MPR Authored

Forget Fancy Algorithms, Give the Merchants a Psych Exam

January 1, 2014Select an answer to each of the following questions:

1. When faced with financial hardship during the course of my loan, I would do the following:

(a) Do nothing and hope my luck changes.

(b) Call the bank and block all debits from the lender and wait for the lender to call me about it.

(c) Change my phone number, hide, and avoid making anymore loan payments at all costs.

(d) Call the lender to inform them of my hardship.

(e) Sell my business and let the lender sort it out with the new owner.

2. The IRS sends you a letter that says they believe you understated your income last year and owe back taxes. As a result I would do the following:

(a) Ignore the letter until it becomes a more pressing issue.

(b) Consult with my accountant/lawyer.

(c) I didn’t file a tax return last year.

(d) Pretend I never got it.

(e) Pay whatever is owed.

—-

Congratulations! based on the answers you chose you have been approved!

—-

According to the New York Times, Banks in 16 countries are using psychometric tests to gauge the creditworthiness of applicants in lieu of credit reports. That’s because the criteria used to score credit in the U.S. is not always available abroad, particularly in developing nations.

According to the New York Times, Banks in 16 countries are using psychometric tests to gauge the creditworthiness of applicants in lieu of credit reports. That’s because the criteria used to score credit in the U.S. is not always available abroad, particularly in developing nations.

There isn’t necessarily a right or wrong answer to each test question. Instead an algorithm measures the loan repayment performance statistics of each answer and learns to approve or decline based on those selections by applicants in the future. Interesting isn’t it? The questions wouldn’t be easy to manipulate either since they are currently psychological. Applicants are asked for example how strongly they believe in or disbelieve in fate.

Would such an idea have legs for alternative business lending in the U.S.? I think there’s something to it. I can say from experience that in my former lifetime as an underwriter, our team would rarely read from a script during a merchant interview. Instead we would engage applicants in a conversation about their business to gauge their attitude and determine the level of commitment to their work. You’d be surprised what this approach would reveal.

In this context, business owners would share that they had no idea whether or not they were losing money, that they planned on closing the business if the advance didn’t turn things around, that they didn’t care about previous loans that they defaulted on, that they weren’t even the person running the business day to day but rather the name on all the paperwork because they had good credit, or that they were using the money to fund a vacation to the carribean because the business was failing and they wanted to get away. We did make sure to steer the conversation towards the requirements on our checklist, but the final decision on borderline deals was often decided on this call.

Some funders use this interview call just to confirm information on the application, but it should no doubt play a role in a deal approval. That’s just my opinion. Once the deal is funded though, it will all come down to fate, hard work, or coincidence. I guess it all depends on how strongly the merchant agreed or disagreed with each of those on the exam.

Underwrite at your own risk.

Amazon Quietly Funding Small Businesses

December 30, 2013 Ever since Amazon announced their exclusive business loan program last year, they’ve been quietly booking deals. I say quietly because no one really talked about it much ever since. Though the loan program is available only to qualified Amazon.com merchants, it’s very similar to how Kabbage started off with eBay. Amazon’s Business Loan program has all the bells and whistles of merchant cash advance financing and their clients tend to have huge daily sales volumes.

Ever since Amazon announced their exclusive business loan program last year, they’ve been quietly booking deals. I say quietly because no one really talked about it much ever since. Though the loan program is available only to qualified Amazon.com merchants, it’s very similar to how Kabbage started off with eBay. Amazon’s Business Loan program has all the bells and whistles of merchant cash advance financing and their clients tend to have huge daily sales volumes.

So are they really doing deals? You betcha they are. Secured Party Name: Amazon Capital Services. I wonder if any of their merchants would do a fixed ACH deal.

Enjoy.

