Archive for 2020

Steve Denis Talks About SBFA Study: APR is a Bad Metric For SMB Loan Transparency

October 19, 2020 In response to regulatory bills in California and New York that will enforce APR disclosures on small business capital providers, the Small Business Finance Association (SBFA) funded a study by Kingsley-Kleimann to find out if APR is a good metric to use for business loans.

In response to regulatory bills in California and New York that will enforce APR disclosures on small business capital providers, the Small Business Finance Association (SBFA) funded a study by Kingsley-Kleimann to find out if APR is a good metric to use for business loans.

Steve Denis, the Executive director of the SBFA, said his group supported the study because the states should test concepts with actual small business owners before passing regulation. In the NY disclosure bill awaiting signature, Denis said there was no concept testing. Some of the companies that support the bill might not have even read what it stipulates.

“You have a group of companies that are pushing these types of disclosures, for no reason other than their own self-interest,” Denis said. “We’re fine with disclosure, we are all for transparency, but it needs to be done in a way that we believe is meaningful to small business owners.”

In qualitative testing of 24 small business owners and executives who have experience taking commercial loans, the study concluded participants did not understand what APR was. The study found that the total cost of financing model was a better way to understand and compare options for their use.

“As one participant, when asked to define APR, answered: ‘I feel like you are asking a kid, why is the sky blue?’ (Participant 3, NY).” The study concluded, “In other words, [APR] is ever-present yet also inscrutable.”

Kingsley-Kleimann is a research-based organization that studies communication and disclosure for government agencies like the FTC and private or public business. Participants were selected from Califonia and NY.

Denis said that the findings show what SMB lending companies have already known- Anual Percentage Rate is not a useful metric for short term loans. Many do not know that APR represents the annualized cost of funds for the loan term, with the fees and additional costs included.

“People don’t know what APR is; it confuses them,” Denis said. “They know it’s a metric they should use, but they don’t know why. The APR is such a marketing tool now, it’s not a valuable tool.”

The study showed most respondents thought APR was the same as an interest rate. It’s not.

Denis said using an annualized rate for shorter-term loans or SMB loans that have no ending date worsens the problems. In those cases, firms estimate an APR, and it is inaccurate.

Denis said using an annualized rate for shorter-term loans or SMB loans that have no ending date worsens the problems. In those cases, firms estimate an APR, and it is inaccurate.

“When you have a merchant cash advance, there’s no term,” Denis said. “So you have to estimate a term, and I mean that is just a recipe for fraud.”

Denis said that the firms supporting California SB1235 and the New York S 5470/A 10118-A disclosure bill and taking credit for writing the laws are the same companies that will suffer under the strict tolerance of an APR rule.

“The companies pushing this, the trade associations pushing it, they like to take credit for writing the bill in California and writing the bill in New York: I don’t even think they’ve read it,” Denis said. “It’s going to subject their own members to potentially millions if not hundreds of millions of dollars in potential liability [fines.]”

The SBFA is not against disclosure by any means, Denis said, but supported other avenues. The trade group believes knowing the total cost of a loan and the cost and timeline of payments will help protect and inform borrowers better than APR. Firms that support the disclosure bill are banking off the positive press, hoping to be seen as pro-consumer protections but forcing APR will make it harder to compare the actual value of loans, Denis said.

Denis is still optimistic that regulators will work with businesses affected by the incoming legislation. He said the NY legislature and governor’s office, as well as the California Department of Business Oversight, understand the problems of using APR.

“They’re receptive to these arguments, and they know what they’re doing,” Denis said. “The last thing they want to do is pass a bill that’s going to further confuse businesses, especially during a pandemic when businesses are relying on this capital to stay afloat.”

