Thinking Capital, Equifax Create Canadian Small Business Credit Grades

July 10, 2018

Equifax and Thinking Capital today announced the launch of BillMarket, a service that will now provide Canadian small businesses with a credit grade, A through E. CEO and cofounder of Thinking Capital Jeff Mitelman told deBanked this is revolutionary because, up until now, a Canadian small business’ creditworthiness has usually been based on the personal credit score of the small business owner.

“BillMarket creates a new language of credit for small business in Canada,” Mitelman said. “For the first time, there is a practical way to talk about and put a dollar value on small business credit in Canada. BillMarket expands the purchasing power for Canadian SMBs and eliminates friction in the supply chain.”

Equifax offers this new credit grade for free, and simultaneously, a small business owner is offered a supply chain financing deal by Thinking Capital. Specifically, if a small business owes money to a vendor in 30 days, Thinking Capital can turn that 30 day invoice into a 120 day invoice. Thinking Capital pays the small business’ vendor and the small business has 120 days to pay Thinking Capital. There are fees associated with this, which are based on the small business’ credit grade, but a small business can simply use Equifax’s credit grade and seek funding elsewhere.

“BillMarket represents a cash flow revolution for the Canadian small business market,” he said.

Traditionally, Thinking Capital provides an MCA product, which it calls Flexible, as well as a term product, which it calls Fixed. The company provides funding up to $300,000 to small to medium sized Canadian businesses. Clients must be in business for at least six months and have average monthly sales of at least $7,000. The funder was acquired in March by Toronto-based Purpose Financial, but it still uses the Thinking Capital name.

Founded in 2006, Thinking Capital employees roughly 200 people and has offices in Montreal and Toronto.

Kalamata Capital Merges with Kings Cash Group

June 28, 2018 Kalamata Capital announced today that it has entered into an agreement to merge with Kings Cash Group, effective July 1. The new entity will be called Kalamata Capital Group, or KCG, retaining the Kalamata Capital brand. Together, the new entity and its affiliates will provide approximately $300 million of capital annually to over 5,000 small businesses.

Kalamata Capital announced today that it has entered into an agreement to merge with Kings Cash Group, effective July 1. The new entity will be called Kalamata Capital Group, or KCG, retaining the Kalamata Capital brand. Together, the new entity and its affiliates will provide approximately $300 million of capital annually to over 5,000 small businesses.

Michael Jaffe and Albert Gahfi have been designated the co-Presidents of Kalamata Capital Group LLC, the direct funding and operating entity, and they will run the day-to-day operations. Steven Mandis, Brandon Laks, Carlos Max, and Connor Phillips will be the Chairman, Chief Operating Officer, Chief Financial Officer, and Chief Credit Officer, respectively, of the holding company, Kalamata Holdings LLC. All are members of the Executive Committee of Kalamata Holdings LLC.

“With this partnership we become the preeminent one stop solution for merchants and strategic partners in the industry,” Gahfi said. “Strategic partners can submit one application, and we will quickly develop competitive, actionable solutions.”

Laks, Chief Operating Officer of KCG told deBanked that employees of both companies will be retained and the former Kalamata Capital offices, both in Bethesda and New York, will remain in place. The Manhattan office of Kings Cash Group will also remain and all products that the two companies used to offer separately, will now be offered by KCG, including small business loans, SBA loans, factoring, equipment leasing and merchant cash advance, among others. Kalamata Capital offered all of these products while Kings Cash Group focused on merchant cash advance.

“With no debt, Kalamata Capital has one of the strongest balance sheets in the industry,” Jaffe, co-President of the newly formed KCG said. “Their Chairman Steven Mandis worked at Goldman Sachs, was a Senior Advisor to McKinsey, has a PhD from Columbia University and teaches at Columbia Business School. He has utilized that experience to build a distinctive partnership culture, established brand, and institutional-grade processes and procedures.”

