Loans

Was This Bitcoin Lender Paying Returns Too Good to Be True?

January 17, 2018 As the rivers flowed red with the blood of crashing cryptocurrencies Tuesday, one company did not survive. BitConnect, a company infamous in the crypto community for paying out obscenely high returns for lending your bitcoins, may have been too good to be true.

As the rivers flowed red with the blood of crashing cryptocurrencies Tuesday, one company did not survive. BitConnect, a company infamous in the crypto community for paying out obscenely high returns for lending your bitcoins, may have been too good to be true.

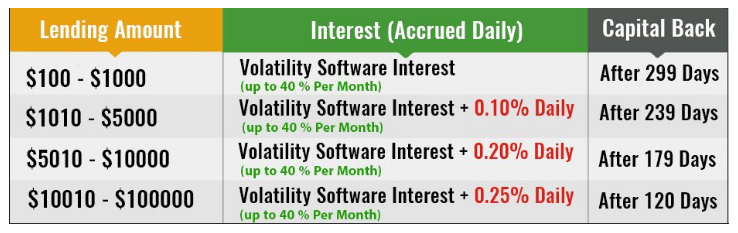

BitConnect offered investors the opportunity to make loans on their platform and earn up to 40% interest per month PLUS an additional .25% daily. The seemingly irresistible returns were enough to allow the market cap of their own company cryptocoin (BCC) to soar to more than $2.6 billion by early January.

On Tuesday, they announced that their lending service and other segments of their business would be discontinued. Cease and desist orders issued by two states, North Carolina and Texas, are said to have played a role. Texas authorities relied more on the company’s obvious flagrant violations of securities laws while North Carolina alleged that the company’s advertised returns were a red flag for a ponzi scheme.

The BitConnect Coin lost nearly 90% of its value immediately after announcing their closure. Meanwhile, the cryptocurrency markets shed more than $200 billion in market cap the same day, according to Coinmarketcap.com. The value of Ripple (XRP), a coin speculators believe will play a role in the future of banking, was not spared. Its price has dropped by 68% since January 5th.

New Mexico Bill Would Allow State Employees to Repay Loans Via Paychecks

January 15, 2018 Proposed legislation would enable New Mexico to offer small loans to state employees that are paid back via deductions from their paychecks.

Proposed legislation would enable New Mexico to offer small loans to state employees that are paid back via deductions from their paychecks.

Put forth by Democratic state Senator Bill Tallman, the bill would put a 30 percent ceiling on interest rates for loans obtained via the program and limit repayment to 12 percent of gross salary or wages.

According to the Associated Press, Tallman says the bill is aimed at lowering debt burdens on state workers.

Should it pass, Tallman’s initiative would serve as another step for the state in its current battle against predatory lending tactics. As of this month, small lenders in New Mexico are held to a maximum of 175 percent interest on all loans finalized from January 1, onward.

Doug Farry, executive vice president of Employee Loan Solutions Inc., which deploys the employee lending service, True Connect, believes such a strategy can prove successful at the state level.

“It’s a benefit program,” said Farry while discussing the bill. “There’s no reason why it can’t work for a state government as well as a county or city.”

Aimed at empowering workers that face obstacles when applying for credit via traditional avenues, True Connect mainly serves private employers but has seen increased interest in the public sector. This includes government organizations such as Santa Fe Public Schools and others within the state of New Mexico.

At no cost to their participating employer and without submitting a credit score, workers can sign up for small loans via the company’s website.

Typically the funds are deposited with in one business day, and the loan is repaid over the course of 26 paychecks at a flat rate of 24.9% interest.

New Mexico’s decision regarding the practice is yet to be determined, but should the bill pass, the state may soon have followers.

Farry says that True Connect is currently in talks with multiple state governments about including a similar system in their benefits package.

