Archive for 2017

Alternative Lenders Spread Their Wings Internationally

June 20, 2017 As alternative lending gains global traction, a growing number of U.S-based alternative lenders are exploring international growth, with large companies like OnDeck, Kabbage and SoFi leading the way.

As alternative lending gains global traction, a growing number of U.S-based alternative lenders are exploring international growth, with large companies like OnDeck, Kabbage and SoFi leading the way.

Some alternative lenders have begun their expedition closer to home by extending their reach into Canada. Others are traveling farther beyond to parts of Europe and Australia, for example, while others are eying eventual growth in Asia.

Propelling the opportunity is the fact that a number of international banks are still unprepared to offer online lending on their own and thus are more amenable to partnerships with U.S.-based alternative lenders, according to Rashmi Singh, senior manager in the wealth management practice at EY.

It also helps that the options for local partners are somewhat limited. “There are not a lot of digital lenders [outside the U.S.] at the same level as some of the folks here,” Singh says.

To be sure, international expansion requires extensive time, money and regulatory know-how, and some U.S. alternative lenders may never reach the critical scale to be able to compete effectively. Nonetheless, as globalization proliferates, industry observers expect that additional forward-thinking companies will push beyond the limits of their current geographical borders.

“The question is not if, but when (and where) U.S. fintech companies will expand internationally,” contends Ryan Metcalf, chief of staff and director of international markets at Affirm, a San Francisco-based fintech that has partnered with Cross River Bank of Fort Lee, New Jersey, to allow shoppers pay for purchases over time with simple-interest loans.

Affirm—which works with more than 900 retailers and recently announced that it had processed its 1 millionth consumer installment loan—has focused on domestic growth so far, but the company is now considering a number of options for international expansion, Metcalf says.

SIZING UP THE MARKET

Certainly, there are numerous opportunities for homegrown lenders to expand internationally given the healthy growth alternative lending is experiencing in other parts of the world. Each market, of course, has its nuances and individual growth patterns.

Europe, for instance, has seen substantial growth over the past few years, with the U.K. leading the way in alternative finance. It has four times higher volumes in aggregate than the rest of Continental Europe, according to a 2016 report from KPMG and TWINO, one of the largest marketplace lending platforms in Europe. (P2P consumer lending is the largest component of alternative online lending in Europe, capturing 72 percent of the total in the first through third quarters of 2016, according to the report.)

After the U.K., France, Germany and the Netherlands are the top three countries for online alternative finance by market volume in Europe, according to a September 2016 report by the Cambridge Centre for Alternative Finance.

Asian markets, meanwhile, show significant promise for alternative finance players to make their mark due to the sizeable population of digitally savvy consumers who are still largely underbanked. China is by far the largest market for alternative lending in Asia. It’s also the world’s largest online alternative finance market by transaction volume, registering $101.7 billion in 2015, according to the March 2016 Cambridge Centre for Alternative Finance report. This constitutes almost 99 percent of the total volume in the Asia-Pacific region, the research shows. To date, most of the growth in China specifically has been from local firms, but that could change as the market there continues to develop.

Although there are many possible international markets to explore, U.S. lenders have to tread carefully before planting roots elsewhere, observers say. Some smaller U.S. lenders may find domestic expansion easier and more cost-effective because of the time, regulatory and financial commitment that goes along with exploring international markets. It’s a lot easier, for instance, to expand from New York to California, than it is to build out internationally.

Although there are many possible international markets to explore, U.S. lenders have to tread carefully before planting roots elsewhere, observers say. Some smaller U.S. lenders may find domestic expansion easier and more cost-effective because of the time, regulatory and financial commitment that goes along with exploring international markets. It’s a lot easier, for instance, to expand from New York to California, than it is to build out internationally.

“Why take on all the added costs and regulatory pressures, when you haven’t fully explored your home market, unless the business that you’re in deems it necessary,” says Mark Abrams, partner with Trade Finance Global, a London-based international corporate finance house, specializing in crossborder trade.

“It doesn’t make sense to start as a U.S. lender, do a few loans and then jump over to the U.K,” he contends.

What’s more, foreign banks looking for alternative lending partners typically prefer to work with larger, more established players. Even though new players’ technology may be ahead of the curve, the banks still want a longer track record. “It’s reputational for these banks,” says Singh of EY.

MANY CHALLENGES TO INTERNATIONAL EXPANSION

Several alternative lenders say they see significant growth opportunities by expanding internationally. At the same time, however, they are mindful of the substantial headwinds they face.

Regulation is among the biggest, if not the biggest, challenge. A lot of firms in the U.S. have invested a lot of time and money to get up to speed on U.S. regulations. When they look to Europe or to Canada or Mexico or elsewhere, there are different regulations. “If you’re speaking to folks in three continents, now you are looking at regulations times three,” says Singh of EY.

Certainly there’s a time commitment involved; it can take six to eight months for a U.S. lender to get their U.S.–based platforms compliant with regulations in another country, she says.

What’s more, regulatory barriers can vary greatly country to country, notes Metcalf of Affirm. Take Canada for example where very low barriers to entry exist with some provincial exceptions. In the U.K., on the other hand, it can take eight months or more to receive a lending license, he says.

That’s why it’s so important for online lenders to make strategic decisions about where they want to invest their time and resources—even if they have sound technology that’s easily adaptable outside the U.S. “The minute you throw in cross-border regulations, it gets very complicated,” Singh says.

Understanding the local culture of the market you’re trying to tap is also crucial, according to Rob Young, senior vice president of international at OnDeck, where he oversees all aspects of the company’s non-U.S. expansion efforts.

Within the past several years, OnDeck has begun offering small business loans to customers in Canada and Australia. Frequently Canada is a first step for U.S. companies that want to expand internationally because of the shared language and similarities between the economies, Young explains.

After the Canadian operation was successfully underway, the opportunity arose for the online lender to expand to Australia—which shares several similarities with the Canadian market. OnDeck doesn’t break out how much of its overall loan portfolio comes from these two markets, but it has announced publicly that it’s delivered more than CAD$50 million in financing to Canadian small businesses since 2014.

