Story Series: COJs

Get The Affidavit or Waive It? Examining Confessions of Judgment

February 1, 2019 Caton Hanson, the chief legal officer and co-founder of the online credit-reporting and business-to-business matchmaker Nav, says that his Salt Lake City-based company would not associate with a small-business financier that included “confessions of judgment” in its credit contracts.

Caton Hanson, the chief legal officer and co-founder of the online credit-reporting and business-to-business matchmaker Nav, says that his Salt Lake City-based company would not associate with a small-business financier that included “confessions of judgment” in its credit contracts.

“If we understood that any of our merchant cash advance partners were using confessions of judgment as a means to enforce contracts,” Hanson told deBanked, “we would view that as abusive and distance ourselves from those partners. As a venture-backed company,” Hanson adds, “we have some significant investors, including Goldman Sachs, and I’m sure they would support us.”

Steve Denis, executive director of the Small Business Finance Association, which represents companies in the merchant cash advance (MCA) industry, says that, as an organization, “We’ve taken a strong stance against confessions of judgment.”

He reports that his Washington, D.C.-based trade group is prepared to work with legislators and policy-makers of any political party, regulators, business groups and the news media “to ban that type of practice.

“We’re fighting against the image that we’re payday lenders for business,” Denis says of the merchant cash advance industry. “We’re trying to figure out internally what we can do to stop that from happening and we have been speaking to members of Congress and their staff.”

“Confessions of judgment,” says Cornelius Hurley, a law professor at Boston University and executive director of the Online Lending Policy Institute, “are to the merchant cash advance industry what mandatory arbitration is to banks. Neither enforcement device reflects well on the firms that use them.”

These are just some of the reactions from members of the alternative lending and financial technology community to a blistering series of articles published by Bloomberg News on the use—and alleged misuse—of confessions of judgment (COJs) by merchant cash advance companies. The series charges the MCA industry with gulling unwary small businesses by not only charging high interest rates for quick cash but of using confession-laden contracts to seize their assets without due process.

The Bloomberg articles also reported that it doesn’t matter in which state the small business debtors reside. By bringing legal action in New York State courts, MCA companies have been able to use enforcement powers granted by the confessions to collect an estimated $1.5 billion from some 25,000 businesses since 2012.

“I don’t think anyone can read that series of articles and honestly say what went on were good practices and in the best interest of small business,” says SBFA’s Denis, noting that none of the companies cited in the Bloomberg series belonged to his trade group. “It’s shocking to see some companies in our space doing things we’d classify as predatory,” he adds. “As an industry we’re becoming more sophisticated, but there are still some bad actors out there.”

A confession of judgment is a hand-me-down to U.S. jurisprudence from old English law. The term’s quaint, almost religious phrasing evokes images of drafty buildings, bleak London fog, and dowdy barristers in powdered wigs and solemn black gowns. (And perhaps debtor prisons as well.)

A confession of judgment is a hand-me-down to U.S. jurisprudence from old English law. The term’s quaint, almost religious phrasing evokes images of drafty buildings, bleak London fog, and dowdy barristers in powdered wigs and solemn black gowns. (And perhaps debtor prisons as well.)

Yet while the legal provision’s wings have been clipped—the Federal Trade Commission banned the use of confessions of judgment in consumer credit transactions in 1985 and many states prohibit their use outright or in such cases as residential real estate contracts—COJs remain alive and well in many U.S. jurisdictions for commercial credit transactions.

Even so, most states where COJs are in use, such as California and Pennsylvania, have adopted safeguards. Here’s how the San Francisco law firm Stimmel, Stimmel and Smith describes a COJ.

“A confession of judgment is a private admission by the defendant to liability for a debt without having a trial. It is essentially a contract—or a clause with such a provision—in which the defendant agrees to let the plaintiff enter a judgment against him or her. The courts have held that such a process constitutes the defendant’s waiving vital constitutional rights, such as the right to due process, thus (the courts) have imposed strict requirements in order to have the confession of judgment enforceable.”

