small business owner’s short term debt by as much as 75% in just 6 to 12 hours.

One small business owner said that after signing up, they were directed to send an initial $1,250 to Corporate Restructure, Inc. via wire transfer. It was suspicious bank activity like this that would ultimately play a role in the scheme unraveling.

“The Postal Inspection Service received a referral from a fraud investigator for Citizens Banks related to multiple accounts with suspicious activity,” Federal Agent Homer wrote in his affidavit.

Bezrukov is alleged to have used over 30 different company names, numerous banks, post office boxes, UPS Store boxes, and employees in an effort to ensure the success of his scheme, and in an effort to hide his true identity and location of operations. Most of the locations were in upstate New York, specifically in Salamanca, Jamestown, Irving, West Seneca, Cheektowaga, Buffalo and Sanborn.

Two other individuals were also charged in connection with the activity, Mark Farnham of Buffalo and Dustin Walker of Salamanca. Farnham is referred to as the Vice President of Bezrukov’s company, Corporate Restructure, Inc., while Walker was the Chief of Security. They are alleged to have committed bank fraud. More than $125,000 was deposited in their accounts just between June 21st and August 12th of this year.

Bezrukov himself was no stranger to alternative business finance. Numerous complaints online date back to his role in a company known as SBC Telecom Consulting, a purported business funding company that was also referenced in the affidavit attached to the criminal complaint against him.

Even in that business, Bezrukov who went by alias John Butler at the time, was known for being outrageous. Last year, shortly before he ventured into the alleged debt settlement scheme, his company filed a $45 million lawsuit against a former sales rep for among other similar claims, allegedly violating a non-compete agreement.

The Buffalo News reports that Bezrukov is being represented in his criminal case by Scott F. Riordan, who declined to comment on the allegations.

Letter From The Editor – Nov/Dec 2016

November 1, 20162016 didn’t produce the robots, laser beams and interplanetary colonization I jokingly predicted in the final issue of last year. Instead, the year was rife with terrestrial matters like profitability, sustainability, legal compliance and adjusted expectations. The advances made in financial technology revealed their vulnerabilities and in some cases, their mortalities. But those still standing at the end of 2016 may be better prepared for the future than when they started. Change, in whatever form it may take, can be good.

You need not look further than Mark Cerminaro, the chief revenue officer of RapidAdvance who once aspired to play football in the NFL. Change came for him in several forms, from a sports injury to a harrowing experience in the World Trade Center on 9/11. Today, he’s a major mover and shaker in alternative finance, having made it on the Commercial Finance Association’s 2016 “40 under 40” list of achievers. In this issue, you’ll learn more about Mark and his rapid advance with RapidAdvance.

Change for another fellow came at a more significant cost. In October, an MCA broker turned-debt negotiator was arrested and charged with mail fraud. It’s alleged those debts he offered to negotiate didn’t actually get negotiated and he left a trail of damaged merchants and funders in his wake as a result. But that’s just the tip of the iceberg, you’ll learn, as the scheme descended into a legal war that involved Native American tribes, fake names and phony lawyers. It’s a side of the story that even federal agents left alone.

Change was also once promised by a man known as Senator Barack Obama, many years ago. Did he accomplish it? One thing for certain is that a bigger change, a “yuuge” change even, is coming in the form of a President Donald Trump. He has pledged to repeal and replace Dodd Frank, a bold intention made by an even bolder man. Trump is the curveball that breaks predictive models, a force that could be really good or really bad. Most of the advances in fintech have only known a world in which Obama is President. Is the industry ready for Trump?

It’s difficult to project what will happen in 2017, but in this issue, funders bid adieu to 2016. See you next year.

Smile, Dial and Trial? Why the Next Call Might be Your Worst Nightmare

October 26, 2016

Aaron Smith sued a merchant cash advance company in the United States District Court of Southern California earlier this year for allegedly making unsolicited calls to his personal cell phone registered on the Do-Not-Call list. His name has been changed for this story because he’s a vexatious litigator, even landing on an official list of vexatious litigants by the State of California in the early 2000s thanks to his tendency to file harassing lawsuits. But that’s not all, Smith has a criminal history that includes stalking and extortion and he’s served time in prison for his role in a multi-million dollar mortgage fraud RICO conspiracy.

These days he’s suing small business financing companies for alleged violating phone calls, at least five of which we could identify through San Diego court records just over the last several months. Two of the suits appeared while we were researching this story, which means that there could probably be even more by the time that you are reading this.

Smith presumably runs a business as his website has and still continues to advertise services to consumers. But if you are not an existing customer or have not been referred by an existing customer, his website warns that attempting to contact him by any means is a violation. Suffice to say that deBanked did not attempt to contact Smith to get his side of the story.

