Loans

Bernie Sanders Poses Bad Lending Question

December 27, 2015Two loans: one with collateral, the other without any. All else being the same, which one do you think would have the higher interest rate?

Given his tweet, Socialist (Democrat) candidate Bernie Sanders might not understand the question.

You have families out there paying 6, 8, 10 percent on student debt but you can refinance your homes at 3 percent. What sense is that?

— Bernie Sanders (@SenSanders) December 26, 2015

The twitterverse was quick to pounce on him for it:

@SenSanders I like you but you have to understand collateralized debt

— Greg Wissinger (@gwiss) December 26, 2015

@SenSanders

A bank can repossess a house. They can't repossess your brain if you quit paying student loans. Though, you make me wonder.

— Smittie (@smittie61984) December 26, 2015

@SenSanders Collateralized vs non collateralized loan. But you knew that already.

— enargins (Neil) (@enargins) December 26, 2015

@SenSanders it makes perfect sense. A 'home' is collateral which the bank can take possession of in case of default. m/t @KurtSchlichter

— All-American Male (@chrisbraly) December 26, 2015

@SenSanders astonishing how you can run president and not understand this basic understanding of collateral.

— Wittorical (@Wittorical) December 26, 2015

@SenSanders I'm generally on your side, but mortgages are secured debt whereas student loans are unsecured and don't always increase income.

— Don Edwards (@DMEdwards) December 26, 2015

@SenSanders wow, big display of stupidity here. The house has resale value. Can we sell people now if they don't pay?

— Ms. Parker (@CaseyParksIt) December 26, 2015

To be fair, student loans might be unsecured debt but they can’t be discharged in bankruptcy. There’s also ways for debt collectors to garnish a paycheck to pay them back. That’s entirely dependent on the borrower generating income though and likely means a substantially longer repayment period. In a famous op-ed by Lee Siegel in the NY Times titled, Why I Defaulted on My Student Loans however, it is apparently possible to just avoid the debt altogether (and apparently feel okay about it).

With stories like that it’s easy to understand why a loan secured by a home would cost less than a loan secured by someone’s willingness and ability to pay. And in the case of Bernie Sanders, a candidate who believes college should be free for everyone, it’s tough to say if his question was really just rhetoric meant to stir up his base or a serious one in which he really doesn’t understand how the underwriting of loans work.

Either way, many people are worried:

.@SenSanders doesn't understand why having collateral would account for a lower interest rate. And people want to make him president?

— Caleb Cassel (@CalebCassel) December 27, 2015

Debt Settlement: A Partner to Alternative Lenders?

August 23, 2015 Call it the flip side of the coin, the part of the universe that helps consumers get out of debt, rather than take more on. Debt settlement, as it’s called, has a bit of a murky reputation thanks to a number of unscrupulous players that operated prior to the implementation of the Telemarketing Sales Rule in 2010.

Call it the flip side of the coin, the part of the universe that helps consumers get out of debt, rather than take more on. Debt settlement, as it’s called, has a bit of a murky reputation thanks to a number of unscrupulous players that operated prior to the implementation of the Telemarketing Sales Rule in 2010.

On October 27th, five years ago, for-profit companies that sold debt relief services over the phone could no longer charge a fee before they settled or reduced a customer’s unsecured debt.

“That law forever changed the industry for the better,” said a company representative at National Debt Relief (NDR), a New York City-based debt settlement firm.

Located right in front of the Bull at 11 Broadway, NDR occupies two floors and employs over four hundred people. And while it may seem that their business model is at odds with the dozens of loan brokers that operate in the neighborhood, they’re actually finding ways to work together.

“We’re monetizing their declines,” said a company representative. Indeed, alternative lenders like to talk about the amount of loans they can issue, but thousands of consumers are ultimately declined.

What those consumers do next and where they go is a storyline that doesn’t get much attention. NDR offers to the consumer an alternative route to become debt free in 36 months.

“NDR is enrolling thousands of consumers per month,” said a company representative. The A+ BBB rating and firm regulatory compliance has enabled them to land several strategic partnerships in this industry ranging from merchant cash advance com- panies to peer-to-peer lenders.

“NDR is enrolling thousands of consumers per month,” said a company representative. The A+ BBB rating and firm regulatory compliance has enabled them to land several strategic partnerships in this industry ranging from merchant cash advance com- panies to peer-to-peer lenders.