“So far we’re very satisfied with the performance,” Young says, referring to its expansion into both Canada and Australia.

Young notes that while a U.S.-based alternative lender can leverage certain things like technology from a central location within its home country, having dedicated teams on the ground in local markets is also critical. Marketing and pricing all have to be competitive with the needs of the local market, he says.

In Canada and Australia, for example, OnDeck has found that the “personal element” is really important. Young says customers there expect to interact with sales representatives who have ties to the community, understand the local market and can relate to the issues small businesses there are facing.

“I don’t think you can establish that rapport if you are trying to serve them with a sales team overseas,” he says.

U.S.-based alternative lenders also need to be careful to create products that fit the culture and needs of a particular market. For instance, alternative players that focus on luxury asset-based lending would want to look at countries with high concentrations of wealth. “It doesn’t make sense to grow to a country where there’s very little wealth because you’re not going to have much success,” says Abrams, of Trade Finance Global.

Even knowing the market well doesn’t guarantee results, which Lending Technologies, a white label technology provider for the MCA space, has discovered first hand.

Markus Schneider, the company’s chief executive, is originally from Switzerland and he knows the market there well, so he set out to fill a void he saw for an MCA-like product. However, Lending Technologies, which has offices in New York and Zurich, has hit some roadblocks along the way.

“It’s a very different mind-set there. People are more risk-adverse,” Schneider says.

The company already has a Swiss distribution partner in place, but has had trouble finding a lender willing to underwrite the funds. Schneider would also be willing to work with a U.S. lender that wants to partner with Lending Technologies to provide MCA services to merchants in his home country.

“We’re going to do this. It’s just a matter of time,” he says. “There’s a tremendously underserved segment of the market there.”

FINDING THE RIGHT FIT

To be successful internationally, U.S. companies also have to be willing to shift gears as needed when things aren’t working out as expected.

Take Kabbage, for example. The small business lender expanded into the U.K. in 2013, two years after its U.S. debut. But the company found that having its own small business lending business in the U.K. was too challenging for regulatory and capital reasons. It no longer offers new loans from this platform.

Instead, the funding company decided that a better global strategy was to license its technology to financial institutions in international markets a less capital-intensive, yet economically sound way of doing business.

Kabbage—which recently announced the establishment of its European headquarters in Ireland—has licensing arrangements with Santander in the U.K., Kikka Capital in Australia, Scotiabank in Canada and Mexico and ING in Spain. The company plans to launch operations in several additional countries this year where banks use Kabbage’s technology to offer online loans to their clients, says Pete Steger, head of business development at Kabbage.

“We are partnering with local experts. That’s our strategy,” Steger says.

Funding Circle has also made changes to its international strategy. Earlier this year, the company—which got its start in the U.K.—announced that it would stop issuing new loans in Spain. The Spanish version of the company’s website says that it continues to monitor ongoing loans so investors receive monthly payments for the projects they have invested in.

A spokeswoman for Funding Circle said the company continues “to look at new geographies, but we have no immediate plans for expansion and are focused on building a successful business here in the U.S., U.K., Germany and the Netherlands.” She declined to comment further.

Without divulging too many details, a handful of U.S.-based alternative financiers say they continue to look at additional markets outside their home turf.

For its part, SoFi has announced plans to expand to Australia and Canada this year. The company’s chief executive has also talked about European and Asian expansion in the future.

On the international front, Affirm is currently evaluating markets that make the most sense for its business model, Metcalf says. Affirm is also looking at possible acquisitions in developed markets such as the U.K. and Sweden as well as considering “serious investment” in new distribution models in southeast Asia, Mexico and Brazil, he says.

LendingClub, meanwhile, last November announced a significant partnership with National Bank of Canada and its U.S. subsidiary Credigy. The agreement provides for Credigy to invest up to $1.3 billion over the subsequent twelve months. A spokeswoman for LendingClub said the company has nothing to share about plans for international expansion.

As for OnDeck, Young says the company is exploring a number of options; it’s a matter of finding markets where gaps exist in small business lending and where potential customers have a willingness to borrow online.

“We want to be the preferred choice for small businesses. It’s not necessarily defined geographically,” Young says. “We review markets all the time. There are a number of markets that are interesting to us.”

Déjà Vu: Some Small Business Funders are Fading Away

June 20, 2017 Apparently I’m old enough to see this happening all over again. A handful of big names in the alternative small business space are faltering and many of you have asked what this means for the industry. It really doesn’t mean anything other than those who do not learn history are doomed to repeat it.

Apparently I’m old enough to see this happening all over again. A handful of big names in the alternative small business space are faltering and many of you have asked what this means for the industry. It really doesn’t mean anything other than those who do not learn history are doomed to repeat it.

We already went through this in 2008-2009 when at least half of the funders in the merchant cash advance industry were wiped out over the course of several months. Merit Capital Advance, Fast Capital, First Funds, Summit, and Global Swift Funding were the Goliaths of their time. Those companies going out of business seemed unthinkable in principle and for what that would mean for the industry as a whole. Smaller players disappeared too, names like iFunds, Infinicap, and others for those of you who might remember.

Those companies failed. The industry continued.

While it’s easy to finger the financial crisis as the culprit for their demise, the truth, or at least the truth through the fog of war and days gone by, is a lot more relatable. Funders were undone by their dependence on a single source of capital, sloppy underwriting, defaults, rogue ISOs, a race to hit origination targets, overpaying commissions, misplaced predictions, and even stacking. If any of those things remind you of what’s happening today, well then of course there are companies failing.

One lesson from the past is that you won’t necessarily get a year or two to adjust and figure things out. It will seem like everything is great and then suddenly it’s not. No company is going to sit you down and tell you their 1-2 year going-out-of-business plan to prepare you for change. They probably don’t have any such plan, will fight to avoid it and their end may be just as much a shock to themselves as it is to everyone else.