Mandis, Chairman of KCG, said: “We know and value KCG’s technology platform and people, and we believe their talent and capabilities will further strengthen our overall merchant value proposition. The partnership will enable us to better serve more small businesses by enhancing our underwriting capabilities to provide access to affordable business financing solutions to help them and their communities grow and thrive.”

An ISO Brokers Main Street Deals – on Main Street

June 25, 2018 Envision a giant office filled with rows of commercial finance brokers on the phone, aggressively selling deals to faceless small town merchants. Then step into the office of Horizon Financial Group and meet brothers and business partners James and John Celifarco. The contrast could not be more striking.

Envision a giant office filled with rows of commercial finance brokers on the phone, aggressively selling deals to faceless small town merchants. Then step into the office of Horizon Financial Group and meet brothers and business partners James and John Celifarco. The contrast could not be more striking.

The most dramatic difference between their office and that of almost every other broker, or ISO, is that you enter the office from the sidewalk. There’s no lobby and no elevator. It’s just the two brothers (plus one salesperson and one assistant) working on the other side of a glass storefront window.

The store isn’t on Madison Avenue or Rodeo Drive. It’s on a modest, roughly three-block commercial strip on Avenue S in a working class section of Brooklyn called Marine Park. There’s a deli, a pizzeria, a barbershop, a pet grooming store and a bunch of other stores that you’re likely to find on Main Street, U.S.A. In other words, Horizon Financial Group’s neighbors are the exact kind of small business owners they seek as customers. And since they opened up shop on this quaint stretch at the end of October, many of their store owner neighbors have already become customers.

The store isn’t on Madison Avenue or Rodeo Drive. It’s on a modest, roughly three-block commercial strip on Avenue S in a working class section of Brooklyn called Marine Park. There’s a deli, a pizzeria, a barbershop, a pet grooming store and a bunch of other stores that you’re likely to find on Main Street, U.S.A. In other words, Horizon Financial Group’s neighbors are the exact kind of small business owners they seek as customers. And since they opened up shop on this quaint stretch at the end of October, many of their store owner neighbors have already become customers.

“It’s a different relationship with the customer,” James said of their neighborhood clients. “You’re not on the phone. You’re face to face with these people. You’re meeting them, you’re shaking their hands, you’re getting to know them personally, which helps with the longevity of the relationship itself.”

Sitting at the glass conference table by their storefront window, James, 34, and John, 37, counted up to six clients by simply pointing out the window at other small stores across the street. Horizon Financial Group is an ISO that brokers working capital deals and does credit card processing, equipment leasing, ATM machines and commercial mortgages. (James has his New York real estate license, so he can also help local store owners buy or sell a house.) The brothers said that about 40 percent of their business is facilitating deals brought to them by other ISOs, another 40 percent comes from merchants that they find directly, and about 20 percent comes from these local customers they’ve developed from having a physical presence in the neighborhood.

“Obviously you can’t build an entire business on just these two streets,” John said, “but it’s extra business that we wouldn’t have had if we weren’t here. And when we came here, we stopped thinking ‘Who are we going to buy leads from?’ and started thinking more outside of the box.”

An example of this was their decision to approach the Brooklyn Chamber of Commerce where they are now one of the chamber’s preferred vendors, which brings them business from the entire borough.

James said they’ve made contributions to the local little league and kids football, and whenever a new store opens in the area, they introduce themselves and explain what they do. It also doesn’t hurt that they grew up in Marine Park, so they already know the town pretty well. James recognized someone on the sidewalk and ran outside to say hi. It was someone who used to be a next door neighbor. There is a truly old-fashion sense of community on Avenue S.

“I buy my pizza from [the pizza store owner] and he does his credit card processing with us,” James said. “When the dry cleaner needed equipment, we got them capital, and I actually got to see the piece of equipment I helped finance. That almost never happens.”

Because there is no building guard or front desk person, customers can stop by whenever they like. As if in a sitcom, a man walked into the store saying to the brothers, “Don’t be mad at me.” It was a customer, the owner of a local paint store. “It’s not completely my fault, but I broke the phone swiper on the job.”