Peer-to-Peer Lending Will Meet MCA Financing

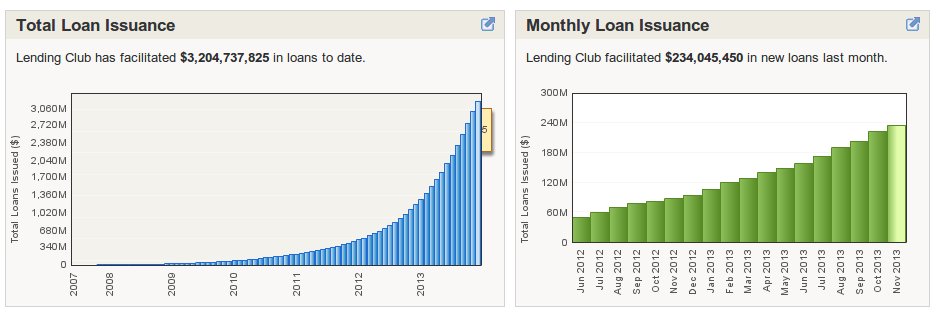

December 29, 2013 In 2014 the peer-to-peer lending industry will collide with merchant cash advance and the rest of alternative business lending. Get familiar with these names: Lending Club, Funding Circle, and Prosper. They are brothers and sisters in the business of non-bank financing. They’re also seasoned, tested, and much like the merchant cash advance industry, experiencing phenomenal growth.

In 2014 the peer-to-peer lending industry will collide with merchant cash advance and the rest of alternative business lending. Get familiar with these names: Lending Club, Funding Circle, and Prosper. They are brothers and sisters in the business of non-bank financing. They’re also seasoned, tested, and much like the merchant cash advance industry, experiencing phenomenal growth.

The old guard of merchant cash advance companies should take notice. After losing significant ground to Kabbage and OnDeck Capital, a new breed of fighter is about to enter the ring. I hear this phrase too often in response to the threat of competition, “there’s enough opportunity out there for everyone.”

But is there? Aside from the ACH repayment boom, one of the biggest drivers of merchant cash advance industry growth has been stacking. Stacking is the process of issuing an additional advance or loan to a merchant without paying off their existing advances or loans. That puts merchants in the position of having 2, 3, 4, or even 5 daily withdrawals to remain in good standing with all of them.

While the legality and risks of stacking have long been debated, the deeper revelation here is that there may not be as much new opportunity as everyone thinks. There has been an ongoing turf war over land that had already been discovered. It’s caused overall annual funding volume to rise significantly, but there’s not much room for 400%, 500% or 1,000% growth.

Funders like Kabbage came in and conquered the online merchant cash advance space without anyone noticing. Some funders have taken 5 years to double output on a monthly basis. Impressive, yes, but Lending Club on the other hand has more than quadrupled monthly funding volume over just the last 18 months. Not only that, but they’re doing more than OnDeck and CAN Capital (formerly Capital Access Network) combined. That’s massive.

Backed by Google and recently valued at $2.3 Billion, Lending Club is expected to go public in the next 12 months. As they seek to extend their dominance from consumer lending to business lending, funders should seriously ask themselves, is there really enough opportunity out there for everyone?

The Achilles Heel for merchant cash advance companies is money. Regardless of how fast they turn it over, there’s no possible way to experience fast triple digit growth without outside capital. Some funders spend a lot of time and energy trying to raise it. Others are content without it and go chugging along at a moderate pace.

Peer-to-peer lenders on the other hand have a unique advantage, unlimited access to cash. That’s because they source all the money from individuals. The money is crowdsourced from an infinite pool of investors and they just book the deals and service them. Combine this model with a sweet infusion from an IPO and alternative business lending will have its very own behemoth.

Peer-to-peer lenders on the other hand have a unique advantage, unlimited access to cash. That’s because they source all the money from individuals. The money is crowdsourced from an infinite pool of investors and they just book the deals and service them. Combine this model with a sweet infusion from an IPO and alternative business lending will have its very own behemoth.