What we’re learning again this time is that some business models just won’t pan out long term. And some business models that used to work no longer work so much today. Things like stacking are not going away. It’s not illegal and no legal precedent has been established against it. If you’re an ISO though, you may be risking a relationship or breaching your own ISO contract by helping a merchant engage in it. So it’s a slippery slope but one that has permanently disrupted the landscape.

I have heard a lot of complaints from ISOs about the supposed decay of funder loyalty, as in they feel their deals are getting swiped. Another lesson from 2008 is that in times of strain, parties are more likely to look to their contracts for guidance and if the contract says they can take your deal after a certain amount of time and they very much financially need to, they probably will do it. The whole hey, we’re friends, we wouldn’t do that kind of thing goes out the window if survival is at stake and the contract allows for certain actions. That also means that if you’re an ISO who has violated an ISO agreement before and got nothing but a shrug in the past, don’t be surprised if suddenly one day you’re put on notice of a breach and are forced to reckon with the consequences of it.

What failures in the industry may also mean is a return to a semblance of order, a return to a code. 2010-2011 was a refreshing time to be in the business with so much unhealthy competition out of the way even though approval terms were less flexible and there were fewer options to shop around for. By 2013 however, a flood of participants discovering the industry for the first time, believed that they had stumbled upon something brand new and lost were the lessons of yore. Some of them introduced lasting change, like ACH debits over merchant accounts splits. Others just replicated the cavalier tactics that had proved fatal in the previous generation, distorting a happy market equilibrium in the process.

Ultimately, the market will prevail, albeit with some new names and new faces at the top. This is the way of things. It has happened before. It will happen again. Look at the companies rising rather than those that are falling. Whatever they are doing may be the future, whether you agree with how they do business or not.

US Treasury Calls for Section 1071 to Be Repealed

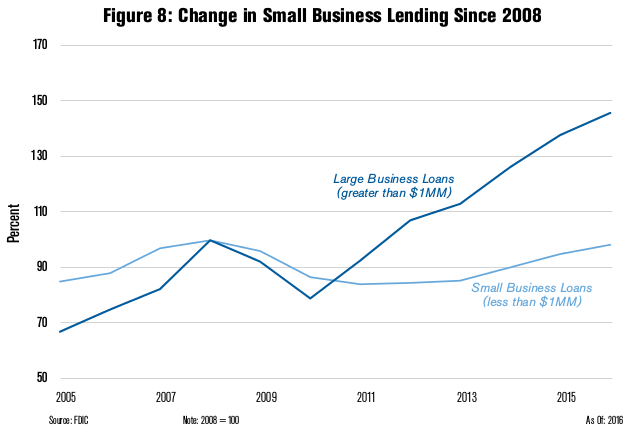

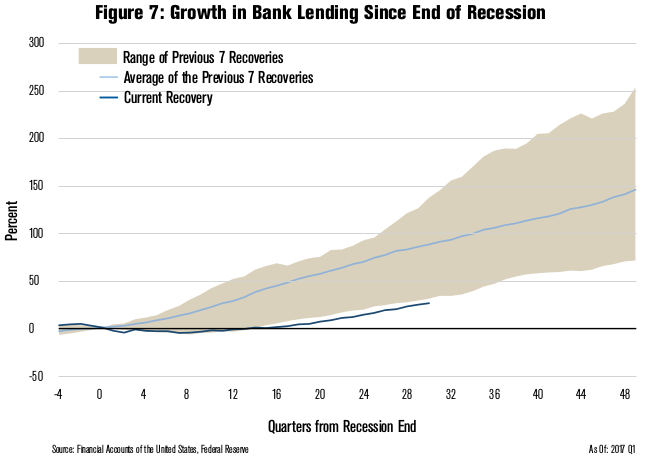

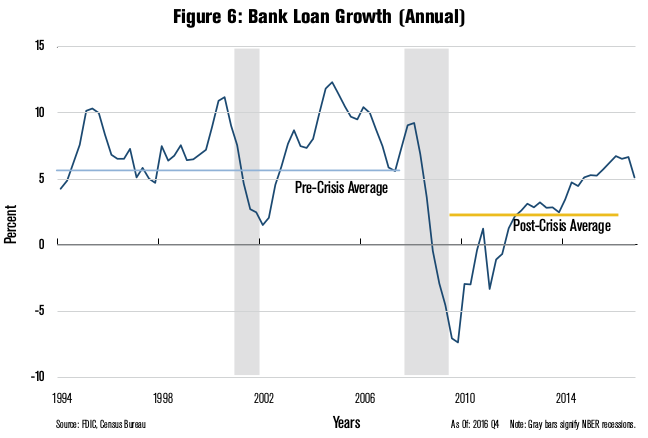

June 19, 2017In a 149-page report prepared for President Trump, the US Treasury has called for the repeal of Section 1071 of Dodd-Frank. Section 1071 is the governing law behind the CFPB’s jump into small business lending data collection. Citing the cost of data collection and anemic small business loan growth since 2008, the Treasury says, “Although financial institutions are not currently required to gather such information [required by the law], many lenders have expressed concern that this requirement will be costly to implement, will directly contribute to higher small business borrowing costs, and reduce access to small business loans.”

“THE PROVISIONS IN THIS SECTION OF DODD-FRANK PERTAINING TO SMALL BUSINESSES SHOULD BE REPEALED TO ENSURE THAT THE INTENDED BENEFITS DO NOT INADVERTENTLY REDUCE THE ABILITY OF SMALL BUSINESSES TO ACCESS CREDIT AT A REASONABLE COST” – US Treasury

The current deadline to reply to the CFPB’s Request For Information is July 14th though industry sources expect the deadline will be pushed back. Of course, if Section 1071 were successfully repealed, the RFI would be moot.

The Choice Act, a bill that just passed the House of Representatives, does indeed repeal Section 1071, but industry sources following the legislation believe the bill will die in the Senate.