Payday Loan Convict Scott Tucker to be Featured in Netflix Docuseries

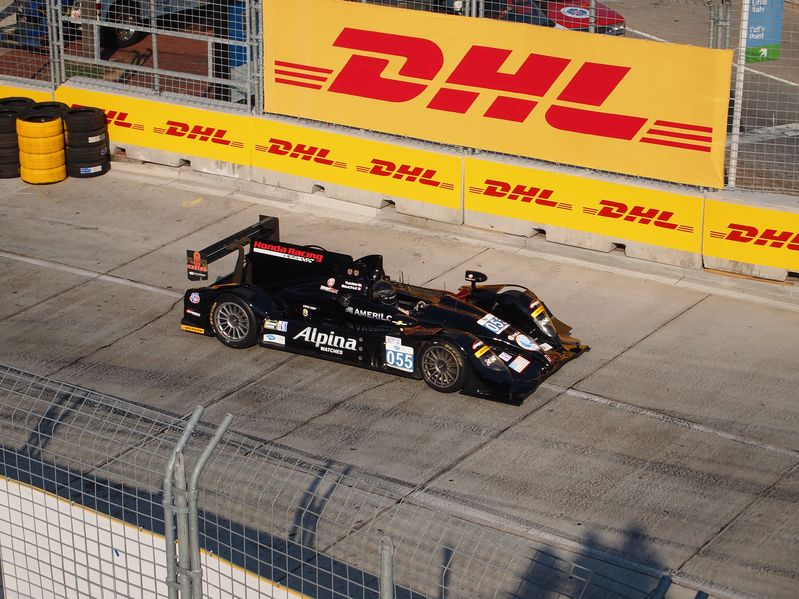

January 14, 2018Payday loan mastermind Scott Tucker, who was recently sentenced to 16 years in prison, will be featured in Dirty Money, a Netflix docuseries focused on tales of greed.

Tucker was among the most prolific payday lenders in the United States, using Native American tribes to shield himself from state laws while generating billions of dollars in revenue. Prior to his conviction on charges of participating in a racketeering enterprise through the collection of unlawful debt, wire fraud, money laundering, and violations of the Truth In Lending Act, he garnered the largest FTC judgment in history, a staggering $1.3 billion.

Tucker was among the most prolific payday lenders in the United States, using Native American tribes to shield himself from state laws while generating billions of dollars in revenue. Prior to his conviction on charges of participating in a racketeering enterprise through the collection of unlawful debt, wire fraud, money laundering, and violations of the Truth In Lending Act, he garnered the largest FTC judgment in history, a staggering $1.3 billion.

Tucker’s penchant for racing fancy cars that includes a professional career with some notable victories likely secured his place in the annals of financial villains.

The docuseries begins on January 26th.

Technology Drives Changes in CRE Lending Space

December 21, 2017 Online technology, which paved new paths for consumer and small business lending, is making similar inroads with the commercial real estate industry.

Online technology, which paved new paths for consumer and small business lending, is making similar inroads with the commercial real estate industry.

Over the last few years, several online marketplaces have been established to try and match commercial real estate borrowers with lenders quickly and efficiently using technology. In the past, commercial real estate lending depended heavily on having local connections, but online platforms are blurring these lines—making geographical borders less relevant and opening doors for new types of lenders to establish themselves.

While banks remain the largest source of commercial real estate mortgage financing, non–bank players—including credit unions, private capital lenders, accredited and non–accredited investors, hedge funds, insurance companies and lending arms of brokerage firms—have become more formidable opponents in recent years. Online platforms offer even more opportunity for these alternative players to gain a competitive edge.

At present, most of these commercial real estate marketplaces are purely intermediaries—they’re matching borrowers and investors, not actually doing the lending. Certainly, it’s an easier business model to develop than a direct lending one, but things could change over time, as borrowers become more comfortable with the online model and develop confidence that these platforms can perform, industry participants say.

“You have to be viewed as credible with a certainty of funding for borrowers to come to you. You can’t just put up a flag and say ‘Hey we’re making loans’ because borrowers won’t trust you and they won’t have the confidence that the loan is going to close,” says Evan Gentry, founder and chief executive of Money360, one of the few online direct lenders in this space. “However, once you develop a reputation of strong performance, the tide turns very quickly and that confidence is established,” he says.

“You have to be viewed as credible with a certainty of funding for borrowers to come to you. You can’t just put up a flag and say ‘Hey we’re making loans’ because borrowers won’t trust you and they won’t have the confidence that the loan is going to close,” says Evan Gentry, founder and chief executive of Money360, one of the few online direct lenders in this space. “However, once you develop a reputation of strong performance, the tide turns very quickly and that confidence is established,” he says.

For now, however, many of the marketplaces say they are content to remain intermediaries and offer business opportunities to lenders instead of competing with them. The sheer size of the market— commercial/multifamily debt outstanding rose to $3.01 trillion at the end of the first quarter, according to data from the Mortgage Bankers Association—and the fact that is an enormously diverse industry with no plain vanilla product makes it more likely that several platforms can co–exist without completely cannibalizing each other’s business, observers say.