In one complaint, Smith claims that the phone number receiving the unsolicited calls is a “private personal cellular telephone.” To his credit, a cursory glance of his business website does not appear to list any phone number for it at all. However, the Internet Archive Wayback Machine which allows users to see archived versions of web pages across time, revealed that very same phone number being prominently displayed on his business website for several years including up to as recent as September, 2015, after which it was removed. There’s reason then to question if Smith might be up to no good.

While the merits of Smith’s claims will be up to the courts to decide, his background doesn’t inspire confidence. Countless other plaintiffs using the Telephone Consumer Protection Act (TCPA) to file lawsuits have colorful backgrounds in their own right, a lot of which can be found using Google. But a suggestion relayed by some of our readers is that plaintiffs appear to be doing what they do for profit, not because they have been harmed by the calls they allegedly receive. deBanked decided to conduct its own independent research on this issue.

SUING FOR PROFIT?

That’s just what the headline of a WDSU TV story alluded to in its coverage in 2004 of a stay-at-home Pennsylvania dad named Stewart Abramson. Titled, Man Who Turns Table On Telemarketers Turns Profit, Too, quotes Abramson as saying, “First, I’ll write them all and tell them that I’m willing to settle for the minimum statutory damages per call, which is $500, but if they don’t want to settle, then I’ll file a civil complaint.”

In a case he won against a debt consolidation firm for calling him with a prerecorded message, Abramson reportedly said, “It would have made sense for them to pay the minimum damages due me, but they wanted to put up a fight. I don’t mind. I’ll take more money.”

Abramson continued to say at the time that he felt empowered by Congress to stop this illegal activity and that he was just doing his part and making a little money for doing so. More than a decade later, Abramson’s name is still showing up as a plaintiff in TCPA cases, including in at least one complaint discovered by deBanked against a small business financing company.

Abramson continued to say at the time that he felt empowered by Congress to stop this illegal activity and that he was just doing his part and making a little money for doing so. More than a decade later, Abramson’s name is still showing up as a plaintiff in TCPA cases, including in at least one complaint discovered by deBanked against a small business financing company.

According to court records, the defendant contended that Abramson was “in the business of suing entities for violations of the TCPA,” an accusation the judge ruled irrelevant to the particular matter at hand.

Michael Goodman, a partner in the Washington DC office of law firm Hudson Cook, who was not asked about this case specifically, said in an emailed interview that generally accusing someone of being a serial plaintiff might not really help.

“Accusing a plaintiff of being a serial or professional TCPA plaintiff is unlikely to affect the outcome much, if at all,” Goodman said. “While there are outliers, the general rule is that the court will assess the merits of each case individually and will not ‘punish’ a plaintiff for being a serial or professional TCPA plaintiff.”

An email address for Abramson could not be located and given the special circumstances of his history, we did not attempt to call him.

If ever there was a TCPA celebrity however, it’d be Diana Mey, a self-described stay-at-home mom who started wrangling with telemarketers in 1998 after what her website described as “a series of intrusive telemarketing calls by a Sears affiliate pitching vinyl siding.”

She’s an important figure in TCPA history, not just because she’s been awarded millions through her lawsuits but also because she helped draft the FTC’s rules. Reports show her participating in FTC-hosted telemarketing forums in 2000 and 2002 and her name even appears in the footnotes of the FTC’s Telemarketing Sales Rule entered into the Federal Register in 2003. And so we followed Mey’s story online, noting that she has actually become famous for her pursuits, even appearing in a TV segment for ABC News in 2012. Her website at www.dianamey.com teaches others how they too can pursue monetary damages from telemarketers that engage in illegal practices.

“The first step is to write a formal ‘demand’ letter to the president of the company, stating that the letter is a formal claim for money […] for violations of the Telephone Consumer Protection Act of 1991,” her website advises.

It was quite a surprise then to discover that this Diana Mey was the same Diana Mey captioned as a plaintiff in a current case against a small business financing company. Almost two decades after her first experience, she is still filing lawsuits for alleged telemarketing violations.

Mey declined to respond to our questions even though they were not about that case, citing pending litigation.

“I’m a mom and I’m a housewife, and I’m an accidental activist,” Mey said in that 2012 ABC News interview. Others have referred to her as a “private attorneys general,” defined as someone who brings a lawsuit considered to be in the public interest.

That same title has been attributed to one Robert Braver who is the man behind www.do-not-call.com which launched in 1998 as “a consumer’s resource for stopping unsolicited telemarketing calls.” His comments appear in FCC records and he was also featured in a Dateline NBC special in 2002 about a new telemarketing scheme that was alarming consumers. Suffice to say Braver has been a consumer proponent in this area of the law for a long time, a role that has not come without risks.