Greenbox Capital® Advocates For Fair Lending to Women- and Minority-owned Businesses in CFPB Panel

October 19, 2020Miami, FL: Greenbox Capital® announced it is serving as a Small Entity Representative (SER) to the Consumer Financial Protection Bureau (CFPB) that is responsible for amending the Equal Credit Opportunity Act (ECOA) protecting women-owned, minority-owned, and small businesses looking for financial assistance. Section 1071 of the Dodd-Frank Act amends the ECOA by requiring certain data be collected and submitted to the Bureau to protect these types of businesses.

“It’s an honor to be selected to the industry panel providing feedback on section 1071 of the Dodd-Frank Act ensuring fair lending laws to women- and minority-owned businesses”, said Greenbox Capital CEO Jordan Fein. “Over 2 million businesses across the U.S. are either women or minority owned and it’s vital they can secure funding as easily as non-minority owned businesses.”

Greenbox Capital, an alternative lender, serves small businesses in all industries across the United States, Puerto Rico, and Canada with the working capital needed to grow. Greenbox Capital is committed to supporting clear, secure, and fair financing solutions and is an active member of the Small Business Financial Association (SBFA).

For more information visit, www.greenboxcapital.com.

deBanked Meets The Kosher Guru

October 19, 2020In a crossover episode, deBanked president and chief editor Sean Murray had lunch with Kosher Guru at Reserve Cut in lower Manhattan. In it, they talked Kosher food, business funding, and more!

Keeping Up With Kabbage

October 17, 2020 On Friday, American Express announced that it had completed its acquisition of Kabbage.

On Friday, American Express announced that it had completed its acquisition of Kabbage.

“Kabbage, An American Express Company will continue to provide quick and easy cash flow management solutions for small businesses, now backed by the trust, service, and security of a American Express,” American Express wrote on social media. “We’re excited to welcome Kabbage’s talented colleagues to American Express. Together we will combine our over 60 years of experience backing small businesses with Kabbage’s innovative technology to support our customers through this challenging time, and help them get back on their feet and thrive.”

Meanwhile, below is a copy of a Q&A deBanked had with Kabbage co-founder Kathryn Petralia that appeared in our magazine’s July/August issue.

Q: How specifically do you think the pandemic will change the way SMEs bank?

A: The pandemic will first change with whom they bank, and that choice will change the way they bank. For perspective, one hundred percent of Kabbage customers have a bank account, but very few of them can get a loan from their bank. We launched Kabbage Checking earlier this year to serve the smallest of businesses without sacrificing the features they expect and offering other products banks don’t. We’re focused on making cash flow tools accessible to the businesses traditionally underserved and overlooked, and the pandemic has been a catalyst for businesses to find new solutions.

A: The pandemic will first change with whom they bank, and that choice will change the way they bank. For perspective, one hundred percent of Kabbage customers have a bank account, but very few of them can get a loan from their bank. We launched Kabbage Checking earlier this year to serve the smallest of businesses without sacrificing the features they expect and offering other products banks don’t. We’re focused on making cash flow tools accessible to the businesses traditionally underserved and overlooked, and the pandemic has been a catalyst for businesses to find new solutions.

Q: How might the dynamic of banking change after the crisis?

A: It was well-reported that businesses without an existing credit relationship with their bank were turned away from applying for PPP loans. We’ve heard directly from many of our PPP customers that this will compel them to change banks, and the demand for Kabbage Checking has reflected that sentiment since its launch. In the short term, businesses of all sizes and ages will seek out and sign up for new, tech-forward banking partners. In the long term, that shift will change customers’ expectations of what banks should offer. For example, prior to the PPP, Kabbage had issued well over a billion dollars to customers during non-banking hours. On-demand, 24/7 access to funding and cash flow insights, or faster settlements and money transfers will soon become commonplace, and large retail banks will need to adapt if they want to capture or reclaim these customers.

Q: How are these changes likely to impact alternative lenders and funders?

A: For starters, single-product lending companies will realize they must diversify their offerings in order to compete in the new financial-services marketplace. I would expect to see lenders launch new products to more resemble a bank. Conversely, traditional banks will need to begin adopting automated ways to serve customers with a tech-forward experience. Especially in the new normal where customers may be apprehensive about in-person banking meetings, they must adapt online to acquire and serve customers.