In California, those “strict requirements” include not only that a written statement be “signed and verified by the defendant under oath,” but that it must be accompanied by an independent attorney’s “declaration.” If no independent attorney signs the declaration or—worse still—the plaintiff’s attorney signs the document, the confession is invalid.

But if the confession is “properly executed,” the plaintiff is entitled to use the full panoply of tools for collection of the judgment, including “writs of execution” and “attachment of wages and assets.”

In Pennsylvania, confessions of judgment are nearly as commonplace as Philadelphia Eagles’ and Pittsburgh Steelers’ fans, particularly in commercial real estate transactions. Says attorney Michael G. Louis, a partner at Philadelphia-area law firm Macelree Harvey, “They may go back to old English law, but if you get a business loan or commercial lease in Pennsylvania, a confession of judgment will be in there. It’s illegal in Pennsylvania for a consumer loan or residential real estate. But unless it’s a national tenant with a ton of bargaining power—a big anchor store and the owner of the shopping center really wants them—95% of commercial leasing contracts have them.

In Pennsylvania, confessions of judgment are nearly as commonplace as Philadelphia Eagles’ and Pittsburgh Steelers’ fans, particularly in commercial real estate transactions. Says attorney Michael G. Louis, a partner at Philadelphia-area law firm Macelree Harvey, “They may go back to old English law, but if you get a business loan or commercial lease in Pennsylvania, a confession of judgment will be in there. It’s illegal in Pennsylvania for a consumer loan or residential real estate. But unless it’s a national tenant with a ton of bargaining power—a big anchor store and the owner of the shopping center really wants them—95% of commercial leasing contracts have them.

“And any commercial bank in Pennsylvania worth its salt includes them in their commercial loan documents,” Louis adds.

Pennsylvania’s laws governing COJs contain a number of additional safeguards. For example, the confession of judgment is part of the note, guaranty or lease agreement—not a separate document—but must be written in capital letters and highlighted. One of the defenses that used to be raised against COJs, Louis says, was that a contractual document was written in fine print “but we haven’t seen fine print for years.”

Other reforms in Pennsylvania have come about, moreover, as a result of a 1994 case known as “Jordan v. Fox Rothschild.” Says Louis: “It used to be lot worse. You used to be able to file a confession of judgment and levy on a defendant’s bank account before he knew what happened. It was brutal. But after the Fox Rothschild case, they changed the law to prevent taking away a defendant’s right of notice and the opportunity to be heard.”

Because of that case, which takes its name from the Fox Rothschild law firm and involved a dispute between a Philadelphia landlord renting commercial space to Jordan, a tenant, the law governing COJs in Pennsylvania requires, among other things, a 30-day notice before a creditor or landlord can execute on the confession. During that period the defendant has the opportunity to stay the execution or re-open the case for trial.

Defenses against the execution of a COJ can entail arguments that creditors failed to comply with the proper language or procedures in drafting the document. But the most successful argument, Louis says, is a “factual defense.” Louis cites the case of a retail clothing store renting space in a shopping center that has a leaky roof. In the 30-day notice period after the landlord invoked the confession of judgment, the tenant was able to demonstrate to the court that he had asked the landlord “ten times” to fix the roof before spending the rent money on roof repairs. In such a case, the courts will grant the defendant a new trial but, Louis says, the parties typically reach a settlement. “Banks generally will waive a jury trial,” he notes, “because they don’t want to take a chance of getting hammered by a jury.”

Defenses against the execution of a COJ can entail arguments that creditors failed to comply with the proper language or procedures in drafting the document. But the most successful argument, Louis says, is a “factual defense.” Louis cites the case of a retail clothing store renting space in a shopping center that has a leaky roof. In the 30-day notice period after the landlord invoked the confession of judgment, the tenant was able to demonstrate to the court that he had asked the landlord “ten times” to fix the roof before spending the rent money on roof repairs. In such a case, the courts will grant the defendant a new trial but, Louis says, the parties typically reach a settlement. “Banks generally will waive a jury trial,” he notes, “because they don’t want to take a chance of getting hammered by a jury.”