Even if a repeal never happens, it is possible that regulations pursuant to Section 1071 may not even go into effect until the early 2020s if similar rulemaking trajectories are to be used as a guide. With payday lending, for example, the CFPB RFI on the matter ended in early 2012 but to-date there still has been no final rule.

The ‘Loan’ Star State – Texas is an alternative finance nexus

June 15, 2017

We’re at Able Lending in Austin, Texas, a financial technology company occupying three floors deep in the heart of the Seaholm power plant overlooking Lady Bird Lake. The fortress-like building anchors an inner-city complex of offices and residences, chic restaurants, boutique shops, and a Trader Joe’s.

Once the main source of electricity for Texas’s capital city, the natural gas-fired boilers have given way to a warren of glassed-in offices and meeting rooms connected by angular metallic stairways and a carpeted mezzanine.

It is here, in a tiny conference room, that Will Davis, a slim man of 35 and an alumnus of Harvard Business School, is drawing a bell curve on a whiteboard. Dressed for the balmy Texas weather in tan Bermuda shorts, a black tee-shirt and Nike running shoes, the company’s chief executive and co-founder is explaining how Able’s friends-and-family lending formula “widens” the risk curve.

“We all compete here in this box on price,” Davis says, drawing a square at the topmost point of the bell curve, indicating where the near-prime borrowers abide and where lenders are crowded in pursuit. But when loans from friends and family form 10%-15% of the total loan, he says, drawing squiggly lines just to the left of the box, a cohort with less-than-stellar credits now becomes credit-worthy.

Because of the “peer pressure” and “behavioral change” exerted by the involvement of family and friends, the formula produces a “positive-selection effect on the loan portfolio” Davis says, declaring: “We can serve more of the market.”

It all sounds very business-schoolish. But here’s the bottom line: Able’s lending model sharply reduces both risk and borrowing costs, allowing it to go head-to-head with national rivals like Funding Circle, Bond Street, OnDeck and StreetShares. Thanks in large part to its reduced risk, asserts Able’s director of development, 30-year-old Matt Irving, the Austin fintech can lend twice as much money as its competitors at half the interest rate.

Since opening its doors and firing up its computers in the fourth quarter of 2014, Able’s average loan size has climbed to $231,200 from $100,000. Of that, an average of 3.2 “backers” have accounted for $40,691, or 17.6% of the average total loan amount. The average “blended” annual percentage rate is 16.41%.

Meanwhile, Able, which has made some $48 million in loans to entrepreneurs through the end of April, 2017, reports CEO Davis, is itself on sound financial footing. According to the data-services firm Crunchbase, Able has raised $12.5 million in three rounds of venture capital financing from 21 investors. Principal equity financiers are Peter Thiel’s Founders Fund, Peterson Ventures, RPM Ventures, and Blumberg Capital. On Sept. 27, 2016, moreover, Able added another $100 million to its arsenal in debt financing from Community Investment Management, a San Francisco investment firm. Borrowers include owners of food trucks and apparel shops; professionals including doctors, dentists, veterinarians, and accountants; “creatives” like public relations and advertising firms; and construction companies. Since its inception, Davis says, just one borrower has defaulted, resulting in an $85,000 charge-off.

So far in 2017, the company has lent out nearly $15 million in the first quarter, but it’s on track to make $80 million this year. “We’re ramping up,” Davis declares.

Welcome to fintech in the Lone Star State. While everything may be bigger in Texas, as the saying goes, that’s not quite true of financial technology. The geographic contours of fintech operations are roughly 60% in California (especially Silicon Valley/San Francisco), 30% New York, and 10% scattered about the rest of the country, says 40-year-old Mihir Korke, the San Francisco-based chief marketing officer at Able.

Nonetheless, Texas offers fertile ground for the burgeoning fintech industry. The vaunted Texas business climate promises a relaxed regulatory regime, the absence of either a personal or corporate income tax, and a lower cost of living. All of which were cited by Able Lending, as well as an additional pair of fintech companies that specialize in factoring and merchant cash advances: Jet Capital, located in North Richland Hills in the Dallas-Fort Worth “metroplex”; and Ironwood Finance in Corpus Christi, a port city on the Gulf of Mexico.

“What’s interesting about fintech companies is that they can choose to locate where they want to do business,” says Erin Fonte, an attorney at Dykema Cox Smith in Austin whose legal practice includes mobile payments, mobile wallets and financial technology. “They don’t necessarily get a regulatory advantage because much of what they do is based on their customers’ location,” says Fonte, who is currently serving as a member of the Federal Reserve’s Faster Payments Taskforce. “That said,” she adds, “some companies have chosen to locate in Texas because of the labor and talent pool, because it’s a good source of venture capital, and it’s more affordable.”

Jet Capital’s 42-year-old chief executive, Kenneth Wardle, confirms many of Fonte’s observations. “So far, Texas has been friendly to MCA companies,” he says, using the initials for “merchant cash advance.” Especially favorable to his industry is the fact that “Texas regulators do not define an MCA as a loan,” he adds.

Prior to co-founding Jet Capital with chief operating officer Allan Thompson, 49, Wardle served as a portfolio manager at Exeter Finance Corp, a $3 billion company in nearby Irving which specializes in subprime auto financing. Wardle has also held leadership positions at AmeriCredit Corp., now GM Financial, and Drive Financial, now Santander Consumer USA.

His 20-year background has included the gritty work of repossessing cars when owners fell into arrears on their auto loans. “Most of my career in auto finance was in risk management and I’ve driven a repo truck,” he says. “You take off with the car right away and then chain it down after you’ve gone a couple of blocks so you don’t lose it out on the highway.”

Backed by more than $5 million in equity financing from a family office in Puerto Rico, Jet Capital makes cash advances of $25,000-$30,000, on average, for working capital.

The sweet spot for Jet’s financings are retail establishments, trucking companies, hair-and-nail spas, and medical doctors. Doctors in particular are prime candidates for a Jet cash advance. “They have a pretty good gap between when they perform services and when they get paid by insurance companies” during which they have to cover payroll expenses and overhead, Wardle notes. Prospecting for customers is done largely through independent sales offices, direct mail, and pay-per-click services offered by Google, among additional online channels.