According to Braver, the attorney for one telemarketer he sued, arranged to have his (then) elementary school age kids stalked and photographed, a terrifying ordeal that was only made worse after the attorney allegedly sent him a fax bragging about it. But he has continued on, noting that while he has gotten much fewer junk faxes, telemarketing calls have gotten more out of hand over time, to the point where they’re disruptive to everyday life.

“My wife is a middle school teacher,” Braver said. “She doesn’t work in the summer and gets home before I do when she is teaching. She typically leaves her phone in her purse in a spot in the kitchen and hangs out in in the den or back patio. It’s gotten so bad at times that when I need to call her, she doesn’t get up and run to look at her phone when it rings, and I have ignored unknown calls on my cell and let them go to voicemail, only to find out later that they were legit calls.”

And sometimes it’s a total mystery how they even get added to a list. “We have two teenage boys still at home, and they have cell phones too. Somehow my youngest son’s cell number got on a marketing list for student loan debt relief, and was getting 10-15 calls a day for a while,” Braver explained.

Contrast that with a story that appeared in the Dallas Observer in 2010 about one Craig Cunningham, another celebrity-like TCPA figure who still has active cases pending, public records reveal.

According to the story, Cunningham stays at home on a “dumpy couch” to wait for a particular type of phone call, “one from a representative of a debt collection agency or a credit card company, whom he’ll try to ensnare like a Venus fly trap,” the Observer reported. Cunningham is said to have learned his trade from online message boards, where we decided to look next to see if there was anyone out there indeed talking about TCPA lawsuits for profit.

On May 25, 2014, a participant using the pseudonym codename47 published a thread titled, TCPA enforcement for fun and for profit up to 3k per call on fatwallet.com, the exact kind of salacious headline that defendant companies have probably imagined in their worst nightmares. Codename47 has a big fan base it seems, with one user even suggesting to him that he should create and sell a “sue telemarketers” package so that people could do what he does for side income.

Codename47 is Craig Cunningham, who we reached out to with some questions through the fatwallet forum. He declined to answer them, citing pending litigation and the fact that he no longer does interviews.

One user on fatwallet in 2010 said of Cunningham, “It’s kind of hard to convince a Federal judge that you are a victim when you are trying to find a publisher for a book called CREDIT TERRORIST.”

WAIT, WHAT?

WAIT, WHAT?

It now being six years later, no such book can be found in Amazon or through Google. A link to where purported information on it once was leads to a page-not-found error. The Archive Wayback Machine however, produces an interesting find.

Tales Of A Debt Collection Terrorist: How I Beat the Credit Industry At Its Own Game and Made Big Money From the Beat Down is the title of a proposed book in 2010 by Craig Cunningham and Brian O’Connell. O’Connell is a writer/content producer for TheStreet.com and a well-known and widely published author. He tells deBanked that he wished he had written it with Cunningham but that they didn’t move forward with it.

But the proposal remains, including the description of Cunningham as being a highly sought after expert in the field of debt collection “revenge” industry.

Outside of fatwallet, the only other real mention of the proposed book could be found on a website called debtorboards.com. Lenders might find the website horrifying considering the forum’s tagline is “Sue Your Creditor and Win.” With more than 20,000 members and nearly 300,000 posts, the forum has an entire section dedicated to TCPA. Legal strategy is a dominant topic and it’s abundantly obvious that people are working together to stop companies from calling them.

Sadly, it’s not all innocent consumers out there. For example, the TCPA has invited abuse to the point where at least one person admitted to buying cell phones to maximize the chances of getting illegal calls so that they could sue. That’s what serial plaintiff Melody Stoops said in a June 2016 deposition as part of her case against Wells Fargo in the Western District of Pennsylvania.

Q. Why do you have so many cell phone numbers?

A. I have a business suing offenders of the TCPA business — or laws.Q. And when you say business, what do you mean by business?

A. It’s my business. It’s what I do.Q. So you’re specifically buying these cell phones in order to manufacture a TCPA? In order to bring a TCPA lawsuit?

A. Yeah.

Purchasing at least 35 phones, she even went so far as to register them with out-of-state area codes in places she thought were more economically depressed and therefore more likely to get violating calls. Stoops sent out so many pre-litigation demand letters and filed so many lawsuits that she could not be certain how many she sent out or how many suits she was in, according her to deposition.