Q: What’s still needed to help Main Street recover?

A: The PPP was only the first phase; we’re not out of the woods yet. Businesses now need to restart and eventually grow. The crisis made business owners realize they need tighter controls over their cash flow, as many found themselves on the back foot and ill-equipped to withstand a long-term crisis such as the one through which we are all muddling.

They’ll need cash-flow tools to be more prudent and appropriately plan for similar events. Having said that, it’s not only on the shoulders of small businesses or tech solutions. They need customer demand, and local economies need to begin to reopen safely so consumers feel comfortable returning to normal commerce. That will take the support of cities and states encouraging consumers to shop local so small businesses have greater incentive to recall their employees and get back to work.

Q: How can alternative lenders and funders best play a role in this recovery?

A: Much of what we’re already doing is exactly what our economy needs. For the most part, fintech companies serve the customers banks won’t or can’t. That reality is unfortunately unchanged today. That’s why during the pandemic Kabbage made every effort possible to provide products that helped SMBs through this crisis. With respect to PPP, we helped nearly 300,000 small businesses access over $7 billion, helping preserve an estimated 945,000 jobs. Our payments product saw a near 4X spike in adoption as businesses sought contactless payment options. We built www.helpsmallbsuiness.com in three days to allow any small business to generate needed revenue by selling online gift certificates. We also launched Kabbage Checking, giving small businesses a new banking option, and Kabbage Insights remains available and free to access for any small business.

Q: What changes do you expect to see in the alternative lending and funding industry as a result of the pandemic?

A: Everyone will expand their services. Whether it’s larger companies expanding their solutions through acquisitions, or start-ups investing beyond their primary product, everyone will aim to enhance their offerings to give customers more data-driven products that help them rebuild.

Q: Kabbage just agreed to be purchased by American Express. Should we expect to see more consolidation in the alternative lending/funding space? If so, over what time frame and why do you expect this to happen?

A: I would not be surprised if we saw more deals announced before the end of the year.

Q: Tell us a little about why Kabbage decided to sell and why the timing was right?

A: For us, it has always been about finding the right company with the right mission and intentions. We just happened to be in the middle of a crisis when the conversations started, despite having the financial capacity to support operations for multiple years. American Express shares our vision to be an essential partner to small businesses, and we couldn’t be more excited at the opportunity to continue the important work of providing solutions and innovative capabilities that address a range of small business cash flow needs alongside AmEx.

SBA Simple $50k Forgiveness- Due Next Year

October 15, 2020 On Oct 2nd, the SBA finally released a simple forgiveness process for PPP loans under $50,000. Though many borrowers wanted forgiveness for all loans below $150,000, the under $50k bracket can fill out a one-page, front and back form.

On Oct 2nd, the SBA finally released a simple forgiveness process for PPP loans under $50,000. Though many borrowers wanted forgiveness for all loans below $150,000, the under $50k bracket can fill out a one-page, front and back form.

The SBA recently clarified in a FAQ section that borrowers do not need to submit the forms before the “expiration date” of 10/31/2020 that appears at the upper right corner.

According to the SBA, that expiration date was merely put there to comply with the 1980 Paperwork Reduction Act, which was intended to limit the amount of paperwork that government agencies can send to the public, and that as such it has no actual bearing on anything related to loan forgiveness.

To clarify, the SBA stated that borrowers can submit a forgiveness form at any time before the maturation of the loan, which is anywhere from two to five years from origination. But, loan payments will begin ten months after the borrowers “loan forgiveness covered period.”

DailyFunder Still #1 Small Business Finance Community

October 14, 2020 DailyFunder, the small business finance forum founded by Sean Murray in 2012, continues to be the leading online community for the industry, according to a recent announcement. The forum recently surpassed 10,000 registered members, in addition to logging more than 2 million page views just in 2020 so far.