Each of the online marketplaces has a different business and pricing model. Some marketplaces focus on small loans, while some have larger minimums; some focus on just debt; some focus on a mixture of equity and debt. Some sites cater to institutional lenders and accredited investors to help fund loans. Other sites invite non–accredited investors who meet certain criteria to participate in loans, opening doors to a segment of the population which previously had minimal access to commercial real estate deals. While the sites differ in their approach, the upshot is clear: banks—while still formidable competitors in commercial real estate lending—are no longer the only game in town for funding these deals.

The struggle for lenders is how to work most effectively with these marketplaces. “If you can acquire customers through only your own channels, then of course you’re going to do that,” says David Snitkof, chief analytics officer at Orchard Platform, which provides data, technology and software to the online lending industry. Otherwise, these marketplaces present a viable opportunity to expand distribution, he says.

GROWTH OPPORTUNITIES ABOUND

The surge of new companies acting as marketplaces between borrowers and lenders of all kinds comes as the commercial real estate industry is finally coming up to speed with respect to technology. The commercial real estate business has been static for decades in terms of how loans are processed and originated, according to industry participants.

“The use of technology is going to be an enormous disrupting force in that space,” says Mitch Ginsberg, co–founder and chief executive of CommLoan, one of the newer marketplaces for commercial real estate lending. Commercial real estate lending is “probably one of the last industries that hasn’t been touched by technology, and it’s ripe for massive disruption,” he says.

CommLoan of Scottsdale, Ariz., was founded in 2014, but the marketplace has only been fully operational since 2016. The platform targets borrowers seeking $1 million to $25 million of capital for all types of commercial real estate loans. It works with more than 440 lenders—including banks, credit unions, commercial mortgage companies, private money lenders and Wall Street firms. Altogether, CommLoan says it has processed more than $680 million in commercial transactions.

Online marketplaces can help make the commercial real estate industry more efficient and transparent, says Yulia Yaani, co-founder and chief executive of RealAtom of Arlington, Va., another new online commercial real estate marketplace. “People are tired of paying huge fees as a result of the market being so opaque,” she says.

RealAtom began operating in 2016 and targets borrowers who are seeking commercial real estate loans from $1 million to $70 million. The lenders on the platform include banks, alternative lenders, insurance companies, pension funds, hedge funds and hard money lenders. The company processed $468 million in commercial loans in its first 11 months of operating, according to Yaani.

Another benefit of online marketplaces is that they “create a liquid, national marketplace where lenders all across the U.S. can bid on a borrower’s business,” says Ely Razin, chief executive of commercial real estate data company CrediFi, which operates the upstart CredifX marketplace. Historically people who own commercial real estate have only been able to get financing through a local relationship with a bank or broker. “For borrowers, this means more certainty of obtaining a loan and optimized capital not limited by the relationship with the local lender,” he says.

CredifX started operating earlier this year to match commercial real estate borrowers, brokers and lenders including banks, finance companies, mortgage companies, hard money and bridge lenders. The platform is for loans of $1 million to $20 million across all major property types in the commercial space. It matches borrowers with appropriate lenders using the information that parent company CrediFi collects and analyzes. The company declined to disclose how much it has processed in commercial transactions.

To be sure, it’s hard to say how the marketplace model will evolve over time and which players will withstand the test of time. Certainly a similar model has faced challenges on the consumer and small business lending side.

“I think the pure marketplace will become more rare as time goes on,” says Peter Renton, founder of Lend Academy, an educational resource for the P2P lending industry. “There are examples of successful companies with a pure marketplace, but they are rare and difficult to scale. The only well-established company that seems completely wedded to the pure marketplace is Funding Circle; pretty much all other companies have switched to a hybrid model of some sort,” he says.

Commercial vs Residential

While much of the recent growth has been within commercial real estate, there are also some marketplaces that cater to residential borrowers or offer a mix of commercial and residential opportunities.

Magilla Loans, for instance, started out in 2016 as a solely commercial marketplace, but expanded outside this silo because customers were asking for residential and other types of loans, says Dean Sioukas, the company’s founder. The company now connects borrowers with lenders for a whole host of loan types—commercial, residential and others like franchise loans and equipment loans. Lenders on the platform include roughly 130 banks, mortgage loan originators, accredited investors, credit unions and online non-depository institutions. The average loan size is $1.4M for business loans and $500K for home loans. Nearly $4 billion in loans has been channeled through the platform since January 2016; of that 70 percent is tied to commercial real estate, according to the company.