“We’ve found that 36% of declines from alternative lenders fit our criteria,” said a company representative. Too much debt is one obvious reason that applicants are getting declined from some of these companies in the first place. And to that end, NDR strives to provide them relief. One condition however is that the client not use credit while in the program.

NDR operates in 42 states and requires a minimum of $10,000 of unsecured debt to be eligible. They are also an accredited member of the American Fair Credit Council, a consumer credit advocacy association that touts the strictest code of conduct in the industry.

At the 2015 LendIt Conference in NYC, NDR stood out as a Gold Sponsor.

“Everybody wanted to know what we did,” said Michael Drehwing who was there as the company’s representative. “I told them we want to monetize your declines. How simple is that?”

Search Engine Lead Generation Is Probably Rigged

March 21, 2015 Hoping to do some nifty SEO to boost your site to the top of search results for valuable keywords? Don’t bother. In August, 2014, I presented six signs that alternative lending is rigged, at least as far as search was concerned.

Hoping to do some nifty SEO to boost your site to the top of search results for valuable keywords? Don’t bother. In August, 2014, I presented six signs that alternative lending is rigged, at least as far as search was concerned.

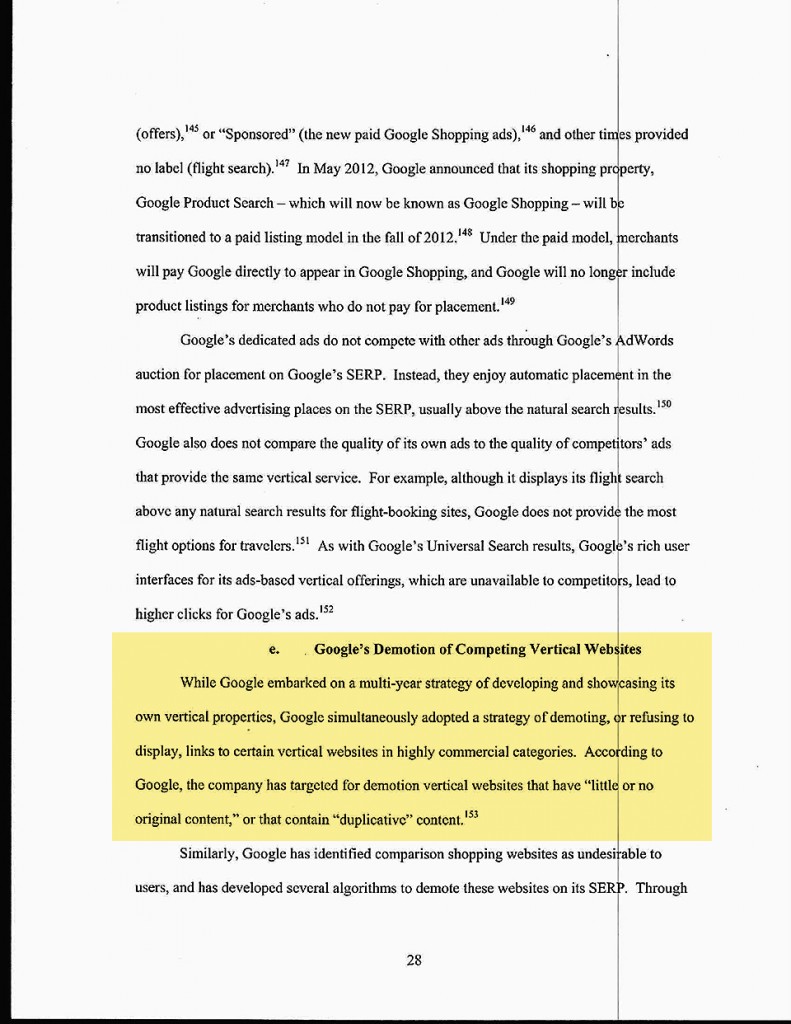

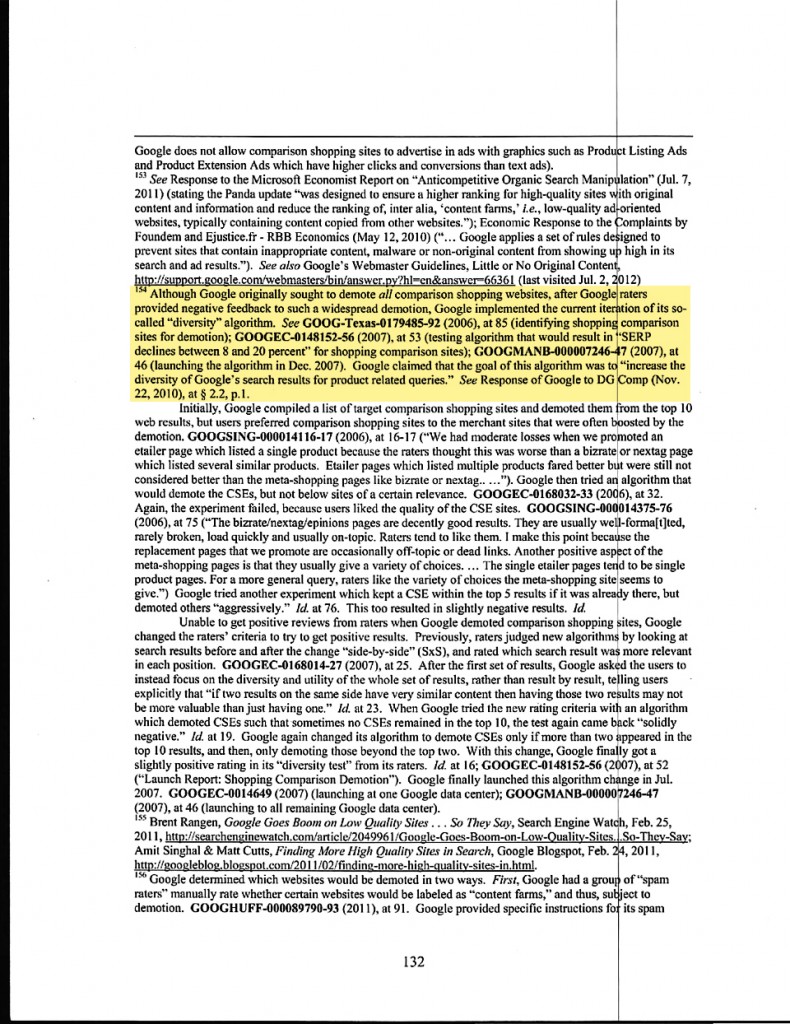

Two days ago, the Wall Street Journal ran a story that exposed a confidential FTC report on Google. The article opens with, “Officials at the Federal Trade Commission concluded in 2012 that Google Inc. used anticompetitive tactics and abused its monopoly power in ways that harmed Internet users and rivals, a far harsher analysis of Google’s business than was previously known.”

