peer2peer lending

Lending Club IPO: The Mirage of Diversifying

September 1, 2014Behold, the fool saith, “Put not all thine eggs in the one basket” – which is but a matter of saying, “Scatter your money and your attention”; but the wise man saith, “Pull all your eggs in the one basket and – WATCH THAT BASKET.

– In Pudd’nhead Wilson by Mark Twain

Is peer-to-peer lending really offering you a chance to diversify your portfolio?

Is peer-to-peer lending really offering you a chance to diversify your portfolio?

Scores of investors just like myself are jumping on the Lending Club bandwagon. The returns are sweet and the concept has mass appeal. Like a gambler getting overconfident after a long winning streak, it’s easy to get caught up in the excitement.

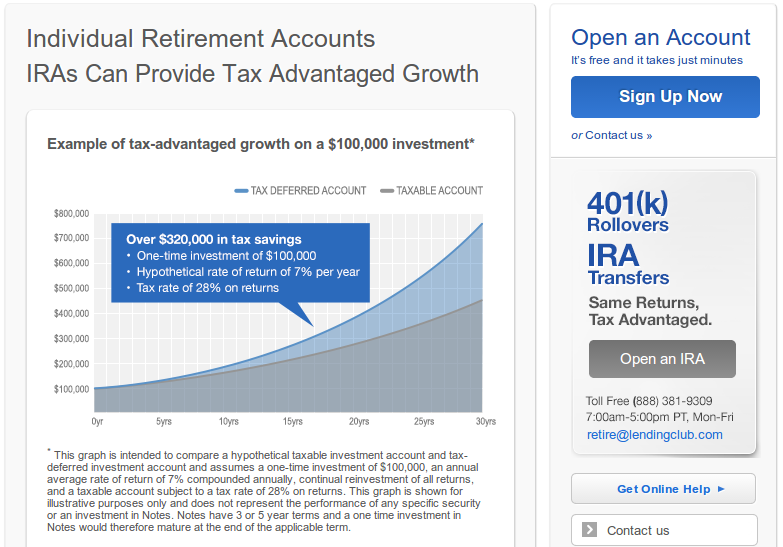

I have tens of thousands invested in Lending Club loans at this very moment and I think it’s time to take a breather. Other people are in deeper, six figures worth, and then there are those who are placing their entire retirement savings in the hands of everyday borrowers.

Once IRAs and 401(k)s enter the picture, the situation gets serious…

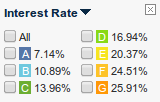

Lending Club appeals to the diversity conscious with their seven risk tiers, A,B,C,D,E,F and G. A rated loans are deemed the least risky but charge the lowest amount of interest. G rated loans carry the most risk but carry interest rates in the neighborhood of 26%.

Lending Club appeals to the diversity conscious with their seven risk tiers, A,B,C,D,E,F and G. A rated loans are deemed the least risky but charge the lowest amount of interest. G rated loans carry the most risk but carry interest rates in the neighborhood of 26%.

To diversify, you could spread your funds into all of them or at least across multiple tiers. You can also make many small investments of $25 as opposed to a few investments in larger sums.

Mirage?

In an excellent Bloomberg article, Matt Levine explains that investors on Lending Club’s platform are not really making loans to consumers, Lending Club’s bank is. They sell the loan to Lending Club and Lending Club creates a note and sells it to you. The borrowers owe Lending Club money and Lending Club owes you money. Your relationship is with Lending Club, not the borrowers, and therefore the entirety of your investments however seemingly diversified, are really in Lending Club itself.

A few months ago I wondered if it made sense to buy Lending Club stock over buying their notes.

The note prospectus explains “the Notes are unsecured and holders of the Notes do not have a security interest in the corresponding Loan or the proceeds of the corresponding Loan.” This means these loans are not collateral if Lending Club goes south.

The note prospectus explains “the Notes are unsecured and holders of the Notes do not have a security interest in the corresponding Loan or the proceeds of the corresponding Loan.” This means these loans are not collateral if Lending Club goes south.

If the company were to file for bankruptcy, you would need to add yourself to the list of unsecured creditors. As stated, “if LendingClub were to become subject to a bankruptcy or similar proceeding, the holder of a Note will have a general unsecured claim against LendingClub that may or may not be limited in recovery to borrower payments in respect of the corresponding member loan.”

Unsecured note holders are still better off than common shareholders in the event of a bankruptcy, but that assumes that the borrowers are still paying their loans.

What if they weren’t? Or worse yet, what if they didn’t have to pay them?

One basket

Lending Club’s S-1 warns of major dangers. “Additional state consumer protection laws would be applicable to the loans facilitated through our platform if we were re-characterized as a lender, and the loans could be voidable or unenforceable,” it says. “In addition, we could be subject to claims by borrowers, as well as enforcement actions by regulators.”

If Lending Club is at some point re-characterized, your portfolio would be killed off instantly. Your eggs however well diversified are in the Lending Club basket. Such a situation happened in a closely related industry where a merchant cash advance company was challenged to be a lender in disguise. In 2008, a class action lawsuit was brought against AdvanceMe Inc in California. The case was settled but AdvanceMe could no longer collect payments and they actually had to give a lot of the money they had already collected back.

In a Lending Club nightmare scenario, note holders could potentially be forced to forfeit any principal and interest they’ve already collected in the event of a harsh judgment or settlement. If Lending Club is only obligated to pay what’s collected to note holders, then what if they’re told give it all back to the borrowers? It’s a nightmare scenario indeed.

Sleep tight

If the goal is to invest in consumer loans, you should spread your investments around. Put some in Lending Club, some in Prosper (their #1 competitor), and at least another. More importantly, don’t invest all of your money in peer-to-peer lending companies or consumers loans as this is not diversifying either. Peer-to-peer lending should be just one component of your overall investment strategy. Stocks, bonds, CDs, and even FDIC insured savings accounts should round out your holdings.