A number of states, including Florida and Massachusetts ban the use of confessions of judgment. That’s one big reason that Miami attorney Roger Slade, a partner at Haber Law, advises clients that “there’s no place like home.” In other words: commercial contracts should specify that any legal disputes will be adjudicated in Florida. “It’s like having home field advantage in the NFL playoffs,” Slade remarked to deBanked. “You don’t want to play on someone else’s turf.”

He has also been warning Floridians for several years against the way that COJs were treated by New York courts. Writing in the blog, “The Florida Litigator,” Slade—a native New Yorker who is certified to practice law there as well as in Florida counseled in 2012: “If you live in New York, a creditor can have your client sign a confession of judgment and, in the event of a default on a loan, can march directly to the courthouse and have a final judgment entered by the clerk. That’s right—no complaint, no summons, no time to answer, no two-page motion to dismiss. The creditor gets to go right for the jugular.”

In addition, because of the “full faith and credit clause of the U.S. Constitution,” Slade notes in an interview, a contract that’s enforced by the New York courts must be honored in Florida. “Courts in Florida have no choice,” Slade says. “It’s a brutal system and it’s unfortunate.”

In December, two U.S. senators from opposing parties—Ohio Democrat Sherrod Brown and Florida Republican Marco Rubio—introduced bipartisan legislation to amend both the Federal Trade Commission Act and Truth in Lending Act to do away with COJs. Their legislative proposal reads:

“(N)o creditor may directly or indirectly take or receive from a borrower an obligation that constitutes or contains a congnovit or confession of judgment (for purposes other than executory process in the State of Louisiana), warrant of attorney, or other waiver of the right to notice and the opportunity to be heard in the event of suit or process theron.”

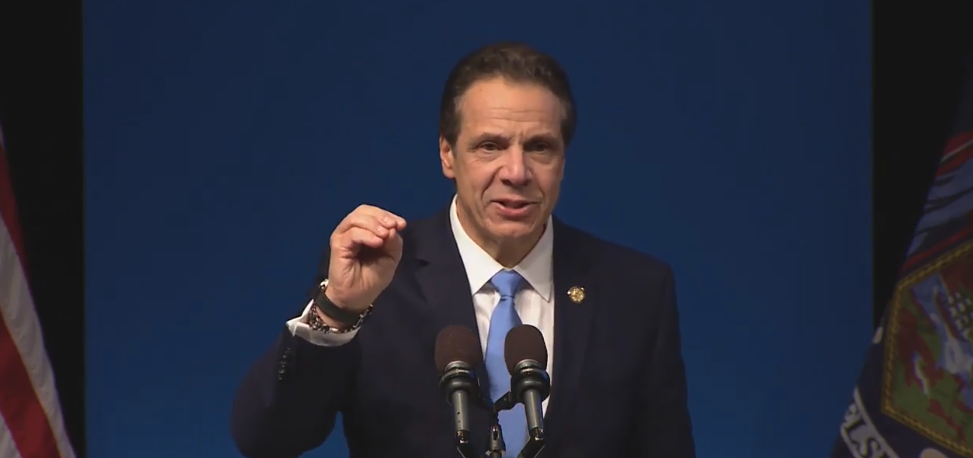

But with a dysfunctional and divided federal government, warring power factions in Washington, and an influential financial industry, there’s no telling how the legislation will fare. Meantime, the New York State attorney general’s office announced in December that it will investigate the use of COJs following the Bloomberg series. And New York Governor Andrew Cuomo has declared support for legislation that will, among other things, prohibit the use of confessions in judgment for small business credit contracts under $250,000 and restrict judgments by New York courts to in-state parties.

But if New York State or Congressional legislation are adopted it can have “unintended consequences” to merchant cash advance firms in the Empire State—and to their small business customers as well—asserts the general counsel for one MCA firm. “Losing the confession of judgment will be removing what little safety net there is in a risky industry,” the attorney says, noting that the industry has roughly a 15% default rate.