I’m not predicting the doom of merchant cash advance at the hands of Lending Club, but quite the opposite. Lending Club will legitimize non-bank business financing once and for all. Merchants will seek capital and investors will seek lucrative returns. Merchant cash advance companies offer a vastly better ROI than what 3-5 year loans can do with regulated interest rates. The top 10 Prosper investors are only earning 15-19%.

Lending Club will carpet bomb businesses across the nation with marketing and likely end up declining 90% of them. If they do indeed stick to their model of 3-5 year loans, they will undoubtedly leave a trail of interested but unfundable merchants. Alternative lenders and merchant cash advance companies will rush in to fill the void.

At the same time, that capital raising problem could fix itself. As everyone jumps on the peer-to-peer/crowdsourcing bandwagon, investors will be thrilled to learn that merchant cash advance is peer-to-peer based as well. Oh you didn’t know? Many funders already crowdsource capital from “syndicates”. Syndication in merchant cash advance is a simplified form of crowdsourcing. ISOs, investors, and account reps can pool funds collectively into deals just as someone could with Prosper or Lending Club.

I first raised this similarity in December 2010 (three years ago!) and even went so far as to make a mock version of Prosper’s site with MCA terminology plastered on it. Eerie isn’t it?

The difference between a company like Lending Club and say a company like RapidAdvance is whether or not funding is meant to be used as working capital or permanent capital.

The consumer lending model is not applicable when it comes to underwriting businesses. Renaud Laplanche, the CEO of Lending Club acknowledged that when he testified before congress a few weeks ago. But is he really ready to experience it for himself?

We shall see in 2014 when the line blurs once and for all. MCA, say hi to your family, P2P.

—————

Get familiar:

Merchant Cash Advance Term Used Before Congress

December 18, 2013 I’d like to think that the term, merchant cash advance, is mainstream enough that a congressman would know what it was. I have no idea if that’s the case though. What I do know is that Renaud Laplanche, the CEO of Lending Club gave testimony before the Committee on Small Business of the United States House of Representatives on December 5, 2013.

I’d like to think that the term, merchant cash advance, is mainstream enough that a congressman would know what it was. I have no idea if that’s the case though. What I do know is that Renaud Laplanche, the CEO of Lending Club gave testimony before the Committee on Small Business of the United States House of Representatives on December 5, 2013.

Watch:

In it, he argued that small businesses have insufficient access to capital and that the situation is getting worse. We knew that already. However, he went on to explain that alternative sources such as merchant cash advance companies are the fastest growing segment of the SMB loan market, but issued caution that some of them are not as transparent about their costs as they could be.

The big takeaway here is that he didn’t say they are charging too much, but rather that some business owners may not understand the true cost. I often defend the high costs charged in the merchant cash advance industry, but I’ll acknowledge that historically there have been a few companies that have been weak in the disclosure department. That said, the industry as a whole has matured a lot and there is a lot less confusion about how these financial products work.

Typically in the context Laplanche used, transparency is code for “please put a big box on your contract that states the specific Annual Percentage Rate” of the deal. That’s good advice for a lender and in many cases the law, but for transactions that explicitly are not loans, filling in a number to make people feel good would be a mistake and probably jeopardize the sale transaction itself. If I went to Best Buy and paid $2,000 in advance for a $3,000 Sony big screen TV that would be shipped to me in 3 months when it comes out, should I have to disclose to Best Buy that the 50% discount for pre-ordering 3 months in advance is equivalent to them paying 200% APR?

This is what happened: I advanced them $2,000 in return for a $3,000 piece of merchandise at a later date.

I got a discount on my purchase and they got cash upfront to use as they see fit. Follow me?

Now instead of buying a TV, I give Best Buy $2,000 today and in return am buying $3,000 worth of future proceeds they make from selling TVs. That’s buying future proceeds at a discounted price and paying for them today. As people buy TVs from the store, I’ll get a small % of each sale until I get the $3,000 I purchased. If a TV buying frenzy occurs, it could take me 6 months to get the $3,000 that I bought. But if the Sony models are defective and hardly anyone is buying TVs, it could take me 18 months until i get the $3,000 back.