Because there is no building guard or front desk person, customers can stop by whenever they like. As if in a sitcom, a man walked into the store saying to the brothers, “Don’t be mad at me.” It was a customer, the owner of a local paint store. “It’s not completely my fault, but I broke the phone swiper on the job.”

Reassuringly, John told him to come to his desk and he helped the customer with a replacement for a piece of credit card processing equipment.

The brothers have each been working in the small business financing industry independently for more than a decade. James established Horizon Financial Group by himself in 2009 while John was working for a different company in the credit card processing and MCA space. John joined James at Horizon Financial Group in September 2017.

John said he prefers co-leading Horizon Financial Group, itself a small business, to running a larger operation in Manhattan.

“Compared to somebody in the city with a huge rent and a huge payroll, I don’t need to do the same numbers he’s doing to end up making the same amount of money.”

John also noted that he doesn’t have to sit on a train for an hour and a half because he lives just six blocks away from the storefront office.

“A lot of people don’t like to say they’re a small company,” John said. “I couldn’t be happier that we’re a small company.”

Running a small business is familiar to the Celifarcos. Horizon Financial Group gets its name from Horizons Dance Center, a successful Brooklyn dance school founded by James and John’s mother. It has been in business for 46 years and is still going strong.

“The name is good luck,” James said.

James lives a short drive away in Rockaway with his wife and daughter. On running a small business like Horizon Financial Group, James said: “It’s also about quality of life. You don’t need to work 7 to 7. I can be on the beach with my daughter. It’s really a different approach.”

When to Hire a Collection Company

June 19, 2018

There is no rule telling a funding company at what point it should seek the help of a collection company when a client defaults on an agreement. That’s entirely up to the funding company. Some have in-house collection teams while others don’t and some go slower to approach a collection agency than others.

At 6th Avenue Capital, CEO Christine Chang said that they generally don’t use collection agencies.

“When we started 6th Avenue Capital, we had a much heavier hand,” she said. Initially, they hired an in-house collections attorney, but found that it wasn’t a very collaborative approach.

“If the first call you get is from a lawyer, you’re not going to call them back,” Chang said.

Instead, they hired an in-house Head of Collections and Chang said that has proven to be more effective.

“Now, it’s more like a call from Amanda who says ‘Mr. Smith, I see you missed a payment or two….tell us your situation and how can we help,” Chang said.

The company will occasionally hire a third party for collections, but after they have exhausted all efforts internally.

But collection agencies in the industry say that they work with some of the biggest funding companies, and at all stages of the process.