DailyFunder, the small business finance forum founded by Sean Murray in 2012, continues to be the leading online community for the industry, according to a recent announcement. The forum recently surpassed 10,000 registered members, in addition to logging more than 2 million page views just in 2020 so far.

“The forum has attracted well over a million visitors since inception and users have historically spent longer than 10 minutes on the site in any given session on average,” Murray said.

deBanked’s parent company fully acquired DailyFunder earlier this year. The announcement was featured prominently in deBanked’s January/February 2020 magazine issue. In it, Murray renewed the website’s objective:

“The mission will be to create a great forum for those involved in day-to-day dealmaking,” he said in a Q&A. “How can we provide a platform that enables those in the industry to make more money? That’s the way I look at it. I think if we can provide that type of value, success will follow.”

Loans Canada Survey Shows Areas to Improve Online Lending

October 14, 2020 As part of the mission to find the best loan options, Loans Canada, a loan matching service, surveyed 1,477 people who have borrowed from online payday lenders. The goal was to look at the average person’s experience that gets an online or payday loan, and the respondents reported problems with the unregulated nature of payday lending.

As part of the mission to find the best loan options, Loans Canada, a loan matching service, surveyed 1,477 people who have borrowed from online payday lenders. The goal was to look at the average person’s experience that gets an online or payday loan, and the respondents reported problems with the unregulated nature of payday lending.

The sample was composed of “credit-constrained” individuals, with 76.2% reporting they had been rejected for a loan in the past year, and 61.5% reporting that they had a low credit score. The data shows that borrowers with poor credit will have to rely on alternative lenders, the survey outlined.

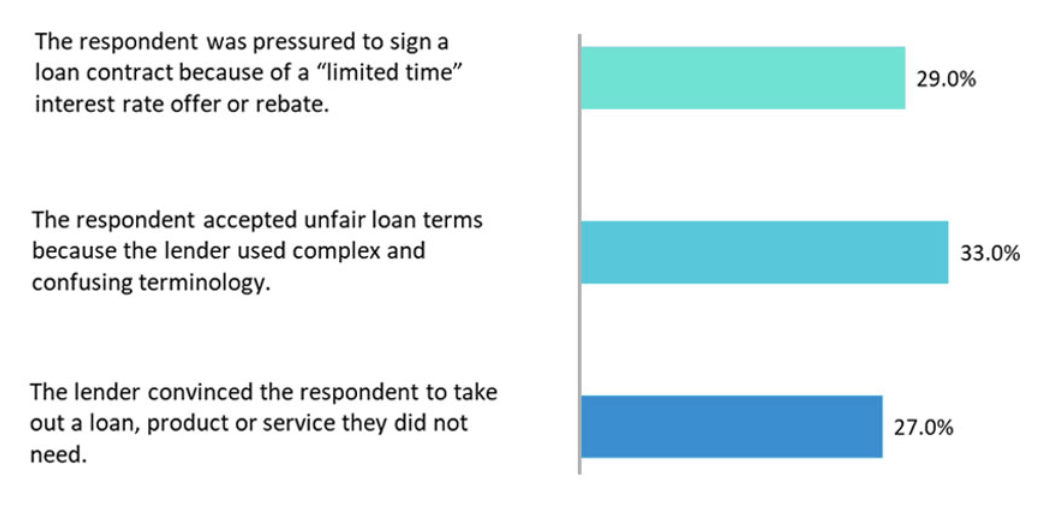

Of those surveyed, more than a fourth reported unfair, problematic lending and debt collecting practices. 33% of respondents said they accepted unfair loan terms because the lender used confusing language and 27% said they took a loan product or service they did not need, convinced by aggressive sales tactics.

Undisclosed and hidden fees were also reported as a problem. 22.4% of respondents said they were charged undisclosed fees while 32.8% were charged fees that “were hidden in the fine print.” 28% of respondents said they were charged without consent at all.