Magilla Loans, for instance, started out in 2016 as a solely commercial marketplace, but expanded outside this silo because customers were asking for residential and other types of loans, says Dean Sioukas, the company’s founder. The company now connects borrowers with lenders for a whole host of loan types—commercial, residential and others like franchise loans and equipment loans. Lenders on the platform include roughly 130 banks, mortgage loan originators, accredited investors, credit unions and online non-depository institutions. The average loan size is $1.4M for business loans and $500K for home loans. Nearly $4 billion in loans has been channeled through the platform since January 2016; of that 70 percent is tied to commercial real estate, according to the company.

While there are marketplaces that focus on residential mortgage lending, some industry participants say that side of the business isn’t as appealing to new online entrants in part because the cost to acquire customers is really high and there are more challenges to working on a national scale.

“It may not be that commercial is more attractive. It may just be easier. Going directly to borrowers in the residential space has proven harder than many companies expected,” says Brett Crosby, co-founder and chief operating officer of PeerStreet, a marketplace for accredited investors to invest in high-quality private real estate backed loans. Experience seems to suggest that for residential mortgage origination, “it’s much better to have a good ground game and know your local market,” he says.

To be sure, as the online market for real estate matures, it’s not so surprising that companies would shift business models to find their own sweet spot. RealtyMogul.com is one example of a company that has morphed over time. The online platform began operating in 2013 in both the residential and commercial space, but has since moved away from the residential business. Accredited investors, non-accredited investors and institutions can use the platform to find equity or debt-based commercial real estate investment opportunities, and borrowers can apply for private hard money loans, bridge loans and permanent loans.

Money360 is another example of a company that has shifted gears. It started out as a pure marketplace, but changed its business model to become a lending platform in 2014. Now the online direct lender in Ladera Ranch, Calif., provides small-to mid-balance commercial real estate loans ranging from $1 million to $20 million. It’s one of the only companies targeting the commercial real estate space in this way and has closed nearly $500 million in total loans since 2014.

Gentry, the company’s founder, says he would expect to see more industrywide changes as the online commercial real estate business continues to evolve. The key to success, he says, is executing well and “knowing when to pivot when you realize something’s not working just right.”

Ultimately, Gentry predicts more online lenders will target the commercial real estate space. He says technology-based alternative lenders have an advantage because they can operate more quickly and efficiently while still being very competitive from a pricing perspective.

“You put all those things together (speed, efficiency and competitive pricing) and that’s what borrowers are looking for,” Gentry says.

LendingPoint: CAN Capital’s Close Neighbor in Kennesaw

August 14, 2017 LendingPoint, a consumer lender staffed largely by former CAN Capital employees, may have something to teach the alternative small-business finance industry about creditworthiness. Three-year-old LendingPoint claims to go beyond FICO scores to bring each applicant’s sense of fiscal responsibility into sharper focus.

LendingPoint, a consumer lender staffed largely by former CAN Capital employees, may have something to teach the alternative small-business finance industry about creditworthiness. Three-year-old LendingPoint claims to go beyond FICO scores to bring each applicant’s sense of fiscal responsibility into sharper focus.

But first, let’s examine the CAN Capital connection. Four or five members of LendingPoint’s top management team came to the company after lengthy tenures at CAN Capital, a LendingPoint official says. That includes Tom Burnside, LendingPoint’s CEO and founder, and Franck Fatras, the company’s president and chief operating officer. Both worked 13 years for CAN Capital, with Burnside leaving as chief operating officer and Fatras departing as chief technology officer, according to biographies posted online.

All told, about 30 of LendingPoint’s 100 or so employees – a total that includes outsourced positions – formerly labored at CAN Capital, according to Fatras. Many put in considerable time at CAN Capital, holding jobs there in management, corporate governance, legal affairs, risk, sales, operations, IT, marketing, analytics, design, customer service, partner success and success delivery, online reports say.

Geography no doubt encourages CAN Capital employees to consider LendingPoint when it’s time to move on to another job. Both companies maintain headquarters in office parks in the Atlanta suburb of Kennesaw. In fact, the two companies operate half a mile apart, both of them just off of Cobb Place Boulevard Northwest, according to Google Maps and Directions.

Great news! Our new logo has OFFICIALLY made it's mark on our new building. What do you think?#Finance #LendingPoint #Logo pic.twitter.com/cpUIQvLy2w

— LPLoans (@LPLoans) March 13, 2017

The way Fatras tells it, LendingPoint hasn’t raided CAN Capital’s workforce. “We post the job, and they end up responding,” he says. “When they’re known quantities and people we have a lot of respect for, we just end up making it work.”