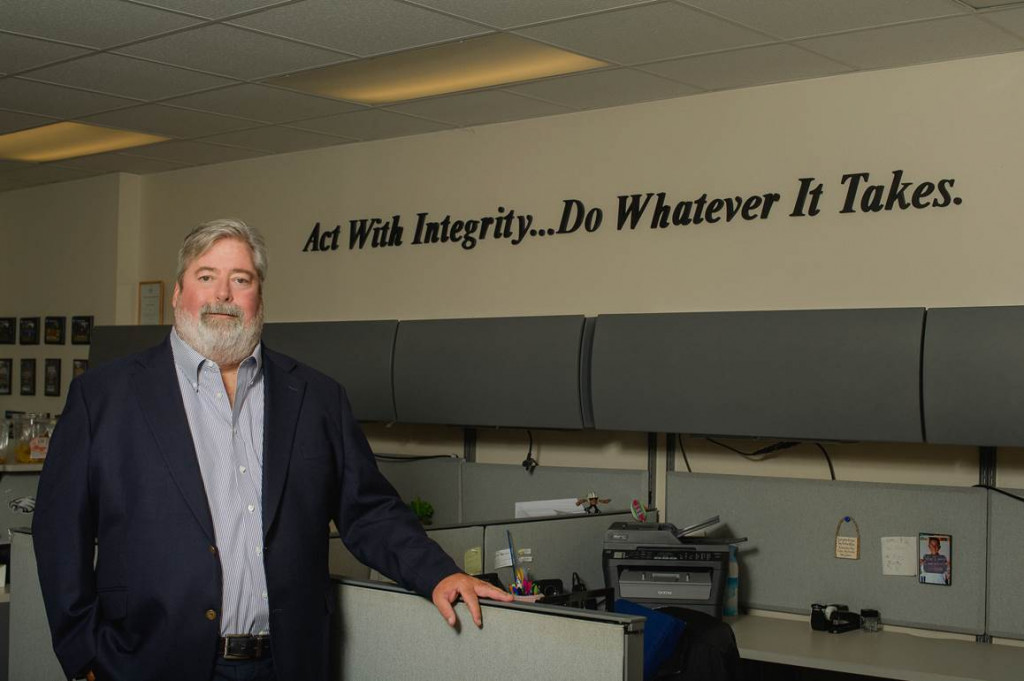

Mark LeFevre, CEO of collections firm Kearns, Brinen and Monaghan (KBM), said that his clients are not only among the top players but he also works with ISOs who have just started funding companies.

“The ones that recognize the problem early, have a better return,” he said. “The ones that kick the can down the road get a lesser return on the dollar.”

As for when LeFevre’s clients send their defaulted merchants to KBM, it varies, he said. He has one client that will send him accounts after 15 days while others will wait 90 to 120 days. He generally won’t take on defaulted accounts after 120 days, or at least will sit down with clients like these to discuss strategy.

Anh Regent, CEO of the MCA collection company, AMA Recovery Group, spoke about the value of having a merchant hear from a third party.

“There’s only so much you can do in house,” Regent said. “You need another voice. [And] when you send it to collections, the price of poker has just gone up,” meaning that the merchant feels a lot more pressure to pay.

Like KBM, Regent said that his MCA clients vary in size, from companies financing $500,000 a month to those financing $25 million a month.

Woman Arrested in Connection With Finance Company Data Theft

June 19, 2018 A woman was arrested in the Bronx this morning and charged with felony computer-related theft. The individual, whose name deBanked is not releasing until more information is known, was reportedly stealing customer data from Yellowstone Capital despite not being employed there. The photo shows police officers escorting her out from her home.

A woman was arrested in the Bronx this morning and charged with felony computer-related theft. The individual, whose name deBanked is not releasing until more information is known, was reportedly stealing customer data from Yellowstone Capital despite not being employed there. The photo shows police officers escorting her out from her home.

She is the third person to be arrested for stealing data from Yellowstone Capital in the last nine months but she’s the first that was not actually working there at the time.

Yellowstone Capital is arguably the largest merchant cash advance company in the country, according to deBanked’s leaderboard. The companies ranked ahead of them are lending companies, not MCA.

Collector Says “No” to Debt Settlement Companies That Want His Data

June 19, 2018

Debt settlement companies often find their leads by scouring through UCC filings, or publicly available forms that a creditor files to give notice that it may have rights to the property of a debtor. In the case of a small business, perhaps the refrigerators in a restaurant.

“[Looking through UCC filings] is a way of getting access to businesses that obviously owe somebody some money for their business,” said Shawn Smith, founder and CEO of Dedicated Commercial Recovery, a commercial collections company in Roseville, Minnesota.

But Smith told deBanked about another approach that debt settlement companies have taken to obtain leads of struggling businesses. He said they come to him.

“Who has a ton of accounts of struggling business owners?” Smith said. “Debt collection agencies that are working on behalf of funding sources. So [we] have like a list of all lists.”

Smith said that he gets approached by debt settlement companies looking for the contact information of struggling companies.

He always says “no.”

“They’re coming to me and saying ‘Hey, you know, for any merchant you send us that’s struggling, if we start working with them to help settle their debts, we will give you a large portion of the fee we make on settling that debt,’” Smith said. “And we of course would never do that.”

Dedicated works in two areas of collections: merchant cash advance and equipment leasing. In both cases, its goal is to recoup money for its clients, either merchant cash advance companies or equipment leasing companies.