In the first situation, if the TV never ships I get my $2,000 back. In the second situation if the TV sales never happen, I don’t get the 3 grand or the 2 grand. I’ll just have to live with whatever I got back up until the point the TV sales stopped, even if that number is a big fat ZERO.

Best Buy is worse off in the first situation, but critics pounce on the 2nd situation. APR, it’s not fair! Transparency, high rate, etc.

Imagine if every retailer that ever had a 30% off sale or half price sale one day woke up and realized the sale they had was too expensive and not transparent enough for them to understand what they were doing. If only consumers had given the cashiers a receipt of their own that explained that they would actually only be getting half the money because of their 50% off sale, then perhaps the store owners would have reconsidered the whole thing. 50% off over the course of 1 day?! My God, that’s practically like paying 18,250% interest!!!

To argue that a business owner might not understand what it means to sell something for a discount is like saying that a food critic has no idea what a mouth is used for.

I will acknowledge that issues could potentially occur if an unscrupulous company marketed their purchase of future sales as if it were a loan. That could lead to confusion as to what the withholding % represents and why it was not reported to credit bureaus. I’m all in favor of increasing the transparency of purchases as purchases and loans as loans, but let’s not go calling purchases, loans. Americans should understand what it means to buy something or sell something. Macy’s knows what they’re doing when they have a Black Friday Sale. They do a lot of business at less than retail price. They are happy with the result or disappointed with it. They’re business people engaged in business. End of the story.

In recent years, the term, merchant cash advance, has become synonymous with short term business financing, whether by way of selling future revenues or lending. When testimony was entered that many merchant cash advance providers charge annual percentage rates in excess of 40%, I do hope that Laplanche was speaking only about transactions that are actually loans. As for any fees outside of the core transaction, those should be clear as day for both purchases and loans. I think many companies are doing a good job with disclosure on that end already.

Part 2

The other case that Laplanche made was brilliant. Underwriting businesses is more expensive than it is to underwrite consumers. Consumer loan? Easy, check the FICO score and call it a day. That methodology doesn’t even come close to working with businesses. He stated:

These figures show that absolute loan performance is not the main issue of declining SMB loan issuances; we believe a larger part of the issue lies in high underwriting costs. SMBs are a heterogeneous group and therefore the underwriting and processing of these loans is not as cost efficient as underwriting consumers, a more homogenous population. Business loan underwriting requires an understanding of the business plan and financials and interviews with management that result in higher underwriting costs, which make smaller loans (under $1M and especially under $250k) less attractive to lenders.

Read the full transcript:

LendingClub CEO Renaud Laplanche Testimony For House Committee On Small Business

Merchant Cash Advance just echoed through the halls of Capitol Hill. And so it’s become just a little bit more mainstream, perhaps too maninstream.

Thoughts?

How Will Obamacare Affect Small Businesses?