The conclusion? Google indeed skewed search results to favor its own services.

The 160 page report that the WSJ draws its analysis from was not supposed to be made public. Only a handful of pages are presented on the WSJ’s website in their entirety. Below are two of them:

Though I cannot find the specific comment anymore on LinkedIn, one of the responses I received on my August post regarding Google’s search results came from a former Google employee. They informed me that my suspicion was preposterous and that Google would never ever manipulate results.

While I made no effort to assert my evidence as anything more than circumstantial, the outright dominance of Google-owned lending companies for high value lending keywords was impossible to ignore. The WSJ story adds fuel to this fire.

Admittedly, the WSJ story doesn’t mention lending, nor do I think lending keywords were a subject of the FTC report (There are 156 pages the WSJ didn’t share). What I think is compelling here is a conclusion that Google did indeed manipulate results and penalized competitors to favor its own financial goals.

Despite the findings, the FTC ultimately did not bring any action against Google.

Is the game rigged? I feel a little bit better about saying, yes. Don’t put all your eggs in the SEO basket.

More Red for OnDeck (ONDK)

February 24, 2015 Back in the red?

Back in the red?

It looked like the tide had finally turned. After 8 years and just in time for their IPO, OnDeck had pulled off their first quarterly profit, a meager amount of $354,000. But it was a start right? After their debut on the NYSE, the price swung heavily from a high of $28.98 to a low of $14.52. It closed at $19.37 right before the report was released.

OnDeck reported a $4.3 million loss for the 4th quarter and an $18.7 million loss for the year. Despite this, their margins are definitely improving.