“It is not as powerful a tool as the Bloomberg news stories would have you believe,” this attorney, who spoke on the condition of anonymity, told deBanked. “The suggestion seems to be that the MCAs can use the confession of judgment to get back the total amount of money due—and then some—while leaving a trail of dead bodies behind. But that’s not the case.

“What is much more likely to be the case,” he adds, “is that MCA companies try to get the defaulting merchant back on track. And—probably more than we should and only after we’ve tried to reach out to them and failed—do we then reluctantly use the COJ as a last resort. At which point we hope we can recover some part of our exposure. The numbers vary, but the losses are always in the thousands of dollars. These are not micro-transactions.

“What’s going to happen,” he concludes, “is that It will not make sense for us to work with those merchants most in need of working capital. The unfortunate reality is that businesses who don’t have collateral and can’t get a Small Business Administration product will be left out in the cold.”

All of which prompts BU professor Hurley to argue that the “Swiss cheese” system of financial regulation among the 50 states continues to be a root cause of regulatory confusion. Echoing Miami attorney Slade’s concern about New York courts’ dictating to Florida citizens, Hurley likens the situation governing COJs with the disorderly array of state laws governing usury regulations.

In the 1978 “Marquette” decision, the U.S. Supreme Court ruled that a Nebraska bank, First of Omaha, could issue credit cards in Minnesota and charge interest rates that exceeded the usury rate ceiling in the Gopher State. Since then, usury rates enacted by state legislatures have become virtually unenforceable.

“The problem we’re seeing with confessions of judgment is a subset of the usury situation,” Hurley says. “One state’s disharmony becomes a cancer on the whole system. It’s a throwback to Colonial times with 50 states each having their own jurisdictions—and it doesn’t work.”

Hurley’s Online Lending Policy Institute has joined with the Electronic Transactions Association and recruited a phalanx of “academics, non-banks, law firms and other trade associations as members or affiliates” to form the Fintech Harmonization Task Force. It is monitoring the efforts by the 50 states to align their regulatory oversight of the booming financial technology industry which was recently recommended by a U.S. Treasury report.

Hurley’s Online Lending Policy Institute has joined with the Electronic Transactions Association and recruited a phalanx of “academics, non-banks, law firms and other trade associations as members or affiliates” to form the Fintech Harmonization Task Force. It is monitoring the efforts by the 50 states to align their regulatory oversight of the booming financial technology industry which was recently recommended by a U.S. Treasury report.

Tom Ajamie, who practices law in New York and Houston and has won multimillion-dollar, blockbuster judgments against “dozens of financial institutions” including Wall Street investment firms, also argues for greater regulatory oversight. He urges greater funding and expansion of the powers of the Consumer Financial Protection Bureau to rein in “the anticipatory use” of confessions of judgment in commercial transactions.

However, notes Catherine Brennan, a partner at Hudson Cook in Baltimore, the job of protecting small businesses is outside the agency’s mandate. “The CFPB doesn’t have authority over commercial products as a general rule,” she explained in an interview. “Consumers are viewed as a vulnerable population in need of protections since the 1960’s.” As a society “we want protection for households because the consequences are high. A family could become homeless if they lose a house. Or (they) could lose employment if they lose a car and can’t drive. And there is also unequal bargaining power between lenders and consumers.

“Large institutions have lawyers to draft contracts and consumers have to agree on a take it or leave it basis. So there’s not a lot of negotiation and government has decided that consumers need protections, including a (Federal Trade Commission) ban on confessions of judgment.”

But Christopher Odinet, a law professor at the University of Oklahoma and a member of Hurley’s harmonization task force, sees the efforts of the federal government and the states to grapple with confessions of judgment as further recognition that small businesses have more in common with consumers than with big business. The COJ controversy follows on the recent passage of a commercial truth-in-lending bill by the State of California which, for the first time, stipulated that consumer-style disclosures should be included in business loans and financings under $500,000 made by non-bank financial organizations.