Moreover, LendingPoint’s connections with other companies don’t begin or end with CAN Capital. Some of the people in top management met when they worked at First Data Corp. and Western Union, Fatras recalls. Juan E. Tavares, co-founder and chief strategy officer, and Victor J. Pacheco, chief product officer, came from those relationships, he says.

Regardless of where they became acquainted, Lendingpoint’s leadership team has come together to form a direct balance-sheet consumer lender specializing in what they call a “near prime” clientele. The company defines the phrase “near prime” to include personal-loan applicants with FICO scores from 600 to 700, Fatras says, adding that the segment’s not sub-prime and not prime. The company has even trademarked “NEARPRIME” as a single word in capital letters, and it appears that way on the company website. It regards those consumers as “deserving yet underserved,” Fatras notes.

To qualify those applicants for credit, LendingPoint considers “behavior,” such as work history, education, and timeliness with paying rent, utility bills and cell phone bills, Fatras says. “A lot of what we do is identify patterns,” he says. “It’s all about asking the right questions.” The process requires tapping into multiple sources to collect the data, he observes.

In a blog published online soon after LendingPoint was launched, executives Burnside and Tavares claim that most credit models search for ways to say no to applicants, while their company uses big data to find ways of saying yes. LendingPoint algorithms predict risk with great precision, they say.

In a blog published online soon after LendingPoint was launched, executives Burnside and Tavares claim that most credit models search for ways to say no to applicants, while their company uses big data to find ways of saying yes. LendingPoint algorithms predict risk with great precision, they say.

In a newspaper opinion piece that ran about the same time, Burnside and Tavares maintain that their model examines cycles in an applicant’s life to pinpoint upward and downward trends. A consumer on the way up deserves a loan, according to the theory.

The company’s willingness to study information that resides outside credit scores did not originate with the CAN Capital connection, Fatras says. “The model is unique and the data structure we are using is unique,” he says. “It’s all about understanding the credit story of the person.”

Latin American lending practices had some influence on LendingPoint, Burnside and Tavares write in one of their editorial pieces. Lenders there review factors other than credit scores because the scores aren’t readily available in some countries, they write.

To analyze that type of non-FICO information, LendingPoint has developed its own internal scoring model and then automated the process, spending a lot of time to develop the technology, Fatras continues. Once again, asking the right questions determines the meaning that the company can extract from the data, he emphasizes. Otherwise, the information’s just not that beneficial, he says.

When consumers come to the LendingPoint website and answer five or six questions, they can receive a firm offer of credit in an average of seven seconds and sometimes as quickly as four seconds, Fatras maintains. The offers are contingent upon the company underwriting department’s validation of income and other figures, ne notes, adding that “we’re pretty happy with the infrastructure we’ve built.”

LendingPoint collects on the loans with automatic payments from customers’ savings or checking accounts twice a month, according to the company website. Deducting the payments twice a month helps customers with budgeting, the site says. Consumers can borrow up to $20,000 and pay it back in 24 to 48 months.

The system was devised by top management with combined experience of more than a century in credit and risk, Fatras says. When those executives with so much commercial lending experience gather around the conference table to talk about the business, the possibility of lending to small businesses occasionally comes up in the conversation.

But Fatras doubts the company will make that move to the commercial side anytime soon because companies in the alternative small-business finance industry are competing for 5 million to 6 million potential customers while the country has 50 million near-prime consumers. “The space is so big where we are,” he says. “The demand could be over a billion dollars a month. We have a lot of room in front of us for growth.”

With that seemingly infinite market, LendingPoint has been growing at a healthy pace, Fatras says. The company, which was self-funded for the first year, made its initial loan in January 2015. In 2016, it did $150 million in business, he notes. By the middle of this year, the company had made a total of $250 million in loans to 25,000 consumers, he says.

It’s a business model that members of the alternative small-business finance community might do well to emulate, Fatras suggests. “There could be a lot of cross-pollination,” between consumer and commercial loans when it comes to going beyond FICO, he says.

LendingPoint executives that were formerly at CAN Capital

Tom Burnside, CEO

formerly a COO and president at CAN

Franck Fatras, President and COO

formerly a CTO at CAN

Mark Lorimer, Chief Marketing Officer

formerly a CMO at CAN

Dave Switzer, Chief Analytics Officer

formerly a VP at CAN

Joe Valeo, EVP of Strategic Development

formerly an EVP at CAN

SmartBiz Loans Expands Its Footprint With a NorCal Bank

April 25, 2017Technology-based lending platform SmartBiz Loans, which is dedicated to facilitating SBA loans, has expanded its bank roster. SmartBiz announced today a new partnership with Sacramento-based Five Star Bank, bringing the tally of the number of banks on the startup’s platform to five and thrusting marketplace lending into the spotlight once again.