The company issued $369 million in loans last quarter, bringing the 2014 total to $1.2 billion. Sales and marketing expenses doubled in 2014 over the prior year with CEO Noah Breslow and CFO Howard Katzenberg acknowledging on the call they’ve made a big go at TV and radio advertising.

Competition? What competition?

Noticeably, the average APR of loans originated in the fourth quarter was 51.2%, down from over 60% in Q4 of 2013.

One analyst asked if competitive pressures were leading to the reduction in interest rates but Breslow said that wasn’t the case. If anything their closing rate or “booking rate” has been improving and rates coming down is an initiative they’ve taken up on their own. Merchants are actually shopping less according to them.

“Overall this market is still characterized by extreme fragmentation,” Breslow said. “The behavior that we see with our customers is that they might research other competitive options online but then when they actually apply to OnDeck and receive that offer, they kind of have this bird in hand dynamic, and there’s so much search cost associated with going out and looking at other places and so much uncertainty around that, they typically just take that offer that OnDeck has provided to them.”

With their cost of capital down, closing rate up, and defaults steady, a net loss should arguably be a tough pill to swallow. In response to a question about potential regulatory threats, Breslow said there wasn’t really anything on the horizon.

With their cost of capital down, closing rate up, and defaults steady, a net loss should arguably be a tough pill to swallow. In response to a question about potential regulatory threats, Breslow said there wasn’t really anything on the horizon.

So was it just a weird quarter? Under Guidance for First Quarter 2015 and Full Year 2015 in their quarterly report, they suggest another long year of losses ahead.

To infinity and beyond!

The economic and regulatory environments couldn’t be any more favorable to a company that now has almost a decade worth of data under its belt. But unfettered growth still seems to be the number one priority on the agenda. Breslow and Katzenberg spoke optimistically about their recent entry in the Canadian market and the potential to set up shop in other countries. As for the OnDeck Marketplace… surprisingly they claimed its only real purpose is to diversify their funding sources. They are not aiming to become a marketplace but rather they view the OnDeck Marketplace as just one of many vehicles to sell off loans.

So when does the profit part come in? None of the analysts on the line asked about profit. They mostly all offered their congratulations on a “great quarter”. Coincidentally they were almost all from companies that originally underwrote their stock offering.

Six months ago I wrote that OnDeck’s lack of profits has been intentional. In An Insider’s Perspective, I wrote, “What scares their competitors though, is that this strategy has been intentional. Very few if any players in the industry have had the luxury, guts, or the purse to lose money for seven years as part of a coup to conquer the market.” Nothing has changed.

As long as they have cash in the bank, they’re going to keep pursuing growth. They had $220 million in cash and cash equivalents as of December 31st. So for now that means continuing to turn up the marketing heat to increase volume domestically while planting seeds in other markets like Canada.

But the question remains, at what point does profitability become important? Sure it’s tempting to be lending $2 billion or $3 billion a year instead of the $1.2 billion size they’re at now because it would mean they’ll be that much bigger right? Heck, maybe they can be a $10 billion a year lender. But if they are running in the red at a moment where their cost of capital is low, the credit markets are liquid, the economy is favorable, regulatory threats are nil, defaults are static, there is supposedly no competition, and their margins are at their peak, then what happens when one or two of those things change? What if all those things change at once?

But the question remains, at what point does profitability become important? Sure it’s tempting to be lending $2 billion or $3 billion a year instead of the $1.2 billion size they’re at now because it would mean they’ll be that much bigger right? Heck, maybe they can be a $10 billion a year lender. But if they are running in the red at a moment where their cost of capital is low, the credit markets are liquid, the economy is favorable, regulatory threats are nil, defaults are static, there is supposedly no competition, and their margins are at their peak, then what happens when one or two of those things change? What if all those things change at once?

Those rates are too high low

OnDeck’s price jumped in afterhours trading. The market is chalking up the results as a positive. It’s just another losing quarter in a long line of losing quarters for OnDeck and they’ve promised more of the same in the year ahead. Nothing to see here folks, business as usual.

OnDeck may have made it easier for small businesses to get a loan, but they have yet to prove since 2006 if their methodology can actually make money. That should be a wake up call to critics that complain their interest rates are too high.