Borrowers faced issues with pre-authorized debits, an agreement where the borrower gives their bank permission to send money to the lender. 33.6% of respondents complained their lender debited their bank when asked not to do so, while 32.5% of respondents had to place a “stop payment” order on the lender.

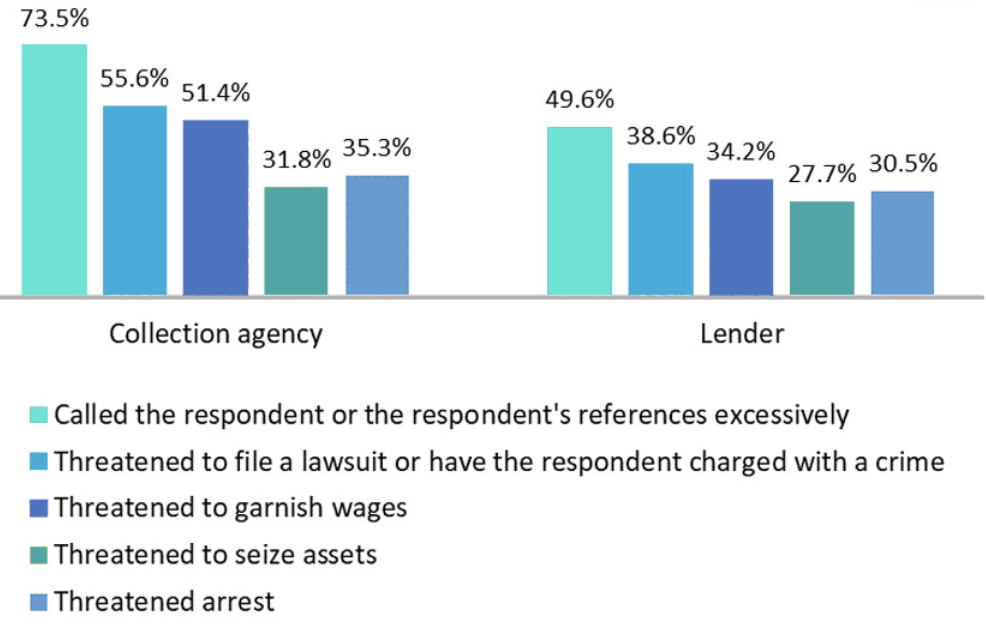

When it came to paying on time, only 21.9% of borrowers did not miss any payments. Of those who did, over a fourth experienced aggressive behavior from a lender.

Finally, 32.9% of people who took out an online or payday loan had their debt sold to a collection agency. The paper argues that Canada’s debt collection businesses have to follow different regulations in different provinces. Sometimes, debt collectors can rely on Canadians not knowing their local rights by using unethical intimidation techniques.

Of those that had their debt sent to agencies, 62.1% reported the agency misrepresented themselves when they contacted the borrower, sometimes as law enforcement or as a law office. 52.7% of respondents sent to collections received calls from an agency masked to hide their true identity.

Among lenders themselves, threats to garnish wages, seizing assets, and arrest were in the toolbox for collecting delinquent payments

Loans Canada hopes the information shows problems with online payday lending but highlights credit lines are a two-way street. As lenders need to be held to standards that aim to fix unfair practices, borrowers need to uphold their side of the agreement. Overborrowing is a one-way street to missing payments, leaving lenders little choice.

The Roosevelt Hotel is Closing Permanently Due to Pandemic Losses

October 13, 2020 After nearly a century of quintessential Manhatten hospitality, the Roosevelt Hotel is closing by the end of the month, sources say. A relic of classic New York that survived the Great Depression, WWII, and Broker Fair 2019, the hotel is officially shutting down for good after suffering pandemic related losses, a spokesperson said.

After nearly a century of quintessential Manhatten hospitality, the Roosevelt Hotel is closing by the end of the month, sources say. A relic of classic New York that survived the Great Depression, WWII, and Broker Fair 2019, the hotel is officially shutting down for good after suffering pandemic related losses, a spokesperson said.