“Our defaults are relatively in line with expectations” and were largely confined to the first year of business, Wardle says. “We made some underwriting and verification changes last September and October,” he adds, “and we changed our minimum credit scores. Since then we’ve seen defaults migrate in the right direction.”

Since Wardle and Thompson took occupancy of an empty office outside Fort Worth in October, 2015, Jet has grown to 12 employees who today have “a variety of roles” says Thompson, citing sales, underwriting, customer service, collections, analytics, and information technology. “They wear a lot of hats and there’s a lot of cross pollination,” he says.

Since Wardle and Thompson took occupancy of an empty office outside Fort Worth in October, 2015, Jet has grown to 12 employees who today have “a variety of roles” says Thompson, citing sales, underwriting, customer service, collections, analytics, and information technology. “They wear a lot of hats and there’s a lot of cross pollination,” he says.

Looking ahead, Wardle foresees Jet expanding its product line beyond merchant cash advances to offer lines of credit and installment loans. “Our goal is to be a one-stop, nonbank financing solution,” Wardle says.

Kevin Donahue, 37, owner of Ironwood bootstrapped the South Texas company, which opened in 2013 using personal savings of $1.5 million remaining from the sale of mobile home parks in South Dakota and Texas. He also plowed earnings into Ironwood from a subsequent job as a commercial loan broker.

Donahue, who grew up in a family of fishermen on the Oregon and California coasts and is a 2006 graduate of California Polytechnic State University at San Luis Obispo, says that he turn up in Corpus Christi somewhat by accident. While operating the mobile home park in nearby Kingsville, he got married, started a family, and put down roots.

With 20 employees, Ironwood focuses on providing merchants cash advances in the $5,000 – $50,000 range, Donahue says, “but we can go up to $1 million.” The average cash advance – usually $10,000-$15,000 – is put to use as working capital by what he dubs “Main Street” businesses: restaurants, boutiques, trucking and transportation companies, professionals, and contractors. Ironwood charges clients factoring fees that are collected via ACH.

“Many times (these businesses) don’t qualify for bank loans,” Donahue says. And even when they do qualify, he notes, “banks take forever – up to three months – while we’re using our own money and can do it in three days. We’re very low on requiring a lot of documents.”

For his part, Donahue wants to see a customer’s bank statements, a photo I.D., voided checks, and a financial report. But, he says: “Cash flow is much more important than financials.”

Clients typically find their way to Ironwood through the website, although they often arrive through referrals from brokers and real estate agents, attorneys, accountants and “anyone doing commercial lending,” he says. Donahue says he closed down a call center. “The way to get leads is more through relationships than marketing,” he says.

Trucking companies are important customers. “They work on thinner margins, the barriers to entry are lower, sometimes their customers don’t pay their bills,” Donahue says of the industry’s economics. “They have huge expenses for fuel, payroll, insurance – and they might not get paid (by their customers) for 30 days or more.”

Ironwood’s advance for a million dollars, cited earlier, was made to a trucking company in Midland, Texas, which hauled both general freight and oilfield equipment. The money was put to use both to smooth out cash flow and as growth capital. The trucking concern “used part of that for expansion, making down-payments with Volvo or Peterbilt,” Donahue recalls.

Backstopped by the titles for 18 trucks valued at roughly $1.5 million, the deal was structured as a three-year, sale-leaseback agreement with “no interest” but rather a fee, Donahue says. Payments were $32,000 monthly, he says, amounting to $152,000 above the advance.

Donahue has no trouble justifying the steep fee schedules. Not only does he release money quickly but in many instances Ironwood has stepped in to bail out businesses that could have gone belly-up. He cites a trucker in the Midwest who had a “very lucrative” business hauling Boeing jet engines worth $30 million to Seattle where they could be worked on and returned to the planes for installment. In order to fulfill the contracts – which earned the hauler $25,000 monthly — the trucking company’s owner needed to purchase pricey insurance.

The owner, however, “had horrible credit,” Donahue says, largely the result of cash flow problems after investing in a special trailer for the jet engines, compounded by a messy divorce. To secure the $10,000 for the special insurance, the trucker sold Ironwood $14,000 of their future receivables. “For his investment of $4,000 he’s making $25,000-a-month forever,” Donahue explains.

Back in Austin, Able is gearing up for another round of capital-raising to bulk up staff and, according to Korke, win licensing to do business in California. At the same time, its friends-and-family credit structure is winning kudos for reaching what researcher David O’Connell calls “the unloaned.”

A senior analyst at Aite Group, a Boston-based consulting firm, O’Connell recently completed a study disclosing that 35% of small and medium-sized businesses in the U.S were unable to obtain credit over a recent two-year period. Able’s lending model is “a good example of using covenants to structure a deal that brings down borrowing risk,” the Bostonian says. “It’s terrific.”

A senior analyst at Aite Group, a Boston-based consulting firm, O’Connell recently completed a study disclosing that 35% of small and medium-sized businesses in the U.S were unable to obtain credit over a recent two-year period. Able’s lending model is “a good example of using covenants to structure a deal that brings down borrowing risk,” the Bostonian says. “It’s terrific.”

Able’s staff doesn’t have to travel far to witness the fruits of their efforts. On Congress Avenue, in the heart of downtown Austin, is Jae Kim’s food truck offering Korean barbecue thanks to a $100,000-plus loan from the fintech lender. Kim, the founder and chief executive at food vendor Chi’lantro, enlisted his mother to pitch in $10,000. All told, family and friends ponied up 30% of the total loan.

In the three years since he hooked up with Able, Kim has gone on to bigger things, including a television appearance last November on Shark Tank that netted him $600,000 from celebrity investor Barbara Corcoran.

Chi’lantro is now operating five restaurants and four food trucks and as Kim disclosed on Shark Tank, annual sales topped $4.7 million last year.

Able Funds Chi'Lantro from Able Lending on Vimeo.