He cites the close-to-home example of an accomplished professional who got in over his head in financial dealings. “I recently observed a situation where a family member who is a very successful and affluent medical professional was relying on his own untrained business skills,” Odinet says. “He was about to enter into a sophisticated and complex business partnership relying on his intuition and general sense of confidence in the other party.”

Odinet says that he recommended that his relative hire a lawyer. Which, Odinet says, he did.

Coming Soon: The End of Confession of Judgments (COJs) in New York State

January 16, 2019 New York State plans to outlaw the use of Confession of Judgments (COJs) in small business loan contracts this year, according to details revealed in Governor Andrew Cuomo’s newly published Justice Agenda.

New York State plans to outlaw the use of Confession of Judgments (COJs) in small business loan contracts this year, according to details revealed in Governor Andrew Cuomo’s newly published Justice Agenda.

The proposal, dubbed “Stopping Predatory Merchant Cash-Advance Loans,” is a 3-part plan to:

- Codify an FTC rule that prohibits COJs in consumer loans

- Prohibit the use of COJs in small business loans under $250,000

- Stop lenders from exploiting New York courts for nationwide collections by requiring that any permissible confession of judgment enforced in New York courts have a nexus to business activity in New York

Cuomo’s proposal echoes calls from the State legislature in response to a series published in Bloomberg Businessweek late last year that speculated COJs were vulnerable to abuse.

Both the Assembly and Senate maintain a Democrat majority, the same party as Cuomo, increasing the likelihood that such a bill could become law.

The proposal is separate from a bill that was recently introduced at the federal level. The Small Business Lending Fairness Act, a bipartisan bill co-sponsored by Senators Marco Rubio and Sherrod Brown, call for a nationwide ban on COJs. That bill has not progressed, perhaps due in part to the government shutdown. Like New York, that initiative was a response to the series published in Bloomberg.

The proposal is separate from a bill that was recently introduced at the federal level. The Small Business Lending Fairness Act, a bipartisan bill co-sponsored by Senators Marco Rubio and Sherrod Brown, call for a nationwide ban on COJs. That bill has not progressed, perhaps due in part to the government shutdown. Like New York, that initiative was a response to the series published in Bloomberg.

A review of Bloomberg’s facts by deBanked revealed highly questionable reporting. In one example, it’s claimed that a business owner had been so victimized by predatory lending that he’d been forced to sell his furniture just to feed himself. deBanked later determined that the “victim” was actually a multimillionaire TV station owner whose account of any such engagement with merchant cash advance companies was incredibly unlikely. The reporters have not responded to deBanked’s findings.

Zeke Faux, who co-authored the series with Zachary Mider, deleted his entire tweet history around the same time that deBanked uncovered strange ties between his editor and the New York Attorney General’s office. The AG is reported to have sent subpoenas to several companies in response to the stories.

On Monday, Faux and Mider reported that clerks in three New York counties, whose job, among other roles, is to enter legally compliant COJs into the public record, were revolting by refusing to process COJs submitted by merchant cash advance companies. Though a clerk’s duties is largely an administrative one, two that spoke on the record with Bloomberg were former state legislators. Erie County Clerk Michael Kearns, for example, who told Bloomberg News that he felt that the use of COJs was criminal, had actually drafted a bill in 2017 when he was an assemblyman that sought to regulate cash advances of a different sort in the litigation financing industry. Although Kearns is a Democrat, he has historically enjoyed support from the Republican Party.

Orange County Clerk Annie Rabbitt and Richmond County Clerk Stephen Fiala, who are rebelling along with Kearns by refusing to enter COJs, are registered as Republicans, demonstrating that the movement is crossing party lines.

According to deBanked, less than half of 1% of all MCA transactions have resulted in the filing of a COJ, despite Bloomberg’s insinuation that the outcome is common or typical.

Among the most prolific filers of merchant cash advance COJs, deBanked found, is Itria Ventures, LLC, a company affiliated with Biz2Credit. Itria filed more than 50 in the last two months. Biz2Credit’s CEO, Rohit Arora, is a writer for both CNBC and Forbes.