Purchasing at least 35 phones, she even went so far as to register them with out-of-state area codes in places she thought were more economically depressed and therefore more likely to get violating calls. Stoops sent out so many pre-litigation demand letters and filed so many lawsuits that she could not be certain how many she sent out or how many suits she was in, according her to deposition.

Apparently Stoops found the line of legal perversion and crossed it. On June 24, 2016, the judge ruled in favor of Wells Fargo because she wasn’t injured by the calls she received, nor were the injuries she claimed within the “zone of interests” the law was meant to protect. “It is unfathomable that Congress considered a consumer who files TCPA actions as a business when it enacted the TCPA,” he wrote.

A TURNING POINT?

Hudson Cook law partner Michael Goodman said, “the impact of Stoops v. Wells Fargo is still to be determined, but I would say that it is significantly fact specific and therefore unlikely to result in large-scale changes in TCPA private actions. Stoops put a lot of effort into becoming a magnet for calls that could violate the TCPA. In many TCPA cases, consumers do not need to try that hard to receive a call that could prompt a TCPA suit.”

Stoops was pursuing calls while most of the advice and discussion uncovered online is about what to do if you get a call, not about how to create the calls in the first place. Even debtorboards, for example, is a registered non-profit, keeping consistent with its image as a consumer empowerment tool.

If the tide is turning though, it’s not in a direction favorable to telemarketers. Goodman said that “in July 2015, the FCC announced a new interpretation of the TCPA’s ‘autodialer’ standard that significantly expanded the definition and introduced a lot of unnecessary uncertainty as to what is and is not a regulated autodialer. That interpretation is currently being challenged in court. There’s a bit of a trend among courts requiring plaintiffs in autodialer cases to do more than simply allege that they were called with an autodialer. These courts, possibly in an effort to frustrate TCPA autodialer cases, are requiring plaintiffs to include circumstantial evidence of dialer use in their complaints: dead air, hang-up calls, generic messages, and so on. But the TCPA’s penalty structure still encourages suits that should not be brought.”

FCC Commissioner Ajit Pai, who was appointed by President Obama, voiced dissent to this new interpretation, echoing Goodman’s comments that it encourages frivolous suits.

An excerpt of Pai’s official dissent is below:

“Some lawyers go to ridiculous lengths to generate new TCPA business. They have asked family members, friends, and significant others to download calling, voicemail, and texting apps in order to sue the companies behind each app. Others have bought cheap, prepaid wireless phones so they can sue any business that calls them by accident. One man in California even hired staff to log every wrong-number call he received, issue demand letters to purported violators, and negotiate settlements. Only after he was the lead plaintiff in over 600 lawsuits did the courts finally agree that he was a “vexatious litigant.”

The common thread here is that in practice the TCPA has strayed far from its original purpose. And the FCC has the power to fix that. We could be taking aggressive enforcement action against those who violate the federal Do-Not-Call rules. We could be establishing a safe harbor so that carriers could block spoofed calls from overseas without fear of liability. And we could be shutting down the abusive lawsuits by closing the legal loopholes that trial lawyers have exploited to target legitimate communications between businesses and consumers.

Instead, the Order takes the opposite tack. Rather than focus on the illegal telemarketing calls that consumers really care about, the Order twists the law’s words even further to target useful communications between legitimate businesses and their customers. This Order will make abuse of the TCPA much, much easier. And the primary beneficiaries will be trial lawyers, not the American public.”

The FCC reviewed 19 individual petitions on the matter, some of which included relatively recent comments from the individuals we’ve mentioned so far. The appearance is that the FCC has collaborated with some individuals continuously over time or that individuals have collaborated continuously with the FCC. It might not matter though. Michael Goodman says that “the TCPA gives distinct enforcement rights to the FCC as well as persons who receive a call that violates the statute.”

“It isn’t really a matter of whether a particular violation should be handled by the FCC or privately,” Goodman adds. “Private plaintiffs have independent incentive to sue thanks to the TCPA’s penalty structure, and, compared to the FCC, private plaintiffs do not have to be as choosy in picking targets for actions.”

And what are the violations and penalties exactly? Goodman explained as follows:

“Depending on the specific TCPA provision at issue, private actions may be brought by individual consumers as well as businesses. The autodialer and prerecorded message provisions can be enforced by individuals and consumers, and they can sue based on a single improper call. For these provisions, the TCPA directs courts to award $500 per violation; courts do not have discretion to award a lesser figure. Courts do have discretion to award up to three times that amount (i.e., up to $1,500) per violation for willful or knowing violations. The TCPA’s do-not-call provisions are enforced by individual consumers, and this type of action requires more than one unlawful call in a 12-month period. For the do-not-call provisions, courts do have discretion to award less than $500 per violation (and can triple the penalty for willful or knowing violations).