In an interview, he told deBanked that he counts himself fortunate to have gotten the Able “micro-loan.” It played a key role in generating the cash flow that qualified his company for a $200,000 bank loan backed by the Small Business Administration. “It was one of many opportunities, and now we have good relationships with banks,” he says.

And then, a little farther south, there’s Stephanie Beard’s “esby apparel,” a women’s clothing boutique named for her initials. Beard, 35, came to Austin in 2013 after a decade in New York designing men’s clothing at Tommy Hilfiger and Converse. Originally from North Carolina and a graduate of Appalachian State University, she had zero connections in Texas and only a little money.

But she had a big vision: She would open a store and design and sell top-quality, flattering clothes for women that had “a menswear mentality.” Men, she had discovered, buy fewer clothes than women. But men tend to buy clothes that are durable, clothes that they can wear again-and-again over many years. After she sold $65,000 worth of her casual clothing line on the website Kickstarter, Beard developed a fan base and was put in touch with Able. “Actually, they contacted me,” she says.

To qualify as an Able borrower, Beard assembled $20,000 from friends and family, she reports, including $2,500 from her future mother-in-law, another $2,500 from the proprietor of a dress shop that “wholesaled” her collection, and the rest from aficionados of her wares. Once that money was gathered, Able lent her $100,000 at a 10% APR in October, 2014, which enabled her to open her shop. The combined interest rate was 9.8%. Monthly payments have automatically been withdrawn from her business’s checking account.

She’s scheduled to repay both Able and her backers in full by this October. Total sales for the shop have cleared $1 million and Beard expects annual revenues for 2017 to hit $900,000. “A lawyer friend who helped me out with the paperwork pro bono told me that Able was practically giving money away,” she says. “I definitely was lucky.”

Fintech Carries the Torch in Northern Delaware

June 14, 2017

Delaware’s history in financial services is rich. The Financial Center Development Act of 1981, for instance, which rolled back the limits on how much lenders could charge as interest on consumer credit, attracted some of the biggest names in banking to the state over the past several decades. Now fintech companies are carrying the torch, evidenced by alternative lender SoFi’s recent expansion into the region.

Glen Trudel, a partner at Ballard Spahr who specializes in fintech, described the view from the rooftop of his downtown Wilmington, DE office as evidence of Northern Delaware’s banking influence. “Many of the large buildings bear the name of a bank. Bank of America. Capital One. Citi. Chase. Barclays. They are all here. And it isn’t just the Financial Center Development Act that makes Delaware a financial services haven. In consumer lending and in certain other financial industry areas, Delaware law provides flexibility that the laws of other states do not. That has drawn a lot of companies from those industries here,” he said, adding that this includes fintech startups in some cases.

SoFi is among them, evidenced by its expansion plans in Claymont, Delaware, which is the home of its recent acquisition, Zenbanx. The alternative lender joins a fintech community that is already flourishing there. J.P.Morgan and Capital One, both of which are partners of Wilmington, Delaware-based non-profit school for coding, Zip Code Wilmington, similarly have an expanding presence in the region.

“That’s why we were created, as a result of that increasing demand for software developers. That increase is the genesis of Zip Code,” said Melanie Augustin, head of school at Zip Code Wilmington.

Rob Meck, SoFi’s senior vice president of operations, told deBanked that Delaware is key to the company’s growth.

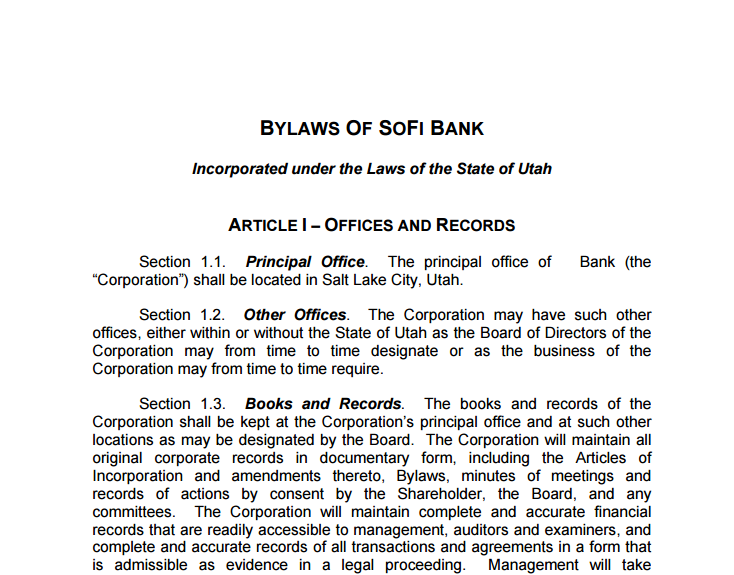

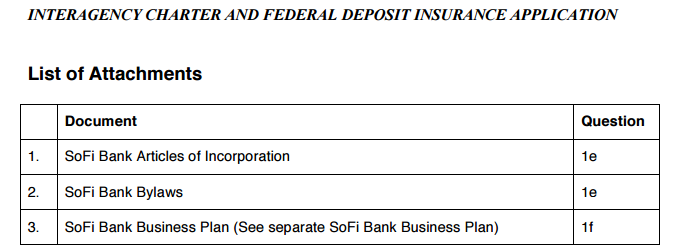

“[Delaware is] a great talent bed for financial services, and with the acquisition of Zenbanx we have a team in the state and executives with ties here,” said Meck. Among those executives is Arkadi Kuhlmann, SoFi’s head of banking products, Zenbanx president and former chief executive of ING Direct USA, which brings Kulhmann full circle and plays into SoFi’s recent hand of applying for a bank charter in Utah, another business friendly state.

“One bank that used to be here [in Delaware] that was bought by Capital One was ING Direct. Their European parent ran into some issues and needed to restructure, so they sold their U.S. online banking arm to Capital One. Guess who ran ING Direct here before?” said Ballard Spahr’s Trudel, pointing to SoFi’s Kulhmann.