Unlike this arrangement, a debt settlement company is not hired by a funding company. Instead, according to Smith, the debt settlement company searches for a struggling company, instructs the merchant to stop paying the funder and then approaches the funder with a settlement deal for often a fraction of what the funder is entitled to under the agreed upon deal. Smith said that settlement companies almost always propose to the funder: 20 percent of the value of the deal over five years.

Smith said he does work with debt settlement companies if they approach him representing a small business that can’t pay its bills, as long as what’s offered is within the range of what the funding company client would accept. Otherwise it’s a no-go. While Smith doesn’t share the names of struggling small businesses in exchange for kickbacks in the event of repayment, he’s convinced that this happens as he continues to be approached.

Founded by Smith in 2015, Dedicated has a staff of 18.

It’s Back to Business For Alternative Funding in Puerto Rico

June 15, 2018

Last year, alternative funding in Puerto Rico ground to a halt after the island was ravaged by two devastating hurricanes in close proximity. Now, however, the alternative funding business in Puerto Rico is getting its second wind, after a several-month hiatus.

Puerto Rico got lashed by high winds and rain from Hurricane Irma in early September 2017, causing large-scale power outages and damage. Then, about two weeks later, Hurricane Maria hit the island square on, causing even more catastrophic destruction. Millions were without power for months (thousands still are), homes were destroyed, multiple lives were lost, businesses were decimated and the island’s already shaky economy teetered on the brink of disaster.

More than half a year later, residents are still trying to pick up the pieces of the epic humanitarian crisis. Hurricane Maria caused an estimated $90 billion in damage, according to the National Hurricane Center, making it the costliest hurricane on record to strike Puerto Rico and the U.S. Virgin Islands. The hurricane knocked out 80 percent of Puerto Rico’s power lines and destroyed its generators. Even months later, the lives of many residents are still in disarray as they wait desperately for insurance payments to materialize and get back to a semblance of their former lives. The island faces additional challenge—and uncertainty— with another hurricane season just around the corner.

In the midst of this turmoil, however, there’s a glimmer of hope for the budding alternative funding sector. Some businesses are once again seeking funds to rebuild or expand, and alternative funders are once again dipping their toes into the Puerto Rican market—albeit somewhat slowly. While some funders have exited the Puerto Rican alternative lending market, other new entrants are starting to stake a claim, citing an expected uptick in economic development that tends to follow natural disasters. Some funders also see Puerto Rico as a sweet spot because the market isn’t as mature as the U.S. and competition from other alternative funders is scant. Banks on the island aren’t always willing to provide businesses there with much- needed funds, so opportunities for non-bank funders are considered plentiful.

Businesses struggling to rebuild from the storms need more help than ever before, says Sonia Alvelo, president of Latin Financial LLC, an ISO that has been arranging funding for business owners in Puerto Rico for three years. “There is no doubt that Puerto Rico has a long, hard road ahead,” she says. But “I can assure you the entrepreneurial spirit is alive and well,” she says.

Latin Financial and other ISOs and funders are back to business—courting merchants and trying to help them get back on their feet. In December, Latin Financial processed its first renewal since Maria; in January it funded its first new client since September. Latin Financial continues to arrange funding of between $500k and $1 million per month on average in Puerto Rico, after some hurricane-related downtime.

“The storm destroyed a lot, but it didn’t set the small business drive back. They’re still pushing hard and really trying to maintain and grow business,” says Brendan P. Lynch, business partner and fiancé to Latin Financial’s Alvelo.

Greenbox Capital in Miami Gardens, Fla., an early entrant to the Puerto Rican alternative funding market, has also returned to funding small businesses on the island after a few-month hiatus. The company put off new deals right before Maria hit, and as a goodwill measure suspended the payments of existing customers for 90 days. Given the extension, almost all customers were able to stay on track and the firm suffered very few losses, says Jordan Fein, the company’s chief executive. Greenbox began funding again in January, he says.