Defunct MCA Company Tried to Escape Signed Confession of Judgment

December 13, 2018 When a Florida-based merchant cash advance company, World Global Financing (WGF), declared bankruptcy this past May, it entered into a binding settlement agreement with its largest creditor, a hedge fund known as Eaglewood.

When a Florida-based merchant cash advance company, World Global Financing (WGF), declared bankruptcy this past May, it entered into a binding settlement agreement with its largest creditor, a hedge fund known as Eaglewood.

There was a caveat.

Eaglewood required that WGF sign a Confession of Judgment (COJ) as part of the agreement that would afford Eaglewood the right to file and obtain a judgment without further litigation if WGF breached the settlement. On August 3, that’s exactly what happened. After WGF failed to make the stipulated payments to Eaglewood, the COJ was filed in the New York Supreme Court so as to obtain a nearly $6 million judgment against WGF and company founder Cyril Eskenazi.

While it can be virtually impossible to invalidate a COJ, the courthouse Clerk nonetheless refused to enter it because of alleged technical defects, one of which involved WGF’s use of an out-of-state notary to witness a New York State affidavit.

“The alleged Affidavit of Confession of Judgment upon which Eaglewood’s request for a Judgment by Confession stands like a house of cards is no affidavit at all under New York law, and cannot be used in a New York litigation,” WGF’s attorney argued.

The absurdity of the argument was not lost on Eaglewood because the notary WGF challenged on technical grounds was the notary that WGF and its counsel had themselves chosen and approved. Eaglewood called the charade of contesting the validity of one’s own affidavit signed in the presence of counsel, utterly frivolous and a fraud upon the Court.

Defects or not, the judge concurred with Eaglewood because WGF had irrevocably and unconditionally agreed to the entry of judgment if they breached the settlement agreement in the first place, which they did, rendering the alleged technical errors with the COJ itself a moot point.

The COJ was therefore deemed valid and the judge ordered the Clerk to enter the judgment.

On Nov 29, a judgment for $5,866,477 was entered against WGF and Eskenazi. The index # is 651489/2018 in the New York Supreme Court.

SBFA Announces Support for The Small Business Fairness Act

December 7, 2018The Small Business Finance Association (SBFA) today announced support for S.3717, The Small Business Fairness Act introduced by Senator Sherrod Brown (D-OH) and Senator Marco Rubio (R-FL). The bill would provide the Federal Trade Commission more clarity to protect small business owners from being forced to sign a “confession of judgment” before obtaining financing. A “confession of judgment” requires a small business owner to waive certain rights in court before obtaining financing and, in some cases, allows the lender to seize the owner’s assets if there is a default.

“This is a bad practice that must be eliminated,” said Jeremy Brown, chairman of RapidAdvance and SBFA. “Unfortunately, certain small business financing providers are misusing “confessions of judgment.” We firmly support any legislation that will provide small businesses protection from the misuse of this practice. If a small business we fund runs into trouble, we believe they should be treated fairly and deserve our commitment to help resolve the issue in a manner that is professional and respectful.”

SBFA is a non-profit advocacy organization dedicated to ensuring Main Street small businesses have access to the capital they need to grow and strengthen the economy. SBFA’s mission is to educate policymakers and regulators about the technology-driven platforms emerging in the small business lending market and how our member companies bridge the small business capital gap using innovative financing solutions. The organization is supported by companies committed to promoting small business owners’ access to fair and responsible capital.

“Our core values are centered on providing fair and responsible financing for small businesses,” said Steve Denis, executive director of SBFA. “Small business owners are the backbone of the American economy and we should empower them with as many tools as possible to grow and create jobs. We look forward to working with Senator Brown and Rubio to eliminate the abuse of the “confession of judgment” and expand the role of responsible lenders nationally.”

In 2016, SBFA released best practices for the alternative finance industry to help better protect small businesses as they seek funding online. SBFA’s best practices are centered on four principles—transparency, responsibility, fairness, and security. As the industry’s leading trade association, the best practices have been agreed to by every member company and exist to give small business owners confidence in their financing decisions. These principles provide them a better understanding of what to expect from responsible alternative finance companies, which includes fully disclosing all terms and costs and ensuring the products SBFA companies offer are in the best interest of the small business customer.