Five Star already delivers SBA loans to customers but through the SmartBiz platform will slash both the time and costs in the underwriting process while reaching new small business customers in the process.

Evan Singer, CEO of SmartBiz Loans, told deBanked that the mindset of the executive team at the Silicon Valley startup has always been to bring banks back into the fold and to incentivize them to fill a void in the market left by the financial crisis by originating smaller loans, in particular SBA loans.

“What we’ve seen in the market is that good businesses cannot get access to low-priced capital if they want to borrow $250,000. So sure, if they want to borrow $5 million they can get access. That’s why we came up with the idea to bring the banks back through fintech,” he said.

Five Star Bank, a privately held bank with $850 million in total assets, is pleased to be among those ranks. James Beckwith, president and CEO of Five Star Bank, was introduced to the SmartBiz technology about a year ago after which time the bank execs began the due diligence process.

“I was intrigued,” Beckwith told deBanked. “We felt the need to somehow play in the space. But we also knew it wasn’t practical for us to develop our own platform. So this was really right in our sweet spot of how we like to partner with people.”

As a result of the partnership Five Star Bank, which makes loans from its own balance sheet, is reaching small business clients the bank did not have access to before.

“Our market presence didn’t allow us to touch a lot of these businesses before, whether from Los Angeles, or Arizona, or San Jose. It’s really people we were unable to touch now being touched through the SmartBiz partnership,” said Beckwith, adding that the small businesses span industry verticals.

“At this point we’re looking at deals in the Western United States and we hope to expand that. The small businesses are really all types – construction companies, PR firms, consulting firms, — there’s no concentration in terms of industry type,” he noted.

The bank’s target customer is seeking a loan for $350,000 or less and the average loan size is $250,000 to $270,000. Terms of an SBA loan on this platform are comprised of a rate of Prime plus 2.75 over a 10-year period.

“The term is much longer and the rate is much lower than traditional loans. Small businesses can save thousands of dollars per month by getting an SBA loan through the SmartBiz and Five Star partnership,” said Singer. In fact, Five Star bank spends about one-tenth of the time on a file or customer originating from SmartBiz than it would on a customer coming from the traditional retail side of their business.

Industry Shakeout

Much of the fallout in the marketplace lending market segment has been tied to the stigma of subprime lending. Beckwith is quick to point out, however, that the underwriting standards for the loans on this platform, which are agreed upon by both Five Star and SmartBiz, are high.

“If you look at some of the average FICO scores we are doing, they are actually good deals. They’re SBA, they’re not subprime deals. I would not characterize them as subprime deals at all,” Beckwith said.

Meanwhile the marketplace lending segment has undoubtedly become more crowded in recent years, attracting the likes of lenders and non-lenders alike, evidenced by the participation of Amazon and Square Capital in this space, for instance.

According to Singer some industry shakeout can be expected in the near term. He expects over the next couple of years that those marketplace lenders and other alternative lenders unable to meet customer demands will either experience a wave of consolidation or they simply won’t be around any longer.

“We are already starting to see a number of our loan proceeds being used to refinance expensive shorter-term debt where they save thousands per month. Businesses are getting smarter with available options and folks that are able to best meet and deliver with small businesses on their minds first are going to come out on top,” said Singer.

SBA 7(a) Cap

As a technology platform dedicated to SBA loans, the issue of the program’s annual allotted cap is something that gets revisited on an ongoing basis. Nonetheless even when the SBA program has come close to suspension, Congress has stepped in to keep it afloat.

“The great thing about SBA is that it has support from both sides of the aisle in D.C. We’ll see what happens this year,” said Singer.

James agrees. “Every year that this becomes an issue the cap has been increased. I feel comfortable that what has happened in the past will happen again in the future because these programs are very viable. The small business space has very strong economic development activity.”

If they’re right this bodes well not only for the Smart Biz and Five Star partnership but also the new banks that the tech-based lender has in its pipeline.

“We are adding banks into the marketplace. And we’re selective about who we add,” Singer said.

Blazing Trails in Unexplored Financial Markets

April 4, 2017 Once upon a time people with health insurance who were treated for medical emergencies, illnesses or chronic health conditions –an illness or accident requiring hospitalization, an appendectomy, or a hip replacement, say – could rest easy. Insurance underwriters like United Health, Wellpoint or Humana would surely handle most, if not all, of a patient’s medical expenses.