Greenbox Capital in Miami Gardens, Fla., an early entrant to the Puerto Rican alternative funding market, has also returned to funding small businesses on the island after a few-month hiatus. The company put off new deals right before Maria hit, and as a goodwill measure suspended the payments of existing customers for 90 days. Given the extension, almost all customers were able to stay on track and the firm suffered very few losses, says Jordan Fein, the company’s chief executive. Greenbox began funding again in January, he says.

To be sure, it’s not exactly business as usual, since many businesses in Puerto Rico are still struggling, Fein says. While the situation should continue to improve, it will take time for the economy and businesses to fully recover, he says.

“They’ve come a long way since September, but they still aren’t fully back. We’re not seeing the same type of submissions that we saw before,” Fein says. Nonetheless, Fein remains positive about the market’s long-term prospects. “I think they are going to come back stronger, I really do,” he says.

To be sure, not all funders are interested the Puerto Rican market. Ripe with political uncertainty and economic instability, Puerto Rico already posed challenges that made many funders hesitant to do business there. The devastation wrought by Irma and Maria complicated matters further, and some funders pulled out of the market completely.

For others, however, the market’s still an opportune one, albeit not as stable as the U.S. market. Certainly, there are reasons for alternative funders to be optimistic. Despite its recent troubles, Puerto Rico is still considered a growth market. What’s more, with new businesses popping up in the wake of the storms, new infrastructure being instituted and businesses anxious to bounce back even bigger and better than before, some funders are striking while the iron is hot.

“This is the right time, as the island is growing,” says Paul Boxer, chief marketing officer and vice president of business development at Quicksilver Capital, a New York-based small business funder. Quicksilver funded its first deal in Puerto Rico in late April.

The company had been mulling over the possibility of doing business in Puerto Rico when an actual funding prospect arose. The company decided to give it a shot, sensing a potentially viable business opportunity. Existing businesses are rebuilding after the hurricane, there’s plenty of new business development and there’s a pressing need for new infrastructure as Puerto Rico continues to recover from the devastation, Boxer says.

Accordingly, Boxer says his company is in the process of vetting additional funding opportunities in Puerto Rico and hopes to continue growing this business in what he says is a largely untapped market. “I see it as a positive addition to what we offer, and I see a lot more opportunity in the future,” Boxer predicts.

Lending Express Opens Office in Silicon Valley

June 13, 2018 Tel Aviv-based Lending Express announced its entrance into the U.S. market yesterday. It opened an office in San Matteo, CA and has officially appointed Moshe Kazimirsky as VP of Strategic Partnerships and Business Development to support the new West Coast office.

Tel Aviv-based Lending Express announced its entrance into the U.S. market yesterday. It opened an office in San Matteo, CA and has officially appointed Moshe Kazimirsky as VP of Strategic Partnerships and Business Development to support the new West Coast office.

“After the immense success we’ve had in the Australian market, we knew that our platform was ready to take on the U.S.,” said Lending Express CEO Eden Amirav.

Lending Express initially launched its business in Australia in October 2016. The company provides an online marketplace that connects merchants to alternative funders. After only a year and a half, Amirav told deBanked that Lending Express is now the largest business of its kind in Australia – even though they only set foot on the continent a month ago.

Meanwhile, Lending Express has also been operating in the U.S. for months and has already partnered with leading online lenders like OnDeck, Kabbage and Fundbox, according to Amirav. Given the company’s experience in both the Australian and American markets, deBanked asked Amirav what he thought the differences were.

“In general, they are much more similar than people think,” Amirav said. “But in the U.S., people like to look around more.”

Generally, if an Australian merchant is approved, they will move forward with the deal right away, Amirav said. Lending Express offers a myriad of products on its platform, including equipment financing, invoice funding, business line of credit and merchant cash advance.

So far, Kazimirsky, who has worked in business development for other Silicon Valley technology companies, will be the only one in the new California office. But Amirav anticipates that the office with grow. The Lending Express office in Tel Aviv has 25 employees, many of whom – namely the account managers – start their day at 3 a.m. in order to speak to their Australian and American customers in different time zones.

Lending Express uses an algorithmic system called MatchScore to pair borrowers with lenders.