“Due to the current, unprecedented environment and the continued uncertain impact from COVID-19, the owners of The Roosevelt Hotel have made the difficult decision to close the hotel, and the associates were notified this week,” the Spokesperson told CNN reporters Friday. “The iconic hotel, along with most of New York City, has experienced very low demand, and as a result, the hotel will cease operations before the end of the year. There are currently no plans for the building beyond the scheduled closing.”

The hotel will be added to the growing list of staple New York City businesses that have closed as a result of COVID. The Roosevelt was named and built to honor the United States’ 26th president and it opened its doors on September 22, 1924. Constructed during Prohibition, the building began the modern trend of featuring designer store windows on the street front.

Appearing as a backdrop for dozens of Hollywood blockbusters like Boiler Room, Malcolm X, and The Irishman, the hotel was iconic. The New Year’s Eve tradition of singing “Auld Lang Syne” was born at the Roosevelt in 1929 when Guy Lombardo and his orchestra broadcast the song live over the radio.

Appearing as a backdrop for dozens of Hollywood blockbusters like Boiler Room, Malcolm X, and The Irishman, the hotel was iconic. The New Year’s Eve tradition of singing “Auld Lang Syne” was born at the Roosevelt in 1929 when Guy Lombardo and his orchestra broadcast the song live over the radio.

The building was purchased by the limited investment branch of Pakistan International Airlines (PIA) in 1999.

In July, government officials and PIA executives debated the hotel’s future, some hoping rumors that President Trump would purchase the property were true. The initial plan was to sell or renovate the city block to create office space, thought to be far more lucrative than the hotel business in 2019. Work-from-home orders threw a wrench into the cogs, and the hotel kept losing money: no one wanted the traditional New York experience during a pandemic.

Posting a loss during this year has become expected of the hospitality industry. According to the Bureau of Labor Statistics, hospitality lost 7.5 million jobs due to shutdowns and travel restrictions in April. CNN reported that only half as many jobs had been added back. In September, NYC hotels were below 40% occupancy.

Posting a loss during this year has become expected of the hospitality industry. According to the Bureau of Labor Statistics, hospitality lost 7.5 million jobs due to shutdowns and travel restrictions in April. CNN reported that only half as many jobs had been added back. In September, NYC hotels were below 40% occupancy.

The decision to ultimately close The Roosevelt might also come from trouble in PIA’s airline business. After the crash of PIA flight 8303 that killed 97 people in Havelian, Pakistan, European and US regulators banned flights from PIA for six months. After the crash, nearly one-third of airplane licenses in Pakistan were found to be fraudulent or forged, further straining the organization’s ability to recover.

Though this may have contributed to The Roosevelt’s closure, the pandemic sealed the deal. According to a study by the American Hotel & Lodging Association, New York has 2,336 hotels statewide that have lost 43,014 jobs this year.

Without further congressional aid, 1,565 hotels might close: the AHLA found that 74% of overall US hotels say more layoffs are coming if the industry doesn’t get additional federal assistance. But successful talks for more aid in the House and Senate are increasingly unlikely due to this election year’s heightened partisanship.

Without further congressional aid, 1,565 hotels might close: the AHLA found that 74% of overall US hotels say more layoffs are coming if the industry doesn’t get additional federal assistance. But successful talks for more aid in the House and Senate are increasingly unlikely due to this election year’s heightened partisanship.

NYC is losing yet another historical business, as the way of life and all things we have come to expect from the big apple struggle to survive. As a destination venue, The Roosevelt was also dear to deBanked. It was the home of Broker Fair 2019, where Sean Murray spoke in the same ballroom that Michel Douglas (as Gorden Gekko) made the famous “Greed is Good” speech as part of the 1987 film Wall Street. Murray made a similar speech but rewrote it to fit the industry that had gathered. “Funding small business, for lack of a better phrase, is good,” he said on stage to an audience of 700 people.

Unfortunately, it was The Roosevelt that ultimately needed funding and didn’t get it.