If the goal is to invest in consumer loans, you should spread your investments around. Put some in Lending Club, some in Prosper (their #1 competitor), and at least another. More importantly, don’t invest all of your money in peer-to-peer lending companies or consumers loans as this is not diversifying either. Peer-to-peer lending should be just one component of your overall investment strategy. Stocks, bonds, CDs, and even FDIC insured savings accounts should round out your holdings.

The Lending Club IRA and 401(k) program is wildly risky at best. Would you invest a significant portion of your retirement savings in the hands of just one company? I considered it for a second…

And then I took a deep breath.

The Lending Club IPO has been labeled an awareness event. Millions of people will be learning about it for the first time through the publicity of a stock offering. If you do decide to put some eggs in, WATCH THAT BASKET!

AmeriMerchant’s CEO David Goldin shared his own thoughts on the IPO on Bloomberg TV:

Earlier today on a large group conference call with Tom Green and Mozelle Romero of LendingClub, I learned a few more details about their business loan program. In the Q&A segment, one attendee came right out and asked if they believed their competition was merchant cash advance companies and online business lenders.

Earlier today on a large group conference call with Tom Green and Mozelle Romero of LendingClub, I learned a few more details about their business loan program. In the Q&A segment, one attendee came right out and asked if they believed their competition was merchant cash advance companies and online business lenders.  Market Size

Market Size In 2013 the MCA industry experienced what many insiders dubbed the summer of fraud. Spurred by advances in technology, small businesses were applying for financing en masse while armed with pristinely produced fraudulent bank statements. Fake documents overwhelmed the industry so hard that today it is commonplace for underwriters to verify their legitimacy with the banks. This is done manually or with the help of tools such as Decision Logic or Yodlee.

In 2013 the MCA industry experienced what many insiders dubbed the summer of fraud. Spurred by advances in technology, small businesses were applying for financing en masse while armed with pristinely produced fraudulent bank statements. Fake documents overwhelmed the industry so hard that today it is commonplace for underwriters to verify their legitimacy with the banks. This is done manually or with the help of tools such as Decision Logic or Yodlee.

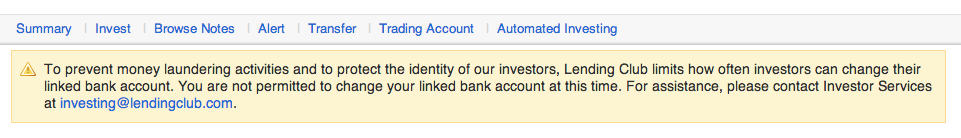

Perhaps as part of wider governmental banking pressure, p2p platform LendingClub has instituted a new controversial Anti-Money Laundering policy. The new rule is that you can only connect your investment account to 1 bank account for deposits. This isn’t a technical limitation since as of recent, you could update your bank information at any time. I regularly made deposits to LendingClub from 2 checking accounts but no longer can I do this.

Perhaps as part of wider governmental banking pressure, p2p platform LendingClub has instituted a new controversial Anti-Money Laundering policy. The new rule is that you can only connect your investment account to 1 bank account for deposits. This isn’t a technical limitation since as of recent, you could update your bank information at any time. I regularly made deposits to LendingClub from 2 checking accounts but no longer can I do this.

Prosper’s President Ron Suber and LendingClub’s CEO Renaud Laplanche have previously explained that there is still a large opportunity for growth because most people still don’t know non-bank lending options exist.

Prosper’s President Ron Suber and LendingClub’s CEO Renaud Laplanche have previously explained that there is still a large opportunity for growth because most people still don’t know non-bank lending options exist. Last week, DailyFunder was a media sponsor of Exponential Finance presented by Singularity University & CNBC. It was a totally different atmosphere from some of the other events I’ve been to this year already (Transact 14, LendIt, etc.). In the upcoming July/August issue of DailyFunder magazine, I’ve got a column that summarizes the event that I think you’ll like.

Last week, DailyFunder was a media sponsor of Exponential Finance presented by Singularity University & CNBC. It was a totally different atmosphere from some of the other events I’ve been to this year already (Transact 14, LendIt, etc.). In the upcoming July/August issue of DailyFunder magazine, I’ve got a column that summarizes the event that I think you’ll like.

Have you heard? Banks aren’t lending. Nobody at LendIt seems to mind though. Ron Suber, the President of Prosper Marketplace, said earlier today that banks are not the competition. That’s an interesting theory to digest when contemplating the future of alternative lending. If banks are not the competition, then who is everyone at LendIt competing against? I think the obvious answer is each other, but much deeper than that, the competition is the traditional mindset of borrowers.

Have you heard? Banks aren’t lending. Nobody at LendIt seems to mind though. Ron Suber, the President of Prosper Marketplace, said earlier today that banks are not the competition. That’s an interesting theory to digest when contemplating the future of alternative lending. If banks are not the competition, then who is everyone at LendIt competing against? I think the obvious answer is each other, but much deeper than that, the competition is the traditional mindset of borrowers.

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us…

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us… Lending Club

Lending Club Peer-to-peer lending has already been under strong scrutiny from the Federal Government. Lending Club and Prosper are regulated by the Securities and Exchange Commission these days, but they may never be free of oversight. Just two months ago, the Federal Reserve published a report on trends in peer-to-peer business lending. They hinted at further regulation.

Peer-to-peer lending has already been under strong scrutiny from the Federal Government. Lending Club and Prosper are regulated by the Securities and Exchange Commission these days, but they may never be free of oversight. Just two months ago, the Federal Reserve published a report on trends in peer-to-peer business lending. They hinted at further regulation.

Commissions

Commissions