The FCC has authority to obtain penalties of up to $16,000 per day of a continuing violation or per violation. FCC rules establish factors for the FCC to consider in calculating a proper penalty figure, including the nature of the violation, history of prior offenses, and ability to pay.”

“The base $500 per violation in statutory damages that consumers are entitled to hasn’t increased since the TCPA went into effect in 1992,” said activist Robert Braver. “This should be increased, especially since the TCPA does not allow for the recovery of attorney’s fees.”

Goodman said that private actions are much more common than FCC enforcement actions. That much is obvious. Private actions are becoming all too common in the small business financing industry where so many cases were uncovered through public records that we lacked the resources to follow them all.

More lawsuits might not be the cure though, according to Braver. He said that “more egregious telemarketing (massive robocall campaigns) should be criminalized on the federal level,” adding that “it’s one thing for an unscrupulous telemarketer to allow their shell corporation to have an uncollectible money judgment, but it’s another thing when individuals can wind up with a felony conviction on their records, and possible jail time.”

More lawsuits might not be the cure though, according to Braver. He said that “more egregious telemarketing (massive robocall campaigns) should be criminalized on the federal level,” adding that “it’s one thing for an unscrupulous telemarketer to allow their shell corporation to have an uncollectible money judgment, but it’s another thing when individuals can wind up with a felony conviction on their records, and possible jail time.”

While that suggestion might antagonize telemarketers, Braver said that his cell phone, which is listed on the Do-Not-Call-Registry, can receive as many as 4-5 telemarketing calls per day, generally robocalls.

Whether plaintiff allegations from cases in this industry are true or not, legal fees over TCPA cases have continued to be an expense that many small business financing companies are contending with. Those costs have a way of being tacked on to the price of financing for small businesses that need capital, making it a lose-lose situation.

One marketing company in the industry who had to remain anonymous because settlement negotiations at the time were likely to include a non-disclosure clause, posed the question, “how are you supposed to help small businesses if you can’t actually call small businesses?”

“More and more merchants are using their cell phone as their business phone,” he argued. “The TCPA regulations need to be changed so that a merchant can’t claim his cell phone is his business phone one minute and his personal phone the next.”

Indeed, the motivations, facts and alleged damages in TCPA complaints are not always clear. And even though the plaintiffs don’t always win, the laws as they are, can make telemarketing difficult no matter how careful one is.

Still dialing for dollars these days? Just know that some folks may be just a little too happy that you called them. And for all the wrong reasons.

Good luck out there.

Grandpa Breslow and What’s in the Deck for OnDeck

October 25, 2016At Money2020, Lendio CEO Brock Blake shared a joke that was made backstage about OnDeck’s CEO, Noah Breslow. “He’s the senior citizen of the industry,” he told a public audience, which referred to how long OnDeck has been around. It’s a label that Breslow lightheartedly embraced on an SMB lending panel he participated in on Tuesday morning.

Just a day earlier, deBanked met with executives from OnDeck, including Breslow to speak among other things, a collaborative initiative to codify business loan disclosures. APRs are among one metric they have recently agreed to display on their contracts, though in fairness they already did that on their line-of-credit product and on all of their loan products in Canada, the company asserted. While they don’t expect it will necessarily increase or reduce borrower interest, they believe that it may help a prospect make comparisons in what has become an increasingly competitive, yet fragmented market. “The use-case for the borrower isn’t changing,” Breslow said.

OnDeck will remain focused on small businesses as the customer and there are no plans to venture into mortgages or student loans like several of their counterparts in consumer lending. There’s also no plans to follow SoFi and integrate a dating feature into their mobile app. Instead their mobile app offers a frictionless experience for their existing line-of-credit customers to draw funds or make payments.

OnDeck will remain focused on small businesses as the customer and there are no plans to venture into mortgages or student loans like several of their counterparts in consumer lending. There’s also no plans to follow SoFi and integrate a dating feature into their mobile app. Instead their mobile app offers a frictionless experience for their existing line-of-credit customers to draw funds or make payments.

The JPMorgan Chase-OnDeck partnership is still in the “initial rollout,” according to Breslow, despite the deal being announced almost a year ago. Metrics such as the number of loans originated through the arrangement have not been disclosed, but for the record, it’s restricted to customers that are applying for a loan online, not those applying in person at a Chase branch.

On the SMB lending panel, Breslow and others asserted that their initiative to be more transparent is not about encouraging business lending to be regulated like consumer lending. “If we regulate commercial lending more like consumer, ultimately less capital is going to flow, when the goal should be to get more capital to flow,” he said. Wise words from an industry senior citizen.