Once upon a time people with health insurance who were treated for medical emergencies, illnesses or chronic health conditions –an illness or accident requiring hospitalization, an appendectomy, or a hip replacement, say – could rest easy. Insurance underwriters like United Health, Wellpoint or Humana would surely handle most, if not all, of a patient’s medical expenses.

Today? Not so much. As healthcare becomes ever more pricey, employers are increasingly offering health insurance plans that are less generous and require consumers to pay higher deductibles. Individuals as well are finding that the same goes for them: The only way to afford health insurance is to purchase a plan with a high deductible.

“We’re at a tipping point where the cost of healthcare is outpacing GDP,” says Adam Tibbs, chief executive and co-founder of Parasail Health, a start-up alternative lender in the San Francisco Bay area. “As a result,” he adds, “the only way health insurance can work is either to raise (the cost of) premiums or opt for higher deductibles.”

Statistics confirm Tibbs’s assertion. As of last autumn, according to a September, 2016, survey by Kaiser Family Foundation, the average deductible for workers’ health insurance policies jumped to $1,478, up by more than 12% from $1,318 in 2015. The survey found, moreover, that – for the first time — slightly more than half of all covered workers have deductibles of at least $1,000. At smaller companies, the average deductible is now more than $2,000.

Parasail, a Sausalito-based alternative lender which opened its doors last September, is angling to fill that void. Funded with seed capital raised from four venture capital firms — Healthy Ventures, Montage Ventures, Peter Thiel, and Tiller Partners, reports online data-publisher Crunchbase – Parasail acts as a go-between, connecting the medical practitioners to third-party lenders.

In partnering with doctors, hospitals, and medical clinics, Parasail employs a business model that resembles an auto dealership. After the customers picks out a four-door sedan or a sport utility vehicle, he or she drives it home thanks to a five-year, monthly-payment plan from, say, Capital One.

Similarly, after agreeing to a costly medical procedure, the patient can strike an arrangement with a medical provider’s billing department for on-the-spot financing. Once the deductible is covered, the patient is cleared to glide into the operating room.

Despite being open for less than a year, Tibbs says, Parasail has enlisted as partners some 2,500 medical practitioners with unpaid patient debt of roughly $4 billion. The typical loan averages $6,000. “Our goal,” remarks Parasails marketing vice-president, Dave Matli, “is to create a normal retail experience” so that financing medical debts is as seamless as swiping a credit card.

Meanwhile, industry experts say that Parasail represents a new breed in the financial technology sector. As online alternative lending and the broader fintech industry grow more established, institutional investors and financiers are increasingly wagering bets on companies that promise more than disruptive technologies or cheaper loans.

Increasingly, they are hunting for companies like Parasail that are introducing new products or blazing trails in unexplored markets. “The area that I find most interesting,” says Phin Upham, a venture capitalist and board member at Parasail, is investing in companies that “are developing products that didn’t exist before, serving people who haven’t been served, and playing a unique role incentivizing long-term behaviors.” (Upham, who is a principal at Peter Thiel’s VC firm, emphasizes that he is speaking only for himself.)

Parasail’s fundraising and launch has taken place against a dramatic drop in both global and U.S. fintech financing, according to KPMG’s annual report on the industry, “The Pulse of Fintech.” The accounting firm reports that total funding for fintech companies and deal activity plummeted by more than 50% in the U.S. in 2016 to $12.8 billion from $27 billion the prior year. KPMG attributed much of the drop to “political and regulatory uncertainty, a decline in megadeals, and investor caution.”

Parasail’s fundraising and launch has taken place against a dramatic drop in both global and U.S. fintech financing, according to KPMG’s annual report on the industry, “The Pulse of Fintech.” The accounting firm reports that total funding for fintech companies and deal activity plummeted by more than 50% in the U.S. in 2016 to $12.8 billion from $27 billion the prior year. KPMG attributed much of the drop to “political and regulatory uncertainty, a decline in megadeals, and investor caution.”

The year “2016 brought reality back to the market” after the banner, record-shattering year of 2015, the report noted.

Venture capital financing in the U.S., however, did not slip as dramatically as overall funding, sliding some 30% to $4.6 billion from $6 billion in 2015. (Almost overlooked in the report was that corporate investment capital was “the most active in the past seven years,” KPMG’s report notes, representing 18 percent of venture fintech financing.)