In fact it is the presence of banking veterans like Kulhmann in addition to the placement of former Citi chief Vikram Pandit on Wilmington, Delaware-based fintech startup Fair Square Financial’s board that tie the fintech theme all together for Trudel, who spent more than a decade of his career as an in-house counsel at MBNA America, one of the banks that established themselves in Delaware as a result of the Financial Center Development Act.

“I don’t think it’s surprising that startups are getting into the fintech space or that SoFi is expanding here given the Kulhmann connection and given the management and people who are trained in various functions as a result of the history of banking here in Wilmington and other parts of Delaware,” said Trudel. “He has worked here. And there is a large labor pool of very experienced business and consumer lending people in all aspects – from marketing, to collections, to operations. This has been going on for many years,” he adds.

Fintech & The First State

SoFi is hiring across many different departments including engineering, business development and finance, with the bulk of the new jobs being in customer service and operations roles. “We’re hiring aggressively to be able to have 100 people in the office by the end of July and to scale from there over the next few quarters to several hundred,” Meck said.

Fortunately for SoFi and other fintech companies in the region, the talent pool from which they have to select is widening thanks to Zip Code. The coding school, which James Spadola, Zip Code’s director of business development describes as a nonprofit software development boot camp, trains people who might not have had the opportunity to learn to code before sending them out to the local workforce.

“We have 200-300 applications in each cohort and three cohorts per year. And our process is selective. We only accept 12 percent of applicants,” Spadola said.

The process seems to be working, evidenced by applicants from as far away as Wisconsin and Zip Code’s 93 percent job placement rate for students within three months of graduating.

Head of School, Zip Code Wilmington

Incorporate vs. Operate

Delaware is the leading state for registering corporations, LLCs and other structures, evidenced by more than 1 million businesses domiciled there. Nonetheless most entities that incorporate in Delaware don’t actually operate there. Still there are benefits, such as generous tax savings including no state income tax for Delaware companies not operating in the state, as Zip Code Wilmington’s Augustin points out.

Another feature is the non-jury Delaware Court of Chancery that focuses on corporate legal issues using judges who are well versed in corporate legal issues and the generally favorable laws for corporations.

“The state of Delaware’s corporate law is cutting edge. There is a sort of partnership between the Delaware State Bar Association and the legislature. The Delaware corporate attorney bar keeps an eye on what is going on nationally and every year a panel of them recommend amendments to the corporate code and other entity codes to the legislatures. And the legislatures will typically pass those,” said Trudel.

Of course there are also a host of reasons for businesses to not only incorporate but also operate in the state.

“We’re in close proximity to I-95, which runs from Maine to Florida, there’s no sales tax and the residents are a microcosm of America. We have beaches, deep country and cities as well, so you get a little bit of everything. There is a general appeal to any employer,” said Spadola, who is also a University of Delaware alum.

Zip Code’s Augustin points to Delaware’s lower cost of living versus New York or the West Coast as another reason why companies don’t only want to incorporate but also operate in the state.

Spadola came to Zip Code Wilmington following a stint in politics including a recent run for State Senator. “Zip Code from the launch has been neat to watch. I’ve always attended civic events, including the launch of Zip Code. They did a boot camp in 2015, and I’ve been following the success of it. Through relationships and community outreach, this opportunity arose at the right time,” he said.

Prior to her role at the nonprofit, Augustin was working as an employment attorney in Washington, D.C. “I was looking for work I was passionate about. Zip Code filled that need,” she said

Meanwhile, although SoFi is not currently a Zip Code partner, their paths have crossed albeit indirectly.

“Speakers from Zenbanx have talked with our students before. We’re connected with them and are impressed with what they’re doing. We’re excited that they’re growing here,” said Augustin.

Catching Up With Marketplace Lending – A Timeline

June 13, 20174/11 Regions Bank recruited Kabbage’s chief technology officer, Amala Duggirala, to become its chief information officer

4/12 Federal Reserve Published their 2016 Small Business Credit Survey

4/13

- Marathon Partners, a minority shareholder of OnDeck, publicly called on the company to make changes

- Fifth Third Bank partnered with Accion to support lending to underserved small businesses

4/17 Affirm surpassed the mark of making more than 1 million loans since inception

4/20 YieldStreet surpassed $100M in loans funded since inception

4/21 Glenn Goldman stepped down as Credibly’s CEO

4/25

- SmartBiz Loans announced partnership with Sacramento-based Five Star Bank

- CommonBond begins offering loans to undergrads directly

4/26 State regulators sued OCC over fintech charter proposal

4/28

- IOU Financial announced that they loaned $107.6M to small businesses in Q1

- China Rapid Finance announced their IPO

5/2

- Funding Circle closed their online forum

- Elevate’s Debt facility with Victory Park Capital increased from $150M to $250M

5/3

- Prosper Marketplace disclosed that it miscalculated returns shown to retail investors

- Square announced that they loaned $251M to small businesses in Q1

- Nav raised $13M from investors that include Goldman Sachs and Steve Cohen’s Point72 Ventures

5/4

- Vermont governor signed into law new licensing requirements for anyone soliciting loans to Vermont borrowers.

- Lending Club announced that they loaned $1.96B in Q1

5/5 Thomas Curry steps down as OCC head, replaced by Acting Head Keith Noreika

5/8

- OnDeck announced it was substantially reducing its workforce as part of its plan to achieve profitability. The stock price proceeded to hit record lows.

- Dv01 announced reporting partnership with SoFi

- With no IPO on the horizon, SoFi revealed that they began letting their employees sell some of their stock

5/9

- In the United States District Court, The Southern District of New York ruled that a purchase of future receivables was not a loan largely because it was not absolutely payable. Colonial Funding Network, Inc. as servicing provider for TVT Capital, LLC v. Epazz, Inc. CynergyCorporation, and Shaun Passley a/k/a Shaun A. Passley

- The value of 1 Bitcoin surpassed $1,700.

5/10

- CFPB announces that it will begin work on small business loan data collection pursuant to Section 1071 of Dodd-Frank.