The Small Business Finance Association (SBFA) is a not-for-profit 501(c)6 trade association representing organizations that provide alternative financing solutions to small businesses.

Senate Bill Introduced to Ban Confession of Judgments Nationwide

December 6, 2018 Senators Sherrod Brown and Marco Rubio have called for a nationwide ban on Confessions of Judgment in response to the Bloomberg Businessweek series published last month. The bill, which would amend the Truth in Lending Act, may be named the Small Business Lending Fairness Act.

Senators Sherrod Brown and Marco Rubio have called for a nationwide ban on Confessions of Judgment in response to the Bloomberg Businessweek series published last month. The bill, which would amend the Truth in Lending Act, may be named the Small Business Lending Fairness Act.

You can download the bill here

Though Businessweek has been successful in pressuring regulators to conduct inquiries into several merchant cash advance companies and the New York City marshals, authors Zachary Mider and Zeke Faux have remained notably silent on the gaping holes in their narrative. Questions posed to each reporter have yet to receive any responses.

deBanked researched the accuracy of Businessweek’s findings only to determine that two of the purported victim’s stories were not credible. In one case, a business owner that was said to have been “wiped out,” was bragging about his new luxury race car on facebook while public records revealed he was still paying himself six figures a year from the allegedly defunct company that had more than $700,000 running through its bank accounts. In another case, a victim that claimed to be selling off household furniture to buy food after a run-in with a predatory lender, turned out to be a multimillionaire TV station owner.

“Out Of State” MCA Funder Not Precluded From Entering COJs in New York, Court Rules

October 18, 2018In May 2017, Funding Metrics (FM), a small business funding provider, entered a signed Confession of Judgment (COJ) in Westchester County, NY against a California-based customer. The Court issued a judgment a mere five days later.

That should have been the end of it, but on July 26th, the customer hired law firm White & Williams to challenge the judgment’s validity on the basis that New York Business Corporations Law § 1314 limits the circumstances in which a non-resident corporation may bring an action or special proceeding against another non-resident corporation. Neither FM nor the customer were based in New York nor had any connections to New York whatsoever, they alleged, which precludes such a judgment from being entered there. But it’s doubly bad, defendants argued, because the judgment by confession statute in New York is unconstitutional as it waives the defendants’ due process rights.

The Honorable Terry Jane Ruderman was unmoved by the arguments, pointing out that not only was FM registered to do business in New York and claimed to have an office there but that defendants incorrectly relied on § 1314 because a Confession of judgment is not an action, nor a special proceeding.

[…]That statute does not preclude the judgment entered here, entered by confession of judgment. By such a document, a person “agree[s] to the entry of judgment upon the occurrence or nonoccurrence of an event” (see Black’s Law Dictionary [10th ed. 2014]), giving the holder a remedy that does not require proof of the nature of the transaction or allow for interposing defenses (see Soler v_Klimova, 5 AD3d 294 [1st Dept 2004]). Therefore, in entering the judgment, the court does not inquire into the underlying transaction, including with regard to such matters as the home state of the corporate plaintiff.

Moreover, while the Business Corporations Law § 1314 applies to “maintaining actions or special proceedings,” the statute providing for judgments by confession does not require commencement of an action; it clearly states that “a judgment by confession may be entered, without an action, … upon an affidavit executed by the defendant” ( CPLR 3218 [emphasis added]).

Defendants’ constitutionality argument was rejected as “meritless” and all of their other arguments not discussed in the order were explicitly rejected.

You can download the decision here.

The case # is 57737/2017 in Westchester County in the New York Supreme Court. The law firm representing plaintiff Funding Metrics was Stein Adler Dabah & Zelkowitz.

MCA Companies Have Won a “Sh*t Ton” of Cases, Judge Declares

August 27, 2018 A judge in Buffalo, New York has finally had enough with merchants trying to claim that merchant cash advances are loans.