Steve Krawciw, a New York-based fintech startup executive asserts that “the business has matured and, yes, there have been defaults, but the business model for fintech has stabilized.” The author of “Real-Time Risk: What Investors Should Know About FinTech, High-Frequency Trading, and Flash Crashes,” Krawciw expects more funding to stream into the industry as new players such as banks, insurance companies, hedge funds and private equity get involved. They’ll “go in a number of different directions,” he reckons, “especially direct lending by hedge funds and private equity firms.”

No figures have yet been released by KPMG for the first quarter of 2017, just ended in March, but fintech industry participants are mightily impressed at news of the $500 million financing for Social Finance Inc. (SoFi). Best known for its refinancing of student loans, the San Francisco firm reported on February 24 that it raised a half-billion dollars in a financing round led by private equity firm Silver Lake Partners. Other investors include SoftBank Group and GPI Capital, bringing SoFi’s total investment to $1.9 billion, the company said in a press release.

SoFi, which plans to use the funds to expand online lending into international markets and devise new financial products, is ambitiously transforming itself into an online financial emporium. Along with a suite of online wares that mimic traditional banking and financial products – savings accounts, life insurance policies and mutual funds – SoFi has also invented new online offerings.

SoFi, which plans to use the funds to expand online lending into international markets and devise new financial products, is ambitiously transforming itself into an online financial emporium. Along with a suite of online wares that mimic traditional banking and financial products – savings accounts, life insurance policies and mutual funds – SoFi has also invented new online offerings.

For example, SoFi formed a partnership with secondary mortgage lender Fannie Mae and, together, the companies are enabling borrowers to refinance both mortgage and student debt. The SoFi financing, says Krawciw, “is not a seminal deal, it’s a sign of what’s coming.”

SoFi may also be providing a road map for fintech companies like Parasail. After building a customer base with health-care loans at 5.88% annual percent rate — compared with credit cards charging interest rates about four times as much – Parasail could be poised to sell additional products to its built-in audience.

Just as SoFi got big on refinancing student loans, Parasail could use healthcare lending as a springboard for future financial endeavors. Its revenues have been growing by 50% month-over-month.

By the first quarter of next year, Tibbs says, the firm will be breaking even.” And at that point, he adds, it expects to roll out a menu of new products too.

For Marketplace Lending Securitizations, A Bumpy Road But Strong Investor Sentiment

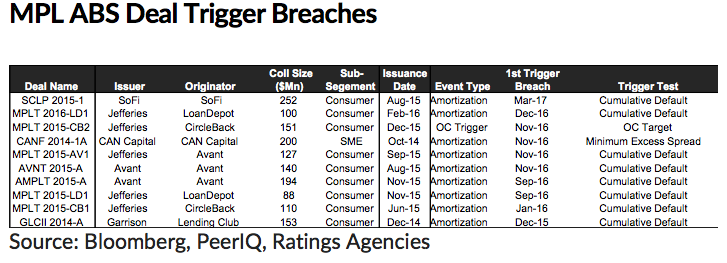

April 3, 2017A new report by published by PeerIQ contains 10 recent examples of trigger breaches in marketplace lending ABS transactions.

“Since the inception of MPL ABS market, we have observed 10% of deals breaching triggers historically,” the report says. It goes on to say that these events are typically manifestations of “unexpected credit performance, poor credit modeling, or unguarded structuring practice.”

“If an early amortization trigger is violated, excess spreads are diverted from equity investors to senior noteholders with the goal of de-risking the senior noteholders as quickly as possible.”

CAN Capital is the lone small business lender on the above list and we reported on their trigger breach back in December. Little public information has come out about the company since they stopped lending late last year.

![]() The most recent trigger breach on the list was SoFi, a company known for courting super prime borrowers.

The most recent trigger breach on the list was SoFi, a company known for courting super prime borrowers.

“Trigger breaching events do not necessarily imply credit deterioration of the collateral pool,” the PeerIQ report states. In another section of the report that addresses increased losses for non-bank lenders, it says that two of the three primary drivers of that are borrowers stacking loans and lenders shifting to riskier borrowers.

Nonetheless, Q1 was a record quarter for marketplace lending securitizations with seven deals priced for $3 billion. That’s a 100% increase over Q12016. “The industry continues to experience strong investor sentiment as evidenced by growing deal size and improved deal execution,” they say.

“We expect higher volatility from rising rates, regulatory uncertainty, and an exit from a period of unusually benign credit conditions. Platforms that can sustain low-cost stable capital access, build investor confidence via 3rd party tools, and embrace strong risk management frameworks will grow and acquire market share.”