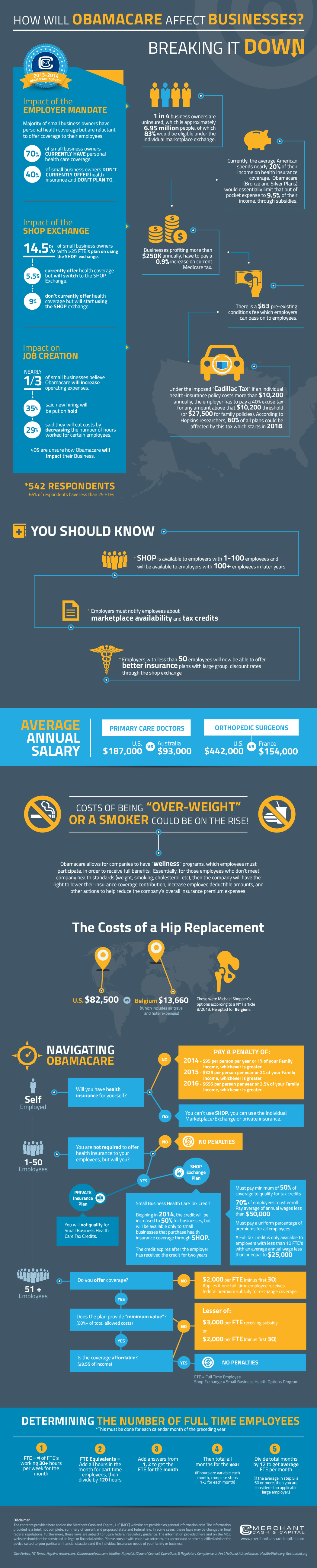

December 12, 2013It’s one thing to assume how small businesses feel about Obamacare and another to hear it straight from the horse’s mouth. New York-based funding provider Merchant Cash and Capital surveyed their clients and this is what they learned:

- Nearly one third of respondents believe the Act will increase operational expenses.

- 40 percent aren’t sure how it will impact their business.

- One in four respondents said they will halt any growth initiatives in the near future as a result of the Act.

Infographic from MCC

Is Everyone Buying into the Technology Craze?

December 6, 2013 Following a wild 18 months of press releases and technology revolutions, I’m hearing that some ISOs are having technology fatigue. VCs and Private Equity want to invest in companies that are automating everything, but that doesn’t necessarily mean account reps are ready for it. The worst fear an account rep has is using an automated system to spit out numbers with a contract, get that contract signed by the merchant, and then have the figures revised or nullified during a later human review. Going back to the merchant with a 2nd contract with new numbers (often times worse) is a major credibility killer for them. It has bait and switch written all over it, even if they’ve made perfectly clear to the merchant that the terms they sign for are subject to a final underwriting review.

Following a wild 18 months of press releases and technology revolutions, I’m hearing that some ISOs are having technology fatigue. VCs and Private Equity want to invest in companies that are automating everything, but that doesn’t necessarily mean account reps are ready for it. The worst fear an account rep has is using an automated system to spit out numbers with a contract, get that contract signed by the merchant, and then have the figures revised or nullified during a later human review. Going back to the merchant with a 2nd contract with new numbers (often times worse) is a major credibility killer for them. It has bait and switch written all over it, even if they’ve made perfectly clear to the merchant that the terms they sign for are subject to a final underwriting review.

This problem has existed for years but that pressure has really been amplified by the recent tech race. Some funders are doing pretty good with it. Others aren’t. There are plenty of account reps that can’t function in a world where the answer is always 1 or 0 regardless. MCA came of age because of the shades of grey. I used to work for a company that was famous for listening to every merchant’s “story.” That factor can’t get baked into an algorithm.

As you might or might not suspect, there are funders thriving simply because they aren’t heavily tech oriented. ISOs get to talk to a human, negotiate the terms with an underwriter, and get exceptions that algorithms are programmed to disallow. When the algorithm says the deal is approved for a maximum of $10,000 and your merchant gets an offer from a competitor for $12,000, you’re going to need to get a human involved to match it. And if you’re a company that simply won’t bend your limits in situations like that, then that ISO isn’t going to send you deals in the first place.

Not everyone in the merchant cash advance business is convinced about automation. Then again, it’s not easy to convince people in this business about many things:

So what’s your criteria again???

We all know this guy

So it’s not actually approved then…

Oh really? What’s this ISO’s name?

As an account rep, I once had a funder make me get six re-signed contracts. Each time I got it re-signed, they decided they weren’t comfortable and revised the offer down. The final advance amount was more than 80% lower than the original approved amount. Streetz is rough.

More Merchant Cash Advance Memes on DailyFunder

News from the Space

November 18, 2013 American Express recently teamed up with Heartland Payment Systems to provide split-processing loans tied to all card transactions rather than just American Express exclusively. The max loan size is $750,000. Prior to this deal American Express and other merchant cash advance companies rarely competed head-to-head. Unless a small business was processing substantial AMEX, they weren’t a candidate for American Express Merchant Financing. I expect them to make similar deals with other card processors.