A judge in Buffalo, New York has finally had enough with merchants trying to claim that merchant cash advances are loans.

At issue were defendants who sought to overturn a confession of judgment filed by SOS Capital. The Honorable Catherine Nugent Panepinto, who presided over the case, didn’t like that one bit, but what was more offensive to her was the manner in which the defendants tried to overturn it.

With a shit ton of case law already weighing against the defendants for filing an improper motion, Judge Nugent Panepinto went a step further by reminding the defendants that there is no merit to the argument that the subject merchant agreement was a loan.

The defendants, who seemed completely doomed to pay SOS Capital’s attorney fees, were saved only by the charm of their affable Long Island attorney.

This case was decided in Erie County, NY under Index #803512/2018.

Ohio Considers Regulation of Confessions of Judgment

March 20, 2016 In a commercial lending context, courts and legislatures have generally assumed that the parties to the agreement have relatively equal bargaining power. Because of this understanding – that a business borrower is more sophisticated than a consumer borrower – regulation has been more “hands off” with regard to the terms commercial loans may contain. One such clause frequently found in commercial loan agreements is a confession of judgment clause, also called a cognovit judgment. A confession of judgment is written authorization by the borrower directing the entry of a judgment against him in the event he defaults on payment. A confession of judgment clause in a loan agreement permits the creditor on default to appear in court and confer judgment against the borrower.

In a commercial lending context, courts and legislatures have generally assumed that the parties to the agreement have relatively equal bargaining power. Because of this understanding – that a business borrower is more sophisticated than a consumer borrower – regulation has been more “hands off” with regard to the terms commercial loans may contain. One such clause frequently found in commercial loan agreements is a confession of judgment clause, also called a cognovit judgment. A confession of judgment is written authorization by the borrower directing the entry of a judgment against him in the event he defaults on payment. A confession of judgment clause in a loan agreement permits the creditor on default to appear in court and confer judgment against the borrower.

Interestingly, Ohio is now considering legislation to regulate the use of the confession of judgment in a commercial loan agreement. House Bill 291 would require attorneys for creditors to include in a petition for confession of judgment the borrower’s last known address so that the borrower can be advised of the creditor’s decision to execute on the confession of judgment. Such notice gives the borrower the opportunity to dispute the execution on the confession of judgment clause. It would further provide that a confession of judgment be made “only for nonpayment of principal and interest under the terms of an instrument evidencing indebtedness,” which would eliminate the ability to obtain other damages. It also bans the use of the clause for something other than a nonmonetary default, which some Ohio courts have allowed. For example, in Fifth Third Bank v. Pezzo Construction, an Ohio appellate court allowed execution on a confession of judgment where the borrower failed to pay all taxes when due as required by the loan agreement. Another court rejected such use of confessions of judgment in Henry County Bank v. Stimmels, Inc. House Bill 291, if adopted, would make clear that only payment defaults can result on a confession of judgment.

Interestingly, Ohio is now considering legislation to regulate the use of the confession of judgment in a commercial loan agreement. House Bill 291 would require attorneys for creditors to include in a petition for confession of judgment the borrower’s last known address so that the borrower can be advised of the creditor’s decision to execute on the confession of judgment. Such notice gives the borrower the opportunity to dispute the execution on the confession of judgment clause. It would further provide that a confession of judgment be made “only for nonpayment of principal and interest under the terms of an instrument evidencing indebtedness,” which would eliminate the ability to obtain other damages. It also bans the use of the clause for something other than a nonmonetary default, which some Ohio courts have allowed. For example, in Fifth Third Bank v. Pezzo Construction, an Ohio appellate court allowed execution on a confession of judgment where the borrower failed to pay all taxes when due as required by the loan agreement. Another court rejected such use of confessions of judgment in Henry County Bank v. Stimmels, Inc. House Bill 291, if adopted, would make clear that only payment defaults can result on a confession of judgment.

House Bill 291 is not yet scheduled for a hearing.