- CFPB publishes a white paper on small business lending

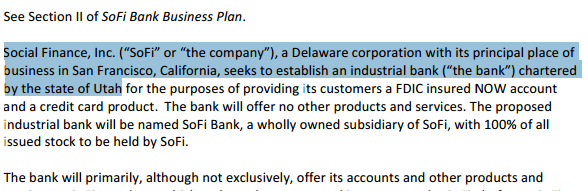

- SoFi revealed that they will apply for an industrial bank charter

5/12 NY’s banking regulator sued the OCC over its proposed fintech charters

5/15

Prosper announced that they lent $585M in Q1 and had a net loss of $23.9M

5/16

- Media outlets reported that SoFi is expanding into wealth management

- Lending Club named PayPal’s former head of Global Credit Steve Allocca as President

- OnDeck’s share price hit a new all-time low

See previous timelines:

2/17/17 – 4/5/17

12/16/16 – 2/16/17

9/27/16 – 12/16/16

That Awkward Moment in Alternative Lending When…

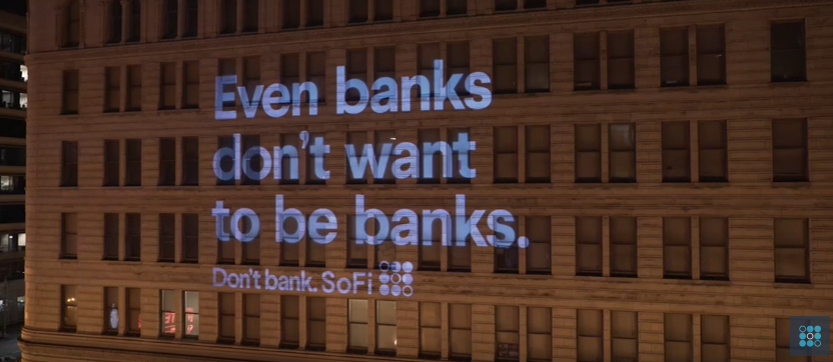

June 13, 2017That awkward moment when you apply for a bank charter (::cough:: SoFi ::cough::) and you realize your company’s motto has literally been #dontbank all along…

Just, don't do it. #DontBank pic.twitter.com/lnxKJHH3QJ

— SoFi (@SoFi) February 11, 2016

Banks send you statements. Our statement is we don’t like banks. Check us out at https://t.co/B5YXtHWKL0. #DontBank pic.twitter.com/RshfsAhdYR

— SoFi (@SoFi) January 26, 2016

Happily not a bank. http://t.co/bDN6i1Fd5W #SoFiSoFun

— SoFi (@SoFi) August 25, 2015

You can view the full bank charter application of the anti-bank whose slogan was #dontbank, here. You can also read an article about it on TechCrunch.

Sound Bites From Underwriting – The Risk of Imperfect Merchants

June 12, 2017

When you’re funding a business, does the risk begin and end with the business? Or does the character of the owners play a role? Can you judge the business on weak financials if your product is geared towards weak financials to begin with? And can you trust unaudited internally prepared financial statements?

At the Factoring Conference during a portfolio warning signs panel, Michael Bagley, VP at Action Capital Corporation, spoke about the risk of internally prepared financials:

“The issue is from a financial standpoint, are they breaking even? That gives you some ability they can function, but one thing that jumps out at you is the payables. It really seems pretty simple. But if you’re in an industry where there’s a critical vendor, or you’ve got a critical supplier, or you’ve got subcontractors and the payables are stretched beyond what is logical past terms, well, that’s a huge warning sign in the underwriting, but it didn’t always show up in underwriting, right, because these were internal financials and 90% of the time and they’re garbage, right?

They’re created by the user so that you at some level have to create or mitigate that by creating procedures that allow you to chase down what are your critical expenses associated with customers. So, for example, in the government space, it would be a subcontractor not getting paid. In manufacturing, it could be a critical vendor that you see on the aging. But if you see that their insurance company had not been paid a couple months, it may not be as big a deal.”

Emma Hart, the COO of Sallyport Commercial Finance, on where the risk lies:

“[…] More than anything I would say even beyond the collateral, it’s the integrity of the client that you’re dealing with. Because in my experience, it’s people that pay you back, not businesses.”

Hart again, on judging a customer’s financial situation:

“[…] quite often, that’s the reason they’re factoring, is because their AP is a mess and you can see the AP is a mess and you raise it in the underwriting, you know. Is anybody suing you? What are you gonna do about it? And they’re like ‘Oh, I’m gonna use the money that you provide to me to sort out my AP.’ ‘Okay then.'”

Melissa Baines, Risk Manager of Republic Business Credit, LLC, on a deal going too smoothly:

“We had a situation where I believe they were doing the parking lot striping, the painting on a parking lot. And it was one invoice. It was a dealership. A car dealership was the account debtor. The account executive who was helping out with the take-on sent out the verification letter. The no-offset verification letter came right back. No issues. And our CEO at that time— Again, going back to the gut feeling, just it was too easy— There weren’t even any questions asked. “What is this?” It was just “Sure. Send it over. I’ll sign it.” And he did and we got it back. And so, our CEO called and talked to him. And he said, “Yeah, yeah, yeah, it’s fine. It’s fine.” It still didn’t feel right. So, we called the dealership main line, got the receptionist. She answered the phone. She said, “Who signed it? Okay. Hold on.” Ended up somebody from the accounting department got on the phone and said, “That’s not real. You’re not the first person to call, you know, and then we’ll call you back.” And then ultimately, the owner of the dealership called back and said, “We will take care of this. It will not happen again, but it is not a real invoice. And please do not fund that to that client.” So, you know, don’t ever give up on that gut instinct. There was nothing that said it wasn’t real to begin with, but thank goodness for [employee’s name]. She just had that gut feeling. It wasn’t right. It was too easy. And here you go.”

This is one of several excerpts from this panel that we plan to post under the Sound Bites From Underwriting tagline.