American Express recently teamed up with Heartland Payment Systems to provide split-processing loans tied to all card transactions rather than just American Express exclusively. The max loan size is $750,000. Prior to this deal American Express and other merchant cash advance companies rarely competed head-to-head. Unless a small business was processing substantial AMEX, they weren’t a candidate for American Express Merchant Financing. I expect them to make similar deals with other card processors.

Lending Club got a valuation boost with a $57 million investment from Yuri Milner’s DST Global and Coatue Management LLC. They’re now worth about $2.3 billion. They are expected to go public in 2014 which will be especially significant given their plans to enter the small business lending space as early as January. Today, alternative small business lenders worth tens of millions or hundreds of millions of dollars are the big shots in the industry. Expect major disruption if Lending Club achieves an IPO valuation in the tens of billions.

Zazma put their own spin on lending by financing the purchases small businesses make. Funds are actually wired directly to the suppliers instead of to the borrower. For now they are only doing up to $5,000 at one time, which is typically the minimum sized deal for the merchant cash advance industry.

ISO&Agent published a great article about merchant cash advance titled, Taming the Wild Frontier.

The end of the year is coming and Capital Access Network, which is now CAN Capital projects they will finish with $800 million in transactions for 2013. 15 years after they started, they are still the biggest in the business.

Merchant Cash Advance Hits Shark Tank

October 26, 2013 If you missed Friday night’s episode of Shark Tank, you absolutely must catch a rerun of it. Jason Reddish and Val Pinkhasov came on the show to pitch their merchant cash advance company, Total Merchant Resources. It was one of the best few minutes in merchant cash advance history for several reasons:

If you missed Friday night’s episode of Shark Tank, you absolutely must catch a rerun of it. Jason Reddish and Val Pinkhasov came on the show to pitch their merchant cash advance company, Total Merchant Resources. It was one of the best few minutes in merchant cash advance history for several reasons:

- Mark Cuban, the 213th richest man in the U.S. feared the growing popularity of expensive short term financing would invite tough government regulation.

- Kevin O’Leary understood that there were no barriers to entry and thus anyone with money can get into the industry.

- Robert Herjavec thought the capital was too expensive for small businesses.

- Kevin O’Leary said that non-bank alternative lenders like Total Merchant Resources were necessary to keep businesses afloat.

- Jason Reddish went at the Sharks like a Shark himself.

TMR walked away with a rather small 400k valuation through the deal they made with Kevin O’Leary that gave them 200k for 50% equity. It was O’Leary’s claim that his connections and capital would blow the lid off their business that was too good to pass up.

O’Leary had a compelling argument for why his terms were non-negotiable. Anyone can be in this business. The valuation itself was moot because two guys with a relatively small operation just became partners with a famous venture capitalist worth $300 million. Had I been in their circumstances, I would’ve taken the deal as well.

O’Leary’s name in the space makes TMR relevant and a company to watch out for, but they are by no means guaranteed success. They are up against much deeper pockets. Dan Gilbert, the 126th richest man in the U.S. owns RapidAdvance (through Rockbridge Growth Equity), a firm that got an enterprise valuation of over $100 million. Google and Peter Thiel have their hand in On Deck Capital. Google also has a stake in Lending Club, a peer-to-peer lender worth $1.55 billion that threatens to disrupt the alternative business loan market with their new loan product come early 2014. Capital Access Network funds nearly three quarters of a billion dollars a year. Every day another power player swoops in and raises the stakes, putting O’Leary in a position he’s probably not used to being in himself, in the shark tank.

At the end of the day, there are a lot of profitable ISOs and small funders. Pinkhasov and Reddish did what no one else to date has done, gone on TV and pitched Mark Cuban on merchant cash advance. And for that, they will go down in history. We’ll follow their story as it develops and I invite them to e-mail me if they’d like to comment.

You can follow the thread about their appearance on the show and find the link to the video on DailyFunder.