It is quite possible that their interest rates are actually too low. At an average of 51.2% APR, that’s a heck of a theory to consider.

But it looks like it’s true.

OnDeck 4th Quarter Earnings Call

February 21, 2015 OnDeck Capital (ONDK) will report Q4 and 2014 earnings on Monday, February 23rd at 5pm EST. If you’d like to view the live webcast, you can register here. You can log in as early as 15 minutes before it starts.

OnDeck Capital (ONDK) will report Q4 and 2014 earnings on Monday, February 23rd at 5pm EST. If you’d like to view the live webcast, you can register here. You can log in as early as 15 minutes before it starts.

This is a surprisingly crucial moment for OnDeck who has recorded losses every quarter since inception except for the one just prior to the IPO. Since then the company has been confused as a Lending Club for businesses. The companies differ in that OnDeck’s core business is lending and Lending Club’s is servicing fees.

Critics have called out OnDeck’s high interest rates which top out at 99% APR.

In just a couple months, OnDeck has bounced from a high of $28.98 per share to a low of $14.52. It closed Friday at $18.37.

With OnDeck IPO, Strangers Walk Among Us

December 18, 2014The future isn’t ours to make anymore. Not ours alone anyway. Last week the industry was a group of insiders. Today the outsiders walk among us.

$ONDK looking good, but surely this will fall by tomorrow.

— Nealio (@IpoBandwagonTagAlong) Dec. 17 at 11:07 AM

I don’t know who IpoBandWagonTagAlong is but he’s now an influencer in the industry. Almost 13 million shares of OnDeck Capital traded today, its very first day on the NYSE.

$ondk new ipo watching this..seems similar business to $lc

— kunal desai (@kunal00) Dec. 17 at 01:59 PM

It hurts to see “seems similar business to [Lending Club]” as the information being gleaned about OnDeck. I could spend an entire week contrasting the differences but it doesn’t matter anymore. Opinions about OnDeck and the industry they’re part of are about to be formed in tweet-sized pieces at rapid fire pace. Anything longer and the opportunity presenting itself on a trade might pass. Wild.

If you’re in the merchant cash advance business, you’re about to learn that describing the purchase of future sales in anything more than 140 characters is going to work against you. You will inevitably be asked if you do what OnDeck does and you better be concise.

Exactly 140:

“We provide working capital to small businesses by leveraging their future sales. It’s not a loan but it is in some ways similar to OnDeck :)”

Or you could simplify it further and just write:

“Seems similar”

Proud to have OnDeck join the NYSE’s community of the world’s leading, most-recognized companies (NYSE: $ONDK ) pic.twitter.com/ReozilWjbR

— NYSE (@nyse) December 17, 2014

The most striking thing I experienced on opening day was watching so many OnDeck bears transform into OnDeck bulls. Lots of buy orders were placed by those that have been chugging hater-ade for years.

I think that despite reservations with their business model, there was a desire to touch the company in some way, to feel like they were a part of the industry’s milestone. I totally get it. But that brings up an interesting question, how much of the stock can you touch until you start to hold some sway?

I mean shareholders are owners right?

Theoretically, could a terminated ISO buy up shares and then start making demands about re-establishing a partnership? What is the protocol here? Can OnDeck’s ISOs buy OnDeck? Or OnDeck’s competitors? I don’t mean a controlling stake but enough to make some noise. Imagine OnDeck being a funder for the ISOs by the ISOs! If a huge ISO is terminated, does that have to be announced to the public at the same time that the ISO community finds out?

This is a very gossipy industry and coincidentally, I run practically all the industry gossip websites so people like me want to know.

What if a merchant owns shares of the company it is applying to? Is that a positive underwriting data point?

With an office close to the New York Stock Exchange, I was able to at least snap off a few pics of the big banner displayed outside.

And if you’re wondering if I bought stock in OnDeck, I did not. I didn’t buy Lending Club either. It has nothing to do with how I feel about either company.

According to Crain’s, OnDeck’s “$1.32 billion market cap at its debut was the biggest for a venture capital-backed New York City tech company since 1999.” The stock exploded upward almost 40% from its open today. A lot of folks in the industry bought in and the rest is history.

Congratulations OnDeck Capital.

Through OnDeck Capital, An Industry Wins

December 16, 2014 Call it merchant cash advance, non-bank business lending, or financial disintermediation. Whatever floats your boat. On December 17th an entire financial methodology will be validated, the daily repayment method. Daily payments don’t exist anywhere else in lending but ’round these parts it’s the standard. It’s what makes unbankable businesses bankable.

Call it merchant cash advance, non-bank business lending, or financial disintermediation. Whatever floats your boat. On December 17th an entire financial methodology will be validated, the daily repayment method. Daily payments don’t exist anywhere else in lending but ’round these parts it’s the standard. It’s what makes unbankable businesses bankable.

OnDeck is a lender. They target small businesses. The costs are high. Anyone could feasibly do those things and plenty are doing them, but only a certain segment of fintech companies utilize daily payments and most of those are merchant cash advance companies. OnDeck is a lender but like it or not their core repayment mechanism overlaps with an industry well known for being even more expensive.

Daily payments are so unique and so revolutionary that it hasn’t sunk in to the masses yet. Even the press glosses over this fine detail to instead dwell on things like APRs and social media’s role in approvals. Daily payment and daily repayment look like tech jargon, some kind of code for a backend computer process to hotwire an anomalous rate algorithm.

Daily payments mean borrowers have to make payments every single business day. It’s daily, get it? If the sun rises and it’s not Saturday or Sunday, it’s time to make a payment. I’m not saying there’s something wrong with this. I’m a proponent of this mechanism. It works for business owners that struggle to make a single lump sum payment each month and it works for lenders who need to mitigate and monitor their risk as much as possible.

I feel it’s better to know there was a problem that started yesterday than to learn there was a problem that started 29 days ago. That’s how OnDeck thinks too. And business owners can incorporate the daily deduction into their normal business operations instead of fretting to cover the balance for a big debit the day before a monthly payment is due.

I feel it’s better to know there was a problem that started yesterday than to learn there was a problem that started 29 days ago. That’s how OnDeck thinks too. And business owners can incorporate the daily deduction into their normal business operations instead of fretting to cover the balance for a big debit the day before a monthly payment is due.

This isn’t just a theoretical design that can’t function in practice. It’s been working for lenders and factors since AdvanceMe (Now CAN Capital) started doing it in 1998. The daily payment methodology has survived the Dot Com Bust and the Great Recession. It’s grown to a $3 – $5 billion a year industry. By some measures, it’s taken a hell of a long time to go this mainstream.

But it’s here. The press will call OnDeck a lender, a tech company, or a combination of both. They’re a sign of the times but they are unique in that they will show the world that daily payments have a place in the modern economy. With OnDeck leading the way, traditional lenders may consider leveraging their methodology to serve categories of risk they usually shy away from.

I’ve never heard of a business credit card that required payments to be made every day. Some might think that defeats the purpose of credit. OnDeck proves it doesn’t. And 100+ merchant cash advance companies serve as a secondary validation. Perhaps there are lenders that have considered a daily payment system previously and feared the political or legal environment was too risky. But OnDeck is making no apology about what they’re doing or how they’re doing it. They’re putting themselves on the open market, surrendering themselves to total scrutiny.

CAN Capital is gearing up to follow them, the pioneers who first experimented with daily payments 16 years ago. And while OnDeck bemoans their loan program being compared to merchant cash advance, CAN is made up of two departments, one of which is undoubtedly a merchant cash advance service provider.

CAN Capital is gearing up to follow them, the pioneers who first experimented with daily payments 16 years ago. And while OnDeck bemoans their loan program being compared to merchant cash advance, CAN is made up of two departments, one of which is undoubtedly a merchant cash advance service provider.

And there you have it. It’s not all about algorithms or tech or using facebook activity to judge a borrower. Those are old ideas now. OnDeck smashes down the door with something completely different, something that nobody is even talking about, daily payments.

December 17th is Wednesday and just about all of OnDeck’s borrowers will be making a payment. A good many of them won’t even notice. That’s the great part about layering it in as a daily cash flow expense. There’s no worrying about it at the end of the month. If they underwrite the borrower financials well enough, it should be completely painless. That’s not always the case, but it’s the goal.

You can’t possibly understand OnDeck until you understand daily payments. With this IPO, an entire industry wins.

2014 was an unbelievable year!

2014 was an unbelievable year!